Franchise Disclosure Document 2021

FRANCHISE DISCLOSURE DOCUMENT

KRISPY KREME DOUGHNUT

CORPORATION

370 Knollwood Street

Winston-Salem, North Carolina 27103

1-888-249-2726

www.krispykreme.com

This Franchise Disclosure Document (“Disclosure Document”) is for a Krispy Kreme Doughnut

franchise. Krispy Kreme Shops (“Krispy Kreme Shops” or “Shops”) offer and serve a variety of

doughnuts, beverages, and other related products and services. Franchises for Krispy Kreme Shops are

offered in 3 different Shop formats: Hot Light Theater Shops, Fresh Shops, and Box Shops.

The total initial investment necessary to begin operation ranges from $1,587,500 to $3,410,000

for a Hot Light Theater Shop, and $440,500 to $1,207,500 for a Fresh Shop, and $200,500 to $453,000

for a Box Shop. These totals include the following amounts that must be paid to us as initial fees and for

a variety of goods and services, as follows: $360,000 to $500,000 for a Hot Light Theater Shop; and

$30,000 to $33,000 for a Fresh Shop, and $30,000 to $33,000 for a Box Shop.

This Disclosure Document summarizes in plain English certain provisions of your franchise

agreement and other information. Read this Disclosure Document and all accompanying agreements

carefully. You must receive this Disclosure Document at least 14 calendar days before you sign a binding

agreement with, or make any payment to, us or our affiliate in connection with the franchise sale. Note,

however, that no governmental agency has verified the information contained in this Disclosure

Document.

You may wish to receive your Disclosure Document in another format that is more convenient for

you. To discuss the availability of disclosures in different formats, contact Lisa Brown at 370 Knollwood

Street, Winston-Salem, North Carolina 27103 or 1-888-249-2726.

The terms of your Franchise Agreement and any Development Agreement (the “Agreements”)

will govern our franchise relationship. Do not rely on this Disclosure Document alone to understand your

Agreements with us. Read all your Agreements carefully. Show this Disclosure Document to an advisor,

like a lawyer or an accountant.

Buying a franchise is a complex investment. The information in this Disclosure Document can

help you make up your mind. More information on franchising, such as “A Consumer’s Guide to Buying

a Franchise,” which can help you understand how to use this Disclosure Document, is available from the

Federal Trade Commission. You can contact the FTC at 1-877-FTC-HELP or by writing to the FTC at

600 Pennsylvania Avenue, NW, Washington, DC 20580. You can also visit the FTC’s home page at

www.ftc.gov for additional information. Call your state agency or visit your public library for other

sources of information on franchising.

There may also be laws on franchising in your state. Ask your state agencies about them.

Issuance Date: September 9, 2021

Franchise Disclosure Document 2021

How to Use This Franchise Disclosure Document

Here are some questions you may be asking about buying a franchise and tips on how to

find more information:

QUESTION

WHERE TO FIND INFORMATION

How much can I earn?

Item 19 may give you information about outlet sales,

costs, profits or losses. You should also try to obtain

this information from others, like current and former

franchisees. You can find their names and contact

information in Item 20 or Exhibits D and E.

How much will I need to invest?

Items 5 and 6 list fees you will be paying to the

franchisor or at the franchisor’s direction. Item 7

lists the initial investment to open. Item 8 describes

the suppliers you must use.

Does the franchisor have the

financial ability to provide

support to my business?

Item 21 or Exhibit F includes financial statements.

Review these statements carefully.

Is the franchise system stable,

growing, or shrinking?

Item 20 summarizes the recent history of the number

of company-owned and franchised outlets.

Will my business be the only

Krispy Kreme

®

business in my

area?

Item 12 and the “territory” provisions in the

franchise agreement describe whether the franchisor

and other franchisees can compete with you.

Does the franchisor have a

troubled legal history?

Items 3 and 4 tell you whether the franchisor or its

management have been involved in material

litigation or bankruptcy proceedings.

What’s it like to be a Krispy

Kreme

®

franchisee?

Item 20 or Exhibits D and E list current and former

franchisees. You can contact them to ask about their

experiences.

What else should I know?

These questions are only a few things you should

look for. Review all 23 Items and all Exhibits in this

disclosure document to better understand this

franchise opportunity. See the table of contents.

Franchise Disclosure Document 2021

What You Need To Know About Franchising Generally

Continuing responsibility to pay fees. You may have to pay royalties and other fees

even if you are losing money.

Business model can change. The franchise agreement may allow the franchisor to

change its manuals and business model without your consent. These changes may

require you to make additional investments in your franchise business or may harm your

franchise business.

Supplier restrictions. You may have to buy or lease items from the franchisor or a

limited group of suppliers the franchisor designates. These items may be more expensive

than similar items you could buy on your own.

Operating restrictions. The franchise agreement may prohibit you from operating a

similar business during the term of the franchise. There are usually other restrictions.

Some examples may include controlling your location, your access to customers, what

you sell, how you market, and your hours of operation.

Competition from franchisor. Even if the franchise agreement grants you a territory,

the franchisor may have the right to compete with you in your territory.

Renewal. Your franchise agreement may not permit you to renew. Even if it does, you

may have to sign a new agreement with different terms and conditions in order to

continue to operate your franchise business.

When your franchise ends. The franchise agreement may prohibit you from operating a

similar business after your franchise ends even if you still have obligations to your

landlord or other creditors.

Some States Require Registration

Your state may have a franchise law, or other law, that requires franchisors to

register before offering or selling franchises in the state. Registration does not mean that

the state recommends the franchise or has verified the information in this document. To

find out if your state has a registration requirement, or to contact your state, use the

agency information in Exhibit A.

Your state also may have laws that require special disclosures or amendments be

made to your franchise agreement. If so, you should check the State Specific Addenda.

See the Table of Contents for the location of the State Specific Addenda.

Franchise Disclosure Document 2021

Special Risks to Consider About This Franchise

Certain states require that the following risk(s) be highlighted:

1. Out-of-State Dispute Resolution. The franchise agreement and development

agreement permit you to litigate with us only in North Carolina. Out of state

litigation may force you to accept a less favorable settlement for disputes. It

may also cost more to litigate with us in North Carolina than in your home

state.

2. The franchise agreement and development agreement state that North Carolina

law governs the agreement, and this law may not provide the same protections

and benefits as local law. You may want to compare these laws.

Certain states may require other risks to be highlighted. Check the “State Specific

Addenda” (if any) to see whether your state requires other risks to be highlighted.

Franchise Disclosure Document 2021 Michigan Notice

Page 1

THE FOLLOWING APPLY ONLY TO TRANSACTIONS GOVERNED BY

THE MICHIGAN FRANCHISE INVESTMENT LAW

THE STATE OF MICHIGAN PROHIBITS CERTAIN UNFAIR PROVISIONS THAT ARE

SOMETIMES IN FRANCHISE DOCUMENTS. IF ANY OF THE FOLLOWING PROVISIONS

ARE IN THESE FRANCHISE DOCUMENTS, THE PROVISIONS ARE VOID AND CANNOT

BE ENFORCED AGAINST YOU.

(a) A prohibition on the right of a franchisee to join an association of franchisees.

(b) A requirement that a franchisee assent to a release, assignment, novation, waiver, or

estoppel which deprives a franchisee of rights and protections provided in the Michigan Franchise

Investment Act. This shall not preclude a franchisee, after entering into a franchise agreement, from

settling any and all claims.

(c) A provision that permits a franchisor to terminate a franchise prior to the expiration of its

term except for good cause. Good cause shall include the failure of the franchisee to comply with any

lawful provision of the franchise agreement and to cure such failure after being given written notice

thereof and a reasonable opportunity, which in no event need be more than 30 days, to cure such failure.

(d) A provision that permits a franchisor to refuse to renew a franchise without fairly

compensating the franchisee by repurchase or other means for the fair market value at the time of

expiration of the franchisee’s inventory, supplies, equipment, fixtures, and furnishings. Personalized

materials which have no value to the franchisor and inventory, supplies, equipment, fixtures, and

furnishings not reasonably required in the conduct of the franchise business are not subject to

compensation. This subsection applies only if: (i) the term of the franchise is less than five years and

(ii) the franchisee is prohibited by the franchise or other agreement from continuing to conduct substan-

tially the same business under another trademark, service mark, trade name, logotype, advertising, or

other commercial symbol in the same area subsequent to the expiration of the franchise or the franchisee

does not receive at least 6 months advance notice of franchisor’s intent not to renew the franchise.

(e) A provision that permits the franchisor to refuse to renew a franchise on terms generally

available to other franchisees of the same class or type under similar circumstances. This section does not

require a renewal provision.

(f) A provision requiring that arbitration or litigation be conducted outside this state. This

shall not preclude the franchisee from entering into an agreement, at the time of arbitration, to conduct

arbitration at a location outside this state.

(g) A provision which permits a franchisor to refuse to permit a transfer of ownership of a

franchise, except for good cause. This subdivision does not prevent a franchisor from exercising a right

of first refusal to purchase the franchise. Good cause shall include, but is not limited to:

(i) The failure of the proposed transferee to meet the franchisor’s then-current

reasonable qualifications or standards.

(ii) The fact that the proposed transferee is a competitor of the franchisor or

subfranchisor.

(iii) The unwillingness of the proposed transferee to agree in writing to comply with

all lawful obligations.

Franchise Disclosure Document 2021 Michigan Notice

Page 2

(iv) The failure of the franchisee or proposed transferee to pay any sums owing to the

franchisor or to cure any default in the franchise agreement existing at the time of the proposed

transfer.

(h) A provision that requires the franchisee to resell to the franchisor items that are not

uniquely identified with the franchisor. This subdivision does not prohibit a provision that grants to a

franchisor a right of first refusal to purchase the assets of a franchise on the same terms and conditions as

a bona fide third party willing and able to purchase those assets, nor does this subdivision prohibit a

provision that grants the franchisor the right to acquire the assets of a franchise for the market or

appraised value of such assets if the franchisee has breached the lawful provisions of the franchise

agreement and has failed to cure the breach in the manner provided in subdivision (c).

(i) A provision which permits the franchisor to directly or indirectly convey, assign, or

otherwise transfer its obligations to fulfill contractual obligations to the franchisee unless provision has

been made for providing the required contractual services.

THE FACT THAT THERE IS A NOTICE OF THIS OFFERING ON FILE WITH THE

ATTORNEY GENERAL DOES NOT CONSTITUTE APPROVAL, RECOMMENDATION, OR

ENFORCEMENT BY THE ATTORNEY GENERAL.

Any questions regarding this notice should be directed to:

State of Michigan

Department of Attorney General

Consumer Protection Division

Attn: Franchise Section

525 West Ottawa Street

G. Mennen Williams Building, 1

st

Floor

Lansing, Michigan 48913

Telephone Number: (517) 373-7117

Franchise Disclosure Document 2021

TABLE OF CONTENTS

ITEM 1 THE FRANCHISOR, AND ANY PARENTS, PREDECESSORS AND AFFILIATES ........... 1

ITEM 2 BUSINESS EXPERIENCE ........................................................................................................ 5

ITEM 3 LITIGATION .............................................................................................................................. 7

ITEM 4 BANKRUPTCY ....................................................................................................................... 10

ITEM 5 INITIAL FEES .......................................................................................................................... 10

ITEM 6 OTHER FEES ........................................................................................................................... 11

ITEM 7 ESTIMATED INITIAL INVESTMENT .................................................................................. 16

ITEM 8 RESTRICTIONS ON SOURCES OF PRODUCTS AND SERVICES ................................... 21

ITEM 9 FRANCHISEE’S OBLIGATIONS ........................................................................................... 23

ITEM 10 FINANCING ............................................................................................................................. 25

ITEM 11 FRANCHISOR’S ASSISTANCE, ADVERTISING, COMPUTER SYSTEMS AND

TRAINING .............................................................................................................................. 25

ITEM 12 TERRITORY ............................................................................................................................ 37

ITEM 13 TRADEMARKS ....................................................................................................................... 39

ITEM 14 PATENTS, COPYRIGHTS AND PROPRIETARY INFORMATION ................................... 41

ITEM 15 OBLIGATION TO PARTICIPATE IN THE ACTUAL OPERATION OF THE

FRANCHISE BUSINESS......................................................................................................... 43

ITEM 16 RESTRICTIONS ON WHAT THE FRANCHISE MAY SELL .............................................. 43

ITEM 17 RENEWAL, TERMINATION, TRANSFER AND DISPUTE RESOLUTION ...................... 44

ITEM 18 PUBLIC FIGURES ................................................................................................................... 48

ITEM 19 FINANCIAL PERFORMANCE REPRESENTATIONS ......................................................... 48

ITEM 21 FINANCIAL STATEMENTS .................................................................................................. 56

ITEM 22 CONTRACTS ........................................................................................................................... 56

ITEM 23 RECEIPTS ................................................................................................................................ 56

Exhibits

A State Agencies/Agents for Service of Process

B-1 Franchise Agreement

B-2 Development Agreement

B-3 Service Provider Agreement

C System Standards Manuals Table of Contents

D List of Franchisees

E List of Franchisees Who Have Left the System

F Financial Statements

G-1 Parent Guarantee of Performance (General)

G-2 Parent Guaranty of Performance (Illinois)

H State Specific Addenda to the Franchise Disclosure Document

I-1 State Specific Amendments to the Franchise Agreement

I-2 State Specific Amendments to the Development Agreement

1

Franchise Disclosure Document 2021

ITEM 1

THE FRANCHISOR, AND ANY PARENTS, PREDECESSORS AND AFFILIATES

The Franchisor

The Franchisor is Krispy Kreme Doughnut Corporation. For ease of reference, we refer to Krispy

Kreme Doughnut Corporation as “we”, “us”, “our”, or “Krispy Kreme” in this Disclosure Document.

We refer to the person or entity who buys a franchise as “you” throughout the Disclosure Document. If

you are a corporation or other business entity, certain provisions of the Development Agreement (as

defined below), and the Franchise Agreement (as defined below) also apply to your owners. This

Disclosure Document provides certain information about us and our affiliates and the terms on which we

currently offer franchises. This Disclosure Document cannot and does not provide all the information a

prospective franchisee should consider in making a decision on whether to enter into any of the

Agreements. Prospective franchisees should make an independent investigation before making a decision

to enter into any of the Agreements, and you should consult with your own advisors, attorneys, and

accountants in advance of entering into any such agreement with us. The terms of previous and

subsequent franchise agreements and development agreements may vary from the terms of the

agreements offered under this Disclosure Document.

Krispy Kreme was founded in 1937 by Vernon Rudolph and has been in the doughnut and coffee

business continuously in various corporate forms since that time. Krispy Kreme is a North Carolina

corporation incorporated in 1947 and re-incorporated in North Carolina on January 11, 1982. We do

business as Krispy Kreme Doughnut Corporation and Krispy Kreme. Our principal business address is

370 Knollwood Street, Winston-Salem, North Carolina 27103. In November 2018, we opened an

additional office located at 2116 Hawkins Street, Charlotte, North Carolina. We operate and franchise

doughnut shops known as “Krispy Kreme Shops” (or “Shops”) and we operate doughnut manufacturing

facilities known as “Doughnut Factories” (formerly, Commissary Facilities). As of December 31, 2020,

we owned and operated 227 Krispy Kreme Shops and Doughnut Factories, and we franchised 136 Krispy

Kreme Shops in the United States. We also produce doughnut production equipment and doughnut mixes

used in Krispy Kreme Shops and Doughnut Factories.

We have been offering franchises since the 1950s. From 2004 to late 2007 we did not offer

franchises in the United States. We began offering franchises of the type described in this Disclosure

Document in the United States in December 2007. We have conducted a business of the type to be

operated by franchisees since 1982. Our store types (Hot Light Theater Shops (formerly, Factory Stores),

Fresh Shops, and Box Shops) are defined under the heading “Krispy Kreme Shops” below. Some of our

current franchisees in the United States and other countries have operated Tunnel Oven Shops, Fresh

Shops, Box Shops, Kiosks, and Doughnut Factories. Specific agreements for Fresh Shops are offerings in

the United States beginning in December 2007. Specific agreements for Box Shops are offerings in the

United States beginning in June 2019. Specific agreements for Tunnel Oven Shops and Doughnut

Factories were offerings in the United States from December 2007 to August 2021. We no longer offer

franchises for Tunnel Oven Shops or Doughnut Factories in the United States. We do not currently and

have never offered franchises in other lines of business.

Our Parents

Our parent company is Krispy Kreme Doughnuts, Inc., a North Carolina corporation (“KKDI”). KKDI

shares our principal business address at 370 Knollwood Street, Winston-Salem, North Carolina 27103.

KKDI is a wholly-owned subsidiary of Cotton Parent, Inc., a Delaware corporation (“Cotton Parent”).

Cotton Parent’s principal business address is 1701 Pennsylvania Ave. NW, Suite 801, Washington, DC

20006. Cotton Parent is a wholly-owned subsidiary of Krispy Kreme, Inc., a Delaware Corporation

2

Franchise Disclosure Document 2021

(“KKI”). KKI’s principal business address is 2116 Hawkins Street, Charlotte, NC 28203. KKI is a

publicly-traded company listed on the Nasdaq Global Select Market. Except as disclosed above, KKDI,

Cotton Parent, and KKI have never offered franchises in this or any other line of business, nor have they

conducted a business of the type to be operated by franchisees. Other than KKDI, Cotton Parent, and

KKI, we do not have any parents, predecessors, or affiliates that must be disclosed in this Disclosure

Document.

Our Affiliate

Our direct subsidiary, HDN Development Corporation, a Kentucky corporation (“HDN”), owns the

Krispy Kreme intellectual property assets. HDN’s principal business address is 370 Knollwood Street,

Winston-Salem, NC 27103. HDN has never offered franchises in this or any other line of business, nor

has it conducted a business of the type to be operated by franchisees.

Our agents for service of process are disclosed in Exhibit A.

Franchises Offered

We offer to qualified persons the opportunity to enter into a development agreement in the form

attached as Exhibit B-2 (“Development Agreement”), which grants the right and obligation to establish a

certain number of Shops in a specified geographic area (“Development Area”). These Shops are to be

developed in accordance with a development schedule contained in the Development Agreement. They

may include more than one format of Krispy Kreme Shop, including Hot Light Theater Shops, Fresh

Shops, and Box Shops. For each Shop developed under the Development Agreement, you will be

required to sign our then-current form of Franchise Agreement. The current form of Franchise

Agreement is attached as Exhibit B-1 (“Franchise Agreement”).

Under the Development Agreement, you must meet the following requirements before you will

have the right to develop each Krispy Kreme Shop:

(a) Development. You and your affiliates are in compliance with the Development

Agreement, all Franchise Agreements, and any other development agreement between

you or your affiliates and us or our affiliates.

(b) Operational. You are conducting the operation of your existing Krispy Kreme Shops, if

any, and are capable of conducting the operation of the proposed Krispy Kreme Shop

(i) in accordance with the terms and conditions of the Development Agreement; (ii) in

accordance with the provisions of the respective Franchise Agreements; and (iii) in

accordance with the System Standards (defined below), as such System Standards may be

amended occasionally.

(c) Financial. You and your owners satisfy our then-current financial criteria for developers

and owners of Krispy Kreme Shops with respect to your operation of your existing

Krispy Kreme Shops, if any, and the proposed Krispy Kreme Shop. No default relating

to any monetary obligations owed to us or our affiliates under the Development

Agreement, any Franchise Agreements, or other agreements between you or any of your

affiliates and us or any of our affiliates either has (i) occurred and is continuing; or

(ii) occurred during the 12 months preceding your request for consent, whether or not

such default was cured or curable.

(d) Legal. You have submitted to us, in a timely manner, all information and documents we

requested before, and as a basis for, the issuance of individual licenses or according to

any right granted to you by the Development Agreement, or by any Franchise

3

Franchise Disclosure Document 2021

Agreement, and have taken such additional actions in connection with such submittal as

we may request. You and your owners have been and are faithfully performing all terms

and conditions of the Development Agreement, each of the existing Franchise

Agreements and any other agreement among us, you or any of either’s affiliates.

(e) Ownership. Neither you nor any owners (as applicable) will have transferred a

controlling interest in you. You and your owners on whom we have relied to perform the

duties under the Development Agreement will continue to own and exercise control over

a controlling interest in you.

Krispy Kreme Shops are typically located in retail shopping centers or amongst or nearby other

retail stores and restaurants in urban and suburban locations which are acceptable to us (“Traditional

Locations”). We may, however, consider sites such as train stations, sports arena, airports, shopping

malls, university campuses or other captive market spaces on a case-by-case basis (“Non-Traditional

Locations”). We typically only consider prospective franchisees for Non-Traditional Locations that have

significant experience in Non-Traditional Locations operations. We do not offer Franchise Agreements

for Fresh Shops or Box Shops on an independent basis, other than (1) to existing Krispy Kreme

franchisees that have one or more existing Hot Light Theater Shops with the capacity to support such

operations, or (2) for Non-Traditional Locations. Fresh Shops and Box Shops must have their doughnuts

supplied by a Hot Light Theater Shop. We no longer offer Doughnut Factory Agreements (formerly,

Commissary Facility Agreements), or Franchise Agreements for Tunnel Oven Shops.

Occasionally, we may sell company-owned Shops and franchise them. In these transactions, we

negotiate with the prospective franchisee to reach mutually acceptable terms of a sale agreement and, if

not acquired, a lease or sublease of the real estate. If you purchase a company-owned Krispy Kreme

Shop, you must sign a Franchise Agreement. We may also require you to sign a Development Agreement

for the further development of Krispy Kreme Shops in the geographic area where the purchased Shop is

located. Depending on the circumstances, the financial and other terms may vary from the standard terms

of our Agreements.

Krispy Kreme Shops

Krispy Kreme Shops may be operated in 3 different formats, namely a Hot Light Theater Shop, a

Fresh Shop, and a Box Shop. Each Shop is a retail facility used principally for on-premises sales of a

variety of fresh doughnuts, beverages, and other related food products and services that we prescribe.

The differences in Shop formats are as follows:

• Hot Light Theater Shop – a retail sales facility that manufactures and produces fresh

doughnuts on-site, under the System Standards (as defined below). Additionally, Hot

Light Theater Shops may have the capacity to supply fresh doughnuts to Fresh Shops and

Box Shops. Hot Light Theater Shops were formerly known as Factory Stores.

• Fresh Shop – a retail sales facility with limited manufacturing capabilities (e.g., icing and

filling equipment), or no manufacturing capabilities, that receives doughnuts from a Hot

Light Theater Shop and finishes them as necessary to sell in accordance with our System

Standards.

• Box Shop – a retail sales facility with no manufacturing capabilities that receives

doughnuts from a Hot Light Theater Shop to sell in accordance with our System

Standards. It is a prefabricated, free-standing self-contained unit resembling a Krispy

Kreme doughnut box (which design elements may vary and be modified from time to

time) and is typically located in an enclosed retail area.

4

Franchise Disclosure Document 2021

Hot Light Theater Shops may provide doughnuts and other products to fundraising customers,

provided that we authorize you to make such sales. We may authorize you to solicit fundraising business

and deliver to fundraising customers outside the store (“Authorized Fundraising Sales”). Our current

form of Authorized Fundraising Sales Agreement is attached as Exhibit E to the Franchise Agreement.

The form of Authorized Fundraising Sales Agreement will be tailored for individual use.

“Doughnut Factories” are manufacturing facilities, owned and operated by us, and are dedicated

solely to the production of doughnuts and other Products to be sold under the Marks that are supplied to

Franchisor’s Krispy Kreme Shops, and to grocery and convenience stores for resale. Doughnut Factories

are not used for retail sales.

Krispy Kreme Shops are characterized by a distinctive system that includes special recipes and

menu items; distinctive design, décor and color scheme; equipment, fixtures and furnishings, including

use of proprietary equipment; standards, specifications, and procedures for operations; procedures for

quality control, training and assistance; and advertising and promotional programs, all of which we may

improve, further develop or otherwise modify occasionally (the “System”). The System is identified by

means of certain service marks, trademarks, logos, emblems, and indicia of origin, including the principal

trademarks identified in Item 13 of this Disclosure Document. Occasionally, we may designate other

service marks, trademarks, slogans, logos, emblems, and indicia of origin for use in the System.

Collectively, these identifiers are referred to as the “Marks”.

Krispy Kreme Shops are required to be operated in accordance with the mandatory and suggested

specifications, standards, operating procedures and rules that we prescribe for the development and

operation of Krispy Kreme Shops, including those pertaining to conversion, site selection, construction,

signage and layouts; the standards, specifications, recipes and other requirements related to the purchase,

preparation, marketing and sale of the Products; advertising and marketing programs and information

technology; sales made at the Shop premises (“On-Premises Sales”), Authorized Fundraising Sales;

customer service; the design, décor and appearance of the Shop; standards and specifications for

equipment, fixtures and furnishings and the use of proprietary equipment; the maintenance and

remodeling of the Shop and the equipment, fixtures and furnishings therein; the use and display of the

Marks; the insurance coverage required to be carried for the Shop; the training of the Shop employees; the

days and hours of the Shop operation; and the content, quality and use of advertising and promotional

materials, all of which Franchisor may improve, further develop or otherwise modify from time to time

(the “System Standards”). The documents and other media that contains the System Standards are

referred to as the “System Standards Manuals”.

Food-service businesses such as Krispy Kreme Shops operate in a highly competitive and

developed market that can be affected significantly by many factors, including changes in local, regional,

or national economic conditions, changes in consumer tastes, consumer concerns about the nutritional

quality of quick-service food, dietary trends, and increases in the number of, and particular locations of,

competing food service businesses. Various factors can adversely affect the food-service industry,

including weather conditions; inflation; increases in ingredient, food, labor, and energy costs; the

availability and cost of suitable sites; fluctuating interest and insurance rates; state and local regulations

and licensing requirements; the availability of ingredients, food items, and an adequate number of

qualified hourly-paid employees; and other factors that may affect restaurants or retailers in general. In

addition, other food-service chains with greater financial resources have similar concepts.

You should consider that certain aspects of any food-service business are regulated by federal,

state, and local laws, in addition to the laws applying to businesses generally, such as the Americans with

Disabilities Act, Federal Wage and Hour Laws, and the Occupational Safety and Health Act. The

Environmental Protection Agency, the U.S. Food and Drug Administration, the U.S. Department of

5

Franchise Disclosure Document 2021

Agriculture, as well as state and local environmental and health departments and other agencies have laws

and regulations concerning the preparation of food and sanitary conditions of food-service facilities.

State and local agencies routinely conduct inspections for compliance with these requirements. Under the

Clean Air Act and state implementing laws, certain state and local areas are required to attain, by the

applicable statutory guidelines, the national quality standards for ozone, carbon monoxide and particulate

matters. Certain provisions of such laws impose limits on emissions resulting from commercial-food

preparation. You should investigate these laws and regulations and any others that may apply to your

business before you acquire the franchise. You should consult with your attorney concerning these and

other local laws and ordinances that may affect your operations.

ITEM 2

BUSINESS EXPERIENCE

Director, President and Chief Executive Officer: Michael Tattersfield

Michael Tattersfield has served as our President, Chief Executive Officer and a member of our

Board of Directors (the “Board”) since January 2017. He also serves in a parallel officer position with

KKI and KKDI. He has served as a member of the Board of Directors of KKI since May 2021 and as a

member of the Board of Directors of KKDI since September 2016. Mr. Tattersfield served as Chairman

of the Board of KKDI from September 2016 to May 2017. Mr. Tattersfield served as the Chief Executive

Officer and a member of the Board of Directors of Caribou Coffee Development Company, Inc.

(“CCDC”), and Chief Executive Officer and President of Caribou Coffee Company, Inc. (“CCC”) in

Minneapolis, Minnesota from August 2008 to July 2017. He also served as a member of the Board of

Directors of CCC from August 2008 to March 2020. Mr. Tattersfield served as the Chief Executive

Officer and a member of the Board of Directors of Einstein Bros. Bagels Franchise Corporation

(“EBBFC”) in Minneapolis, Minnesota from February 2016 to July 2017, Chief Executive Officer and a

member of the Board of Directors of Einstein and Noah Corporation, as well as Chief Executive Officer

and a member of the Board of Directors of Manhattan Bagel Company from January 2015 to July 2017.

Director, Chief Operating Officer and Chief Financial Officer: Josh Charlesworth

Josh Charlesworth has served as our Chief Operating Officer since May 2019, Chief Financial

Officer since April 2017, and a member of the Board since May 2021. He also serves in a parallel officer

position with KKI and KKDI. Mr. Charlesworth has served as a member of the Board of Directors of

KKDI since May 2021. He served as our Corporate Secretary of from July 2018 to August 2020. He also

served as Corporate Secretary of KKDI from July 2018 to August 2020. Prior to joining Krispy Kreme,

Mr. Charlesworth held various positions since joining Mars, Incorporated in McLean, Virginia in 1997.

He most recently served as Global Chief Financial Officer of Mars Chocolate from January 2015 to April

2017.

Director and North America President: Andrew Skehan

Andy Skehan has served as our North America President since November 2017 and as a member

of the Board since May 2021. He also serves in a parallel officer position with KKI and KKDI. Prior to

joining Krispy Kreme, Mr. Skehan held various positions with Popeyes Louisiana Kitchen in Atlanta,

Georgia, including President of North America from March 2017 to October 2017 and President of

International from March 2015 to March 2017.

Chief Growth Officer: Matthew Spanjers

Matthew Spanjers has served as our Chief Growth Officer since August 2019. He also serves in a

parallel officer position with KKI and KKDI. Mr. Spanjers served as our Chief Strategy and

6

Franchise Disclosure Document 2021

Development Officer from April 2017 to August 2019. Prior to joining Krispy Kreme, Mr. Spanjers

served as Chief Development Officer with EBBFC in Minneapolis, Minnesota from February 2016 to

April 2017, as well as Chief Development Officer and Senior Vice President Commercial with CCDC in

Minneapolis, Minnesota from February 2015 to April 2017.

Chief Legal Officer and Corporate Secretary: Cathy Tang

Cathy Tang has served as our Chief Legal Officer since July 2020 and as Corporate Secretary

since August 2020. She also serves in a parallel officer position with KKI and KKDI. Prior to joining

Krispy Kreme, Ms. Tang held various positions with Yum! Brands in Plano, Texas. She most recently

served as Vice President and Associate General Counsel of Yum! Brands from January 2017 to July

2020, Chief New Business Development Officer of Yum! Brands (KFC Global) from July 2015 to

January 2017, and Chief Legal Officer of KFC Corporation, a subsidiary of Yum! Brands, from August

2009 to July 2015.

Vice President – Shop Experience and Real Estate: Levi Hetrick

Levi Hetrick has served as our Vice President of Shop Experience and Real Estate June 2018.

Prior to joining Krispy Kreme, Mr. Hetrick was an Associate Partner with McKinsey & Company in New

York, New York from July 2012 to June 2018.

Chief Financial Officer – U.S. and Canada: Caren Prince

Caren Prince has served as our Chief Financial Officer of U.S. and Canada since August 2019.

She served as our Vice President of Retail Ventures from May 2018 to August 2019. Prior to joining

Krispy Kreme, Ms. Prince held various positions since joining Mars, Incorporated in McLean, Virginia in

1995. She most recently served as Chief Financial Officer of the M&Ms Retail Division from October

2014 to April 2018.

Chief Supply Chain Officer: Sherif Riad

Sherif Riad has served as our Chief Supply Chain Officer since July 2021. Prior to joining

Krispy Kreme, Mr. Riad served as Senior Director of Supply and Procurement, North America, with

Mondelez International in East Hanover, New Jersey from January 2016 to June 2021.

Chief Operating Officer – U.S. and Canada: Maria Rivera

Maria Rivera has served as our Chief Operating Officer of U.S. and Canada since August 2019.

She served as our Vice President of U.S. and Canada Operations from September 2018 to August 2019.

Ms. Rivera served as our Vice President of Company Store Operations from November 2016 to

September 2018. Prior to joining Krispy Kreme, Ms. Rivera served as Executive Vice President of

Operations for Logan’s Roadhouse, Inc. in Nashville, Tennessee from April 2015 to November 2016.

Senior Director – Franchise Relations: Dave Horn

Dave Horn has served as our Senior Director of Franchise Relations since March 2019. Prior to

joining Krispy Kreme, Mr. Horn was a self-employed contractor in Sewell, New Jersey from September

2018 to February 2019. Prior to that, he served as Divisional President with Steak N Shake in

Indianapolis, Indiana from December 2017 to September 2018, Regional Vice President with Noodles

and Company in Broomfield, Colorado from November 2015 to September 2017.

Note: Unless otherwise indicated above, the location of the employer is Winston-Salem, North Carolina

or Charlotte, North Carolina.

7

Franchise Disclosure Document 2021

ITEM 3

LITIGATION

Prior Actions - Franchisee Litigation

1. K

2

ASIA Ventures v. Robert Trota (Case No. 09 CVS 2766), Forsyth County, North

Carolina Superior Court, filed April 20, 2009. K

2

ASIA Ventures, Ben C. Broocks, and James G.J. Crow

served a complaint filed against us and KKDI, our franchisee in the Philippines, and other persons

associated with the franchisee. The suit alleges that we and the other defendants conspired to deprive the

plaintiffs of claimed “exclusive rights” to negotiate franchise and development agreements with

prospective franchisees in the Philippines, and seeks unspecified damages. The complaint also alleges that

we tortiously interfered with plaintiffs’ contract with the co-defendants, and committed fraud and unfair

trade practices. On July 26, 2013, the Superior Court dismissed the Philippines-based defendants for lack

of personal jurisdiction, and the plaintiffs have noticed an appeal of that decision. On January 22, 2015,

the North Carolina Supreme Court denied the plaintiffs’ request to review the case. We moved for

summary judgment on May 7, 2015. On November 9, 2018, the Superior Court entered an order treating

our motion for summary judgment as a motion to dismiss for failure to prosecute, and the Superior Court

granted our motion, dismissing the suit. The lone remaining plaintiff filed a notice of appeal from that

order to the North Carolina Court of Appeals on December 13, 2018. Plaintiff served the proposed record

on appeal on February 15, 2019. Plaintiff requested multiple extensions of the briefing deadlines, and the

briefing was completed on September 25, 2019. On December 3, 2019, the Court of Appeals issued a

calendar notice scheduling the case to be heard without oral argument on January 7, 2020. The Court of

Appeals on September 1, 2020 affirmed the trial court’s November 13, 2018 order dismissing the action.

On September 16, 2020, the plaintiff filed a petition for rehearing en banc, which the Court of Appeals

denied on October 16, 2020. On November 2, 2020, the plaintiff filed with the North Carolina Supreme

Court a petition for discretionary review. We filed a response to this petition on November 16, 2020. On

August 10, 2021, the North Carolina Supreme Court denied the plaintiff’s petition, which is the final level

of appellate review on the arguments raised by plaintiff.

Prior Actions – Securities Litigation

2. Ronnie Stillwell v. Tim E. Bentsen, et al. (Case No. 16-CVS 3101), Forsyth County,

North Carolina Superior Court, filed May 26, 2016 (the “Stillwell Action”). A purported KKDI

shareholder (“Plaintiff”), on behalf of himself and purportedly on behalf of a class of KKDI’s

shareholders that owned KKDI’s common stock as of May 9, 2016 (the “Purported Class”), filed an

action against KKDI’s Board of Directors (the “KKDI Board”), JAB Holding Company, Inc. (“JAB”),

JAB’s wholly-owned subsidiaries Cotton Parent, Inc. and Cotton Sub, Inc. (the “Cotton Defendants”)

and KKDI as a nominal defendant. This action alleges, among other things, that in connection with the

definitive merger agreement entered into between JAB Beech, Inc. (“JAB Beech”) and KKDI on May 9,

2016, the KKDI Board breached fiduciary duties owed to KKDI’s shareholders because it failed to

properly value KKDI, it failed to act in KKDI’s best interests, it took steps to avoid competitive bidding

for KKDI, and it did not protect against potential conflicts of interest between the KKDI Board and

KKDI. This action alleges that KKDI, JAB, and the Cotton Defendants aided and abetted the KKDI

Board’s breach of its fiduciary duties. It also alleges a derivative claim against the KKDI Board for

breach of its duties to KKDI. The action seeks class certification or, alternatively a declarative order that

the action is a shareholder derivative suit. Plaintiff also seeks a declaratory judgment, rescission of the

transaction or, if the merger is consummated, an award to Plaintiff and the Purported Class of an

unspecified amount of rescissory damages, together with reimbursement and costs and expenses of the

litigation and other unspecified relief. We plan to vigorously defend these claims. Due to the nature of

the transaction between KKDI and JAB Beech, we anticipate that other lawsuits similar to this one may

be brought against KKDI asserting substantially the same allegations.

8

Franchise Disclosure Document 2021

As anticipated, the following additional lawsuits as listed below have been filed making

allegations substantially similar to those asserted in the above lawsuit.

a. Grajzl v. Krispy Kreme Doughnut, Inc., et al. (Case No. 16 CVS 3239), Forsyth County,

North Carolina Superior Court, filed May 31, 2016 (the “Grajzl Action”).

b. Horton v. Krispy Kreme Doughnut, Inc., et al. (Case No. 16 CVS 3102), Forsyth County,

North Carolina Superior Court, filed May 26, 2016 (the “Horton Action”).

c. Bonnin v. Bentsen, et al. (Case No. 16 CVS 3651), Forsyth County, North Carolina

Superior Court, filed June 14, 2016 (the “Bonnin Action”).

d. Weers v. Bentsen, et al. (Case No. 16 CVS 3669), Forsyth County, North Carolina

Superior Court, filed June 16, 2016 (the “Weers Action”).

e. Graham v. Krispy Kreme Doughnut, Inc., et al. (Case No. 1:16-cv-00612), United States

District Court, Middle District of North Carolina, filed June 13, 2016 (the “Graham

Action”).

f. Lomax v. Krispy Kreme Doughnut, Inc., et al. (Case No. 1:16-cv-00923), United States

District Court, Middle District of North Carolina, filed July 8, 2016 (the “Lomax

Action”).

On July 11, 2016, the five actions brought in North Carolina Superior Court (the Stillwell Action,

Horton Action, Grajzl Action, Bonnin Action, and Weers Action) were consolidated into a single

litigation titled In re Krispy Kreme Shareholders Litigation (Case No. 16-CVS-3669), Forsyth County,

North Carolina Superior Court (the “Consolidated Action”).

Plaintiffs in each of the lawsuits described above (the Consolidated Action, the Graham Action,

and the Lomax Action, collectively the “Actions”) and Defendants in the Actions reached an agreement

in principle to settle the Actions and the North Carolina Business Court approved this settlement on

January 2, 2018, dismissing all claims. Without admitting any wrongdoing, or that any supplemental

disclosure was required to be made, KKDI made certain supplemental disclosures in a Form 8-K that was

filed with the SEC on July 15, 2016. Defendants received a full and complete release from the plaintiffs

and any purported members of the non-opt out class. On January 2, 2018 the North Carolina Business

Court approved the settlement, dismissing all claims in the Actions. The Court, however, retained

jurisdiction of the matter for the purposes of considering and approving the request for the award of

attorneys’ fees and expenses. On June 20, 2018, the Court awarded $150,000 in attorneys’ fees and the

Actions have concluded.

Prior Actions - Other Litigation

3. Irina Agajanyan v. Krispy Kreme Doughnut Corporation (Case No. 2:18-CV-02885),

United States District Court, Central District of California, filed April 6, 2018. Irina Agajanyan

individually, on behalf of herself, and on behalf of all others similarly situated, and the general public

(“Plaintiff”) filed a Class Action Complaint against us and DOES 1 through 10 (the “Action”). The

Action is based on our alleged false and misleading business practices with regard to the marketing and

sale of “Maple Iced Glazed” doughnuts, and “Glazed Blueberry Cake” doughnuts and doughnut holes

(collectively, the “Products”). Based solely on the names of these Products, Plaintiff claims that she

thought they would contain actual maple sugar or syrup, and blueberries, respectively. Plaintiff also

claims on information and belief that these Products in fact did not contain these ingredients. Plaintiff

alleges that if she and other consumers had known that the Products allegedly did not contain these

9

Franchise Disclosure Document 2021

ingredients, and did not include the alleged nutrients and health benefits allegedly associated with these

ingredients, they would not have purchased the Products or would have paid significantly less for them.

The Action alleges (i) Breach of Express Warranty; (ii) Breach of Implied Warranty; (iii) Breach of

Contract; (iv) Common Law Fraud; (v) Intentional Misrepresentation; (vi) Negligent Misrepresentation;

(vii) violation of California’s Consumer Legal Remedies Act, Cal. Civ. Code § 1750 et seq.; (viii)

violation of California’s Unfair Competition Law, Cal. Civ. Code § 17200 et seq.; (ix) violation of

California’s False Advertising Law, Cal. Civ. Code § 17500 et seq.; and (x) Quasi

Contract/Restitution/Unjust enrichment. Plaintiff seeks: (i) an order certifying a nationwide class, a

California subclass, and a California consumer subclass, naming Plaintiff as representative of all classes,

and naming her attorneys as class counsel for all classes; (ii) actual damages, if adequate; (iii) any

additional and consequential damages suffered by Plaintiff and the Class; (iv) statutory damages in an

amount of not less than $1,000 per Plaintiff or Class member pursuant to California Civil Code §

1780(a)(1); (v) restitution, as appropriate; (vi) statutory pre-judgment interest; (vii) reasonable attorneys’

fees and the costs of the action; (viii) an order enjoining defendants from selling the Products; (ix) an

order enjoining defendants from using the words “blueberry” and “maple” in the names of the Products;

(x) declaratory and/or equitable relief under the causes of action stated in the complaint; and (xi) other

relief as the court may deem just and proper. On May 11, 2018, we waived proper service of the

summons and complaint and were granted an extension of time to respond. On June 18, 2018, we filed

our Motion to Dismiss the Action. On August 6, 2018, the parties entered into a settlement agreement

whereby we paid a total amount to Plaintiff of $5,000 and no additional amount to Plaintiff’s counsel in

exchange for a general release by Plaintiff. On August 9, 2018, the Court entered an order dismissing the

Action. We have vigorously denied, and continue to vigorously deny, all of the claims that were alleged

in the Action.

4. Jason Saidian v. Krispy Kreme Doughnut Corporation (Case No. 2:16-CV-08338),

United States District Court, Central District of California, filed November 9, 2016, amended Complaint

filed December 5, 2016. Jason Saidian, individually and on behalf of all others similarly situated

(“Plaintiff”) filed a First Amended Class Action Complaint against us (the “Action”). The Action was

based on our alleged false and misleading business practices with regard to the marketing and sale of our

“Chocolate Iced Raspberry Filled” doughnuts, “Maple Iced Glazed” and “Maple Bar” doughnuts, and

“Glazed Blueberry Cake” doughnuts and doughnut holes (collectively, the “Products”). Based solely on

the names of these Products, Plaintiff claimed that he thought they would contain actual raspberries,

maple sugar or syrup, and blueberries, respectively. Plaintiff also claimed on information and belief that

these Products in fact did not contain these ingredients. Plaintiff alleged that if he and other consumers

had known that the Products allegedly did not contain these ingredients, and did not include the alleged

nutrients and health benefits allegedly associated with these ingredients, they would not have purchased

the Products or would have paid significantly less for them. The Action alleged (i) violation of

California’s Consumer Legal Remedies Act, Cal. Civ. Code § 1750 et seq.; (ii) violation of California’s

Unfair Competition Law, Cal. Civ. Code § 17200 et seq.; (iii) California’s False Advertising Law, Cal.

Civ. Code § 17500 et seq.; (iv) breach of express warranty, Cal. Com. Code § 2313; (v) breach of implied

warranty, Cal. Com. Code § 2314; (vi) fraud; (vii) intentional misrepresentation; (viii) negligent

misrepresentation; (ix) breach of contract; and (x) unjust enrichment/restitution. Plaintiff sought: (i) an

order certifying a nationwide class, a California subclass, and a California consumer subclass, naming

Jason Saidian as representative of all classes, and naming his attorneys as class counsel for all classes; (ii)

an order declaring that our alleged conduct violates the statutes and laws referenced in the Action; (iii) an

order finding in favor of Plaintiff and all classes on all counts asserted; (iv) an order awarding all alleged

compensatory and punitive damages, including under the California Consumers Legal Remedies Act on

behalf of the purported California consumer subclass, in amounts to be determined by the court and/or

jury; (v) prejudgment interest on all amounts awarded; (vi) interest on the amount of any and all alleged

economic losses at the prevailing rate; (vii) an order of restitution and all other forms of equitable

monetary relief; (viii) injunctive relief as pleaded or as the court may deem proper; (ix) an order awarding

Plaintiff and all purported classes their reasonable attorneys’ fees, expenses and costs of suit, including as

provided by statute such as under California Code of Civil Procedure section 1021.5; and (x) any other

10

Franchise Disclosure Document 2021

relief as the court deems just and proper. On January 4, 2017, we filed a Motion to Dismiss or Stay

Complaint and Motion to Strike which was denied by the court on February 27, 2017. On March 13.

2017, we filed our Answer to First Amended Class Action Complaint. On April 26, 2017, the parties

entered into a settlement agreement whereby we paid Plaintiff $8,500 and Plaintiff’s counsel $76,500 in

exchange for a general release by Plaintiff. On April 26, 2017, the parties filed a Stipulation to Dismiss

Action, voluntarily dismissing all of Plaintiff’s claims with prejudice and any class action allegations

without prejudice. We have vigorously denied, and continue to vigorously deny, all of the claims that

were alleged in the Action.

Other than these 4 actions, no litigation is required to be disclosed in this Item.

ITEM 4

BANKRUPTCY

The following bankruptcy case involves a company unrelated to Krispy Kreme but with which

one of our officers was associated before her employment with us.

Our Chief Operating Officer of U.S. and Canada, Maria Rivera, was the Executive Vice President

of Operations for Logan’s Roadhouse, Inc. (“Logan’s Roadhouse”) from April 2015 until November

2016. Logan’s Roadhouse is a chain of sit-down casual company-owned and franchised restaurants with

its headquarters at 3011 Armory Drive, Suite 300, Nashville, TN 37204. On August 8, 2016, Logan’s

Roadhouse filed a voluntary bankruptcy petition under Chapter 11 of the U.S. Bankruptcy Code (Logan’s

Roadhouse, Inc., 1:16-bk-11825, Delaware Bankruptcy Court). On December 6, 2016, the matter was

concluded after the presiding judge confirmed its plan of reorganization which included a restructure of

its debt, closing of 34 restaurants, and renegotiation of leases and contracts.

Other than this 1 action, no bankruptcy information is required to be disclosed in this Item.

ITEM 5

INITIAL FEES

Development Agreement

The standard development fees (each, a “Development Fee”) are $25,000 for a Hot Light Theater

Shop, $12,500 for a Fresh Shop, and $12,500 for a Box Shop.

You must sign a Development Agreement regardless of the total number of Krispy Kreme Shops

you commit to develop. You must pay us a Development Fee applicable for the number of Krispy Kreme

Shops to be developed under the Development Agreement. The number and format of Krispy Kreme

Shops to be developed under a particular Development Agreement are determined by mutual agreement.

In determining that number, we look at a number of factors, including format of Shop, size of the

territory, demographic data and trends, population density and growth rates, and other conditions. The

Development Fee is payable on execution of the Development Agreement, is fully earned and is non-

refundable, except that a pro rata portion will be refundable if we exercise our right to terminate the

Development Agreement based upon our determination that an applicable law, enacted or revised after

the Development Agreement was signed, will have a materially adverse effect on our rights, remedies or

discretion in franchising Krispy Kreme Shops.

11

Franchise Disclosure Document 2021

Franchise Agreement

The standard initial franchise fees (each, an “Initial Franchise Fee”) are $25,000 for a Hot Light

Theater Shop, $12,500 for a Fresh Shop, and $12,500 for a Box Shop. The Initial Franchise Fee, which is

in addition to the Development Fee, is payable on execution of the Franchise Agreement and is deemed

fully earned at that time. It is not refundable. Separate Franchise Agreements are required for each Shop

opened under a Development Agreement.

Required Purchases

Before you open your Shop, you must purchase certain items from us. The estimated costs of

these items are:

• Opening Inventory Package. The cost of the opening inventory of supplies, raw materials

and related products that you must purchase ranges from $40,000 to $50,000 for a Hot

Light Theater Shop, $5,000 to $8,000 for a Fresh Shop, and $5,000 to $8,000 for a Box

Shop. (See Item 7)

• Production Equipment. The cost of the production equipment ranges from $270,000 to

$400,000 for a Hot Light Theater Shop. (See Item 7) No production equipment is

necessary for a Fresh Shop or Box Shop.

All of these payments are non-refundable, unless otherwise indicated above. Although we have

waived or negotiated certain of these fees in the past, we expect that they will be uniformly imposed on

franchisees who receive this Disclosure Document.

ITEM 6

OTHER FEES

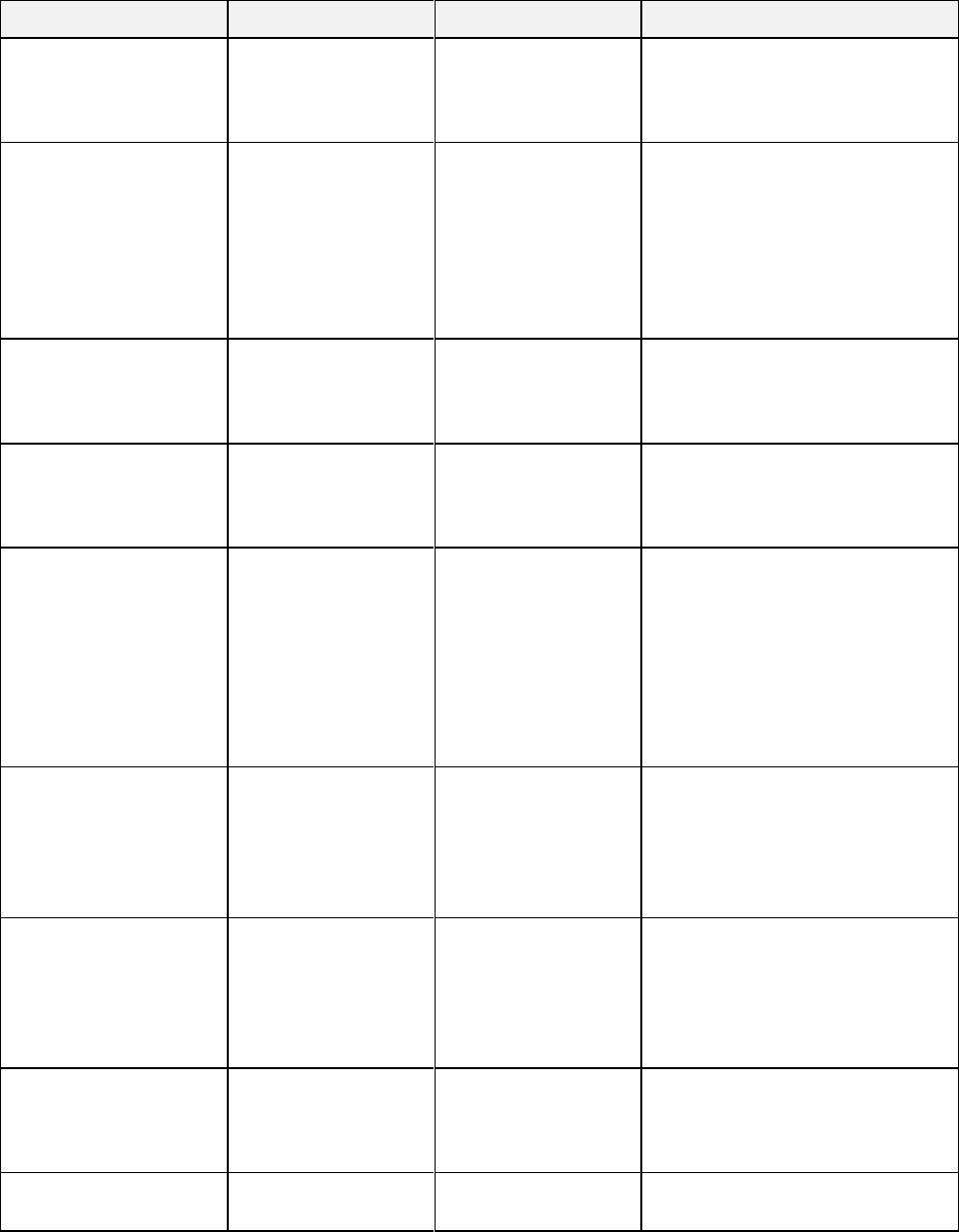

Franchise Agreement

TYPE OF FEE

(1)

AMOUNT

DUE DATE

REMARKS

Royalties

4.5% of Net Sales

(2)

of

the Shop, including

Fundraising Sales.

Payable each week on

the day of the week

we periodically

designate, currently

Friday

We will debit your bank account for

Royalties due.

(3)

Transfer

$5,000, plus any

applicable transfer fee

for any other

agreements, as well as

our costs and expenses

(including legal and

accounting fees)

incurred in relation to

the transfer.

Before consummation

of transfer

Payable on transfer of an interest in

you, any owner, or any interest in a

Franchise Agreement.

12

Franchise Disclosure Document 2021

TYPE OF FEE

(1)

AMOUNT

DUE DATE

REMARKS

Opening Team

Cost and expenses our

opening team incurs in

connection with the

opening of your Shop,

other than travel,

room and board and

salaries, for which we

are responsible.

As incurred

As specified in the Development

Agreement and the Franchise

Agreement, if you and your

affiliates are opening multiple

Shops under Development

Agreements, we will provide for 7

days (i) entire opening team for the

1

st

Shop; (ii) ½ of an opening team

for the 2

nd

Shop; (iii) a field

consultant for the 3

rd

Shop; and (iv)

at our option, a field consultant for

any subsequent Shops.

Brand Fund

Up to a maximum of

2% of Net Sales

(2)

Payable each week on

the day of the week

we periodically

designate, currently

Friday

We will debit your bank account for

Brand Fund payments due.

(3)

Advertising Placement

Fund

Up to a maximum of

1% of Net Sales

(2)

Payable each week on

the day of the week

we periodically

designate, currently

Friday

We will debit your bank account for

Advertising Placement Fund

payments due.

(3)

Additional Copies of

Advertising (Franchise

Agreement only)

Cost associated with

providing additional

copies of advertising

materials

As incurred

Local Advertising

Requirement

At least 2.5% of Net

Sales

(2)

As incurred

For each year of the Franchise

Agreement, you must spend at least

2.5% of Net Sales on approved local

advertising and promotion.

Local and/or Regional

and/or National

Advertising

Cooperatives

Up to 3% of Net

Sales

(2)

As incurred

We currently do not require

Franchisees to be members of local

and/or regional and/or national

advertising cooperatives. If we

establish a local and/or regional

and/or national advertising

cooperative, we will credit your

required contributions against your

local advertising requirement. The

amount of these contributions will

be determined by each cooperative

by majority vote. At this time, we

have not determined what the

amount of the contributions would

be if we own a majority of Shops in

the cooperative.

13

Franchise Disclosure Document 2021

TYPE OF FEE

(1)

AMOUNT

DUE DATE

REMARKS

Required Purchases

Varies

As incurred

Currently, you must purchase from

us the following items: doughnut-

making equipment, proprietary

doughnut mixes and related

ingredients, coffee beans and

associated beverage syrups, coffee

grinders, employee apparel, logoed

items and apparel, paper goods, and

other related items and supplies –

See Item 8 for additional

information. You must purchase

such items in sufficient quantity to

operate your Shop. See Items 7 and

8 for additional information. We

may debit your bank account for

amounts due.

(3)

Hosting Fee

$150 per Shop per

month

As incurred

Under the Service Provider

Agreement, you must pay this fee if

we license you to use our Platform

in accordance with the Service

Provider Agreement. See Items 8

and 11 for additional information.

Maintenance Fee

$150 per Shop per

month

As incurred

Under the Service Provider

Agreement, you must pay this fee if

we license you to use our Platform

in accordance with the Service

Provider Agreement. See Items 8

and 11 for additional information.

Additional Service Fee

$65 per hour

As incurred

Under the Service Provider

Agreement, you must pay this fee at

the time of service request if we

provide you with services not

related to the then-current version of

the Platform.

Systems Fee

Our then-current fees

(currently $0)

As incurred

We do not currently charge a fee for

the use of software beyond the

Hosting Fee, Maintenance Fee and

Additional Service Fee described

above, but we have the right to

charge additional fees for software,

hardware or computer systems and

enhancements that we license to you

or other computer support services

we provide to you.

Replacement Fee for

System Standards

Manuals

Currently $1,000

As incurred

You must obtain a replacement

copy of the System Standards

Manuals if your copy is lost,

destroyed or significantly damaged.

We reserve the right to charge a fee

for replacement copies.

14

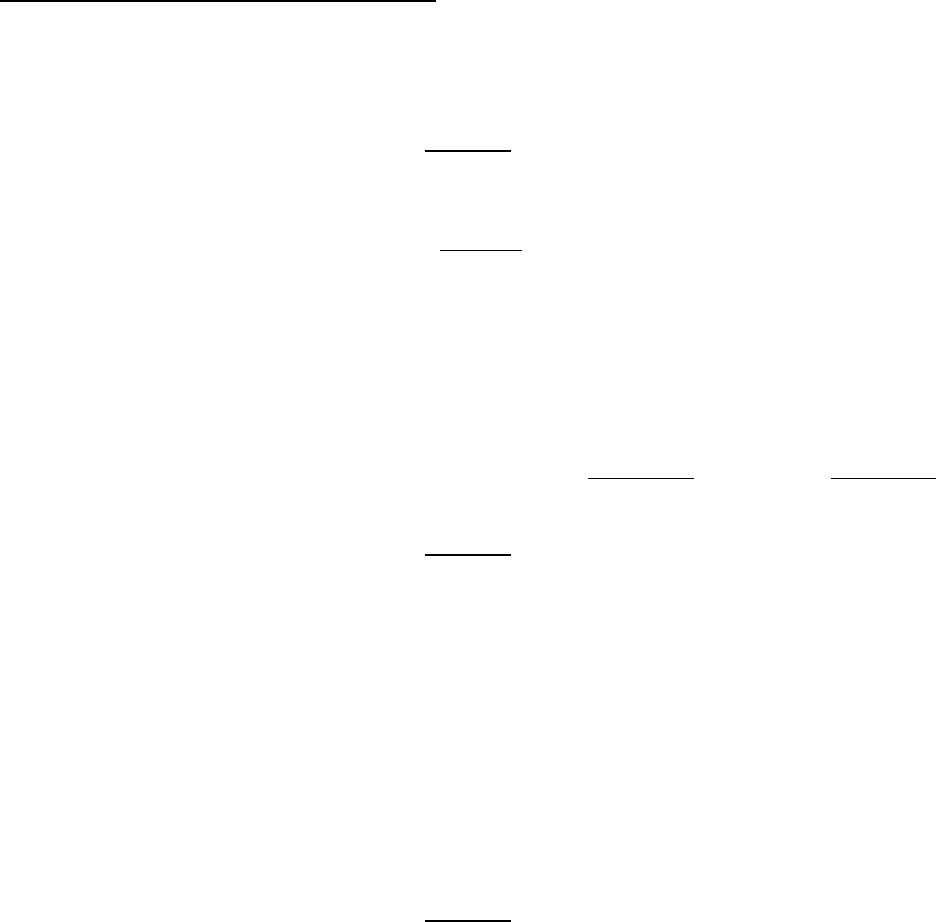

Franchise Disclosure Document 2021

TYPE OF FEE

(1)

AMOUNT

DUE DATE

REMARKS

Relocation Fee

Fee of $2,500 plus our

expenses associated

with the relocation of

a Shop.

As incurred

Payable if we grant your request to

relocate the Shop.

Audit/Inspection

Expenses

Cost of audit or

inspection, includes

legal fees,

accountants’ fees and

travel expenses, room

and board, per diem

charges and other

associated expenses.

15 days after receipt

of inspection or audit

report

Payable if you (i) fail to provide in a

timely manner any reports or

supporting records relating to the

operation of the Shop, or (ii)

understate Net Sales by more than

2%.

Costs and Attorneys’

Fees

Varies

As incurred

The prevailing party in any legal

action arising under your agreement

is entitled to reasonable attorneys’

fee and costs.

Indemnification

Varies

As incurred

You must reimburse us for any

claims against us related to the

development or operation of your

Shop.

Training of Additional

Managers

You must pay your

managers’ wages,

salaries, travel, room

and board, and living

expenses during

training.

As incurred

Before the opening of the Shop, we

will provide our standard initial

training for 1 of your general

managers. After opening, we will

provide our standard training

annually for up to 1 additional

manager for the Shop. We reserve

the right to charge fees for the

training of any additional managers.

Additional or Special

Training

Our reasonable fee

plus your managers’

wages, salaries, travel,

room and board, and

living expenses during

training.

As incurred

Your managers must attend any

additional or special training we

require, for which we have the right

to charge a reasonable fee.

Interest on late payment

1.5% per month or the

highest rate of interest

permitted by law,

whichever is less

As incurred

If you fail to make any payments to

us when due. If you fail to make

payments when due under the

Service Provider Agreement, the

late payment will bear interest of

1% per month.

Fees to evaluate

proposed alternative

suppliers

Our reasonable costs

and expenses

As incurred

We may impose fees to cover our

costs in evaluating alternative

suppliers you propose in accordance

with the Franchise Agreement.

Successor Fee

$10,000

Upon execution of a

successor agreement

See Item 17.

15

Franchise Disclosure Document 2021

Development Agreement

If you sign a Development Agreement, you should review both the above table of fees applicable

to Franchise Agreements, as well as the following table of fees.

TYPE OF FEE

(1)

AMOUNT

DUE DATE

REMARKS

Transfer

$5,000, plus any applicable

transfer fee for any other

agreements, as well as our

costs and expenses (including

legal and accounting fees)

incurred in relation to the

transfer.

Before

consummation of

transfer

Payable on transfer of an interest

in you, any owner, or any interest

in the Development Agreement,

plus any transfer fees required

under your franchise

agreement(s), as applicable.

Costs and Attorneys’

Fees

Varies

As incurred

Payable if incurred by us in

enforcement of any term of the

Development Agreement.

Indemnification

Varies

As incurred

You have to reimburse us for

claims against us related to your

breach of the Development

Agreement or the development

and operation of your Shops

(1) All fees are uniformly imposed by and payable to us. All fees are non-refundable.

(2) “Net Sales” means all the Shop’s revenue from food, beverages, and other products and

merchandise of any type sold, whether or not produced at the Shop or acquired from any third party,

including Krispy Kreme products purchased from other Krispy Kreme franchises (regardless whether

owned by you) and services rendered at or away from your Shop’s site (whether or not such sales are

authorized by us) or from any use of the Marks, recorded using the accrual basis of accounting and

otherwise in accordance with accounting principles generally accepted in the United States. “Net Sales”

includes, but is not limited to: (a) On-Premises Sales and Fundraising Sales; (b) all amounts you receive

or have the right to receive from the conveyance of products and services, whether such sales are made

for cash or cash equivalents (including, but not limited to, credit, debit, and gift cards) or on credit terms,

but excludes (i) sales and similar taxes collected by you from customers and which you must by law remit

to a taxing authority, (ii) customer refunds, (iii) credits for product returns, (iv) the value of redeemed

customer coupons and customer discounts, and (v) sales or delivery of products to other Krispy Kreme

Shops (whether or not owned by you); and (c) will not be reduced by any charge or other provision for

uncollectible accounts. Neither the inclusion of any type of revenue in the definition of Net Sales nor our

demand or receipt of Royalties, Brand Fund, or Advertising Placement Fund contributions on those

revenues will constitute waiver or approval of any unauthorized sales by you, and we reserve all rights

and remedies if you make unauthorized sales.

(3) Before opening, you must sign and deliver to us and your bank all required documents

that permit us to debit your bank account for each week’s Royalty, Brand Fund, and Advertising

Placement Fund contributions, any purchases that you make from us, and any other amounts due to us. If

you fail to report Net Sales, we will be authorized to debit your bank account in an amount equal to the

Royalty payment, Brand Fund contribution, Advertising Placement Fund contribution, payment for

purchases, and any other amount transferred from your account based on 200% of Net Sales for the last

week for which reports of Net Sales of the Shop were provided to us or based on information reasonably

known to us. Within 10 days after proper reports have been submitted and reviewed, we will apply any

overpayment. Any deficiency will be debited against your account.

16

Franchise Disclosure Document 2021

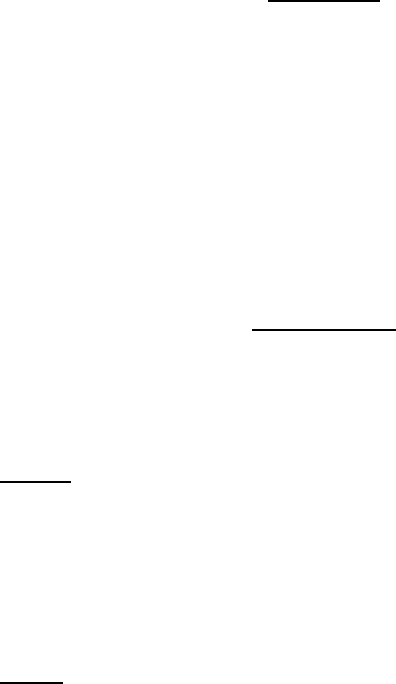

ITEM 7

ESTIMATED INITIAL INVESTMENT

ESTIMATED INITIAL INVESTMENT

FOR A HOT LIGHT THEATER SHOP*

TYPE OF

EXPENDITURE

AMOUNT

METHOD OF

PAYMENT

WHEN DUE

TO WHOM

PAYMENT IS TO

BE MADE

Development Fee

$25,000

Lump Sum

On signing

Development

Agreement

Us

Initial Franchise Fee

$25,000

Lump Sum

On signing

Franchise

Agreement

Us

Real Estate and

Improvements –

3 Months

(1)

$20,000 to $75,000

As Agreed

As Incurred

Third Parties

Construction Costs

(2)

$800,000 to $2,200,000

As Agreed

As Incurred

Outside Suppliers

Equipment/Signage/

Furniture/Fixtures

(3)

$230,000 to $370,000

As Agreed

As Incurred

Us, Our Affiliates,

Outside Suppliers

Truck

(3)

$25,000 to $50,000

per truck

As Agreed

As Incurred

Outside Suppliers

Initial Inventory

(4)

$40,000 to $50,000

Lump Sum

As Incurred

Us, Our Affiliates,

Outside Suppliers

Production Equipment

(5)

$270,000 to $400,000

Lump Sum

As Incurred

Us, Our Affiliates

Grand Opening

Marketing Program

(6)

$25,000 to $45,000

As Agreed

As Incurred

Advertising

Sources

Training Expenses

$45,000 to $50,000

Lump Sum

As Incurred

Outside Vendors,

Your Employees

Security Deposits and

Other Pre-Paids

$7,500 to $20,000

Lump Sum

As Incurred

Outside Suppliers

Additional Funds –

3 Months

(7)

$75,000 to $100,000

As Agreed

As Incurred

Outside Suppliers

TOTAL

ESTIMATED

INITIAL

INVESTMENT

(8)

$1,587,500 to $3,410,000

* Unless otherwise stated, all fees are uniformly imposed by and payable to us and are non-

refundable.

(1) Real Estate and Improvements. Your land acquisition costs will vary depending on a

multitude of factors including whether the property is purchased or leased, the size and location of the

property, and the availability of financing on commercially reasonable terms. For a Hot Light Theater

Shop, the approximate size of the site is 27,000 to 50,000 square feet and the building itself will be

17

Franchise Disclosure Document 2021

between 2,700 and 3,500 square feet. Hot Light Theater Shops may be located only in freestanding

buildings on leased or owned property. The Hot Light Theater Shop location must be one accessible to

vehicular traffic and have a drive-thru window. In addition, site improvement costs may vary based on

numerous factors, including but not limited to, soil and environmental conditions, availability of utilities

to the site, the topography of the site, the size of the parcel, and local zoning and other building

requirements. If you elect to purchase the site, it is anticipated the range of cost of the property plus the

site improvements may be $500,000 to $1,500,000 depending on location. Acquisition costs may be

beyond this range in certain cases or localities. Rent will vary widely from location to location, but

should range from $80,000 to $300,000 per year plus other occupancy related costs including common

area maintenance, property taxes, and insurance. The amounts in the chart are estimates of rent for a 3-

month period.

(2) Construction Costs. This item assumes building a new structure. We will provide you

with the general, model plans, specifications, and standards that you will need to adapt for the

construction of a Hot Light Theater Shop. The building must be a stand-alone building of construction

that meets all applicable building requirements with a drive-thru corridor and an indoor dining facility.

Construction costs may be beyond this range in certain cases or localities.

(3) Equipment/Signage/Furniture/Fixtures. This line item is for the standard furniture,

fixtures and equipment including interior and exterior signs, point of sale computer systems, headsets and

furniture (including retail equipment such as drink dispensers, cup dispensers, product display cases, etc.).

You must purchase or lease certain of these items from us, our affiliates or designated suppliers. (See

Item 8) If your Hot Light Theater Shop produces Products for Fresh Shops and Box Shops, you will need

additional equipment such as racks, rack covers, and pans, among other items. The amount you will

spend depends on the number of Fresh Shops and Box Shops to which you deliver. You will also need to

purchase or lease a truck. The cost to purchase a truck generally ranges between $25,000 and $50,000.

Typically, a truck can be leased with payments ranging from $1,300 to $1,600 per month depending on

the type of truck and lease. Truck lease payments are not included in the chart.

(4) Initial Inventory. The inventory start-up package includes doughnut mix which must be

purchased from us or a designated supplier. You must purchase certain items in the initial inventory of

supplies and raw materials from us, our affiliates, or designated suppliers. You may purchase other items

from approved suppliers. (See Items 5 and 8)

(5) Production Equipment. We manufacture certain production equipment used in Hot

Light Theater Shops. You must purchase the production equipment from us. The price includes freight,