2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 22

*December 2013

22-1

VOLUME 4, CHAPTER 22: “COST FINDING”

SUMMARY OF MAJOR CHANGES

All changes are denoted by blue font.

Substantive revisions are denoted by a * preceding the section, paragraph, table,

or figure that includes the revision.

Unless otherwise noted, chapters referenced are contained in this volume.

Hyperlinks are denoted by bold, italic, blue and underlined font.

The previous version dated May 2010 is archived.

PARAGRAPH

EXPLANATION OF CHANGE/REVISION

PURPOSE

Throughout

Updated hyperlinks for USC citations, SFIS citations, and

Treasury Department citations

, and removed redundant

hyperlinks.

Update

Throughout

Clarified wording.

Update

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 22

*December 2013

22-2

Table of Contents

VOLUME 4, CHAPTER 22: “COST FINDING” ......................................................................... 1

2201 GENERAL ..................................................................................................................... 4

*220101. Purpose ................................................................................................................. 4

*220102. Overview .............................................................................................................. 4

2202 POLICY ......................................................................................................................... 4

*220201. Documentation ..................................................................................................... 4

*220202. Identification of Cost Objects .............................................................................. 5

*220203. Identification of Organizations Involved ............................................................. 6

*220204. Identification of Cost Elements ............................................................................ 7

*Figure 22-1 IDENTIFICATION AND CLASSIFICATION OF PARTICIPATING

ORGANIZATIONS..................................................................................................................... 7

*Figure 22-2 EXPENSE TYPE EXAMPLES ............................................................................ 8

*220205. Application of Prescribed Rates ........................................................................... 8

*220206. Identification of Source Documents ..................................................................... 9

220207. Selection of the Appropriate Cost-Finding Technique ...................................... 10

2203 COST-FINDING TECHNIQUES ................................................................................ 10

220301. Observation ........................................................................................................ 10

Figure 22-3 OBSERVATION TECHNIQUE .......................................................................... 10

220302.

Statistical Sampling ............................................................................................ 11

220303. Independent Appraisal........................................................................................ 11

220304. Commercial Cost ................................................................................................ 11

220305. DELPHI Technique ............................................................................................ 12

220306. Memorandum Records ....................................................................................... 12

*220307. Analysis of Responsibility Center/Cost Center .................................................. 12

*220308. Combination of Cost-Finding Techniques ......................................................... 12

*220309. Determination of Time and Cost ........................................................................ 13

*ADDENDUM: CASE STUDY - Determination of the Costs Associated With Paying A

Contractor Invoice ..................................................................................................................... 14

Figure 22-4 STATEMENT OF PURPOSE .............................................................................. 16

Figure 22-5 COST OBJECTS ................................................................................................... 17

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 22

*December 2013

22-3

Table of Contents (Contintued)

Figure 22-6 NOTIONAL INSTALLATION ORGANIZATION CHART .......................... 18

* Figure 22-7 PROCESS FLOW FOR ISSUING PAYMENTS TO CONTRACTORS ...... 19

* Figure 22-8 ORGANIZATION HIERARCHY ASSOCIATED WITH FINAL AND

INTERIM COST OBJECT .................................................................................................... 20

*Figure 22-9 COST ELEMENTS ......................................................................................... 21

*Figure 22-10 PERSONNEL ASSIGNED TO DIRECT ACTIVITIES .............................. 22

*Figure 22-11 EQUIPMENT AND REAL PROPERTY USED BY DIRECT ACTIVITIES

................................................................................................................................................ 23

Figure 22-12 SUMMARY OF TIME SPENT ...................................................................... 25

*Figure 22-13 COMPUTATION OF COSTS ...................................................................... 25

*Figure 22-14 SOURCE DOCUMENTS ............................................................................. 26

*Figure 22-15 TIME REQUIREMENTS ............................................................................. 26

*Figure 22-16 SUMMARY OF COSTS ............................................................................... 29

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 22

*December 2013

22-4

CHAPTER 22

COST FINDING

2201 GENERAL

220101. Purpose

The DoD components are developing and fielding integrated Enterprise Resource Planning

(ERP) systems which will provide more accurate, traceable, consistent, and visible methodologies

to track and report costs. Situations which require the manual development of cost estimates will

continue to exist. This chapter provides general cost estimation principles for those situations.

This guidance will be followed by DoD Components when using cost finding techniques to

determine the costs related to performing a service, to be charged for goods or services, or to obtain

costs for decision-making or other purposes. Organizations employing formal cost accounting

capabilities may use cost finding techniques to identify unfunded costs. However, any

organization may from time to time have a need to use these techniques.

220102. Overview

A. Chapter 19 prescribes the basic policy for measuring and allocating costs.

This chapter applies that basic policy to cost finding, establishes cost finding documentation

policy, and describes generally recognized cost finding techniques and their application.

B. Cost finding is an approach used when the cost accounting system does not

provide the actual costs incurred to provide a service, produce a product, or to obtain cost

information for decision making and informational purposes. It is available for activities that do

not have automated cost accounting capability as part of their accounting system, but who

periodically provide reimbursable services or products to other DoD Components, Federal

Agencies, or to the public. Cost finding may also be necessary when the cost of an item has not

been recorded in the accounting system and the item is being transferred, sold, or recorded in the

accounting system for the first time or when measuring productivity.

C. The proper application of cost finding requires knowledge of cost

accounting and of the organizational functions associated with the final and intermediate cost

objects. The cost finding structure must be consistent with Standard Financial Information

Structure (SFIS) and SFIS Business Rules

2202 POLICY

220201. Documentation

A. Cost finding techniques must be documented when used. The

documentation must contain the following:

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 22

*December 2013

22-5

1. The cost objects (both intermediate and final) to which cost finding

techniques are to be applied.

2. The organizations involved in performing the cost objects and the

tasks performed by each.

3. The applicable cost elements.

4. A plan that includes the specific cost finding techniques to be used

and the criteria followed in selecting the specific cost finding technique.

5. A description of how those techniques will accomplish the cost

object.

B. The statement and the work papers shall be retained for the same length of

time as other documentation used to support billings to the public.

C. A case study is presented as an addendum to illustrate the application of this

chapter. Discussions in the chapter are at the micro level. When different approaches may be

usable to document the costs associated with a different cost object (e.g. at the macro level),

information will be presented on the alternative approaches.

*220202. Identification of Cost Objects

A. Cost objects are functions or work units for which management decides to

identify, measure, and accumulate costs. Cost objects shall be discrete and described to a sufficient

level of detail as needed to identify the specific function or product for which a cost is to be

established. See the Defense Chief Management Office’s (DCMO) SFIS matrix for a discussion of

SFIS components relating to organizational units and funding centers.

B. When the cost object is identified as being at a macro (an organizational

level, for example) level, the amount of effort required to determine the relevant costs and the

associated quantitative data should be less refined than if the cost object is identified as being at the

micro (a specific function or operation) level. At the macro level, it is possible that the accounting

system, through the use of coding structures and the general ledger operating program expense

accounts shown in the Account Transactions section of the U.S. Treasury Financial Management

Service (FMS) USSGL web site or detailed DoD-specific transactions available at the SFIS web

site, can provide much of the financial data to establish relevant cost information. At the micro

level, it probably will be necessary to use one of the methods described in section 2203 to

determine the time required to perform the cost object and develop the cost information.

C. The classification of organizations as either direct (directly involved in

performing the cost object) or indirect (performing as a support organization), is dependent on

identifying cost objects. At the macro level, staff organizations (not directly involved in

production) will be classified as indirect, and line (directly producing outputs) organizations will

be classified as direct. At the micro level, it is possible that a staff organization, could be classified

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 22

*December 2013

22-6

as a direct organization. The distinction between the macro and micro levels will be an important

consideration in complying with Office of Management and Budget (OMB) productivity

requirements discussed in section 2204 of this chapter. The cost accountant must be able to

translate the measurement requirements into source documents, allocation techniques, and other

such analysis techniques as necessary to meet the management requirement. Establishing a cost

object is a management decision and is essential to the proper application of cost finding

techniques to a cost object.

D. Identifying and describing cost objects are very important. Within the

Department of Defense, cost finding techniques may be used to compare costs of different

organizational units or operations performing the same cost object, prepare budget justification

material, to measure productivity, or to measure the cost of performing a particular operation. For

example, the costs to issue an electronic funds transfer payment at a disbursing office might be

compared with the same costs at other disbursing offices. Cost finding techniques are a tool in

identifying more efficient methods of performing a task. Cost objects may also be used to compare

organizational efficiency. For example, the costs for an intermediate object, such as processing a

personnel action at a personnel office, might be compared with the cost at other personnel offices.

220203. Identification of Organizations Involved

A. Once the cost objects have been identified, the organizational units

contributing resources to the cost object must be identified. Generally, the units will be within the

organization itself (the installation or unit level; and possibly further within these levels).

B. The initial task is to classify the installation-level organizational units as

direct or indirect. A unit responsible for actually performing the work is direct. A unit that

provides support or performs an administrative function is indirect.

1. Organizations or units may be either direct or indirect depending on

the cost objects identified.

2. An organization classified as indirect will not always be recognized

in the computation of costs for a final cost object. At the macro level, staff organizations generally

will be recognized as an indirect organization and the related costs allocated among direct

organizations. At the micro level, materiality and usefulness will be determining factors.

C. Organizational units can be classified through use of an iterative process or

through the use of organizational charts or tables. The iterative process is a series of questions

designed to establish the relationship each organization has with the product or service for which

cost finding techniques are being developed (Figure 22-1 is a suggested list of such questions).

First, the organizational units directly involved in the process are identified. Then the

organizations providing indirect functions to the direct organizations are identified through an

iterative process consisting of a series of questions designed to establish the relationship of

supporting activities to direct line organizations. The procedure is repeated until all organizational

units are classified as direct or indirect for all identified cost objects.

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 22

*December 2013

22-7

D. In order to determine which organizations are involved, it is necessary to

identify the flow of actions related to the cost object and the related intermediate cost objects.

E. It is important to understand that the organizational activities involved in a

particular cost object or interim cost object can cross organizational lines of responsibility.

220204. Identification of Cost Elements

A. An important aspect of any cost finding technique is identifying the direct

and indirect cost elements applicable to the product or service. Both the direct and indirect

activities may have the same cost elements. The difference is in the allocation of all applicable

indirect costs (factory burden). Chapters 19 and 20 provide guidance to determine factory burden.

*Figure 22-1 IDENTIFICATION AND CLASSIFICATION OF PARTICIPATING

ORGANIZATIONS

SUGGESTED LIST OF QUESTIONS USED TO IDENTIFY AND

CLASSIFY PARTICIPATING ORGANIZATIONS

What organizations are involved in the final and intermediate cost objects?

Which organization has primary responsibility for the final cost object?

Which organizations perform intermediate cost objects?

Which organization acts in a support role to the organization(s) performing the final or

intermediate cost objects.?

What are the specific tasks performed by each of the identified organizations?

In what order do the organizations involved perform their delegated responsibilities?

B. All cost elements must be identified. The first step is to identify all possible

cost elements and determine which are significant. Personnel Compensation, Purchased Services,

Supplies and Materials are typical major categories within the SFIS Cost Element Code. Current

General Ledger accounts are described at the USSGL web site, while the SFIS provides detailed

information on transactions and on required cost information. Figure 22-2 gives an example of

application of possible expense types (which may be consolidated into one or more USSGL

accounts) to direct and indirect activities. After the potential applications are identified, a decision

must be made as to which cost elements are sufficiently significant as to warrant separate

consideration.

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 22

*December 2013

22-8

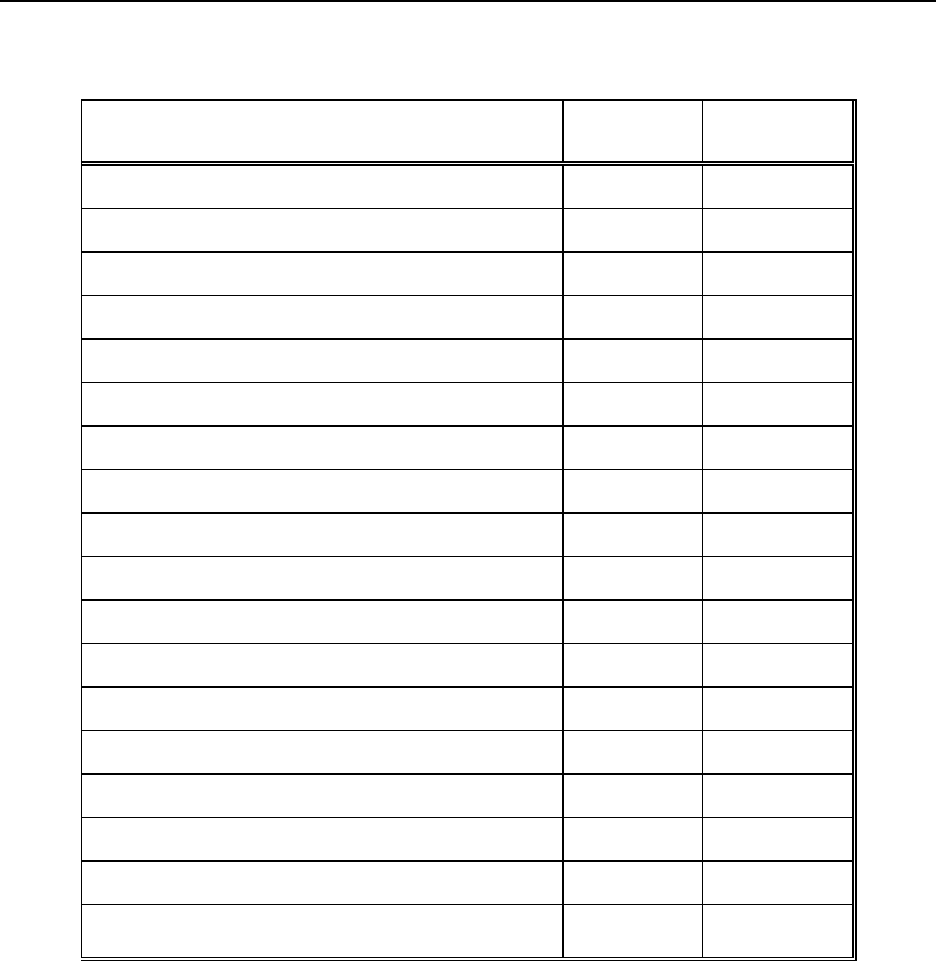

Figure 22-2 EXPENSE TYPE EXAMPLES

EXAMPLE EXPENSE TYPES

DIRECT

ACTIVITY

INDIRECT

ACTIVITY

Personnel Compensation-Civilian X X

Personnel Compensation-Military X X

Personnel Benefits-Civilian X X

Personnel Benefits-Military X X

Benefits for Former Personnel X

Travel and Transportation of Persons X X

Transportation of Things X X

Rent, Communications and Utilities X X

Printing and Reproduction X X

Other Services X X

Supplies and Materials X X

Equipment (not capitalized) X X

Insurance Claims and Indemnities X

Depreciation of Equipment X X

Depreciation of Real Property X X

Amortization of Leasehold Improvements X X

Bad Debts X

Annual Leave

X

X

C. After developing the cost data, the individual or group responsible for

applying cost finding to the cost object can make a decision as to the significance of each cost

element in the final determination. Remember that the information is, at this point, only raw data.

Decisions must be made as to the relevance and materiality of each cost element to the cost object.

Materiality is determined by analyzing whether excluding the data could distort the computed

value for the final cost object.

220205. Application of Prescribed Rates

A. The purpose of using cost-finding techniques is to determine that all

applicable cost elements are included in the final cost. When the purpose is the preparation of an

internal report or an external report for another Federal Agency or non-federal organization, the

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 22

*December 2013

22-9

guidance contained in Volume 11 shall be followed to assure that all applicable costs are

considered. When the purpose is to establish the cost of an activity associated with the Security

Assistance Program, the guidance contained in Volume 15, shall be followed.

B. The following rules shall be applied when determining the individual costs

of intermediate and final cost objects:

1. Civilian direct labor costs are computed using step 5 of the

applicable pay grade for GS- and GM-series personnel. For Wage Board employees, use step 4 of

the applicable pay grade. Amounts included as direct labor costs shall recognize only productive

time; that is, the time actually used to perform the function. All other time is indirect labor time,

and is included in overhead (factory burden). Actual costs may be used, if known, provided

appropriate documentation is available to support their substitution.

2. Civilian personnel benefits costs are computed using the rates

contained in Volume 11.

3. Costs for Military personnel are accomplished using the rates for

each applicable military grade using standard military composite rates in accordance with guidance

in Volume 11.

4. Both military and civilian labor shall be included. Labor that is

actually chargeable to jobs shall be recorded as direct labor. Indirect labor (labor that cannot be

charged to a specific job) shall be used in computing overhead. Chapters 19 through 21 provide

guidance in computing overhead.

5. Direct material cost is determined using standard prices unless the

actual cost is known from vendor invoices. Standard prices can be obtained from vendor catalogs,

supply system stock databases, recent contract purchases of similar items, or any other available

data source.

6. Other costs that can be directly related to the cost object are

determined using source documents such as vendor invoices, travel vouchers, and so forth.

7. Indirect costs are based on algorithms that are used to prorate the

overhead costs to the cost object based on factors such as the ratio of direct labor costs for the cost

object to total labor costs for the installation.

220206. Identification of Source Documents

A. Before the values for each cost can be determined, the source documents for

the required data must be identified and copies obtained, together with the documents’ locations.

In addition, it is necessary to determine the quantities of documents involved, especially if the cost

object is to determine average unit costs for a certain action.

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 22

*December 2013

22-10

B. When the final cost object is to determine the cost of performing one single

event, the specific documents involved must be identified. When the cost object is much broader

(for example, determining the average cost of issuing electronic payments without regard to whom

they are issued), identification of the specific documents involved may not be as significant as the

operating costs (including the materials and supplies used) of the organizational units directly

involved in the process.

220207. Selection of the Appropriate Cost-Finding Technique

The development of a final cost for the cost object can be made using one of several

different techniques or a combination thereof. The decision on the method used will often depend

on the purposes for which the cost object has been established. Those cost objects established to

determine costs to meet a statutory or a recurring use need could require the use of cost finding

techniques with a higher degree of precision than those cost objects established to meet an internal

management need. Section 2203 describes various techniques that may be useful in cost finding.

2203 COST-FINDING TECHNIQUES

220301. Observation

A. The observation technique is normally used when the specific effort for

which a cost is to be established or a similar effort is currently in process. The first step is to

complete the requirements statement required by paragraph 220201. The observer then physically

follows the product or service through the various performing organizations, documenting the

following:

Figure 22-3 OBSERVATION TECHNIQUE

1.

Events incident to performance.

2.

The grade levels of personnel directly working on the effort.

3.

The length of time spent on the activity.

4.

Direct material used.

5.

Indirect material used.

6.

Types of support received from other organizations.

7.

Any other factors that have an impact on the cost of producing the

product or performing the service

B. A traditional flow chart of the entire process may be helpful in organizing,

visualizing, and understanding the process under review. The process flow shown in the Figure

22-7 (p. 22-19) illustrates the data gathered through the use of this technique.

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 22

*December 2013

22-11

C. The observer then lists and computes the cost of each of the identified cost

elements. These elements are frequently found in consolidated general ledger expense accounts

such ”Operating Expenses/Program Costs” and “Benefit Expense.”. The SFIS provides detailed

information on transactions and on required cost information.

D. Any other assumptions must be carefully and accurately documented so that

users of the resulting information will have a better understanding of the process used.

220302. Statistical Sampling

A. This technique is normally used when there is a large volume of similar type

work being performed on a continuous task basis. An example of the use of this technique is

packing, crating, and handling costs incurred at a depot. A random sample of items is selected and

a special job order tag is attached to each item selected when it is initially placed into the

performance cycle. All personnel who come into physical contact with the items are required to

record their organization, pay grade, length of time involved, and type and quantity of material or

supplies used. Completed tags are returned to the personnel conducting the study who ensure that

all tags have been returned and properly completed.

B. All of the cost elements identified to the cost object are assigned a cost.

C. Resulting cost estimates shall be annotated to disclose the confidence level

of the resulting estimate within a specific range.

220303. Independent Appraisal

The independent appraisal technique is normally used when the cost determination is made

after the cost object has been completed, and there is no similar product being produced.

Normally, the effort would be accomplished by an engineer or an individual who is an expert in the

production process. Under this procedure, a list of all resources involved in fabricating the product

or performing the service is made. Each resource is then analyzed to establish a reasonable input

cost. The total cost of the applied resources represents a reasonable estimate of costs incurred in

the cost object.

220304. Commercial Cost

This technique is normally used with incidental activities carried out during a DoD mission

requirement. In these circumstances, the application of normal full cost to the production of a

product or provision of service would not be representative of the incurred cost. An example

would be a Navy carrier transporting a disabled foreign aircraft to a repair facility incident to the

performance of its normal mission. In this case, a determination of the commercial charge to

transport the disabled aircraft might be more representative of the cost incurred by the Navy vessel.

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 22

*December 2013

22-12

220305. DELPHI Technique

This technique is useful in those instances when the more traditional cost estimation

techniques cannot be applied to a cost object. Accordingly, it is probably the least precise

estimating technique, but one that is still useful if another technique is not available or applicable.

A. This technique uses a series of estimates made by a group of experts that is

refined as subsequent estimates are made. For example, five construction experts might be given

the task of estimating the costs associated with a new construction technique. These experts would

be given the initial parameters of the project such as location; required specifications;

geographical, environmental, time, and political constraints; and, any other known relevant data at

the time of project initiation. Each group member would then develop an initial estimate of

component costs and reconvene to discuss their individual analyses. After discussion, each expert

would be asked to refine their estimate based on what was learned at the meeting. The evaluation

process would be repeated by each participant to arrive at a revised estimate. The process would

be repeated as often as necessary, until the group achieved consensus that the estimate at hand was

the best available, given the uncertainty of the nature of the project and dissimilarity with other

efforts in their experience.

B. This technique is probably more useful in determining what some new

product or service should cost rather than determining the actual cost of an existing product or

service. However, some of the principles involved may be helpful.

220306. Memorandum Records

This technique is an informal method for gathering cost data and should only be used in

those cases when the value of the cost data is of little significance. It is the preparation of

memoranda documenting estimates of costs for a specific product or service. It should not be used

when significant decisions are to be based on the cost estimates derived or when other more

accurate methods are available. It is useful as a cost accumulating tool for those low priority, low

value projects or products when it is known that some cost data may be required in the future.

However, in this case, a traditional cost accounting system is too costly or too cumbersome relative

to the underlying effort.

220307. Analysis of Responsibility Center/Cost Center

This technique can be used where documented, well-supported organizational costs are

available through some responsibility center or cost center organizational structure. Costs

associated with the center can be allocated to a product or service of the center as a way to estimate

at least part of the cost of that product or service.

220308. Combination of Cost-Finding Techniques

Multiple cost finding techniques may be used if it results in a more cost-effective or more

accurate estimate. The techniques can also be used to augment data that is generated by a

conventional cost accounting system. Use the cost accumulation system or method that gives the

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 22

*December 2013

22-13

highest quality cost data at the lowest cost. Other techniques may be used if they are logical,

accurate, and documented.

220309. Determination of Time and Cost

A. After determining the required time to perform each element of the final and

intermediate cost objects, the costs associated with each element must be determined. Since real

and capitalized personal property is involved, the cost of these assets must also be included. Figure

22-2 (p. 22-8) in paragraph 220204 illustrates the form that can be used to determine the total costs

associated with a final cost object.

B. Personnel costs are obtained from the following sources:

1. Civilian Personnel. Pay scales issued by the Office of Personnel

Management.

2. Military Personnel. Standard military composite pay rates issued by

OUSD (C). These standard rates include fringe benefits.

3. Civilian Personnel Fringe Benefits. These are determined using the

add-on factors in Volume 11.

C. Depreciation and Amortization of Capitalized Personal Property. Refer to

Chapters 1 and 6, and Volume 11B for the Defense Working Capital Fund.

D. Depreciation and Amortization of Real Property. Refer to Chapters 1 and

6, and Volume 2B, Chapter 9 for the DWCF.

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 22

*December 2013

22-14

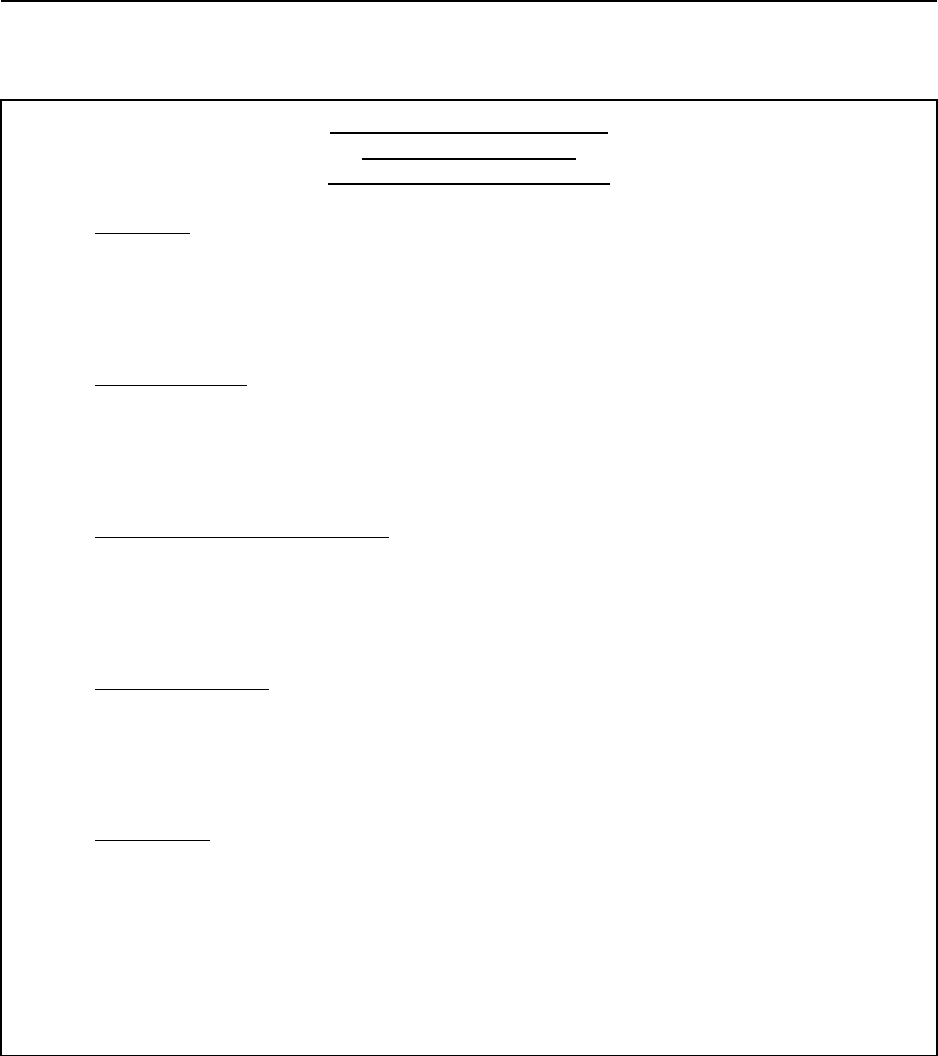

*ADDENDUM: CASE STUDY - Determination of the Costs Associated With Paying a

Contractor Invoice

This case study demonstrates the application of the various requirements contained in this

chapter to determining the costs associated with paying a contractor invoice. The situation selected

was chosen as being typical of the types of operations occurring within the Department of Defense

for which comparisons between organizations can be made.

Paragraph 220201 of this chapter requires a clear statement of the cost objects to which

cost finding techniques are to be applied and those techniques to be applied, among other things.

Such a statement is presented in Figure 22-4 (p. 22-16.)

The intermediate cost objects related to the final cost object are listed in Figure 22-5

(p. 22-17.) The list is at the summary level and serves as a basis for identifying the processes

which must be examined in detail. The compilation is based on the guidance contained in

paragraph 220202.

The organizational elements and their relationship to the intermediate and final cost objects

are identified in Figure 22-6 (p.22-18.) As described in paragraph 220203, it is developed using

the organization chart and descriptions of organization functions. It also categorizes the

installation's organizational units as direct (those that are involved in the final cost object) and

indirect. Those classified as indirect provide varying degrees of support to the organizational units

that are identified as direct. Direct activities may or may not be a part of the same organization.

The process flow associated with paying a contractor invoice, as described in paragraph

220203 is illustrated in Figure 22-7 (p. 22-19.) A comparison of this process flow chart with the

organization chart in Figure 22-6 (22-18) will identify organizations that may not be shown on the

organization chart. For example, the contract administration activity is not shown on the

organization chart and could be a part of supply operations. Similarly, the mail room might be part

of base operations. These situations arise when the organization chart is at a higher level than the

operation being costed.

The organizational activities realigned as direct and indirect for the purposes of this cost

finding study are shown in Figure 22-8 (22-20.) This chart is provided as a basis for clearly

identifying which activities are to be classified as direct activities, as described in paragraph

220203.

Examples of the cost elements to be considered in determining the relevant costs associated

with this task are identified in Figure 22-9 (p. 22-21.) They are based on Figure 22-2 in paragraph

220204.

The personnel assigned to the direct activities associated with paying a contractor's invoice

are listed in Figure 22-10 (p. 22-22.) This information is necessary to support the determination of

personnel costs as described in paragraph 220204.

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 22

*December 2013

22-15

Statistical information as to the equipment, real property, and supplies and materials used

in performing the final and intermediate cost objects is provided in Figure 22-11 (p. 22-23.) In

addition, the equipment is subdivided between capitalized and expensed equipment.

The personnel rates associated with the personnel assigned to the direct organization

activities are summarized Figure 22-12 (p. 22-25.) The costs associated with the final and

intermediate cost objects using the guidance in paragraph 220205 concerning application of

prescribed rates are computed and shown in Figure 22-13 (p. 22-25.)

The source documents associated with the intermediate and final cost objects are listed in

Figure 22-14 (p. 22-26.) Copies of each of these documents would be obtained and included as

supporting documentation in the working papers associated with the cost finding task, as required

in paragraph 220206.

A compilation of the time required to perform each of the various actions associated with

processing a contractor invoice for payment is shown in Figure 22-15 (pp. 22-26 through 22-28.)

The civilian or military grade for each person involved in the process, as well as the equipment

used and the time of use also is identified. The requirements contained in paragraph 220207 are

also addressed in Figure 22-15.

The costs associated with paying a contractor invoice are summarized in Figure 22-16

(p. 22-29.)

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 22

*December 2013

22-16

Figure 22-4 STATEMENT OF PURPOSE

STATEMENT OF PURPOSE

Determination of Costs

To Pay A Contractor's Invoice

A. PURPOSE

This effort will determine the cost incurred by one DoD organization to pay a contractor's

invoice. The information is required to identify the various types of activities involved and the related

costs for comparison with similar costs incurred by other DoD organizations.

B. COST OBJECTS

The intermediate and final cost objects associated with this effort include those required to

administratively process contract documents, receiving reports and invoices and issue a check or

electronic payment.

C. ORGANIZATIONS INVOLVED

Those organizational activities directly involved in processing the contract, processing

invoices, mailing documents, and issuing checks or electronic payments will be classified as direct

activities. All other activities are considered as indirect activities.

D. COST ELEMENTS

The cost elements in Volume 11 applicable to other Federal Agencies will be accumulated.

The following cost elements to be identified for the purposes of this task include personnel (civilian

and military), personnel benefits, communications, and supplies and materials.

E. APPROACH

Cost finding is used to establish the cost to pay a contractor invoice. Observation and

questions are used to establish the sequence of observations. Time measurement is used to establish

the time required to perform each action in the process. These techniques are considered the best

approach because preliminary indications are that each action requires only a few minutes of any

employees' time. In addition, the use of specific material, equipment and documents can be readily

identified and measured. Personnel costs are be based on hourly rates obtained from pay scales for

civilian personnel, and standard military composite rates for military personnel.

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 22

*December 2013

22-17

Figure 22-5 COST OBJECTS

FINAL AND INTERMEDIATE COST OBJECTS

TO PAY A CONTRACTOR INVOICE

FINAL COST OBJECT: Pay a contractor invoice

INTERMEDIATE COST OBJECTS: Establish voucher file

Maintain voucher file

Receive receiving reports

Receive invoices

Compare invoice to receiving reports and

contracts

Verify whether proposed payment requires

additional funding

Verify that right of offset exists against amounts

due the Government by the contractor

Prepare payment voucher

Schedule voucher for payment

Print check (issue e-payment)

Mail check (NA for e-payment)

Record payment

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 22

*December 2013

22-18

Figure 22-6 NOTIONAL INSTALLATION ORGANIZATION CHART

(Support services may be located at other sites but are shown here for simplicity)

Operations

Transportation

EEO

Personnel

Civilian

Military

Employee

Relations

Staffing

Communications

Security

Telecom-

munications

Postal

Installation

Commander

Medical

Tactical

Training

Administrative

Counsel

Accounting

Commercial

Accounts

Payroll

General

Accounting

Disbursing

Support

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 22

*December 2013

22-19

* Figure 22-7 PROCESS FLOW FOR ISSUING PAYMENTS TO CONTRACTORS

(Functional titles may vary)

Vendor

Pay

Contract

Administration

Mail

Room

Receiving

Station

Disbursing

Send copy of contract to

Vendor Pay

File receiving report until

invoice received

Establish contract

file

Receive

vo

ucher

Transmit

payment

Prepare

payment

Receive invoice and send to Vendor

Pay

Match invoice to receiving report & contract.

Determine if added funds are required and if

there is a right of offset against contract.

Prepare voucher for

payment

Schedule voucher for

payment

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 22

*December 2013

22-20

* Figure 22-8 ORGANIZATION HIERARCHY ASSOCIATED WITH FINAL AND INTERIM

COST OBJECT

Receiving Station

Acct’g

Operations

Commander

Indirect Activity

Direct Activity

Counsel

Vendor Pay

Disbursing Office

Contract Admin

Mail Room

Supply

Payroll

Acct’g

=

=

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 22

*December 2013

22-21

Figure 22-9 COST ELEMENTS

COST ELEMENTS

The cost elements potentially associated with the cost of issuing a payment to a

contractor are summarized as follows:

(1) Personnel costs, both military and civilian.

(2) Personnel benefits, both military and civilian.

(3) Communications (telephone).

(4) Supplies and materials.

(5) Postage.

(6) Utilities.

(7) Equipment (depreciation).

(8) Buildings (depreciation).

(9) Leasehold improvements (amortization).

(10) Computer software (amortization).

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 22

*December 2013

22-22

Figure 22-10 PERSONNEL ASSIGNED TO DIRECT ACTIVITIES

NUMBER OF PERSONNEL ASSIGNED TO DIRECT ACTIVITIES

ASSOCIATED WITH FINAL COST OBJECT

(Notional, may not reflect current organizations)

VENDOR

PAY

RECEIVING

STATION

DISBURSING

OFFICE

CONTRACT

ADMIN.

MAIL

ROOM

Captain (O-3) 1 1

1st Lieutenant (O-2) 2 3

2nd Lieutenant (O-1) 1 1 2 1

Sergeant (E-5) 2 2 1

Private (E-3) 3 4 1

Civilian (GS-8) 2 2 2

Civilian (GS-6) 2 1 4 2 1

Civilian (GS-5) 5 2 4 4 2

Civilian (GS-3) 2 2 5

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 22

*December 2013

22-23

Figure 22-11 EQUIPMENT AND REAL PROPERTY USED BY DIRECT ACTIVITIES

EQUIPMENT AND REAL PROPERTY USED BY DIRECT ACTIVITIES

ASSOCIATED WITH FINAL COST OBJECT

(Notional, may not reflect current requirements)

VENDOR PAY

RECEIVING

STATION

DISBURSING

OFFICE

CONTRACT

ADMIN.

MAIL

ROOM

CAPITALIZED EQUIPMENT:

Imaging

Machines

1

1

Data Storage and

Retrieval Devices

5

1

8

EXPENSED EQUIPMENT:

Personal

Computers

6 3 7

Calculators

12

10

16

8

Laser Printers

2

Desks 16 6 20 11 2

Chairs 25 7 24 15 11

REAL PROPERTY:

Office Space

(Sq. Ft.)

1,778

480

2,540

1,390

498

Warehouse Space

(Sq. Ft.)

1,638

ADDITIONAL INFORMATION: Imaging machines cost $252,000 each and have a life expectancy

of 10 years for depreciation purposes. Data storage devices cost $265,000 and have a life expectancy of

10 years for depreciation purposes.

Age of Imaging

Machines:

3 years old

4 years old

1

1

Age of Data

Storage Devices:

2 years old

3 years old

5 years old

4

1

1

3

3

2

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 22

*December 2013

22-24

Figure 22-11 EQUIPMENT AND REAL PROPERTY USED BY DIRECT ACTIVITIES

(Continued)

EQUIPMENT AND REAL PROPERTY USED BY DIRECT ACTIVITIES

ASSOCIATED WITH FINAL COST OBJECT

(CONTINUED)

Real Property:

1. Office space is converted warehousing constructed during 1996. Conversion was

made in 2005 at a cost of $755,000. Total amount of warehousing space converted was

35,768 sq. ft.

2. The receiving station is located in another warehouse constructed in 1999 at a cost of

$1,547,277.

3. Total warehouse space is 295,480 sq. ft. The office space occupied by the receiving

stations was constructed at that time. No improvements have been made to the space since

original construction.

Material and Supplies:

1. Standard price per 1,000 of any contract package (includes forms, instructions, and

supporting addenda) is $250.

2. Standard price per 1,000 of receiving report forms (DD 250) is $35.

3. Standard price per 1,000 of legal size envelopes is $9.50.

4. Standard price per 1,000 blank check stock is $12.80.

5. Standard price of any accounting form, including voucher schedules is $15.50.

6. Standard monthly prorated cost of office supplies is $125. This includes PC tapes,

correspondence paper, pencils, pens, etc.

Expensed Equipment:

1. When necessary, expensed equipment (desks, chairs, etc.) would have a prorated

monthly charge of $50 per office. This is a composite rate for all expensed office equipment.

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 22

*December 2013

22-25

Figure 22-12 SUMMARY OF TIME SPENT

SUMMARY OF TIME SPENT BY PERSONNEL GRADE

TO ISSUE A PAYMENT TO A CONTRACTOR

(IN MINUTES)

VENDOR

PAY

RECEIV

.

STAT.

DISB.

OFC.

CONT.

ADMIN.

MAIL

ROOM

TOTAL

Captain

6

7

13

Sergeant (E-5)

18

18

Private (E-3)

8

8

Civilian (GS-8)

4

8

2

14

Civilian (GS-6)

68

10

78

Civilian (GS-5)

23

6

29

Civilian (GS-3) 17 29 26 72

Figure 22-13 COMPUTATION OF COSTS

COMPUTATION OF COSTS ASSOCIATED WITH ISSUING A PAYMENT TO A

CONTRACTOR

ANNUAL

RATE

HOURLY

RATE

MINUTE

RATE

TIME

USED

COST

PERSONNEL COSTS:

Captain (O-3) $ 135,410 $ 65.10 $ 1.08 13 $ 14.04

Sergeant (E-5) 76,878 36.96 .61 18 10.98

Private (E-3)

56,039

26.94

.44

8

3.52

Civilian (GS-8)

139,937

67.27

1.12

14

15.68

Civilian (GS-6)

107,155

51.51

.85

78

66.30

Civilian (GS-5)

91,632

44.05

.73

29

21.17

Civilian (GS-3)

56,039

26.94

.44

72

31.68

Note: Hourly rates recognize all benefit costs.

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 22

*December 2013

22-26

Figure 22-14 SOURCE DOCUMENTS

SOURCE DOCUMENTS

1. DD Form 1155, "Order for Supplies or Services"

2. DD Form 250, "Material Inspection and Receiving Report"

3. DD Form 350, "Individual Contracting Action Report"

4. Payment Voucher Schedule

5. Blank check (If check payment)

Figure 22-15 TIME REQUIREMENTS

TIME REQUIREMENTS

TO PAY A CONTRACTOR INVOICE

TIME

REQUIRED

(IN MINUTES)

VENDOR PAY:

1. Receives contract from Contract Administration. Date and time stamps and

sends to voucher clerk. (Date and time stamp machine used: 10 seconds)

(GS-5 Secretary)

4

2. Establish contract file and insert contract. (PC used: 1 minute) (Data

storage used: 15 seconds) (GS-6 Voucher examiner clerk)

7

RECEIVING STATION:

1. Receives material and counts. (GS-3 Receiving clerk) 10

2. Prepares DD 250. (GS-3 Receiving clerk) 5

3. Delivers to Receiving Station Supervisor. (GS-3 Receiving clerk) 2

4. Receiving Stations Supervisor approves and sends to Vendor Pay. (GS-8

receiving Station Supervisor)

8

VENDOR PAY:

1. Receives receiving report from Receiving Station Supervisor; date and time

stamps; sends to voucher examiner clerk. Date and time stamp machine

used: 10 seconds) (GS-5 Secretary)

6

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 22

*December 2013

22-27

Figure 22-15 TIME REQUIREMENTS (Continued)

TIME REQUIREMENTS

TO PAY A CONTRACTOR INVOICE (CONT’D)

TIME

REQUIRED

(IN MINUTES)

2. Voucher examiner clerk pulls contract file; reviews receiving report to

assure that material received is what was ordered; determines that coding is

correct. (PC used: 20 seconds) (Data Storage used: 15 seconds) (GS-6

Voucher examiner clerk)

12

MAIL ROOM:

1. Receives envelope from contractor; opens it; places in Vendor Pay mail

pouch (GS-3 Mail clerk)

4

2. Mail clerk delivers to Vendor Pay. (GS-3 Mail clerk) 22

VENDOR PAY:

1. Receives mail pouch from mail clerk; removes invoice from mail pouch;

date and time stamps; sends to voucher examiner clerk. (PC used: 2

minutes) (GS-5 Secretary)

7

2. Voucher examiner clerk pulls contract file; reviews invoice to assure that

invoice agrees with contract and receiving report; determines that coding is

correct. (PC used: 22 seconds) (Data Storage used: 11 seconds) (GS-6

Voucher examiner clerk)

9

3. Audits voucher and prepares voucher for payment. (PC used: 18 seconds)

(GS-6 Voucher examiner clerk)

8

4. Schedules voucher for payment. (PC used: 2 minutes, 35 seconds) (GS-6

Voucher examiner clerk)

5

5. Forwards voucher, together with supporting documents to supervisor for

approval. (GS-6 Voucher examiner clerk)

3

6. Vendor Pay supervisor approves voucher and gives to secretary for

transmittal to the disbursing office. (GS-8 Supervisor)

4

7. Secretary gives voucher and supporting documents to Captain. (GS-5

Secretary)

2

8. Captain reviews, approves, and returns to secretary 6

9. Secretary inserts in disbursing office pouch. (GS-5 Secretary) 2

10. Voucher clerk delivers pouch to disbursing office. (GS-6 Voucher

examiner clerk)

12

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 22

*December 2013

22-28

Figure 22-15 TIME REQUIREMENTS (Continued)

TIME REQUIREMENTS

TO PAY A CONTRACTOR INVOICE (CONT’D)

TIME

REQUIRED

(IN MINUTES)

DISBURSING OFFICE:

1. Receives pouch from voucher examiner clerk; opens pouch; delivers

payment schedule to disbursing clerk. Date and times stamps documents.

(Date and time stamp machine used: 10 seconds) (GS-3 Clerk)

3

2. Disbursing clerk reviews and schedules for payment; gives package to

supervisor for approval. (PC used: 3 minutes, 18 seconds) (GS-5

Disbursing clerk)

6

3. Disbursing supervisor reviews and approves; gives to Captain. (GS-6

Supervisor)

4

4. Captain reviews, approves, and returns to disbursing supervisor. 4

5. Disbursing supervisor gives to Sergeant (E-5). (GS-6 Supervisor) 2

6. Sergeant gets blank check from safe; prepares check writer; prints check;

gives to disbursing supervisor (Check writer used: 54 seconds)

18

7. Disbursing supervisor gives to Captain (GS-6 Supervisor) 2

8. Captain signs check and returns to disbursing supervisor. 3

9. Disbursing supervisor gives to Private (E-3). (GS-6 Supervisor) 2

10. Private prepares envelope and puts check in envelope. 4

11. Clerk receives envelope from Private and delivers to Mail Room. (GS-3

Clerk)

13

12. Private gives supporting documentation to disbursing supervisor. 4

13. Disbursing supervisor gives documents to clerk. (GS-6 Supervisor) 2

14. Clerk returns documents to Vendor Pay. (GS-3 Clerk) 13

VENDOR PAY:

1. Secretary receives documents from clerk; date and time stamps. (Date and

time stamp machine used: 8 seconds) (GS-5 Secretary)

2

2. Secretary gives to voucher examiner clerk who files documents in contract

file. (Data Storage used: 17 seconds) (GS-6 Voucher examiner clerk)

12

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 22

*December 2013

22-29

Figure 22-16 SUMMARY OF COSTS

SUMMARY OF THE COSTS

ASSOCIATED WITH FINAL COST OBJECTIONS

ISSUE CHECK TO CONTRACTOR

PERSONNEL COSTS (INCLUDING BENEFITS):

Military

Civilian

$ 28.54

134.83

Total Personnel Costs $ 163.37

CAPITAL EXPENSES:

Depreciation - Personal Property

Depreciation - Real Property

Amortization - Real Property Improvements

Amortization - ADP Software

-0-

-0-

-0-

-0-

Total Capital Expenses -0-

OTHER EXPENSES:

Travel of Persons

Transportation of Things

Rent, Communications, Utilities

Printing and Reproduction

Contractual Services

Supplies and Materials

Equipment (not capitalized)

All other expenses

-0-

-0-

-0-

-0-

-0-

-0-

-0-

-0-

Total Other Expenses -0-

TOTAL COSTS ASSOCIATED WITH FINAL COST OBJECT $ 163.37

Note: Capital expenses and other expenses were not computed because neither category contributed a

value that would meaningfully affect the outcome. The Data Storage devices are used constantly

and the amount of time allocable to document retrieval associated with a particular check is

measured in terms of less than one minute. Real property occupied represented approximately 2

percent of total space and if allocated to the cost object based on time required to process a check

would be substantially less than $1. Similarly the value of other expenses would be substantially

less than $1 (the standard price of the blank check would be $.0128).