October 2020

Global Banking Practice

The 2020

McKinsey Global

Payments Report

2The 2020 McKinsey Global Payments Report

The public health crisis triggered by COVID19 has

had an impact on nearly all aspects of daily life for

people across the globe, and has put the world

economy on an uncertain footing. For the payments

industry, the pandemic and its consequences

have accelerated a series of existing trends in both

consumer and business behaviors, and introduced

new developments, such as a restructuring of both

supply chains and cross-border trade. Ongoing

shifts toward e-commerce, digital payments

(including contactless), instant payments, and

cash displacement have all been significantly

boosted in the past six months. And while a degree

of reversion to past behavior is likely for some of

these shifts, the overall trajectory for these trends

has received a strong push forward. Overall, the

crisis is compressing a half-decade’s worth of

change into less than one year—and in areas that

are typically slow to evolve: customer behavior,

economic models, and payments operating models.

As with most structural shifts, challenges will

inevitably arise.

The impact of the crisis has not been consistent

across sectors or geographies, of course. Travel and

entertainment, which had been among the most

advanced e-commerce sectors, was hit particularly

hard and faces an uncertain path to recovery.

Payments providers in regions that have lagged

in digitization, meanwhile, in many cases possess

greater potential for revenue increases in the new

environment. On the other hand, a protracted period

of low interest rates, which began before the current

crisis, will pressure payments revenues, as will a

persistent slowdown in economic activity.

This is the context in which we release our annual

report on the global payments industry. As always,

these insights are informed by McKinsey’s Global

Payments Map and by continuing dialogue with

practitioners throughout the payments ecosystem.

Given the impact of the changes and challenges

in 2020, however, we are taking a different lens to

our analysis, focusing more on the current moment

and on the future, than on examining past growth.

Our first chapter briefly tells the story of 2019—a

solid year with broad-based revenue growth—but

focuses primarily on current developments and

takes a forward-looking view of the payments

landscape. It also details the actions we believe

payments providers will need to take to weather

the pandemic and position themselves for the

“next normal.”

Our “now-cast” analysis of 2020 paints a contrast

between the first and second halves of the year—

namely, an estimated 22 percent payments revenue

decline in the first half will be softened somewhat

by stronger performance in the second half. Still, we

expect full-year 2020 global payments revenue to

be roughly 7 percent lower than it was in 2019—a

$140-billion decline roughly equal to recent years’

annual gains, and 11 to 13 percent below our pre-

pandemic projection. Beyond this, in some countries

and segments, the likely sustained increase in

digital penetration could result in a recovery of

revenue pools to levels matching our pre-COVID19

expectations for 2021.

In following chapters, we explore four areas of

payments we consider critical to achieving success

in the context of accelerated change. Like many

aspects of payments, the merchant-acquiring

business was already undergoing significant

transformation. Consolidation had driven scale

economy imperatives, and non-bank market

entrants were gaining inroads with underserved

verticals. Our experts detail the need to redefine

acquiring offerings to encompass a full suite of

value-added services extending well beyond

payments settlement—including fraud controls and

cart optimization for the fast-growing e-commerce

segment. In a separate chapter we look at the

specific opportunity for small- and medium-size

enterprises, a segment that has historically been

expensive to serve for large incumbents, but which

has been the focus of many fintech attackers and is

well overdue for a closer look.

Supply chain finance has long been considered

to be a source of untapped value, but unlike other

payments sectors, has struggled to develop enough

momentum to address its structural challenges.

Foreword

3The 2020 McKinsey Global Payments Report

Alessio Botta

Leader, Europe Payments Practice

Phil Bruno

Co-leader, North America Payments Practice

Reet Chaudhuri

Leader, Asia Payments Practice

Marie-Claude Nadeau

Co-leader, North America Payments Practice

Gustavo Tayar

Leader, Latin America Payments Practice

Carlos Trascasa

Leader, Global Payments Practice

Given an expected increased focus on working

capital, a step change in digital adoption at scale,

and the potential geographic re-shuffling of roughly

$4 trillion of cross-border supply chain spending in

the next five years—the value embedded in supply-

chain finance will become even more attractive. The

question is whether it will be enough to spur a long-

anticipated transformation.

Finally, in this overview of global payments, we

look at a challenge many established payments

providers are facing—the need to transform the

operating model to meet the growing imperatives

for efficiency, scale, modularity (e.g., Payments-as-

a-Service), and global interoperability. With many

banks likely unwilling to commit the hundreds of

millions of investment dollars needed to modernize

existing payments infrastructure, we outline various

paths worth considering before more focused

players can establish an insurmountable advantage.

We hope you find the insights in these pages

thought-provoking and valuable as you navigate

these uncertain times.

McKinsey’s Global Banking Practice leaders would like to thank the following colleagues for their

contributions to this report: Maria Albonico, Fabio Cristofoletti, Vaibhav Dayal, Olivier Denecker, Nunzio

Digiacomo, Puneet Dikshit, Alberto Farroni, Diana Goldshtein, Reinhard Höll, Reema Jain, Baanee Luthra,

Tobias Lundberg, Yaniv Lushinsky, Pavan Kumar Masanam, Albion Murati, Tamas Nagy, Marc Niederkorn,

Nikki Shah, Lit Hau Tan, and Jonathan Zell.

4The 2020 McKinsey Global Payments Report

For the global payments sector, the events of

2020 have reset expectations and significantly

accelerated several existing trends. The public

health crisis and its many repercussions—among

them, government measures to protect citizens and

rapid changes in consumer behavior—changed the

operating environment for businesses, large and

small, worldwide. For the payments sector, global

revenues declined by an estimated 22 percent in the

first six months of the year compared to the same

period in 2019. We expect revenues to recover (only

to a degree) in the second half of 2020, ending 7

percent lower than full-year 2019. Over the past

several years, payments revenues had grown

by roughly 7 percent annually, which means this

crisis leaves revenues 11 to 13 percent below our

prepandemic revenue projection for 2020.

Given the impact of COVID19 on the operating

environment, we are diverging from our usual

approach of delivering perspectives on the current

year’s global payments landscape relative to the

prior year. Instead, we focus primarily on the state

of the payments ecosystem in 2020 and explore the

actions payments providers need to take to compete

effectively in the “next normal.”

The insights in this report are informed by

McKinsey’s proprietary Global Payments Map, which

for over 20 years has provided a granular, data-

based view of the industry landscape.

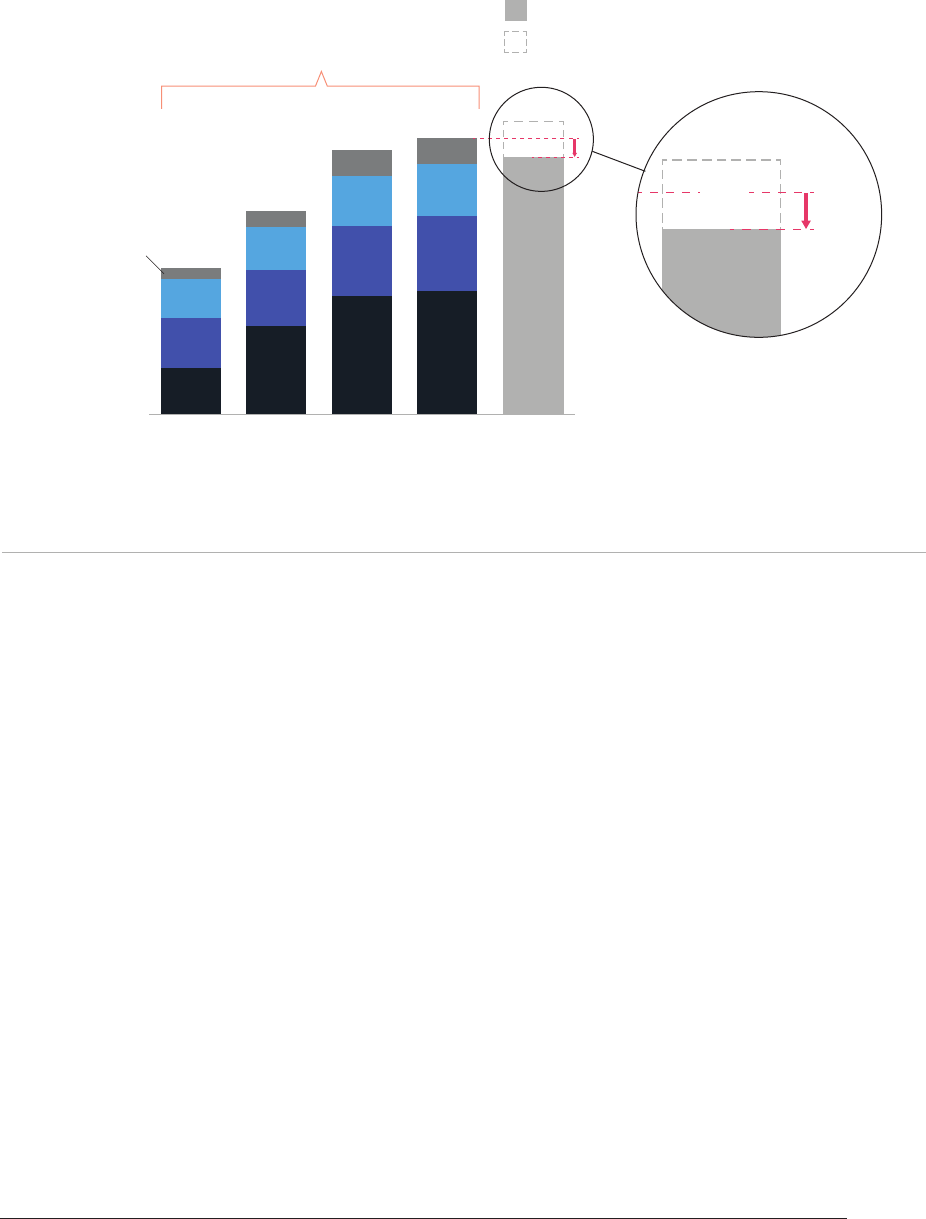

A half decade of change in a few

months

For global payments, 2020 stands in dramatic

contrast to the year before, which was a relatively

stable year. Global revenues grew at nearly 5 percent

in 2019, bringing total global payments revenue

to just under $2 trillion (Exhibit 1). Payments also

continued to grow faster than overall banking

revenues, increasing its share to just under 40

percent, compared with roughly one-third only five

years earlier.

Any stability was quickly disrupted in early 2020

by changing geopolitics coupled with reactions

to the COVID19 pandemic, both public (physical-

distancing measures, limits on business activity) and

private (anticipatory and causal shifts in consumer

and commercial behavior). As a result of the public-

health crisis, payments revenues in the first six

months of 2020 contracted by an estimated 22

percent (roughly $220 billion) relative to the first six

months of 2019. We expect full-year 2020 global

payments revenue to be roughly $140 billion lower

than in 2019—a decline of about 7 percent from

2019—a change equal in size to prior years’ annual

gains, which leaves revenues 11 to 13 percent below

our prepandemic revenue projection for 2020.

What we already know

Once COVID19 moved from a local outbreak to

a global pandemic, many governments moved

to protect their citizens, leading to lockdowns

with various degrees of limitation. The immediate

consequence was, of course, a steep reduction

in discretionary spending and a severe demand-

side shock, along with reductions in cash usage.

Discretionary spending initially sank by 40 percent

globally. The impact was especially great on the

travel and entertainment category, which was off 80

to 90 percent. While some categories of spending

The accelerating

winds of change in

global payments

The COVID-19 crisis is having a significant and

widespread effect on global payments across sectors.

The most striking and potentially lasting impact is

an accelerating pace of change in the industry.

Philip Bruno

Olivier Denecker

Marc Niederkorn

5The 2020 McKinsey Global Payments Report

rebounded, consumers’ well-documented shift from

the point of sale (POS) to digital commerce accounts

for the reduced use of cash.

Overall, in retail, the impact was not a decline but

a shift in buying behavior. In the first six months of

the year, consumers spent $347 billion online with

US retailers, up 30 percent from the same period

in 2019—corresponding to six times the annualized

2019 growth rate of online retail.

1

Amazon’s second-

quarter 2020 numbers recorded 40 percent

year-over-year growth, boosted in particular by

the tripling of grocery sales. In Europe, differences

in shopping behavior between geographies were

strongly reduced and differences between age

groups eroded as many consumers (in particular,

older shoppers) turned to online shopping for

the first time.

Consequently, all forms of electronic peer-to-peer

and consumer-to-business payments have been

1

Fareeha Ali, “Charts: How the coronavirus is changing ecommerce,” Digital Commerce 360, August 25, 2020, digitalcommerce360.com.

2

“Payments and cash withdrawals,” Swiss National Bank, data.snb.ch, last modified September 21, 2020.

3

Retail payment: May 2020,” Reserve Bank of Australia, rba.gov.au, July 7, 2020.

boosted. In many regions, this has mostly benefited

debit cards, which typically align with lower-value

transactions and are a logical cash substitute for

contact-averse consumers. Switzerland reported

an increase in share of debit-card spending from

65 percent to 72 percent between January and

May 2020,

2

mostly at the expense of cash. Higher

limits for contactless payments also triggered rising

adoption rates across the globe, making inroads

beyond debit’s typical domain of smaller-value

transactions. For credit cards, the picture is more

nuanced; consumers in certain geographies seemed

to be paying off credit-card balances in preparation

for challenging times ahead. In Australia, for

example, credit-card share among total card

spending fell by five percentage points between

February and June 2020, in favor of debit cards.

3

In

Asia, however, alternative payments, such as instant

and mobile payments, grew, while credit cards

retained their strong incumbent position supporting

Note: Figures may not sum to listed totals, because of rounding.

Source: McKinsey Global Payments Map

Global payments revenue, $ trillion

2010

0.9

0.3

0.4

2014

0.6

0.4

0.1

0.4

0.5

2018

0.2

0.5

0.9

2019

0.3

2.0

0.3

1.9

2020E

0.4

1.1

1.5

1.9

7.4%

6%

4%

7%

4%

Share of banking

revenues

28% 33% 38%

39%

North America

EMEA

Asia-Pacific

Latin America

5%

Current estimate

Pre-COVID-19 estimate

CAGR

2018-19

1.9

2.12

-7%

0.26

Exhibit 1

McKinsey expects global payments revenues to end 2020 down 7% compared to 2019.

6The 2020 McKinsey Global Payments Report

e-commerce and POS transactions.

Logically, given the steep reduction of in-person

purchases, cash transactions and ATM usage

declined—the latter after an initial wave of

withdrawals by anxious consumers. Germany

and the United States each saw spikes in cash

withdrawals in the days leading up to lockdowns.

The fear of contracting COVID19 through high-

traffic ATMs and, in some cases, the refusal of

merchants to accept cash (often despite legal

obligations) nudged consumers toward electronic

payment options to complete purchases. ATM usage

fell by 47 percent in April 2020 in India, while the

United Kingdom experienced 46 percent declines

per month on average from March to July 2020. By

the end of 2020, we expect a shift of four to five

percentage points in the share of global payment

transactions executed via cash—down from 69

4

“Thousands of ATMs in Australia removed, branches closed due to coronavirus,” ATM Marketplace, August 17, 2020, atmmarketplace.com.

percent in 2019—propelled by evolving behavior

in both mature and emerging markets (Exhibit 2).

This is equivalent to four to five times the annual

decrease in cash usage observed over the last few

years. The reduced use of cash benefits banks

overall: the cost of cash handling exceeds cash-

related revenue inflows, and electronic payments

generate incremental revenue.

The pandemic has accelerated the move from

“physical” to “virtual” banking. Banks in multiple

geographies are closing branches (or in some cases

will not reopen branches they closed due to the

pandemic), as well as ATMs. In Australia, the top

four banks have removed 2,150 ATM terminals and

closed 175 bank branches since June.

4

These accelerated behavior changes in response

to the COVID19 crisis caused a fundamental shift

in adoption of technologies, such as real-time

Source: McKinsey Global Payments Map

Cash usage by country

Percent of cash used in total transactions by volume, %

95

86

99

100

100

93

97

79

66

59

51

55

53

56

52

Mexico

Indonesia

Sweden

Argentina

Brazil

Malaysia

Japan

China

United Kingdom

India

Korea

Singapore

2010

United States

Finland

Netherlands

Emerging markets

Mature markets

87

74

41

89

96

72

86

54

34

39

28

23

24

9

14

2020E

Exhibit 2

COVID-19 will likely lead to a further decline in cash usage.

7The 2020 McKinsey Global Payments Report

account-to-account payment infrastructures,

that had been developed over recent years.

Investments in instant payments have begun

to reap greater benefits, both in POS and

e-commerce usage of instant solutions. The trend

comes in response to customer expectations for

speed, price differences, and greater adoption of

customer-facing applications, such as specialists

like GrabPay in Singapore or bank solutions like

MobilePay in Denmark. In the United Kingdom,

as payment speed becomes more important,

consumers and businesses have increasingly

opted to settle bills online; for example, the

average daily value of transactions processed by

the Faster Payments service rose by more than

10 percent from the fourth quarter of 2019 to the

end of March 2020. In India, banks stepped up

their digital propositions, integrating bill payment,

e-commerce links, and Unified Payments Interface

(UPI)—the nation’s local real-time payment

system—into mobile banking apps to present three

digital options in a single customer interface. UPI

spending increased by roughly 70 percent over the

first seven months of 2020.

At the same time, governments have tried to

protect the economy as a whole and the well-being

of companies as well as citizens. Additional easing

of monetary policies led to lower interest rates,

further deteriorating interest margins. Monetary

authorities reduced benchmark rates in Europe

and the United States and then in emerging

markets, including Brazil, India, and South Africa,

to limit the impact of pandemic-related recession,

making net-interest-margin (NIM) compression

a global phenomenon. Large and small markets

alike are experiencing rate cuts of 100 to 300

basis points. Overall, we expect global interest

margins to contract on average by approximately

one-quarter percent in 2020, compared with a six-

basis-point reduction in 2019, shrinking payments

revenues globally by approximately $82 billion.

Digitization benefits must first fill this gap before

generating growth.

Cross-border payments flows also have been

severely affected by the pandemic, as well as

by geopolitical dynamics. In 2019, cross-border

payments totaled $130 trillion, generating

payments revenues of $224 billion (up 4

percent from the previous year). In the first half

of 2020, many cross-border fundamentals

radically changed:

International travel all but ground to a halt, with

more than 90 percent of countries imposing

restrictions. Transaction-fee margins on

remaining volume also declined, due to waivers

offered to stimulate demand to offset the impact

of a reduction in leisure and business travel

flows, which fell by more than 70 percent.

During the pandemic, interregional trade saw

greater impact than intraregional. Drops in

interregional flows for Asia (−13 percent), Europe

(−20 percent), and the United States (−23

percent) directly cut into cross-border payments

volumes, while the prices of oil and other

commodities fell sharply.

Business-to-consumer payouts (often salary

disbursements) and remittance payments

slowed, because of restrictions on movement

of cross-country workers and growing

unemployment.

Cross-border e-commerce volumes provided

a notable exception to the gloomy news: the

second quarter brought double-digit growth as

initial logistic challenges were resolved. UPS

and PayPal, for example, reported double-digit

growth on cross-border shipment volumes and

value of merchandise sold.

Increased volatility and uncertainty have

enabled growth in foreign-exchange-related

revenues and pushed up treasury-related

transactions as companies scramble to mobilize

surplus cash.

In addition to the health crisis, certain geopolitical

forces that began to materialize in 2019 have grown

stronger since. Many companies are realizing the

strategic weaknesses in their existing global supply

chains, given trade frictions and potentially recurring

public-health disruptions, leading to the exploration

of nearshoring and other rebalancing. McKinsey

analysis reveals potential shifts of as much as $4.6

trillion of global trade flows over the next five years

(see chapter 3, “Supply-chain finance: A case of

convergent evolution?”, for more). The value-chain

shifts that began before the crisis are yet to take full

effect—because of the complexity of moving such

supply chains and the challeng e of building new

ones—so this is a longer-term trend.

The rest of 2020 and beyond

The second half of 2020 presents a quite different

outlook. Broadly, we see some pressures from

the first half continuing but with pronounced

8The 2020 McKinsey Global Payments Report

geographic variations.

Our forecast uses McKinsey’s nine COVID19

macroeconomic scenarios.

5

According to a survey

of more than 2,000 executives around the world,

the most likely outcome is the “muted recovery”

scenario (A1), a combination of virus recurrence

and a muted economic recovery, with regional

differences.

Applying the A1 scenario to global payments,

we forecast that most categories of payment

transactions are poised for sharp and rapid

rebounds as lockdowns are lifted and behavioral

shifts from cash to electronic payments are

largely sustained. On the downside, interest-

dependent revenue components are likely to

remain suppressed for an extended period, mostly

affecting banks that provide payment services.

For specialists and fee-based revenues, much will

depend on differences in spend patterns (for both

businesses and consumers) before and after the

crisis. For instance, dining, travel, and entertainment

expenditures, which often carry higher transaction

fees, are unlikely to rebound in the near term.

As we indicated, not all players, countries,

and products will arrive at the same end state

(see sidebar “A regional overview of the year

in payments”). At a regional level, the following

differences are notable:

• Asia–Pacific (excluding China) could suffer

larger declines, as its revenue model is more

affected by NIM contraction, faces increasing

government pressures on mass-market

transaction fees, and has greater exposure to

long-term affected industries, such as travel,

tourism, and international remittance payments.

• Europe may be poised for a swifter rebound,

for two reasons: First, NIMs were already so

compressed before COVID19 that there was

little room for further squeezing; second, volume

growth is being fueled by the acceleration

of digital migration in Southern and Eastern

Europe, and by government stimulus measures.

• In North America, the revenue benefit from an

accelerated shift to digital channels has been

more than offset by credit-card economics—

outstanding balances are down roughly 29

percent from 2019 levels, and increased

5

Sven Smit, Martin Hirt, Kevin Buehler, Susan Lund, Ezra Greenberg, and Arvind Govindarajan, “In the tunnel: Executive expectations about

the shape of the coronavirus crisis,” April 2020, McKinsey.com.

delinquencies are a possibility. Considering

credit cards are the largest source of the

region’s payments revenue, at roughly 44

percent, the decline in outstanding balances

alone will outweigh the benefits of increased use

of digital channels.

• In Latin America, which is characterized by a

significant unbanked population, cash usage

will likely remain resilient. Among the banked,

Visa-supported mobile wallets such as PLIN

and Yape have gained more than a million users

since December 2019, with the pandemic

accelerating this trend.

• Overall, the greatest recovery opportunities

reside in countries with low electronic

penetration (Brazil, India, Indonesia, Thailand),

as the next normal provides impetus for

electronification. However, countries starting

from a high level of digitization (France, Germany,

the United Kingdom) are also seeing COVID-

19-induced behavior push cash usage to the

minimum—fueling payments-revenue growth.

Overall, while the global health crisis leaves banks

and specialists with meaningful revenue concerns,

the real challenge—as well as the real opportunity—

lies in embracing the acceleration of change. If that

issue is addressed properly, the global impact on

payments could be significantly more positive than

the outlook for GDP (see sidebar “The relationship

between GDP and payments revenue”).

Looking forward: New rules for

engagement

Long-term forecasting is unusually difficult in the

current global environment, given the looming

uncertainty on multiple fronts: economic recovery,

interest rates, global trade, and a murky time

frame for public-health breakthroughs. One thing

seems clear, however. The imperative to accelerate

transformations to a digital-first and more agile

organization has never been greater, and it

exists globally.

Still, the current global context removes many

of the long-standing impediments to embracing

transformation. As financial institutions enter this

period of change, we propose five major themes

to which payments and bank executives should be

particularly attentive:

9The 2020 McKinsey Global Payments Report

• Choose where you play wisely. The composition

of your customer portfolio matters more

than ever, as restructuring of consumer and

commercial commerce reshapes where value

is captured in payments. Growth is notably

accelerating in the small and medium-size

enterprise (SME) segment, B2B–to consumer

(B2B2C) business models, and new customer

arenas, such as cross-border e-commerce.

The role of platforms also is growing fast, with

ecosystems a new growth segment. The shift to

digital makes it possible for providers to create

far more tailored solutions, and customers have

shown a willingness to pay for these if sellers

demonstrate value.

• Services and solutions, not financial products.

Commercial customers expect bank and

payments partners to enable greater sales

by improving end-customer experience and

the adoption of new business models—for

1

For countries covered by Global Payments Map

Source: McKinsey Global Payments Map

Payments revenue versus GDP

$ trillion

2010 2018 2019

1.5

1.1

1.9

2.0

2014

+8.6% p.a. +6.7% p.a. +5.0% p.a.

+5.1% p.a. +4.9% p.a. +5.0% p.a.

77.8

2010 2014 2018 2019

50.2

74.1

61.2

Payments revenues

to GDP multiplier

Nominal GDP

1

Global payments revenues

1.7X 1.4X 1.0X

Exhibit A

Growth in payments revenues has outpaced GDP growth.

The relationship between GDP and payments revenue

Over the last decade, payments revenues have grown substantially faster than GDP (Exhibit A). Between 2010 and 2019,

nominal GDP has grown at roughly 5.0 percent in the geographies covered by the Global Payments Map, while payments

revenues have grown at 7.4 percent, or 1.5 times the GDP growth rate. This multiple has, however, been decreasing, largely

as a result of an increasingly global contraction of net interest margins (NIMs), as well as ongoing regulatory pressures,

which mostly affected card fees. In 2019, payments revenues grew at 5.0 percent, roughly 1.01 times GDP growth, mainly

resulting from contraction in NIMs.

10The 2020 McKinsey Global Payments Report

¹ Cross-border payment services (B2B, B2C).

² Net interest income on current accounts and overdrafts.

³ Fee revenue on domestic payments transactions and account maintenance (excluding credit cards).

⁴ Remittance services and C2B cross-border payments services.

Source: McKinsey Global Payments Map

Payments revenue,

2019, % (100% = $ billion)

19%

5%

16%

16%

30%

Latin

America

Cross border

transactions

1

33%

Credit cards

4%

10%

100% = 891 542 371 194

Asia-Pacic

6%

8%

15%

12%

4%

3%

21%

9%

6%

North America

14%

23%

11%

11%

9%

Account-related

liquidity

2

33%

10%

16%

17%

EMEA

14%

2%

12%

3%

3%

Commercial

Consumer

“Commercial driven”

“Credit card driven” “Balanced”

“Credit card &

liquidity driven”

3%

Domestic

transactions

3

Cross border

transactions

4

Credit cards

Account-related

liquidity

2

Domestic

transactions

3

Exhibit A

Asia-Pacic continued to dominate the global payments revenue pool.

A regional overview of the year in payments

The relative contributions to global revenues of all four geographic regions remained consistent in 2019. Each region posted

solid mid-single-digit growth in payments, led by Latin America at 6 percent. Asia–Pacific continued to lead both in growth

and in its contribution to global revenue—45 percent of the total, with China generating the lion’s share (Exhibit A). The

rate of Asia–Pacific payments growth continued to moderate from its double-digit rates of a few years ago, given margin

compression on current-account balances across the region and China’s GDP expansion receding to a more sustainable rate.

At slightly over a quarter of the overall pool, North America remains the second-largest contributor to global revenues and

grew at par with global trends. Growth in Eastern Europe, the Middle East, and Africa (EMEA) slightly exceeded the global

average, mainly due to acceleration in the emerging markets of Eastern Europe and Africa (10 percent growth in revenues).

Western Europe grew at just 1 percent, although it had already largely absorbed the effects of interest-margin compression

that had affected the region in earlier years.

Globally, the number of electronic-payment transactions continued to grow at healthy rates in 2019, just shy of 20 percent

annually (at 10 percent in terms of value conveyed). Disproportionately high contributions came from China (56 percent

11The 2020 McKinsey Global Payments Report

Source: McKinsey Global Payments Map

Size of bubble denotes

payments revenue in 2019

Countries where growth rate of

electronic transactions is 10% or higher

Countries where growth rate of

electronic transactions is less than 10%

Growth rate of electronic transactions,

2018-19, %

Payments revenue growth rate,

2018-19, %

2-15 4

14

4

-3-5 19-2 20-1 0 1 65 15

2

187 8

22

119 1712 13 16 93

0

6

18

8

10

12

16

20

24

26

50

52

54

3

56

10

58

-4 14

Denmark

France

Germany

Greece

Hong Kong

Hungary

India

Norway

Romania

Indonesia

Nigeria

Ireland

ItalyJapan

Korea

Malaysia

Mexico

Morocco

United Kingdom

Netherlands

Pakistan

Peru

Poland

Portugal

Russia

Singapore

Finland

Slovenia

Switzerland

South Africa

Sweden

Taiwan

Argentina

Thailand

Australia

United States

Spain

Austria

Belgium

Canada

Chile

Colombia

Czech Republic

Slovakia

Brazil

China

Exhibit B

Countries with high revenue growth are also characterized by rapidelectronic transaction

growth.

growth), India (48 percent), and Russia (19 percent). Despite a reduction in fee margins per transaction globally (from an average

of $0.97 to $0.89 per transaction for electronic payments), these additional volumes propelled overall fee-based revenues from

electronic payments to new highs (a 9.75 percent increase in fee income for all products except cash and checks).

Alternative payment methods (APMs), such as e-wallets and instant-payment-based solutions, continue to play a key role in

accelerating cash substitution, particularly in developing countries. APMs have particularly gained traction in China, where they

generated about $43 billion in 2019 revenues, far exceeding the approximately $22 billion for the rest of the world collectively

(Exhibit B).

12The 2020 McKinsey Global Payments Report

instance, marketplace onboarding, B2B2C

credit, and loyalty services—that do more

than move money and manage cash flow. For

consumers, the payment step is moving into the

background of the shopping journey, and they

expect support with conducting commerce and

avoiding negative consequences, not merely a

means to pay.

• Sales excellence. Transaction banking and

acquiring are nearly a decade behind the

technology and telecom sectors in sales and

customer-management practices. These other

industries have an entirely different skill set and

language for sales and service: sales motions,

agile sales, inside sales, customer success—all

made possible by data and algorithms delivering

the best adapted solutions for the market.

Closing this decade-wide gap over the next two

years will deliver significant value.

• Transaction-banking client experience. New

challenges in supply chains and growing trade

pressures are accelerating what has been a slow

disruption in international payments and trade.

Delivering the long-promised step-change

improvement to corporate clients will require

fundamental organizational change, particularly

for siloed banks.

• Changing the focus from “time value of money”

to “money value of time.” Becoming digital

by default requires significantly redefining

the institution’s operations through the lens

of customer journeys. To plan that digital

transformation, most players have built road

maps spanning the next five to six years.

But given the modified revenue context,

continued investment requirements, and

market expectations spurred by the new

environment, winners will find a way to deliver

on this transformation within 18 to 24 months. In

chapter 4 of this report, we explore the various

models that such a payments modernization

could leverage.

The events and trends of 2020 have undeniably

created a changed global context for payments.

What is most significant about this change is not

so much the importance of the payments business

or the kinds of trends transforming the market,

but the speed at which the change is occurring.

Change in 2020 takes place four or five times faster

than before. This puts all actors on the payments

landscape under pressure to transform and adapt in

order to preserve their positions and results.

Philip Bruno is a partner in McKinsey’s New York

office, Olivier Denecker is a partner in the Brussels

office, and Marc Niederkorn is a partner in the

Luxembourg office.

The authors would like to thank Vaibhav Dayal and

Baanee Luthra for their contributions to this chapter.

13The 2020 McKinsey Global Payments Report

Merchant acquiring:

The rise of merchant

services

The shift to electronic transactions has placed front

and center the need for merchant acquiring companies

to update and differentiate their service offerings.

Globally, merchant acquiring has evolved over the

past decade from a legacy processing and hardware

business to a full-stack software and merchant-

services solution. This shift, coupled with the

fragmentation of the merchant-facing payments

value chain, is dramatically affecting the economics

and business models of merchant acquisition

as it was done in the past, favoring instead the

value-added approach of the new merchant-

services players.

The evolution of merchant services typically

involves a pattern in which revenues from merchant

processing are being commoditized, and in

response, players seek to differentiate, either by

expanding their product suite or by building scale—

mostly through acquisitions—across geographies,

distribution (e.g., integrated software vendors, bank

led), and delivery channels (e.g., digital, point of

sale). Although the trends and trajectory are similar

across regions, certain geographies are further

ahead. As acquirers shape their priorities for the

next decade, the transformations spurred by 2020’s

public-health crisis will play a big part in the way

they rethink their vertical focus, platform strategy,

and investment priorities.

New winners and complex needs

compel a reevaluation of focus and

value propositions

As detailed in Chapter 1, one of the COVID19

pandemic’s most visible impacts on financial services

has been the dramatic acceleration in shifts toward

e-commerce and digital payments. This is true not

only in more mainstream verticals, such as fashion

and groceries, but also in merchant segments like

healthcare, professional services, and education,

which historically have not received a material portion

of payments through B2C digital channels.

This has led to an unprecedented digitization of

small-business commerce across geographies,

mostly through marketplace platforms. Marketplace

Platforms like Amazon, eBay, Etsy, Flipkart, and

Shopify have seen seller sign-ups increase by 70 to

150 percent since the start of the pandemic, based

on their most recent filings and public statements

(Exhibit 1), while proprietary platforms are losing

share. In healthcare, there has been a surge in

provider participation for services like telemedicine,

which in turn is highlighting a growing need for B2C

digital payments in professional services, education,

and other areas.

This shift to digital is driving up merchants’

payments-acceptance costs, which are expected

to rise by an incremental $8 billion to $15 billion

(about 6 to 10 percent) as commerce migrates to

these higher-cost channels. Just as importantly,

merchants also face higher decline and fraud

rates on digital transactions, with ramifications for

customer experience.

As these at-scale marketplaces and platforms

consolidate their share of digital sales, they naturally

seek to lower their cost of acceptance, which in

turn adversely impacts margins for acquirers. At

the same time, however, digitization of commerce

has created greater willingness to pay for enhanced

services and solutions. Merchants are willing to

accept higher fees for demonstrated value, such

as improved authorization rates, a more seamless

payments experience, or improved cart conversion

through point-of-sale financing. Even in sectors like

grocery, where acquirer margins have approached

Puneet Dikshit

Tobias Lundberg

14The 2020 McKinsey Global Payments Report

structural floors over the past few years, merchants

are willing to pay 20 to 30 percent higher rates

for better payments performance, particularly

when the impact on the business is positive and

significant. Higher-margin verticals, such as fashion

and accessories, are seeing increased demand for

financing solutions and affiliate marketing products.

As an example, within the fashion and accessories

verticals in the United States, the number of

merchants signed up for buy-now, pay-later

solutions has nearly tripled.

Leading acquirers are starting to transform in

two distinct directions: adding targeted value

propositions and becoming marketplaces

themselves. Industry-focused value propositions

address market needs for service and risk levels,

fees, value-added features, partnerships, and back-

end integration. This approach is not necessarily

industry specific; acquirers are increasingly

segmenting industries into groups based on

specific needs, such as a pay-later segment,

delivery segment, prebook segment, and repeat-

visit segment. Just as importantly, acquirers

themselves are beginning to resemble marketplaces

by offering solutions like payments disbursement,

financing and onboarding for small and medium-size

enterprises (SMEs), commerce marketplace know-

your-customer services, sub-merchant account

creation and management, and SME-facing risk and

identity solutions.

Most large acquirers have invested heavily in core

payment-enablement services like authentication,

fraud, and alternative-payment-method (APM)

acceptance and in creating omnichannel

acceptance and settlement, but relatively few have

capitalized on the opportunity to deliver enhanced

value-added services to large retailers (Exhibit 2).

Given the growing willingness of large retailers to

pay for such services and to seek these from their

current providers, this is a significant opportunity

for current portfolio monetization and margin

protection. The focus of these investments in add-

on services will be influenced by the vertical focus of

each merchant-services provider.

1

Includes retail; travel, media, and entertainment; food and beverages; bill payments; and others.

Source: McKinsey Global Payments Map; McKinsey Digital Commerce Benchmark

Global digital-commerce market,

1

platform sales breakdown,

$ trillion

6.1

(40%)

9.2

(60%)

2.6

(38%)

4.3

(62%)

2.7

(74%)

0.9

(26%)

2015 2019 2023E

3.6

6.9

15.3

Proprietary

platform sales

Marketplace

platform sales

22%/year18%/year

Exhibit 1

Digital marketplaces are expected to account for about 60 percent of digital-commerce volume

in the next few years.

15The 2020 McKinsey Global Payments Report

Acquisitions have helped build

geographic and capability scale, but

not solution scale

The consolidation in merchant acquiring over the

past several years has enabled acquirers to build

scale across geographies and to enhance their

suite of capabilities to stay competitive in the face

of next-generation merchant-services platforms,

including Adyen, Checkout.com, and Stripe.

However, this spate of acquisitions has also led

to acquirers being laden with numerous regional,

duplicative, and subscale solutions, adding to

technology overhead. Over time, this will impede

efficiency and interfere with acquirers’ ability to

serve multi-geography merchants, especially in

digital segments. Some of the largest acquirers are

saddled with 12 to 15 different regional gateways or

platforms that leave them, unlike next-generation

acquirers, ill-equipped to offer their clients an

at-scale, multi-geography solution.

Although continued consolidation is likely, an

increasingly important tactic is for acquirers to

invest in building a set of scalable solutions fit

for purpose for priority merchant segments. As

margins on traditional payments services continue

to be compressed, solution scalability will become

increasingly critical to sustain the business’s

economic viability.

In addition to the scalability of solutions, significant

untapped opportunity lies in enhancing the

scalability and sophistication of data infrastructure

to enable targeted use cases around enhanced

authorization, fraud, and performance-based

payments arrangements. For example, payments-

services providers are offering performance-based

arrangements that include authorization warranties,

which are fee constructs linked to fraud reduction

based on advanced analytics.

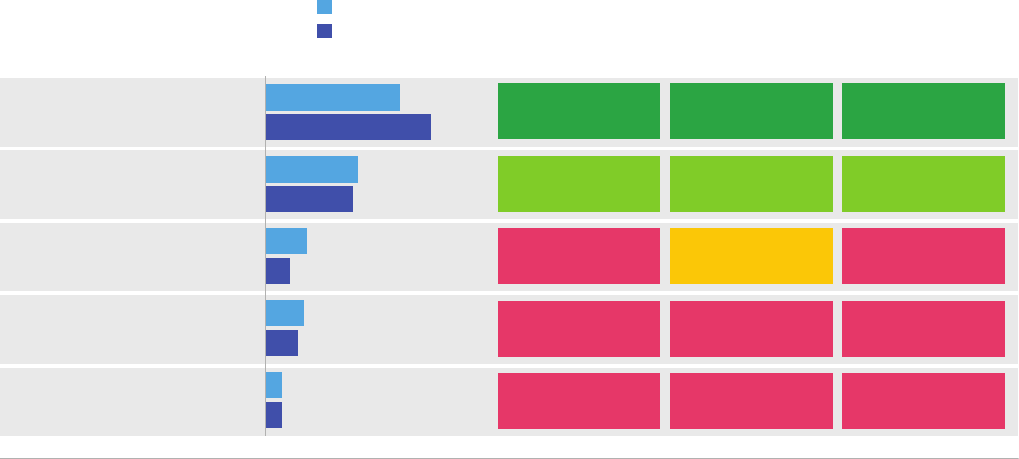

Source: McKinsey Payments Practice

Total

91%

34%

5,175

9%

66%

94%

644

3,853

518

495

299

92

1,771

OtherCustomer

support

Tax,

accounting,

and legal

Payroll,

employee

management

Loyalty

and gift

Marketing

support

Software,

cloud,

and design

FinancingEnhanced

payments

FraudData

analytics

41%

88%

1,955

4,025

18,975

59%

93%

150

Large

Small and medium size

Value-added services (VAS) revenues captured by merchant services providers,

by type of service and business size, 2019

$ million

~70% of all VAS

Merchant size: Mostly large

Growth rate: 8–10% per year

Gross margins: 40–60%

~30% of all VAS

Merchant size: Mostly small and medium

Growth rate: 40–45% per year

Gross margins: 50–70%

Exhibit 2

Small and medium-size enterprises are contributing to a growing share of value-added services

in payments revenue.

16The 2020 McKinsey Global Payments Report

The acceleration of SME digitization

has further underscored the value in

the long tail

Even prior to COVID19, most of merchant-services

providers’ revenue growth came from the long tail of

SME customers. Most acquirers have targeted this

opportunity through indirect distribution channels

(e.g., integrated software vendors and web-store

providers), as scaling through direct channels poses

a more complex challenge. In markets with bank-

owned acquirers, this transition to indirect channels

has been slower, given the ability of bank-owned

acquirers to sell directly within their own base.

Regardless of the channel, however, SMEs have

accounted for about three-quarters of all new

revenue growth in the merchant-services space

over the past three years, especially in established

markets (Exhibit 3). Serving SMBs requires

hyperregional strategies for distribution and scale.

In mature markets, acquirers are increasingly

focusing on distribution through ISOs (independent

sales organizations), ISVs (integrated software

vendors), and other indirect channels, relinquishing

40 to 80 percent of revenue margins as residuals

to their channel partners. As COVID19 has

accelerated a flight to digital for SMEs across

verticals, some of banks’ ISV-led models have been

taken a financial hit. Within the restaurant space,

for example, at-scale food-delivery apps like Just

Eats, Uber Eats, and Zomato have gained scale, and

transaction volume has shifted from the in-store

ISV to the food-delivery applications, meaning

those transactions are no longer processed by

the restaurant’s acquirer or processor. Under

those conditions, acquirers need to rethink their

1

Total excludes network assessment fees.

2

Small and medium-size enterprises, classied as businesses with <$100 million in revenues or sales where the cost of payments acceptance is directly borne by the SME; excludes marketplace-like

models that do not directly pass on acceptance costs.

3

Growth from underlying growth in sales; value-added service revenues attributed to services linked to processing a transaction but sold separately (eg, enhanced authorization).

4

Growth linked to price changes. Recent pricing pressure has led to price declines.

Source: McKinsey Payments Practice

Value-added services

(including hardware)

Core processing

Deconstruction of revenue growth, merchant services, US market example

$ billion

Share of growth

coming from SMEs

2

71%

29%

23.7 1.8

1.8

-0.1

18.7

Revenues,

2017

1.5

74%

26%

76%98% 27% 72%0%

Revenues,

2019

From new

merchants

From

volume growth

of existing

merchants

3

From new

VAS sales

From price

changes

4

Exhibit 3

Most revenue growth in merchant services is from small and medium-size enterprises.

17The 2020 McKinsey Global Payments Report

approach to partnerships and develop models that

deliver more value to merchants through their ISV

partners—for instance, merchant cash advances,

point-of-sale financing solutions, analytics, and

omnichannel reconciliation.

In emerging markets, ISVs are steadily gaining

share, but most of the sales still leverage

traditional agent-based or direct models. Bank-

owned acquirers have an advantage in many of

these markets but often lag in sales and product

sophistication. In these markets, acquirers still have

the opportunity to invest in building a point-of-sale

platform-based business that enables them to serve

a broad swathe of merchant needs and monetize the

SME relationship in a more holistic fashion.

Trade barriers and government

intervention hinder market expansion

and enable local wins

The economic slowdown has increased many

governments’ willingness to accept additional

investment avenues, somewhat counterbalancing

the impact of recent trade disputes. The competing

priorities of regional governments are likely to

interfere with companies’ ability to enter into new

markets organically. Acquirers will need to consider

regional sponsorships, acquisitions, or joint ventures

to enter priority markets.

This “slow-balization” is also expected to fuel the

growth of regional supply chains. This will create a

need for regionally integrated solutions, especially

in B2B payments. Acquirers that have been slower

to pursue the value pools in B2B digital commerce,

due to its multi-geography complexities, may now

be able to pursue opportunities at a regional level.

Preparing for 2021 and beyond

As acquirers and merchant-services players reorient

to prepare for the next decade, several key areas

require focus:

• Investing to transform into a platform business

for larger merchants. Most large merchants

are grappling with the accelerated shift

to e-commerce, which has created more

pronounced payments digitization needs

at the point of sale, including contactless

payments, enhanced authorization, fraud and

chargeback mitigation solutions, financing at

point of sale, sub-merchant onboarding, and

payments remittances. Acquirers have a unique

opportunity to shift from being a traditional

payments acquirer or processor and bring

together proprietary and partner solutions into

a single platform for larger merchants, which

also enables bundled economics and better

value creation.

• Investing in SME channels in emerging

geographies to capture share. The shift toward

ISV-led models across markets is imminent;

acquirers need to assess their strategic posture

to address this trend. The build-out and scaling of

direct-to-SME models will be capital intensive but

potentially more lucrative if acquirers can create

SME-focused one-stop-shop platforms. Investing

in these channels and value propositions over

the next 18 to 36 months, before these markets

tilt toward ISV-led models, will position them to

compete much more effectively.

• “De-cluttering” infrastructure. The spate of

acquisitions has led to often redundant data and

software platforms that are burdening at-scale

merchant acquirers, hindering their ability to

compete with next-generation players that have

built more integrated, scalable solutions. There

is a dramatic need for rationalization of software,

data platforms, infrastructure, etc. to enable

acquirers to support merchants efficiently

across geographies, verticals, and devices.

• Aligning and simplifying organizations to

mirror emerging and at-scale merchant profit

pools and needs. Segmenting customers into

enterprise (and within this marketplace models,

pure-play subscription, travel, at-scale retail)

and SMEs (and within this direct, bank-led,

ISO/ISV/VAR led, partner-led) and organizing

the business around segments based on how

customers buy is critical to compete effectively.

Such alignment will enable acquirers to invest

appropriately in sales effectiveness and

commercial enablement, thereby improving

go-to-market and pricing approaches as well as

progress tracking.

• Directing investments to digital ISVs and

payments-adjacent offerings. With traditional

processing revenues under sustained pressure,

acquirers should focus investment on scaling

integrations with digital ISVs and creating

payments-adjacent offerings where they have a

value-added play (e.g., POS financing, rewards

redemption at point of sale, SME financing)

Acquirers should better monetize their role

within the value chain as an enabler between

1

Total excludes network assessment fees.

2

Small and medium-size enterprises, classied as businesses with <$100 million in revenues or sales where the cost of payments acceptance is directly borne by the SME; excludes marketplace-like

models that do not directly pass on acceptance costs.

3

Growth from underlying growth in sales; value-added service revenues attributed to services linked to processing a transaction but sold separately (eg, enhanced authorization).

4

Growth linked to price changes. Recent pricing pressure has led to price declines.

Source: McKinsey Payments Practice

Value-added services

(including hardware)

Core processing

Deconstruction of revenue growth, merchant services, US market example

$ billion

Share of growth

coming from SMEs

2

71%

29%

23.7 1.8

1.8

-0.1

18.7

Revenues,

2017

1.5

74%

26%

76%98% 27% 72%0%

Revenues,

2019

From new

merchants

From

volume growth

of existing

merchants

3

From new

VAS sales

From price

changes

4

Exhibit 3

Most revenue growth in merchant services is from small and medium-size enterprises.

18The 2020 McKinsey Global Payments Report

issuers/service providers and merchants, e.g.,

explore the material opportunity to act like a

marketplace or and “app-store.”

• Differentiating through data. Differentiate

solutions on data and monetize data more

effectively to enable enhanced authentication,

fraud, and chargeback use cases. The shift

to digital has created a much greater demand

for enhanced authorization, real-time data

connectivity, better data-enabled fraud, sub-

merchant underwriting decisions etc. Acquirers

possess a gold mine of data but the complexity

of disparate platforms, unclear data strategy,

poor data architecture, and limited build-

out capabilities have impaired the ability to

effectively monetize this asset.

• Avoiding complacency on alternative payment

methods. The growth of APMs, fueled by

evolving regulation, ongoing innovation and

retailer interest, will necessitate their inclusion

in acquirer portfolios. APM strategies must

evolve to a point where acquirers have a clear

view on when and how to directly integrate

vs. license through APM aggregators or other

consolidators. In addition, as APMs capture a

growing share of transactions, acquirers will

need to refine pricing/revenue/fraud models to

drive value.

• Rationalizing customer processes. As the

number of devices, interfaces, payment means,

and channels continues to increase, acquirers

are in a privileged position to aggregate,

triage, and monetize a “guaranteed best route”

experience. A customer journey-based view of

payments evolution is critical to its enablement.

The merchant acquiring industry will likely see

continued consolidation on the acquiring side and

sustained fragmentation on the distribution side.

Growing commoditization of processing will need

to be offset by improved sophistication of solutions

and enhanced back-end efficiencies. Competing

effectively will require scale not just across

geographies and verticals but across solutions

as well. As merchants across sectors rethink their

acceptance and payments needs and journeys post-

COVID19, the acquirers who orient themselves to

innovate around these needs and journeys are best

positioned to win.

Puneet Dikshit is a partner in McKinsey’s New

York office, and Tobias Lundberg is a partner in the

Stockholm office.

The authors would like to acknowledge the

contributions of Diana Goldshtein and Tamas Nagy

to this chapter.

19The 2020 McKinsey Global Payments Report

Supply-chain finance:

A case of convergent

evolution?

The complexity of the supply-chain finance industry

poses difficulties in a time of economic turmoil, but

innovative players have opportunities to seize.

Alessio Botta

Reinhard Höll

Reema Jain

Nikki Shah

Lit Hau Tan

Significant value in the global supply-chain

finance (SCF) market remains untapped. Nearly

80 percent of eligible assets do not benefit from

better working-capital financing, and the remaining

one-fifth of assets are often inefficiently financed.

Despite improvements made in recent years,

advances have been largely incremental.

We now see change accelerating in the market in

response to a convergence of factors: an increased

focus on working capital, structural changes in

financing for small and medium-size enterprises

(SMEs), a step change in digital adoption, and the

potential geographic relocation of $2.9 trillion to

$4.6 trillion in spending on cross-border supply

chains (for 16 to 26 percent of global goods exports)

over the next five years. Could these events spur the

long-anticipated transformation of the landscape?

The answer may be yes. In this chapter, we outline

key drivers and how they could lead to real change

in access to and availability of SCF. We then offer a

vision of what such a transformation could look like

and what it would mean for market participants.

Supply-chain finance: An age-old need

Supply-chain finance may well be one of the earliest

commercial-payments activities. It has enabled

every major trade and supply-chain flow through

time, from trade exchange in early Mesopotamia to

receivables credit in the 1800s Industrial Revolution,

to letters of credit and even blockchain for global

supply chains today (see sidebar “What is supply-

chain finance?”).

1

See “Risk, resilience, and rebalancing in global value chains,” McKinsey Global Institute, August 2020, on McKinsey.com.

The industry fulfills banking’s basic promise of

financing the working capital necessary to run any

business. When successfully delivered, supply-

chain finance benefits the entire ecosystem: it

enables corporate buyers to secure inventory

by extending payments terms, and it improves

certainty on forward orders for suppliers. Banks

and nonbank SCF providers generate stable, short-

duration (and hence lower-risk), often recurring

transaction volumes while creating an avenue for

broader offerings such as foreign exchange, cash

management, and capital-markets products.

SCF has only partially delivered on this promise,

however. Often it is focused on larger, well-financed

multinational corporations and their supply chains,

whereas smaller and less well-financed enterprises

face barriers to access. Many catalysts—including

digital delivery, fintech innovation, industry

utilities, blockchain, and API technologies—could

stimulate cheaper and more accessible SCF, but

change has been slow. Now in 2020, the impact of

COVID19 has contributed to accelerating digital

adoption and reconfiguration of trade and supply

chains—for example, to improve resilience and

diversify sourcing.

1

A promise made but not (yet) kept

While supply-chain finance fulfills an age-old need,

its potential continues to be limited by its complexity.

We can measure this complexity along four major

axes: fragmentation of delivery, fragmentation of the

underlying assets, limited credit and expertise, and

geopolitical turmoil.

20The 2020 McKinsey Global Payments Report

Hidden text

2

2

fake footnote

Source: McKinsey Global Transaction Banking service line

Value of assets

nanced,

$ trillion

Expected

CAGR,

2019-24

Description Model

Total trade and

SCF turnover

Seller-side

nance

Documentary

business

Buyer-led SCF

Reverse

factoring

Dynamic

discounting

FUNDER

BUYERS

SELLER

FUNDER

PLATFORM

BUYER

SELLER

PLATFORM

BUYER

SELLER

Seller provides all information linked

to receivables nancing; suppliers

typically sell/borrow against full

accounts receivable

Platforms facilitate nancing on the

basis of buyer-approved invoices

Platforms can be supplied by individual

banks, ntechs, and other industry

players (eg, consortia)

Platforms facilitate modied

payments terms (invoice discounts)

between buyers and suppliers directly

No funding involvement – “platforms” are

typically supplied by ntechs

7.3

3.0

0.4

0.1

3–5%

Seller provides all transaction-related

shipping documents to their bank,

which works with the buyer's bank to

process the payment

3.8

1-2%

15–20%

25–30%

Exhibit A

Buyer-led solutions are the fastest-growing part of the $7 trillion trade and

supply-chain nance landscape.

What is supply-chain finance?

The overall trade finance market can be roughly differentiated into three segments, each with unique product dynamics

(Exhibit A):

— Documentary business includes traditional off-balance-sheet trade finance instruments, such as letters of credit,

international guarantees, and banks’ payments obligations. These instruments are typically used to cover the two

corporate parties against potential transaction risks (e.g., an exporter protecting against country-related risks of its

importer’s domestic market).

— Seller-side finance includes two main financial instruments: factoring and invoice finance.

2

These instruments

address the financing needs of corporate sellers by anticipating liquidity related to commercial transactions.

— Buyer-side finance (referred to as supply-chain finance throughout this article) is typically aimed at large buyers

and their suppliers. It covers the financing needs of suppliers originated by large buyers, like reverse factoring, where

suppliers can access third-party financing for buyer-approved invoices, as well as dynamic discounting, where buyers

pay suppliers early in exchange for discounts on the invoice. This has traditionally been a smaller and more fragmented

market (roughly $500 billion of turnover financed), but is now growing at double-digits, driven by increasing interest

and new offerings by players

2

Some market participants also include variations of invoice finance, including receivables finance, pre-shipping finance, and even

commercial overdrafts and commodities finance.

21The 2020 McKinsey Global Payments Report

Fragmentation of delivery

While SCF providers are increasing in scale and

product range, delivery tends to be fragmented. A

fully digital, seamless experience is held back by

several remaining barriers:

• Manual and fragmented process flows.

There are technology solutions that can

streamline the financing process, e.g., by

allowing automated data flow via integration

with enterprise-resource-planning (ERP) and

procurement systems and with core systems.

However, many corporates shy away from

fully digitizing procure-to-pay and invoicing

processes. For example, ERP integration

of a single SCF system usually takes two to

four months or more and requires upfront

investment and resources, which increases the

difficulty of justifying automation and speeding

up supply-chain financing triggers.

• Fragmented data sharing. Companies continue

to work on developing data-sharing utilities

such as standard application programming

interfaces (APIs) and arm’s-length data

repositories. But these solutions have not

yet demonstrated sufficient ease of use and

earned the confidence customers seek before

they will share ERP and invoice data at scale.

As a result, SCF providers must bear the

costs and delays of cleansing and shaping

invoice data before making onboarding and

financing decisions.

• Slow onboarding and credit decisions. SCF

processes still involve long cycle times and

uncertain time to decisions. As payments

expectations move to real time, SCF will need

to accelerate the typical multiday cycles that

inhibit corporates from accessing working-

capital relief.

Fragmentation of underlying assets

Along with delivery, underlying assets tend

to be fragmented. Payables and receivables

vary widely in terms, duration, and underlying

creditworthiness. Much of SCF has focused on

higher-rated, larger corporates and recurring,

high-value invoices, especially given the higher

costs attributable to fragmented delivery. Often,

less than half of total spend is eligible for financing,

with uptake at about 60 to 70 percent of eligible

3

Susan Lund, James Manyika, Jonathan Woetzel, Jacques Bughin, Mekala Krishnan, Jeongmin Seong, and Mac Muir, “Globalization in

transition: The future of trade and value chains,” January 2019, Mckinsey.com.

volumes. Furthermore, small and medium-size

corporates, as well as one-off, more variable

invoices, struggle to access SCF.

Limited credit provision and SCF expertise

With a limited secondary market, provision of

supply-chain financing is restricted by the number

of individual banks and nonbank providers with

sufficient risk appetite and know-how. Many

institutions cannot offer the full range of SCF

assets, because they have limits on exposure or risk

and limited expertise in underwriting and because

they lack existing processes. As a result, large

segments of corporates—for example, those where

most SMEs are customers of small banks—have no

access to SCF.

Fundamental shifts in global trade

Global trade volume grew by 6 percent (CAGR)

between 1990 and 2007. From 2011 to 2018, the

trade volume grew at a 3 percent CAGR, pushing the

absolute trade volume to new heights, according

to the World Bank. According to McKinsey’s latest

report

3

on global trade and value chains, in 2017,

total global trade stood at $22 trillion, with trade

in goods at $17 trillion. Trade in services, though

smaller at $5 trillion, has outpaced growth in goods

trade by more than 60 percent over the past decade

(CAGR of 3.9 percent).

We believe there are three fundamental forces that

will affect global value chains in the near future:

As domestic consumption grows in countries like

China, global demand—which historically has

tilted toward advanced economies, is shifting to

a greater focus on developing nations. Emerging

markets are expected to consume almost

two-thirds of the world’s manufactured goods

by 2025, with products such as cars, building

products, and machinery leading the way. By

2030, developing countries are projected

to account for more than half of all global

consumption.

Developing economies are building

comprehensive domestic supply chains,

reducing their reliance on imported intermediate

inputs and thereby reducing cross-border

trade flows.

Global value chains are being reshaped by

cross-border data flows and new technologies,

22The 2020 McKinsey Global Payments Report

including digital platforms, the internet of things,

automation, and AI.

Why this time is different

While many of the drivers of SCF growth are long-

standing, ongoing changes might signal a structural

shift in the ecosystem. Corporates, both small

and large, have structurally increased their use of

supply-chain finance, systematically considering

how to support smaller suppliers’ working-capital

needs. In a May 2020 McKinsey survey, 93 percent

of global supply-chain leaders expressed plans to

increase supply-chain resilience, with 44 percent

willing to do so at the expense of short-term savings

(Exhibit 1). This could double historically low SCF

eligibility and uptake levels from below 40 percent

to as much as 80 percent.

Unsurprisingly then, the recent supply shock from

COVID19 led to the increased use of supply-chain

financing. For instance, Prime Revenue saw growth

of more than 25 percent in the number of corporate

users in the first half of 2020 relative to the prior

year, with the share of financed invoices exceeding

90 percent in some months, compared with the

more typical 70 to 75 percent.

Supply-chain diversification as a catalyst for

holistic SCF

A once-in-a-generation supply-chain diversification

creates a catalyst for modern, holistic SCF solutions.

The McKinsey Global Institute estimates that up

to $4.6 trillion of global exports (26 percent of the

total and up to 60 percent in industries such as

pharmaceuticals) could be in scope for relocation

over the next five years. This will structurally

shift the ecosystem, likely in favor of players

with holistic offerings across receiving corridors,

whether in intra-domestic trade, in regional

trade, and/or across a more diverse set of global

corridors. This may result in additional support for

solutions catering to the needs to domestic bank

customers. Examples include Deutsche Bank and

Commerzbank targeting automotive value chains.

Tackling fragmentation with digitization

Digitization resolves issues arising from

fragmentation of delivery as corporates are actively

focusing on their supply chains. The aforementioned

2020 survey across industries identified 79 percent

of respondents planning investments in digital

supply chains. One corporate executive stated that

COVID19 has forced “a change of mindset” from

the historically slow pace in digitizing supply-chain

activities. Similarly, banks are forced to develop truly

end-to-end digital capabilities, from onboarding

and application through approval and execution to

improve servicing, capacity, and ability to automate

underwriting and risk management.

Changing competitive forces

Many nontraditional players are aggressively

targeting attractive niches in this business,

threatening banks’ revenue streams:

— Fintechs are developing value propositions

centered on digital platforms to provide

Source: McKinsey survey of 60 senior supply-chain executives , 2Q 2020

Percent of total respondents

Plan to increase level of resilience across supply chain

93%

Expect changes to supply-chain planning after COVID-19

54%

Plan to increase in-house digital supply-chain talent

90%

Exhibit 1

Supply-chain leaders will focus on resilience and digitization.

23The 2020 McKinsey Global Payments Report

Source: McKinsey Global Transaction Banking service line

Assets eligible for SCF programs

$ trillion, 2018

Global COGS Spend

addressable through

buyer-led SCF

Excluded spend

Managed directly

(not nanced)

Currently addressed by seller-side

nance solutions

(eg, factoring, invoice discounting)

Unaddressed short-term

gap for nancing

Addressed through buyer-led

solutions

Global supply-chain spend

of addressable buyers in

relevant industries, payable

to addressable suppliers

for buyer-led SCF

Excludes industries with

limited supply-chain spend

and fragmentation,

non-supply chain spend, and

un-addressable suppliers

Cost of goods sold of

global public and private

institutions with spend

>$500 million

~48

17

~14

~2.5

~0.5

3

~65

~17

Exhibit B

There is signicant room for growth in supply-chain nance programs.

Room for growth in supply-chain finance?

Conceptually speaking, the potential market for supply-chain finance encompasses every invoice and receipt issued

by corporates—up to $17 trillion globally (Exhibit B). In practice, however, there is a large global gap in trade finance,

estimated to be $1.5 trillion, rising to $2.5 trillion by 2025. This estimate was forecast by the World Economic Forum before

the start of the COVID19 pandemic. The trend is likely accelerating as the pandemic and trade conflicts prompt further

reshuffling and nearshoring.

To date, several practical constraints have impeded the financing of these balances:

• lack of coverage of buyer-led solutions, which typically target only the largest suppliers

• manual and fragmented processes for supplier-led solutions, leading to inefficiencies that erode the business model

for many financing opportunities

• inability to address invoices for non-investment-grade suppliers, less than 10 percent of which are financed

non-financial services, directly connecting

corporates. For instance, fintechs (e.g.,

Us-based C2FO) are offering dynamic

discounting, an innovative nonlending-based

supply-chain finance product enabling buyers

to make early payments to suppliers in return

for a discount. Tradeshift, another example,

4

For example, Taulia received a new strategic funding round led by Ping An and JPMorgan, and Deutsche Bank invested in Traxpay, an SCF

fintech.

offers an integrated platform to large buyers and

SME suppliers spanning the procurement value

chain. Recent partnerships and investments

in companies like these are signs that model is

catching on.

4