Completed acquisition by

Hunter Douglas N.V. of

convertible loan notes and

certain rights in 247 Home

Furnishings Ltd. In 2013 and

the completed acquisition by

Hunter Douglas N.V. of a

controlling interest in 247

Home Furnishings Ltd. in

2019

Final report

14 September 2020

© Crown copyright 2020

You may reuse this information (not including logos) free of charge in any format or

medium, under the terms of the Open Government Licence.

To view this licence, visit www.nationalarchives.gov.uk/doc/open-government-

licence/ or write to the Information Policy Team, The National Archives, Kew, London

Website: www.gov.uk/cma

Members of the Competition and Markets Authority

who conducted this inquiry

Kirstin Baker (Chair of the Group)

Robin Foster

Anne Fletcher

Mark Thatcher

Chief Executive of the Competition and Markets Authority

Andrea Coscelli

The Competition and Markets Authority has excluded from this published version

of the report information which the Inquiry Group considers should be excluded

having regard to the three considerations set out in section 244 of the Enterprise

Act 2002 (specified information: considerations relevant to disclosure). The

omissions are indicated by []. Some numbers have been replaced by a range.

These are shown in square brackets. Non-sensitive wording is also indicated in

square brackets.

1

Contents

Page

Summary .................................................................................................................... 4

Background ........................................................................................................... 5

The Parties ...................................................................................................... 5

The Transactions ............................................................................................. 5

The industry ..................................................................................................... 6

Jurisdiction....................................................................................................... 8

Counterfactual ................................................................................................. 8

Market Definition .............................................................................................. 9

Our approach to assessing the 2019 Transaction ........................................... 9

Countervailing factors .................................................................................... 12

Findings .................................................................................................................... 15

1. The reference ..................................................................................................... 15

2. The Parties ......................................................................................................... 17

Main Parties ........................................................................................................ 17

Hunter Douglas .............................................................................................. 17

247 Home Furnishings .................................................................................. 19

3. The Transactions ................................................................................................ 21

Timeline of events ............................................................................................... 21

Events leading up to the Transactions and valuations ................................... 21

The Parties’ rationale for the Transactions .................................................... 26

4. Industry background ........................................................................................... 29

Window coverings overview ................................................................................ 29

Distribution Channels .......................................................................................... 32

In-store and In-home ..................................................................................... 32

Online ............................................................................................................ 33

Figure 8: 247 Customer Journeys – Devices used March 2013 to April 2020 .......... 34

Competitors and main parties ............................................................................. 36

Trends within the Sector ..................................................................................... 37

Improvements in the customer offering ......................................................... 37

Technology .................................................................................................... 38

5. Relevant merger situation ................................................................................... 39

Relevant Merger Situation – the jurisdictional test .............................................. 39

Enterprises ceasing to be distinct ....................................................................... 40

Enterprises .................................................................................................... 40

Ceasing to be Distinct .................................................................................... 40

The 2013 Transaction .................................................................................... 43

The 2019 Transaction .................................................................................... 48

The Share of Supply Test – Nexus with UK ........................................................ 49

Time at which the relevant thresholds should be assessed ........................... 49

Share of Supply .................................................................................................. 52

Time period for investigating mergers ................................................................. 53

6. Counterfactual..................................................................................................... 55

Introduction ......................................................................................................... 55

The CMA’s counterfactual assessment framework ............................................. 55

Parties’ views on the appropriate counterfactual ................................................ 56

Assessment ........................................................................................................ 58

Introduction .................................................................................................... 58

2

Scenario 1: Continuation of majority ownership by the 247 Founding

Shareholders ................................................................................................ 59

Scenario 2: Alternative purchaser of Founding Shareholders’ stakes in 247 . 60

Scenario 3: Alternative purchaser for 100% of 247 ....................................... 62

Assessment of scenarios ............................................................................... 63

Findings on the most likely counterfactual .......................................................... 65

7. Market definition .................................................................................................. 66

Product market definition .................................................................................... 66

Curtains and shutters .................................................................................... 68

Ready-made blinds ........................................................................................ 71

In-store and in-home ..................................................................................... 80

Geographic market definition .............................................................................. 84

Conclusion on market definition .......................................................................... 84

8. Competitive assessment ..................................................................................... 85

Market shares ..................................................................................................... 85

Approach to market share calculations .......................................................... 86

Market share estimates ................................................................................. 87

How competition works in the market ................................................................. 89

Parties’ submissions on the customer journey and importance of online

advertising .................................................................................................... 90

Traffic and marketing spend .......................................................................... 91

Search behaviour and customer journey ....................................................... 95

Conclusion ................................................................................................... 100

Closeness of competition .................................................................................. 101

The Parties’ service proposition ................................................................... 102

Online presence .......................................................................................... 107

Survey evidence .......................................................................................... 120

Internal documents ...................................................................................... 123

Pricing analysis ............................................................................................ 125

Third party evidence .................................................................................... 125

Competitive significance of 247 ................................................................... 126

Conclusion on closeness of competition ...................................................... 128

Remaining constraints ...................................................................................... 128

Competition from other online M2M blind retailers ...................................... 129

Competition from multi-channel retailers ..................................................... 138

Competition from eBay and Amazon ........................................................... 145

Out-of-market constraints ............................................................................ 149

Conclusion on remaining constraints ........................................................... 152

Impact of the Merger ......................................................................................... 153

Parties submissions on the impact of the merger ........................................ 155

Our assessment of the Parties’ submissions ............................................... 156

Conclusion on competitive assessment ............................................................ 158

9. Countervailing factors ....................................................................................... 161

Entry and Expansion ......................................................................................... 161

CMA framework for assessing entry and expansion .................................... 161

The Parties’ views ....................................................................................... 162

Our assessment of barriers to entry and expansion .................................... 162

Possible sources of entry and expansion .................................................... 171

Conclusions ................................................................................................. 184

10. The decision ..................................................................................................... 186

11. Remedies .......................................................................................................... 187

3

Introduction ....................................................................................................... 187

CMA framework for assessing remedies .......................................................... 188

Overview of remedy options ............................................................................. 188

Full divestiture of 247 ........................................................................................ 190

Description of remedy .................................................................................. 190

Remedy design issues ................................................................................ 191

Assessment of the effectiveness of full divestiture ...................................... 199

Partial divestiture of 247 ................................................................................... 199

Description of remedy .................................................................................. 199

Remedy design issues ................................................................................ 199

Assessment of the effectiveness of partial divestiture ................................. 211

Conclusion on remedy effectiveness ................................................................ 211

Relevant customer benefits (RCBs) .................................................................. 211

Framework for assessing RCBs .................................................................. 212

Parties’ and third-party views on RCBs ....................................................... 213

Assessment of RCBs ................................................................................... 213

The proportionality of effective remedies .......................................................... 213

Framework for assessment of proportionality of remedies .......................... 213

Conclusion on proportionality ...................................................................... 217

Remedy implementation ................................................................................... 217

Divestiture risks ........................................................................................... 218

Composition risk .......................................................................................... 218

Asset risk ..................................................................................................... 218

Purchaser risk .............................................................................................. 219

Decision on remedies ....................................................................................... 220

Appendices

A: Terms of reference and conduct of inquiry

B: Provisional view on the ability of Hunter Douglas to block a sale by the 247

Founding Shareholders

C: CMA analysis of Parties’ survey methodology

D: Price analyses

E: Online presence and the role of Google

F: Generating traffic as a potential barrier to entry and expansion

Glossary

4

Summary

Overview

1. The Competition and Markets Authority (CMA) has found that the completed

acquisition by Hunter Douglas N.V. (Hunter Douglas) of a controlling interest

in 247 Home Furnishings Ltd (247, and together with Hunter Douglas, the

Parties or the Merged Entity) in 2019 (the 2019 Transaction) has resulted, or

may be expected to result, in a substantial lessening of competition (SLC) in

the online retail supply of made-to-measure (M2M) blinds in the UK.

2. The CMA has also found that the completed acquisition by Hunter Douglas of

convertible loan notes and certain rights in 247 Home Furnishings in 2013

(the 2013 Transaction) has not resulted in the creation of a relevant merger

situation (RMS) within the meaning of the Enterprise Act 2002 (the Act).

Our inquiry

3. On 1 April 2020, the CMA referred the 2013 Transaction and the 2019

Transaction (together, the Transactions) for an in-depth phase 2 merger

inquiry.

4. The CMA is required by its terms of reference to decide with respect to each

of the Transactions:

(a) whether the Transaction constitutes an RMS;

(b) if so, whether the Transaction has resulted or may be expected to result in

an SLC within any market or markets in the United Kingdom for goods or

services; and

(c) whether action should be taken for the purposes of remedying, mitigating

or preventing any SLC or resulting adverse effect we have identified.

5. In addressing the questions above, we have considered a range of different

evidence that we received from the Parties, other retailers and suppliers. This

includes evidence received through submissions, responses to information

requests, telephone calls, and hearings. We have also considered a survey of

their customers prepared and submitted by the Parties that we consider is in

accordance with our best practice. Given that competition in the relevant

market primarily occurs online (as discussed below), we also have analysed

how online search is utilised by the Parties and their competitors in the retail

supply of online M2M blinds. Lastly, we have considered the Parties’

response to our Provisional Findings, which we published on 16 July 2020.

5

Background

The Parties

6. The acquirer is Hunter Douglas, a global provider of window coverings,

including blinds, shutters and curtains. In the UK, Hunter Douglas operates

through different companies at manufacturing, wholesale and retail level,

using several different brands. With respect to online M2M blinds, Hunter

Douglas is active in the UK through its subsidiary Blinds2Go Limited

(Blinds2Go). Blinds2Go is the UK’s largest online M2M retailer for blinds. In

2019 Hunter Douglas had global revenues of approximately £3 billion.

7. The target, 247, is a UK-based online supplier of window coverings including

blinds, shutters and curtains. In 2019, 247’s global turnover was £22.2 million.

8. The Parties overlap in the supply of window coverings in the UK (including the

online retail supply of blinds, shutters and curtains). However, the principal

area of overlap between the Parties is between Hunter Douglas’ subsidiary

Blinds2Go and 247 in relation to the online retail supply of M2M blinds in the

UK. Accordingly, this competitive overlap has been the focus of our inquiry.

The Transactions

9. Hunter Douglas acquired its interests in 247 through two separate

transactions in 2013 and 2019, respectively. Notwithstanding these separate

transactions, the Parties submit that they entered into the 2013 Transaction

on the understanding that this was a single acquisition by Hunter Douglas of

247 that would ultimately complete in 2019. The Parties accordingly view the

2019 Transaction as a formality that gave effect to their previous agreement in

2013.

The 2013 Transaction

10. Pursuant to the 2013 Transaction, Hunter Douglas invested in 247 via the

acquisition of convertible loan notes which had been issued by 247 to 247’s

founding shareholders (the 247 Founding Shareholders).

11. Attached to these loan notes were certain rights in 247 granted to Hunter

Douglas, including: (i) 49% of the voting rights and a 49% share of the profits

in 247; (ii) the right to convert the loan notes at any time to ordinary shares;

(iii) the right to nominate a non-executive Director to the 247 Board; and (iv)

certain veto rights in respect of the 247 business.

12. At the same time, reciprocal put and call options were granted to both Hunter

Douglas and each of the 247 Founding Shareholders. Under the put and call

6

options, the 247 Founding Shareholders could each require the purchase of

their shares by Hunter Douglas and Hunter Douglas could require the sale of

the shares held by each of the 247 Founding Shareholders by written notice in

the period 1 March to 1 June 2019.

13. The terms of the 2013 Transaction prevented either Party from publicising the

transaction. The Parties submitted that the 2013 Transaction was kept

confidential in order to avoid the potential for ‘channel conflicts’ between

Hunter Douglas, as a wholesale supplier, and its customers as retail

suppliers. We understand that Hunter Douglas did not have a retail presence

in the supply of online M2M blinds in the UK prior to the 2013 Transaction.

The 2019 Transaction

14. Pursuant to the 2019 Transaction, Hunter Douglas acquired 100% of the

shares in 247. This followed an indication from the 247 Founding

Shareholders to Hunter Douglas that they both intended to exercise their put

options granted in 2013. The 2019 Transaction completed on 28 February

2019.

Other relevant transactions in the period between the 2013 and 2019 transactions

15. Hunter Douglas acquired two additional businesses active in the retail supply

of online M2M blinds in the UK in the intervening period between the

Transactions.

16. On 21 June 2016 Hunter Douglas acquired a 60% stake in Blinds2Go (the

2016 Transaction). Hunter Douglas subsequently acquired a further 5%

interest in Blinds2Go in 2019.

17. On 21 July 2017 Hunter Douglas acquired Hillarys (the 2017 Transaction),

which at the time had a presence in the supply of online M2M blinds through

Web Blinds. Web Blinds has subsequently been incorporated into Blinds2Go.

This acquisition was reviewed and cleared by the CMA at phase 1.

The industry

18. As noted above, the primary area of overlap between the Parties is the online

retail supply of M2M blinds. These products are part of the broader window

coverings sector, which also includes curtains and shutters.

19. Window coverings (including blinds) typically are supplied in either a ready-

made or M2M format. Ready-made products are largely finished and sold in

one of many available sizes, whereas M2M products are tailored to the

7

specifications of the customer. The main channels through which window

coverings are sold in the UK are the in-home, in-store and online retail

channels.

20. In-store and in-home are traditional retail channels in which customers have

some degree of interaction with the product or a salesperson prior to

purchase. We also note that some of these retailers also have an online

presence, although not all in-store or in-home retailers sell online. Those

retailers who sell in-store/in-home and online are referred to as multi-channel

retailers.

21. With respect to online M2M blinds, these products are purchased through

websites that enable customers to customise blinds in accordance with their

desired measurements and design preferences. This differentiates M2M

blinds from ready-made products. In contrast to the in-home and in-store

channels, the leading retailers of online M2M blinds provide limited sales

advice prior to purchase and typically require customers to fit the blind

themselves once they have received their order. Competition between

retailers primarily occurs online and so retailers’ generation of website traffic

through online search (primarily through Google), their position in search

rankings and the use of online advertisements are of particular competitive

importance in the supply of online M2M blinds. We have therefore considered

these parameters of competition as part of our competitive assessment.

22. In addition to retailers’ websites, online marketplaces (namely Amazon and

eBay) also allow retailers to sell blinds. We understand that the majority of

sales through these channels are for ready-made blinds. This may be

reflective of the fact that these platforms do not offer the same functionality

and customer service options as online M2M blinds retailers and therefore are

not directly comparable.

23. The competitive landscape of the window coverings sector differs by product

type and channel. With respect to the broader window coverings sector as a

whole, multi-channel retailers are the leading suppliers with Dunelm, Hillarys,

John Lewis, and Next being largest competitors.

24. We note however that the competitive landscape is different for the online

retail supply of M2M blinds. In particular, the leading retail suppliers of online

M2M blinds in the UK are focussed primarily on supplying M2M blinds online

(although they may supply other window coverings to a lesser extent).

8

Findings

Jurisdiction

25. We have assessed whether each of the 2013 Transaction and the 2019

Transactions created a RMS.

26. We conclude that the 2013 Transaction did not create a RMS. The rights

attached to the convertible loan notes acquired by Hunter Douglas through

the 2013 Transaction were sufficient to give it material influence over 247’s

policy. However, we were not satisfied that the share of supply test is met in

relation to the 2013 Transaction, taking account of the particular and unusual

circumstances of this case, in particular, the very lengthy period which had

elapsed since the 2013 Transaction occurred and the lack of overlap between

the Parties at the time of the 2013 Transaction.

27. In contrast, we have found that the 2019 Transaction created a RMS. We find

that Hunter Douglas’ acquisition of 100% of the shares in 247 amounts to the

acquisition of a controlling interest in 247. In particular, as a consequence of

owning 100% of 247, Hunter Douglas acquired the ability to unilaterally

determine 247’s strategic policy and increased its share of the company’s

profits. Moreover, we find that the share of supply test is met as a result of the

Parties having a combined share in excess of 25% in the online retail supply

of M2M blinds in the UK.

28. In light of our findings on jurisdiction, our substantive assessment considers

whether the 2019 Transaction has resulted, or may be expected to result, in

an SLC in the UK.

Counterfactual

29. The counterfactual is an analytical tool used to help answer the question of

whether a merger may be expected to result in an SLC. It does this by

providing the basis for a comparison of the competitive situation in the market

with the merger against the most likely future competitive situation in the

market absent the merger.

30. We may examine several possible scenarios to determine the appropriate

counterfactual. We have found no evidence to suggest that Blinds2Go would

have done anything other than continue to compete in line with the conditions

prevailing at the time of the 2019 Transaction. For 247, we have considered

three scenarios:

9

(a) Scenario 1: Continuation of majority ownership by 247 Founding

Shareholders

(b) Scenario 2: Alternative purchaser of the 247 Founding Shareholders’

stake in 247

(c) Scenario 3: Alternative purchaser for 100% of 247

31. We find that, absent the 2019 Transaction, the most likely scenario is that the

247 Founding Shareholders would have sought to sell their shares in 247 to a

third-party buyer (as per Scenario 2). In our view, it was the intention of the

247 Founding Shareholders to sell their shares in 247 and that, at the point of

the 247 Founding Shareholders selling their shares, Hunter Douglas would no

longer have been able to exercise the veto and other rights it previously held

in 247. This would have resulted in 247 having more independence than it

had prior to the 2019 Transaction.

Market Definition

32. Our finding is that the relevant market for the assessment of the 2019

Transaction is the online retail supply of M2M blinds in the UK. This position is

supported by our assessment of the Parties’ own customer survey, their

monitoring activities, as well as the views received from third parties.

33. We have not included other window covering products, ready-made blinds or

the in-store and in-home channels in the relevant market. However, we note

that market definition does not determine the outcome of our competitive

assessment and we take into account the constraint of these alternative

products where relevant. With respect to ready-made blinds in particular, we

acknowledge that these products do act as a distant competitor to online M2M

blinds.

Our approach to assessing the 2019 Transaction

34. We have assessed the competitive effects of the 2019 Transaction by

reference to a horizontal unilateral effects theory of harm, that is where one

firm merges with a competitor that previously provided a competitive

constraint, allowing the merged firm profitably to raise prices on its own and

without needing to coordinate with its rivals. In particular, we have assessed

whether Hunter Douglas acquiring 100% control over 247 and increasing its

share of the company’s profits as a result of the 2019 Transaction would likely

result in Hunter Douglas increasing prices and/or lowering the quality of its

products or customer service, and/or reducing the range of its

products/services across the brands it controls.

10

Competitive assessment

35. We have found that the 2019 Transaction may be expected to result in an

SLC in relation to the retail supply of online M2M blinds in the UK.

36. In reaching this view, we found that the Parties are two of only three retailers

with a market share above 5%. Blinds2Go is the largest supplier of online

M2M blinds in the UK and several times larger than the second largest

supplier, while 247 is of meaningful scale in this market as the third largest

supplier and is approximately three times larger than the fourth largest

supplier. Outside of the top three suppliers, we have identified few retailers

with a market share above 1%. In light of these findings, we find that the

combined share of the Parties is very high, at 60-70%, and that the increment

from 247 is significant in the context of an already concentrated market.

37. We find that the Parties’ offerings in terms of price, quality and range are

similar and we have identified only two other retailers that have a broadly

similar offering to the Parties.

38. Our assessment of the Parties’ online presence shows that the Parties are

two of only three retailers that consistently rank highly in Google paid search

results, indicating that the Parties are both highly effective at competing for

the top positions in paid search results. Our assessment also shows that the

Parties, together with two other retailers, feature frequently in the top three

organic search positions.

39. Evidence on the Parties’ monitoring of competitors’ prices, as recorded in their

own documents, shows that the Parties monitor each other and that the set of

other retailers monitored is relatively small. Survey evidence on the reported

diversion of Blinds2Go’s and 247’s customers is also consistent with the

Parties being close competitors, with the constraint from Blinds2Go on 247

appearing to be stronger than the constraint from 247 on Blinds2Go.

40. Overall, we find the Parties to be close competitors that pose a significant

competitive constraint on each other.

41. We have also assessed the post-merger constraints on the Parties. With

respect to other suppliers of online M2M blinds, we consider that Interior

Goods Direct, which is only slightly larger than 247, is the only other

significant constraint on the Parties. Whilst we have identified a number of

smaller online M2M blinds retailers, we do not view them as an effective

competitive constraint on the Parties, individually or in aggregate. This is

reflected in their limited share of the market, the fact that they do not appear

to be closely monitored by the Parties, the Parties’ own survey evidence, and

also the limited visibility of smaller suppliers in search results.

11

42. Further, we find that multi-channel retailers currently exert only a limited

constraint on the Parties and are not an effective alternative for most of the

Parties’ customers. This is reflected in the limited share of multi-channel

retailers in the supply of online M2M blinds, their potentially differentiated

product range (with respect to price and quality), limited online range and lack

of prominence in online search. We also note the lack of consistent monitoring

of multi-channel retailers by the Parties and other online suppliers. We find

that the Parties’ survey evidence relating to multi-channel retailers potentially

overstates the strength of their constraint. In particular, we consider that the

reported diversion to large multi-channel retailers is likely subject to an

upward bias, due to customers being more familiar with these brands but

potentially unaware of the true nature of their offerings. Notwithstanding this

finding, we have assessed whether the constraint they exert may increase

going forward in our assessment of the potential entry and expansion of

retailers.

43. We have found that online marketplaces are a weak constraint on online M2M

blinds retailers. In particular, these platforms are not comparable to online

retailers’ websites in terms of functionality, and the majority of their sales are

of ready-made rather than M2M blinds. We also note that marketplaces do not

constitute a standalone constraint given that their position is attributable to

collections of individual retailers.

44. With respect to out-of-market constraints, we find that other window covering

products and M2M blinds sold through the in-store and in-home channel do

not pose a material competitive constraint on the Parties, while ready-made

blinds pose a weak competitive constraint. Whilst we recognise that the out-

of-market constraints, in aggregate, impose some degree of constraint on the

Parties’ ability to raise prices due to the aggregate diversion to these

alternatives, we find that this is likely to only exert a weak competitive

constraint on the Parties, and further note that the Parties’ survey evidence

and monitoring activities indicate other retailers’ online M2M blinds as being

the main competitive constraint on the Parties.

45. As part of our competitive assessment we have found that the 2019

Transaction results in Hunter Douglas having the ability and the incentive to

raise both 247 and Blinds2Go’s prices (or otherwise worsen the offering of

247 and Blinds2Go). This conclusion is informed by our findings that the

Parties are close competitors, with evidence of diversion between them.

Hunter Douglas has acquired the ability to increase 247’s prices as a direct

consequence of the 2019 Transaction. Additionally, we find that Hunter

Douglas will have an incentive to increase 247’s prices, as Hunter Douglas

will benefit from a significant share of sales that would likely be diverted to

Blinds2Go. At the same time, we also find that Hunter Douglas has the ability

12

and the incentive to increase Blinds2Go’s prices, with Hunter Douglas now

benefitting from a 100% interest in 247, rather than only 49% pre-merger.

Countervailing factors

Entry and Expansion

46. We have considered factors that may mitigate or prevent the effect of the

merger on competition and in particular whether entry or expansion by third

parties might prevent the SLC identified. We have concluded that no such

entry or expansion would be timely, likely, and sufficient as regards any

individual current or potential competitor, or when considered in aggregate. In

reaching this view, we have considered both whether any barriers to

entry/expansion in the relevant market exist, and whether there is evidence of

actual or planned entry/expansion by rivals.

47. We have found that there is some evidence of barriers to entry and expansion

in the retail supply of online M2M blinds. These barriers relate to generating

website traffic, and to a lesser extent to website costs, brand awareness and

customer loyalty. However, we also note that the impact of any such barriers

may vary depending on the nature of the firm seeking to enter or expand.

48. Whilst it may be the case that individual barriers may in some circumstances

be overcome, we note that a new entrant to the market will likely find

themselves faced with a series of barriers to entry which might have a

significant cumulative effect on entry. With respect to existing rivals, we find

that barriers to further expansion may not be as high as for new entrants,

however the Parties’ existing strengths in the market for online M2M blinds

(as discussed in the competitive assessment section) mean that it is likely to

be difficult for rivals to achieve sufficient expansion to replace the loss of 247

as an independent competitor.

49. In any event, evidence obtained from third parties in relation to actual and/or

planned entry or expansion in this market does not show that entry or

expansion will be timely, likely and sufficient.

50. Of the leading online M2M blinds suppliers contacted in our inquiry, we

understand that certain other competitors may have plans to grow, however,

the evidence available to us does not reliably indicate how these growth plans

would be achieved. In particular, we note that Decora, a manufacturer of M2M

blinds, recently entered the market through its acquisition of Swift Direct

Blinds. However, this acquisition reflects the expansion of an existing

competitor, rather than entry by a new competitor. Moreover, the growth plans

of smaller online M2M blinds retailers would have to considerably outperform

13

an already fast-growing market in order to provide a sufficient constraint to

mitigate the effects of the Merger between the first and third largest retailers.

In this regard, we have found insufficient evidence to demonstrate how any

stated growth plans would be achieved so as to result in these competitors

providing a significantly increased individual or aggregate constraint on the

Parties post-Merger. We also observe limited growth from smaller existing

retailers in recent years. Indeed, the fact that there has been little change in

the identity of the leading suppliers in the market over several years suggests

that there is a degree of incumbency advantage in the market that may

constrain further expansion.

51. The evidence received from multi-channel retailers suggests a variety of

different plans regarding entry or expansion, however the evidence does not

demonstrate that any expansion or re-entry into the market will be timely,

likely, and sufficient. In addition, whilst they may have expressed a previous

interest in developing a presence in this market, all of these retailers have

indicated to us that their plans have been significantly impeded by the current

COVID-19 pandemic. Moreover, current plans for future growth through the

online channel for multi-channel retailers encompass their entire online

product offering, of which M2M blinds comprise a small part. Therefore, even

if entry or expansion from these retailers was timely and likely (which we do

not consider to be the case), based on the evidence provided to us (including

pursuant to our legal information gathering powers), we consider that any

entry or expansion would not be sufficient (either individually or in aggregate)

to constrain the Merged Entity.

52. Whilst we have considered different potential sources of entry and expansion

in the online M2M blinds market, the evidence available to us indicates that

even if they were to be considered on an aggregated basis, they would not be

timely, likely and sufficient.

Conclusion on the substantial lessening of competition test

53. We find that the 2013 Transaction did not create an RMS and that the 2019

Transaction did create an RMS.

54. For the reasons discussed above, we have found that the 2019 Transaction

has resulted in, or may be expected to result in, an SLC as a result of

horizontal unilateral effects in the online retail supply of M2M blinds in the UK.

In particular, we find that the 2019 Transaction removes a direct competitor

from this market, resulting in an ability and incentive for the Merged Entity to

increase retail prices, lower the quality of its products or customer service,

and/or reduce the range of its products/services.

14

Remedies

55. Having concluded that the 2019 Transaction has resulted in, or may be

expected to result in, an SLC, we are required by the Act to decide what, if

any, action should be taken to remedy, mitigate or prevent that SLC or any

adverse effect resulting from the SLC.

56. In deciding on the appropriate remedy, the CMA will seek remedies that are

effective in addressing the SLC and its resulting adverse effects and will then

select the least costly and intrusive remedy that it considers to be effective,

having regard to the need to achieve as comprehensive a solution as is

reasonable and practicable to the substantial lessening of competition and

any adverse effects resulting from it. The CMA will also seek to ensure that no

remedy is disproportionate in relation to the SLC and its adverse effects.

57. We considered the following remedy options:

(a) Requiring the full divestiture of 100% of the ordinary share capital of 247;

and

(b) Requiring a partial divestiture of 51% of the ordinary share capital of 247.

58. We have found that both of these options would, in principle, be an effective

and proportionate remedy to address the SLC and its resulting adverse

effects we have found, provided a suitable purchaser could be found.

59. We find that a partial divestiture of 51% of the ordinary shares of 247 to be the

least onerous effective remedy. While full divestiture has a lower cost

associated with it than the partial divestiture option as it would not require any

ongoing monitoring by the CMA, this option is also significantly more intrusive

as it would leave Hunter Douglas with no shareholding in 247. This compares

to the conditions of competition in the counterfactual that we found, where it

would still hold a 49% stake. In addition, we have identified a number of

conditions in order to ensure that a suitable remedy is achieved and that the

CMA has sufficient oversight over the remedies process. In particular, any

suitable purchaser will be required to operate the business in a manner that

ensures effective competition between Blinds2Go and 247.

15

Findings

1. The reference

On 1 April 2020, in exercise of its duty under section 33(1) of the Enterprise

Act 2002 (the Act) the Competition and Markets Authority (CMA) referred:

(a) the completed acquisition by Hunter Douglas N.V. (Hunter Douglas)

of convertible loan notes and certain rights in 247 Home Furnishings

Ltd (247) in 2013 (the 2013 Transaction); and

(b) the completed acquisition by Hunter Douglas of a controlling interest

in 247 in 2019 (the 2019 Transaction) (together with the 2013

Transaction, ‘the Transactions’).

for further investigation and report by a group of independent panel

members (the Inquiry Group).

The terms of reference, along with information on the conduct of the

inquiry, are set out in Appendix A. The Inquiry Group is required to publish

its final report by 15 September 2020.

Section 35 of the Act sets out the statutory questions that the CMA needs

to decide in a Phase 2 inquiry pursuant to, as in this case, a reference

under section 22 of the Act. In this investigation, the Inquiry Group must

decide:

(a) For each of the 2013 Transaction and the 2019 Transaction, whether

a relevant merger situation (RMS) has been created (the First

Statutory Question); and

(b) If so, in each case, whether the creation of that situation has resulted

or may be expected to result in a substantial lessening of

competition (SLC) within any market or markets in the United

Kingdom for goods or services (the Second Statutory Question).

If the Inquiry Group answers both statutory questions in the affirmative in

relation to any of the Transactions, then the Group must also decide what

action the CMA should take for the purposes of remedying, mitigating or

preventing any SLC or resulting adverse effect we have identified. This is

the subject of the notice of possible remedies we have published alongside

these provisional findings, in which we have discussed what measures

could effectively remedy the SLC we have provisionally found.

16

This document, together with its appendices, constitutes the Inquiry

Group’s findings, published in line with the CMA’s rules of procedure.

Further information relevant to this Inquiry, including non-confidential

versions of the submissions received from Hunter Douglas and 247, can be

found on the CMA’s website.

Throughout this document we refer to Hunter Douglas and 247 collectively

as the Parties and as applicable, the Merged Entity.

17

2. The Parties

Main Parties

Hunter Douglas

Hunter Douglas is a global provider of window coverings such as blinds,

shutters and curtains, and is headquartered in The Netherlands. The

company was founded by H. Sonnenberg in 1946, although the origins of

the company go back to 1919. The Hunter Douglas Group went public in

1969; the majority of its shares are owned by the Sonnenberg family.

1

The

Hunter Douglas Group is comprised of 134 companies with 47

manufacturing and 87 assembly operations and marketing organisations

across more than 100 countries.

2

In the UK, Hunter Douglas operates through different companies at the

manufacture, wholesale and retail level, using several different brands.

3

At

the retail level, Hunter Douglas is active in the UK through Thomas

Sanderson Limited, Hillarys Blinds Limited, Blinds2Go Limited (Blinds2Go),

Tuiss LLP and 247 Home Furnishings Limited. This is illustrated in Figure 1

below.

1

The Sonnenberg Family own 82.68% common shares and 99.4% preferred shares. Hunter Douglas website,

accessed 30 June 2020.

2

See Hunter Douglas Annual Report 2019, page 1

3

At wholesale level, Hunter Douglas is active in the UK through: Stevens (Scotland) Limited, Arena Blinds

Limited, Custom West Trading Limited, Holis Industries Limited, Orgon Windows Fashion Limited and Orgon

Limited Sunflex, Luxaflex, and HD Direct. Hunter Douglas used the following brands at wholesale level in the UK:

Sunflex, Luxaflex, and HD Direct.

18

Figure 1: Blinds, shutters and curtains supply chain and the Parties’ business units active at

each level

Source: CMA’s summary based on Parties’ submissions

In 2019 Hunter Douglas had global revenues of just over £3.0 billion ($3.7

billion

4

) and UK revenues of £[] in 2019. In the UK, Hunter Douglas

supplies blinds online through the 247 blinds, Blinds2Go and Web Blinds

brands and websites.

5

Blinds2Go

Established in 2000, Blinds2Go is the UK’s largest online made-to-measure

(M2M) retailer for blinds. Web Blinds was formerly part of the Hillarys

Group, but was subsequently integrated into the Blinds2Go Group by

Hunter Douglas after its acquisition of Hillarys in 2017.

Blinds2Go’s total UK revenue for the financial year (FY) 2019 was £[].

Based on the data in table 1 below, Blinds2Go’s total revenue increased on

average by 45% per year between FY 2013 to FY 2019. The average rate

of growth between FY 2018 and FY 2019 has been considerably lower at

18% per year, compared to an average of 58% from FY 2013 to FY 2017.

Blinds2Go’s average gross profit has been 39% over the last 7 years.

4

See Hunter Douglas Annual Report 2019. See also Hunter Douglas’s response to CMA’s request for

information dated 21 February 2020.

5

Web Blinds is owned by Blinds2Go and Hunter Douglas has a 65% controlling interest in Blinds2Go.

19

Table 1: Blinds2Go Total Revenue and Profit margin FY 2013 to FY 2019

£ million

2013

2014

2015

2016

2017

2018

2019

Total Revenue

[

]

[

]

[

]

[

]

[

]

[

]

[

]

Gross Profit

[]

[]

[]

[]

[]

[]

[]

Gross Profit %

[

]

[

]

[

]

[

]

[

]

[

]

[

]

Figure 2 below shows Blinds2Go’s performance from FY 2008 to FY 2019.

Consistent with Table 1 above, this shows a stable gross profit margin of

between 35% and 40% over this period.

Figure 2: Blinds2Go UK sales of M2M blinds and gross and net profit margins FY 2008 – FY

2019)

[]

Source: Blinds2Go Management accounts (2013-2019) and financial reports (FY 2008 – FY 2012)

247 Home Furnishings

247 is a UK-based and online supplier of window coverings to retail

customers, including blinds, shutters and curtains. The company was

founded in 1997 by Jason Peterkin and David Maher (247 Founding

Shareholders). The company was a mail-order business for the first 8 years

while the 247 Founding Shareholders built up the web design and e-

commerce aspects before launching their in-house e-commerce project in

2005. This move also included the offer of M2M blinds online. Following the

success of their first two years’ sales of M2M blinds, with second-year

sales exceeding £3 million, in 2007 the company moved to focus

exclusively on selling M2M blinds online.

In 2019, 247’s total turnover for all products for the year ended 19 February

2019 was £22.2 million, of which £[] was in the UK.

The data in Table 2, and illustrated by Figure 3, set out 247’s total revenue

from selling M2M blinds in the UK. 247’s total revenue increased on

average by 10% from 2008 to 2019. 247’s average gross profit margin has

been around 34% over the same timeframe.

20

Table 2: 247 UK M2M Blind income and UK M2M blind gross profit margin 2008 to 2019

£ million

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

Total Revenue

[]

[]

[]

[]

[]

[]

[]

[]

[]

[]

[]

[]

Gross Profit

[]

[]

[]

[]

[]

[]

[]

[]

[]

[]

[]

[]

Gross Profit %

[

]

[

]

[

]

[

]

[

]

[

]

[

]

[

]

[

]

[

]

[

]

[

]

Source: 247 management accounts 2008 to 2019

Figure 3 : 247 UK M2M Blind income and UK M2M blind gross profit margin 2008 to 2019

[]

Source: 247 management accounts 2008 to 2019

Note: 247’s Financial year ends after February, therefore the FY year represents the figures for the year ended 28 or 29

February the year after (e.g. FY 2009 is the year ending 28 February 2010).

21

3. The Transactions

Timeline of events

Hunter Douglas acquired its interests in 247 through two separate

transactions in 2013 and 2019, respectively. In the intervening period,

Hunter Douglas made changes to its voting rights in 247, the details of

which are outlined below. Also during this period, Hunter Douglas

expanded its presence in the UK window coverings sector through

separate acquisitions of a majority stake in Blinds2Go and of Hillarys.

These are indicated in the timeline below, which shows developments in

relation to 247 below the timeline, and other Hunter Douglas developments

above the timeline:

Figure 4: A timeline of the Parties’ transactions

Source: CMA analysis of Parties’ submissions

Events leading up to the Transactions and valuations

2013 Transaction

The Parties submitted that the timeline of the events leading up to the

decision to enter into the 2013 Transaction is as follows:

6

(a) In September 2012 David Sonnenberg (then and currently co-CEO

of Hunter Douglas) initiated discussions with the 247 Founding

Shareholders concerning a possible investment by Hunter Douglas.

This was followed up by another meeting the following month

6

[].

22

between David Maher and Michiel de Heer (of Hunter Douglas) to

discuss further details of the investment.

(b) On 18 December 2012, there was a further meeting between David

Sonnenberg, David Maher and Jason Peterkin in Rotterdam to

discuss details of the investment.

(c) In early January 2013, negotiations took place leading to the

agreement of Heads of Terms for the 2013 Transaction on 10

January 2013.

(d) On 30 April 2013, the 2013 Transaction was then implemented by

way of a series of agreements; a [].

Hunter Douglas completed the 2013 Transaction by [].

7

This translates to

an Enterprise Value of £[] for 247 at the time of the 2013 Transaction.

Attached to these loan notes were certain rights in 247, which Hunter

Douglas also acquired as a result. These included:

(a) 49% of the voting rights at shareholder level and a 49% share in the

profits in 247;

(b) A right to convert the loan notes at any time to ordinary shares;

(c) A right to nominate a non-executive Director to the 247 Board; and

(d) Veto rights, notably over the following matters:

(i) Appointment of additional directors (beyond the 247 Founding

Shareholders);

(ii) Approval of the annual budget;

(iii) Acquisitions;

(iv) Entering into new lines of business other than (a) M2M window

coverings, (b) curtain-in-a-box in the UK; standard Velux roof-window

blinds, accessories associated with the above and any other items

sold by 247 on its UK website at the date of the agreement, all of

which are to be sold principally through the internet without

specifically targeting the large scale B2B market (interior designers,

property management companies and letting agents);

7

[].

23

(v) Geographic expansion;

(vi) Any backward integration into assembly or production of any of the

products sold by 247;

(vii) Long term agreements (exceeding one year in duration);

(viii) Financing arrangements with banks or other parties;

(ix) Dividends in excess of 35% of profit after tax;

(x) Offers on the website at less than 15% gross profit; and

(xi) Termination of the existing supply agreement with Hunter Douglas.

8

Notwithstanding the contractual provisions between the Parties, the Parties

have submitted that 247 has been operated as an independent business

since the time of the 2013 Transaction. The Parties stated in their main

submission that Blinds2Go and 247 have continued to compete as

independent rivals from 2016 to the present date.

9

Hunter Douglas has

said this is a matter of policy and principle; co-CEO David Sonnenberg

stated at the hearing with the CMA ‘we have a very long history, over 60

years, of conducting ourselves in the industry in this way, leaving our

companies alone, very much like the way Berkshire Hathaway manages its

subsidiaries. In practice, the only way I am able to oversee 130 companies

is by running companies independently.’

Reciprocal put and call options were granted to Hunter Douglas and the

247 Founding Shareholders (the Put and Call Options) under separate Put

and Call Option Agreements between Hunter Douglas and the 247

Founding Shareholders. Under the Put and Call Options, the 247 Founding

Shareholders could require the purchase of 100% of their shares by Hunter

Douglas and/or Hunter Douglas could require the sale of the shares held by

the 247 Founding Shareholders, under normal circumstances,

10

by written

notice, in the period 1 March to 1 June 2019.

A Stakeholders Agreement was entered into between Hunter Douglas

(through Buismetaal), 247 and the 247 Founding Shareholders. Key

provisions of the Stakeholders Agreement included granting the rights set

out at paragraph 3.4 above to Hunter Douglas.

Additionally, two identical ‘Bonus Agreements’ were set up between Hunter

Douglas and each of the 247 Founding Shareholders which paid a bonus of

8

[].

9

Main Submission, 20 May 2020, paragraph 3.23.

10

Under the bad leaver, death or disability provisions the option can be exercised outside this period.

24

[]% to the 247 Founding Shareholders for annual purchases of finished

blinds up to £[] within the Hunter Douglas Group, and []% for any

purchases exceeding £[]. This agreement was valid for the financial year

ending 28 February 2014 to the financial year ending 28 February 2017. An

‘additional bonus payment’ of []% was made on all finished blinds from

within the hunter Douglas Group. in the financial years ending 28 February

2014 and 28 February 2015.

Confidentiality provisions

The terms of the 2013 Transaction prevented either Party from publicising

the Transaction. This allowed Hunter Douglas to keep its investment in 247

confidential.

The Parties told us that the 2013 Transaction was kept confidential in order

to avoid the potential for ‘channel conflicts’ between Hunter Douglas, as a

wholesale supplier, and its customers as retail suppliers. Hunter Douglas

submits that it was concerned about the reaction of (and thus ‘conflict’ with)

its retail level customers to news that Hunter Douglas was itself entering

that market through its investment in 247. 247 submitted that it wished to

keep the 2013 Transaction confidential in order to avoid disrupting its

relationships with suppliers other than Hunter Douglas.

Other relevant Transactions in the intervening period

After the 2013 Transaction, but before the 2019 Transaction, Hunter

Douglas acquired two other businesses who were active in the supply of

window coverings.

On 21 June 2016 Hunter Douglas acquired a 60% equity stake in

Blinds2Go for £[] million

(the 2016 Transaction). Hunter Douglas

subsequently acquired a further 5% interest in Blinds2Go in 2019.

11

Hunter

Douglas has future options to acquire the remainder of the shares in

Blinds2Go; two put and call options have been built into the structure of the

deal for Hunter Douglas to acquire a further 15% equity stake in 2021 and

the remaining 20% in 2026.

12

On 17 July 2017 Hunter Douglas acquired Hillarys (the 2017 Transaction).

This acquisition was reviewed and unconditionally cleared by the CMA at

phase 1. The Merger Notice submitted by Hunter Douglas in relation to the

2017 Transaction did not disclose the existence of the 2013 Transaction.

11

Main submission, footnote 26.

12

Main submission, paragraph 6.10.

25

The only reference in the Merger Notice to Hunter Douglas having any

relationship with 247 was in a footnote, which stated that: []

13

[].’

Hunter Douglas reduction of voting rights in 247

On 6 December 2016, Hunter Douglas reduced its shareholder level voting

rights in 247 from 49% to 24.9%. Hunter Douglas submits that this arose as

a result of changes to UK corporate governance rules as part of the

implementation of the EU Fourth Money Laundering Directive, specifically

the requirement for UK companies to maintain a register of persons with

significant control (PSC). The CMA understands that reducing its voting

rights in 247 to under 25% allowed Hunter Douglas to maintain

confidentiality over its interest in 247 by avoiding having to be identified on

247’s register of PSCs. The CMA understands that this desire to continue

maintaining the confidentiality of Hunter Douglas’ interest in 247 was

motivated by the perceived risk of ‘channel conflicts’ noted above. Hunter

Douglas’ other rights set out at paragraph

3.4 above remained unchanged.

Subsequently, on 11 May 2017, just prior to the 2017 Transaction, Hunter

Douglas further reduced its shareholder level voting rights in 247 from

24.9% to 4.9%. Again, Hunter Douglas’ other rights, as per paragraph 3.4

above in 247 remained unchanged.

Hunter Douglas submits that its reason for reducing its voting rights was to

avoid having to disclose its interest to the CMA in any investigation of the

2017 Transaction. Hunter Douglas have stated that they were concerned

that the CMA might disclose the 2013 Transaction in the course of any

such investigation, leading to the transaction no longer being confidential:

The reason for this was that Hunter Douglas was aware that the

CMA might investigate its proposed acquisition of Hillarys, a

much larger business with overlaps upstream in components and

assemblers, as well as retail operations including a small online

web brand (Web Blinds) and its main in-home service. Hunter

Douglas was concerned that any such review might lead to the

disclosure in the decision of its interest in 247. This would have

undermined the position so recently taken to reduce its voting

rights from 49% to 24.9% to preserve confidentiality.

13

[].

26

2019 Transaction

The Parties submit that the timeline of the events leading up to the decision

to enter into the 2019 Transaction is as follows:

(a) In December 2017 the 247 Founding Shareholders met with Hunter

Douglas to discuss continuation plans if the put or call options were

exercised.

(b) In 2018 the 247 Founding Shareholders made it known to Hunter

Douglas that they would be exercising their respective put options.

(c) In 2018/2019 a number of calls concerning the optimum deal

structure occurred between the 247 Founding Shareholders and

Hunter Douglas.

(d) On 19 February 2019 the 2019 Transaction was implemented. The

2019 Transaction took place slightly earlier than anticipated in 2019

(as stated above, it was originally planned to take place between

March and June 2019) to ensure it came before the end of 247’s

financial year.

(e) The 2019 Transaction completed on 28 February 2019, at the end of

247’s 2018/19 financial year. The terms of the 2019 Transaction

gave effect to the Put and Call Options, albeit these were not

formally exercised.

The total consideration paid for all the issued share capital of 247 was

£[]. This is consistent with the purchase price that would have been paid

had the Put or Call Option been exercised, the calculation of which was to

be based upon 247’s profits in the two years prior to the exercise of the Put

or Call Option.

The Parties’ rationale for the Transactions

The Parties submit that the 247 Founding Shareholders ‘entered the 2013

Transaction in the belief that they were selling the business to Hunter

Douglas in a staggered transaction that would finally complete in 2019 and

which would ensure the most tax efficient outcome (through entrepreneur

relief) for the individuals.’

As a result, the Parties were not of the view that the 2013 and 2019

transactions were independent. At the main party hearing with 247, Jason

Peterkin stated of his and David Maher’s understanding:

27

David never considered the 2013 and 2019 transactions to be

distinct from each other. We looked at the 2013 as a single

transaction which ended in 2019... David and myself to a lesser

extent were both very keen to give ourselves an exit plan. The

deal that Hunter Douglas offered us gave us exactly that. It also

gave us access, certainly perceived access, to their resource.

247 has submitted that ‘the structure provided a guaranteed exit route.

David Maher, in particular, was looking to retire and the put option allowed

both of the 247 Founding Shareholders to exit the business whilst

maximising the value which could be achieved.’

Notwithstanding the stated exit plan for the 247 Founding Shareholders,

the Parties’ submitted the following further considerations motivating the

Transactions.

2013 Transaction

Hunter Douglas submitted the following in relation to the 2013 Transaction:

In 2013, we were aware of the emerging importance of e-com to

our business. Home Depot had bought Blinds.com and we were

supplying them, so we could see the growth. We began to worry

that over the long run we may need to transform into more of a

retailer ourselves, as difficult as that might be given the efficiency

of the direct-to-consumer businesses in e-com, in particular,

versus traditional retail. UK e-com seemed to be emerging and a

good place to learn.

Hunter Douglas [], describing, in a Board report at the time of the

Blinds2go acquisition, that ‘[]’.

The Parties have submitted that another motivation for the 2013

Transaction was to support 247’s expansion overseas,

14

more specifically

across mainland Europe.

15

Hunter Douglas stated, in internal documents at

the time of the transaction, that:

‘[247] requires a reliable strategic supplier with wide geographic

reach and product breadth as well as additional capital for

geographic expansion on the European Continent.

14

247 submitted that the 247 Founding shareholder were considering expansion plans at the time of the

2013.transaction; an extension into flooring products, or international expansion.

15

[].

28

HD is willing to acquire a 49% stake in [247] to support this

expansion.

The structure of the existing cooperation as well as the expansion

to Continental Europe should be optimized to reflect the fiscal

position of the parties, e.g. to allow for Entrepreneurial Relief for

David and Jason, where possible earning income in a permanent

establishment in a jurisdiction with lower tax rate than the U.K.,

licensing structures for existing and future IP rights, gearing,

etc.

16

’

The Strategic Business Plan prepared as part of the 2013 Transaction

states that [].

17

As a result, a Bonus Agreement was entered into with

247’s Founding Shareholders.

2019 Transaction

As described above, the 2019 Transaction was at the instigation of the 247

Founding Shareholders, and in particular the retirement of David Maher.

The 247 Founding Shareholders discussed potential continuation plans

after the call and put options with David Sonnenberg as early as 2017

before discussing their intention to exercise their put option in 2018 and exit

from the business.

[].

18

[].

16

[].

17

[].

18

[].

29

4. Industry background

In this section we provide an overview of the industry in which the Parties

are active. In particular, we will discuss the wider window coverings sector

in the UK, with a focus on the retail market for online M2M blinds, being the

principal area of overlap between the Parties.

Window coverings overview

The window coverings sector includes blinds, curtains, shutters, and

suspension systems. Customers typically purchase products in the sector

in ready-made format (ie a product that is largely finished and available in

one of many available sizes) or M2M (ie tailored to the exact specifications

of the customer). As discussed below, customers in the UK primarily

purchase window coverings through in-home, in-store, and online retail

channels.

Market research reports received estimate that in 2018 the size of the UK

window coverings sector was approximately £1.5 billion. AMA Research,

Domestic window coverings market report UK 2020-2024 (the AMA report),

estimated the sector to be approximately £1.5 billion in size and

GlobalData, Window dressings November 2018 (the GlobalData Report),

estimates the sector size at £1.6 billion.

19

This includes sales for all

channels; online, in-store and in-home. Global Data estimate the total

growth of the sector as a whole between 2018 and 2023 is expected to be

9 to 11%, an annual average growth of approximately 2%.

20

Window coverings fall in the broader category of home accessories, and

account for the largest proportion of consumer spending within the

category. According to a Mintel report, ‘Accessorising the home – March

2020’, almost half of consumer spending on home accessories in the UK is

on window coverings. Figure 1 below shows that M2M window coverings

(curtains and blinds) is the single largest sub-category within home

accessories, followed by ready-made window coverings (curtains and

blinds).

21

19

We note these reports are both now two years old and so their estimates of market size and growth should be

treated with some caution. We note that we do not hold industry reports that contain market data for online M2M

blinds specifically. The industry reports quoted in this paper draw their findings from consumer research,

including consumer surveys, to inform their forecasts data for the wider sector.

20

Global Data estimates the window coverings sector will grow 9.2% from 2018-2023, Global Data Report, Page

8 and AMA research estimate the market to grow 6% from 2020-2042, AMA report, page 10.

21

Mintel, Accessorising the home – March 2020, p24.

30

Figure 5: Consumer spending on accessorising the home, % of total 2019, UK

Source: Mintel Report

22

As a category of home accessories, the performance of the window

coverings sector is driven to some extent by the performance of the

housing market. AMA Report described growth of the sector as ‘relatively

consistent’ in the period 2012 to 2017 with year on year growth. See Figure

2 below taken from the AMA Report.

22

Mintel, Accessorising the home – March 2020, p24.

31

Figure 6: UK Window Coverings Market and Forecasts 2015 to 2024 by value (£m RSP)

Source: AMA Research Ltd/Trade Estimates

23

Prior to the COVID-19 pandemic, the window coverings sector had seen

year-on-year growth for the last several years. A previous AMA Report

stated that ‘better performance in the housing market and wider economy

has fuelled demand for both replacement and new window coverings.’

24

However, the GlobalData Report states that ‘2018 has seen the window

dressings category grow by just 0.8%, with a slow housing market and

cautiousness about spending large amounts on homes…with consumers

nervously following Brexit negotiations.’ As a result, ‘the category has been

reliant on sales to “improve not movers.”’

The current COVID-19 pandemic has affected retailers and suppliers in the

sector. The AMA report says ‘whilst indications at the beginning of the year

tended towards underlying but modest growth rates into the medium-term,

the events of March and April have turned this forecast on its head. The

revised forecast for 2020 shows decline of around 9% in 2020 followed by

annual growth rates of 3-5%.’

25

However these trends are for the window

coverings sector as a whole and not specific to the in-home, in-store, or

online retail channels.

[].

26

[].

27

However, there has been some knock-on effect for customers. [].

28

23

AMA Research, Domestic window coverings market report UK 2020-2024, page 10.

24

AMA Research, Domestic window coverings market report UK 2018-2022, page 8.

25

AMA Research, Domestic window coverings market report UK 2020-2024, page 12.

26

[].

27

[].

28

[].

32

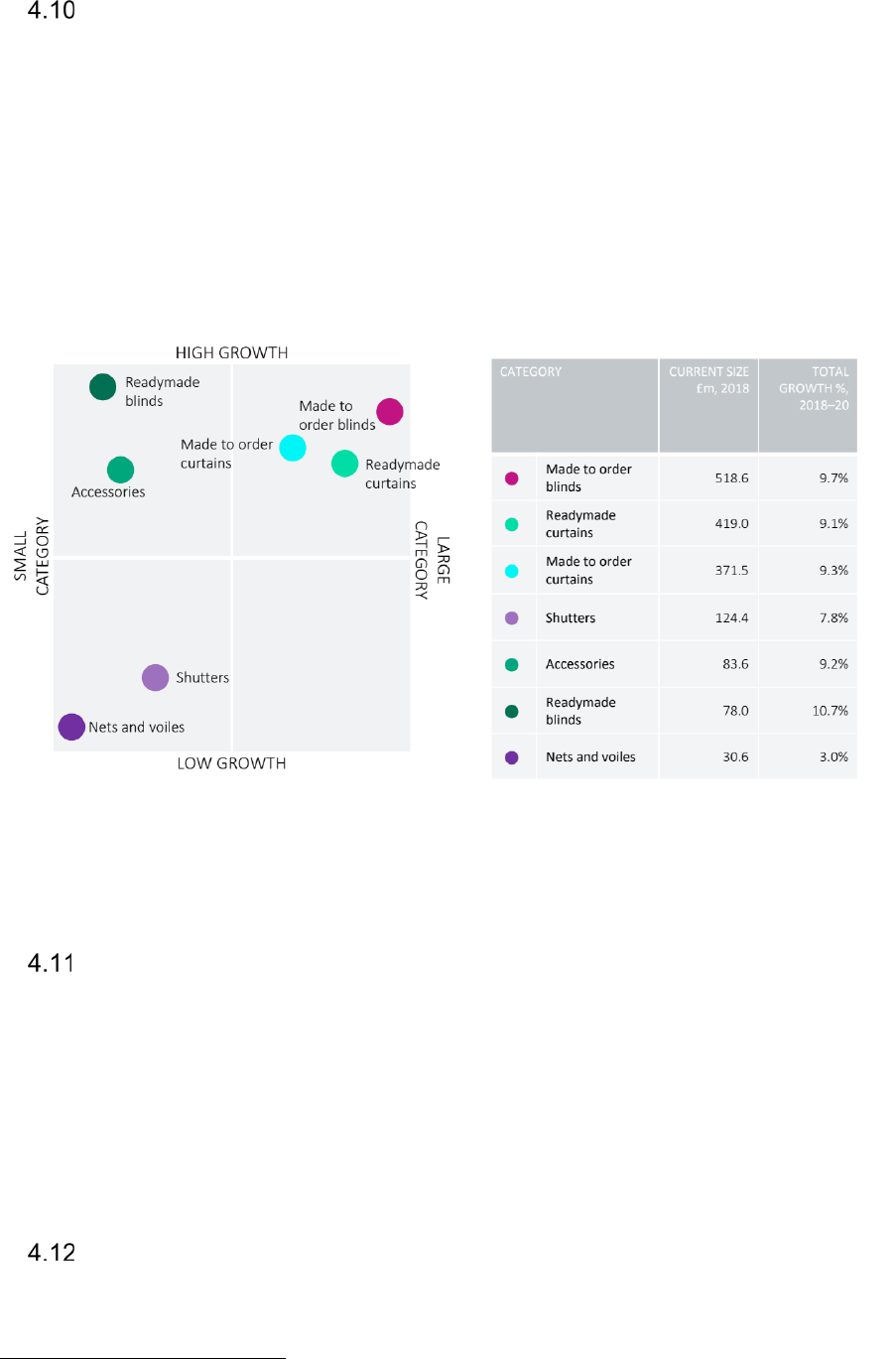

In Figure 7 below, the GlobalData Report charts the forecast relative

growth and size of each window covering type in the UK across distribution

channels.

29

This indicates that blinds (ready-made and M2M) are estimated

to be the highest growth products, with total forecast growth rates of 10.7%

and 9.7% respectively over the period 2018 to 2020 in the UK. M2M blinds

is the largest category at £518.6m, roughly one third of the total window

coverings sector and almost 30% larger than the market for M2M

curtains.

30

Figure 7: Forecast category growth and size: 2018-20, UK

Source: GlobalData, Window Dressings November 2018, p16

Distribution Channels

Distribution within the window coverings sector is highly diverse, with

options available in-store, in-home and online for the relevant products.

These are described as ‘channels’ within the industry. Each channel

presents customers with a different range of potential purchasing options,

as well as service and installation propositions. We discuss the main

features of each below.

In-store and In-home

The in-store and in-home channels are traditional retail channels in which

customers have a degree of interaction with a salesperson and/or the

products before purchase. These interactions take place either inside the

29

GlobalData, Window dressings November 2018, p16.

30

GlobalData estimates the M2M curtains market to be £371.5m in 2018.

33

retailer’s physical store (in-store) or inside the customer’s home (in-home).

Both ready-made and M2M blinds are sold through these channels.

As set out in paragraph 7.57, in-store and in-home retailers appear to

position themselves as full-service providers, offering a more personal

experience and the option of a measuring and installation service. The

evidence we have seen also indicates that in-store and in-home retailers

tend to be more expensive than online retailers.

31

Retailers in the in-store channel are able to display a variety of window

coverings as well as their range of fabric options, although they are limited

by the available space. As a result, customers can review the colour, style

and materials for their window coverings, whether ready-made or M2M, in

person. Often, there will be a window covering specialist to assist a

customer to design their desired window covering.

As part of a retailer’s in-home offering, a consultant visits a customer’s

home with a limited range of samples in order to review colour, style and

materials for their window coverings, and may offer style advice as part of

the consultation. The consultant may also take measurements for the

customer, and fit the final product once complete.

Some in-store and in-home retailers also have an online presence,

although not all such retailers sell blinds online. Retailers who sell blinds

online and in-store are referred to as ‘multi-channel’ retailers. We note that

no supplier active in the in-store and in-home channel has a significant

position within the online M2M blinds market, and, for some, their online

presence is part of a general online store (ie covering products and

services unrelated to blinds or window coverings).

Online

Customers are able to purchase both ready-made and M2M window

coverings online. However, measuring and fitting typically are not provided

by retailers with an exclusively online presence. Customers select colour,

style and materials for their window covering online using retailer-supplied