* Freddie replaced appraisal waivers with ACE+PDR in July 2022 for no cash out loans with LTV greater than 90% and all cash out loans. The

new program requires onsite property information collection.

** Fannie's value acceptance + property data program was activated in Desktop Underwriter on Apr. 15

th

and is reported as “Appraisal

Waiver plus Property Data Collection – Condition” in the data from June 20

th

onwards. Freddie’s ACE+PDR was initially reported as “Onsite

Property Data Collection”, but the reporting changed to "Appraisal Waiver plus Property Data Collection - Condition" on Sep. 7

th

, 2023.

“Onsite Property Data Collection” is now renamed to “Appraisal Waiver plus Property Data Collection – Value”. “Appraisal Waiver plus

Property Data Collection – Condition”, “Appraisal Waiver plus Property Data Collection – Value” and Waiver counts are mutually exclusive.

To read our comment letter to FHFA on appraisal-related policies, practices, and processes, please click here.

Sources: Fannie Mae & Freddie Mac, tabulated by the AEI Housing Center.

Key Points:

• The share of appraisal waivers for both GSEs

combined for January 2024 stood at 12%, down 0.3

ppts. from last month and down 37 ppts. from its

series’ peak in March 2021. In August 2023, shares

for Fannie and Freddie converged for the first time

since June 2021 and have moved in lock step since

then.

• Freddie introduced ACE+PDR* in July 2022. In

January 2024, these shares stood at 1.7%, 9.4% and

4.8% for Purchase, Cash-Out, and No Cash-Out

loans, respectively.

• Fannie introduced Value Acceptance + Property

Data (VA+PD)** in April 2023. In January 2024, the

share of the new program was 0.5%, 5.5%, and

1.6% for Purchase, Cash-Out, and No Cash-Out

loans, respectively.

• The introduction of both programs subsequently

reduced waiver shares, but the data show that both

programs have not picked up the entire slack,

suggesting further policy changes and/or slow

market pick-up.

• Waivers are granted using a data-based analysis of

the reasonableness of the applicant’s self-valuation.

The data measure whether an appraisal waiver was

used, not only granted, on the loan.

• For detailed and historical data, please see the

spreadsheet on our website.

Prevalence of GSE Appraisal Waivers

January 2024 originations

Appraisal waiver and new program counts and shares by agency and purpose

0%

10%

20%

30%

40%

50%

60%

GSE combined

Freddie

Fannie

Share of GSE loans with appraisal waiver, by guarantor

Waiver shares in Jan.2024:

• Fannie: 11%, down from 44% in Sept. 2021

• Freddie: 12%, down from 36% in Sept. 2021

0%

1%

2%

3%

4%

5%

6%

7%

8%

9%

10%

Shares of GSE loans with the new programs

Freddie ACE+PDR Purchase

Freddie ACE+PDR Cash-Out

Freddie ACE+PDR No Cash-Out

Fannie VA+PD Purchase

Fannie VA+PD Cash-Out

Fannie VA+PD No Cash-Out

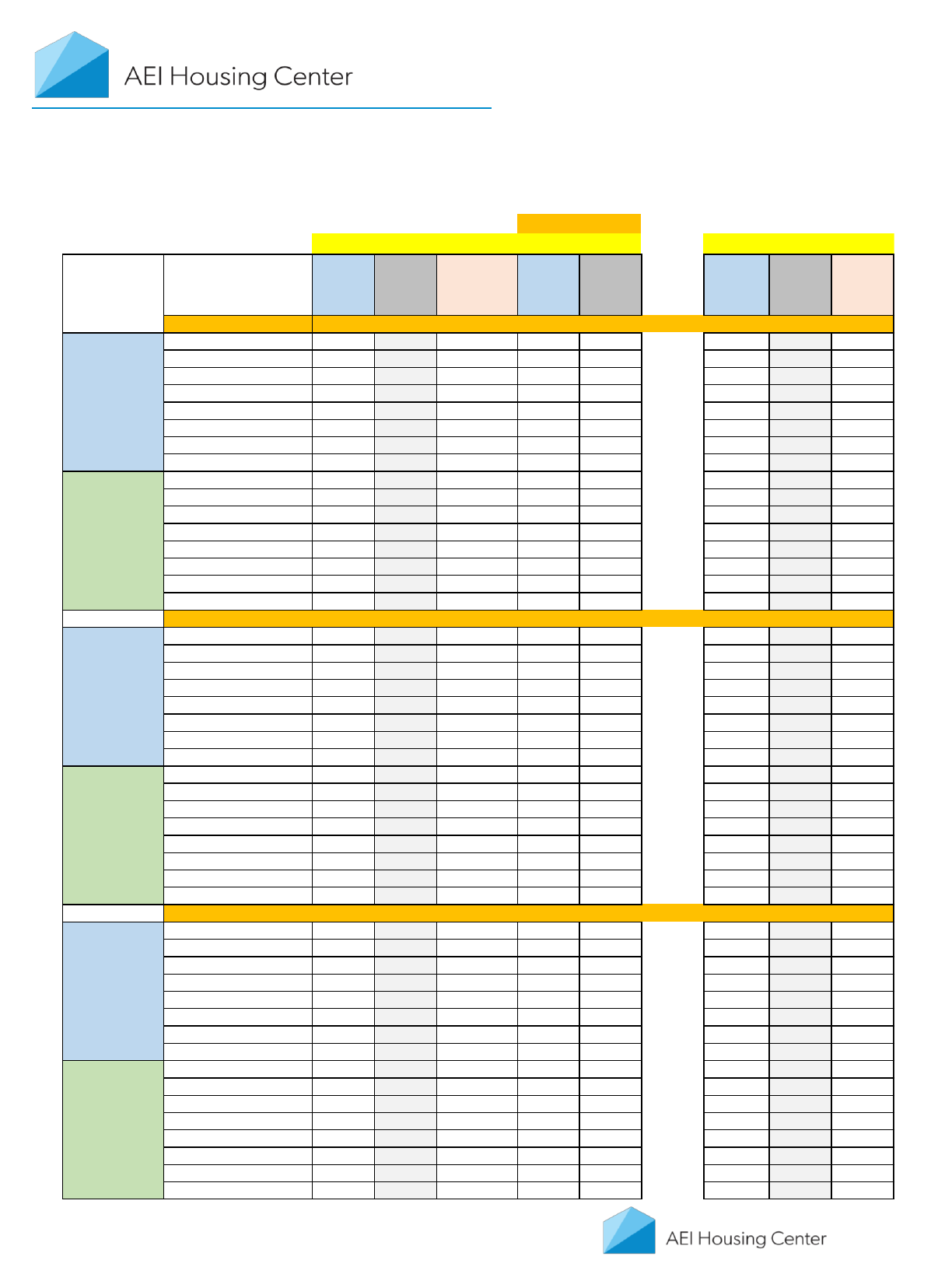

Cash-Out No Cash-Out Purchase Total Cash-Out No Cash-Out Purchase Total

Appraisal 6,237 2,030 43,588 51,855 5,136 2,379 49,163 56,678

Appraisal Waiver plus Property Data Collection - Condition 645 121 887 1,652 420 48 293 760

Appraisal Waiver plus Property Data Collection - Value 0 0 0 0 232 23 192 447

Waiver 0 349 6,893 7,241 1,801 580 4,861 7,242

Total 6,882 2,500 51,367 60,749 7,590 3,029 54,509 65,128

Cash-Out No Cash-Out Purchase Total Cash-Out No Cash-Out Purchase Total

Appraisal 90.6% 81.2% 84.9% 85.4% 67.7% 78.5% 90.2% 87.0%

Appraisal Waiver plus Property Data Collection - Condition 9.4% 4.8% 1.7% 2.7% 5.5% 1.6% 0.5% 1.2%

Appraisal Waiver plus Property Data Collection - Value 0.0% 0.0% 0.0% 0.0% 3.1% 0.7% 0.4% 0.7%

Waiver 0.0% 14.0% 13.4% 11.9% 23.7% 19.1% 8.9% 11.1%

Total 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0%

January 2024: Counts

Freddie Mac

Fannie Mae

January 2024: %

Freddie Mac

Fannie Mae

* Data are for purchase and refinance loans combined. The top lenders are ranked based on their use of the new valuation programs

(Freddie’s ACE+PDR and Fannie’s VA+PD) from June 2022 to January 2024.

** Include all GSE loans using full appraisal, waiver, or the new valuation programs.

Sources: Fannie Mae & Freddie Mac, tabulated by the AEI Housing Center.

Freddie ACE+PDR

• A number of smaller lenders were among the early adopters of Freddie’s ACE+PDR program from July 2022 to March

2023.

• In April 2023, Rocket Mortgage began using ACE+PDR and has since become the top lender using the new program.

• In January 2024, Rocket Mortgage (23%) and United Wholesale Mortgage (17%) are the two largest lenders using

ACE+PDR.

Fannie VA+PD

• There has been a distinct shift in the adoption of Fannie’s VA+PD program as it moves away from many smaller

lenders towards a few larger ones.

• For example, a total of 168 lenders used VA+PD in September 2023; however, only 54 lenders used VA+PD in

November 2023.

• Rocket Mortgage has grown to be the largest lender using VA+PD, accounting for 49% (375 out of 760 loans) of all

VA+PD loans in January 2024.

Use of the New Valuation Programs by Lender

January 2024 originations

Top lenders using the new valuation programs by agency

June 2022 - January 2024: Shares*

Freddie

ACE+PDR

Fannie

VA+PD

All GSE

Loans**

Rocket Mortgage

23% 33% 9%

United Wholesale Mortgage

21% 15% 9%

Mr. Cooper

11% 4% 2%

Guaranteed Rate

6% 5% 2%

Pennymac

4% 3% 6%

Rest

36% 40% 72%

Total 100% 100% 100%

Benchmarked against their market shares of all GSE loans**, Rocket Mortgage, United Wholesale Mortgage, Mr. Cooper,

and Guaranteed Rate have a significantly larger share for the new programs. These 4 lenders account for 60% of Freddie’s

ACE + PDR and for 57% of Fannie’s VA + PD. By contrast, they only account for 22% of all GSE loans**.

0

200

400

600

800

1,000

1,200

1,400

1,600

1,800

2,000

Rocket Mortgage

United Wholesale Mortgage

Rest

Use of Freddie ACE+PDR by Lender*

0

200

400

600

800

1,000

1,200

1,400

1,600

1,800

2,000

Rocket Mortgage

United Wholesale Mortgage

Rest

Use of Fannie VA+PD by Lender*

* New valuation programs refer to Freddie ACE+PDR program and Fannie VA+PD program.

** Include all GSE loans using full appraisal, waiver, or the new valuation programs.

Note: Freddie ACE+PDR loans started to appear in our data from September 2022, and Fannie VA+PD loans started to appear from June 2023.

Sources: Fannie Mae & Freddie Mac, tabulated by the AEI Housing Center.

Compared to banks, non-banks are more likely to originate loans with the new programs*.

From January 2023 to January 2024,

• Non-banks accounted for 91% of GSE loans with a new valuation program (purchase and refinance combined),

but for only 72% of all GSE loans**.

• Banks accounted for 8% of GSE loans with a new valuation program (purchase and refinance combined), but

for 25% of all GSE loans**.

Use of the New Valuation Programs by Lender Type

January 2024 originations

In January 2024, the share of loans using the new valuation programs* is about twice as high for non-banks

as it is for banks.

• The share of Freddie loans using ACE+PDR is 3.1%, 1.3%, and 1.7% for non-banks, large banks, and other

banks, respectively.

• The share of Fannie loans using VA+PD is 1.5%, 0.6%, and 0.1% for non-banks, large banks, and other banks,

respectively.

91%

4%

4%

1%

0%

Share by Lender Type

(New Valuation Programs*)

Non-bank

Other bank

Large bank

Credit union

State housing agencies

72%

9%

15%

2%

1%

Share by Lender Type (All GSE Loans**)

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

3.0%

3.5%

Large Bank Non-Bank Other Bank Combined

Share of Freddie loans using ACE+PDR

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

Large Bank Non-Bank Other Bank Combined

Share of Fannie loans using VA+PD

Risk Characteristics of GSE Appraisal Waivers

SHARE OF FREDDIE/FANNIE LOANS WITH AN APPRAISAL OR APPRAISAL WAIVER BY LTV BIN WITH AVERAGE MORTGAGE DEFAULT RATE (MDR)

LTV bin is a major constraint on appraisal waiver eligibility. Even after taking LTV bin into account, the MDRs on loans with an appraisal waiver

are generally lower than for loans without a waiver, indicating the GSEs are applying other credit constraints that further reduce risk.

Sources: Fannie Mae & Freddie Mac, tabulated by the AEI Housing Center

CLTV Buckets Appraisal

Waiver

Used

Share Using

Waiver

Appraisal

Waiver

Used

Appraisal

Waiver

Used

Share

Using

Waiver

Purchase

60% or below 13.4% 34.8% 29% 1.7% 1.6% 6.7% 24.3% 25%

61 to 70% 7.3% 14.9% 24% 3.8% 3.5% 4.4% 15.1% 24%

71-75% 9.3% 13.0% 18% 5.7% 4.6% 7.7% 14.9% 15%

76-80% 20.8% 37.3% 22% 6.8% 5.9% 26.2% 45.7% 14%

81-85% 4.6% 0.0% 0% 4.7% 0.0% 0%

86-90% 12.1% 0.0% 0% 13.8% 0.0% 0%

91-95% 22.9% 0.0% 0% 28.4% 0.0% 0%

Above 95% 9.6% 0.0% 0% 8.0% 0.0% 0%

60% or below 12.5% 30.3% 19% 1.7% 1.5% 7.3% 22.3% 13%

61 to 70% 7.5% 13.8% 15% 3.8% 3.5% 4.9% 11.7% 10%

71-75% 9.9% 12.2% 11% 5.5% 4.5% 7.8% 11.4% 7%

76-80% 21.7% 43.8% 17% 6.5% 5.9% 24.4% 54.6% 10%

81-85% 4.8% 0.0% 0% 4.2% 0.0% 0%

86-90% 12.7% 0.0% 0% 12.9% 0.0% 0%

91-95% 20.0% 0.0% 0% 25.6% 0.0% 0%

Above 95% 10.9% 0.0% 0% 12.8% 0.0% 0%

Cash-Out

60% or below 60.2% 0% 32.5% 66.5% 2%

61 to 70% 20.2% 0% 20.1% 32.4% 1%

71-75% 10.5% 0% 19.0% 0.0% 0%

76-80% 9.1% 0% 28.4% 0.3% 0%

81-85% 0.0% N/A 0.0% 0.0% 0%

86-90% 0.0% N/A 0.0% 0.0% N/A

91-95% 0.0% N/A 0.0% 0.3% 100%

Above 95% 0.0% N/A 0.0% 0.5% 67%

60% or below 60.0% 84.6% 31% 6.7% 6.5% 32.0% 63.0% 31%

61 to 70% 19.5% 15.4% 20% 14.3% 12.9% 20.9% 37.0% 29%

71-75% 10.6% 0.0% 0% 19.7% 0.0% 0%

76-80% 9.9% 0.0% 0% 27.4% 0.0% 0%

81-85% 0.0% 0.0% N/A 0.0% 0.0% N/A

86-90% 0.0% 0.0% N/A 0.0% 0.0% N/A

91-95% 0.0% 0.0% N/A 0.0% 0.0% N/A

Above 95% 0.0% 0.0% N/A 0.0% 0.0% N/A

No Cash-Out

60% or below 48.4% 46.1% 13% 4.8% 4.6% 23.8% 32.9% 61%

61 to 70% 16.9% 20.4% 16% 10.1% 8.2% 13.8% 24.0% 66%

71-75% 10.7% 12.4% 16% 14.2% 9.8% 11.3% 23.9% 71%

76-80% 11.5% 14.2% 17% 12.7% 10.4% 16.6% 18.7% 56%

81-85% 3.9% 2.8% 10% 16.0% 17.2% 10.1% 0.2% 2%

86-90% 3.8% 4.0% 15% 17.5% 18.5% 12.6% 0.3% 3%

91-95% 4.4% 0.0% 0% 11.1% 0.0% 0%

Above 95% 0.2% 0.0% 0% 0.6% 0.0% 2%

60% or below 42.4% 63.5% 26% 4.4% 4.6% 24.7% 28.7% 57%

61 to 70% 17.5% 15.8% 18% 10.0% 7.8% 14.8% 19.1% 59%

71-75% 13.3% 10.2% 16% 12.3% 11.0% 11.7% 21.1% 67%

76-80% 12.8% 6.7% 11% 11.5% 11.9% 15.7% 18.6% 57%

81-85% 3.8% 1.1% 7% 14.7% 11.4% 9.6% 5.1% 38%

86-90% 5.1% 2.6% 11% 18.6% 16.2% 11.8% 7.5% 42%

91-95% 5.0% 0.0% 0% 11.0% 0.0% 0%

Above 95% 0.1% 0.0% 0% 0.6% 0.0% 0%

Fannie Mae

Agency

Freddie Mac

Fannie Mae

Freddie Mac

Fannie Mae

Average MDR

January 2024

January 2024

April 2020

Freddie Mac