The IAS / IFRS standards • 31Edion 2020 ©

IAS 7

Statementofcashows

1. Objecve

The objecve of IAS 7 is to specify the requirements enes must comply with

when preparing informaon related to cash ows so as to allow the readers of

their nancial statements to understand the potenal implicaons of incoming

and outgoing cash ows and cash equivalents.

The Standard requires that a statementofcashows be provided in the form of

a summarydocument, giving users the possibility to:

• assess the abilityoftheentytogeneratecashandcashequivalents;

• assess the enty’snancingrequirements;

• forecast the enty’s changeincashposion.

• improve the understanding of howtheentygeneratesandusescashows

for operang, invesng and nancing acvies over the relevant period.

The statement of cash ows presents inowsandoulowsofcash based on

type (operang, invesng and nancing).

2. Scope

2.1 Introducon

Before dealing with requirements relang to the presentaon of a state-

ment of cash ows, the terms “cash” and “cash equivalents” need to be

dened, which include the following items:

• cashonhandanddemanddeposits;

• cashequivalents readily converble to known amounts of cash and which

are subject to an insignicant risk of changes in value, such as:

ü short-term investments,

ü liquid investments.

32 • The IAS / IFRS standards Edion 2020 ©

Cash and cash equivalents therefore may include the following:

• cash deposits;

• demand deposits;

• me deposits and related accrued interest not yet due, made less than three

months before the end of the period and with a maturity of less than three

months;

• risk-free investment securies;

• debit balances of bank accounts and related accrued interest not yet payable.

Cash and cash equivalents do not include:

• me deposits and related accrued interest not yet due, made more than

three months before the end of the period and with a maturity of over three

months;

• bonds with a maturity of over three months;

• equity investments, except if they are, in substance, cash equivalents;

• credit balances of bank accounts and other authorized overdras used for

nancing purposes;

• the share of loans and nancial debts due within less than three months

when originally contracted for a term of over three months.

2.2 PresentaonofaStatementofcashows

It is important to remember that IAS 7 categorises dierent types of cash ow

depending on the acvity which generated them: operang, invesng or nan-

cing acvies.

2.2.1 Cash ows from operang acvies

Operang acvies are the principal revenue-producing acvies of the enty

and other acvies that are not invesng or nancing acvies. They include

operang cash ows corresponding to operang income and expenses, and

other incoming and outgoing payments related to the company’s business ac-

vies.

2.2.2 Cash ows from invesng acvies

Invesng acvies are dened as those related to the acquision and disposal

of long-term assets and other investments that are not included in cash equiva-

lents.

In parcular, invesng acvies include acquisions and disposals of tangible

and intangible xed assets, acquisions of interests in other enes, and other

The IAS / IFRS standards • 33Edion 2020 ©

nancial xed assets such as deposits and guarantees, and investment securies

that are not recognized as cash.

2.2.3 Cash Flows from nancing acvies

Financing acvies are acvies that result in changes in the size and composi-

on of the enty’s nancial resources in the form of equity and borrowings. The

following are examples of items of cash ows from nancing acvies and which

should be presented separately:

• increases in, or redempon of, share capital;

• borrowings which have been contracted or repaid;

• distribuon of dividends.

It should be noted that the distribuon of dividends may be presented either as

a ow related to operang acvies or as a ow related to nancing acvies

depending on whether the dividend is considered to be a resource derived from

operaons or a return on capital invested.

2.3 Presentaonofcashows

2.3.1 Presentaon of cash ows from operang acvies

Two methods of presentaon are allowed:

• the direct method, whereby major classes of gross cash receipts and gross

cash payments are disclosed;

• the indirect method, whereby prot or loss is adjusted for the eects of:

ü transacons of a non-cash nature,

ü any deferrals or accruals of past or future operang cash receipts or

payments,

ü items of income or expense associated with invesng or nancing cash

ows.

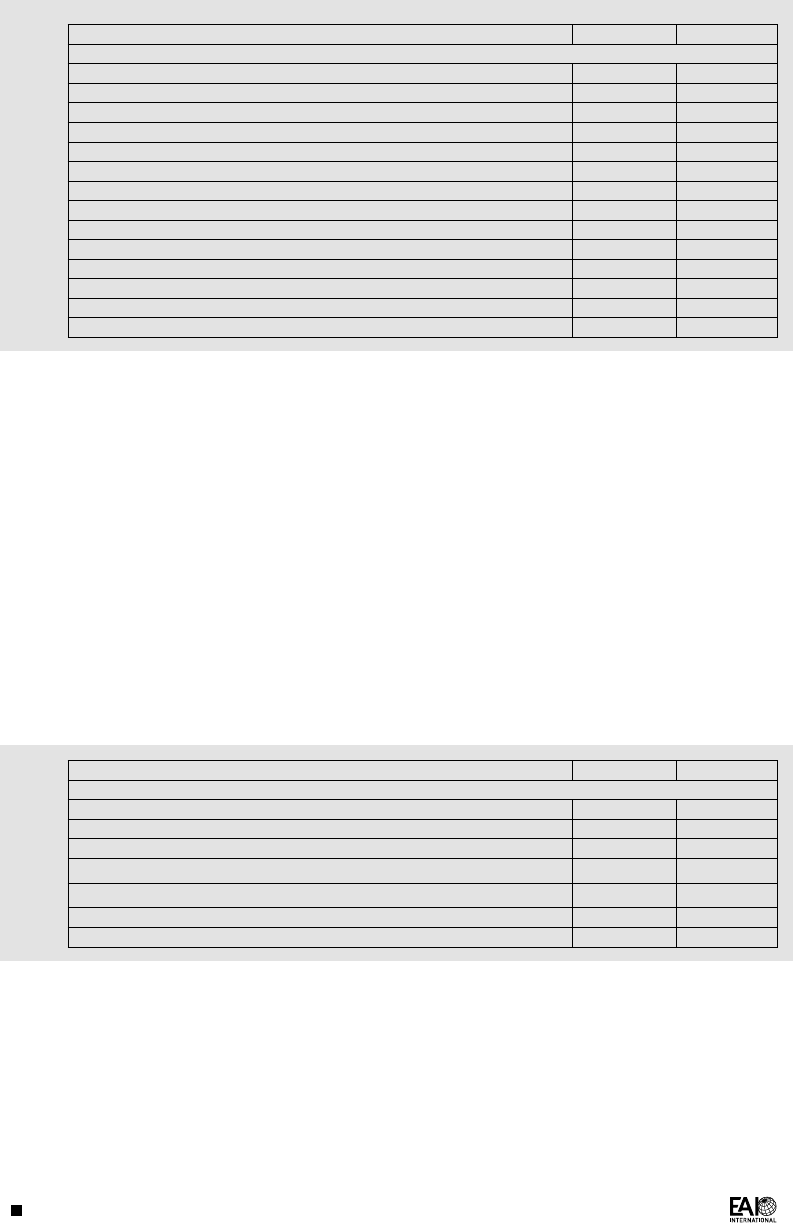

Below is an example of an extract from a Statement of cash ows presented

using the indirect method and showing the top part of the statement relang to

cash ows from operang acvies:

34 • The IAS / IFRS standards Edion 2020 ©

Year N Year N-1

Cashowsrelatedtooperangacvies

Net prot or loss before corporate income tax 25,000 15,000

Amorzaon/depreciaon allowances 10,000 7,500

Depreciaon of assets 3,500 7,000

Other items 1,500 1,500

TotalcashowsfromoperangacviespriortochangeinWCR 40,000 31,000

Increase/Decrease of long-term receivables (beyond one year) 7,500 3,500

Increase/Decrease of customer receivables and other long-term assets 3,500 7,000

Decrease of debts with maturity of maximum one year - 3,550 - 4,250

ChangeinWorkingCapitalRequirements 7,450 6,250

Netcashowsfromoperangacvies 47,450 37,250

Corporate income tax paid 3,800 2,400

Interest income received 1,500 750

Financing charges related to borrowings - 3,500 - 4,000

Netchangeincashowsfromoperangacvies 49,250 36,400

2.3.2 Presentaon of cash ows from invesng acvies

The following requirements apply here:

• only payments and receipts that result in the recognion or de-recognion

of an asset in the Statement of nancial posion are eligible for classicaon

as cash ows from invesng acvies;

• the main classes of incoming and outgoing gross cash ows are presented

separately;

• the aggregate cash ows generated through the acquision of subsidiaries,

joint ventures and associates are classied as investments.

Below is a presentaon of the secon of the statement reporng this type of

cash ow:

Year N Year N-1

Cashowsfrominvesngacvies

Increase of intangible xed assets - 1,500 - 1,250

Increase of tangible xed assets - 30,000 - 25,000

Proceeds from disposal of tangible xed assets 25,000 2,500

Proceeds from disposal of intangible xed assets 750

Disposal of business acvies 18,000

Other investments 5,000 - 1,500

Netchangeincashowsfrominvesngacvies - 1,500 - 6,500

2.3.3 Presentaon of cash ows from nancing acvies

Cash ows from nancing acvies must be disclosed with the main classes of

incoming and outgoing gross cash ows presented separately.

The IAS / IFRS standards • 35Edion 2020 ©

The following cash ows may be presented on a net basis:

• cash receipts and payments on behalf of customers when the cash ows

reect the acvies of the customer rather than those of the enty;

• cash receipts and payments for items in which the turnover is quick, the

amounts are large, and the maturies are short.

Informaon on the following changes in cash ows from nancing acvies

must be disclosed:

• changes in cash ows used for nancing acvies

• changes of ownership interest leading to obtaing tenon or losing ss of

control of subsidiaries or other businesses

• eects of changes of foreign exchange rates

• changes in fair value

• other changes.

Below is a presentaon of the secon of the Statement of cash ows reporng

cash ows from nancing acvies:

Year N Year N-1

Cashowsfromnancingacvies

Capital increase 10,000

Borrowings contracted 50,000 15,000

Borrowings repaid - 8,900 - 3,500

Dividends paid - 2,500 - 1,250

Net change in cash ows from nancing acvies 48,600 10,250

Autres opéraons d’invesssement 5 000 - 1 500

Variaonneedelatrésorerieliéeauxopéraonsd’invesssement - 1 500 - 6 500

In this example, payment of dividends was considered as compensaon to inves-

tors and recognized as part of nancing acvies.

2.4 SpecialRulesapplicabletopreparaonofaStatementofcash

ows

The following special rules apply to the preparaon of a Statement of cash ows:

• interest is classied based on type - either from operang acvies, investment

acvies or nancing acvies;

• cash ows related to corporate income tax are normally classied as cash ows

from operang acvies;

• cash ows denominated in foreign currencies are reported at the exchange rate

in force on the date of the cash ow;

• when an investment in an enty is accounted for using the equity or cost me-

thod, an investor restricts its reporng in the Statement of cash ows to the cash

36 • The IAS / IFRS standards Edion 2020 ©

ows between itself and the investee.

As an example, the Statement of cash ows below presents all of the cash ows

detailed above:

Year N Year N-1

Cash ows from operang acvies

Net prot before corporate income tax 25,000 15,000

Amorzaon/depreciaon allowances 10,000 7,500

Depreciaon of assets 3,500 7,000

Other items 1,500 1,500

TotalcashowsfromoperangacviespriortochangeinWCR 40,000 31,000

Increase/Decrease of long-term receivables (beyond one year) 7,500 3,500

Increase/Decrease of customer receivables and other long-term assets 3,500 7,000

Decrease of debts with maturity of maximum one year - 3,550 - 4,250

ChangeinWorkingCapitalRequirements 7,450 6,250

Netcashowsfromoperangacvies 47,450 37,250

Corporate income tax paid 3,800 2,400

Interest income received 1,500 750

Financing charges related to borrowings - 3,500 - 4,000

Netchangeincashowsfromoperangacvies 49,250 36,400

Cash ows from invesng acvies

Increase of intangible xed assets - 1,500 - 1,250

Increase of tangible xed assets - 30,000 - 25,000

Proceeds from disposal of tangible xed assets 25,000 2,500

Proceeds from disposal of intangible xed assets 750

Disposal of business acvies 18,000

Other investments 5,000 - 1,500

Netchangeincashowsfrominvesngacvies - 1,500 - 6,500

Cash ows from nancing acvies

Capital increase 10,000

Borrowings contracted 50,000 15,000

Borrowings repaid - 8,900 - 3,500

Dividends paid - 2,500 - 1,250

Netchangeincashowsfromnancingacvies 48,600 10,250

Netchangeincashowsfortheperiod 96,350 40,150