Vincenzo Sopracolle

Quick Reference Guide:

Financial Accounting with SAP

®

Bonn

�

Boston

313_Book.indb 3 4/7/10 11:22:21 AM

Contents at a Glance

1 General SAP Conguration for Financial Accounting .............. 17

2 Organizational Structure: Denition and Assignment ............ 43

3 General Ledger Conguration ................................................. 77

4 General Ledger Accounts and Postings ................................... 155

5 Accounts Receivable and Accounts Payable ........................... 225

6 Asset Accounting .................................................................... 359

7 Banking ................................................................................... 463

8 Special Purpose Ledger ........................................................... 523

A Tables and Views ..................................................................... 591

B Transaction Codes ................................................................... 605

C Program Codes ........................................................................ 621

D Menu Paths and Customizing Paths ....................................... 625

E The Author ............................................................................... 643

313_Book.indb 5 4/7/10 11:22:21 AM

7

Contents

Introduction ............................................................................................... 15

1 General SAP Conguration for Financial Accounting ............... 17

1.1 Countries .................................................................................... 17

1.1.1 Dening Countries in mySAP Systems ............................ 19

1.1.2 Setting Country-Specic Checks ..................................... 21

1.1.3 FAQ and Troubleshooting Tips ........................................ 26

1.2 Currencies ................................................................................... 28

1.2.1 Creating a New Currency ................................................ 28

1.2.2 Setting Decimal Places ................................................... 30

1.2.3 Checking Exchange Rate Types ....................................... 32

1.2.4 Dening Translation Ratios for Currency Translations ...... 35

1.2.5 Entering Exchange Rates ................................................ 37

1.2.6 Manual Entry Versus Automatic Retrieval of the

Exchange Rate ................................................................ 38

1.2.7 FAQ and Troubleshooting Tips ........................................ 40

1.3 Summary .................................................................................... 42

2 Organizational Structure: Denition and Assignment ............. 43

2.1 Denition of Organizational Entities Relevant to Financial

Accounting ................................................................................. 43

2.1.1 Company ........................................................................ 44

2.1.2 Company Code ............................................................... 46

2.1.3 Credit Control Area ........................................................ 53

2.1.4 Business Area ................................................................. 55

2.1.5 Consolidation Business Area ........................................... 57

2.1.6 Functional Area .............................................................. 57

2.1.7 Controlling Area ............................................................. 59

2.1.8 Operating Concern ......................................................... 61

2.1.9 FAQ and Troubleshooting Tips ........................................ 62

2.2 Assignment of Organizational Entities Relevant to

Financial Accounting ................................................................... 65

2.2.1 Company Code to Company ........................................... 66

313_Book.indb 7 4/7/10 11:22:22 AM

8

Contents

2.2.2 Company Code to Credit Control Area ............................ 66

2.2.3 Business Area to Consolidation Business Area ................. 67

2.2.4 Company Code to Controlling Area ................................ 68

2.2.5 Controlling Area to Operating Concern .......................... 69

2.2.6 Plant to Company Code ................................................. 70

2.2.7 Sales Organization to Company Code ............................. 71

2.2.8 Personnel Area to Company Code .................................. 72

2.2.9 FAQ and Troubleshooting Tips ........................................ 73

2.3 Summary .................................................................................... 74

3 General Ledger Conguration ................................................... 77

3.1 Company Code Settings .............................................................. 77

3.2 Parallel Currencies ....................................................................... 82

3.2.1 Dening Additional Local Currencies

(Maximum of Two) ......................................................... 83

3.2.2 Dening Additional Local Currencies with

Additional Ledgers (Classic General Ledger) .................... 85

3.3 Fiscal Year Variants ..................................................................... 87

3.3.1 FAQ and Troubleshooting Tips ........................................ 89

3.4 Conguring Charts of Accounts and General Ledger Accounts ..... 90

3.4.1 Dening Charts of Accounts ........................................... 90

3.4.2 Dening Account Groups ............................................... 93

3.4.3 Conguring Screen Layout for Creating, Displaying,

and Changing General Ledger Accounts .......................... 95

3.4.4 Dening Retained Earnings Accounts ............................. 97

3.4.5 FAQ and Troubleshooting Tips ........................................ 98

3.5 Conguring General Ledger Settings for Postings ......................... 99

3.5.1 Dening Document Types .............................................. 99

3.5.2 Dening Posting Keys ..................................................... 103

3.5.3 Maintaining Field Statuses from the General Ledger

Account ......................................................................... 107

3.5.4 Dening Number Ranges ............................................... 109

3.5.5 FAQ and Troubleshooting Tips ........................................ 112

3.6 SAP General Ledger Settings Only ............................................... 116

3.6.1 Dening General Ledgers ............................................... 116

3.6.2 Dening Ledger Groups ................................................. 117

3.6.3 Leading and Non-Leading Ledger Settings ...................... 119

313_Book.indb 8 4/7/10 11:22:22 AM

9

Contents

3.6.4 Assigning Scenarios ........................................................ 121

3.6.5 Conguring Document Splitting ..................................... 123

3.6.6 Conguring Document Types and Number Ranges

for Non-Leading Ledger Postings .................................... 128

3.6.7 Dening Segments ......................................................... 129

3.6.8 Dening Prot Centers ................................................... 130

3.6.9 FAQ and Troubleshooting Tips ........................................ 132

3.7 Validations and Substitutions ...................................................... 135

3.7.1 Validations ..................................................................... 135

3.7.2 Substitutions .................................................................. 145

3.7.3 FAQ and Troubleshooting Tips ........................................ 148

3.8 Automatic Account Determination ............................................. 150

3.8.1 Differences in General Ledger Account Clearing ............. 150

3.8.2 Exchange Rate Differences ............................................. 152

3.9 Summary .................................................................................... 154

4 General Ledger Accounts and Postings .................................... 155

4.1 General Ledger Accounting Master Data ..................................... 155

4.1.1 General Ledger Account Management ............................ 156

4.1.2 Primary Cost Elements .................................................... 174

4.1.3 Master Data Reporting and Utilities ............................... 177

4.1.4 FAQ and Troubleshooting Tips ........................................ 179

4.2 General Ledger Accounting Postings ........................................... 182

4.2.1 Posting with the Classic General Ledger .......................... 182

4.2.2 Posting with SAP General Ledger .................................... 192

4.2.3 Financial Accounting Documents Generated from

IDocs ............................................................................. 194

4.2.4 Editing General Ledger Documents ................................ 197

4.2.5 Clearing General Ledger Open Items .............................. 203

4.2.6 Reversal of Financial Accounting Documents .................. 207

4.2.7 FAQ and Troubleshooting Tips ........................................ 210

4.3 Tax on Sales/Purchases for Financial Accounting Documents ....... 216

4.3.1 Tax on Sales/Purchases Conguration ............................. 216

4.3.2 Tax Reporting ................................................................. 220

4.3.3 FAQ and Troubleshooting Tips ........................................ 222

4.4 Summary .................................................................................... 224

313_Book.indb 9 4/7/10 11:22:22 AM

10

Contents

5 Accounts Receivable and Accounts Payable ............................. 225

5.1 Customer Master Data ................................................................ 225

5.1.1 Conguring Customer Master Data ................................ 226

5.1.2 Managing Customer Master Data ................................... 235

5.1.3 Reporting and Utilities for Customer Master Data .......... 250

5.1.4 FAQ and Troubleshooting Tips ........................................ 255

5.2 Vendor Master Data ................................................................... 258

5.2.1 Conguring Vendor Master Data .................................... 258

5.2.2 Managing Vendor Master Data ....................................... 264

5.2.3 Reporting and Utilities for Vendor Master Data .............. 271

5.2.4 FAQ and Troubleshooting Tips ........................................ 273

5.3 Conguring Business Transactions in Accounts Receivable

and Accounts Payable ................................................................. 275

5.3.1 Maintaining Payment Terms ........................................... 275

5.3.2 Dening Default Document Types for Enjoy

Transactions ................................................................... 280

5.3.3 Dening Payment Block Reasons .................................... 281

5.3.4 Conguring Automatic Payments .................................... 283

5.3.5 Conguring Dunning Procedures .................................... 293

5.3.6 Conguring Interest Calculations .................................... 295

5.3.7 Customizing Exchange Rate Calculations ........................ 301

5.3.8 Conguring Special General Ledger Indicators for

Accounts Receivable Posting .......................................... 305

5.3.9 FAQ and Troubleshooting Tips ........................................ 308

5.4 Accounts Receivable Postings ..................................................... 309

5.4.1 Financial Accounting Outgoing Invoices ......................... 309

5.4.2 Outgoing Credit Memos in Financial Accounting ............ 316

5.4.3 Manual Incoming Payments and Clearings ...................... 318

5.4.4 Posting and Clearing Down Payments ............................. 322

5.4.5 Posting with Special General Ledger Indicator ................ 324

5.4.6 Reporting Customer and Vendor Line Items ................... 325

5.4.7 FAQ and Troubleshooting Tips ........................................ 328

5.5 Accounts Payable Postings .......................................................... 331

5.5.1 Financial Accounting Incoming Invoices ......................... 331

5.5.2 Financial Accounting Incoming Credit Memos ................ 335

5.5.3 Automatic Outgoing Payments ....................................... 336

5.5.4 FAQ and Troubleshooting Tips ........................................ 341

313_Book.indb 10 4/7/10 11:22:22 AM

11

Contents

5.6 Accounts Receivable and Accounts Payable Period-End

Functions .................................................................................... 342

5.6.1 Automatically Clearing Open Items ................................ 342

5.6.2 Dunning ......................................................................... 346

5.6.3 Calculating Interest and Invoicing ................................... 351

5.6.4 Foreign Currency Valuation ............................................ 354

5.6.5 FAQ and Troubleshooting Tips ........................................ 357

5.7 Summary .................................................................................... 358

6 Asset Accounting ...................................................................... 359

6.1 Conguring Asset Accounting ..................................................... 359

6.1.1 Copying Charts of Depreciation ...................................... 360

6.1.2 Setting the Chart of Depreciation for Customizing .......... 362

6.1.3 Assigning Charts of Depreciation .................................... 363

6.1.4 Dening Asset Classes .................................................... 364

6.1.5 Deactivating Asset Classes in Charts of Depreciation ...... 365

6.1.6 Dening Number Ranges for Asset Master Data ............. 366

6.1.7 Specifying Account Determination ................................. 367

6.1.8 Creating Screen Layout Rules ......................................... 368

6.1.9 Dening Evaluation Groups ............................................ 370

6.1.10 Dening Validations for Asset Master Data ..................... 372

6.1.11 Substitutions for Asset Master Data ................................ 375

6.1.12 Dening Depreciation Areas ........................................... 376

6.1.13 Specifying Transfer of APC Values to Another

Depreciation Area .......................................................... 379

6.1.14 Specifying the Transfer of Depreciation Terms

from Another Depreciation Area .................................... 380

6.1.15 Integrating Depreciation Areas and the SAP General

Ledger ............................................................................ 381

6.1.16 Deactivating Depreciation Areas in Asset Classes ............ 383

6.1.17 Specifying General Ledger Accounts for APC Posting

and Depreciation ........................................................... 384

6.1.18 Specifying Posting Keys for Asset Posting ....................... 388

6.1.19 Specifying Document Type for Depreciation ................... 388

6.1.20 Dening Depreciation Area Currency .............................. 389

6.1.21 Maintaining Depreciation Keys ....................................... 391

6.1.22 Activating Controlling Objects for Posting in Asset

Accounting ..................................................................... 394

313_Book.indb 11 4/7/10 11:22:22 AM

12

Contents

6.1.23 Activating Controlling Objects for Posting in Asset

Accounting per Company Codes ..................................... 395

6.1.24 Specifying Posting Rules for Depreciation ....................... 397

6.1.25 Transaction Types ........................................................... 399

6.1.26 Conguring the Asset History Sheet ............................... 404

6.1.27 Using Asset Accounting Enhancements (User Exits) ........ 407

6.1.28 FAQ and Troubleshooting Tips ........................................ 408

6.2 Asset Master Data Management ................................................. 411

6.2.1 Creating a Main Asset .................................................... 411

6.2.2 Creating Sub-Assets ........................................................ 415

6.2.3 Blocking Assets .............................................................. 416

6.2.4 Deleting Assets .............................................................. 417

6.2.5 Creating Assets with Acquisition or Transfer

Transactions ................................................................... 418

6.2.6 Reporting on Asset Master Data ..................................... 419

6.2.7 FAQ and Troubleshooting Tips ........................................ 422

6.3 Posting Transactions to Assets ..................................................... 424

6.3.1 Posting Acquisitions with Automatic Offsetting Entries ... 424

6.3.2 Posting Acquisitions with Financial Accounting

Vendor Invoices ............................................................. 427

6.3.3 Posting Acquisitions from Logistics (Settlement from

WBS or Internal Order) .................................................. 428

6.3.4 Posting Acquisitions from Afliated Companies .............. 430

6.3.5 Transferring Assets from Company to Company

(in the Same Client) ........................................................ 431

6.3.6 Transferring from Asset to Asset Within Company Codes ... 434

6.3.7 Posting a Retirement ...................................................... 436

6.3.8 Posting an Unplanned Depreciation ............................... 438

6.3.9 Changing an Asset Document ......................................... 439

6.3.10 Reversing an Asset Document ........................................ 440

6.3.11 Using the Asset Explorer ................................................. 441

6.3.12 FAQ and Troubleshooting Tips ........................................ 443

6.4 Depreciation and Other Periodic Postings ................................... 446

6.4.1 Executing Depreciation Runs .......................................... 448

6.4.2 Periodic Posting of Transactions ...................................... 451

6.4.3 FAQ and Troubleshooting Tips ........................................ 453

6.5 Year-End Activities ...................................................................... 455

6.5.1 Running Fiscal Year Changes .......................................... 456

6.5.2 Executing Fiscal Year Closings ......................................... 457

313_Book.indb 12 4/7/10 11:22:22 AM

13

Contents

6.5.3 Reopening Closed Fiscal Years ........................................ 459

6.5.4 FAQ and Troubleshooting Tips ........................................ 460

6.6 Summary .................................................................................... 462

7 Banking ..................................................................................... 463

7.1 Bank Data (Database of Bank Branches) ...................................... 463

7.1.1 Bank Data Manual Update ............................................. 464

7.1.2 Mass Update with Local Database .................................. 467

7.1.3 Mass Update with the BIC Database .............................. 469

7.1.4 Bank Branch Data Deletion ............................................ 472

7.1.5 FAQ and Troubleshooting Tips ........................................ 472

7.2 House Banks and House Bank Accounts ...................................... 473

7.2.1 Dening House Banks .................................................... 474

7.2.2 Dening House Bank Accounts ....................................... 475

7.2.3 FAQ and Troubleshooting Tips ........................................ 477

7.3 Bank Chains ................................................................................ 478

7.3.1 Customizing Bank Chains ............................................... 478

7.3.2 Maintaining Bank Chains ................................................ 481

7.3.3 Bank Chains in Payments ................................................ 484

7.3.4 FAQ and Troubleshooting Tips ........................................ 485

7.4 Electronic Bank Statements ......................................................... 486

7.4.1 Conguring Electronic Bank Statements ......................... 486

7.4.2 Importing Electronic Bank Statements into SAP .............. 496

7.4.3 FAQ and Troubleshooting Tips ........................................ 504

7.5 Cash Journal ............................................................................... 505

7.5.1 Customizing Cash Journals .............................................. 506

7.5.2 Cash Journal Postings ..................................................... 511

7.5.3 Cash Journal Reporting ................................................... 518

7.5.4 FAQ and Troubleshooting Tips ........................................ 519

7.6 Summary .................................................................................... 521

8 Special Purpose Ledger ............................................................. 523

8.1 Special Purpose Ledger Conguration ......................................... 523

8.1.1 Installing Table Groups ................................................... 524

8.1.2 Dening Field Movement ............................................... 526

8.1.3 Creating the Ledger ........................................................ 529

313_Book.indb 13 4/7/10 11:22:22 AM

14

Contents

8.1.4 Assigning Companies or Company Codes to the

Ledger ............................................................................ 531

8.1.5 Special Ledger Settings for Company and

Company Codes ............................................................. 533

8.1.6 Assigning Activities to the Special Ledger ....................... 535

8.1.7 Conguring the Ledger Selection .................................... 537

8.1.8 Conguring Validations and Substitutions ....................... 539

8.1.9 Conguring Manual Special Ledger Postings ................... 540

8.1.10 FAQ and Troubleshooting Tips ........................................ 547

8.2 Special Ledger Postings ............................................................... 552

8.2.1 Posting from Other SAP Components ............................. 552

8.2.2 Posting Within the Special Ledger .................................. 556

8.2.3 Actual Allocations in the Special Ledger ......................... 558

8.2.4 FAQ and Troubleshooting Tips ........................................ 559

8.3 Main Special Ledger Functionalities ............................................ 561

8.3.1 Balance Carryforward ..................................................... 561

8.3.2 Reconciliation Between Ledgers ..................................... 565

8.3.3 Actual Data Transfer ....................................................... 567

8.3.4 Deleting and Reposting Data .......................................... 570

8.3.5 Reconciliation Between Total Data and Line Items ......... 573

8.3.6 FAQ and Troubleshooting Tips ........................................ 574

8.4 Total Data Reporting ................................................................... 575

8.5 Other Special Ledger Functionalities ........................................... 578

8.5.1 Plan Data in the Special Ledger ...................................... 578

8.5.2 Rollup ............................................................................ 579

8.5.3 FAQ and Troubleshooting Tips ........................................ 586

8.6 Summary .................................................................................... 587

Appendices ................................................................................... 589

A Tables and Views .................................................................................. 591

B Transaction Codes ................................................................................ 605

C Program Codes ..................................................................................... 621

D Menu Paths and Customizing Paths ...................................................... 625

E The Author ........................................................................................... 643

Index ........................................................................................................ 645

313_Book.indb 14 4/7/10 11:22:22 AM

43

This chapter covers the functions related to the global assignment of orga-

nizational entities in Financial Accounting, with major emphasis on com-

pany codes and controlling areas.

Organizational Structure2 :

Denition and Assignment

In this chapter, we discuss the denition and assignment of the organizational enti-

ties relevant to Financial Accounting. The rst section focuses on how to dene

these entities, and the second section focuses on how to assign them.

Definition of Organizational Entities Relevant to 2.1

Financial Accounting

In this section, we explain how to dene the following organizational entities rel-

evant for Financial Accounting:

Company

Company code

Credit control area

Business area

Consolidation business area

Functional area

Controlling area

Operating concern

Note

For information about segments, please refer to Section 3.6.7; for information about

prot centers, refer to Section 3.6.8.

313_Book.indb 43 4/7/10 11:22:32 AM

44

Organizational Structure: De nition and Assignment

2

Company2.1.1

Quick Reference

Menu path: IMG

•

Enterprise Structure

•

De nition

•

Financial Accounting

•

De ne

Company

Transaction: OX15

Table/view: T880 /V_T880

A company (also known as an internal trading partner ) is an organizational unit

used for consolidation purposes. In general, you don’t post directly to a company;

instead, you assign a company code to a company and then post to that company

code. By assigning a company to a company code , the company inherits the post-

ings of the other company codes assigned to that company. In addition to being

assigned to a company code, a company can also be assigned to customers and

vendors, which helps you keep track of the transactions against your business

partners. (Company codes will be discussed in more detail in Section 2.1.2, Com-

pany Code.)

Company Data RecordFigure 2.1

You can create or change companies using Transaction OX15 (Figure 2.1). To cre-

ate a new company, select the New Entries button, and then specify the name,

address, language, and currency. (In general, the naming convention of the compa-

nies is de ned by the parent company , the holding company of your group; if you

313_Book.indb 44 4/7/10 11:22:32 AM

45

Denition of Organizational Entities Relevant to Financial Accounting

2.1

don’t know it, check with your accounting department.) Then save. No additional

activity is required in this step.

Companies in a Global Special Ledger

If you use companies in a global special ledger, you have to assign the company to the

ledger. (We discuss this in more detail in Chapter 8, Special Purpose Ledger.)

If the company is used in non-standard tables (i.e., tables that start with a Z or a

Y), you may need to update them when you create a new company. You can search

for non-standard tables that use the company by following these steps:

Run Transaction SE111. .

Select the Data Type option, and specify the RASSC value. Then select 2. Utilities

•

Where-Used List.

Select the Table Fields option, and click on the Search Area button.3.

In the Object Name eld, specify the values Y* and Z*. Conrm the selection, 4.

and click the Continue button (

). The system then displays a list of the non-

standard tables that use the company.

Searching the Usage of Company in Tables

In some tables, it’s possible to use a data type different from RASSC. To see all similar

data types, specify the RASSC data type, and then click on the Display button. In the

following screen, the domain to which the data type belongs is displayed; double-click

on the domain (for RASSC, it’s RCOMP). From Utilities

•

Where-Used List, select Data

Elements. The system displays all of the similar data elements.

The company is also used to keep track of transactions that are performed against

a subject that belongs to the same consolidation group. For this purpose, you

can manually specify a company in the Financial Accounting document. Alterna-

tively, you can specify the company in the following types of master data (if you

do this, the documents that use these master data will automatically contain this

information):

Assets (Table ANLA)

General ledger account (Table SKA1)

Customer (Table KNA1)

Vendor (Table LFA1)

313_Book.indb 45 4/7/10 11:22:33 AM

46

Organizational Structure: Denition and Assignment

2

Company Code2.1.2

Quick Reference

Menu path: IMG

•

Enterprise Structure

•

Denition

•

Financial Accounting

•

Edit,

Copy, Delete, Check Company Code

Transactions: OX02 (edit company code), EC01 (copy, delete, check company code)

Table/view: T001/V_T001

You can create a company code in two ways:

Copy an existing company code and then change the necessary settings (e.g.,

the company code description, the currency, etc.). The system automatically

performs most of the necessary customizing settings, copying them from the

reference company code.

Create a company code from scratch; in this case, you need to perform all of the

company code customizing settings step by step.

When you run Transaction EC01, the system presents two alternatives (Figure

2.2):

Copy, Delete, Check Company Code

Due to the large number of customizing steps needed to congure a company

code from scratch, we highly recommend using this method. To copy an exist-

ing company code to the new one, select the Copy Org. Object button (

)

and specify the reference company code (From Company Code) and the com-

pany code to be created (To Company Code). Conrm. The system asks you two

questions:

Do you want to copy the general ledger accounts from the reference com-

pany code? You should always answer “No” if the new company code must

have a different chart of accounts. However, you can always copy the accounts

from a reference company using Transaction FS15. In general, we recom-

mend not copying the general ledger accounts.

Do you want to create the new company code with a different currency? If

yes, specify the new currency.

After the copy is done, review the company code customizing with the transac-

tions listed in Table 2.1. All of the relevant settings are described in detail in

subsequent chapters.

313_Book.indb 46 4/7/10 11:22:33 AM

47

Denition of Organizational Entities Relevant to Financial Accounting

2.1

Deleting and Renaming Company Codes

In the screen where you copy the company code, you can also perform two additional

activities:

Delete the company code: If you incorrectly created a company code, and you’ve

never used it in a production system, you can use the Delete button ( ) to erase all

of the customizing settings that refer to the specied company code.

Rename the company code: If you created a company code with an incorrect ID, and

you’ve never used it in a production system, you can use the Rename button ( ) so

that all customizing settings that refer to the specied company code are transferred

to a company code with a new ID. (The old company code will no longer exist in the

system.)

Edit Company Code

Data

Use this transaction to start the creation of a company code with the step-by-

step technique. Specify company code ID, name, and address. Then perform all

of the needed customizing settings; you can use Table 2.1 as a checklist. Note

that many of the listed transactions may not be needed in your SAP

implementation.

Company Code Denition ToolsFigure 2.2

313_Book.indb 47 4/7/10 11:22:33 AM

48

Organizational Structure: Denition and Assignment

2

Non-Standard Tables

If you need to add the company code to non-standard tables and you want to know

which tables must be updated, follow the procedure described in Section 2.1.1, Com-

pany Code, using the data type BUKRS.

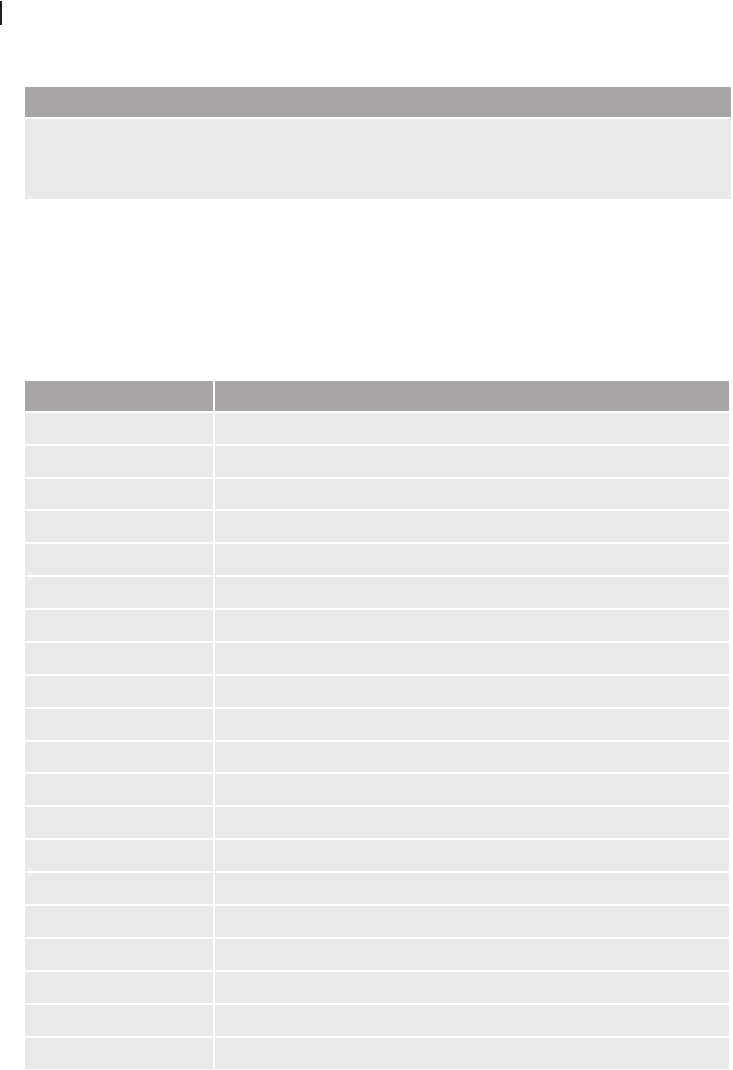

Table 2.1 can be used as a checklist for creating a company code from scratch. Note

that only the customizing that involves company-code-specic entries is included.

If the new company code belongs to a country for which no specic conguration

is already available in the system, you must perform additional steps (e.g., the

denition of VAT codes in the new country).

Transaction

Description

OX02

Edit, Copy, Delete, Check Company Code

OX16

Assign Company Code to Company

OB38

Assign Company Code to Credit Control Area

OF18

Assign Company Code to Financial Management Area

OX19

Assign Company Code to Controlling Area

OX18

Assign Plant to Company Code

OVX3

Assign Sales Organization to Company Code

OX01

Assign Purchasing Organization to Company Code

OH05

Assignment of Personnel Area to Company Code

OBB5

Cross-System Company Codes

OBY6

Enter Global Parameters

OB22

Dene Additional Local Currencies

OBR3

Set Company Code to Productive

OB37

Assign Company Code to a Fiscal Year Variant

OBB9

Assign Posting Period Variants to Company Code

FBN1

Dene Document Number Ranges

OBH1

Copy Number Ranges to Company Code

OBH2

Copy Number Ranges to Fiscal Year

OB28

Validation in Accounting Documents

OBBH

Substitution in Accounting Documents

Checklist for Creating a New Company Code Table 2.1

313_Book.indb 48 4/7/10 11:22:34 AM

49

Denition of Organizational Entities Relevant to Financial Accounting

2.1

Transaction

Description

OB64

Dene Maximum Exchange Rate Difference per Company

Code

OBC5

Assign Company Code to Field Status Variants

OBA4

Dene Tolerance Groups for Employees

OB32

Document Change Rules, Line Item

OB63

Enable Fiscal Year Default

OB68

Default Value Date

OBWJ

Assign Company Code to a Workow Variant for Parking

Documents

SM30/TBUVTX

Transfer Posting of Tax for Cross-Company Code Transactions

SM30/V_T001WT

Assign Withholding Tax Types to Company Codes

SM30/V_T001_EXT

Activate Extended Withholding Tax

OB62

Assign Company Code to Chart of Accounts

OB67

Assign Company Code to Rule Type (Sample Accounts)

OB78

Assign Programs for Correspondence Types

OBYA

Prepare Cross-Company Code Transactions

SM30/V_001_NP

Permit Negative Posting

SM30/V_TACE001_

BUKRS

Assign Company Codes to Accrual Engine

sm30/V_TACE_

COMBINATN

Accrual Engine: Assign Accounting Principle to Company Code

OB21

Dene Screen Layout per Company Code (Customers)

OB24

Dene Screen Layout per Company Code (Vendors)

SM30/V_T076B

Assign Company Code for EDI Incoming Invoice

OBBE

Dene Reason Codes (Manual Outgoing Payments)

OB60

Prepare Cross-Company Code Manual Payments

FBZP

Automatic Payment Global Setup

OBZO

Dene Document Types for Enjoy Transactions

OBA3

Dene Tolerances (Customers)

SPRO/V_T076B

Assign Company Code for EDI Payment Advice Notes

Table 2.1 Checklist for Creating a New Company Code (Cont.)

313_Book.indb 49 4/7/10 11:22:34 AM

50

Organizational Structure: Denition and Assignment

2

Transaction

Description

OB61

Dene Dunning Areas

SM30/T047

Company Code Dunning Control

OBBA

Dene Value Date Rules

OBA8

Bill of Exchange Receivables: Dene Additional Days for

Remaining Risk

OB54

Dene Failed Payment Transactions (Bills of Exchange)

OT67

Returned Bills of Exchange Payable: Dene Exception Types

OT68

Dene Account for Returned Bills of Exchange

OT65

Assign Forms for Returned Bills of Exchange Payable

OT66

Dene Sender Details for Form for Returned Bills of Exchange

SM30/V_T018V

Dene Clearing Accts. for Receiving Bank for Acct. Transfer

SM30/V_ATPRA_FI

Dene Clearing Accounts for Cross-Country Bank Account

Transfers

SM30/V_T042Y

Bank Clearing Account Determination

SM30/V_TBKDC

Dene Diff. in Days Betw. Value Date of House/Partner Bank

SM30/V_TBKPV

Dene Number of Days Between Payment Run Date and

Value Date at House Bank

SM30/V_T042EA

Dene ALE-Compatible Payment Methods

OBAV

Prepare Payment Authorization/POR Procedure

SM30/V_TCJ_MAX_

AMOUNT

Cash Journal: Amount Limit

FBCJC1

Dene Number Range Intervals for Cash Journal Documents

FBCJC0

Set Up Cash Journal

FBCJC2

Create, Change, Delete Business Transactions (Cash Journal)

FBCJC3

Set Up Print Parameters for Cash Journal

OAB1

Assign Chart of Depreciation to Company Code

AO11

Specify Number Assignment Across Company Codes

OBCL

Assign Input Tax Indicator for Non-Taxable Acquisitions

OAYN

Specify Financial Statement Version for Asset Reports

OAB3

Specify Document Type for Posting of Depreciation

Table 2.1 Checklist for Creating a New Company Code (Cont.)

313_Book.indb 50 4/7/10 11:22:34 AM

51

Denition of Organizational Entities Relevant to Financial Accounting

2.1

Transaction

Description

OAYR

Assets: Specify Intervals and Posting Rules for Depreciation

ACSET

Specify Account Assignment Types for Account Assignment

Objects

OAMK

Assets: Reset Reconciliation Accounts

SM30/V_T093C_

APER

Specify Document Type for Periodic Posting of Asset Values

OAYK

Specify Amount for Low Value Assets

OAYO

Specify Rounding of Net Book Value and/or Depreciation

OAYJ

Specify Changeover Amount

OAYI

Specify Memo Value for Depreciation Areas

SM30/V_T093C_06

Specify Other Versions on Company Code Level

OAYP

Dene Reduction Rules for Shortened Fiscal Years

SM30/V_T093C_07

Use of Half Months in the Company Code

OAYL

Specify Areas for Individual Period Weighting

OAYH

Dene Depreciation Areas for Foreign Currencies

OAYM

Specify Depreciation Areas for Group Assets

AO25

Dene Unit-of-Production Depreciation

AFAM_093B

Propose Values for Depreciation Areas and Company Codes

AFAM_093C

Propose Acquisition Only in Capitalization Year for Company

Codes

SM30/V_T093C_10

Assign Time-Dependent Period Controls to Dep. Keys

OAW2

Dene Maximum Base Value

OAYQ

Reserves for Special Depreciation: Specify Gross or Net

Procedure

OAYR

Revaluation of Fixed Assets: Maintain Posting Rules

SM30/J_1AVAA02

Revaluation of Fixed Assets: Revaluation Keys

SM30/J_1AVAA05A

Maintain Additional Settings for Ination Transaction Types

AO31

Net Worth Tax: Specify Depreciation Area

SM30/V_T093C_16

Assets: Specify Time-Independent Management of Organiz.

Units

Table 2.1 Checklist for Creating a New Company Code (Cont.)

313_Book.indb 51 4/7/10 11:22:34 AM

52

Organizational Structure: Denition and Assignment

2

Transaction

Description

AOCO

Specify Cost Center Check Across Company Codes

OARC

Assets: Specify Retention Periods for Archiving

OACV

Assets: Dene Validation

OACS

Assets: Dene Substitution

sm30/V_T093C_

NOSKONTO

Prevent Subsequent Capitalization of Discounts

OA01

Determine Asset for Gain/Loss Individually (Substitution)

AO72

Post Net Book Value Instead of Gain/Loss

OAAZ

Asset Under Construction: Assign Settlement Prole to

Company Code

OAYU

Specify Capitalization of AUC/Down-Payment

SM30/V_T093C_15

Asset Under Construction: Assign Value Date Variant to

Company Code

SM30/V_T093C_09

Assets: Set Company Code Status

OAYE

Asset Data Transfer: Specify Sequence of Depreciation Areas

SM30/V_T093C_08

Asset Data Transfer: Specify Transfer Date/Last Closed Fiscal

Year

OAYC

Asset Data Transfer: Specify Last Period Posted in Prv. System

(Transf. During FY)

SM30/V_T093C_11

Asset Data Transfer: Specify Entry of Net Book Value (No

Accum. Ordinary Depr.)

OAYF

Asset Data Transfer: Recalculate Depreciation for Previous

Years

SM30/V_T093C_12

Asset Data Transfer: Recalculate Base Insurable Values

OAYG

Asset Data Transfer: Recalculate Replacement Values

OAYD

Asset Data Transfer: Transfer Foreign Currency Areas

GCL2

Assign Company Code to Ledger

GCVV

Maintain Local Validations (Special Ledger)

GCVX

Maintain Local Substitutions (Special Ledger)

GCP3

Maintain Local Version Parameters (Special Ledger)

GB02

Maintain Local Number Ranges - Plan (Special Ledger)

Table 2.1 Checklist for Creating a New Company Code (Cont.)

313_Book.indb 52 4/7/10 11:22:34 AM

53

Denition of Organizational Entities Relevant to Financial Accounting

2.1

Transaction

Description

GB04

Maintain Local Number Ranges - Actuals (Special Ledger)

SM37

Check Variants in Scheduled Programs

SM30

Check Company Code Usage in Non-Standard (Y* or Z*)

Tables

SE71

Check Forms (SAPscripts)

SMARTFORMS

Check Smart Forms

SO10

Check Standard Texts

Table 2.1 Checklist for Creating a New Company Code (Cont.)

Credit Control Area2.1.3

Quick Reference

Menu path: IMG

•

Enterprise Structure

•

Denition

•

Financial Accounting

•

Dene

Credit Control Area

Transaction: OB45

Table/view: T014/V_T014

The credit control area is the organizational unit under which the credit manage-

ment tools of Financial Accounting are managed. It can be company-code-specic,

or comprise more than one company code. (See Section 2.2.2, Company Code

to Credit Control Area, for more information about the relationship between the

credit control area and the company code.)

Use Transaction OB45 to create a new credit control area or to check the settings

of existing ones (Figure 2.3). Specify the credit control area code (four digits) and

the description.

The following additional customizing settings are available for each credit control

area:

Currency

(

1

)

One credit control area can comprise many company codes. The company codes

can have different local currencies, but there is just one credit limit. The cur-

rency in which the credit limit is managed is specied here, in the credit control

area.

313_Book.indb 53 4/7/10 11:22:34 AM

54

Organizational Structure: Denition and Assignment

2

Credit Control AreaFigure 2.3 Customizing Settings

Data for Updating SD

(

2

)

The settings in this area of Figure 2.3 are extremely important for credit con-

trolling. The Update eld species which SD (Sales and Distribution) documents

update the credit exposure of the customer, which is compared to the credit

limit when a new transaction is carried out. The credit exposure is recorded in

the customer credit master (Transaction FD32) and is broken down into the fol-

lowing four values:

Sales orders

Deliveries

Billing documents

not posted to Financial Accounting

Financial Accounting balances

When a sales order is delivered, the sales order exposure is reduced, and the

exposure for the deliveries is increased. The same happens for the other steps

in the sales chain. The Update eld species whether the credit exposure is

updated when you receive an order from a customer, or when the goods are

delivered. Four options are available:

Blank:

No update from SD. Only the Financial Accounting documents update

the credit exposure. SD orders, delivery, and billing documents not yet

313_Book.indb 54 4/7/10 11:22:35 AM

55

Denition of Organizational Entities Relevant to Financial Accounting

2.1

posted to Financial Accounting don’t have any effect on the credit

exposure.

000012:

The sales orders, deliveries, billing documents, and Financial

Accounting documents update the credit exposure.

000015:

Deliveries and Financial Accounting documents update the credit

exposure.

000018:

Sales orders, billing documents, and Financial Accounting docu-

ments update the credit exposure.

FY Variant

(

3

)

This is used to update the value for the sales order exposure based on the fore-

casted delivery date (Table SSSS).

Risk Category

(

4

)

If you specify a value here, all of the newly created customers (in one of the

company codes that belong to the credit control area) are automatically assigned

to the specied risk category.

Credit Limit

(

5

)

If you specify a value here, all of the newly created customers (in one of the

company codes that belong to the credit control area) automatically receive the

specied credit limit.

Rep. Group

(

6

)

If you specify a value here, all of the newly created customers (in one of the

company codes that belong to the credit control area) are automatically assigned

to the specied representative group.

All Co. Codes

(

7

)

If you select this ag, all of the company codes present in the system can post

to this credit control area.

Business Area2.1.4

Quick Reference

Menu path: IMG

•

Enterprise Structure

•

Denition

•

Financial Accounting

•

Dene

Business Area

Transaction: OX03

Table/view: TGSB/V_TGSB

313_Book.indb 55 4/7/10 11:22:35 AM

56

Organizational Structure: De nition and Assignment

2

The business area is an organizational unit that you can use freely for internal or

external reporting to depict segmentation of you business within or across com-

pany codes. The business area is available in general ledger reporting (in both the

classic General Ledger and the new SAP General Ledger), and can be set up in the

special ledger tables.

You create a business area using Transaction OX03 (Figure 2.4). Specify the busi-

ness area code (four digits) and the description, and save your entries.

Business AreasFigure 2.4

If you use the consolidation business areas , you assign the business area to the con-

solidation business area; see Section 2.2.3, Business Area to Consolidation Busi-

ness Area, for more details about this.

The business area can be assigned to the following nancial and controlling

objects:

Asset classes (Table ANKA)

Fixed assets (Table ANLP)

Cost centers (Table CSKS)

Internal orders (Table AUFK)

Investment program positions (Table IMPR)

Project de nitions (Table PROJ)

WBS elements (Table PRPS)

If you need to add the business area to non-standard-tables, and you want to know

which tables must be updated, follow the procedure described in Section 2.1.1,

Company, using the data type GSBER .

313_Book.indb 56 4/7/10 11:22:35 AM

57

De nition of Organizational Entities Relevant to Financial Accounting

2.1

Consolidation Business Area2.1.5

Quick Reference

Menu path: IMG

•

Enterprise Structure

•

De nition

•

Financial Accounting

•

Main-

tain Consolidation Business Area

Transaction: OCC1

Table/view: TGSBK /V_ TGSBK

You manage company codes and assign them to companies for consolidation pur-

poses. In the same way, you can assign business areas to consolidation business

areas for internal consolidation purposes.

Create a consolidation business area using Transaction OCC1 (Figure 2.5). Specify

the consolidation business area code (four digits long, according to the naming

convention de ned in your SAP implementation) and description. Then assign the

business areas to the consolidation business areas, as described in Section 2.2.3,

Business Area to Consolidation Business Area.

Consolidation Business AreaFigure 2.5

The consolidation business area can be managed in general ledgers, special ledgers,

and in the SAP consolidation tools.

Functional Area2.1.6

Quick Reference

Menu path: IMG

•

Enterprise Structure

•

De nition

•

Financial Accounting

•

De ne

Functional Area

Transactions: OKBD (older releases), FM_FUNCTION (new releases)

Table/view: TFKB /V_TFKB

313_Book.indb 57 4/7/10 11:22:36 AM

58

Organizational Structure: De nition and Assignment

2

With the functional area, you can keep track of the macro-departments where costs

and revenues arise, for example:

Administration

Production

Procurement

Sales

Human Resources

This type of accounting (i.e., accounting by department) is called cost-of-sales

accounting .

You create functional areas using Transaction FM_FUNCTION (OKBD in older

releases). For each of them, specify the functional area ID (16-digit maximum)

and the functional area description (Figure 2.6).

Functional AreaFigure 2.6 De nition

Functional area transaction data are updated in real time in the ledger 0F (Total

Table GLFUNCT , and Line Item Table GLFUNCA). The functional area can also be

used in your general ledgers and special ledgers.

You can assign the functional area in the master data of the following objects:

Fixed assets (Table ANLP)

Cost elements (Table CSKA)

313_Book.indb 58 4/7/10 11:22:36 AM

59

Denition of Organizational Entities Relevant to Financial Accounting

2.1

Cost centers (Table CSKS)

Cost center categories (Table TKA05)

Internal orders (Table AUFK)

Investment program positions (Table IMPR)

Project denitions (Table PROJ)

WBS elements (Table PRPS)

General ledger accounts (Table SKA1)

It’s also possible to use substitutions for the functional data update:

Transaction OBZM for functional area substitutions

Transaction OBBZ for assigning the substitutions to company codes

Note on Functional Area Activation

To use the functional data in the master data specied previously and to have the trans-

action data updated by functional area, you need to activate the cost of sales accounting

in customizing. Go to Financial Accounting

•

Financial Accounting Global Settings

•

Company Code

•

Cost of Sales Accounting

•

Activate Cost of Sales Accounting. You

also need to update the settings of the ledger 0F using Transaction GCL2; for example,

you need to assign the company code to the ledger. Refer to Chapter 7, Banking, for

more details about this.

If you need to add the functional area in non-standard tables and you want to

know which tables must be updated, follow the procedure described in Section

2.1.1, Company, using the data type FKBER.

Controlling Area2.1.7

Quick Reference

Menu path: IMG

•

Enterprise Structure

•

Denition

•

Controlling

•

Maintain Con-

trolling Area

Transaction: OX06

Table/view: TKA01/V_TKA01_GD

The controlling area is the organizational unit under which the Controlling (CO)

module works. Cost centers, prot centers, WBS elements, internal orders, and

cost elements are all objects whose master data are managed under a controlling

313_Book.indb 59 4/7/10 11:22:36 AM

60

Organizational Structure: De nition and Assignment

2

area. You assign one or more company codes to a controlling area; see Section

2.2.4, Company Code to Controlling Area, for instructions about how to do this.

Note on Controlling Area Creation

Refer to a SAP Controlling manual for a full description of how to create a controlling

area. A brief description is provided in this manual, but a more comprehensive descrip-

tion is beyond the scope of the book.

Create the controlling area using Transaction OX06, and follow these steps:

Select New Entries, and specify the controlling area code (four digits, according 1.

to the naming convention de ned for your SAP installation) and a description.

Then select Basic Data.

Controlling Area SettingsFigure 2.7

In the Basic Data screen (Figure 2.7), specify some of the most important set-2.

tings of the controlling area; refer to a CO manual for a comprehensive descrip-

313_Book.indb 60 4/7/10 11:22:37 AM

61

De nition of Organizational Entities Relevant to Financial Accounting

2.1

tion of the meaning of those settings. For the organizational structure de nition,

the CoCd R CO Area eld is fundamental; here, you specify if the controlling

area can be assigned to exactly one company code (Controlling Area Same as

Company Code ) or to more than one company code (Cross-Company-Code Cost

Accounting ).

Operating Concern2.1.8

Quick Reference

Menu path: IMG

•

Enterprise Structure

•

De nition

•

Controlling

•

Create Operat-

ing Concern

Transaction: KEP8

Table: TKEB

The operating concern is the organizational unit that occupies the highest level of

the SAP organizational hierarchy. It is used in the Pro tability Analysis module,

where you can analyze the pro t and loss of your company according to multiple

dimensions, such as customers, regions, products, and so on. You assign con-

trolling areas to exactly one operating concern; thus, each company code is also

assigned to exactly one operating concern. Refer to a CO manual for a comprehen-

sive guide to the creation of the operating concern and the con guration of the

COPA SAP module; a more thorough discussion than is provided here is beyond

the scope of this book.

Using Transaction KEP8 (Figure 2.8), you can create the operating concern ID and

the description. All of the speci c customizing settings and the generation of the

COPA environment are performed using Transaction KEA0.

Operating ConcernFigure 2.8

313_Book.indb 61 4/7/10 11:22:37 AM

62

Organizational Structure: Denition and Assignment

2

FAQ and Troubleshooting Tips2.1.9

Next we answer some frequently asked questions and offer helpful troubleshoot-

ing tips.

FAQ

Question:1. Are the company and the trading partner the same object in SAP?

Answer: Yes. The terms “company,” “trading partner,” and “internal trading

partner” are synonymous and all refer to the same organizational unit in SAP.

Question:2. What is the difference between the company and the global com-

pany code?

Answer: The company is used in your system to keep track of the company

code transactions and intercompany transactions from a consolidation point of

view; the global company code is needed to exchange information between

SAP systems with ALE (Application Linking and Embedding) interfaces.

Question: 3. When I copy one company code into another, what happens to the

number ranges?

Answer: The number ranges are copied from one company code to the other

but not recorded into the transport request. For internal number ranges, the

last number used is also copied.

Question:4. I’ve changed the update mode in the credit control area and trans-

ported to production. What should I do to have the new settings applied to all

of the existing customers?

Answer: If the update mode is changed, the system has to re-read all of the rel-

evant SD and Financial Accounting documents to get the credit exposure

updated. Run Transaction F.28 for the reconstruction of the credit limit.

Question: 5. I haven’t specied any default data for new customers (Risk Catego-

ry, Credit Limit, and Rep. Group left blank). I expected that the new customers

would be set up with a credit limit of zero; instead, there is no data in FD32,

and the credit control doesn’t work at all for the customer. What’s wrong?

Answer: If you don’t specify any default value in the credit control area set-

tings, the new customers are automatically set up as irrelevant to credit control-

ling (in technical terms, the record in Table KNKK, where the credit control

information is stored, isn’t created). To make the customer relevant for credit

controlling, you must manually process the customer using Transaction FD32.

If you want to ensure that new customers are automatically set up for credit

313_Book.indb 62 4/7/10 11:22:38 AM

63

Denition of Organizational Entities Relevant to Financial Accounting

2.1

controlling, make sure at least one entry in the Default Data for Automatically

Creating New Customers area (refer to Figure 2.3) is supplied. This guarantees

that the customer is automatically created in Table KNKK.

Question: 6. If I put a default value for Risk Category and/or Rep. Group, but I

don’t specify any default credit limit, will the new customers automatically

have a credit limit of zero?

Answer: Yes, exactly.

Question: 7. What is the relationship between the business area and the com-

pany code? Can I specify the possible business areas for each company code?

Answer: There is no hierarchical relationship between the company code and

the business area; as such, there is no standard customizing activity to assign

a business area to a company code, or to assign a company code to a business

area. If you want to limit the possible business areas in one company code,

you can create a validation. If the control requires a complete mapping

between several business areas and company codes, it may be worth creating

a non-standard table. In this case, you must use a user exit in the validation to

use the table for control purposes.

Question: 8. Can I still use the business area in SAP General Ledger?

Answer: Yes, the business area can be used as a dimension in SAP General

Ledger. If you look at the standard total table for SAP General Ledger, FAGL-

FLEXT, the eld RBUSA (Business Area) is included, so you don’t need to

enhance the SAP General Ledger tables using Transaction FAGL_GINS. How-

ever, if you are planning to upgrade from the classic General Ledger to SAP

General Ledger, you should consider using prot centers and segments

instead, as SAP is focusing its development on these two dimensions for seg-

ment reporting.

Question: 9. Is table group GLFUNC* still available if I use SAP General

Ledger?

Answer: Yes, it can be used as a dimension in SAP General Ledger. If you look

at the standard total table for SAP General Ledger, FAGLFLEXT, the eld

RFAREA (Functional Area) is included, so you don’t need to enhance the SAP

General Ledger tables using Transaction FAGL_GINS.

Question: 10. If I change the assignment of an object to a functional area, does it

affect the old postings or only the newly created postings?

Answer: In general ledger accounting tables and in the GLFUNC* tables, the

system updates the records with the functional area available at the time of

313_Book.indb 63 4/7/10 11:22:38 AM

64

Organizational Structure: Denition and Assignment

2

the postings. The reporting that reads these tables reads the historical assign-

ment to the functional area, not the assignment at the time the report is run.

Question:11. In my SAP implementation, SAP General Ledger isn’t active. I’m

trying to run Program RFBILA00, but I can’t get the functional area in the

output.

Answer: The functional area isn’t updated in Table GLT0, where the transac-

tion data is read from Program RFBILA00. The function isn’t supported.

Question:12. What does the generation of the COPA environment mean?

Answer: The COPA tables are specic to each operating concern; in other

words, the COPA table names include the name of each operating concern.

Therefore, the COPA tables are created by you, online, after you have com-

pleted the COPA customizing. The COPA environment generation is the cre-

ation of the COPA operating-concern-specic tables.

Question:13. Why is it possible to create the operating concern with Transaction

KEP8 with minimal settings (operating concern code and ID)? Wouldn’t it be

better to create an operating concern using Transaction KEA0, where a com-

plete COPA setup is possible?

Answer: The system allows the creation of an operating concern with mini-

mal settings so that the user can build up the enterprise structure, including

the assignment of controlling areas to operating concerns, in an early stage of

the SAP implementation project. At this point, it’s likely that high-level deci-

sions on the structure of the controlling have been made, but all of the details

about the building of the COPA module (characteristics, key gures, etc.)

aren’t yet dened.

Troubleshooting Tips

Issue:1. The extended withholding tax customizing isn’t copied.

Solution: Create the customizing manually. Maintain views (Transaction SM30)

V_T001WT and V_T001_EXT with the company-code-relevant data.

Issue:2. I receive error message TK455, “Enter numeric values only,” when copy-

ing the company code.

Solution: The error and the relevant solution is described in SAP Note

494490.

313_Book.indb 64 4/7/10 11:22:38 AM

65

Assignment of Organizational Entities Relevant to Financial Accounting

2.2

Issue:3. I receive message FC125, “Certain data was not copied,” when copying

the company code.

Solution: This is just an information message. The following assignments aren’t

copied from the source to the destination company code:

Assignment of company code to company. Perform this assignment using

Transaction OX16

Assignment of company code to FM area. Perform this assignment using

Transaction OF18.

Assignment of company code to cross-system company code (or global com-

pany code). Perform this assignment using Transaction OBY6.

Assignment of company code to controlling area. Perform this assignment

using Transaction OX19.

Issue: 4. I receive error message FC158 when copying the company code.

Solution: If the source company code is assigned to prot center ledger 8A, the

destination company code inherits the same assignment — even though the

assignment to the controlling area isn’t copied. You can’t use prot center

accounting in a company code without assigning the company code to a con-

trolling area; to avoid this error message, make sure this is done.

Assignment of Organizational Entities Relevant to 2.2

Financial Accounting

Now that you understand how to dene the organizational entities relevant for

Financial Accounting, we explain how to assign them. In this section, we discuss

the following assignments:

Company code to company

Company code to credit control area

Business area to consolidation business area

Company code to controlling area

Controlling area to operating concern

Plant to company code

Sales organization to company code

Personnel area to company code

313_Book.indb 65 4/7/10 11:22:38 AM

66

Organizational Structure: De nition and Assignment

2

(Refer to the appropriate manuals for information about the creation of plants,

sales organizations, and personnel areas; because they aren’t Financial Accounting

or Controlling organizational entities, we don’t discuss them here.)

Company Code to Company2.2.1

Quick Reference

Menu path: IMG

•

Enterprise Structure

•

Assignment

•

Financial Accounting

•

As-

sign Company Code to Company

Transaction: OX16

Table/view: T001 /V_001_Y

For consolidation purposes, each company code can be assigned to a company. Use

Transaction OX16 (Figure 2.9) for this purpose. The system automatically presents

all of the company codes available, and you specify the company to which they

belong in the Company column. Save your settings. Note that this step can also

be performed in Transaction OBY6, together with all of the most relevant settings

of the company code.

Assign Company Code to CompanyFigure 2.9

Company Code to Credit Control Area2.2.2

Quick Reference

Menu path: IMG

•

Enterprise Structure

•

Assignment

•

Financial Accounting

•

As-

sign Company Code to Credit Control Area

Transaction: OB38

Table/view: T001/V_001_X

313_Book.indb 66 4/7/10 11:22:38 AM

67

Assignment of Organizational Entities Relevant to Financial Accounting

2.2

The SAP Credit Management module allows you to keep track of the credit expo-

sure of customers and also to set credit limits. You can also issue warnings or error

messages if the credit exposures overrun a certain percentage of the credit limit.

The credit management isn’t performed at the company code level but at the credit

control area level, and you must assign each company code to a credit control area.

The same credit control area can have one or many company codes assigned to it.

Each time a transaction relevant for the credit control is performed in the company

code, the credit exposure in the connected credit control area is updated, and the

credit limit set in the connected credit control area is checked.

You assign the company code to the credit control area in customizing using Trans-

action OB38. The system presents all of the company codes, and you specify the

connected credit control area in the relevant column (Figure 2.10). In addition,

you can specify whether it’s possible to use a different credit control area in the

document itself by selecting the Overwrite CC Area ag in the last column of the

screen.

Many (company code)

TO

One (credit control area)

ASSIGNMENT

Activate the possibility

to specify the credit

control area in each

document

Assigning Company Code to Credit Control AreaFigure 2.10

313_Book.indb 67 4/7/10 11:22:39 AM

68

Organizational Structure: Denition and Assignment

2

Business Area to Consolidation Business Area2.2.3

Quick Reference

Menu path: IMG

•

Enterprise Structure

•

Assignment

•

Financial Accounting

•

As-

sign Business Area to Consolidation Business Area

Transaction: OBB6

Table/view: TGSB/V_GSB_A

You assign each business area to a consolidation business area using Transaction

OBB6. The system presents all of the business areas available in the system and

allows you to assign them to a consolidation business area in the Cons.Bus.Area

column. This is all you need to do under the Enterprise Structure denition.

Note that the consolidation business area has a very limited use in the SAP envi-

ronment; as such, you should make an in-depth investigation before deciding to

use this organizational unit in your SAP implementation. For example, unlike the

business area, the consolidation business area isn’t updated in the general ledger

total tables GLT0 and FLAGFLEXT, so it’s not available in most of the standard

Financial Accounting reports.

Company Code to Controlling Area2.2.4

Quick Reference

Menu path: IMG

•

Enterprise Structure

•

Assignment

•

Controlling

•

Assign Com-

pany Code to Controlling Area

Transaction: OX19

Table/view: TKA02/V_TKA02

You assign each company code to a controlling area to manage your internal con-

trolling in an integrated way. Note that activities such as internal allocations of

costs can be performed between objects (such as cost centers) that belong to dif-

ferent company codes only if the two company codes belong to the same control-

ling area.

To assign a company code to a controlling area, use the path specied in the pre-

ceding box and follow these steps (Figure 2.11):

Select a Controlling area, and double-click the Assignment of Company Code(s) 1.

folder (

1

).

313_Book.indb 68 4/7/10 11:22:39 AM

69

Assignment of Organizational Entities Relevant to Financial Accounting

2.2

In the right side of the resulting screen, you can see the company codes assigned 2.

to the controlling area you have selected (

2

). To assign a new controlling area,

select New Entries.

If you click on the matchcode for the company codes, the system displays all of 3.

the company codes not yet assigned to a controlling area. Select the company

code you want to assign, and save your entries.

Assign Company Code to Controlling AreaFigure 2.11

Controlling Area to Operating Concern2.2.5

Quick Reference

Menu path: IMG

•

Enterprise Structure

•

Assignment

•

Controlling

•

Assign Con-

trolling Area to Operating Concern

Transaction: KEKK

Table/view: TKA01_ER/TKA01_ER

313_Book.indb 69 4/7/10 11:22:41 AM

70

Organizational Structure: De nition and Assignment

2

You can assign several controlling areas to one operating concern using Transac-

tion KEKK (Figure 2.12). The system displays all of the controlling areas available

in the system and allows you to assign them to the operating concern in the OpCo

column. That’s all you need to do under the Enterprise Structure de nition.

In assigning a controlling area to an operating concern, you also indirectly assign

the company code to the operating concern. Refer to a Controlling manual to fully

understand the consequence of this assignment; a more thorough discussion is

beyond the scope of this book.

Assigning Controlling Area to Operating ConcernFigure 2.12

Plant to Company Code2.2.6

Quick Reference

Menu path: IMG

•

Enterprise Structure

•

Assignment

•

Logistics General

•

Assign

Plant to Company Code

Transaction: OX18

Table/view: T001K_ASSIGN /V_T001K_ASSIGN

The plant is the basic organizational unit in the Logistics modules and can repre-

sent a factory, branch, or any physical segmentation of a legal entity. Each plant is

assigned to exactly one company code. The assignment of the plant to a company

code can be performed by a Materials Management (MM) expert or by a Financial

Accounting expert, depending on the organizational rules de ned in your com-

pany. To perform the assignment, follow this procedure:

313_Book.indb 70 4/7/10 11:22:42 AM

71

Assignment of Organizational Entities Relevant to Financial Accounting

2.2

Select Transaction OX18 (Figure 2.13). The system displays a list of all of the 1.

company codes present in the system and all of the plants assigned to each of

them.

If you need to assign a new plant to an existing company code, position the cur-2.

sor on the company code, and click the Assign button.

The system displays a list of the plants not yet assigned to any company code. 3.

Select your plant, and click the Continue button (

). Save your entries.

Assign Plant to Company CodeFigure 2.13

If you make a mistake in the assignment and the plant has never been used, you can

correct the mistake by positioning the cursor over the plant and pressing the Delete

button. Then follow the procedure just described to perform the correct assignment.

Sales Organization to Company Code2.2.7

Quick Reference

Menu path: IMG

•

Enterprise Structure

•

Assignment

•

Sales and Distributions

•

As-

sign Sales Organization to Company Code

Transaction: OVX3

Table/view: TVKO/V_TVKO_ASSIGN

313_Book.indb 71 4/7/10 11:22:42 AM

72

Organizational Structure: Denition and Assignment

2

Each sales organization is assigned to exactly one company code. The assignment

of the sales organization to a company code can be performed by an SD expert or

by a Financial Accounting expert, depending on the organizational rules dened

in your company. To perform the assignment, follow these steps:

Select Transaction OVX3 (Figure 2.14). The system displays a list of all of the 1.

company codes present in the system and of the sales organization assigned to

each of them.

If you need to assign a new sales organization to an existing company code, 2.

position the cursor over the company code, and click Assign.

The system displays a list of all of the sales organizations not yet assigned to 3.

any company codes. Select your sales organization, and conrm the selection.

Save your entries.

Assign Sales Organization to Company CodeFigure 2.14

If you make a mistake in the assignment and the sales organization has never been

used, you can correct the mistake by positioning the cursor over the sales organiza-

tion and pressing the Delete button. Then follow the procedure just described to

perform the correct assignment.

313_Book.indb 72 4/7/10 11:22:43 AM

73

Assignment of Organizational Entities Relevant to Financial Accounting

2.2

Personnel Area to Company Code2.2.8

Quick Reference

Menu path: IMG

•

Enterprise Structure

•

Assignment

•

Human Resources Manage-

ment

•

Assignment of Personnel Area to Company Codes

Table/view: T500P/V_T500P

The personnel area is an organizational unit used in SAP Human Resources Man-

agement (SAP HRM). Each personnel area must be assigned to exactly one com-

pany code. Because the assignment requires an in-depth knowledge of SAP HRM,

we strongly recommend that this customizing activity is performed by, or in coor-

dination with, an SAP HRM consultant. A more thorough description of this pro-

cess is beyond the scope of this book.

FAQ and Troubleshooting Tips2.2.9

Next we answer some frequently asked questions and offer helpful troubleshoot-

ing tips.

FAQ

Question:1. What happens if I change the assignment of a company code to a

company when the company code is already productive?

Answer: You shouldn’t change assignments when a company code is already in