Page1of48

NAIC2022LIQUIDITYSTRESSTESTFRAMEWORK

ForLifeInsurersMeetingtheScopeCriteria

December13,2022

Page2of48

TableofContents

INTRODUCTION...................... ... ............. ............. ... ............. ............. .. ............. ............. ... ............. ............... ..4

MacroprudentialImplicationsofaLiquidityStress....................... ... ............. ............. .. ............. ............. ... ....4

BACKGROUND...................... .. ............. ............. ... ............. ............. ... ............. ............. .. ............. ................ .. ..5

NAICMacroprudentialInitiative..................... ............. ............. .. ............. ............. ... ............. ............. .. ..........5

LiquidityAssessmentSubgroup...................... .. ............. ............. ... ............. ............. ... ............. ............ ... .......6

Mandate..........................................................................................................................................6

DataGaps........................................................................................................................................6

DiscussionswithInsurers................................................................................................................7

RegulatoryGoalsoftheLiquidityStressTest.................................................................................9

[Beginningof]2022Liquidity

StressTestingFramework–tobeincluded/referencedintheNAICFinancial

AnalysisHandbook................................. ... ............. .. ............. ............. ... ............. ............. .. ............. ...............9

Section1.ScopeCriteriaforDeterminingGroupsSubjectto2022LST......... ... ............. ............. .. ............. ..9

Section2.LiquidityStressTest........... ............. ... ............. ............. ... ............. .. ............. ............. ... ............. ..11

2.1Summary..................................................................................................................................11

2.2TimeHorizons..........................................................................................................................11

2.3Insurer’sInternalLiquidityStress

TestingSystem.................................................................13

Section3.LegalEntitiesRequiredtoPerformtheLSTforInsurersMeetingtheScopeCriteria... ... ..........13

Section4.CashFlowApproach–LiquiditySourcesandUses........... ... ............. ............. .. ............. ... ..........16

4.1BaselineAssumptionsforCashflows.....................................................................................17

Section5.StressScenariosandtheirAssumptions...................... ............. ... ............. ............. .. ............. .....17

5.1

AdverseLiquidityStressScenarioforInsurers.......................................................................19

5.1.1Narrative...............................................................................................................................19

5.1.2Regulator‐PrescribedAssumptions.....................................................................................20

5.1.3MarketCapacityAssumption..............................................................................................21

5.1.4EconomicVariablesforAdverseScenario...........................................................................23

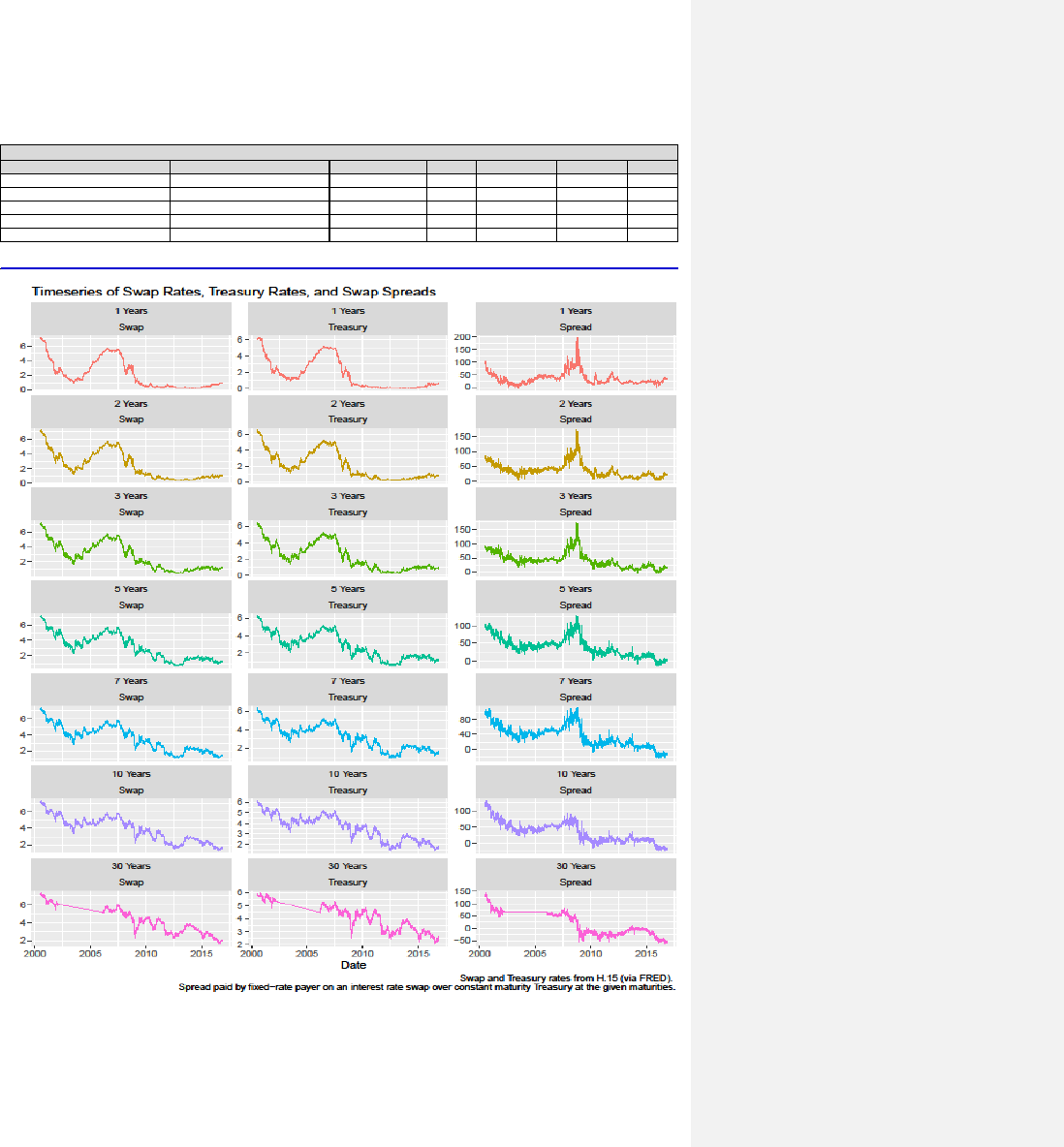

5.1.5SWAPSpreads......................................................................................................................24

5.1.6SwaptionVolatility...............................................................................................................24

5.1.7Moody’sTransitionMatrix/MigrationRates......................................................................25

5.1.8

Moody’sDefaultTable.........................................................................................................25

5.1.9Moody’sRecoveryRateTable.............................................................................................25

5.1.10“WhatIf”Modification......................................................................................................26

5.1.11Company‐SpecificAssumptions.........................................................................................26

Page3of48

5.2InterestRateSpikeScenario...................................................................................................26

5.2.1Narrative...............................................................................................................................26

5.2.2Regulator‐PrescribedAssumptions.....................................................................................27

5.2.3Company‐SpecificAssumptions...........................................................................................27

5.3InsurerSpecificInformationRequest‐Worst‐CaseScenario................................................28

5.3.1Narrative...............................................................................................................................28

Section6.AvailableandExpectedAssetSales........ ... ............. ............. .. ............. ............. ... ............. ..........28

Section7.Reporting....... .. ... ............. ............. .. ............. ............. ... ............. ............. ... ............. ............. .. .....29

Section8.Templates............ ............. .. ............. ............. ... ............. ............. ... ............. ............. .. ............. .....32

8.1LiquiditySourcesTemplate.....................................................................................................32

8.2LiquidityUsesTemplate..........................................................................................................33

8.3AssetsTemplate......................................................................................................................34

Narrative/ExplanatoryDisclosuresnotedinthe2022LST.................... ............. .. ............. ............. ... ..........36

[Endof2022LiquidityStressTestingFramework–tobeincludedasan

appendixintheNAICFinancial

AnalysisHandbook]......... .. ............. ............. ... ............. .. ............. ............. ... ............. ............. .. ............. ........37

DataAggregation.. ............. ... ............. .. ............. ............. ... ............. ............. ... ............. ............. .. ..................37

RegulatoryAuthority....... ............. ............. .. ............. ............. ... ............. .. ............. ............. ... ............. ..........37

Confidentiality........................... ... ............. ............. .. ............. ... ............. ............. .. ............. ..........................38

Timeline... ... ............. ... ............ ............. ... ............. ............. ... ............. ............. .. ............. ................ .. .............38

Annex1:OriginalScopeCriteriawithAnnualStatementReferences.......................... ............. ... ............. ..39

Annex2:RegulatoryPrescribedAssumptions.......... ... ............. .. ............. ............. ... ............. ............. ... .......41

Annex2i.EconomicandMarketVariables...................................................................................

41

Annex2ii.MarketCapacityAssumption......................................................................................44

Annex2iii,A.Year‐endStructuredSpreadBaselineValues........................................................45

Annex2iv.SWAPSpreadTable.....................................................................................................46

Annex2v.ImpliedVolatilityofIRSwaptions...............................................................................47

Annex2vi.CreditAssumptions:Moody’sTransitionMatrix/MigrationRates...........................47

Annex2vii.CreditAssumptions:Moody’sDefault

Table............................................................48

Annex2viii.CreditAssumptions:Moody’sRecoveryRateTable................................................48

Page4of48

INTRODUCTION

MacroprudentialImplicationsofaLiquidityStress

Beginningmid‐year2017,the NAICembarkedona project todevelopa liquidity stresstesting

framework.WhiletheNAIChasexistingtoolsandprocessesforassessingliquidityriskatalegal

entitylevel (i.e.,‘inward’impacts totheinsurer),therewasrecognition thatthe NAICtoolbox

couldbefurtherenhanced

withtheadditionofmoregranulardataintheannualstatementand

a tool that would enable an assessment of macroprudential impacts on the broader financial

markets (i.e., ‘outward’ impacts) of a liquidity stress impacting a large number of insurers

simultaneously.

Post‐financialcrisis,therewereseveralattemptstoassess

potentialmarketimpactsemanating

fromaliquiditystressintheinsurancesector.Manyoftheseanalysesreliedheavilyonanecdotal

assumptions and observations from behaviors of other financial sectors. To provide more

evidence‐basedanalyses,theNAICdecidedtodevelopaLiquidity StressTest (LST)Framework

forlargelife insurers that

wouldaim to capture the outwardimpacts on the broaderfinancial

marketsofaggregateassetsalesunderaliquiditystress.

Thestresstestwillberunannuallyandthefindings,onanaggregatebasis,reportedannuallyas

part of the NAIC’s continuous macroprudential monitoring efforts. The NAIC’s pursuit of the

liquidity stresstestshould not suggestanypre‐judgementofthe outcomes. TheNAICbelieves

there is value to the exercise whether it points to vulnerabilities of certain asset classes or

marketsor, alternatively, suggests that even a severe liquidity stress impacting the insurance

sectorisunlikelytohavematerialimpacts

onfinancialmarkets.TheNAICliquiditystresstesting

framework is intended to supplement, not replace, a firm‐specific liquidity risk management

framework.TheNAIChasnotyetdiscussedstepsthatmightbetakentoaddressanyidentified

vulnerabilities but acknowledges that any recommendations may require collaboration with

otherfinancialregulators.

Page5of48

The NAIC’s revised proposed liquidity stress testing framework is contained in the pagesthat

follow. The NAIC recognizes that, at least in the early years, the stress testing process and

analyseswillbeiterative.Weexpectrefinementsastheframeworkisdeveloped,especiallyafter

thefirstyear’simplementation.

BACKGROUND

NAICMacroprudentialInitiative

TheNAIC’sMacroprudentialInitiative(MPI)commencedin2017.Itrecognizedthepost‐financial

crisisreformsthatbecamepartofourSolvencyModernizationInitiative(SMI)thatcontinueto

serve us well today. However, in the ensuingyears since those reforms,insurers have had to

contendwithsustainedlow interestrates,changingdemographics

andrapidadvancementsin

communication and technology. They have responded by offering new products, adjusting

investmentstrategies,makingstructuralchanges,andexpandingintonewglobalmarkets.There

are new market players, new distribution channels, and a complex web of interconnections

betweenfinancialmarketplayers.

Whathasnotchangedsincethe

financialcrisisisthescrutinyontheinsurancesectorintermsof

understanding how insurers react to financial stress, and how that reaction can impact, via

various transmission channels, policyholders, otherinsurers,financialmarketparticipants, and

thebroaderpublic.

Theproposedworkonmacroprudentialmeasuresisreflectiveofthestateinsurance

regulators’

commitment to ensure that the companies they regulate remain financially strong for the

protectionofpolicyholders,whileservingasastabilizingforcetocontributetofinancialstability,

includinginstressedfinancialmarkets.Tothatend,theNAIC’sthree‐yearstrategicplan(2018‐

2020), “State Ahead”, reflects the objective of

“Evaluating Gaps and regulatory opportunities

arisingfrommacroprudentialsurveillance,anddevelopappropriateregulatoryresponses.”

TheNAIC’sworkonmacroprudentialsurveillanceisoverseenbytheFinancialStabilityTaskForce

oftheNAICExecutiveCommittee.InApril2017,theTaskForcewasaskedtoconsidernewand

improved tools to better monitor and

respond to both the impact of external financial and

Page6of48

economicrisks on supervised firms, as well asthe risksemanating from oramplified by these

firmsthatmightbetransmittedexternally.TheTaskForce,inturn,focuseditseffortsonpotential

enhancementstoidentify and monitorliquidityrisk, amongotherareas.More specifically, the

TaskForcewasrequestedtofurther

developtheU.S.regulatoryframeworkonliquidityriskwith

a focus on life insurers due to the long‐term cash‐buildup involved in many life insurance

contractsandthepotentialforlargescaleliquidationofassets.

LiquidityAssessmentSubgroup

To carry out its work on assessing liquidity considerations, the Task Force established the

LiquidityAssessmentSubgroup(“Subgroup”)mid‐year2017.

Mandate

ThechargesandworkplanoftheSubgroupreflectthefollowingassignments:

Reviewexistingpublicandregulator‐onlydatarelatedtoliquidityrisk,identifyanygapsbased

onregulatory

needsanddeterminethescopeofapplication,andproposerecommendations

toenhancedisclosures.

Develop a liquidity stress testing framework proposal for consideration by the Financial

Condition (E) Committee, including the proposed universe of companies to which the

frameworkwillapply(e.g.,largelifeinsurers).

Oncethestresstesting

frameworkiscompleted,considerpotentialfurtherenhancementsor

additionaldisclosures.

Inaddition,asmallinformalstudygroupcomprisedofregulators,industryparticipantsandNAIC

staffwas formed to consider thespecificdata needsandtechnical aspectsoftheproject.The

studygroupisNOTanofficialNAICworkinggroup.Allrecommendations

fromthestudygroup

must be vetted and considered by the Liquidity Assessment Subgroup and/or the Financial

Stability(EX)TaskForceaccordingtoNAICprocedures.

DataGaps

PriortoundertakingworkontheLiquidityStressTest,theSubgroupconstructedaninventorylist

ofexistinglifeinsurerdisclosuresasof2018

thatcontributetoanunderstandingofliquidityrisk.

Page7of48

Whenassessingthecurrentstate,theSubgrouprecogni zedtheavailabilityofsignificantdetailed

investment‐related disclosures but contrasted it to the relati vely sparse liability‐related

disclosures.Toremedythisimbalance,ablanksproposalwasconstructedtosignificantlyincrease

thedisclosuresforlifeinsuranceproducts.

Specifically,theAnalysisofOperationsbyLine

ofBusinessschedulewasexpandedfromasingle

exhibittofiveexhibits,oneeachforIndividualLife,GroupLife, IndividualAnnuity,GroupAnnuity,

andAccidentandHealth.TheAnalysisofIncreaseinReservesschedulewassimilarlyexpanded.

Withineachofthefivenewexhibits,columnswereaddedformoredetailed

productreporting.

Forexample,columnswereaddedtotheIndividualandGroupLifeexhibitstocaptureuniversal

lifeinsuranceanduniversallifeinsurancewithsecondaryguarantees,andcolumnswereadded

totheIndividualandGroupAnnuityexhibitstocapturevariableannuitiesandvariableannuities

withguaranteedbenefits.Inaddition,twonew

lineswereaddedtothenowfiveexhibitsofthe

AnalysisofIncreaseinReservesschedule:onecapturingthecashsurrendervalueoftheproducts

outstandingandanothercapturingtheamount of policyloans available(lessamounts already

loaned).A new addition wasalsoproposed to the Life Notesto

FinancialStatement.Thenew

Note33consideredthetypeofliquidityconcernsdisclosedinNote32forannuitiesanddeposit‐

typecontractsandaddeddisclosuresforlifeinsuranceproductsnotcoveredinNote32.

TheseproposalswereexposedandcommenteduponseveraltimesattheLiquidityAssessment

Subgroup,theFinancialStability

(EX)TaskForce,andattheBlanks(E)WorkingGroup.Ultimatel y,

theywereadoptedbyNAICPlenaryforinclusioninthe2019LifeAnnualStatementBlank.Asan

interimstep,TheFinancialStabilityTaskForceperformedadatacallrequestingafewkeylines

of information from the newly adopted

2019 format of the Analysis of Operations by Line of

BusinessscheduleandtheAnalysisofIncreaseinReservesschedule,aswellasthenewNote33,

butpopulatedwith2018year‐enddata.ThisdatacallwascompletedinJuly2019.

DiscussionswithInsurers

Duringthelatterpartof2017

andfirstquarterof2018,theSubgroupconductedcallswithseveral

large life insurers who agreed to share their internal liquidity risk assessment processes. The

Page8of48

dialogueprovidedextremelyhelpfulinputand informedtheestablishmentoftheinitialdirection

oftheLiquidityStressTestingFramework.Feedbackfromthesediscussionsinclude:

• Scopecriteriashouldberisk‐focused,notsolelybasedonsize.

• Stress test framework should align with internal management reporting and leverage the

ORSA.

•

Stress test should be principle‐based and complement a company’s internal stress testing

methodology.

• Regulatory guidance should be provided to help define liquidity sources and uses,

products/activities with liquidity risk, time horizons, level of aggregation, reporting

frequency,andestablishingstressscenarios.

• Public disclosureofresults shouldbecarefully

consideredto avoidexacerbating aliquidity

crisis.

Regarding the specifics of liquidity assessments/stress test approaches, significant diversity in

practicesexist.Keyobservationsinthisregardincluded:

• Liquiditytestsare performedatthematerialentitylevelandattheholdingcompanylevel.

Definitionsofmaterialentitiesdiffer.

• Mostfirmsdetermine

somesortof coverageratio(LiquiditySources)/(LiquidityUses),for

BaseandStressscenariosandmonitorresultstoensuretheyalignwiththefirm’s(internal)

riskappetite.Categoriesofliquiditysourcesandusesdifferacrossfirmsandassumptionsvary

dependingontimehorizon.Someinsurersdeterminecoverageratiosutilizing

balancesheet

values, applying different haircuts by asset class, time horizon and type of stress. Other

insurersdetermineliquiditycoveragegaps(LiquidityInflows–LiquidityOutflows)utilizinga

cashflowapproach.

• Stress scenarios vary by company, reflecting a combination of market‐driven, as well as

idiosyncraticandinsurer‐specificscenarios.

• Timehorizonstestedalsovary,typicallyrangingfrom7daysto1year.

Page9of48

RegulatoryGoalsoftheLiquidityStressTest

• Theprimarygoalofthisliquiditystresstesting,andthespecificstressscenariosutilized,isfor

macroprudentialuses – to allow the FSTF regulators to identify amounts of asset sales by

insurers that could impact the markets under stressed environments. Thus, the selected

stressscenariosare consciously focusedonindustry‐wide stresses – thosethatcan impact

manyinsurerswithinasimilartimeframe.Thesemaynotbethemoststressfulscenariosfor

specific legal entity insurers, or even their groups. Regulators have indicated the liquidity

stresstestingisalsomeanttoassistregulators

intheirmicroprudentialsupervision,inthe

context of being helpful for domiciliary and lead state regulators to better understand

liquidity stress testing programs at those legal entities and groups. There is no intent to

requirethesestressscenariostobeusedbyindividualinsurersforsomesortofassessment

or

regulatoryinterventionmechanism.Similarly,therehasnotbeenanyconsiderationgiven

torequiringtheminthemanagementofanyentitiesinreceivership.

• Regulatoryconcerns regardingliquidityriskfor legalentityinsurersand/or groups ismore

aboutthestressscenariosofmostconcerntothoseentities(notthoseidentifiedfor

macro

prudentialpurposes).Similarly,whenconsideringliquidityriskatalegalentityand/orgroup,

regulatorsneedtounderstandtheinsurer’sentireriskmanagementframework.Muchofthis

understandingmaycomefromtheORSAfilings.Thus,theLSTisnotmeanttobealegalentity

insurer requirement, or used as a

ranking too l, etc. However, it is recognized that simply

reviewingtheseLSTresultsmayhelpregulatorsbetterunderstandtheroleofliquiditystress

testing within the entities – which may result inmore questionsand information requests

regarding the entities’ own liquidity risk management framework and dynamics of their

internal

liquiditystresstests.

[Beginningof]2022LiquidityStressTestingFramework–tobe

included/referencedintheNAICFinancialAnalysisHandbook

Section1.ScopeCriteriaforDeterminingGroupsSubjectto2022LST

HISTORY–ScopeCriteriafortheInitial2020LST:

Page10of48

Indeterminingthecompaniessubjecttotheliquiditystresstest(LST),considerationwasgiven

to activities assumed to be correlated with liquidity risk. Another consideration was the

desirabilityoftyingdatausedinthecriteriabacktothestatutoryfinancialstatements.Ultimately

six activities were identified. Those activities are Fixed and

Indexed Annuities, Funding

Agreements, Derivatives, Securities Lending, Repurchase Agreements and Borrowed Money.

Minimumthresholdswereestablishedforeachofthesesixactivities.Alifeinsurancelegalentity

orlifeinsurancegroupexceedingthethresholdfor anyofthesixactivitiesissubjecttothestress

test(seeAnnex1for

moredetails).

While the scope criteria only utilize statutory annual statement data, the stress test is not

similarlylimited.Thus,thestresstestwillconsidermanymoreliquidityrisk elementsthanthe

scopecriteria,andinternalcompanydatawillbethesourceformanyofthoseelements.

Just as the liquidity

stress test structure and methodology may change over time, the scope

criteriamayalso bemodified,for example,inresponsetonewdatapointsintheNAICAnnual

StatementBlank.Thescopecriteriawillbereviewedannually.

Usingtheagreedcriteria,NAICstaffobtainedtheamountsforalllifeinsurance

legalentitiesfrom

the 2018 annual statutory financial statements (filed by March 1, 2019). If two or more life

insurerswerepartofaninsurancegroupwithanNAICgroupcode,thenthenumbersforeachof

those legal entity life insurers was summed together to represent an insurance group result.

Thus,alegalentitylifeinsurernotinaninsurancegroupcanmeetthethresholdonitsown,or

thesumoflegalentitylifeinsurersinagroupcouldmeetthethreshold.Twenty‐threeinsurance

groupsmettheinitialscopecriteria.

Inestablishingwhetheraninsurerorgroupmet

orexceededthethresholdcriteria,theSubgroup

memberssupportedusingthemostcurrentsingleyearactivityratherthanamulti‐yearaverage.

Thisresultedincoverageamountsrangingfrom60%to80%oftheindustrytotalforeachactivity

based on 2018 data.

It was recognized that using single year activity could result in more

instancesofaninsurancegroupbeinginscopeoneyearandoutofscopethenext,butregulators

vieweditmoreimportanttohavethemostrecentfinancialdatautilizedfordeterminingscope.

Toaddressconcernsaboutinsurersmoving

inandoutofscope,regulatoryjudgmentwillbeused

Page11of48

toaddressaninsurer’sexitfromorentrytothescopeofinsurerssubjecttotheliquiditystress

test.PerrevisionstothemodelHoldingCompanyAct,theleadstateregulatorwillconsultwith

the Task Force in determining when it is appropriate to remove an insurer from the LST

requirement

ifitnolongermeetsthescopecriteria.Similarly,leadstateregulatorsshouldhave

theability to consultwiththeTaskForceandrequire the LST fromaninsurernotmeetingthe

scopecriteria(e.g.,aninsurerclosetotriggeringthescopecriteriaformorethanoneyear).

CURRENT–

ScopeCriteriaforthe2022LST:

Regulatorsagreedtoretainthesame6criteriaandthresholdsfromthe2020and2021LSTScope

Criteriaforuseasthe2022LSTScopeCriteria.The2022LSTScopeCriteriahavebeenappliedto

the2021annualstatementdata(dataasofDec.31,

2021,filedbyMarch1,2022).

Section2.LiquidityStressTest

2.1Summary

Thestresstestingframeworkemploysacompany cashflowprojectionapproachincorporating

liquidity sources and uses over various time horizons under a baseline assumption and some

number of stress scenarios (for 2022 there are 2 stress scenarios and also an insurer‐specific

request for information). The available assets are then recorded

by asset category. The

frameworkthencallsforidentificationofexpectedassetsalesbycategory,orotherfundingas

allowedinthestresstest,tocureanycashflowdeficits(liquidityusesexceedliquiditysources)

under the stress scenarios. The stress tests are to be performed at the legal entity

level; the

aggregatedgroupdoesnotperformtheLST.

2.2TimeHorizons

The time horizons chosen by regulators are 30 days, 90 days, and 1 year, because, overall,

insuranceproductsaredesignedtobeforthebenefitofcustomersasriskprotectionoverthe

longtermandnotdesignedtoprovideshorttermliquiditylikeotherfinancialproducts.Historical

experienceintimesof

stressdemonstrateslowpolicyholderreactioninshortperiodsoftime,as

opposedtoaneventthatoccursovermonthsoryears.Featuresdesignedtoprotectthelong‐

termnatureoftheproductforthepolicyholdersultimatelyreducethelikelihoodofpolicyholder

Page12of48

reaction to short‐term volatility in markets. Therefore, evaluating shorter than 30‐day time

horizons has been deemed not warranted for the overarching macroprudential purpose of

gaugingliquidityriskintheLifeinsuranceindustry.

Policyholdersdonot“run”fromaninsurerintimesofeconomicstresstotheextentdepositors

do

fromabank,becauseinsuranceispurchasedtoobtaintheprotectioninsuranceprovides,not

asasourceofliquidityordiscretionaryfunds.IntheUnitedStates,lifeinsuranceandannuities

are purchased primarily for long‐term financial protections upon death or retirement.

Surrendering a life insurance contract to harvest its

cash surrender value would leave the

policyholderwithoutdeathbenefitprotectionthatwouldbeexpensiveorimpossibletoreplace

ata future date. Surrenderingavariable annuity contractwouldlock in potentially temporary

decreasesinaccountvalueandcouldresultinthelossoflivingbenefitprotectionthatbecomes

more valuable

when market conditions depress account values below trigger points. Further,

mitigating contract features such as surrender charges and the insurer’s right to delay the

processingofwithdrawalsandsurrendersforupto30daysarecommon.

There are also non‐contractual mitigating factors at play, such as potential negative tax

consequences,thatfurtherreducetheshort‐termnatureofliquidityriskforlifeinsurers.

Simplyput,policyholdersarehighlydisincentivizedtogiveupthelikelyirreplaceableprotection

forwhichtheyhavealreadypaid.Therun‐likemasssurrenderofinsurancepolicieswouldrequire

largenumbersofpolicyholderstoactagainsttheir

self‐interest.

Fromaholisticriskperspective,liquiditystressistraditionallyexperiencedontheassetside.One

short‐term consequence of market turmoil could be a requirement to post collateral in

connection with existing derivative contracts. However, even in this scenario, collateral is

typicallypostedintheformofsecurities,

soademandforcashisnotgenerated.

Wedoacknowledgeliquidityriskdoesexistwithrespecttoshortertimehorizonsandthatmany

insurersdoconsidershortertimehorizons(7‐daysforexample)aspartoftheirinternalliquidity

stresstestingframework.Thisisviewedasacashmanagement/Treasuryfunction

impactingthe

dailyoperationsofindividualinsurers,however,thatwouldnotaffecttheindustryasawhole.

Page13of48

Hence, these considerations are typically reviewed as part of individual/microprudential

surveillanceeffortsintheU.S.

2.3Insurer’sInternalLiquidityStressTestingSystem

Insurersaretousetheirown internalliquiditystresstestingsystem to perform theregulatory

LST, adjusting for regulatory assumptions, metrics, etc., as specified in this document. For

example, assessing materiality of stressed cash flows for inclusion in the liquidity uses and

sources templates is per theinsurer’sowninternal methodology,

butdeterminingwhich legal

entities are to perform the LST and report on those templates is specified in this document.

Insurersshouldprovideanarrativedescriptionoftheirinternalliquiditystresstestingsystemand

processes, including for example their materiality thresholds for stressed cash flows and

methodologyforconvertingforeign

currenciestoUSdollars(seeSection7.Reporting).Thestress

scenariosmayvaryfromyear‐to‐yearandcontainvariationsreferredtoas“What‐if”scenarios.

The following sections provide a further description of each of the key components of the

framework.

Section3.LegalEntitiesRequiredtoPerformtheLSTforInsure rsMeetingthe

ScopeCriteria

The scope of entities included within an insurance group for the purposes of liquidity stress

testingtoassessthepotentialforlargescaleliquidationofassets(i.e.,thelegalentitieswithin

thegroupwhichshouldperformtheLST),shouldinclude:

U.S.Life insurancelegal entities,includingreinsurers,regardless of corporate

structure,so

includingcaptive(regulatorsspecificallywantallU.S.lifeinsurance/reinsurancelegalentities

to perform the 2022 LST for informational purposes – future LST iterations may see a

materialityconsiderationadded);

Non‐guaranteed/market value separate accounts are not included in the 2022

LST. However, regulators may want to perform

a separate account study in the

future. The current thinking is that even though non‐guaranteed/market

valueseparate accountsmay experience asset sales during stressed

environments,thosesalesareatthepolicyholder’sdiscretionanddonotgenerate

Page14of48

liquidity stress for the insurer/group. As such they are deemed other market

activityratherthaninsuranceentityactivity.Thus,forannuitiesthatprovideboth

non‐guaranteed and guaranteed benefits,insurers should onlyinclude the cash

flow impact of the guaranteed benefits. Though not required for the 2022 LST,

insurersshouldconsider

includingnon‐insulatedseparateaccountamountsasif

theyweregeneralaccountamounts.

Non‐U.S.lifeinsurance/reinsurancelegalentitiesshouldperformthe2022LSTif

theyposematerialliquidity risksto the U.S. group(seebelow on non‐U.S. legal

entities).

Whereapplicable,holdingcompaniesthatcouldbe

asource ordrawofliquiditytothelife

insurancelegalentities;and

Non‐life insuranceentitiesand non‐insurance entities with materialsourcesof liquidity, or

thatcarr youtmaterialliquidityrisk‐bearingactivitiesandcould,directlyorindirectly,pose

materialliquidityrisktotheU.S.group.Thismateriality

considerationshouldoccurwithinthe

context of the specific stress scenario (and “what if” modification if applicable). The

materialitycriteriaand initial list of legalentities in scopeshould be reviewed by the lead

stateregulatorandmodifiedbytheinsurerasneededbasedonregulatordirection.

Non‐U.S.

legalentities(includingnon‐U.S.holdingcompanies)aresubjecttothis

materialityconsiderationandshouldbesubjecttoperformingtheLSTiftheypose

materialliquidityrisktotheU.S.group.

U.S.non‐life insurers andreinsurers arenotautomaticallyexempted.IftheU.S.

non‐life insurerposes materialliquidity

risk, per the stress scenario,to the U.S.

group,thenthatlegalentityinsurershouldperformtheLST.

Legal entity asset managers and mutual funds(both U.S. and non‐U.S.) are excluded from

performingthe2022LST.

However, those legal entities performing the LST (e.g., holding comp anies that

couldbeasourceoruseofliquidityforthelifeinsurers)mustreflectanymaterial

stressed cash flowsfrom/tothelegalentityassetmanager/mutualfund intheir

2022LST results(e.g.,theliquidity sources

andliquidityusestemplates,asthey

Page15of48

dowithanyothertypeoflegalentitythathasmaterialstressedcashflowsfrom/to

thelegalentitiesperformingtheLST).

Ifsuchmaterialstressedcashflowsfrom/tothelegalentityassetmanager/mutual

fundexist,theregulatorswantspecificdisclosuresonthoseintheresults(either

by adjusting the templates

to include a line for these and/or in the

narrative/explanatorydisclosuressubmittedalongwiththetemplates).

Examples of when such legal entity asset manager/mutual fund considerations

anddisclosureswouldneedtobemadeforaspecificstressscenarioinclude:

o Iftheholdingcompanyor anotherlegalentity(ies)in

thegroupisexpected

tofundamaterialliquidityshortfallofamutualfund/assetmanager(i.e.,

redemptionsexceedtheabili tytosellassets),thentheexpectedcashflows

must be reflected (especially where there are established inter‐affiliate

supportagreements);

o Iftheholdingcompanyor anotherlegalentity(ies)inthe

groupisexpected

to provide capital to the mutual fund/asset manager or is expecting

dividendsfromthem,thematerialexpectedcashflowsmustbereflected;

and

o Iftheassetmanagermanagesfinancialinstrumentsunderwhichitretains

somerisk,suchasnewEuropeanCLOs, orhas contractual riskretention

agreementsforUSCLOs,therequiredriskretentionlimit(5%forEurope)

must bereflectedif sourced from the holding companyor another legal

entity(ies)inthegroupandconsideredmaterial.

Legalentitybanks(bothU.S.andnon‐U.S.)areexcludedfromperformingthe2022LST.

However, those legal entities performing the LST (e.g., holding companies that

couldbeasourceoruseofliquidityforthelifeinsurers)mustreflectanymaterial

stressed cashflows from/to the legal entity bank in their2022 LST results (e.g.,

theliquiditysourcesandliquidityusestemplates,asthey

dowithanyothertype

of legal entity that has material stressed cash flows from/to the legal entities

performingtheLST).

Page16of48

If such material stressed cash flows from/to the legal entity bank exist, the

regulatorswantspecificdisclosuresonthoseintheresults(eitherbyadjustingthe

templates to include a line for these and/or in the explanatory disclosures

submittedalongwiththetemplates).

Examples of when such legal entity

bank considerations and disclosures would

needtobemadeforaspecificstressscenarioinclude:

o Iftheholdingcompanyor anotherlegalentity(ies)inthegroupisexpected

tofundamaterialliquidityshortfallofabank,thentheexpectedcashflows

must be reflected (especially where there are

established inter‐affiliate

supportagreements);and

o Iftheholdingcompanyor anotherlegalentity(ies)inthegroupisexpected

to provide capital to the bank or is expecting dividends from them, the

materialexpectedcashflowsmustbereflected.

For2022,thelegalentitiesidentifiedinthebulletsabove,per

aCompany’sORSAand/orother

materiality criteria applied to the specific stress scenario, must be considered as material or

identifiedascarryingoutmaterialliquidity riskbearingactivities and hencesubjecttointernal

liquiditystresstestingrequirements.Althoughalegalentityinthegroupmaynotberequiredto

perform

thestresstestduetomaterialityconsiderationsorexemptions,thoseentities'material

cashimpactson entities performing the stress test must be captured in the sources and uses

templates of the entities performing the LST. Theinsurer will need to disclose the materiality

criteria(agreeduponbytheLeadStateregulator)

usedindeterminingthelegalentitiessubject

tothe2022LSTinthesubmissionofitsresults.Basedontheresultsofthe2020initialLSTexercise

andthoseofthe2021and2022LSTfilings,theSubgroupwilldetermineifadditionalmateriality

criteriashouldbedevelopedtoensurebetter

comparabilityamongstinsurers.

Section4.CashFlowApproach–LiquiditySourcesandUses

TheLiquidityStressTestingFrameworkisanchoredbyacashflowapproach,utilizingcompanies’

actual cash flo w projections of sources and uses of liquidityovervarious time horizons based

uponexperienceandexpectations.ThiscontrastswithaBalanceSheetApproach,whichemploys

Page17of48

static balance sheet amounts and generic assumptions about asset liquidity. While a Balance

SheetApproachiseasiertoapplyandprovidescalculationconsistency(andthustheperception

ofincreasedcomparability),its‘one‐sizefitsall’approachcouldresultinamisleadingassessment

of liquidity risk and fail to capture certain asset

activities or product features under different

stressscenariosandtimehorizons.Thecashflowapproachisdeemedmoredynamicandhence

tocaptureliquidityriskimpactsmoreprecisely.

Theinsurershouldproducecashflowprojectionsforsourcesofliquidityandusesofliquiditythat

cover:operatingitems,investments and derivatives,

capitalitems,andfunding arrangements.

(See Liquidity Sources and Uses templates in Section 7). To clarify an issue regarding funding

arrangements, the projected cash flows for liquidity sources and uses should include already

existingfundingarrangementssuchasFHLBdrawsoutstandinginthecurrenttimeperiod.Also,

specifictotheholding

company,theseprojectedcashflowsforliquiditysourcesandusesshould

includematerialnon‐U.S.impactsaswell.

The insurer will produce these liquidity sources and uses cash flow projections in a baseline,

normalcourseofbusiness scenario, foreachtime horizon.The insurerwillalsoproducethese

cashflows

foreachtimehorizonforaspecificnumberofrequiredstressscenarios(for2022there

are2stressscenariosandalsoaninsurer‐specificworst‐casescenario).

4.1BaselineAssumptionsforCashflows

Baseline (pre‐stress) cash flows are the insurer‐specific cash flows from normal expected

operations.Insurersshouldpreparecashflowprojectionsundernormaloperatingconditionsand

reportthenetcashflows(projectedliquiditysourceslessuses)foreachtimehorizon.Thesecash

flowprojectionsshould be consistentwith those used for

internal baseline liquidity forecasts,

suchasthoseusedforfinancialplanningandanalysis(FP&A),riskmanagement,etc.Apositive

netcashflowispresumedinthebaselinecashflowssincecompaniesareusuallynotexpected

tobeoperatinginanetcashflowdeficiencystate.

Section5.StressScenariosandtheirAssumptions

Foryear‐end2022therearetworegulatoryliquiditystressscenarios:anadverseliquiditystress

scenario for insurers, and an interest rate spike scenario. There is also an insurer‐specific

Page18of48

informationrequestforeachgroup’sownmostadverseliquiditystressscenario(s).Theadverse

liquidity stress scenario contains a regulator provided narrative, regulator‐prescribed

assumptions,andcompany‐specificassumptions.Theinterestratespikescenarioallowsall other

narrativedescriptioncomponentsandkeymetrics(includinghowmuchinterestratesspike)to

be provided

by each company. The insurer‐specific information request contains a company

providednarrativeandadescriptionofkeycompanymetrics.Theregulatorprovidednarrative

willbeaqualitative descriptionofthe specifiedstressscenarioto highlighttheparticular risks

andsensitivitiesassociatedwiththatstressscenario.Theregulatorprescribedassumptions

are

specificparametersinsurersshouldincorporateintotheirprocessforaparticularstressscenario.

Company‐specific assumptions should be consistent with the information provided in the

regulatorprovidednarrativeandregulatorprescribedassumptions,andrepresentthedetailed

assumptionsneededforaspecificcompany’sliquiditystresstestingprocess.Examplesofwhere

companies

should provide their assumptions include: debt issuance, lapse sensitivity, new

business sensitivityand mortality sensitivity. Regulators expect insurers to utilize policyholder

behavior assumptions (e.g., surrenders and policy loan withdrawals, existence of new sales

activity) as well as the insurer’s response (e.g., assuming delays in payment of policyholder

benefits),consistentwith

theseverity ofthe stress,andto provide very thoro ughexplanatory

information. All key business activities and product‐ type impacts to liquidity should be

consideredbythecompanies.

If the insurer’s internal model does not utilize a specific economic and/or company‐specific

assumption included in this document, the internal model does

not need to be modified to

incorporateit.However,iftheinsurer’sinternalmodeldoesutilizeaspecificeconomicand/or

company‐specific assumption included in this document, the insurer should use the approach

outlined below to calculate the value for that assumption. (This emphasizes the macro

surveillancebenefitofthe

2022LST,allowingforalevelofconsistencyofassumptionsacrossthe

industry.Asdiscussedpreviously,thisisnotmeanttospecifyassumptionsusedbytheinsurers

intheirowninternalliquiditystresstestingwork.)Ifthereisnospecificvalueincludedinthe2022

LST Framework and instead there is

an illustrative value or suggested guidance, the company

should use a value consistent with the illustrative value or suggested guidance. For example,

Page19of48

guidance is given below on using Moody’s values for migration, default, and recoveries.

However,insurersmayuseS&Pdataorotherappropriatedatasources.

5.1AdverseLiquidityStressScenarioforInsurers

5.1.1Narrative

Insurers are required to apply an adverse liquidity stress scenario as one of the two stress

scenarios. The following is a summary of market conditions in the adverse scenario extracted

fromtheFederalReserveBoard’s2017SupervisoryScenariosforAnnualStressTestsRequired

undertheDodd‐FrankActStress

TestingRulesandtheCapitalPlanRule.

The adverse scenario is characterized by weakening economic activity across all economies

includedinthescenario.Thiseconomicdownturnisaccompaniedbyaglobalaversiontolong‐

termfixed‐incomeassetsthat,despitelowershort‐termrates,bringsaboutanear‐termrise

in

long‐termratesandsteepeningyieldcurvesintheUnitedStatesandthefourcountries/country

blocksinthescenario.

Theeconomic indicatorlevelsdescribedbelowprovidethebackdropfortheeconomicclimate

insurers should assume in the adverse scenario. The actual levels insurers should use in the

adversescenarioare

providedinAnnex2.

Macroeconomic

o RealGDPfallsslightlymorethan2percentfromthepre‐recessionpeakinthe

fourthquarterof2016totherecessiontroughinthefirstquarterof2018.

o Unemploymentrateincreases.

o HeadlineCPIfallsandthenrisesoverthescenario

period.

InterestRatesandCreditSpreads

o Short‐termTreasuryratesfallandremainnearzerothroughoutthestress.

o 10‐yearTreasuryyieldsrise.

o InvestmentGrade(IG)corporatecreditspreadswiden.

AssetValuations

o Equitypricesdeclinebyroughly40%.

Page20of48

o TheVolatilityIndex(VIX)peaksatapproximately35.

o Housingpricesandcommercialrealestatepricesdeclinethrough8quarters.

DescriptionofInternationalMarketConditions

o Recessions and slowdowns in growth are experienced in the Euro area, United

Kingdom,Japan,anddevelopingAsiaeconomies.

o Allforeigneconomiesexperience

adeclineinconsumerprices.

o U.S. Dollar appreciates against the Euro, British Pound, and developing Asia

currencies.

o U.S.Dollardepreciatesmodestly againsttheJapaneseYen,drivenbyflight‐to‐safety

capitalflow.

5.1.2Regulator‐PrescribedAssumptions

InsurersshouldutilizethevaluesfortheeconomicindicatorsfromtheFederal

ReserveBoard’s

annualSupervisoryScenariosforAnnualStressTestsRequiredundertheDodd‐FrankActStress

TestingRulesandtheCapitalPlanRuleasthebasisforscenarioassumptions,TableA.1Historical

dataandTableA.5(Annex2i,A)Supervisoryadversescenario.Insurersshouldusetheversion

publishedinFebruary2017

(refertothetablesinAnnex2i).Specifically,insurersshouldrunthe

adverseliquiditystressscenariousingthedeltasfortheTreasurycurve,Corporatespreads,GDP,

Unemployment, U.S. Inflation (CPI), Housing Price Index (HPI), S&P 500 index (SPX SPOT),

CommercialRealEstateIndex(CREI)andVIXindex.Theseseconomicvariables

shouldbeused

totheextentthesevariablesareincludedinaninsurer’sinternal liquiditystresstestprocessor

models.

Insurers should apply the same change in economic variables experienced between Q4 2016

TableA.1andthestressscenariosinTableA.5tocurrenteconomicvariablelevels(Annex2i,D).

Insurers

shouldusethetablesinAnnex2iforanillustrativeexampleofhowthedeltasfromthe

2017Fed’sCCARareappliedtothecurrentreferencequarter(Q42020)forthe2020LST(Annex

2i,B).Forexample,insurersshoulduse2022(ormostrecentyear‐end)10Yr.Treasury

ratesand

applythesamepercentageorabsoluteb.p.changeshownfromQ42016tothe2017TableA.5

amountsintheir2022LSTstressscenarios.TableC(Annex2i,C)showsthe2017deltasapplied

Page21of48

to2021year‐endlevelsonanabsoluteandpercentagebasisfor3monthand1‐yearhorizonsfor

easeofuse.Thedeltasto applyareprovidedforthe30‐day,90‐dayand1‐yearhorizons.Note,

the tables also include structured spread assumptions described below in section 5.1.4.

The

tablesareincludedinAnnex2iofthisdocument.

Inaddition,othermarketindicatorsarenecessaryforinsurerstoapplytostressedcashflowsand

toassess the impactonexpectedassetsales.These areasfollows(withdetailstobefoundin

Annex2):

MarketCapacityAssumption

EconomicVariablesforAdverseScenario

SWAPSpreads

SwaptionVolatility

CreditAssumptions:Moody’sTransitionMatrix/MigrationRates

CreditAssumptions:Moody’sDefaultTable

CreditAssumptions:Moody’sRecoveryRateTable

Necessaryeditsfor2022year‐endvalueswillbepostedasLeadStat eGuidancetotheAnnexes

in

early2023.

5.1.3MarketCapacityAssumption

Thefollowingissuggestedguidancetodeterminemarketconstraintsonassetcategoriestobe

soldinti mesofstress.Itrepresentsstandardsfollowedbymanyinsurerstoestimateassetssales

by stress scenario, asset category and time hor izon that can be sold without meaningfully

impactingtheentiremarketbywideningbid‐offerspreads.Werecognizeeachcompanyhasits

ownindividualmethodologyfordeterminingpotential

assetsalesunderstress,andwe request

awrittennarrativebeprovidedastohowtheymaketheirdetermination.

Onceanassetclasshasbeenidentifiedasavailabletobesoldtosatisfyacashdeficiencyfrom

cashflow stress testing, theinsurershouldcalculateitspercentageofthetotal

amountissued

Page22of48

andoutstanding.Nexttheinsurershouldobtainaveragedailytradingvolumes(ADTV)andmake

anassumptionforthehaircutamounttoapplytothatvolumetoreflectstressedconditions(the

“haircut ADTV”). Next, the insurer would apply its calculated percentage of total outstanding

ownedtothehaircutADTV,andtheresult

wouldbedividedbythenumberofdaysinthestress

testingtimehorizon to arriveatadailyamountthatcanbesold.Thisdailyamountabletobe

soldwouldbemultipliedbythenumberofdaysinthe prescribedtimehorizon:30daysforthe

30‐day

horizon,60daysforthe90‐dayhorizon(31‐90days)and274daysforthe1‐yearhorizon

(91‐365days).Anillustrativeexamplebestexplainstheabove‐describedprocess.

Illustrativeexample(alsoincludedinAppendix2ii):

Step1:EstimateUnconstrainedSalesPerDay

InsurerAhasa$100billionportfolioofinvestment‐gradecorporatebonds,pricedatpar.

InsurerAestimatesthatitholdsapproximately5%ofoutstandingcorporatebonds.Inthe

adverseliquiditystressscenario,InsurerA’sunconstrainedliquiditystresstestingmodel

assumesthatitcansell:

TimeHorizon %Ableto

Be

Sold

SalePrice TotalSale Sales/Day

First30Days 10% 97 $9.7B $440M

31‐90Days 20% 94 $18.8B $430M

91‐365Days 50% 90 $45.0B $230M

Step2:AddMarketCapacityConstraint

Assumetheaveragedailytradingvolumeinthesecondarymarketforinvestmentgradecorporate

bondshasbeen$13.0Billionoverthepastyear.InsurerAestimatesthattradingvolumeswould

declineby40%intheadverseliquiditystressscenarioto$8.0Bperday.

SinceInsurerAis5%ofthe

market,InsurerAcanonlytrade$400Mperday($8Bx5%)withoutpayingasignificantilliquiditypremium

andimpactingtheoverallmarket.

InsurerAthenrepeatsthisprocessforeveryassetclassinitsinvestmentportfolio.

Page23of48

TimeHorizon UnconstrainedSales/

Day

MarketCapacity

Assumption

Impact

First30Days $440M $400M ($40M)

31‐90Days $430M $400M ($30M)

91‐365Days $230M $400M $0

5.1.4EconomicVariablesforAdverseScenario

Insurers should use Annex 2i and 2iii to assist in determining cashflows, asset values and the

quantityof assetstobesoldinstressedmarkets.Forbaselinevalues,theindustryshallsubmit

year‐endspreadstotheregulatorsshortlyafteryear‐end.Theregulators

willreviewandapprove

thevaluesforuseinthetableforliquiditystresstestingpurposes.Structuredspreaddatawas

derivedfromtheJPMorganABSWeeklyAssetSpreadDatasheet.Thespreadswerescaledtoa

stressed economic environment consistent with an adverse scenario as describedby the Fed,

described above

and adopted for this stress testing. For the 2020 LST, economic conditions

experienced in March of 2020 were deemed consistent with an adverse scenario. Therefore,

structuredspreadsfromMarch2020wereusedasthebasisforthestressedspreadsassumptions

for insurers to use in their stress testing scenario for the

30‐day, 90‐day and 1‐year horizons.

Note, to calculate structured spreads for CLO/CDO 5.5‐7 year and ABS Auto3 year, it was

necessarytoconstructaTreasuryyieldcurvewith3‐yearand7‐yearpoints.Thesepointswere

calculatedusingastraight‐linelinearinterpolationmethod.For

the2022LST,thesameMarch

2020structuredspreadsweredeemedappropriateforuse.

Regulators ask industry members to agree on one set of structured spread values amongst

themselves to submit for approval, not each insurer submitting values that each need to be

approved. Regulators and/or the NAIC need to do a reasonableness check of current

baseline/market levels of spreads insurers use before applying the stressed amounts in the

JPMorgan spreadsheet. For example, if current spreads are already greater than the JPMorgan

stressed spread amounts, regulators may have to consider alternatives or additional stressed levels.

One agreed upon set of values will help provide uniformity, consistency, and comparability of

stress testing results across insurers.

Page24of48

When utilizing these spreads, insurers should assume the percentage increase in spreads

experienced in March 2020 from the JPMorgan ABSWeeklyAssetSpreadDatasheet; and apply

the absolute increase to the agreed upon December 31 baseline spreads. These tables are provided

in Annex 2i, B.

Since the reasonableness check is merely a check of current market rates, it is not anticipated that

it will be burdensome for insurers to provide an agreed upon set of December 31 baseline values

to regulators by January 31 of each year or for the regulators to be able to respond by February 28

of every year to allow insurers sufficient time to incorporate into their stress testing framework.

Baseline amounts are included in Annex 2i, B.

For the 2022 LST – NAIC values are to be established as Lead State guidance in early 2023 after

the 2022 LST Framework has been adopted. These NAIC values will be established using the

industry developed process.

5.1.5SWAPSpreads

Stressedspreadlevelsmayimpactassetspricesforexpectedsalescalculationsnecessaryforthe

stress scenarios. Insurers should complete the SWAP Spread table in Annex 2iv to document

assumptionsusedindeterminingassetvaluesandthe

quantityofassetstobesoldinstressed

markets.SWAPspreadsourcedataisnolongerprovidedintheFederalReserve’sH.15FREDdata.

UseofBloombergSwapSpreadsispreferred–ifoptionsexistwithinBloomberg, identifywhich

option was used. If a different source from Bloomberg is used,

then identify the source and

option.

5.1.6SwaptionVolatility

InsurersshouldusethetableinAnnex2vtoassistindeterminingassetvaluesandthequantity

ofassetstobesoldinstressedmarkets.Insurersshouldobtaintheinformationtopopulatethe

tableusingBloomberg’sSwaptionVolatilityforvarioustimehorizonsandexpiry.Forconsistency,

insurersshouldusethetablefoundonBloombergatNSV[Go].

Commented [ST1]: TobeupdatedasLeadStateGuidance

inearly2023.

Page25of48

5.1.7Moody’sTransitionMatrix/MigrationRates

InsurersshouldusethetableinAnnex2vitoassistindeterminingcorporatecreditmigrations,

assetvaluesandthequantityofassetstobesoldinstressedmarkets.Thetableisimportedfrom

Moody’s Corporate‐Global: Annual default study, Exhibit 36‐Average one‐year alphanumeric

ratingmigrationrates,1983‐2021.Ifavailable,insurersshouldusetheequivalentMoody’stables

forU.S.PublicFinanceformunicipalbondsand the appropriateMoody’stablesfor structured

/asset‐backedsecurities.Alternativesourcesmaybeusedbutshouldbedisclosedaswellasthe

rationalefortheiruse.

5.1.8Moody’sDefaultTable

InsurersshouldusethetableinAnnex2viitoassistindeterminingasset

valuesandthequantity

ofassetstobesoldinstressedmarkets.ThetableisimportedfromMoody’sCorporate‐Global:

Annual default study, Exhibit 41‐Averagecumulativeissuer‐weighted global default rates by

letter rating, 1983‐2021. Insurers should use the equivalent Moody’s tables for U.S. Public

Financefor municipal bonds andthe appropriateMoody’stablesfor structured /asset‐backed

securities.Alternativesourcesmaybeusedbutshoulddisclosedaswellastherationalefortheir

use.

5.1.9Moody’sRecoveryRateTable

InsurersshouldusethetableinAnnex2viiitoassistindeterminingassetvaluesandthe

quantity

ofassetstobesoldinstressedmarkets.ThetableisimportedfromMoody’sCorporate‐Global:

Annualdefault study,Exhibit8‐Averagecorporatedebtrecoveryratesmeasuredby ultimate

recoveries,1987‐2021.InsurersshouldusetheequivalentMoody’stablesforU.S.PublicFinance

formunicipalbondsandtheappropriateMoody’stablesforstructured/asset‐backedsecurities.

Alternativesourcesmaybeusedbutshoulddisclosedaswellastherationalefortheiruse.

If relevant for a given insurer, the adverse liquidity stress scenario for insurers can be run

consideringsourcesotherthanexpectedasset

sales(e.g.,FHLBcreditlinedraws,banklinesof

credit and holding company contributions). Should that be the case, the insurer must clearly

identifythesourcesotherthanassetsalesutilizedtomeetexpectedliquiditydeficiencies.

Commented [ST2]: TobeupdatedasLeadStateGuidance

inearly2023.

Commented [ST3]: TobeupdatedasLeadStateGuidance

inearly2023.

Commented [ST4]: TobeupdatedasLeadStateGuidance

inearly2023.

Page26of48

5.1.10“WhatIf”Modification

The“Whatif”modificationtotheadverseliquiditystressscenarioremovestheabilityforinsurers

touseextraordinaryinternalandexternalfundingsourcestosatisfyanyliquiditydeficiencyunder

stress,i.e.,noactionstakeninresponsetothestress(asopposedtoongoingoperationalfunding

agreementsincluded

intheinsurer’sbaselinetemplates)orinresponsetoaliquiditydeficiency.

Intragroup “keep well” agreements would be considered extraordinary transactions. Thus,

expectedassetsaleswillbetheprimarysourceofmeetinganyliquiditydeficiencyforthe“What

if”scenario.Anyexistingfundingsuchascommercialpaperwillnotbe

assumedtoroll,norwill

FHLBfacilitiesabilitytorolluponmaturity.

5.1.11Company‐SpecificAssumptions

Insurers must construct the assumptions needed for their internal models to run the above

adverseliquiditystressscenarioforinsurers.Companyspecificassumptionsshouldbeconsistent

withtheabovescenarioasnarrativeandregulatorprescribed

assumptions.Examplesincludethe

inability to roll or issue new debt, potential increases in lapse rates, new business sensitivity,

mortalityexperienceandpolicyholderbehavior(e.g.,surrendersandpolicyloans).

5.2InterestRateSpikeScenario

5.2.1Narrative

Insurers should run an interest rate spike stress test that resembles the late 70’s/early 80’s

inflationaryperiodasitmostcloselymirrorstheregulatorydesiredinterestratespikescenario.

Historicaldatafromthelate70’s/early80’sshowthefollowingeconomicconditions:

Inflationary forces caused interest rates to rise quickly.

Investors rotated out of fixed income and into equities, real estate, and commodities.

Central bank responded by tightening monetary policy in tandem, eventually causing the

yield curve to invert.

Insurers

should provide a detailed narrative outlining their scenario and assumptions around

generaleconomicconditionsbulletedaboveandspecificassumptionsforeconomicvariablesfor

each time horizon. The economic variables in the table below and the amount of expected

Page27of48

movementineachvariableshouldbefullydescribedinthenarrativetotheextentareusedina

company’sinternalmodel.Thetableoutlinesthedirectionalmovementof therelevanteconomic

indicators.Insurersshouldspecifytheamountofmovementforeachvariabletheyconsiderto

be part of the scenario for

a severe interest rate spike. For example, insurers may indicate a

parallelshiftinTreasuryratesup100bpsinthefirst30days,up200bpsin90daysand300bps

over12months.Thetableisaguideandnottobeinterpretedasastricttemplateandmaybe

supplemented or customized by the insurer.Narrative/Explanatory disclosures should explain

theseassumptions.

5.2.2Regulator‐PrescribedAssumptions

Regulatorsdidnotadoptanyregulator‐prescribedassumptionvaluesforthisstressscenario.

Instead,theyprovidedthebelowregulatorguidanceforinsurerstousewhenestablishingtheir

owncompanyspecificassumptionsforthisstressscenario.

EconomicVariable ExpectedMovement Comments

Treasuryrates Increaserapidly Criticalfactorsformodelingimpactsto

assetprices,collateralflows,and

productcashflows

Equityprices Increaserapidly

Creditspreads Increasemoderately

Inflationrates Increaserapidly Thesefactorshelpdefinethe

macroeconomicconditionsofthe

scenario

RealGDPgrowth Flat

T

hesefactorshelpdefinethe

macroeconomicconditionsofthe

s

cenario

Unemploymentrate Flat

Realestateprices Increase

Swapspreads Increase Impactderivativecollateral

requirements

FXrates Unclear

Impliedvolatility Increase

Creditassumptions

(transition,default,recovery

rates)

Unclear Maynotbeanimportantassumptionto

defineforthescenario

5.2.3Company‐SpecificAssumptions

Insurersmustconstructtheassumptionsneededfortheirinternalmodelstoruntheabovestress

scenario. Companiesareencouragedto provide more information beyond these guidelinesas

they feel is appropriate to help regulators understand their assumptions for the scenario.

Page28of48

Company specific assumptions should be consistent with the stress scenario’s narrative and

regulator prescribed assumptions. Based on the 2022 significant increases to inflation and

interest rates, insurers should consider increasing the 2021 values for use in the 2022 LST to

ensurea“severeinterestratespike.”

5.3InsurerSpecificInformation

Request‐Worst‐CaseScenario

5.3.1Narrative

Thisinformationrequestrequiresinsurerstoprovide adetailednarrativeof their most severe

liquidity stress scenario(s) to obtain greater insight to the drivers of liquidity risk for specific

insurers.Themostseverescenarioshouldbeonethatresultsinthelargestliquiditydeficiency

(liquidity sources less uses) from

their existing internal liquidity stress testing process. The

scenarioshouldbefocusedontheinsurer’sinternalmodelscenariowiththeworst‐caseoutcome

forthegroup.Regulatorsmayusethisinformationtoinformfutureprescribedstressscenarios.

Insurers should provide a comprehensive narrative describing the stress scenario(s) and the

economic

environment(s).Thisstressscenario(s)could beacombination of multiplestressor s.

Insurersshouldreviewthesescenariostoensuretheyareworstcasefortheirbusinessmodel,

products,etc.,particularlyifnoliquiditydeficienciesareidentified.

Section6.AvailableandExpecte dAssetSales

Oncethe stressedsourcesand uses of liquidityhave beenestablished,andthe net cash flows

calculated, insurers then project the assets available at the end of the time horizon by asset

category(pleaserefertotheassetcategoriesintheAssetsTemplateinSection7).Thevaluation

of available assets

for the baseline scenario utilizes current and projected asset values for a

normal operating environment. The valuation of available assets for a stress scenario will be

baseduponfairvaluehaircutsperthespecificstressscenarionarrative,itsregulatoryprescribed

assumptions,and/orthecompanyassumptionsbasedonthenarrativeand

regulatoryprescribed

assumptions (e.g., fair market value haircuts and capacity indicators). Note: Any securities

pledged as part of institutional funding agreements (e.g., FHLB) should be excluded and

Page29of48

consideredencumbered.However,anypre‐pledgedassetsthatarenotsecuringcreditthathas

beenextendedandremainsoutstanding(i.e.,excess)shouldbeconsideredunencumbered.

Totheextentthatstressedcashinflowsareinsufficienttomeettheanticipatedcashoutflows,

the insurer must provide for cash flows to meet the deficiency.

Unless a stress scenario (or

“What‐if”modificationofastressscenario)indicatesotherwise,theinsurercanutilizeinternal

andexternal fundingsources(e.g.,FHLB newdraws)aswellasassetsalestosatisfyaliquidity

deficiency. Any expected asset sales must be reported in the appropriate column(s) of the

template.Insurersdecidewhichcategoriesofavailableassetstosell,aswellasthequantityto

sell.(PleaserefertotheAssetsTemplateinSection7.)

Asset sales will appear in two different places‐1) within the liquidity sources template for

expected/plannedactivityduringthetimehorizon(pre‐liquiditydeficiencycalculation),

and2)in

theassetstemplateforanyamountofassetsalesusedtomeetaliquiditydeficiency(Liquidity

SourceslessLiquidityUses).Ifaninsurerhasnoliquiditydeficiency,thentherearenoassetsales

neededintheAssetsTemplate(thoughavailableassetsstillapply).Similarly,ifcashon

handwas

sufficienttomeettheliquiditydeficiencyandtheinsurerchosetoutilizethatcash,thennoasset

saleswouldbereportedintheAssetstemplate.

Theexpectedassetsalesamountscalculatedbasedontheinsurer’sownmodelsshouldalsobe

subjected toportfoliomanagerand/or ChiefInvestment Officer (CIO)

feedback.This feedback

maytaketheformof“topside”adjustmentstotheexpectedassetsales.Regulatorsexpectrobust

disclosuresaround thechief investmentofficer’s(orequivalent title or designee)assumptions

and decisions on expected asset sales. The intent is for these asset sales to most accurately

represent what actions the

insurer could reasonably take in the given scenario, market

conditions,andthecompany’santicipatedinvestmentpolicyand/orstrategy.

Section7.Reporting

Insurers should submit datain the reporti ng template for liquidity sources, liquidity uses, and

assets(availableassetsandexpectedassetsales)inUSdollars.Thesetemplatesutilizecategories

for 30‐day, 90‐day and 1‐year time horizons. The assets template further illustrates available

Page30of48

assets and final expected asset sales by asset sub‐category to cover any liquidity deficiency

(negativeamountsofnetliquiditysourceslessliquidityusesover theprescribedtimehorizons).

Useoftheseconsistentsub‐categoriesofassetsiscriticalforallowingtheTaskForcetoaggregate

theassetsalesresults.

Page31of48

LiquiditySourcesandLiquidityUsesTemplates:

Aliquiditysources reportandaliquidityusesreportshould be generated for each legal entity

withinthegroupthatwassubjectedtoliquiditystresstesting,usingtheNAICtemplates.These

legalentityamountsshouldalsobeaggregatedintoagroupliquiditysourcesreportand

agroup

liquidity uses report for submission (the LST is not performed at the group level; rather it is

performed at the legal entity level and those results are aggregated to present a group level

report).

FortheBaseline,theAdverseLiquiditystressscenario,andtheInterestRateSpike

stress

scenario,LiquiditySourcesandLiquidityUsestemplatesatboththeindividualentitylevel

andtheaggregatedgrouplevelaretobesubmitted.

Forthe“WhatIf”VariationoftheAdverseLiquiditystressscenario,agrouplevelLiquidity

Sourcestemplateand/oragrouplevelLiquidityUsestemplateisonlyrequired

ifthereis

a material difference from the Adverse Liquidity stress scenario’s group level Liquidity

SourcesandLiquidityUsestemplates.

AssetsTemplate:

AswiththeLiquidityUsesandLiquiditySourcestemplates,theAssetstemplateistobegenerated

for each legal entity performing the LST. For the 2022 LST, the

insurer may submit the assets

templateatthegrouplevelonly,withoutsubmissionofthelegalentityassetsalestemplates.

A group level assets template is required for the Baseline and all stress scenarios,

includingthe“WhatIf”variationoftheAdverseLiquiditystressscenario.

ModificationofTemplates:

Insurers

areallowedtoaddlinestothetemplatestoprovidemoredetailedbreakdownofexisting

categories(e.g.,forcashflowsto/fromlegalentityassetmanager/mutualfundsaswellasbanks),

butdeletionsofexistinglines/categoriesarehighlydiscouraged.

SubmissionDeadline:

Thereportingtemplatesandmanyothernarrativedisclosuresreferencedin

thisdocumentare

tobesubmittedtotheLeadStatebyJune30,2023.

Page32of48

Section8.Templates

8.1LiquiditySourcesTemplate

Note 1: Certain flows could be settled in securities (e.g., margins on derivatives, capital contributions/dividends,

etc.).SeethemorespecificSecurityCollateralguidancewithintheExceltemplates.

Note2: AssetSales(pendingsettlement)shouldincludetradesexecutedpriortothereportingdatewithaknown

settlementdateafterthereporting

date(forexample12/30tradedateand01/03settledate).

Note3: AssetCommitmentsshouldincludeanticipatedcashflowsrelatedtosettlementofafutureobligationto

acounterpartytotheextent,andintheamount,appropriateforthespecificstressscenarioandeconomic

assumptions.Examplescouldinclude capitalcallsfor

alternativeinvestments,mortgageloan fundings,

etc.,andshouldincludeeachcompany’sbestestimateastowhattheywouldexpecttofundundereach

scenario.Ifthesecommitmentshavebeenexplicitlyprefunded/collateralizedbyhighlyliquidassets,asset

commitments should be reported on a net basis, including proceeds from the sale of

the highly liquid

assetsinanamountconsistentwiththespecificstressscenarioandeconomicassumptions.Thislineitem

may includesomepercentage amountofcommitments to fund privateplacement revolvers consistent

withthespecificstressscenarioandeconomicassumptions,butrevolversandlinesofcreditthemselves

shouldbecapturedin

thecreditfacilitieslineintheSourcesFundingsection.

CashFlow CFType CFCategory 1Month 3Month 1 2 Month 1Month 3Month 12Month

PremiumsandDeposits(Renewal/NewBusiness) ‐ ‐ ‐ ‐ ‐ ‐

CashCharges/Fees ‐ ‐ ‐ ‐ ‐ ‐

ReinsuranceRecoverables ‐ ‐ ‐ ‐ ‐ ‐

Expenses–IntercompanySettlements ‐ ‐ ‐ ‐ ‐ ‐

TaxPayments(Inflows) ‐ ‐ ‐ ‐ ‐ ‐

OtherFlows ‐ ‐ ‐ ‐ ‐ ‐

‐ ‐

‐ ‐ ‐ ‐

PrincipalandInterest ‐ ‐ ‐ ‐ ‐ ‐

Dividends/Distributions ‐ ‐ ‐ ‐ ‐ ‐

InitialandVariationMargi nReceived ‐ ‐ ‐ ‐ ‐ ‐

OtherCollateralReceived ‐ ‐ ‐ ‐ ‐ ‐

AssetSales(PendingSettlement) ‐ ‐ ‐ ‐ ‐ ‐

OtherFlows ‐ ‐ ‐ ‐ ‐ ‐

‐ ‐ ‐ ‐ ‐ ‐

CapitalContributions ‐ ‐ ‐ ‐ ‐ ‐

Commitments ‐ ‐

‐ ‐ ‐ ‐

DividendsfromSubsidiaries ‐ ‐ ‐ ‐ ‐ ‐

OtherFlows ‐ ‐ ‐ ‐ ‐ ‐

‐ ‐ ‐ ‐ ‐ ‐

DebtIssuance/Refinancing ‐ ‐ ‐ ‐ ‐ ‐

GICs ‐ ‐ ‐ ‐ ‐ ‐

FHLB ‐ ‐ ‐ ‐ ‐ ‐

Repo/SecuritiesLending ‐ ‐ ‐ ‐ ‐ ‐

CreditFacilities(Incl.ContingencyFundingFacilities) ‐ ‐ ‐ ‐ ‐ ‐

IntercompanyLoans ‐ ‐

‐ ‐ ‐ ‐

CommercialPaper ‐ ‐ ‐ ‐ ‐ ‐

OtherFlows ‐ ‐ ‐ ‐ ‐ ‐

‐ ‐ ‐ ‐ ‐ ‐

GroupSummary

Sources Operating

InvestmentandDerivatives

Capital

Funding

TotalSources(beforeAssetSales)

LegalEntity1

Page33of48

8.2LiquidityUsesTemplate

Note1: Certainflowscouldbesettledinsecurities(e.g.,marginsonderivatives,capitalcontributions/dividends,

etc.).SeethemorespecificSecurityCollateralguidancewithintheExceltemplates.

Note2: AssetPurchases(pendingsettlement)shouldincludetrades executedprior tothereportingdatewitha

knownsettlementdateafterthereportingdate

(forexample12/30tradedateand01/03settledate).

Note3: AssetCommitmentsshouldincludeanticipatedcashflowsrelatedtosettlementofafutureobligationto

acounterpartytotheextent,andintheamount,appropriateforthespecificstressscenarioandeconomic

assumptions.Examplescouldinclude capitalcallsfor

alternativeinvestments, mortgageloan fundings,

etc.,andshouldincludeeachcompany’sbestestimateastowhattheywouldexpecttofundundereach

scenario.Ifthesecommitmentshavebeenexplicitlyprefunded/collateralizedbyhighlyliquidassets,asset

commitments should be reported on a net basis, including proceeds from the sale of the

highly liquid

assetsinanamountconsistentwiththespecificstressscenarioandeconomicassumptions.Thislineitem

may includesomepercentage amountofcommitments to fund privateplacement revolvers consistent

withthespecificstressscenarioandeconomicassumptions,butrevolversandlinesofcreditthemselves

shouldbecapturedin

thecreditfacilitieslineintheSourcesFundingsection.

CashFlow CFType CFCategory 1Month 3Month 1 2 Month 1Month 3Month 12Month

Non‐ElectiveBenefits/Claims ‐ ‐ ‐ ‐ ‐ ‐

ElectiveBenefits/Claims ‐ ‐ ‐ ‐ ‐ ‐

Commissions ‐ ‐ ‐ ‐ ‐ ‐

ReinsurancePayables ‐ ‐ ‐ ‐ ‐ ‐

Expenses‐Other ‐ ‐ ‐ ‐ ‐ ‐

Expenses‐IntercompanySettlements ‐ ‐ ‐ ‐ ‐ ‐

InsuranceProductCommitments ‐ ‐ ‐ ‐ ‐ ‐

TaxPayments(Outflows) ‐ ‐ ‐ ‐ ‐ ‐

OtherFlows ‐ ‐ ‐ ‐ ‐ ‐

‐ ‐ ‐ ‐ ‐ ‐

AssetCommitments ‐ ‐ ‐ ‐ ‐ ‐

InitialandVariationMargi nPaid ‐ ‐ ‐ ‐ ‐ ‐

OtherCollateralPledge d ‐ ‐ ‐ ‐ ‐ ‐

AssetPurchases(Pendi ngSettlement) ‐ ‐ ‐ ‐ ‐ ‐

OtherFlows ‐ ‐ ‐ ‐ ‐ ‐

‐ ‐ ‐ ‐ ‐ ‐

Shareholder/PolicyholderDividends

‐ ‐ ‐ ‐ ‐ ‐

CapitalContributionstoSubsidiaries ‐ ‐ ‐ ‐ ‐ ‐

DividendstoParent ‐ ‐ ‐ ‐ ‐ ‐

OtherFlows ‐ ‐ ‐ ‐ ‐ ‐

‐ ‐ ‐ ‐ ‐ ‐

DebtMaturities/DebtServicing ‐ ‐ ‐ ‐ ‐ ‐

GICs Benefits/Maturities ‐ ‐ ‐ ‐ ‐ ‐

FHLB ‐ ‐ ‐ ‐ ‐ ‐

Repo/SecuritiesLending ‐ ‐ ‐ ‐ ‐ ‐

CreditFacilities(Incl.ContingencyFundingFacilities) ‐ ‐ ‐ ‐ ‐ ‐

IntercompanyLoans ‐ ‐ ‐ ‐ ‐ ‐

OtherFlows ‐ ‐ ‐ ‐ ‐ ‐

‐ ‐ ‐ ‐ ‐ ‐

‐ ‐ ‐ ‐ ‐ ‐

GroupSummary

Use s Operating

InvestmentandDerivatives

Capital

Funding

LegalEntity1

TotalUses

Page34of48

8.3AssetsTemplate

AssetCate gory AssetSub‐Category 1Month 3Month 12 Month

Cash Cash&CashEquivalents ‐ ‐ ‐

TreasuryBonds ‐ ‐ ‐

AgencyBonds ‐ ‐ ‐

OtherIGSove reigns&RegionalGovernment‐ ‐ ‐

BelowIGSovereigns&RegionalGovernment ‐ ‐ ‐

AgencyCM O ‐ ‐ ‐

AgencyMBS ‐ ‐ ‐

AgencyCM B S ‐ ‐ ‐

AgencyABS ‐ ‐ ‐

IGPublic

CorporateBonds ‐ ‐ ‐

IGMuni cipalBonds ‐ ‐ ‐

BelowIGPublicCorporateBonds ‐ ‐ ‐

BelowIGMunicipalBonds ‐ ‐ ‐

IGPrivatePlacementBonds ‐ ‐ ‐

IG144As ‐ ‐ ‐

BelowIGPrivatePlace mentBonds ‐ ‐ ‐

BelowIG144As ‐ ‐ ‐

IGCMO ‐ ‐ ‐

IGMBS ‐ ‐ ‐

IGCMBS ‐ ‐ ‐

IGABS ‐ ‐ ‐

IGCLO ‐ ‐ ‐

BelowIGCMO ‐ ‐ ‐

BelowIGMBS ‐ ‐ ‐

BelowIGCMBS ‐ ‐ ‐

BelowIGABS ‐ ‐ ‐

BelowIGCLO ‐ ‐ ‐

CommonStock ‐ ‐ ‐

PreferredStock ‐ ‐ ‐

OtherEquityandAlternativeInvestments ‐ ‐ ‐

Commercial,Residential,Agricultural,BankandOtherLoans ‐ ‐

‐

Other ‐ ‐ ‐

‐

‐ ‐

PublicBonds

PrivateBonds

Non‐AgencyStructuredDebt

Equity

Other

TotalInvestedAssetsAvailableforSale

GroupSummary

GovernmentSecurities

CashandInvestedAssetsAvailableforSale

Scenario Summary

AsofDate

1Month 3Month 12Month 1Month 3Month 12Month

TotalSources(beforeAssetSales) ‐ ‐ ‐ ‐ ‐ ‐

TotalUses ‐ ‐ ‐ ‐ ‐ ‐

NetSources&Uses(DeficitbeforeAssetSales) ‐ ‐ ‐ ‐ ‐ ‐

TotalInvestedAsse t sAvailableforSale ‐ ‐ ‐ ‐ ‐ ‐

Cashappliedtodeficit ‐ ‐ ‐ ‐ ‐ ‐

Deficit

Sub‐total ‐ ‐ ‐ ‐ ‐ ‐

TotalAssetsSold‐ ‐ ‐ ‐ ‐ ‐

Deficitsatisfiedifzeroorgreater ‐ ‐ ‐ ‐ ‐ ‐

Confidential‐‐ForDiscussionPurposesOnly,DoNotDistribute

GroupSummary LegalEntity1

Page35of48

Note1:Insurerswillenter“Illiquid”inadatafieldforanyassetcategorydeemedsuchwithinaspecifictimehorizon.

(Regulatorscanthenfollowupwithquestionslaterifthereareconcerns,etc.)

Note 2: Any securities pledged as part of institutional funding agreements (e.g., FHLB) should be excluded

and

consideredencumbered.However,anypre‐pledgedassetsthatarenotsecuringcreditthathasbeenextendedand

remainsoutstanding(i.e.,excess)shouldbeconsideredunencumbered.

Note3:Reminderthatregulatorswantrobustdisclosuresregardingthechiefinvestmentofficer’s(orequivalenttitle

ordesignee)assumptionsanddecisionsonexpectedassetsales.

Mightneedtosupplementthetemplatecomments

withadditionalnarrativedisclosures.

Note4:Excludingthe“WhatIf”variation,insurersaretoprovidedisclosuresindicatingwhenaffiliatedamountsare

providedtoassistalegalentityinaddressingaliquiditydeficiency.

AssetCate gory AssetSub‐Category 1Month 3Month 12 Month

Cash Cash&CashEquival ents ‐ ‐ ‐

TreasuryBonds ‐ ‐ ‐

AgencyBonds ‐ ‐ ‐

OtherIGSove reigns&RegionalGovernment‐ ‐ ‐

BelowIGSovereigns&RegionalGovernment ‐ ‐ ‐

AgencyCM O ‐ ‐ ‐

AgencyMBS ‐ ‐ ‐

AgencyCM B S ‐ ‐ ‐

AgencyABS ‐ ‐ ‐

IGPublic

CorporateBonds ‐ ‐ ‐

IGMuni cipalBonds ‐ ‐ ‐

BelowIGPublicCorporateBonds ‐ ‐ ‐

BelowIGMunicipalBonds ‐ ‐ ‐

IGPrivatePlacementBonds ‐ ‐ ‐

IG144As ‐ ‐ ‐

BelowIGPrivatePlace mentBonds ‐ ‐ ‐

BelowIG144As ‐ ‐ ‐

IGCMO ‐ ‐ ‐

IGMBS ‐ ‐ ‐

IGCMBS ‐ ‐ ‐

IGABS ‐ ‐ ‐

IGCLO ‐ ‐ ‐

BelowIGCMO ‐ ‐ ‐

BelowIGMBS ‐ ‐ ‐

BelowIGCMBS ‐ ‐ ‐

BelowIGABS ‐ ‐ ‐

BelowIGCLO ‐ ‐ ‐

CommonStock ‐ ‐ ‐

PreferredStock ‐ ‐ ‐

OtherEquityandAlternativeInvestments ‐ ‐ ‐

Commercial,Residential,Agricultural,BankandOtherLoans ‐ ‐

‐

Other ‐ ‐ ‐

‐ ‐ ‐

PrivateBonds

Non‐AgencyStructuredDebt

Equity

Other

TotalInvestedAssetsFinalSale

GroupSummary

GovernmentSecurities

PublicBonds

FinalExpectedAssetSalesAfterAdjustments

Page36of48

Narrative/ExplanatoryDisclosuresnotedinthe2022LST

Narrative/explanatorydisclosuresareexpectedtobeinEnglish.

Insurers should provide a narrative description of their internal liquidity stress testing

systemandprocesses,includingforexampletheirmaterialitythresholdsforstressedcash

flowsandmethodologyforconvertingforeigncurrenciestoUSdollars.

Specific disclosures on material stressed cash flows

to/from legal entity banks/asset

managers/mutualfundsifneeded.

Company‐specific narrative on assumptions and metrics used for the adverse liquidity

stressscenarioforinsurers,forexampletheinabilitytorollorissuenewdebt,potential

increasesinlapserates,newbusinesssensitivity,mortalityexperienceandpolicyholder

behavior(e.g.,surrenders

andpolicyloans).

Company‐specific narrative on the interest rate shock scenario, assumptions around

general economic conditions bulleted in 5.2.1 Narrative, and specific metrics for

economicvariables for each time horizon.The economicvariablesin the table in 5.2.2

Regulator‐Prescribed Assumptions should be fully described in the narrative, to

the

extenttheyareuseinthecompany’sinternalmodel.

Insurersshouldprovidea comprehensivenarrativedescribing their worst‐caseliquidity

stressscenario(s)andtheeconomicenvironment(s),includingassumptions,keymetrics

andresults.

Written narrative on the insurer’s own individual methodology for determining asset

salesunderstress.

Robust disclosures regarding the chief investment officer’s (or equivalent title or

designee)assumptionsanddecisionsonexpectedassetsales,ifneeded.

Excluding the “What If” variation, disclosures to identify when affiliated amounts are

contributedtoassistalegalentityinaddressingaliquiditydeficiency.

Disclosewhenaregulatoryprescribed

variableis notused fortheLST becauseitisnot

usedintheinternalliquiditystresstestingprocessormodels.

Page37of48

[Endof2022LiquidityStressTestingFramework–tobeincludedasan

appendixintheNAICFinancialAnalysisHandbook]