Modications to the Opinion in the Independent Auditor’s Report 1197

AU-C Section 705

Modifications to the Opinion in the

Independent Auditor’s Report

(Supersedes SAS No. 122 section 705.)

Source: SAS No. 134; SAS No. 137; SAS No. 141.

Effective for audits of nancial statements for periods ending on or

after December 15, 2021.

Introduction

Scope of This Section

.01 This section addresses the auditor's responsibility to issue an appro-

priate report in circumstances in which, in forming an opinion in accordance

with section 700, Forming an Opinion and Reporting on Financial Statements,

or section 703, Forming an Opinion and Reporting on Financial Statements of

Employee Benet Plans Subject to ERISA, the auditor concludes that a modi-

cation to the auditor's opinion on the nancial statements is necessary. This

section also deals with how the form and content of the auditor's report is af-

fected when the auditor expresses a modied opinion. In all cases, the reporting

requirements in section 700 or section 703, Forming an Opinion and Reporting

on Financial Statements of Employee Benet Plans Subject to ERISA, apply;

those requirements are not repeated in this section unless they are explicitly

addressed or amended by the requirements of this section.

Types of Modified Opinions

.02 This section establishes three types of modied opinions, namely, a

qualied opinion, an adverse opinion, and a disclaimer of opinion. The deci-

sion regarding which type of modied opinion is appropriate depends on the

following:

a. The nature of the matter giving rise to the modication, that is,

whether the nancial statements are materially misstated or, in

the case of an inability to obtain sufcient appropriate audit evi-

dence, may be materially misstated

b. The auditor's judgment about the pervasiveness of the effects or

possible effects of the matter on the nancial statements (Ref:

par. .A1)

.03 Section 706, Emphasis-of-Matter Paragraphs and Other-Matter Para-

graphs in the Independent Auditor's Report, and section 701, Communicating

Key Audit Matters in the Independent Auditor's Report, address additional com-

munications in the auditor's report that are not modications to the auditor's

opinion.

©2021, AICPA AU-C §705.03

1198 Audit Conclusions and Reporting

Effective Date

.04 This section is effective for audits of nancial statements for periods

ending on or after December 15, 2021. [As amended, effective for audits of -

nancial statements for periods ending on or after December 15, 2021, by SAS

No. 141.]

Objective

.05 The objective of the auditor is to express clearly an appropriately mod-

ied opinion on the nancial statements that is necessary in the following cir-

cumstances:

a. The auditor concludes, based on the audit evidence obtained, that

the nancial statements as a whole are materially misstated.

b. The auditor is unable to obtain sufcient appropriate audit ev-

idence to conclude that the nancial statements as a whole are

free from material misstatement.

Definitions

.06 For purposes of generally accepted auditing standards, the following

terms have the meanings attributed as follows:

Modied opinion. A qualied opinion, an adverse opinion, or a dis-

claimer of opinion on the nancial statements.

Pervasive. A term used, in the context of misstatements, to describe

the effects on the nancial statements of misstatements or the

possible effects on the nancial statements of misstatements, if

any, that are undetected due to an inability to obtain sufcient ap-

propriate audit evidence. Pervasive effects on the nancial state-

ments are those that, in the auditor's judgment,

•

are not conned to specic elements, accounts, or items of

the nancial statements;

•

if so conned, represent or could represent a substantial

proportion of the nancial statements; or

•

regarding disclosures, are fundamental to users' under-

standing of the nancial statements.

Requirements

Circumstances in Which a Modification to the Auditor’s Opinion

Is Required

.07 The auditor should modify the opinion in the auditor's report when

a. the auditor concludes that, based on the audit evidence obtained,

the nancial statements as a whole are materially misstated or

(Ref: par. .A2–.A8)

b. the auditor is unable to obtain sufcient appropriate audit evi-

dence to conclude that the nancial statements as a whole are

free from material misstatement. (Ref: par. .A9–.A13)

AU-C §705.04 ©2021, AICPA

Modications to the Opinion in the Independent Auditor’s Report 1199

Determining the Type of Modification to the Auditor’s Opinion

Qualified Opinion

.08 The auditor should express a qualied opinion in the following circum-

stances:

a. The auditor, having obtained sufcient appropriate audit evi-

dence, concludes that misstatements, individually or in the aggre-

gate, are material but not pervasive to the nancial statements.

b. The auditor is unable to obtain sufcient appropriate audit evi-

dence on which to base the opinion, but the auditor concludes that

the possible effects on the nancial statements of undetected mis-

statements, if any, could be material but not pervasive.

Adverse Opinion

.09 The auditor should express an adverse opinion when the auditor, hav-

ing obtained sufcient appropriate audit evidence, concludes that misstate-

ments, individually or in the aggregate, are both material and pervasive to the

nancial statements.

Disclaimer of Opinion

.10 The auditor should disclaim an opinion when the auditor is unable to

obtain sufcient appropriate audit evidence on which to base the opinion, and

the auditor concludes that the possible effects on the nancial statements of

undetected misstatements, if any, could be both material and pervasive. (Ref.

par. .A14–.A15)

Consequence of an Inability to Obtain Sufficient Appropriate Audit

Evidence Due to a Management-Imposed Limitation After the Auditor Has

Accepted the Engagement

.11 If, after accepting the engagement, the auditor becomes aware that

management has imposed a limitation on the scope of the audit that the au-

ditor considers likely to result in the need to express a qualied opinion or to

disclaim an opinion on the nancial statements, the auditor should request that

management remove the limitation.

.12 If management refuses to remove the limitation referred to in para-

graph .11, the auditor should communicate the matter to those charged with

governance, unless all of those charged with governance are involved in manag-

ing the entity,

1

and, if appropriate, determine whether it is possible to perform

alternative procedures to obtain sufcient appropriate audit evidence.

.13 If the auditor is unable to obtain sufcient appropriate audit evidence,

the auditor should determine the implications as follows:

a. If the auditor concludes that the possible effects on the nancial

statements of undetected misstatements, if any, could be material

but not pervasive, the auditor should qualify the opinion.

b. If the auditor concludes that the possible effects on the nancial

statements of undetected misstatements, if any, could be both ma-

terial and pervasive so that a qualication of the opinion would

1

Paragraph .09 of section 260, The Auditor's Communication With Those Charged With Gover-

nance.

©2021, AICPA AU-C §705.13

1200 Audit Conclusions and Reporting

be inadequate to communicate the severity of the situation, the

auditor should

i. disclaim an opinion on the nancial statements or

ii. withdraw from the audit, when practicable. (Ref: par.

.A16–.A17)

.14 If the auditor decides to withdraw from the audit in accordance with

paragraph .13bii, before doing so, the auditor should communicate to those

charged with governance any matters regarding misstatements identied dur-

ing the audit that would have given rise to a modication of the opinion. (Ref:

par. .A17)

Other Considerations Relating to an Adverse Opinion or Disclaimer

of Opinion

.15 When the auditor considers it necessary to express an adverse opin-

ion or disclaim an opinion on the nancial statements as a whole, the audi-

tor's report should not also include an unmodied opinion with respect to the

same nancial reporting framework on a single nancial statement or one or

more specic elements, accounts, or items of a nancial statement (piecemeal

opinion). To include such an unmodied opinion in the same report

2

in these

circumstances would contradict the auditor's adverse opinion or disclaimer of

opinion on the nancial statements as a whole. (Ref: par. .A18–.A19)

Auditor Is Not Independent But Is Required by Law or Regulation to Report

on the Financial Statements

.16 When the auditor is not independent but is required by law or reg-

ulation to report on the nancial statements, the auditor should disclaim an

opinion and should specically state that the auditor is not independent. The

auditor is neither required to provide, nor precluded from providing, the rea-

sons for the lack of independence; however, if the auditor chooses to provide the

reasons for the lack of independence, the auditor should include all the reasons

therefor. (Ref: par. .A20)

Form and Content of the Auditor’s Report When the

Opinion Is Modified

Auditor’s Opinion

.17 When the auditor modies the audit opinion, the auditor should use

the heading "Qualied Opinion," "Adverse Opinion," or "Disclaimer of Opinion,"

as appropriate, for the "Opinion" section. (Ref: par. .A21–.A23)

Qualied Opinion

.18 When the auditor expresses a qualied opinion due to a material mis-

statement in the nancial statements, the auditor should state that, in the au-

ditor's opinion, except for the effects of the matters described in the "Basis for

Qualied Opinion" section of the auditor's report, the accompanying nancial

statements present fairly, in all material respects, […] in accordance with [the

applicable nancial reporting framework]. When the modication arises from

an inability to obtain sufcient appropriate audit evidence, the auditor should

2

Section 805, Special Considerations — Audits of Single Financial Statements and Specic El-

ements, Accounts, or Items of a Financial Statement, addresses special considerations relevant to an

audit of a single nancial statement or of a specic element, account, or item of a nancial statement.

AU-C §705.14 ©2021, AICPA

Modications to the Opinion in the Independent Auditor’s Report 1201

use the corresponding phrase "except for the possible effects of the matters…"

for the modied opinion. (Ref: par. .A24–.A25)

Adverse Opinion

.19 When the auditor expresses an adverse opinion, the auditor should

state that, in the auditor's opinion, because of the signicance of the matters

described in the "Basis for Adverse Opinion" section of the auditor's report, the

accompanying nancial statements do not present fairly […] in accordance with

[the applicable nancial reporting framework].

Disclaimer of Opinion

.20 When the auditor disclaims an opinion due to an inability to obtain

sufcient appropriate audit evidence, the auditor should do the following:

a. State that the auditor does not express an opinion on the accom-

panying nancial statements.

b. State that, because of the signicance of the matters described

in the "Basis for Disclaimer of Opinion" section of the auditor's

report, the auditor has not been able to obtain sufcient appro-

priate audit evidence to provide a basis for an audit opinion on

the nancial statements.

c. Amend the statement required by paragraph .25b of section 700,

or paragraph .64b of section 703, Forming an Opinion and Report-

ing on Financial Statements of Employee Benet Plans Subject

to ERISA, as applicable, which indicates that the nancial state-

ments have been audited, to state that the auditor was engaged

to audit the nancial statements.

Basis for Opinion

.21 When the auditor modies the opinion on the nancial statements, the

auditor should, in addition to including the specic elements required by section

700 or section 703, Forming an Opinion and Reporting on Financial Statements

of Employee Benet Plans Subject to ERISA, do the following: (Ref: par. .A26)

a. Amend the heading "Basis for Opinion" required by paragraph .28

of section 700 or paragraphs .67 or .107 of section 703, Forming an

Opinion and Reporting on Financial Statements of Employee Ben-

et Plans Subject to ERISA, as applicable, to "Basis for Qualied

Opinion," "Basis for Adverse Opinion," or "Basis for Disclaimer of

Opinion," as appropriate.

b. Within this section of the auditor's report, include a description

of the matter giving rise to the modication.

.22 If there is a material misstatement of the nancial statements that

relates to specic amounts in the nancial statements (including quantita-

tive disclosures), the auditor should include in the "Basis for Opinion" sec-

tion a description and quantication of the nancial effects of the misstate-

ment, unless impracticable. If it is not practicable to quantify the nancial ef-

fects, the auditor should state that in the "Basis for Opinion" section. (Ref: par.

.A27–.A28)

.23 If there is a material misstatement of the nancial statements that

relates to qualitative disclosures, the auditor should include an explanation of

how the disclosures are misstated in the "Basis for Opinion" section.

©2021, AICPA AU-C §705.23

1202 Audit Conclusions and Reporting

.24 If there is a material misstatement of the nancial statements that

relates to the omission of information required to be presented or disclosed, the

auditor should do the following:

a. Discuss the omission of such information with those charged with

governance.

b. Describe in the "Basis for Opinion" section the nature of the omit-

ted information.

c. Include the omitted information, provided that it is practicable to

do so and the auditor has obtained sufcient appropriate audit

evidence about the omitted information. (Ref: par. .A29–.A30)

.25 If the modication results from an inability to obtain sufcient appro-

priate audit evidence, the auditor should include the reasons for that inability

in the "Basis for Opinion" section. (Ref. par. .A31)

.26 When the auditor expresses a qualied or an adverse opinion, the au-

ditor should amend the statement required by paragraph .28d of section 700

or paragraphs .67 or .107 of section 703, Forming an Opinion and Reporting

on Financial Statements of Employee Benet Plans Subject to ERISA, as appli-

cable, about whether the audit evidence obtained is sufcient and appropriate

to provide a basis for the auditor's opinion, to include the word "qualied" or

"adverse," as appropriate.

.27 When the auditor disclaims an opinion on the nancial statements,

the auditor's report should not include the elements required by paragraphs

.28b and .28d of section 700 or paragraphs .67b and .67d or .107b and .107d

of section 703, Forming an Opinion and Reporting on Financial Statements of

Employee Benet Plans Subject to ERISA, as applicable. Those elements are

a. a reference to the section of the auditor's report where the audi-

tor's responsibilities are described and

b. a statement about whether the audit evidence obtained is suf-

cient and appropriate to provide a basis for the auditor's opinion.

.28 Even if the auditor has expressed an adverse opinion or disclaimed an

opinion on the nancial statements, the auditor should describe the reasons

for any other matters of which the auditor is aware that would have required

a modication to the opinion, and the effects thereof, in the "Basis for Opinion"

section. (Ref: par. .A32–.A33)

Description of Auditor’s Responsibilities for the Audit of the Financial

Statements When the Auditor Disclaims an Opinion on the Financial

Statements

.29 When the auditor disclaims an opinion on the nancial statements

due to an inability to obtain sufcient appropriate audit evidence, the audi-

tor should amend the description of the auditor's responsibilities required by

paragraphs .35–.37 of section 700 or paragraphs .74–.76 or .115–.119 of section

703, Forming an Opinion and Reporting on Financial Statements of Employee

Benet Plans Subject to ERISA, as applicable, to include only the following:

(Ref: par. .A34)

a. A statement that the auditor's responsibility is to conduct an au-

dit of the entity's nancial statements in accordance with audit-

ing standards generally accepted in the United States of America

and to issue an auditor's report

AU-C §705.24 ©2021, AICPA

Modications to the Opinion in the Independent Auditor’s Report 1203

b. A statement that, however, because of the matters described in

the "Basis for Disclaimer of Opinion" section of the auditor's

report, the auditor was not able to obtain sufcient appropriate

audit evidence to provide a basis for an audit opinion on the -

nancial statements

c. A statement that the auditor is required to be independent and

to meet other ethical responsibilities, in accordance with the rele-

vant ethical requirements relating to the audit, required by para-

graph .28c of section 700 or paragraph .67c or .107c of section

703, Forming an Opinion and Reporting on Financial Statements

of Employee Benet Plans Subject to ERISA, as applicable

Considerations When the Auditor Expresses an Adverse Opinion or

Disclaims an Opinion on the Financial Statements

.30 When the auditor expresses an adverse opinion or disclaims an opinion

on the nancial statements, the auditor's report should not include a "Key Au-

dit Matters" section in accordance with section 701.

3

(Ref: par. .A35–.A36) Also,

when the auditor disclaims an opinion on the nancial statements, the audi-

tor's report should not include an "Other Information" section in accordance

with section 720, The Auditor's Responsibilities Relating to Other Information

Included in Annual Reports. [As amended, effective for audits of nancial state-

ments for periods ending on or after December 15, 2021, by SAS No. 137.]

Communication With Those Charged With Governance

.31 When the auditor expects to modify the opinion in the auditor's report,

the auditor should communicate with those charged with governance the cir-

cumstances that led to the expected modication and the wording of the modi-

cation. (Ref: par. .A37)

Application and Other Explanatory Material

Types of Modified Opinions (Ref: par. .02)

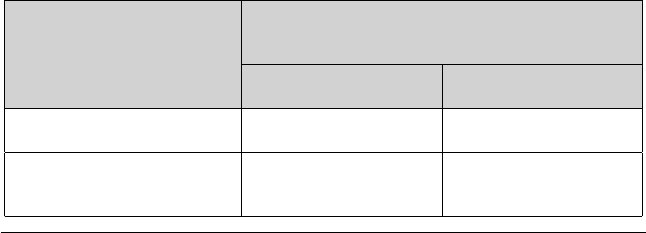

.A1 The following table illustrates how the auditor's professional judgment

about the nature of the matter giving rise to the modication, and the perva-

siveness of its effects or possible effects on the nancial statements, affects the

type of opinion to be expressed:

Auditor's Professional Judgment About the

Pervasiveness of the Effects or Possible Effects

on the Financial Statements

Nature of Matter Giving

Rise to the Modication

Material but Not

Pervasive

Material and

Pervasive

Financial statements are

materially misstated

Qualied opinion Adverse opinion

Inability to obtain

sufcient appropriate

audit evidence

Qualied opinion Disclaimer of opinion

3

Paragraphs .10–.12 of section 701, Communicating Key Audit Matters in the Independent Audi-

tor's Report.

©2021, AICPA AU-C §705.A1

1204 Audit Conclusions and Reporting

Circumstances in Which a Modification to the Auditor’s Opinion

Is Required

Nature of Material Misstatements (Ref: par. .07a)

.A2 Sections 700 and 703, Forming an Opinion and Reporting on Financial

Statements of Employee Benet Plans Subject to ERISA, require the auditor, in

order to form an opinion on the nancial statements, to conclude whether rea-

sonable assurance has been obtained about whether the nancial statements

as a whole are free from material misstatement.

1

This conclusion takes into

account the auditor's evaluation of uncorrected misstatements, if any, on the

nancial statements, in accordance with section 450, Evaluation of Misstate-

ments Identied During the Audit.

.A3 Section 450 denes a misstatement as a difference between the re-

ported amount, classication, presentation, or disclosure of a nancial state-

ment item and the amount, classication, presentation, or disclosure that is re-

quired for the item to be in accordance with the applicable nancial reporting

framework. Accordingly, a material misstatement of the nancial statements

may arise in relation to the following:

•

The appropriateness of the selected accounting policies

•

The application of the selected accounting policies

•

The appropriateness of the nancial statement presentation, or

the appropriateness or adequacy of disclosures in the nancial

statements

Appropriateness of the Selected Accounting Policies

.A4 Regarding the appropriateness of the accounting policies management

has selected, material misstatements of the nancial statements may arise, for

example, when

•

the selected accounting policies are not consistent with the appli-

cable nancial reporting framework,

•

the nancial statements do not correctly describe an accounting

policy relating to a signicant item therein, or

•

the nancial statements do not represent or disclose the underly-

ing transactions and events in a manner that achieves fair pre-

sentation.

.A5 Financial reporting frameworks often contain requirements for the ac-

counting for, and disclosure of, changes in accounting policies. When the entity

has changed its selection of signicant accounting policies, a material misstate-

ment of the nancial statements may arise when the entity has not complied

with these requirements. If a change in accounting policy does not meet the

conditions described in section 708, Consistency of Financial Statements,then

a material misstatement of the nancial statements may arise.

Application of the Selected Accounting Policies

.A6 Regarding the application of the selected accounting policies, material

misstatements of the nancial statements may arise

1

Paragraph .13 of section 700, Forming an Opinion and Reporting on Financial Statements and

paragraph .38 of section 703, Forming an Opinion and Reporting on Financial Statements of Employee

Benet Plans Subject to ERISA.

AU-C §705.A2 ©2021, AICPA

Modications to the Opinion in the Independent Auditor’s Report 1205

•

when management has not applied the selected accounting poli-

cies consistently with the nancial reporting framework, includ-

ing when management has not applied the selected accounting

policies consistently between periods or to similar transactions

and events (consistency in application).

•

due to the method of application of the selected accounting policies

(such as an unintentional error in application).

Appropriateness of the Financial Statement Presentation or Appropriateness or

Adequacy of Disclosures in the Financial Statements

.A7 Regarding the appropriateness of the nancial statement presenta-

tion or the appropriateness or adequacy of disclosures in the nancial state-

ments, material misstatements of the nancial statements may arise when the

following occur:

•

The nancial statements do not include all the disclosures re-

quired by the applicable nancial reporting framework.

•

The disclosures in the nancial statements are not presented in

accordance with the applicable nancial reporting framework.

•

The nancial statements do not provide the additional disclosures

necessary to achieve fair presentation beyond disclosures speci-

cally required by the applicable nancial reporting framework.

•

Information required to be presented in accordance with the ap-

plicable nancial reporting framework is omitted either because

a required statement (for example, a statement of cash ows) has

not been included or because the information has not otherwise

been disclosed in the nancial statements.

Paragraph .A23 of section 450 provides further examples of material misstate-

ments that may arise in qualitative disclosures.

.A8 Adequate disclosures relate to the presentation of the nancial state-

ments and the related notes, including, for example, the terminology used, the

amount of detail given, the classication of items in the statements, and the

bases of amounts set forth.

Nature of an Inability to Obtain Sufficient Appropriate Audit Evidence

(Ref: par. .07b)

.A9 The auditor's inability to obtain sufcient appropriate audit evidence

(also referred to as a limitation on the scope of the audit) may arise from the

following:

•

Circumstances beyond the control of the entity

•

Circumstances relating to the nature or timing of the auditor's

work

•

Limitations imposed by management

.A10 An inability to perform a specic procedure does not constitute a lim-

itation on the scope of the audit if the auditor is able to obtain sufcient ap-

propriate audit evidence by performing alternative procedures. If this is not

possible, the requirements in paragraphs .08b and .10 apply as appropriate.

Limitations imposed by management may have other implications for the au-

dit, such as for the auditor's assessment of risks of material misstatement due

to fraud and consideration of engagement continuance.

.A11 Examples of circumstances beyond the control of the entity include

the following:

©2021, AICPA AU-C §705.A11

1206 Audit Conclusions and Reporting

•

The entity's accounting records have been destroyed.

•

The accounting records of a signicant component have been

seized indenitely by governmental authorities.

.A12 Examples of circumstances relating to the nature or timing of the

auditor's work include the following:

•

The entity is required to use the equity method of accounting for

an investee, and the auditor is unable to obtain sufcient appro-

priate audit evidence about the latter's nancial information to

evaluate whether the equity method has been appropriately ap-

plied.

•

The timing of the auditor's appointment is such that the auditor

is unable to observe the counting of the physical inventories, and

the auditor is unable to obtain sufcient appropriate audit evi-

dence through other appropriate procedures, such as performing

a rollback of inventory.

•

The auditor determines that performing substantive procedures

alone is not sufcient, but the entity's controls are not effective.

.A13 Examples of an inability to obtain sufcient appropriate audit evi-

dence arising from a limitation on the scope of the audit imposed by manage-

ment include the following:

•

Management prevents the auditor from observing the counting of

the physical inventory.

•

Management prevents the auditor from requesting external con-

rmation of specic account balances.

Determining the Type of Modification to the Auditor’s Opinion

Effect of Uncertainties (Ref: par. .10)

.A14 Absence of the existence of information related to the outcome of an

uncertainty does not necessarily lead to a conclusion that the audit evidence

supporting management's assertion is not sufcient. Rather, the auditor's pro-

fessional judgment regarding the sufciency of the audit evidence is based on

the audit evidence that is, or should be, available. If, after considering the ex-

isting conditions and available evidence, the auditor concludes that sufcient

appropriate audit evidence supports management's assertions about the na-

ture of a matter involving an uncertainty and its presentation or disclosure in

the nancial statements, an unmodied opinion ordinarily is appropriate.

.A15 In cases involving multiple uncertainties, the auditor may conclude

that it is not possible to form an opinion on whether the nancial statements

as a whole are fairly presented in accordance with the applicable nancial re-

porting framework due to the interaction and possible cumulative effects of the

uncertainties.

Consequence of an Inability to Obtain Sufficient Appropriate Audit

Evidence Due to a Management-Imposed Limitation After the Auditor Has

Accepted the Engagement (Ref: par. .13)

.A16 The practicality of withdrawing from the audit may depend on the

stage of completion of the engagement at the time that management imposes

the scope limitation. If the auditor has substantially completed the audit, the

auditor may decide to complete the audit to the extent possible, disclaim an

AU-C §705.A12 ©2021, AICPA

Modications to the Opinion in the Independent Auditor’s Report 1207

opinion, and explain the scope limitation in the "Basis for Disclaimer of Opin-

ion" section.

.A17 In certain circumstances, withdrawal from the audit may not be pos-

sible if the auditor is required by law or regulation to continue the audit en-

gagement. This may be the case for an auditor who is appointed or elected to

audit the nancial statements of governmental entities. It may also be the case

in circumstances in which the auditor is appointed to audit the nancial state-

ments covering a specic period or is appointed for a specic period and is pro-

hibited from withdrawing before the completion of the audit of those nancial

statements or before the end of that period. In such circumstances, the auditor

may consider it necessary to include an other-matter paragraph in the auditor's

report.

2

Other Considerations Relating to an Adverse Opinion or Disclaimer of

Opinion (Ref: par. .15)

.A18 The following are examples of reporting circumstances that would

not contradict the auditor's adverse opinion or disclaimer of opinion:

•

In an initial audit, the expression of an unmodied opinion regard-

ing the nancial position and a disclaimer of opinion regarding the

results of operations and cash ows, when relevant. In this case,

the auditor has not disclaimed an opinion on the nancial state-

ments as a whole.

•

The expression of an unmodied opinion on nancial statements

prepared under a given nancial reporting framework and, within

the same report, the expression of an adverse opinion on the same

nancial statements under a different nancial reporting frame-

work.

Considerations Specic to Audits of Governmental Entities

.A19 Because the auditor of a state or local governmental entity expresses

an opinion or disclaims an opinion for each opinion unit,

3

an auditor's report in

these circumstances may include an unmodied opinion with respect to one or

more opinion units and a modied opinion for one or more other opinion units.

Auditor Is Not Independent but Is Required by Law or

Regulation to Report on the Financial Statements (Ref: par. .16)

Considerations Specic to Governmental Entities

.A20 The nature of a government auditor's lack of independence may have

a limited effect because the impairment may result from the government au-

ditor's association with only a component of the overall governmental entity.

A government auditor may determine that the lack of independence affects

only one or more, but not all, of the governmental entity's opinion units, and in

such circumstances, the auditor may disclaim an opinion on the affected opin-

ion units while expressing unmodied, qualied, or adverse opinions on other

opinion units. The more signicant the affected opinion units are to the overall

governmental entity, the more likely that it will be appropriate for the auditor

to disclaim an opinion on the nancial statements of the overall governmental

entity.

2

Paragraphs .10–.11 of section 706, Emphasis-of-Matter Paragraphs and Other-Matter Para-

graphs in the Independent Auditor's Report.

3

Paragraph .A6 of section 700, Forming an Opinion and Reporting on Financial Statements.

©2021, AICPA AU-C §705.A20

1208 Audit Conclusions and Reporting

Form and Content of the Auditor’s Report When the Opinion Is

Modified

Illustrative Auditor’s Reports (Ref: par. .17)

.A21 Illustrations 1 and 3 in the exhibit to this section contain auditor's

reports with qualied and adverse opinions, respectively, because the nancial

statements are materially misstated.

.A22 Illustration 4 in the exhibit contains an auditor's report with a quali-

ed opinion because the auditor is unable to obtain sufcient appropriate audit

evidence. Illustration 5 contains a disclaimer of opinion due to an inability to

obtain sufcient appropriate audit evidence about a single element of the nan-

cial statements. Illustration 6 contains a disclaimer of opinion due to an inabil-

ity to obtain sufcient appropriate audit evidence about multiple elements of

the nancial statements. In each of the latter two cases, the possible effects on

the nancial statements of the inability to obtain sufcient appropriate audit

evidence are both material and pervasive. The exhibits to other AU-C sections

that include reporting requirements also include illustrations of auditor's re-

ports with modied opinions.

Auditor’s Opinion (Ref: par. .17)

.A23 Amending the heading required by paragraph .17 makes it clear to

the user that the auditor's opinion is modied and indicates the type of modi-

cation.

Qualied Opinion (Ref: par. .18)

.A24 When the auditor expresses a qualied opinion, it would not be ap-

propriate to use phrases such as "with the foregoing explanation" or "subject to"

in the "Opinion" section because these are not sufciently clear or forceful. Be-

cause accompanying notes are part of the nancial statements, wording such as

"fairly presented, in all material respects, when read in conjunction with note

1" is likely to be misunderstood and would also not be appropriate.

.A25 When the auditor expresses a qualied opinion due to a scope limi-

tation, paragraph .18 requires that the auditor state in the opinion paragraph

that the qualication pertains to the possible effects of the matter on the nan-

cial statements and not to the scope limitation itself. Wording such as "In our

opinion, except for the above-mentioned limitation on the scope of our audit…"

bases the exception on the restriction itself rather than on the possible effects

on the nancial statements and, therefore, is unacceptable.

Basis for Opinion (Ref: par. .21, .22, .24, .28)

.A26 Consistency in the auditor's report helps promote users' understand-

ing and helps users identify unusual circumstances when they occur. Accord-

ingly, although uniformity in the wording of a modied opinion and the descrip-

tion of the reasons for the modication may not be possible, consistency in both

the form and content of the auditor's report is desirable.

.A27 An example of the nancial effects of misstatements that the auditor

may describe within the "Basis for Opinion" section in the auditor's report is the

quantication of the effects on income before taxes, income taxes, net income,

and equity if inventory is overstated. If such disclosures are made in a note to

the nancial statements, the "Basis for Opinion" section may refer to the note.

AU-C §705.A21 ©2021, AICPA

Modications to the Opinion in the Independent Auditor’s Report 1209

.A28 In considering the adequacy of disclosure, and in other aspects of the

audit, the auditor uses information received in condence from management.

Without such condence, the auditor would nd it difcult to obtain informa-

tion necessary to form an opinion on the nancial statements. The "Condential

Client Information Rule" (ET sec. 1.700.001) of the AICPA Code of Professional

Conduct states that the auditor should not disclose any condential client infor-

mation without the specic consent of the client. Accordingly, the auditor may

not make available, without management's consent, information that is not re-

quired to be disclosed in the nancial statements to comply with the applicable

nancial reporting framework.

.A29 Practicable, as used in the context of paragraphs .22 and .24c,means

that the information is reasonably obtainable from management's accounts and

records and that providing the information in the report does not require the

auditor to assume the position of a preparer of nancial information. For exam-

ple, the auditor would not be expected to prepare a basic nancial statement

and include it in the auditor's report when management omits such informa-

tion.

.A30 Disclosing the omitted information within the "Basis for Opinion"

section would not be practicable if

•

the information has not been prepared by management or the in-

formation is otherwise not readily available to the auditor or,

•

in the auditor's judgment, the information would be unduly volu-

minous in relation to the auditor's report.

.A31 When the auditor modies the opinion due to an inability to obtain

sufcient appropriate audit evidence, it is not appropriate for the scope of the

audit to be explained in a note to the nancial statements because the descrip-

tion of the audit scope is the responsibility of the auditor and not that of man-

agement.

.A32 An adverse opinion or a disclaimer of opinion relating to a specic

matter described within the "Basis for Opinion" section does not justify the

omission of a description of other identied matters that would have otherwise

required a modication of the auditor's opinion. In such cases, the disclosure of

such other matters of which the auditor is aware may be relevant to users of

the nancial statements.

.A33 The auditor may consider whether there is a need to describe in an

emphasis-of-matter or other-matter paragraph

4

any other matters of which

the auditor is aware that would not require a modication of the auditor's

opinion.

Description of Auditor’s Responsibilities for the Audit of the Financial

Statements When the Auditor Disclaims an Opinion on the Financial

Statements (Ref: par. .29)

.A34 When the auditor disclaims an opinion on the nancial statements,

the following statements are better positioned within the "Auditor's Responsi-

bilities for the Audit of the Financial Statements" section of the auditor's report,

as illustrated in illustrations 5–6 of the exhibit to this section:

4

See section 706.

©2021, AICPA AU-C §705.A34

1210 Audit Conclusions and Reporting

•

The statement required by paragraph .28a of section 700 or para-

graph .67a or .107a of section 703, Forming an Opinion and Re-

porting on Financial Statements of Employee Benet Plans Sub-

ject to ERISA, as applicable, amended to state that the auditor's

responsibility is to conduct an audit of the entity's nancial state-

ments in accordance with auditing standards generally accepted

in the United States of America

•

The statement required by paragraph .28c of section 700 or para-

graph .67c or .107c of section 703, Forming an Opinion and Re-

porting on Financial Statements of Employee Benet Plans Sub-

ject to ERISA, as applicable, about independence and other ethical

responsibilities

Considerations When the Auditor Issues an Adverse Opinion or Disclaims

an Opinion on the Financial Statements (Ref: par. .30)

.A35 Describing the reasons for the modication of the opinion within the

"Basis for Opinion" section of the auditor's report provides information to users

that is useful in understanding why the auditor has expressed an adverse

opinion or disclaimed an opinion on the nancial statements. Furthermore, de-

scribing these reasons may guard against inappropriate reliance on the nan-

cial statements. However, providing further details about the audit may over-

shadow the reasons for the modication of the opinion and may potentially be

confusing to users.

.A36 When the auditor expresses an adverse opinion, the communication

of any key audit matters other than the matters giving rise to the modied opin-

ion may overshadow the fact that the nancial statements as a whole are ma-

terially misstated. When the auditor disclaims an opinion, the communication

of any key audit matters other than the matters giving rise to the disclaimer of

opinion may suggest that the nancial statements are more credible in relation

to those matters than would be appropriate in the circumstances and would be

inconsistent with the disclaimer of opinion on the nancial statements as a

whole. Similarly, it would not be appropriate for the auditor to make any state-

ments about the auditor's consideration of the consistency of other information

in an annual report with the nancial statements. Accordingly, paragraph .30 of

this section prohibits the inclusion of a "Key Audit Matters" section in the audi-

tor's report when the auditor issues an adverse opinion or disclaims an opinion

on the nancial statements and also prohibits the inclusion of an "Other Infor-

mation" section in the auditor's report when the auditor disclaims an opinion

on the nancial statements. [As amended, effective for audits of nancial state-

ments for periods ending on or after December 15, 2021, by SAS No. 137.]

Communication With Those Charged With Governance

(Ref: par. .31)

.A37 Communicating with those charged with governance the circum-

stances that lead to an expected modication to the auditor's opinion and the

proposed wording of the modication enables the following:

•

The auditor to give notice to those charged with governance of the

intended modication and the reasons (or circumstances) for the

modication

•

The auditor to seek the concurrence of those charged with gover-

nance regarding the facts of the matters giving rise to the expected

AU-C §705.A35 ©2021, AICPA

Modications to the Opinion in the Independent Auditor’s Report 1211

modication, or to conrm matters of disagreement with manage-

ment as such

•

Those charged with governance to have an opportunity, when ap-

propriate, to provide the auditor with further information and ex-

planations regarding the matters giving rise to the expected mod-

ication

©2021, AICPA AU-C §705.A37

1212 Audit Conclusions and Reporting

.A38

Exhibit — Illustrations of Auditor’s Reports With

Modifications to the Opinion

Illustration 1 — An Auditor's Report Containing a Qualied Opinion Due to

a Material Misstatement of the Financial Statements

Illustration 2 — An Auditor's Report Containing a Qualied Opinion for In-

adequate Disclosure

Illustration 3 — An Auditor's Report Containing an Adverse Opinion Due to

a Material Misstatement of the Financial Statements

Illustration 4 — An Auditor's Report Containing a Qualied Opinion Due to

the Auditor's Inability to Obtain Sufcient Appropriate Audit Evidence

Illustration 5 — An Auditor's Report Containing a Disclaimer of Opinion Due

to the Auditor's Inability to Obtain Sufcient Appropriate Audit Evidence

About a Single Element of the Financial Statements

Illustration 6 — An Auditor's Report Containing a Disclaimer of Opinion Due

to the Auditor's Inability to Obtain Sufcient Appropriate Audit Evidence

About Multiple Elements of the Financial Statements

Illustration 7 — An Auditor's Report in Which the Auditor Is Expressing

an Unmodied Opinion in the Prior Year and a Modied Opinion (Qualied

Opinion) in the Current Year

Illustration 8 — An Auditor's Report in Which the Auditor Is Expressing an

Unmodied Opinion in the Current Year and a Disclaimer of Opinion on the

Prior-Year Statements of Income, Changes in Stockholders' Equity, and Cash

Flows

AU-C §705.A38 ©2021, AICPA

Modications to the Opinion in the Independent Auditor’s Report 1213

Illustration 1 — An Auditor’s Report Containing a Qualified

Opinion Due to a Material Misstatement of the Financial

Statements

Circumstances include the following:

•

Audit of a complete set of general purpose nancial statements

(comparative). The audit is not a group audit.

•

Management is responsible for the preparation of the nancial

statements in accordance with accounting principles generally ac-

cepted in the United States of America as promulgated by the Fi-

nancial Accounting Standards Board.

•

The terms of the audit engagement reect the description of man-

agement's responsibility for the nancial statements in section

210, Terms of Engagement.

•

Inventories are misstated. The misstatement is deemed to be ma-

terial but not pervasive to the nancial statements. Accordingly,

the auditor's report contains a qualied opinion.

•

Based on the audit evidence obtained, the auditor has concluded

that there are no conditions or events, considered in the aggregate,

that raise substantial doubt about the entity's ability to continue

as a going concern for a reasonable period of time in accordance

with section 570, The Auditor's Consideration of an Entity's Abil-

ity to Continue as a Going Concern.

•

The auditor has obtained all the other information prior to the

date of the auditor's report, and the matter giving rise to the qual-

ied opinion on the nancial statements also affects the other in-

formation included in the annual report.

•

The auditor has not been engaged to communicate key audit mat-

ters.

Independent Auditor's Report

[Appropriate Addressee]

Report on the Audit of the Financial Statements

1

Qualied Opinion

We have audited the nancial statements of ABC Company, which comprise the

balance sheets as of December 31, 20X1 and 20X0, and the related statements

of income, changes in stockholders' equity, and cash ows for the years then

ended, and the related notes to the nancial statements.

In our opinion, except for the effects of the matter described in the Basis for

Qualied Opinion section of our report, the accompanying nancial statements

present fairly, in all material respects, the nancial position of ABC Company

as of December 31, 20X1 and 20X0, and the results of its operations and its

cash ows for the years then ended in accordance with accounting principles

generally accepted in the United States of America.

1

The subtitle "Report on the Audit of the Financial Statements" is unnecessary in circumstances

in which the second subtitle, "Report on Other Legal and Regulatory Requirements," is not applicable.

©2021, AICPA AU-C §705.A38

1214 Audit Conclusions and Reporting

Basis for Qualied Opinion

ABC Company has stated inventories at cost in the accompanying balance

sheets. Accounting principles generally accepted in the United States of Amer-

ica require inventories to be stated at the lower of cost or market. If the Com-

pany stated inventories at the lower of cost or market, a write down of $XXX

and $XXX would have been required as of December 31, 20X1 and 20X0, re-

spectively. Accordingly, cost of sales would have been increased by $XXX and

$XXX, and net income, income taxes, and stockholders' equity would have been

reduced by $XXX, $XXX, and $XXX, and $XXX, $XXX, and $XXX, as of and for

the years ended December 31, 20X1 and 20X0, respectively.

We conducted our audits in accordance with auditing standards generally ac-

cepted in the United States of America (GAAS). Our responsibilities under

those standards are further described in the Auditor's Responsibilities for the

Audit of the Financial Statements section of our report. We are required to be

independent of ABC Company and to meet our other ethical responsibilities, in

accordance with the relevant ethical requirements relating to our audits. We

believe that the audit evidence we have obtained is sufcient and appropriate

to provide a basis for our qualied audit opinion.

Responsibilities of Management for the Financial Statements

Management is responsible for the preparation and fair presentation of the

nancial statements in accordance with accounting principles generally ac-

cepted in the United States of America, and for the design, implementation,

and maintenance of internal control relevant to the preparation and fair pre-

sentation of nancial statements that are free from material misstatement,

whether due to fraud or error.

In preparing the nancial statements, management is required to evaluate

whether there are conditions or events, considered in the aggregate, that raise

substantial doubt about ABC Company's ability to continue as a going concern

for [insert the time period set by the applicable nancial reporting framework].

Auditor’s Responsibilities for the Audit of the Financial Statements

Our objectives are to obtain reasonable assurance about whether the nancial

statements as a whole are free from material misstatement, whether due to

fraud or error, and to issue an auditor's report that includes our opinion. Rea-

sonable assurance is a high level of assurance but is not absolute assurance and

therefore is not a guarantee that an audit conducted in accordance with GAAS

will always detect a material misstatement when it exists. The risk of not de-

tecting a material misstatement resulting from fraud is higher than for one

resulting from error, as fraud may involve collusion, forgery, intentional omis-

sions, misrepresentations, or the override of internal control. Misstatements

are considered material if there is a substantial likelihood that, individually or

in the aggregate, they would inuence the judgment made by a reasonable user

based on nancial statements.

In performing an audit in accordance with GAAS, we:

•

Exercise professional judgment and maintain professional skep-

ticism throughout the audit.

•

Identify and assess the risks of material misstatement of the -

nancial statements, whether due to fraud or error, and design and

perform audit procedures responsive to those risks. Such proce-

dures include examining, on a test basis, evidence regarding the

amounts and disclosures in the nancial statements.

•

Obtain an understanding of internal control relevant to the audit

in order to design audit procedures that are appropriate in the

AU-C §705.A38 ©2021, AICPA

Modications to the Opinion in the Independent Auditor’s Report 1215

circumstances, but not for the purpose of expressing an opinion on

the effectiveness of ABC Company's internal control. Accordingly,

no such opinion is expressed.

2

•

Evaluate the appropriateness of accounting policies used and the

reasonableness of signicant accounting estimates made by man-

agement, as well as evaluate the overall presentation of the nan-

cial statements.

•

Conclude whether, in our judgment, there are conditions or events,

considered in the aggregate, that raise substantial doubt about

ABC Company's ability to continue as a going concern for a rea-

sonable period of time.

We are required to communicate with those charged with governance regard-

ing, among other matters, the planned scope and timing of the audit, signicant

audit ndings, and certain internal control–related matters that we identied

during the audit.

Other Information [or another title, if appropriate, such as "Infor-

mation Other Than the Financial Statements and Auditor’s Report

Thereon"]

[Reporting in accordance with the reporting requirements in section 720, The

Auditor's Responsibilities Relating to Other Information Included in Annual

Reports.]

Report on Other Legal and Regulatory Requirements

[The form and content of this section of the auditor's report would vary depend-

ing on the nature of the auditor's other reporting responsibilities.]

[Signature of the auditor's rm]

[City and state where the auditor's report is issued]

[Date of the auditor's report]

2

In circumstances in which the auditor also has responsibility to express an opinion on the effec-

tiveness of internal control in conjunction with the audit of the nancial statements, omit the follow-

ing: "but not for the purpose of expressing an opinion on the effectiveness of ABC Company's internal

control. Accordingly, no such opinion is expressed."

©2021, AICPA AU-C §705.A38

1216 Audit Conclusions and Reporting

Illustration 2 — An Auditor’s Report Containing a Qualified

Opinion for Inadequate Disclosure

Circumstances include the following:

•

Audit of a complete set of general purpose nancial statements

(comparative). The audit is not a group audit.

•

Management is responsible for the preparation of the nancial

statements in accordance with accounting principles generally ac-

cepted in the United States of America as promulgated by the Fi-

nancial Accounting Standards Board.

•

The terms of the audit engagement reect the description of man-

agement's responsibility for the nancial statements in section

210, Terms of Engagement.

•

The nancial statements have inadequate disclosures. The audi-

tor has concluded that (a) it is not practicable to present the re-

quired information and (b) the effects are such that an adverse

opinion is not appropriate. Accordingly, the auditor's report con-

tains a qualied opinion.

•

Based on the audit evidence obtained, the auditor has concluded

that there are no conditions or events, considered in the aggregate,

that raise substantial doubt about the entity's ability to continue

as a going concern for a reasonable period of time in accordance

with section 570, The Auditor's Consideration of an Entity's Abil-

ity to Continue as a Going Concern.

•

The auditor has obtained all the other information prior to the

date of the auditor's report, and the matter giving rise to the qual-

ied opinion on the nancial statements also affects the other in-

formation included in the annual report.

•

The auditor has been engaged to communicate key audit matters.

Independent Auditor's Report

[Appropriate Addressee]

Report on the Audit of the Financial Statements

3

Qualied Opinion

We have audited the nancial statements of ABC Company, which comprise the

balance sheets as of December 31, 20X1 and 20X0, and the related statements

of income, changes in stockholders' equity, and cash ows for the years then

ended, and the related notes to the nancial statements.

In our opinion, except for the omission of the information described in the Basis

for Qualied Opinion section of our report, the accompanying nancial state-

ments present fairly, in all material respects, the nancial position of ABC Com-

pany as of December 31, 20X1 and 20X0, and the results of its operations and

its cash ows for the years then ended in accordance with accounting principles

generally accepted in the United States of America.

Basis for Qualied Opinion

ABC Company's nancial statements do not disclose [describe the nature of the

omitted information that is not practicable to present in the auditor's report]. In

3

The subtitle "Report on the Audit of the Financial Statements" is unnecessary in circumstances

in which the second subtitle, "Report on Other Legal and Regulatory Requirements," is not applicable.

AU-C §705.A38 ©2021, AICPA

Modications to the Opinion in the Independent Auditor’s Report 1217

our opinion, disclosure of this information is required by accounting principles

generally accepted in the United States of America.

We conducted our audits in accordance with auditing standards generally ac-

cepted in the United States of America (GAAS). Our responsibilities under

those standards are further described in the Auditor's Responsibilities for the

Audit of the Financial Statements section of our report. We are required to be

independent of ABC Company and to meet our other ethical responsibilities, in

accordance with the relevant ethical requirements relating to our audits. We

believe that the audit evidence we have obtained is sufcient and appropriate

to provide a basis for our qualied audit opinion.

Key Audit Matters

Key audit matters are those matters that were communicated with those

charged with governance and, in our professional judgment, were of most sig-

nicance in our audit of the nancial statements of the current period. These

matters were addressed in the context of our audit of the nancial statements

as a whole, and in forming our opinion thereon, and we do not provide a sepa-

rate opinion on these matters. In addition to the matter described in the Basis

for Qualied Opinion section, we have determined the matters described below

to be the key audit matters to be communicated in our report.

[Description of each key audit matter in accordance with section 701, Commu-

nicating Key Audit Matters in the Independent Auditor's Report]

Responsibilities of Management for the Financial Statements

Management is responsible for the preparation and fair presentation of the

nancial statements in accordance with accounting principles generally ac-

cepted in the United States of America, and for the design, implementation,

and maintenance of internal control relevant to the preparation and fair pre-

sentation of nancial statements that are free from material misstatement,

whether due to fraud or error.

In preparing the nancial statements, management is required to evaluate

whether there are conditions or events, considered in the aggregate, that raise

substantial doubt about ABC Company's ability to continue as a going concern

for [insert the time period set by the applicable nancial reporting framework].

Auditor’s Responsibilities for the Audit of the Financial Statements

Our objectives are to obtain reasonable assurance about whether the nancial

statements as a whole are free from material misstatement, whether due to

fraud or error, and to issue an auditor's report that includes our opinion. Rea-

sonable assurance is a high level of assurance but is not absolute assurance and

therefore is not a guarantee that an audit conducted in accordance with GAAS

will always detect a material misstatement when it exists. The risk of not de-

tecting a material misstatement resulting from fraud is higher than for one

resulting from error, as fraud may involve collusion, forgery, intentional omis-

sions, misrepresentations, or the override of internal control. Misstatements

are considered material if there is a substantial likelihood that, individually or

in the aggregate, they would inuence the judgment made by a reasonable user

based on nancial statements.

In performing an audit in accordance with GAAS, we:

•

Exercise professional judgment and maintain professional skep-

ticism throughout the audit.

•

Identify and assess the risks of material misstatement of the -

nancial statements, whether due to fraud or error, and design and

©2021, AICPA AU-C §705.A38

1218 Audit Conclusions and Reporting

perform audit procedures responsive to those risks. Such proce-

dures include examining, on a test basis, evidence regarding the

amounts and disclosures in the nancial statements.

•

Obtain an understanding of internal control relevant to the audit

in order to design audit procedures that are appropriate in the

circumstances, but not for the purpose of expressing an opinion on

the effectiveness of ABC Company's internal control. Accordingly,

no such opinion is expressed.

4

•

Evaluate the appropriateness of accounting policies used and the

reasonableness of signicant accounting estimates made by man-

agement, as well as evaluate the overall presentation of the nan-

cial statements.

•

Conclude whether, in our judgment, there are conditions or events,

considered in the aggregate, that raise substantial doubt about

ABC Company's ability to continue as a going concern for a rea-

sonable period of time.

We are required to communicate with those charged with governance regard-

ing, among other matters, the planned scope and timing of the audit, signicant

audit ndings, and certain internal control–related matters that we identied

during the audit.

Other Information [or another title, if appropriate, such as "Infor-

mation Other Than the Financial Statements and Auditor’s Report

Thereon"]

[Reporting in accordance with the reporting requirements in section 720, The

Auditor's Responsibilities Relating to Other Information Included in Annual

Reports.]

Report on Other Legal and Regulatory Requirements

[The form and content of this section of the auditor's report would vary depend-

ing on the nature of the auditor's other reporting responsibilities.]

[Signature of the auditor's rm]

[City and state where the auditor's report is issued]

[Date of the auditor's report]

4

In circumstances in which the auditor also has responsibility to express an opinion on the effec-

tiveness of internal control in conjunction with the audit of the nancial statements, omit the follow-

ing: "but not for the purpose of expressing an opinion on the effectiveness of ABC Company's internal

control. Accordingly, no such opinion is expressed."

AU-C §705.A38 ©2021, AICPA

Modications to the Opinion in the Independent Auditor’s Report 1219

Illustration 3 — An Auditor’s Report Containing an Adverse

Opinion Due to a Material Misstatement of the Financial

Statements

Circumstances include the following:

•

Audit of a complete set of consolidated general purpose nancial

statements (single year). The audit is a group audit. The auditor

is not making reference to a component auditor in the auditor's

report.

•

Management is responsible for the preparation of the consoli-

dated nancial statements in accordance with accounting prin-

ciples generally accepted in the United States of America as pro-

mulgated by the Financial Accounting Standards Board.

•

The terms of the audit engagement reect the description of man-

agement's responsibility for the nancial statements in section

210, Terms of Engagement.

•

The nancial statements are materially misstated due to the

nonconsolidation of a subsidiary. The material misstatement is

deemed to be pervasive to the nancial statements. Accordingly,

the auditor's report contains an adverse opinion. The effects of

the misstatement on the nancial statements have not been de-

termined because it was not practicable to do so.

•

Based on the audit evidence obtained, the auditor has concluded

that there are no conditions or events, considered in the aggregate,

that raise substantial doubt about the entity's ability to continue

as a going concern for a reasonable period of time in accordance

with section 570, The Auditor's Consideration of an Entity's Abil-

ity to Continue as a Going Concern.

•

The auditor has obtained all the other information prior to the

date of the auditor's report, and the matter giving rise to the qual-

ied opinion on the nancial statements also affects the other in-

formation included in the annual report.

•

The auditor is precluded from communicating key audit matters

when issuing an adverse opinion.

Independent Auditor's Report

[Appropriate Addressee]

Report on the Audit of the Consolidated Financial Statements

5

Adverse Opinion

We have audited the consolidated nancial statements of ABC Company and

its subsidiaries, which comprise the consolidated balance sheet as of December

31, 20X1, and the related consolidated statements of income, changes in stock-

holders' equity, and cash ows for the year then ended, and the related notes to

the nancial statements.

In our opinion, because of the signicance of the matter discussed in the Ba-

sis for Adverse Opinion section of our report, the accompanying consolidated

5

The subtitle "Report on the Audit of the Consolidated Financial Statements" is unnecessary in

circumstances in which the second subtitle, "Report on Other Legal and Regulatory Requirements,"

is not applicable.

©2021, AICPA AU-C §705.A38

1220 Audit Conclusions and Reporting

nancial statements do not present fairly the nancial position of ABC Com-

pany and its subsidiaries as of December 31, 20X1, or the results of their opera-

tions or their cash ows for the year then ended in accordance with accounting

principles generally accepted in the United States of America.

Basis for Adverse Opinion

As described in Note X, ABC Company has not consolidated the nancial state-

ments of subsidiary XYZ Company that it acquired during 20X1 because it has

not yet been able to ascertain the fair values of certain of the subsidiary's ma-

terial assets and liabilities at the acquisition date. This investment is there-

fore accounted for on a cost basis by the Company. Under accounting principles

generally accepted in the United States of America, the subsidiary should have

been consolidated because it is controlled by the Company. Had XYZ Company

been consolidated, many elements in the accompanying consolidated nancial

statements would have been materially affected. The effects on the consolidated

nancial statements of the failure to consolidate have not been determined.

We conducted our audit in accordance with auditing standards generally ac-

cepted in the United States of America (GAAS). Our responsibilities under

those standards are further described in the Auditor's Responsibilities for the

Audit of the Financial Statements section of our report. We are required to be

independent of ABC Company and to meet our other ethical responsibilities,

in accordance with the relevant ethical requirements relating to our audit. We

believe that the audit evidence we have obtained is sufcient and appropriate

to provide a basis for our adverse audit opinion.

Responsibilities of Management for the Financial Statements

Management is responsible for the preparation and fair presentation of the con-

solidated nancial statements in accordance with accounting principles gener-

ally accepted in the United States of America, and for the design, implementa-

tion, and maintenance of internal control relevant to the preparation and fair

presentation of consolidated nancial statements that are free from material

misstatement, whether due to fraud or error.

In preparing the consolidated nancial statements, management is required to

evaluate whether there are conditions or events, considered in the aggregate,

that raise substantial doubt about ABC Company's ability to continue as a go-

ing concern for [insert the time period set by the applicable nancial reporting

framework].

Auditor’s Responsibilities for the Audit of the Financial Statements

Our objectives are to obtain reasonable assurance about whether the consol-

idated nancial statements as a whole are free from material misstatement,

whether due to fraud or error, and to issue an auditor's report that includes

our opinion. Reasonable assurance is a high level of assurance but is not ab-

solute assurance and therefore is not a guarantee that an audit conducted in

accordance with GAAS will always detect a material misstatement when it ex-

ists. The risk of not detecting a material misstatement resulting from fraud is

higher than for one resulting from error, as fraud may involve collusion, forgery,

intentional omissions, misrepresentations, or the override of internal control.

Misstatements are considered material if there is a substantial likelihood that,

individually or in the aggregate, they would inuence the judgment made by a

reasonable user based on consolidated nancial statements.

In performing an audit in accordance with GAAS, we:

•

Exercise professional judgment and maintain professional skep-

ticism throughout the audit.

AU-C §705.A38 ©2021, AICPA

Modications to the Opinion in the Independent Auditor’s Report 1221

•

Identify and assess the risks of material misstatement of the con-

solidated nancial statements, whether due to fraud or error, and

design and perform audit procedures responsive to those risks.

Such procedures include examining, on a test basis, evidence re-

garding the amounts and disclosures in the nancial statements.

•

Obtain an understanding of internal control relevant to the audit

in order to design audit procedures that are appropriate in the

circumstances, but not for the purpose of expressing an opinion on

the effectiveness of ABC Company's internal control. Accordingly,

no such opinion is expressed.

6

•

Evaluate the appropriateness of accounting policies used and the

reasonableness of signicant accounting estimates made by man-

agement, as well as evaluate the overall presentation of the con-

solidated nancial statements.

•

Conclude whether, in our judgment, there are conditions or events,

considered in the aggregate, that raise substantial doubt about

ABC Company's ability to continue as a going concern for a rea-

sonable period of time.

We are required to communicate with those charged with governance regard-

ing, among other matters, the planned scope and timing of the audit, signicant

audit ndings, and certain internal control–related matters that we identied

during the audit.

Other Information [or another title, if appropriate, such as "Infor-

mation Other Than the Financial Statements and Auditor’s Report

Thereon"]

[Reporting in accordance with the reporting requirements in section 720, The

Auditor's Responsibilities Relating to Other Information Included in Annual

Reports.]

Report on Other Legal and Regulatory Requirements

[The form and content of this section of the auditor's report would vary depend-

ing on the nature of the auditor's other reporting responsibilities.]

[Signature of the auditor's rm]

[City and state where the auditor's report is issued]

[Date of the auditor's report]

6

In circumstances in which the auditor also has responsibility to express an opinion on the effec-

tiveness of internal control in conjunction with the audit of the consolidated nancial statements, omit

the following: "but not for the purpose of expressing an opinion on the effectiveness of ABC Company's

internal control. Accordingly, no such opinion is expressed."

©2021, AICPA AU-C §705.A38

1222 Audit Conclusions and Reporting

Illustration 4 — An Auditor’s Report Containing a Qualified

Opinion Due to the Auditor’s Inability to Obtain Sufficient

Appropriate Audit Evidence

Circumstances include the following:

•

Audit of a complete set of general purpose nancial statements

(single year). The audit is not a group audit.

•

Management is responsible for the preparation of the nancial

statements in accordance with accounting principles generally ac-

cepted in the United States of America as promulgated by the Fi-

nancial Accounting Standards Board.

•

The terms of the audit engagement reect the description of man-

agement's responsibility for the nancial statements in section

210, Terms of Engagement.

•

The auditor was unable to obtain sufcient appropriate audit evi-

dence regarding an investment in a foreign afliate. The possible

effects of the inability to obtain sufcient appropriate audit evi-

dence are deemed to be material but not pervasive to the nancial

statements. Accordingly, the auditor's report contains a qualied

opinion.

•

Based on the audit evidence obtained, the auditor has concluded

that there are no conditions or events, considered in the aggregate,

that raise substantial doubt about the entity's ability to continue

as a going concern for a reasonable period of time in accordance

with section 570, The Auditor's Consideration of an Entity's Abil-

ity to Continue as a Going Concern.

•

The auditor has obtained all the other information prior to the

date of the auditor's report, and the matter giving rise to the qual-

ied opinion on the nancial statements also affects the other in-

formation included in the annual report.

•

The auditor has not been engaged to communicate key audit mat-

ters.

Independent Auditor's Report

[Appropriate Addressee]

Report on the Audit of the Financial Statements

7

Qualied Opinion

We have audited the nancial statements of ABC Company, which comprise the

balance sheet as of December 31, 20X1, and the related statements of income,

changes in stockholders' equity, and cash ows for the year then ended, and the

related notes to the nancial statements.

In our opinion, except for the possible effects of the matter described in the

Basis for Qualied Opinion section of our report, the accompanying nancial

statements present fairly, in all material respects, the nancial position of ABC

Company as of December 31, 20X1, and the results of its operations and its

cash ows for the year then ended in accordance with accounting principles

generally accepted in the United States of America.

7

The subtitle "Report on the Audit of the Financial Statements" is unnecessary in circumstances

in which the second subtitle, "Report on Other Legal and Regulatory Requirements," is not applicable.

AU-C §705.A38 ©2021, AICPA

Modications to the Opinion in the Independent Auditor’s Report 1223

Basis for Qualied Opinion

ABC Company's investment in XYZ Company, a foreign afliate acquired dur-

ing the year and accounted for under the equity method, is carried at $XXX

on the balance sheet at December 31, 20X1, and ABC Company's share of

XYZ Company's net income of $XXX is included in ABC Company's net in-

come for the year then ended. We were unable to obtain sufcient appropri-

ate audit evidence about the carrying amount of ABC Company's investment

in XYZ Company as of December 31, 20X1, and ABC Company's share of XYZ

Company's net income for the year then ended because we were denied access

to the nancial information, management, and the auditors of XYZ Company.

Consequently, we were unable to determine whether any adjustments to these

amounts were necessary.

We conducted our audit in accordance with auditing standards generally ac-