TRD-41413 Instructions Inst.pg.1 www.tax.newmexico.gov

Rev. 07/01/2024

CONTACTING THE DEPARTMENT

Local Taxation and Revenue Oces

If you need to visit the Department in person you can visit

one of our tax district oces at one of the following locations:

ALBUQUERQUE

10500 Copper Ave. NE, Suite C

Albuquerque, NM 87123

SANTA FE

Manuel Lujan Senior Building

1200 S. St. Francis Dr.

Santa Fe, NM 87505

FARMINGTON

3501 E. Main St., Ste N

Farmington, NM 87402

LAS CRUCES

2540 El Paseo Bldg. 2

Las Cruces, NM 88001

ROSWELL

400 N. Pennsylvania Ave., Ste 200

Roswell, NM 88201

Phone Contact

You can contact the Department’s call center and they can

provide full service and general information about the De-

partment’s taxes, Taxpayer Access Point (TAP), programs,

classes, and forms. They can also provide assistance with

information specic to your account including your ling sit-

uation, payment plans, and delinquent account information.

Call Center: (866) 285-2996.

You may also locate your account information through the

Taxpayer Access Point (TAP), https://tap.state.nm.us.

What You Need

When you call or visit us on the web, make sure to have

your New Mexico Business Tax Identication Number

(NMBTIN)(previously known as your CRS number), a copy

of your tax return, or letter in question.

Note: If you are inquiring about a letter please locate the

Letter ID in the top right hand corner to provide to the De-

partment’s agent.

Mailing Address

If you want to write us about your return, please address

your letter to:

Gross Receipts Tax Correspondence

Taxation and Revenue Department

P.O. BOX 25128

Santa Fe, NM 87504-5128

If you are writing in response to a letter, please include the

Letter ID in your response.

Email Contacts

The Taxation and Revenue Department provides several

email contacts for you.

If you have questions about your in-progress Gross Receipts

Tax (GRT) return, the instructions, a return you already sub-

mitted, or your refund, email: GRT[email protected].

If you have questions about New Mexico tax law and need

additional clarication on statutes and regulations, email:

Policy.Oce@tax.nm.gov.

Forms and Instructions

You can nd forms and instructions on

our website at

www.tax.newmexico.gov.

At the top of the page, click

FORMS & PUBLICATIONS.

Online Services

The TAP website at https://tap.state.nm.us is a secure online

resource that lets you electronically le your return for free:

• See information about your return, payment, and refund

• Pay existing tax liabilities online

• Check the status of a refund

• Change your contact information

• Register a business

NEW MEXICO TAXATION AND REVENUE DEPARTMENT

GROSS RECEIPTS TAX RETURN

GENERAL INFORMATION

This document provides instructions for the New Mexico

Form TRD - 41413, Gross Receipts Tax Return. Each Form

TRD-41413 is due on or before the 25th of the month following

the end of the tax period being reported. Certain taxpayers

are required to le the Form TRD-41413 electronically. For

more information on whether electronic ling is required for

your business, please see FYI-108, Electronic Filing Mandate

which is available through your local district oce or online

at https://www.tax.newmexico.gov/forms-publications/.

Please Note: When completing your form, all pertinent col-

umns must be clearly lled out and completed or your Form

TRD-41413 may be rejected and returned for correction and

will need to be resubmitted.

Important: If you will be having another party outside of the

taxpayer wanting access to your account, you will need to

complete Form ACD-31102, Tax Information Authorization

Disclosure, which can be located on our website in the "Tax

Authorization folder here:

https://www.tax.newmexico.gov/forms-publications/.

GENERAL INSTRUCTIONS

TRD-41413 Instructions Inst.pg.2 www.tax.newmexico.gov

WHAT TO KNOW AND DO BEFORE YOU BEGIN

Who Must File A Gross Receipts Tax Return

The gross receipts tax is a tax imposed on persons engaged

in business in New Mexico for the privilege of doing busi-

ness in New Mexico.

“Engaging in business” means carrying on or causing to be

carried on any activity with the purpose of direct or indirect

benet. For those that lack physical presence in New

Mexico, including a marketplace provider, it means having

at least $100,000 of taxable gross receipts sourced to New

Mexico in the previous calendar year. See What is Gross

Receipts Tax below for more information. For more informa-

tion on physical presence or nexus, see our website here:

https://www.tax.newmexico.gov/businesses/determining-nexus/.

What is Gross Receipts Tax

“Gross receipts” means the total amount of money or the

value of other consideration received from selling property in

New Mexico, leasing or licensing property employed in New

Mexico, from granting a right to use a franchise employed in

New Mexico, performing services in New Mexico or selling

research and development services performed outside New

Mexico the product of which is initially used in New Mexico.

Gross receipts includes receipts from:

• Sales of tangible personal property handled on consign-

ment;

• Commissions and fees received;

• Amounts paid by members of any cooperative associa-

tion;

• Fees received by persons for serving as disclosed agents

for another;

• Amounts received by persons providing telephone or

telegraph services;

• Amounts received by a New Mexico orist from the sale

of owers, plants, etc., that are lled and delivered out-

side New Mexico by an out-of-state orist;

• Providing intrastate mobile telecommunications services

(i.e., the services originate and terminate in the same

state) to customers whose place of primary use is in New

Mexico; and

• Amounts collected by a marketplace provider engaging

in business in the state from sales, leases and licens-

es of tangible personal property, sales of licenses and

sales of services or license for use of real property that

are sourced to New Mexico by a marketplace provider on

behalf of a marketplace seller(s) regardless if the market-

place seller(s) are engaging in business in New Mexico.

For more detail, see FYI-105,Gross Receipts & Compensating

Taxes: An Overview available through your local district oce

or at https://www.tax.newmexico.gov/forms-publications/.

Gross Receipts and Compensating Tax Rate Table

Gross receipts tax is based on municipality/county locations

and reported/collected based on location code. The Depart-

ment releases the Gross Receipts and Compensating Tax

Rate Schedule semiannually and has the listing of counties,

municipalities, location codes for each, and the tax rate.

The location codes are used to determine which tax rate

should be used when ling your return. The gross receipts

and compensating tax rates can change on January 1 and

July 1 of each year, so it is important to check the Gross

Receipts and Compensating Tax Rate Schedule for new

rates located online at

https://www.tax.newmexico.gov/governments/gross-receipts-

location-code-and-tax-rate-map/

.

Location Code and Tax Rate

Gross receipts tax is required to be reported by municipality,

county, and location code as described in Section 7-1-14

NMSA 1978 as follows:

B. Reporting location for receipts from the sale, lease, or

granting of a license to use real property located in New

Mexico and any related deductions shall be the location

of the property.

C. Reporting location for receipts from the sale or license

of property, other than real property, and any related de-

ductions, shall be at the following locations:

(1) if the property is received by the purchaser at the

New Mexico location of the seller, the location of the

seller;

(2) if the property is not received by the purchaser at a

business location of the seller, the location indicated

by instructions for delivery to the purchaser, or the

purchaser's donee, when known to the seller;

(3) if Paragraphs (1) and (2) of this subsection do not

apply, the location indicated by an address for the

purchaser available from the business records of the

seller that are maintained in the ordinary course of

business; provided that use of the address does not

constitute bad faith;

(4) if Paragraphs (1) through (3) of this subsection do not

apply, the location for the purchaser obtained during

consummation of the sale, including the address of a

purchaser's payment instrument, if no other address

is available; provided that use of this address does

not constitute bad faith; or

(5) if Paragraphs (1) through (4) of this subsection do

not apply, including a circumstance in which the

seller is without sucient information to apply those

standards, the location from which the property was

shipped or transmitted.

D. The reporting location for gross receipts from the lease

of tangible personal property, including vehicles, other

transportation equipment and other mobile tangible per-

sonal property, and any related deductions, shall be the

location of primary use of the property, as indicated by

the address for the property provided by the lessee that

is available to the lessor from the lessor's records main-

tained in the ordinary course of business; provided that

use of this address does not constitute bad faith. The

location of primary use shall not be altered by intermit-

tent use at dierent locations, such as use of business

property that accompanies employees on business trips

TRD-41413 Instructions Inst.pg.3 www.tax.newmexico.gov

FILING METHODS

Dierent Filing Methods

You can le your Gross Receipts Tax Return (TRD-41413) on

paper or electronically. Both options are described here to

help you choose the most convenient method. The Depart-

ment asks that the Gross Receipts Tax return be led online

using the Taxpayer Access Point (TAP) whenever possible.

TAP is a free online ling option that can be located by going

to our website at https://tap.state.nm.us.

Important: After completing your paper or electronic return,

make a copy for your records and keep it in a safe place.

Electronic Filing and Payment Mandate

For taxpayers with an average monthly tax liability for gross

receipts tax during the preceding calendar of $1,000 or more,

shall be electronically led and remitted by electronic means.

The following electronic methods of remitting tax payments

will be accepted: credit card, ACH debit, and ACH credit. For

more information see FYI-401, Special Payment Methods

located on our website here: https://www.tax.newmexico.gov/

forms-publications/ in the "Publications" folder.

For more information about ling electronically see the next

section Filing Methods.

Getting Ready to File

Follow these steps before you start lling out your TRD-41413,

Gross Receipts Tax Return:

1. Collect all forms and schedules you are required to le,

publications you need to reference, and all your tax

records.

For a description of dierent forms and schedules, see

Required Forms and Attachments starting on page 4 of

these instructions. To nd out where to get the forms and

schedules you need, see Contacting the Department on

page 1.

2. Read the next section, Valid Identication Number Re-

quired, to learn about New Mexico Business Tax Identi-

cation Number (NMBTIN), Federal Employer Identica-

tion Number (FEIN), Social Security Numbers (SSN) and

Individual Taxpayer Identication Numbers (ITIN).

Benets of Filing Electronically

The Department encourages you to le electronically when-

ever possible. Electronic ling is fast, safe, secure, and it

provides these benets:

• Filing is free on the Department website.

• File return, pay, and request a refund.

• View all letters sent by the Department.

• View your account and see if there are any missing

returns or payments.

• You can speak with an agent while viewing your account

and they can walk you through using TAP or any noti-

cations you may be seeing on your account.

• You can also provide third-party access to your accoun-

tant to be able to complete returns, le, and pay your tax

due.

• The state saves tax dollars in processing costs and

results in faster processing times for returns and pay-

ments submitted to the Department.

Using The Department Website, Taxpayer Access Point

(TAP)

To le your return on the Department website, follow these

steps:

1. Logon or create a TAP account at https://tap.state.nm.us.

2. Select Gross Receipts Tax (GRT).

3. Within the Return Panel Select File Now.

4. After you complete all your entries, check the Signature

box, then click Submit to le.

5. Select OK in the Conrmation box to continue.

and service calls.

E. The reporting location for gross receipts from the sale,

lease or license of franchises, and any related deduc-

tions, shall be where the franchise is used.

F. The reporting location for gross receipts from the perfor-

mance or sale of the following services, and any related

deductions, shall be at the following locations:

(1) for professional services performed in New Mexico,

other than construction-related services, or per-

formed outside New Mexico when the product of the

service is initially used in New Mexico, the location of

the performer of the service or seller of the product of

the service, as appropriate;

(2) for construction services and construction-related

services performed for a construction project in New

Mexico, the location of the construction site;

(3) for services with respect to the selling of real estate

located in New Mexico, the location of the real estate;

(4) for transportation of persons or property in, into or

from New Mexico, the location where the person or

property enters the vehicle; and

(5) for services other than those described in Paragraphs

(1) through (4) of this subsection, the location where

the product of the service is delivered.

Using the Out-of-State Location Codes

88-888 4.875 % If you are reporting for an out-of-

state location for a professional ser-

vice or shipping goods out-of-state.

77-777 4.875 % If you are performing research and

development services outside NM

as a professional service.

If you transact business with tribal non-members on tribal

territory, use the tribal location of the sale or delivery. If

a tribe, pueblo, or nation has entered into a cooperative

agreement with New Mexico they will have a separate

location code listed.

For more detail, see FYI-200, Gross Receipts Reporting

Location and the Appropriate Tax Rate available online

at https://www.tax.newmexico.gov/forms-publications/ or

through your local district oce.

TRD-41413 Instructions Inst.pg.4 www.tax.newmexico.gov

TRD-41413 Followed by Forms and Attachments

Submit in This Order:

• TRD-41413, Gross Receipts Tax Return.

• Schedule A, if required.

• Schedule CR, if required.

• Supplemental Schedule CR, if required.

• GRT-PV, if required.

• RPD-41071, Application for Refund, if required.

• Other required schedules or attachments.

TRD-41413 Required

Every person required to le a New Mexico gross receipts

tax return must complete and le a TRD-41413, Gross Re-

ceipts Tax Return.

Schedule A

Use the Schedule A, New Mexico Gross Receipts Tax

Schedule A if additional space is needed to report gross

receipts from multiple locations. Include this page with the

TRD-41413 Form.

Schedule CR

Use the Schedule CR, New Mexico Business-Related Tax

Credit Schedule. Attachments for each credit are required.

The attachments are specied next to each credit on this

form. See table, Attachments Required to Claim Schedule

CR Business-Related Tax Credits on page 5.

If you will be claiming a refundable credit you will also need

to submit RPD-41071, Application for Refund.

Important: If you believe you may qualify for business tax

credits please see the FYI-106, Claiming Business-Related

Tax Credits for Individuals and Business

Supplemental Schedule CR

If you are claiming more than 10 credits, also le Supple-

mental Schedule CR, Gross Receipts Tax Business-Related

Tax Credit Supplemental Schedule CR. Attachments for each

credit are required. The attachments are specied next to each

credit type on this form. See table, Attachments Required to

Claim Schedule CR Business-Related Tax Credits on page 5

Payment Voucher

If making a payment, place the payment and voucher at the

front of the return, in this order.

• Payment (check or money order)

• GRT-PV Payment Voucher

When paying by check or money order, make sure to indicate

the correct ling period of the return to which you want the

payment to apply. The Department supports the fast and

REQUIRED FORMS AND ATTACHMENTS

6. Select Print Conrmation Page s h o w i n g y o u r c o n r m a -

tion number as proof and verication that you led online.

7. Select Print Return to print a copy of your return for

your records.

8. Click Print to print a copy of your return for your records.

Important: Do not mail the conrmation page or the return

you led online to the Department. Mailing in the return can

cause processing issues.

If you need assistance ling your return on TAP, you can

email, GRT.TRDHelp@tax.nm.gov or you can call the Call

Center at: (866) 285-2996.

For help with TAP, email: TAP.TechnicalHelp@tax.nm.gov.

Where To Get Paper Tax Forms

Gross Receipts Tax forms and schedules can be lled out

by hand and mailed to the Department. You can get these

tax forms from any district oce, request they be mailed to

you or by downloading them from the Department website.

In Person

Ask for forms at the Department’s local district oces. Use

CONTACTING THE DEPARTMENT information listed on

page 1 of these instructions.

Downloading Forms and Instructions

To download tax forms

, follow these steps:

1. Go to https://www.tax.newmexico.gov/

.

2. At the top of the web page, click FORMS & PUBLICA-

TIONS.

3. Locate the folders toward the bottom of the page, click

the Business Taxes folder.

4. Click on the Gross Receipts Tax folder.

Check the Print Quality

Make sure the printer can clearly print a logo. If it can, it will

print a quality tax form. It is important to use an original. Never

submit a return with a form that has been photocopied or

photo shopped as it will not be accepted by our process-

ing machines.

Valid Identication Number Required

Enter your business name and New Mexico Business Tax

Identication Number (NMBTIN) on all forms, schedules, and

correspondence you send to the Department. The Department

cannot accept a return without a valid identication number.

***Important Guidelines***

Review the following items before making your entries:

• Complete all required information on your form. Failure

to do this delays processing your return and may cause

errors when the Taxation and Revenue Department per-

forms calculations during processing.

• Leave blank all spaces and boxes that do not apply to

you. Do not draw lines through or across areas you leave

blank.

• Write numbers clearly and legibly to reduce processing

errors and increase eciently. Use the boxes on the form

as a guide for your handwritten entries.

• Do not use dollar signs ($) or any punctuation marks or

symbols other than a comma (,).

TRD-41413 Instructions Inst.pg.5 www.tax.newmexico.gov

secure ling of electronic payments.

To print vouchers, go to https://www.tax.newmexico.gov/ At

the top of the page, click FORMS & PUBLICATIONS then

select the following items in this order:

• Business Taxes

• Gross Receipts Tax and then click Payment Voucher

GRT-PV, Gross Receipts Tax Payment Voucher

If your return shows a balance due and you choose to pay by

mail or delivery to one of our local oces, you must complete

the GRT-PV payment voucher and include it with your check

or money order. Also include GRT-PV when submitting your

payment with your paper return. Important: On all checks

and money orders, write your New Mexico Business Tax

Identication Number (NMBTIN) (previously known as your

CRS number), GRT- PV, and the ling period.

Amended Return

Any change to New Mexico gross receipts, exemptions,

deductions, or credits require an amended TRD-41413.

When ling an amended return mark the amended box on

your return clearly. You will le this return as if it is an original

return and must submit all required forms that apply to your

TRD- 41413. Note: Do not enter only supplemental amounts

on the return.

If you will be requesting a refund of taxes previously paid or

you have a refundable credit you will need to submit RPD-

41071, Application for Refund with supporting documentation.

RPD-41071, Application for Tax Refund

This form will need to be submitted with your return if you

determine that a refund is due on your account. You can also

submit an application for a Tax Refund for gross receipts tax

online through your taxpayer access point (TAP) account.

For the information required on an application for refund and

what needs to be submitted please see Refunds on page 13.

Other Forms That May Be Needed

This section describes forms that are related to TRD-41413

that you may need.

Notify the Department of a change to your business:

• ACD-31015, Business Tax Registration Application

and Update Form

If you need anyone to have access to your account infor-

mation the following form will need to be submitted to the

Department:

• ACD-31102, Tax Information Authorization Tax Disclo-

sure

If you are required to le an electronic return but you are

unable to le electronically complete and submit the ap-

plicable form below:

• RPD-41350, E-le and E-Pay Exception Request

• RPD-41351, E-File and E-Pay Waiver Request

If you are eligible for the food deduction under Section 7-9-

92 NMSA 1978 and you are a new ler in New Mexico or

you are unable to see the deduction in TAP please submit

the following form:

• RPD- 41295, Application for NM Retail Food Store

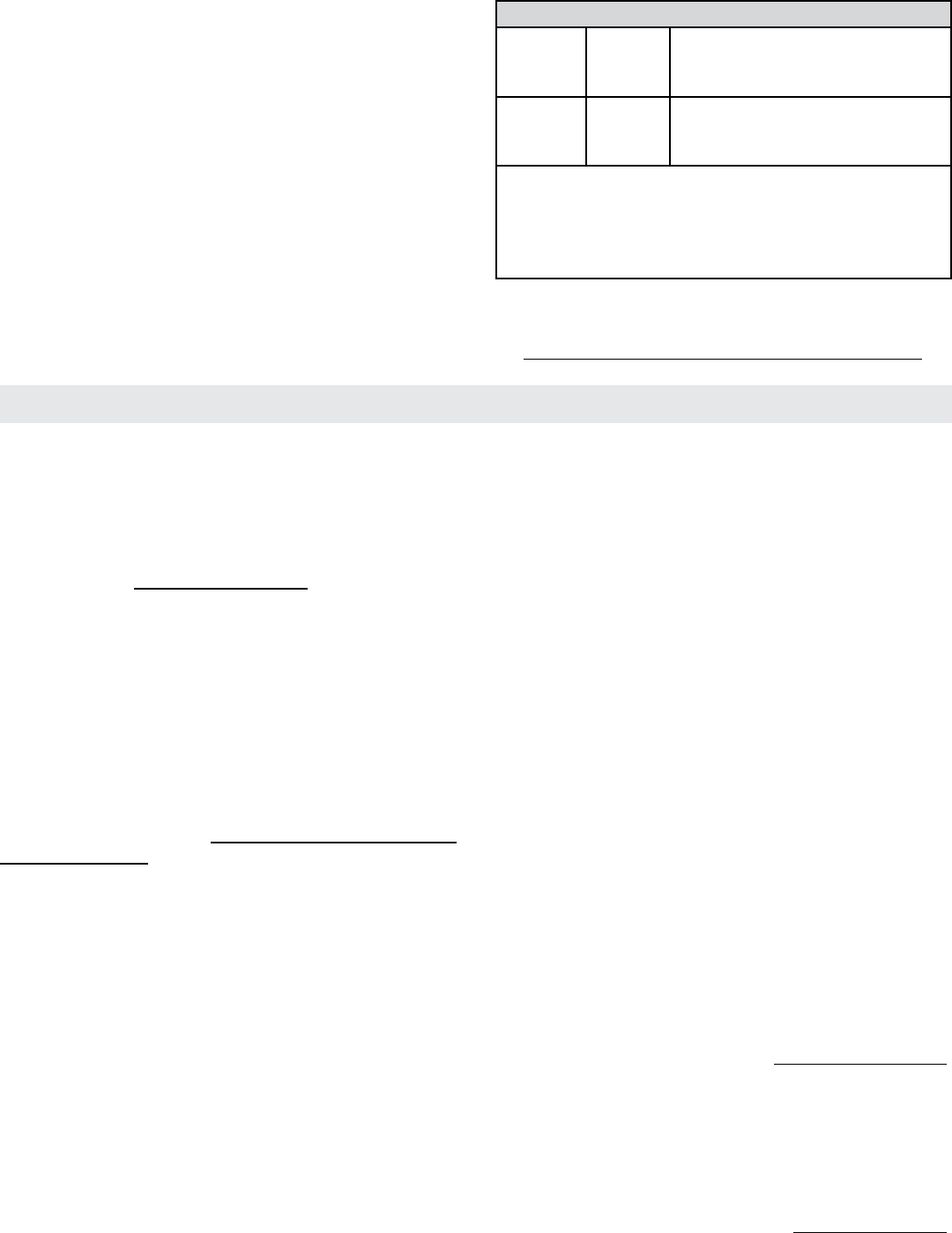

Attachments Required to Claim Schedule CR Business-Related Tax Credits

To Claim These Gross Receipts Tax

Schedule CR Credits

Attach Gross Receipts Tax Business Related Tax Credit Schedule CR and these

items

Aordable Housing Tax Credit RPD-41301, Aordable Housing Tax Credit Claim Form, and a copy of voucher(s) is-

sued by Mortgage Finance Authority (MFA).

Alternative Energy Tax Credit RPD-41331, Alternative Energy Product Manufacturers Tax Credit Claim Form

Biodiesel Blending Facility Tax Credit RPD-41321, Biodiesel Blending Facility Tax Credit Claim Form

High-wage Jobs Tax Credit RPD-41290, High-Wage Jobs Tax Credit Claim Form

Investment Tax Credit RPD-41212, Investment Credit Claim Form

Laboratory Partnership with Small

Business Tax Credit

RPD-41325, Application For Laboratory Partnership With Small Business Tax Credit

Legal Services for Wildre

Compensation Recovery Credit

TRD-41423, Legal Services for Wildre Compensation Recovery Credit

Application and Claim Form.

Rural Job Tax Credit RPD-41243, Rural Job Tax Credit Claim Form.

Sale of Dyed Special Fuel Used for Agri-

cultural Purposes Credit

TRD-41424, Sale of Dyed Special Fuel Used for Agricultural Purposes Credit Applica-

tion and Claim Form.

Technology Readiness Gross

Receipts Tax Credit

RPD-41407, Technology Readiness Gross Receipts Tax Credit Application

Technology Jobs And Research And

Development Tax Credit

RPD-41386, Technology Jobs And Research and Development Tax Credit Claim Form.

Unpaid Doctor Services Credit RPD-41323, Gross Receipts Tax Credit for Certain Unpaid Doctor Services

TRD-41413 Instructions Inst.pg.6 www.tax.newmexico.gov

WHEN AND WHERE TO FILE AND PAY

When and Where to File

File your return as soon as you have all the necessary

information. Each Form TRD-41413 is due on or before

the 25th of the month following the end of the tax period

being reported. If you le or pay late, you may need to pay

interest and penalties. See Interest and Penalties on page

13. If the date falls on a weekend, a legal, state or national

holiday, your Form TRD-41413 and payment due date will

be extended to the next business day.

Important: If you le your return electronically either through

TAP or a third-party do not submit a paper return. The du-

plicate return will slow down processing.

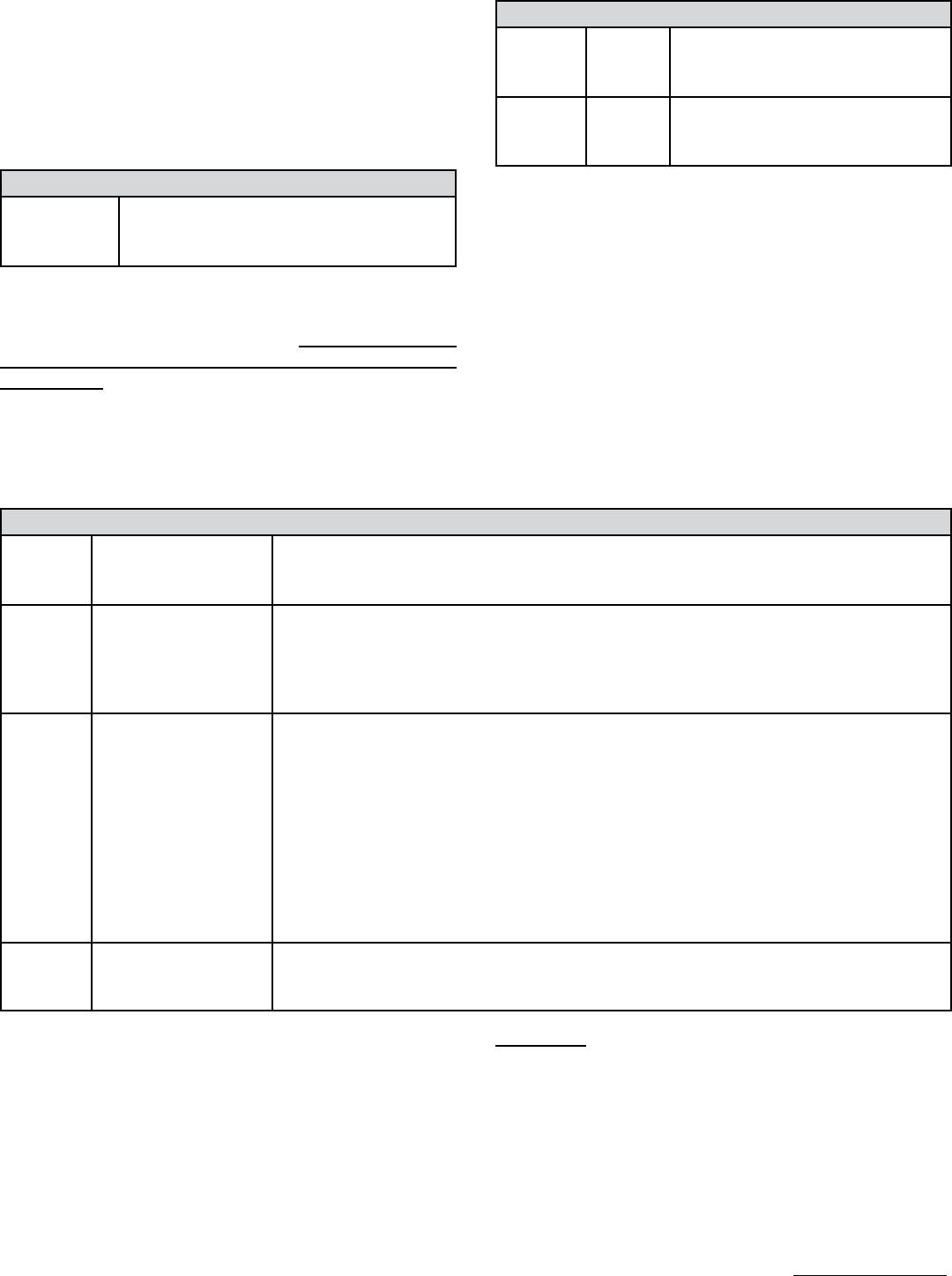

Filing Periods and Due Dates

These dates should be selected based on your ling status.

Your ling status can be located on your Registration Cer-

ticate received from the Department. The ling frequency

will be monthly, quarterly or semiannually.

MONTHLY FILING STATUS**

BEGINNING ENDING DUE DATE*

January 1 January 31 February 25

February 1 February 28 or

29

March 25

March 1 March 31 April 25

April 1 April 30 May 25

May 1 May 31 June 25

June 1 June 30 July 25

July 1 July 31 August 25

August 1 August 31 September 25

September 1 September 30 October 25

October 1 October 31 November 25

November 1 November 30 December 25

December 1 December 31 January 25

QUARTERLY FILING STATUS

BEGINNING ENDING DUE DATE*

January 1 March 31 April 25

April 1 June 30 July 25

July 1 September 30 October 25

October 1 December 31 January 25

SEMI-ANNUAL FILING STATUS

BEGINNING ENDING DUE DATE*

January 1 June 30 July 25

July 1 December 31 January 25

**Monthly Filing Status If you are a seasonal, temporary,

or special event ler use the monthly ling status. These l-

ing frequencies allow for businesses that do not do regular

business in New Mexico to le a singular return for the time

period that business was conducted in New Mexico.

Electronic Returns and Payments

If you have an electronic ling requirement, you must le

electronically. See FYI-108, Electronic Filing Mandate for

more information. You can le the return and pay at dier-

ent times but dierent penalty and interest may apply if you

miss the due date of the return. No Penalty will be imposed

for reporting and paying early.

ØTAP TIP: TAP will allow you to le online as of the rst

day of the ling period. You must acknowledge that you

are aware you are ling a return for a period that has not

ended yet.

Paper Returns To Mail

File paper returns no later than the deadline of 25th of the

month following the end of the tax period being reported.

No Penalty will be imposed for reporting and paying early.

Determining a Timely Mailing Date for Paper Returns

If the U.S. Postal Service postmark on the envelope bears a

date on or before the due date, a

mailed New Mexico gross

receipts tax re

turn and tax payment are timely. If the due

date falls on a Saturday, Sunday, or a state or national legal

holiday, the tax return is timely when the postmark bears the

date of the next business day.

If the date recorded or marked by a private delivery service is

on or before the due date, delivery through a private delivery

service is timely.

Where To Mail Paper Returns and Payments

Mail refund requests and returns to:

Gross Receipts Tax Correspondence

Taxation and Revenue Department

P.O. BOX 25128

Santa Fe, NM 87504-5128

How To Pay

Select the most convenient way to pay your taxes. You can

pay with an electronic check, a credit card, a paper check,

or a money order. See Paying Your Taxes on page 12.

Mailing a Payment and Voucher

Do the following when mailing any payment by check or

money order:

• Make it payable to New Mexico Taxation and Revenue

Department.

• Write your New Mexico Business Tax Identication Num-

ber (NMBTIN), GRT-PV, and the ling period on it.

• Mail the voucher with your payment.

Payment Vouchers for TRD-41413

Certication

If you are a marketplace provider please see the form

below:

• TRD-31117, Marketplace Provider Data Sharing

Agreement

TRD-41413 Instructions Inst.pg.7 www.tax.newmexico.gov

What To Do Next

Fill in your return using the line instructions that start on this

page. When you nish lling in your TRD-41413, see Before

Filing Your Return on page 13.

Top of Page 1

The top section of TRD-41413, page 1 gathers all your busi-

ness information. Please be sure to ll out all applicable elds.

Incomplete elds may result in processing delays.

New Mexico Business Tax Identication Number

(NMBTIN)

This number was issued to you by the New Mexico Taxation

and Revenue Department and can be located on your Regis-

tration Certicate. Note: This number was previously referred

to as the combined reporting system number or CRS ID.

No New Mexico Business Tax Identication Number?

If you do not have NMBTIN, apply for one using the ACD-

31015, Business Tax Registration Application and Update

Form. DO NOT le a return unless you have a NMBTIN is-

sued by the Department. Filing a return without this number

could result in a lost return or misapplied payment.

Federal Employer Identication Number (FEIN)

This number is issued by the Internal Revenue Service. If

you have a FEIN associated to your business please add

your FEIN here. If you do not have a FEIN leave this eld

blank. One reason you may not have a FEIN number is that

your business is a sole proprietorship.

Social Security Number (SSN)

Clearly enter your name and social security number (SSN)

if your NMBTIN is associated with your SSN.

Business Name

Clearly print the name of the business associated with the

New Mexico Business Tax Identication Number (NMBTIN).

New or Changed Address Check Box

If the mailing address has changed or is a new address

please mark X in this box. This will allow for your address

to be updated in the Department’s system. If you need

to change your address for all of your business accounts

please complete and submit the ACD-31015, Business Tax

Registration Application and Update Form.

Mailing address, City, State, Postal/ Zip Code

Enter your mailing address here. If you have a new or

changed mailing address please select the check box above.

See above for more information.

If you have a foreign address, enter the street address, city

name and postal code in the appropriate line. Also complete

the spaces for the foreign province and/or state and country.

Follow the country’s practice for entering the foreign postal

code, the province or state, and country. Do not abbreviate

the country name. If your address is located within the United

States of America leave these boxes blank.

E-mail address

Enter the e-mail address you would like the Department to

use to contact you if there are any questions about the return

you are submitting.

Phone Number

Enter the phone number you would like the Department to

use to contact you if there are any questions about the return

you are submitting.

Tax Period

These dates should be selected based on your ling status.

Your ling status can be located on your Registration Cer-

ticate received from the Department. The ling frequency

will be monthly, quarterly or semiannually. Use the format

MM/DD/CCYY. The dates should match your ling status.

See table on page 6.

Amended Return

Check the box above only if you are amending over your

original return. Be sure to ll out this return as it should

have been originally led for the specied Tax Period. The

amended return will override all information reported on your

original return. Do not enter only supplemental amounts on

the amended return.

If you fail to check the amended box this will cause process-

ing errors. If your Amended Return does not have the box

checked it will delay posting of the return or it may cause

the return to be rejected.

Important: If your amended return will result in an overpay-

ment on your account, you must submit a RPD-41071, Ap-

plication for Refund. In order for the Department to validate

the overpayment and issue a refund all required documents

must be provided.

COLUMNS A THROUGH H

Column A. Municipality/County Name

On separate lines, enter the name of each municipality

or county where you have a gross receipts tax to report.

Refer to the Gross Receipts and Compensating Tax Rate

Schedule, https://www.tax.newmexico.gov/governments/

gross-receipts-location-code-and-tax-rate-map/.

Eective July 1, 2021, gross receipts are reported using

destination-based sourcing. This means that gross receipts,

with some exceptions, will generally be reported under the

location code where the customer is located. Prior to July

1, 2021, New Mexico gross receipts were reported using

origin-based sourcing rules. This meant that gross receipts

LINE INSTRUCTION

Whether you submit your payment with or without your tax

return, complete GRT-PV, Gross Receipts Tax Payment

Voucher and submit it with your payment.

TRD-41413 Instructions Inst.pg.8 www.tax.newmexico.gov

were reported at the location of the business address, with

the exception of construction, real estate sales, utilities, or

tribal agreements. More information can be located under

Location Code and Tax Rate on page 2.

Certain situations or types of receipts require a special nota-

tion in Column A that has no relation to a county, municipality

or other physical location, refer to table T1.

T1. Special Notations

Out-of-State Use when an in state rate does not ap-

ply. See below and table T2 Out-Of-State

Codes for more information.

Column B. Location Code

Enter the Location Code from the current Gross Receipts

and Compensating Tax Rate Schedule, https://www.tax.new-

mexico.gov/governments/gross-receipts-location-code-and-

tax-rate-map/. Make sure that the location code corresponds

with the municipality or county you listed in Column A.

When applicable, use one of the out-of-state special locations

and/or deduction codes listed in table T2.

T2. Out-of-State Codes

88-888 4.875 % If you are reporting for an out-of-

state location for a professional ser-

vice or shipping goods out-of-state.

77-777 4.875 % If you are performing research and

development services outside NM

as a professional service.

Column C. Special Rate Code

Enter the alpha Special Rate Code from table T3. These

codes are account specic. Do not use these codes unless

they apply to your tax situation. These codes alert the De-

partment’s computer system to a special rate, distribution,

or reporting requirement that may apply to your industry or

to the type of deduction being reported.

ØTAP TIP: These special rates codes are granted based

on the information provided to the Department on your

ACD-31015, Business Tax Registration Application and

Updates Form. If you can not see these in TAP and need

them, please submit an updated ACD-31015.

Note: Manufacturers who have entered into a Form RPD-

41377, Manufacturers Agreement to Pay Gross Receipts

Tax on Behalf of a Utility Company for Certain Utility Sales

with a utility company must use the special rate codes listed

in table T4.

Important: A separate row is needed for gross receipts as-

sociated with Special Rate Codes (not the rate listed for the

Municipality/County). Do not combine receipts calculated

under the regular rates from the Gross Receipts and Com-

pensating Tax Rate Schedule.

Example 1 (Column C): Taxpayer has gross receipts in

the Albuquerque to report under the Medical Special Rate

Code "M". The taxpayer will review the Gross Receipts and

Compensating Tax Rate Schedule to locate the Municipal-

ity/County (Albuquerque) and the Location Code (02-100),

these are entered in Column A and Column B of the return.

The taxpayer would enter the "M" code under Column C.

Special Rate. The taxpayer would continue to Column D,

then Column F. In Column F the taxpayer would put the

same amount listed in Column D. In Column G and Column

I that taxpayer would enter Zero as instructed in table T3.

T3. Special Rate Codes

A Local

Economic Develop-

ment Act (LEDA)

Only qualifying entities under Section 5-10-14 NMSA 1978 use this special rate code.

For more information on who qualies for the special rate code please refer to the Lo-

cal Economic Development Act Fund Section 5-10-14 NMSA 1978.

F Food Retailers Only food retailers reporting deductible receipts under Section 7-9-92 NMSA 1978 need

to use this special code. For more information on who qualies, please see FYI-201.

When using this special code, be sure to indicate zero in Columns G and I for the re-

spective line. Note: Do NOT claim this deduction for federal food stamp sales paid for

with food cards. Not all food retailers qualify for the special code “F” deduction.

M Certain

Health Care Practi-

tioners

Only licensed health care practitioners or an association of health care practitioners

reporting deductions under Section 7-9-93 NMSA 1978 use this special code. For more

information on who qualies for the special code “M” deduction, see FYI-202. When

using this special code, be sure to indicate zero in Columns G and I for the respective

line. Note: Do not use the special code in Column B for other receipts reported by li-

censed health care practitioners. Use a separate line for other types of medical-related

deductions. Co-payment or deductible (7-9-93(B)). Starting July 1, 2023, and prior to

July 1, 2028, receipts from a co-payment or deductible paid by an insured or enrollee

to a health care practitioner or an association of health care practitioners for commer-

cial contract services pursuant to the terms of the insured's health insurance plan or

enrollee's managed care health plan may be deducted from gross receipts.

NH Sales by a Nonprot

hospital

“Nonprot hospital” means a hospital that has been granted exemption from federal

income tax by the United States commissioner of internal revenue as an organization

described in Section 501(c)(3) of the Internal Revenue Code. Rate of 4.875%. (7-9-41.5)

TRD-41413 Instructions Inst.pg.9 www.tax.newmexico.gov

Column D. Gross Receipts (excluding Tax)

The amounts in Column D should be the gross receipts

amount excluding the tax associated with those receipts.

This includes taxable gross receipts and deductible gross

receipts. Note: In order to report this correctly you may need

to back the tax out. See Example 2.

Gross Receipts Including Tax ÷

1.0(insert tax rate without the decimal)

Example 2 (Column D): Taxpayer’s gross receipts including

tax is $342.50 and the tax rate is 8.1875%. The taxpayer

would back out the tax by dividing 342.50 by 1.081875, the

answer is 316.580001... (round this number to the nearest

cent). The gross receipts excluding tax would be $316.58.

This is the amount the taxpayer would put in Column D.

Important: A separate row is needed for gross receipts as-

sociated with special rates or separately reported deductions

(required or optional).

Column E. Deduction Code

When using deduction codes, the gross receipts and deduc-

tion associated with amounts that have deduction codes that

are *required* to be reported will have to be reported on a

separate line. All other deductions can be claimed together

on one line by leaving column E blank and lling in Column

F with the deduction dollar amount, see the fourth line on

Example 3 below. See Example 3.

Required to be reported separately by statute: Deductions

that have a separate reporting requirement (D0) can be lo-

cated on page 10, see on table T5. Deductions Requiring

Separate Reporting.

All other deductions that are available for New Mexico

gross receipts tax that are not required to be separately

reported are reported only in column F as a dollar amount.

For a list of these deductions see T6. Other New Mexi-

co GRT Deductions starting on page 15 or the FYI-105,

Gross Receipts & Compensating Taxes - An Overview.

COLUMN F. Deduction Amount

All deductions are to be reported in this column. Deductions

must be supported by Nontaxable Transaction Certicate

(NTTC), alternative evidence, statute, or regulation.

If you complete this column, Column E must have a deduction

code for special rate codes and deductions required to be

separately reported, see instructions for Column E above.

If you are reporting a special rate code please refer to the

instructions for Column C.

T4. Manufactures Agreement Special Rate Codes

E Certain Sales of Electricity to a Manufacturer Please refer to FYI-275 for detailed special reporting requirements

for qualied transactions that require the use of this special code.

When using this special code, be sure to indicate zero in Columns

G and I for the respective line.

G Certain Sales of Natural Gas to a Manufac-

turer

Please refer to FYI-275 for detailed special reporting requirements

for qualied transactions that require the use of this special code.

When using this special code, be sure to indicate zero in Columns

G and I for the respective line.

W Certain Sales of Water to a Manufacturer Please refer to FYI-275 for detailed special reporting requirements

for qualied transactions that require the use of this special code.

When using this special code, be sure to indicate zero in Columns

G and I for the respective line.

O Certain Sales of Other Utilities to a Manufac-

turer

Please refer to FYI-275 for detailed special reporting requirements for

qualied transactions that require the use of this special code. When

using this special code, be sure to indicate zero in Columns G and

I for the respective line.

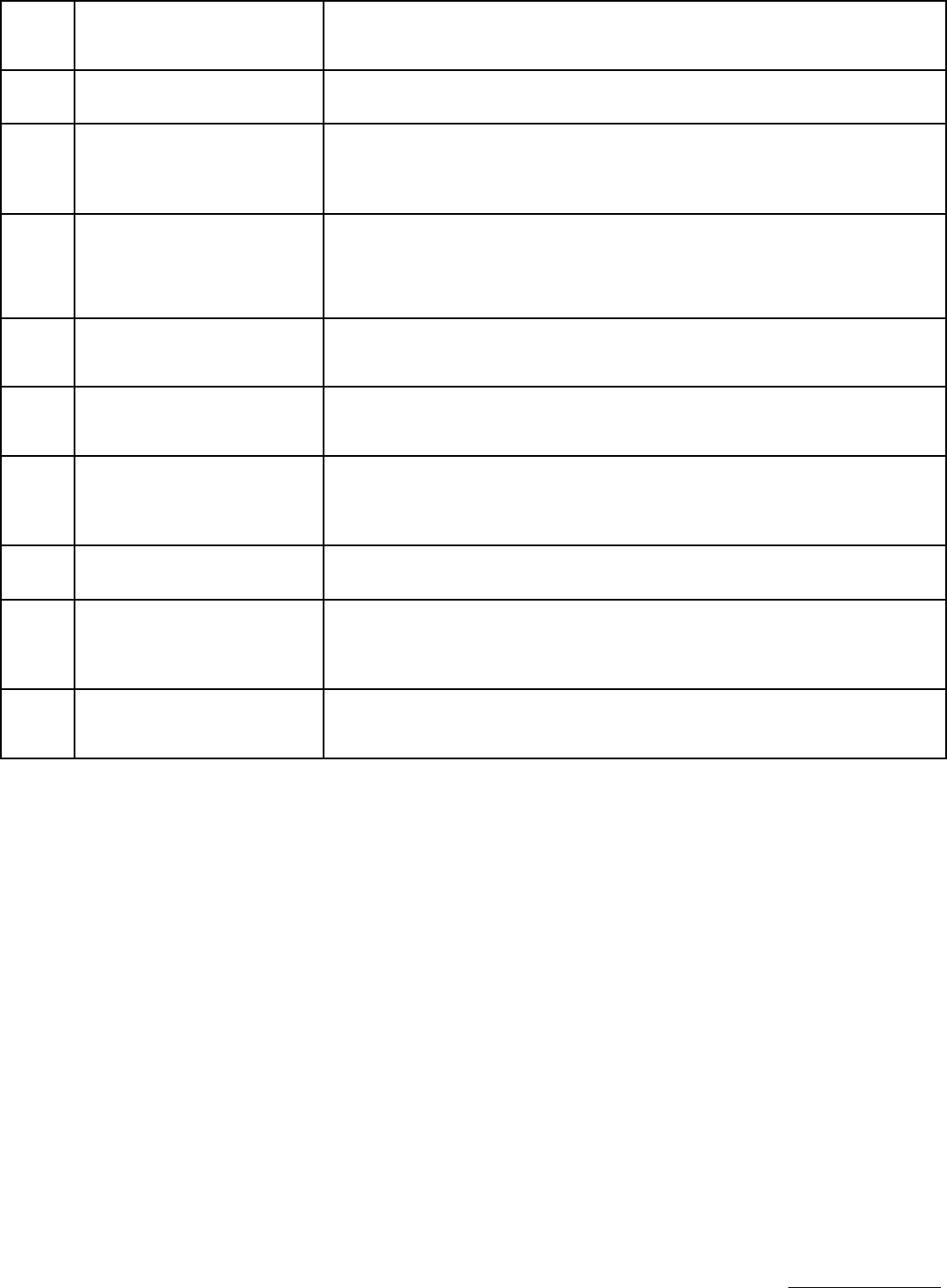

Example 3 (Column E): Taxpayer A has gross receipts tax (GRT) for Santa Fe City and Santa Fe County - Remainder of

County. They have 1 required D0- deduction code and 2 deductions that fall under deductions that are not required to be

separately reported and 1 special rate code applicable to their monthly gross receipts. Taxpayer A will report as follows:

Col. A Col. B Col. C Col. D Col. E Col. F Col. G Col. H Col. I

Muni/County Location

Code

Special

Rate Code

GR (ex-

clude Tax)

Deduction

Code

Deduction

Amount

Taxable

GR

Tax Rate GRT Due

Santa Fe 01-123 M 12,500 12,500 0 0

Santa Fe 01-123 16,000 D0-010 16,000 0 8.1875% 0

Santa Fe 01-123 10,500 10,500 0 8.1875% 0

SF R. of Co. 01-001 31,500 10,000 21,500 6.8750% 1,478.13

TRD-41413 Instructions Inst.pg.10 www.tax.newmexico.gov

REQUIRED DEDUCTION CODES

T5. Deductions Requiring Separate Reporting

D0-001 Uranium Hexauoride (7-9-90) If you sell uranium hexauoride and your receipts are deductible under Section

7-9-90.

D0-002 Manufacturing - Ingredient

(7-9-46(A))

If you sell tangible personal property to a manufacturer who incorporates the

property as an ingredient or component part of a manufactured product and your

receipts are deductible under Section 7-9-46(A).

D0-003 Manufacturing - Consumed

(7-9-46(B))

If you sell tangible personal property that is a manufacturing consumable and

your receipts are deductible under Section 7-9-46(B).

D0-004 Converting Electricity

(7-9-103.1)

If you transmit electricity and provide ancillary services and your receipts are

deductible under Section 7-9-103.1.

D0-005 Electricity Exchange

(7-9-103.2)

If you operate a market or exchange for the sale or trade of electricity and your

receipts are deductible under Section 7-9-103.2.

D0-006 Sale of Ag Implement or Aircraft

50% (7-9-62(A))

If you sell agricultural implements, vehicles or aircraft and your receipts 50% of

can be deducted under Section 7-9-62(A).

D0-007 Sale of Aircraft or Flight Sup-

port (7-9-62(B))

If you sell aircraft, provide ight support and training and your receipts are de-

ductible under Section 7-9-62(B).

D0-008 Aircraft Parts and Maintenance

(7-9-62 (C))

If you sell aircraft parts, provide maintenance services for aircraft and aircraft

parts and your receipts are deductible under Section 7-9-62(C).

D0-009 Commercial/Military Aircraft

(7-9-62.1)

If you sell or provide services for commercial and military aircraft and your receipts

are deductible under Section 7-9-62.1.

D0-010 Medicare

(7-9-77.1(A))

If you provide medical and health care services to Medicare beneciaries and

your receipts are deductible under Section 7-9-77.1(A).

D0-011 TRICARE Program

(7-9-77.1(C))

If you provide medical and health care services as a third-party administrator

for the TRICARE program and your receipts are deductible under Section 7-9-

77.1(C).

D0-012 Indian Health Service

(7-9-77.1 (D))

If you provide medical and health care services to Indian Health Service of the

United States Department of Health and Human Services to covered beneciaries

and your receipts are deductible under Section 7-9-77.1(D).

D0-013 Medicare - Clinical Laboratory

(7-9-77.1(E))

If you are a clinical laboratory and provide medical and health care services

to Medicare beneciaries and your receipts are deductible under Section 7-9-

77.1(E).

D0-014 Medicare - Home Health

(7-9-77.1 (F))

If you are a home health agency and provide medical, other health and pallia-

tive services to Medicare beneciaries and your receipts are deductible under

Section 7-9-77.1(F)

D0-015 Medicare - Dialysis Facility

(7-9-77.1(G))

Prior to July 1, 2032, if you are a dialysis facility and you provide medical and

other health services to Medicare beneciaries and your receipts are deductible

under Section 7-9-77.1(G).

D0-016 Durable Medical Equipment

(7-9-73.3)

If you sell or rent durable medical equipment or medical supplies and your receipts

are deductible under Section 7-9-73.3.

D0-017 Military Transformational Ac-

quisition (7-9-94)

If you perform research and development, test and evaluation services at New

Mexico major range and test facility bases and your receipts are from military

transformational acquisition programs and deductible under Section 7-9-94.

D0-018 Directed Energy and Satellites

(7-9-115)

If you sell goods and services to the United States Department of Defense

related to directed energy or satellites and your receipts are deductible under

Section 7-9-115.

D0-019 Border Zone Trade-Support

Company (7-9-56.3)

If you are a trade-support company and have receipts from business activities

and operations at the business’ border location and your receipts are deductible

under Section 7-9-56.3.

TRD-41413 Instructions Inst.pg.11 www.tax.newmexico.gov

D0-020 Small Business Saturday

(7-9-116)

If you are a qualied small business and have receipts from the sale at retail of

certain tangible personal property on the rst Saturday after Thanksgiving and

your receipts are deductible under Section 7-9-116.

D0-022 Jet Fuel 40%

(7-9-83)

If you sell jet fuel for use in turboprop or jet engines 40% can be deducted under

Section 7-9-83.

D0-023 Back to School Tax Holiday

(7-9-95)

If you have receipts from retail sales of specied tangible personal property, if

the sale of the property occurs during the period between 12:01 a.m. on the rst

Friday in August and ending at midnight the following Sunday your receipts are

deductible under Section 7-9-95.

D0-024 Dispenser's License Holder

(7-9-119)

The receipts of a dispenser liquor license holder who held the license on June

30, 2021, may be deducted up to $50,000 from the sale of alcoholic beverages

for taxable years 2022 through 2025 as long as the sales of alcoholic beverages

for consumption o premises are less than 50% of total alcoholic beverage

sales.

D0-025 Manufacturing - Equipment

7-9-46(C)

If you sell or lease qualied equipment to a person engaged in the business of

manufacturing or a manufacturing service provider under Section 7-9-46(C). The

investment credit shall not be claimed on the same equipment.

D0-026 Hospice or Nursing Home

(7-9-77.1(B))

If your receipts are for medical and other health and palliative services provided

by hospice or nursing home to Medicare beneciaries and your receipts are

deducted under Section 7-9-77.1(B).

D0-027 Sales of services to manufac-

turers (7-9-46.1)

If your receipts are from selling professional services to a person engaged in

the business of manufacturing and your receipts are deductible under Section

7-9-46.1. The professional service has to be related to the product that the buyer

is in the business of manufacturing.

D0-028 Feminine Hygiene Products

(7-9-120)

If your receipts are from the sale of feminine hygiene products and your receipts

are deductible under Section 7-9-120.

D0-029 Child Care Assistance Services

(7-9-77.2(A))

If your receipts are from the sale of child care assistance services provided based

on a contract or grant with the Early Childhood Education and Care Department

to provide those services through a licensed child care assistance program your

receipts are deductible under Section 7-9-77.2(A).

D0-030 Pre-Kindergarten Providers

(7-9-77.2(B))

If your receipts are by a for-prot pre-kindergarten providers for the sale of pre-

kindergarten services pursuant to the Pre-Kindergarten Act your receipts are

deductible under Section 7-9-77.2(B).

TRD-41413 Instructions Inst.pg.12 www.tax.newmexico.gov

Note: If you are claiming multiple deductions that require

separate reporting (Column E) the associated location code,

gross receipts, and deduction for each will have to be reported

on a separate line. See example 3.

Important: Deductions are not the same as business ex-

penses. Do not include business expenses on your Gross

Receipts Tax Return as business expenses are not deductible

or exempt from gross receipts tax.

A taxpayer must maintain in their possession a nontaxable

transaction certicate (NTTC), other acceptable alternative

evidence or documentation for each deduction claimed in

this column. Deductions cannot exceed the gross receipts

reported in Column D for that same location.

For a listing of available deductions, please see FYI-105:

Gross Receipts & Compensating Taxes - An Overview, avail-

able at your local district oce or online at

https://www.tax.newmexico.gov/forms-publications/

COLUMN G. Taxable Gross Receipts

Column D minus Column F.

Note: This amount can never be less than zero.

COLUMN H. Tax Rate

Enter the rate from the Gross Receipts and Compensating

Tax Rate Schedule or a special tax rate if you entered the

special rate code “NH" for non-prot hospitals.

COLUMN I. Gross Receipts Tax Due

Enter the Gross Receipts Tax Due for each line by multiplying

Column G by Column H.

ROW A THROUGH B

ROW A. COLUMN D and COLUMN F.

Row A allows for the subtotal amounts from page 1 of the

return for Column D and Column F.

ROW A. COLUMN I. Enter the total amount of gross re-

ceipts tax due here.

Use this row to provide the subtotal of gross receipts tax due

from the above rows.

ROW B. COLUMN D and COLUMN F.

Row B allows for the subtotal amounts from all return Schedule

A’s used in determining your ling tax liability. Please include

the subtotal amounts for Column D and Column F in the space

provided at the bottom of these columns on page 1.

ROW B. COLUMN I. Enter the total amount of gross re-

ceipts tax from all Schedule A pages.

Use this row to provide the subtotal of gross receipts tax due

from all Schedule A’s used to determine your tax liability for

the return you are ling.

LINES 1 THROUGH 8

LINE 1. Total Gross Receipts Tax.

Enter the sum of all Column I, Row A and Row B on Line 1

for the total amount of gross receipts tax due. Remember to

include all of the Column I in your calculation from any ad-

ditional Schedule A pages for the reporting period.

LINE 2. Business Related Tax Credits Applied

If you do not have any Business-Credits to apply, skip Line 2.

Business-Related business tax credits applied from Sched-

ule CR, line A. Attach Schedule CR. The amount on this line

should not be more than Line 1. For information about these

credits, see the instructions for Schedule CR.

If you are eligible,

do the following:

• C

omplete Schedule CR

.

• From Schedule CR, line A, enter the total amount you

claimed and applied to your tax due one TRD-41413, line

2,

• From Schedule CR, line B, enter the total amount of tax

credit that may be refunded to you, on TRD-41413, line 7.

See instructions for line 7.

• A

ttach Schedule CR (and

any required forms or docu-

mentation to support your claim)

to your TRD-41413

.

LINE 3. Net Tax

Subtract Line 2 from Line 1. If no amount was claimed on

Line 2, carry amount in Line 1 down to Line 3. This amount

cannot be more than Line 1.

LINE 4. Penalty.

If you le late and owe tax, or if you do not pay the tax on or

before the date your return is due, enter penalty here.

Penalty is applied for failure to pay or le on time. Penalty is

calculated at a rate of 2% of Line 4 per month or partial month

(any fraction of a month is a full month) the TRD-41413 or

payment is late, up to 20% of the tax due or a minimum of

$5.00, whichever is greater.

Note: The minimum $5.00 Penalty is also imposed for failure

to le this form even if no tax is due.

LINE 5. Interest

See Example 4. Interest is calculated daily but the rate will be

set at the rate established for individual income tax purposes

by the U.S. Internal Revenue Code (IRC). The IRC rate, which

changes quarterly, is announced by the IRS in the last month

of the previous quarter. The annual and daily interest rates

for each quarter are posted on our website at

https://www.tax.newmexico.gov/individuals/le-your-taxes-overview/

penalty-interest-rates/.

Tax Due X Quarterly Interest X Number of Days Late

= Interest Due

Example 4 (Line 5): Taxpayer’s tax due on Line 3 is $1,000.

The payment due is fteen days late.

TRD-41413 Instructions Inst.pg13 www.tax.newmexico.gov

To calculate the interest due: multiply $1,000 by the daily

rate of 0.01643856% (the daily interest rate for the 2nd

quarter of 2019). The result is $0.16438356, which is the

interest due for one day. Multiply $0.1643856 by fteen

(the number of days the payment is late). The interest is

$2.465753425. (Round this number to the nearest cent)

Enter the interest due of $2.47 on Line 5.

$1,000 X 0.00016438356 X 15 = $2.465753425

Note: You are not liable for interest if the total interest due

is less than $1.00.

Important: When you pay your principal tax liability, interest

stops accruing. Because it stops accruing, you do not need

to calculate the amount of interest due on your return past

the date you pay the principal tax.

LINE 6. Total Amount Due

Add Lines 3, 4 and 5. A TRD-41413 payment should not be

combined on the same check or money order with any other

tax or fee being paid to the Department. If possible include

your New Mexico Business Tax Identication Number (NMB-

TIN).

Please send your completed Form TRD-41413, Gross Re-

ceipts Tax Return with payment to:

New Mexico Taxation and Revenue Department

P.O. Box 25128

Santa Fe, NM 87504-5128

Important: Continue to Line 7 only if you are claiming refund-

able business-related credits.

Paying Your Taxes

Make your check or money order payable to New Mexico

Taxation and Revenue Department. Mail the GRT-PV with

your payment to:

New Mexico Taxation and Revenue Department

P.O. Box 25128

Santa Fe, NM 87504-5128

Important: Put your NMBTIN and ling period on your check

or money order.

Taxpayer Access Point (TAP): https://tap.state.nm.us

If you le using TAP and you owe tax, you will be given the

option to pay your tax once you are nished ling your return.

You may use a credit card for an online payment. You can

also pay by electronic check, or mail a check or money order

to the Department with a payment voucher. Note: A conve-

nience fee is applied for using a credit card. The State of New

Mexico uses this fee, calculated on the transaction amount,

to pay charges from the credit card companies. There is no

charge for an electronic check.

LINE 7. Refundable Business-Related Tax Credits.

Refundable Business-Related tax credits applied from Sched-

ule CR, line B. DO NOT include business-related tax credit

amounts applied to your tax liability on Line 2. Attach Sched-

ule CR and required supporting documentation specied on

Schedule CR to your TRD-41413, Gross Receipts Tax Return.

LINE 8. Overpayment

Subtract Line 7 from Line 6, enter total overpayment/refund-

able credit here.

Important: Any overpayment or refund requests must be ac-

companied by a completed RPD-41071, Application for Tax

Refund and any required additional documentation. Providing

this information will decrease the time it takes to review and

process your refund request.

FUEL ONLY- This box replaces the reporting requirement for

information return form RPD-41296, Report on Sales or Use

of Fuel Specially Prepared and Sold for Use in Turboprop or

Jet-Type Engines.

• Enter the total amount of gross receipts tax attributable

to the sale of fuel specially prepared and sold for use in

turbo-prop or jet-type engine.

Before Filing Your Paper Return

Now that you have completed your TRD-41413:

1. Check the gures and your arithmetic on your TRD-41413

and on all your attachments. Make sure these are original,

ocial TRD-41413 form and Schedules.

2. If you created a working TRD-41413, use blue or black ink

to carefully transfer your gures onto the clean TRD-41413

you plan to submit.

3. Sign and date your TRD-41413.

4. If your return shows tax due on Line 6, complete the GRT-

PV payment voucher.

5. Assemble your return as shown for most ecient process-

ing. If there is a tax due, place your payment and voucher

at the front of the return.

6. Make a copy of your original return and attachments for

your records, and keep it in a safe place in case you need

to refer to it later. If someone prepares your return for you,

get a copy for your records.

Important: Do not staple or tape your payment to the pay-

ment voucher.

TRD-41413 Instructions Inst.pg14 www.tax.newmexico.gov

YOUR RIGHTS UNDER THE TAX LAW

Your Rights

To help avoid tax problems, keep accurate tax records and

stay current with tax law changes. Information in these instruc-

tions and other Department publications help you do both.

While you can resolve most tax problems informally, it is

important to understand you must exercise certain rights

provided to you under law within specic time frames. If

the Department makes an adjustment to your return, the

Departments sends you a notice explaining the adjustment

and the procedures to use if you disagree.

Refunds

If the Department denies your claim for refund in whole or

in part, you may le a protest with the Department within 90

days of either mailing or service of the denial, or you may

le a lawsuit with the Santa Fe District Court.

If the Department requests additional relevant documentation

from you, the claim is not complete until the documentation

is received within the specied time period. The date the

complete claim is submitted will determine when the 180 days

begin. If you do not provide the additional requested relevant

documentation, the claim for refund remains incomplete and

will not be processed.

Useful Publications

Publication FYI-402, Taxpayer Remedies and FYI-406, Your

Rights Under the Tax Law are available at

https://www.tax.newmexico.gov/. At the top, click FORMS &

PUBLICATIONS, then select FYIs from the Publications folder.

Interest

Interest accrues on tax that is not paid on or before the due

date of your return.

Important: Interest is a charge for the use of money and by

law it cannot be waived.

When you pay your principal tax liability, penalty and interest

stop accruing.

Negligence Penalty for Late Filing or Late Payment

If you le late and owe tax, or if you do not pay your tax when

due, you receive a penalty of 2% of the tax due for each

month or part of a month you do not le the return or you do

not pay the tax, up to a maximum of 20%.

This penalty applies when your failure to timely le or pay is

due to negligence or disregard of the rules and regulations,

but without intent to defraud.

Returned Check Penalty

A check that is not paid by a nancial institution does not

constitute payment. A penalty of $20 is assessed for a bad

check in addition to other penalties that may apply to a late

payment.

Tax Fraud

A person is guilty of tax fraud if the person:

• Falsies any return, statement, or other document;

• Willfully assists, procures, advises, or counsels the ling

of a false return, statement, or document;

• Files any return electronically, knowing the information

on the return is not true and correct as to every material

matter; or

• Removes, conceals, or releases or aids in the removal,

concealment, or release of any property on which levy is

authorized by the Department.

Whoever commits tax fraud may be found guilty of a petty

misdemeanor, misdemeanor, fourth degree felony, third de-

gree felony, or second degree felony. Additional information

can be located under Section 7-1-73 NMSA 1978.

INTEREST AND PENALTIES

REFUNDS

Refunds

If your account has an overpayment and you are due a

refund or you are claiming a refundable business-related

tax credit you must submit Form RPD-41071, Application

for Tax Refund and all required supporting documentation.

Information Required to Claim a Refund

According to Section 7-1-26 NMSA 1978, the following in-

formation is required to claim a refund:

• Taxpayer's name, address, and identication number

• Type of tax for which the refund is claimed, the credit or

rebate denied, or the property levied upon

• Sum of money or other property claimed

• Period(s) for which the overpayment was made

• Brief statement of the facts and law on which the claim

is based, referred to as the basis for refund, and docu-

mentation to support and substantiate the taxpayer's

basis for the refund.

• If applicable, a copy of an amended return for each tax

period for which the refund is claimed.

See Form RPD-41071, Application for Tax Refund for

more information.

TRD-41413 Instructions Inst.pg15 www.tax.newmexico.gov

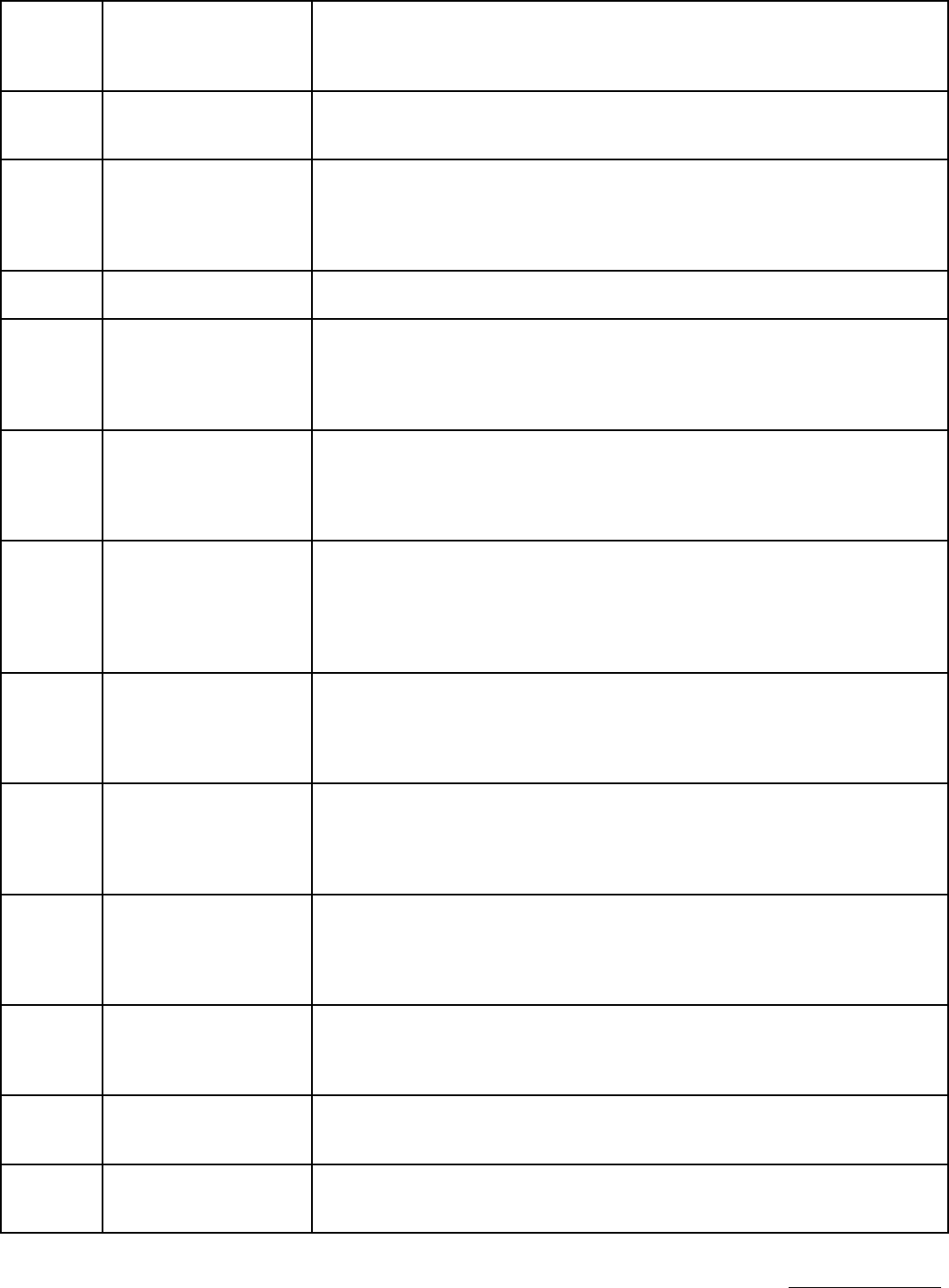

T6. Other New Mexico GRT Deductions

Statute

Reference

Short Title Summary

7-9-47 Tangible Personal

Property or License for

Resale

Receipts from sales of tangible personal property or licenses may be deducted

if the sale is made to a person who delivers a nontaxable transaction certicate

(NTTC) or alternative evidence to the seller.

7-9-48 Service for Resale Receipts from selling a service for resale may be deducted from if the sale is

made to a person who delivers a NTTC or alternative evidence to the seller.

7-9-49 Tangible Personal Prop-

erty and Licenses for

Leasing

Receipts from selling tangible personal property and licenses may be deducted if

the sale is made to a person who delivers a NTTC or alternative evidence to the

seller. Does not apply to furniture or appliances, the receipts from the rental or

lease; coin-operated machines; or manufactured homes.

7-9-50 Lease for Subsequent

Lease

Receipts from leasing tangible personal property or licenses may be deducted

from gross receipts if the lease is made to a lessee who delivers a NTTC or al-

ternative evidence to the lessor .Does not apply to furniture or appliances, the re-

ceipts from the rental or lease; coin-operated machines; or manufactured homes.

7-9-51 Construction Material Receipts from selling construction material may be deducted if the sale is made to

a person engaged in the construction business who delivers a NTTC or alterna-

tive evidence to the seller.

7-9-52 Construction and Re-

lated Services

Receipts from selling a construction service or a construction related service may

be deducted if the sale is made to a person engaged in the construction business

who delivers a NTTC or alternative evidence to the person performing the con-

struction service or a construction related service.

7-9-52.1 Lease of Construction

Equipment

Receipts from leasing construction equipment may be deducted if the construc-

tion equipment is leased to a person engaged in the construction business who

delivers a NTTC or alternative evidence to the person leasing the construction

equipment.

7-9-53 Sale or Lease of Real

Property

Receipts from the sale or lease of real property and from the lease of a manufac-

tured home.

7-9-54 Sales to Governmental

Agencies

Deductions from receipts from selling tangible personal property or from selling

licenses to use digital goods for the purpose of loaning those digital goods to the

public, to the United States or to New Mexico or a governmental unit, subdivision,

agency, department or instrumentality thereof, Indian tribe, nation or pueblo or a

governmental unit, subdivision, agency, department or instrumentality thereof for

use on Indian reservations or pueblo grants.

7-9-54.1 Sale of Aerospace Ser-

vices to Certain Organi-

zations

Receipts from performing or selling an aerospace service for resale may be de-

ducted from gross receipts if the sale is made to a buyer who delivers a NTTC or

alternative evidence.

7-9-54.2 Spaceport Operations Receipts from launching, operating or recovering space vehicles or payloads in

New Mexico, preparing a payload in New Mexico, operating a spaceport in New

Mexico, receipts from the provision of research, development, testing and evalu-

ation services for the United States air force operationally responsive space pro-

gram may be deducted.

7-9-54.3 Wind and Solar Equip-

ment to Governments

Prior to July 1, 2034, receipts from selling wind generation equipment or solar

generation equipment to a government for the purpose of installing a wind or

solar electric generation facility may be deducted. Prior to July 1, 2034, receipts

from selling energy storage equipment or related equipment to a government for

the purpose of installing an energy storage facility may be deducted.

7-9-55 Transaction in Interstate

Commerce

Receipts from transactions in interstate commerce may be deducted from gross

receipts to the extent that the imposition of the gross receipts tax would be un-

lawful under the United States constitution; Receipts from transmitting messages

or conversations by radio receipts, from the sale of radio or television broadcast

time under certain circumstances may be deducted.

OTHER NEW MEXICO GRT DEDUCTIONS

TRD-41413 Instructions Inst.pg16 www.tax.newmexico.gov

7-9-56 Intrastate Transportation

and Services Interstate

Commerce

Receipts from transporting persons or property from one point to another in this

state; receipts from handling, storage, drayage or packing of property or any other

accessorial services on property, receipts from providing telephone or telegraph

services in this state that will be used by other persons in providing telephone or

telegraph services to the nal user may be deducted.

7-9-56.1 Certain Telecommunica-

tion and Internet Ser-

vices

Receipts from providing leased telephone lines, telecommunications services,

internet services, internet access services or computer programming that will be

used by other persons in providing internet access and related services to the -

nal user may be deducted from gross receipts if the sale is made to a person who

is subject to the gross receipts tax or the interstate telecommunications gross

receipts tax.

7-9-56.2 Hosting World Wide Web

Sites

Receipts from hosting world wide web sites may be deducted from gross receipts.

For purposes of this section, "hosting" means storing information on computers

attached to the internet.

7-9-57 Services to an Out-of-

State Buyer

Receipts from performing a service may be deducted if the sale of the service is

made to an out-of-state buyer who delivers to the seller either a NTTC, alternative

evidence, or other evidence acceptable to the secretary unless the buyer of the

service or any of the buyer's employees or agents makes initial use of the product

of the service in New Mexico or takes delivery of the product of the service in New

Mexico.

7-9-57.2 Sale of Software Devel-

opment Services

The receipts of an eligible software development company from the sale of soft-

ware development services that are performed in a qualied area may be de-

ducted.

7-9-58 Agriculture-Feed and

Certain Fertilizers

Receipts from selling feed for livestock (including the baling wire or twine used

to contain the feed), sh raised for human consumption, poultry or for animals

raised for their hides or pelts, seeds, roots, bulbs, plants, soil conditioners, fertiliz-

ers, insecticides, germicides, insects used to control populations of other insects,

fungicides or weedicides or water for irrigation to persons engaged in the busi-

ness of farming or ranching and receipts of auctioneers from selling livestock or

other agricultural products at auction (7-9-58). Requirement: farmer or rancher

statement.

7-9-59 Receipts for Certain Ag-

riculture Production

Receipts from warehousing grain or other agricultural products and receipts from

threshing, cleaning, growing, cultivating or harvesting agricultural products in-

cluding the ginning of cotton, testing or transporting milk for the producer or non-

prot marketing association from the farm to a milk processing or dairy product

manufacturing plant or processing for growers, producers or nonprot marketing

associations of agricultural products raised for food and ber, including livestock.

7-9-60 Sales to Certain 501(c)

(3) Organizations

Receipts from selling tangible personal property to 501(c)(3) organizations may

be deducted if the sale is made to an organization that delivers a NTTC or alter-

native evidence to the seller. Does not apply to receipts from selling construction

material, excluding tangible personal property.

7-9-61.1 Certain Loan Receipts Receipts from charges made in connection with the origination, making or as-

sumption of a loan or from charges made for handling loan payments may be

deducted.

7-9-61.2 Sales to State-Chartered

Credit Unions

Receipts from selling tangible personal property to credit unions chartered under

the provisions of the Credit Union Act are deductible to the same extent that re-

ceipts from the sale of tangible personal property to federal credit unions may be

deducted.

7-9-63 Publication Sales Receipts from publishing newspapers or magazines, except from selling advertis-

ing space, may be deducted; Receipts from selling magazines at retail may not

be deducted.

7-9-64 Newspaper Sales Receipts from selling newspapers, except from selling advertising space may be

deducted.

TRD-41413 Instructions Inst.pg17 www.tax.newmexico.gov

7-9-65 Chemicals and Reagents Receipts from selling chemicals or reagents to any mining, milling or oil company

for use in processing ores or oil in a mill, smelter or renery or in acidizing oil

wells, and receipts from selling chemicals or reagents in lots in excess of eigh-

teen tons to any hard-rock mining or milling company for use in any combination

of extracting, leaching, milling, smelting, rening or processing ore at a mine site,

may be deducted from gross receipts. Receipts from selling explosives, blasting

powder or dynamite may not be deducted from gross receipts.

7-9-66 Commissions for Sale

of Tangible Personal

Property

Receipts derived from commissions on sales of tangible personal property which

are not subject to the gross receipts tax receipts of the owner of a dealer store

derived from commissions received for performing the service of selling from the

owner's dealer store a principal's tangible personal property may be deducted.

7-9-66.1 Certain Real Estate

Commissions

Receipts from real estate commissions on that portion of the transaction subject

to gross receipts tax pursuant to Subsection A of Section 7-9-53 NMSA 1978 may

be deducted with supporting documents.

7-9-67 Refunds; Uncollectible

Debts

Refunds and allowances made to buyers or amounts written o the books as an

uncollectible debt under certain circumstances.

7-9-68 Warranty Obligations Receipts of a dealer from furnishing goods or services to the purchaser of tan-

gible personal property to fulll a warranty obligation of the manufacturer of the

property may be deducted.

7-9-69 Administrative and Ac-

counting Services

Receipts of a business entity for administrative, managerial, accounting and cus-