Handbook on Supply and Use

Tables and Input Output-Tables

with Extensions and Applications

ST/ESA/STAT/SER.F/

74

/Rev.1

Department of Economic and Social Affairs

Statistics Division

Studies in Methods

Handbook of National Accounting

Series F No.74, Rev.1

Handbook on Supply and Use Tables and

Input-Output Tables with Extensions and

Applications

Edited white cover version

United Nations

New York 2018

Department of Economic and Social Affairs

The Department of Economic and Social Affairs of the United Nations is a vital interface between

global policies in the economic, social and environmental spheres and national action. The

Department works in three main interlinked areas: (i) it compiles, generates and analyses a wide

range of economic, social and environmental data and information on which United Nations

Member States draw to review common problems and to take stock of policy options; (ii) it

facilitates the negotiations of Member States in many intergovernmental bodies on joint courses

of action to address ongoing or emerging global challenges; and (iii) it advises interested

Governments on the ways and means of translating policy frameworks developed in United

Nations conferences and summits into programmes at the country level and, through technical

assistance, helps build national capacities.

Note

The designations employed and the presentation of the material in the present publication

do not imply the expression of any opinion whatsoever on the part of the United Nations

concerning the legal status of any country or of its authorities, or the delimitations of its frontiers.

The term “country” as used in this report also refers, as appropriate, to territories or areas. The

designations of country groups are intended solely for statistical or analytical convenience and do

not necessarily express a judgement about the stage reached by a particular country, territory or

area in the development process. Mention of the names of firms and commercial products does not

imply endorsement by the United Nations. The symbols of United Nations documents are

composed of capital letters and numbers.

ST/ESA/STAT/SER.F/74/Rev.1

UNITED NATIONS PUBLICATION

Sales No.:

ISBN: 978-92-1-1

eISBN: 978-92-1-0

Copyright © United Nations, 2018

All rights reserved

i

Preface and acknowledgements

The present Handbook on Supply and Use Tables and Input-Output Tables with Extensions

and Applications has been prepared as part of a series of handbooks on national accounting in

support of the implementation of the System of National Accounts 2008 (2008 SNA). The

objective of this Handbook is to provide step-by-step guidance for the compilation of supply and

use tables (SUTs) and input-output tables (IOTs) and an overview of the possible extensions of

SUTs and IOTs which increase their usefulness as analytical tools.

Preparation of the Handbook started as an update of the 1999 United Nations publication

entitled Handbook of National Accounting: Input-Output Table Compilation and Analysis,

1

with

the aim of incorporating changes in the underlying international economic accounting standards,

most notably the 2008 SNA, and classifications; extending the scope of the Handbook to provide

fuller coverage of SUTs; and providing practical compilation guidance for countries with advanced

and less advanced statistical systems. In this process, however, the Handbook has also evolved to

include an innovative approach to the compilation of SUTs and IOTs in the following three main

areas: first, the underlying use of an integrated approach to statistics; second, the use of a business

model for the compilation of SUTs and IOTs linking the various parts through the compilation

scheme known as the “H-Approach”; and, third, the mainstreaming of environmental

considerations.

The Handbook builds on the experience, practices and guidance available at national and

regional level, including the Eurostat Manual of Supply, Use and Input-Output Tables (Eurostat,

2008). It provides a consistent worked example of SUTs and IOTs, which runs throughout the

chapters (as far as practically possible) in order to facilitate understanding of the various

compilation steps. It also provides examples of best practices to illustrate certain aspects of the

compilation of SUTs, along with clear recommendations, principles and guidelines in order to

ensure best practice.

For the preparation and drafting of the Handbook, an editorial board was established in

May 2013, comprising 12 members and the United Nations Statistics Division. The editorial board

members were leading international experts, including members of the International Input-Output

Association, with decades of accumulated knowledge and experience from different regions and

from different institutions, such as national statistical offices, central banks, international

organizations and the academic community.

An editor (Sanjiv Mahajan, Office for National Statistics, United Kingdom) was appointed

to lead the work of the editorial board and coordinate the contributions of experts for the various

1

ST/ESA/STAT/SER.F/74, Sales No. E.99.XVII.9.

ii

chapters. Initial drafts of the chapters were prepared by members of the editorial board, including

the editor. These were further refined and aligned by the editor in liaison with respective members

of the board and the United Nations Statistics Division into a coherent set of chapters. This was

achieved through many bilateral electronic communications between the editor and chapter

authors, a face-to-face meeting of all board members in New York in May 2014, and a final

editorial board review prior to a global consultation.

The Handbook is therefore the outcome of a collaborative team effort led by the editor in

liaison with the United Nations Statistics Division and the editorial board. This team comprises

the following:

• Sanjiv Mahajan, editor Office for National Statistics, United Kingdom

• Joerg Beutel Konstanz University of Applied Sciences, Germany

• Simon Guerrero Central Bank of Chile

• Satoshi Inomata Institute of Developing Economies, Japan External Trade

Organization

• Soren Larsen Statistics Denmark

• Brian Moyer Bureau of Economic Analysis, United States of America

• Isabelle Remond-Tiedrez European Commission, Eurostat

• José M. Rueda-Cantuche European Commission, Joint Research Centre

• Liv Hobbelstad Simpson Norway

• Bent Thage Denmark

• Catherine Van Rompaey Statistics Canada

• Piet Verbiest Statistics Netherlands

• Ilaria Di Matteo United Nations Statistics Division

The editorial board members contributed initial draft chapters and a detail review of all the

chapters in the various rounds of consultation. Substantive contributions on specific topics,

including initial draft chapters, were provided by the editorial board members as follows: Joerg

Beutel (transforming SUTs into IOTs, compiling physical SUTs (PSUTs) and environmentally

extended IOTs (EE-IOTs), extension of SUTs and IOTs and modelling applications of IOTs);

Simon Guerrero (examples of country practices); Satoshi Inomata (multi-country SUTs and IOTs);

Soren Larsen (compiling the use table); Brian Moyer (compiling the import use table and domestic

use table); José M. Rueda-Cantuche (transforming SUTs into IOTs and projecting SUTs and

IOTs); Liv Hobbelstad Simpson (guidance for countries with limited statistical resources and

examples of country practices); Bent Thage (classification of industries and products, compiling

the supply table, use table, valuation matrices, import use table and domestic use table, and

transforming SUTs into IOTs); Catherine Van Rompaey (regional SUTs); and Piet Verbiest

(compiling SUTs in volume terms and balancing). The editor also provided substantive

contributions to these topics, initial draft chapters and all other topics in the Handbook, and brought

iii

all the material together through numerous iterations with editorial board members reflecting many

changes and improvements.

The contributions by the editor and the members of the editorial board and their

commitment to the Handbook are very much acknowledged and appreciated. The following

specific contributions are also acknowledged: Joerg Beutel, in formatting and standardizing tables,

charts, boxes and figures throughout the Handbook; Ilaria Di Matteo, in reorganizing the chapters

and ensuring overall coherence and consistency of the Handbook; and Erwin Kolleritsch (Statistics

Austria), in kindly providing and checking much of the empirical data supporting the SUTs and

IOTs in parts two and three of the Handbook.

The Handbook also benefited from specific inputs provided by Issam Alsammak (Statistics

Canada), Gary Brown (Office for National Statistics, United Kingdom), Andrew Cadogan

(Australian Bureau of Statistics), Duncan Elliot (Office for National Statistics, United Kingdom),

Antonio F. Amores (European Commission Joint Research Centre), Ziad Ghanem (Statistics

Canada), Manfred Lenzen (University of Sydney, Australia), Bo Meng (Institute of Developing

Economies, Japan External Trade Organization), Louis de Mesnard (University of Bourgogne,

France), Carol Moylan and Tom Howells (Bureau of Economic Analysis, United States), Jan

Oosterhaven (University of Groningen, Netherlands), Ole Gravgard Pedersen (Statistics

Denmark), Xesús Pereira (University of Santiago de Compostela, Spain), Joao Rodrigues

(Technical University of Lisbon, Portugal), Jaroslav Sixta (Czech Statistical Office), Silke Stapel-

Weber (European Commission, Eurostat), Umed Temursho (European Commission Joint

Research Centre), Norihiko Yamano and Nadim Ahmad (OECD), and Herman Smith, Julian

Chow, Gulab Singh, Benson Sim and Alessandra Alfieri (United Nations Statistics Division).

Feedback was also received from participants at various meetings and conferences, most

notably the annual International Input-Output Association (2014, 2015 and 2016) and various

regional national accounts meetings. The Handbook has benefited greatly from the numerous

useful comments and suggestions made by national statistical offices, central banks, regional

commissions, academic associations and international organizations, and also by the

Intersecretariat Working Group on National Accounts during the global consultation in the period

August to October 2017.

The Handbook was prepared under the supervision of Herman Smith and the overall

responsibility of Ivo Havinga, both of the United Nations Statistics Division.

iv

Handbook on Supply and Use Tables and Input-Output Tables with Extensions and Applications

v

Contents

PREFACE AND ACKNOWLEDGEMENTS ........................................................................................................... I

CONTENTS ................................................................................................................................................................ V

ABBREVIATIONS ............................................................................................................................................... XVII

PART ONE ................................................................................................................................................................... 1

CHAPTER 1. INTRODUCTION ......................................................................................................................... 3

A. BACKGROUND ................................................................................................................................................... 3

B. USES OF SUTS AND IOTS .................................................................................................................................. 5

C. SYSTEM OF NATIONAL ACCOUNTS .................................................................................................................... 7

D. OBJECTIVES OF THIS HANDBOOK .................................................................................................................... 12

E. STRUCTURE OF THE HANDBOOK ...................................................................................................................... 15

PART TWO ............................................................................................................................................................... 21

CHAPTER 2. OVERVIEW OF THE SUPPLY AND USE TABLES AND INPUT-OUTPUT TABLES ... 23

A. INTRODUCTION ................................................................................................................................................ 23

B. OVERVIEW OF SUTS ....................................................................................................................................... 23

C. OVERVIEW OF IOTS ........................................................................................................................................ 35

D. STRUCTURE OF SUTS AND IOTS: BASIC ELEMENTS......................................................................................... 38

E. COMPILING SUTS AS AN INTEGRAL PART OF THE NATIONAL ACCOUNTS ......................................................... 57

CHAPTER 3. BUSINESS PROCESSES AND PRODUCTION STAGES ..................................................... 69

A. INTRODUCTION ................................................................................................................................................ 69

B. INSTITUTIONAL ARRANGEMENTS..................................................................................................................... 70

C. OVERVIEW OF THE GENERIC STATISTICAL BUSINESS PROCESS MODEL .......................................................... 71

D. OVERALL STRATEGY FOR THE COMPILATION OF SUTS AND IOTS ................................................................... 75

ANNEX A TO CHAPTER 3: EXAMPLES OF INSTITUTIONAL ARRANGEMENTS IN COUNTRIES .... 90

A. CENTRALIZED PRODUCTION OF ECONOMIC STATISTICS: CANADA ................................................................... 90

B. CENTRALIZED PRODUCTION OF ECONOMIC STATISTICS: NORWAY .................................................................. 91

C. CENTRALIZED PRODUCTION OF ECONOMIC STATISTICS: UNITED KINGDOM .................................................... 92

D. DECENTRALIZED PRODUCTION OF ECONOMIC STATISTICS: CHILE ................................................................... 93

E. DECENTRALIZED PRODUCTION OF ECONOMIC STATISTICS: UNITED STATES OF AMERICA ............................... 95

CHAPTER 4. SPECIFY NEEDS, DESIGN, BUILD AND COLLECT STAGE ........................................... 99

A. INTRODUCTION ................................................................................................................................................ 99

B. SPECIFY NEEDS, DESIGN AND BUILD PHASES ................................................................................................... 99

C. COLLECT PHASE ............................................................................................................................................ 120

PART THREE ......................................................................................................................................................... 129

CHAPTER 5. COMPILING THE SUPPLY TABLE .................................................................................... 131

A. INTRODUCTION .............................................................................................................................................. 131

B. STRUCTURE OF THE SUPPLY TABLE ............................................................................................................... 131

C. DOMESTIC OUTPUT ........................................................................................................................................ 135

Handbook on Supply and Use Tables and Input-Output Tables with Extensions and Applications

vi

D. IMPORTS OF GOODS AND SERVICES ................................................................................................................ 145

ANNEX A TO CHAPTER 5: SAMPLE QUESTIONNAIRE COLLECTING SALES OF GOODS AND

SERVICES, INVENTORIES OF GOODS AND TRADE-RELATED DATA .................................................. 153

CHAPTER 6. COMPILING THE USE TABLE ............................................................................................ 157

A. INTRODUCTION .............................................................................................................................................. 157

B. STRUCTURE OF THE USE TABLE ..................................................................................................................... 157

C. INTERMEDIATE CONSUMPTION PART OF THE USE TABLE ................................................................................ 162

D. GVA PART OF THE USE TABLE ....................................................................................................................... 170

E. FINAL CONSUMPTION EXPENDITURE PART OF THE USE TABLE ....................................................................... 173

F. GROSS CAPITAL FORMATION PART OF THE USE TABLE ................................................................................... 182

G. EXPORTS ....................................................................................................................................................... 196

ANNEX A TO CHAPTER 6: SAMPLE QUESTIONNAIRE COLLECTING PURCHASES OF GOODS AND

SERVICES FOR INTERMEDIATE CONSUMPTION ...................................................................................... 198

ANNEX B TO CHAPTER 6: IMPACT OF CAPITALIZING THE COSTS OF RESEARCH AND

DEVELOPMENT IN SUTS AND IOTS ............................................................................................................... 201

A. RESEARCH AND DEVELOPMENT AS FIXED CAPITAL FORMATION .................................................................... 201

B. IMPLICATIONS OF VALUATION OF OUTPUT AS SUM OF COSTS ......................................................................... 202

C. OWN-ACCOUNT RESEARCH AND DEVELOPMENT AS PRINCIPAL OR SECONDARY OUTPUT ............................... 203

D. BALANCING SUPPLY AND USE OF RESEARCH AND DEVELOPMENT SERVICES .................................................. 205

CHAPTER 7. COMPILING THE VALUATION MATRICES .................................................................... 207

A. INTRODUCTION .............................................................................................................................................. 207

B. VALUATION OF PRODUCT FLOWS ................................................................................................................... 207

C. TRADE MARGINS ........................................................................................................................................... 216

D. TRANSPORT MARGINS ................................................................................................................................... 229

E. TAXES ON PRODUCTS AND SUBSIDIES ON PRODUCTS ..................................................................................... 236

ANNEX A TO CHAPTER 7. EXAMPLE FOR DERIVING TRADE MARGINS IN SUTS BASED ON

SURVEY DATA ...................................................................................................................................................... 241

A. SUPPLY TABLE ............................................................................................................................................... 243

B. USE TABLE .................................................................................................................................................... 245

CHAPTER 8. COMPILING THE IMPORTS USE TABLE AND DOMESTIC USE TABLE ................. 249

A. INTRODUCTION .............................................................................................................................................. 249

B. STRUCTURE OF THE IMPORTS USE TABLE AND DOMESTIC USE TABLE ............................................................ 250

C. COMPILATION OF THE IMPORTS USE TABLE ................................................................................................... 255

D. SPECIFIC ISSUES IN THE COMPILATION OF THE IMPORTS USE TABLE .............................................................. 259

E. ENHANCEMENTS TO THE IMPORTS USE TABLE FOR ANALYTICAL USES .......................................................... 268

CHAPTER 9. COMPILING SUTS IN VOLUME TERMS .......................................................................... 271

A. INTRODUCTION .............................................................................................................................................. 271

B. RECOGNITION OF ALTERNATIVE APPROACHES............................................................................................... 272

C. OVERVIEW OF THE STEPS IN THE H-APPROACH WITH A FOCUS ON VOLUMES ................................................ 273

D. PRICE AND VOLUME INDICATORS IN THEORY................................................................................................. 284

E. PRICE AND VOLUME INDICATORS IN PRACTICE .............................................................................................. 285

F. INPUT-OUTPUT TABLES IN VOLUME TERMS .................................................................................................... 301

Handbook on Supply and Use Tables and Input-Output Tables with Extensions and Applications

vii

CHAPTER 10. LINKING THE SUPPLY AND USE TABLES TO THE INSTITUTIONAL SECTOR

ACCOUNTS 303

A. INTRODUCTION .............................................................................................................................................. 303

B. INSTITUTIONAL SECTORS AND SUBSECTORS .................................................................................................. 304

C. TABLE LINKING SUTS AND INSTITUTIONAL SECTOR ACCOUNTS .................................................................... 307

D. COMPILATION METHODS ............................................................................................................................... 315

CHAPTER 11. BALANCING THE SUPPLY AND USE TABLES ............................................................... 319

A. INTRODUCTION .............................................................................................................................................. 319

B. OVERVIEW OF THE SYSTEM AND BASIC IDENTITIES ....................................................................................... 320

C. BALANCING ................................................................................................................................................... 324

D. STEP-BY-STEP PROCEDURE FOR SIMULTANEOUS BALANCING ........................................................................ 332

E. ALTERNATIVE BALANCING METHODS ............................................................................................................ 336

F. EXTENDING THE BALANCING OF SUTS TO INCLUDE INSTITUTIONAL SECTOR ACCOUNTS, IOTS, PSUTS AND EE-

IOT

S 338

G. PRACTICAL ASPECTS OF BALANCING ............................................................................................................. 342

ANNEX A TO CHAPTER 11. BALANCING SUPPLY AND USE TABLES ................................................... 350

CHAPTER 12. TRANSFORMING THE SUPPLY AND USE TABLES INTO INPUT-OUTPUT TABLES

369

A. INTRODUCTION .............................................................................................................................................. 369

B. OVERVIEW OF THE RELATIONSHIP BETWEEN IOTS AND SUTS ...................................................................... 369

C. CONVERSION OF SUTS TO IOTS .................................................................................................................... 374

D. INPUT-OUTPUT FRAMEWORK ......................................................................................................................... 379

E. EMPIRICAL APPLICATION OF THE TRANSFORMATION MODELS ....................................................................... 400

ANNEX A TO CHAPTER 12. MATHEMATICAL DERIVATION OF DIFFERENT IOTS ......................... 411

A. PRODUCT-BY-PRODUCT IOTS AND INDUSTRY-BY-INDUSTRY IOTS ............................................................... 411

B. PRODUCT-BY-PRODUCT IOTS ........................................................................................................................ 412

C. INDUSTRY-BY-INDUSTRY IOTS ..................................................................................................................... 414

D. USE OF A HYBRID TECHNOLOGY ASSUMPTION FOR PRODUCT-BY-PRODUCT IOTS ......................................... 416

ANNEX B TO CHAPTER 12. CLASSICAL CAUSES AND TREATMENT OF NEGATIVE CELL ENTRIES

IN THE PRODUCT TECHNOLOGY ................................................................................................................... 419

A. CLASSICAL CAUSES OF NEGATIVE ELEMENTS IN THE PRODUCT TECHNOLOGY ............................................... 419

B. OVERALL STRATEGY FOR REMOVING NEGATIVES .......................................................................................... 421

C. SPECIFIC APPROACHES TO DEALING WITH NEGATIVES ................................................................................... 421

ANNEX C TO CHAPTER 12. EXAMPLES OF REVIEWS OF APPROACHES TO THE TREATMENT OF

SECONDARY PRODUCTS ................................................................................................................................... 427

CHAPTER 13. COMPILING PHYSICAL SUPPLY AND USE TABLES AND ENVIRONMENTALLY

EXTENDED INPUT-OUTPUT TABLES ............................................................................................................. 429

A. INTRODUCTION .............................................................................................................................................. 429

B. OVERVIEW OF PSUTS ................................................................................................................................... 430

C. COMPILATION OF PSUTS .............................................................................................................................. 442

D. ENVIRONMENTAL EXTENDED IOTS ............................................................................................................... 449

E. COMPILATION OF EE-IOTS ........................................................................................................................... 453

F. COUNTRY EXAMPLES .................................................................................................................................... 454

Handbook on Supply and Use Tables and Input-Output Tables with Extensions and Applications

viii

CHAPTER 14. SUPPLY AND USE TABLES AND QUARTERLY NATIONAL ACCOUNTS ................ 467

A. INTRODUCTION .............................................................................................................................................. 467

B. QUARTERLY NATIONAL ACCOUNTS ............................................................................................................... 468

C. SUTS AND QUARTERLY NATIONAL ACCOUNTS .............................................................................................. 474

CHAPTER 15. DISSEMINATING SUPPLY, USE AND INPUT-OUTPUT TABLES ................................ 487

A. INTRODUCTION .............................................................................................................................................. 487

B. USER IDENTIFICATION ................................................................................................................................... 487

C. DISSEMINATION STRATEGY ........................................................................................................................... 488

D. COMMUNICATIONS OF SUTS AND IOTS WITH USERS .................................................................................... 493

E. DISSEMINATION FORMAT FOR SUTS AND IOTS............................................................................................. 494

F. STATISTICAL DATA AND METADATA EXCHANGE INITIATIVE ........................................................................ 497

PART FOUR ............................................................................................................................................................ 499

CHAPTER 16. REGIONAL SUPPLY AND USE TABLES ........................................................................... 501

A. INTRODUCTION .............................................................................................................................................. 501

B. ISSUES ARISING IN AND METHODS FOR THE COMPILATION OF REGIONAL SUTS AND IOTS ............................ 501

C. EXAMPLE OF BOTTOM-UP METHODS FOR REGIONAL SUTS: CANADIAN EXPERIENCE .................................... 504

CHAPTER 17. MULTI-COUNTRY SUPPLY AND USE TABLES AND INPUT-OUTPUT TABLES ..... 521

A. INTRODUCTION .............................................................................................................................................. 521

B. OVERVIEW OF MULTI-COUNTRY SUTS AND IOTS AND MAIN COMPILATION ISSUES ...................................... 522

C. COMPILATION PROCEDURE ............................................................................................................................ 530

D. MULTI-COUNTRY INPUT-OUTPUT DATABASE INITIATIVES ............................................................................. 541

E. WAY AHEAD .................................................................................................................................................. 543

CHAPTER 18. PROJECTING SUPPLY, USE AND INPUT-OUTPUT TABLES ....................................... 549

A. INTRODUCTION .............................................................................................................................................. 549

B. SITUATIONS NEEDING PROJECTION METHODS ................................................................................................ 549

C. GENERAL APPROACHES TO PROJECTION FROM A HISTORICAL PERSPECTIVE .................................................. 551

D. NUMERICAL EXAMPLES ................................................................................................................................. 567

E. CRITERIA TO CONSIDER WHEN CHOOSING A METHOD .................................................................................... 580

CHAPTER 19. EXTENSIONS OF SUTS AND IOTS AS PART OF SATELLITE SYSTEMS .................. 583

A. INTRODUCTION .............................................................................................................................................. 583

B. OVERVIEW OF POSSIBLE EXTENSIONS ............................................................................................................ 584

C. SOCIAL ACCOUNTING MATRIX ....................................................................................................................... 591

D. EXTENDED INPUT-OUTPUT TABLES ................................................................................................................ 597

E. OTHER EXAMPLES OF SATELLITE SYSTEMS .................................................................................................... 601

CHAPTER 20. MODELLING APPLICATIONS OF IOTS ........................................................................... 603

A. INTRODUCTION .............................................................................................................................................. 603

B. NUMERICAL EXAMPLE OF IOTS AS A STARTING POINT .................................................................................. 604

C. DISTINCTION BETWEEN PRICE, VOLUME, QUANTITY, QUALITY AND PHYSICAL UNITS .................................... 605

D. INPUT COEFFICIENTS ..................................................................................................................................... 609

E. OUTPUT COEFFICIENTS .................................................................................................................................. 611

F. QUANTITY MODEL OF INPUT-OUTPUT ANALYSIS ........................................................................................... 612

G. PRICE MODEL OF INPUT-OUTPUT ANALYSIS ................................................................................................... 616

Handbook on Supply and Use Tables and Input-Output Tables with Extensions and Applications

ix

H. INPUT-OUTPUT MODELS WITH INPUT AND OUTPUT COEFFICIENTS ................................................................. 622

I. CENTRAL MODEL OF INPUT-OUTPUT ANALYSIS ............................................................................................. 623

J. INDICATORS .................................................................................................................................................. 626

K. MULTIPLIERS................................................................................................................................................. 629

L. INTER-INDUSTRIAL LINKAGE ANALYSIS ........................................................................................................ 636

CHAPTER 21. EXAMPLES OF COMPILATION PRACTICES .................................................................. 641

A. INTRODUCTION .............................................................................................................................................. 641

B. BASIC CONSIDERATIONS FOR THE COMPILATION OF NATIONAL ACCOUNTS AND SUTS ................................. 642

C. EFFECT ON GDP OF INTEGRATING SUTS IN THE NATIONAL ACCOUNTS FOR MALAWI................................... 655

D. DEVELOPMENT OF THE APPLICATION OF THE INPUT-OUTPUT FRAMEWORK IN THE CZECH REPUBLIC ............ 659

E. CONTINUAL CHANGE, DEVELOPMENT AND IMPROVEMENT IN CHILE ............................................................. 663

REFERENCES ........................................................................................................................................................ 675

ADDITIONAL READING ..................................................................................................................................... 695

Box 1.1 Evolution of the SUTs and IOTs within the national accounts ....................................... 13

Box 2.1 Numerical example of the SUTs system ......................................................................... 28

Box 2.2 Numerical example showing a use table split between consumption of domestic

production and imports ................................................................................................................. 29

Box 2.3 SUTs and product-by-product IOTs ................................................................................ 37

Box 2.4 SUTs and industry-by-industry IOTs .............................................................................. 38

Box 2.5 Three approaches to measuring GDP .............................................................................. 41

Box 2.6 Other classifications of products ..................................................................................... 46

Box 2.7 SNA recommendations on partitioning of vertically and horizontally integrated enterprises

....................................................................................................................................................... 53

Box 2.8 Overview of the valuation in SUTs and IOTs ................................................................. 57

Box 2.9 Calculation of output for market and non-market producers .......................................... 60

Box 2.10 Example of derivation of GDP from balanced SUTs .................................................... 64

Box 3.1 Examples of the main recommendations, principles and guidelines provided in this

Handbook ...................................................................................................................................... 85

Box 4.1 Example of in-house custom-built software: Statistics Netherlands ............................. 100

Box 4.2 ERETES ........................................................................................................................ 101

Box 4.3 Data sources generally used .......................................................................................... 121

Box 5.1 Redefinitions ................................................................................................................. 144

Box 5.2 Consistency issues with the CIF/FOB adjustment ........................................................ 150

Box 6.1 Example of a calculation of the values of an input column .......................................... 168

Box 6.2 Classification of individual consumption according to purpose ................................... 174

Box 6.3: Non-durable, semi-durable and durable goods ............................................................ 176

Box 6.4 Classification of the purposes of NPISHs ..................................................................... 179

Box 6.5 Classification of functions of government .................................................................... 181

Box 6.6 Gross fixed capital formation by type of asset .............................................................. 183

Handbook on Supply and Use Tables and Input-Output Tables with Extensions and Applications

x

Box 7.1 Compilation process for trade margins ......................................................................... 221

Box 7.2 Examples of transport costs which do not form transport margins ............................... 231

Box 7.3 Options to consider where no data exists on transport margins .................................... 234

Box 8.1 Standard services components of BPM 6 ...................................................................... 257

Box 9.1 Treatment of newly introduced and disappearing taxes and subsidies ......................... 297

Box 10.1 Compilation methods used to link SUTs to the institutional sector accounts ............. 315

Box 11.1 Example of discrepancies balanced in current prices and in volume terms ................ 331

Box 11.2 Example of simultaneous balancing comparing volume indices ................................ 331

Box 11.3 Methods used for automated balancing SUTs ............................................................. 345

Box 12.1 Clarification of IOTs terminology ............................................................................... 373

Box 12.2 Input-output framework for domestic output and imports .......................................... 381

Box 12.3 Basic transformations of SUTs to IOTs ...................................................................... 383

Box 13.1 Selected reference material ......................................................................................... 444

Box 15.1 Fundamental Principles of Official Statistics .............................................................. 488

Box 15.2 Reference metadata in the SDMX metadata structure for SUTs and IOTs ................ 493

Box 17.1 Background papers of each database initiative ........................................................... 541

Box 17.2 Overview of the main features of the various databases ............................................. 543

Box 18.1 Methods for projection of SUTs and IOTs.................................................................. 554

Box 18.2 SUTs and IOTs for Austria, 2005 and 2006................................................................ 568

Box 18.3 Results using the GRAS Method ................................................................................ 570

Box 18.4 Flow diagram of the GRAS method ............................................................................ 571

Box 18.5 Results using the SUT-RAS method ........................................................................... 574

Box 18.6 Flow diagram of the SUT-RAS method ...................................................................... 575

Box 18.7 Results using the SUT-Euro method ........................................................................... 578

Box 18.8 Flow diagram of the SUT-EURO method................................................................... 580

Box 19.1 Measurement performance and social progress: overview of Stiglitz-Sen-Fitoussi

Commission 2009 report ............................................................................................................. 588

Box 20.1 Quantities, prices, values and volumes in IOTs .......................................................... 607

Box 20.2 Quantity input-output model ....................................................................................... 620

Box 20.3 Price input-output model ............................................................................................. 621

Box 20.4 Multipliers in the input-output model ......................................................................... 631

Box 21.1 Material product system and Phare projects ............................................................... 660

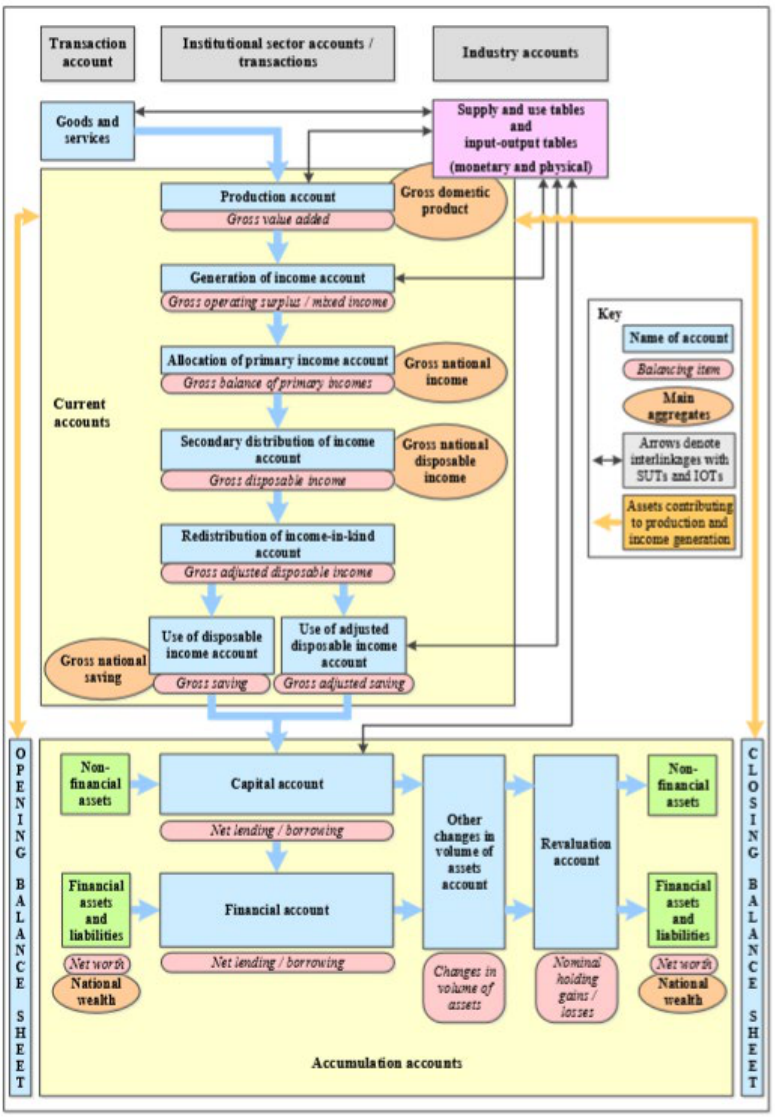

Figure 1.1 Overview of the links between SUTs and the SNA framework .................................... 9

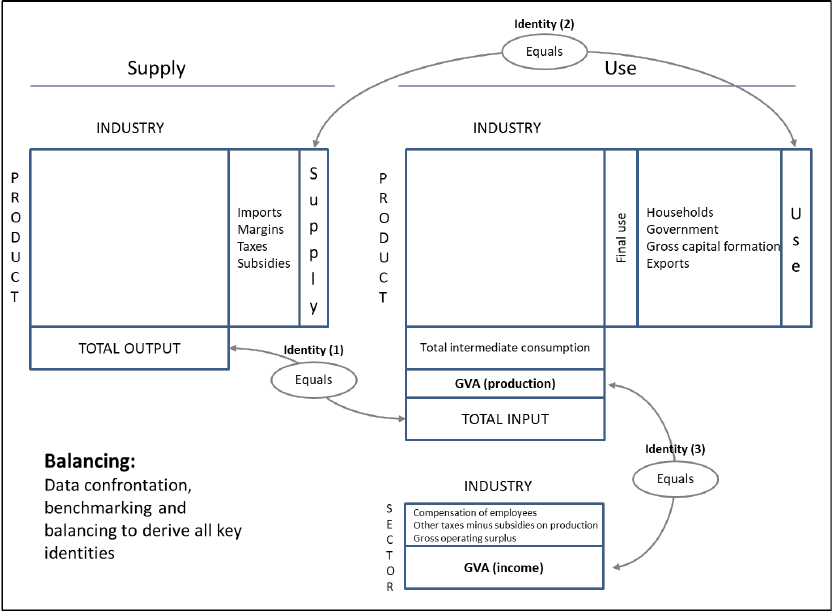

Figure 2.1: Graphical overview of supply and use tables ............................................................. 27

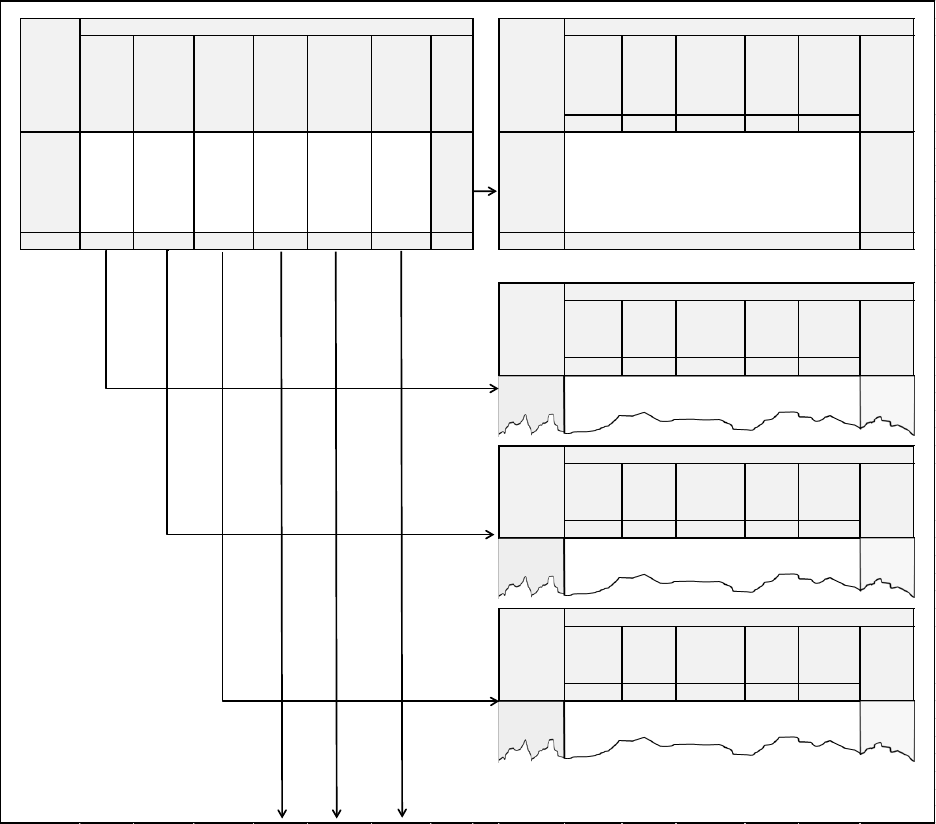

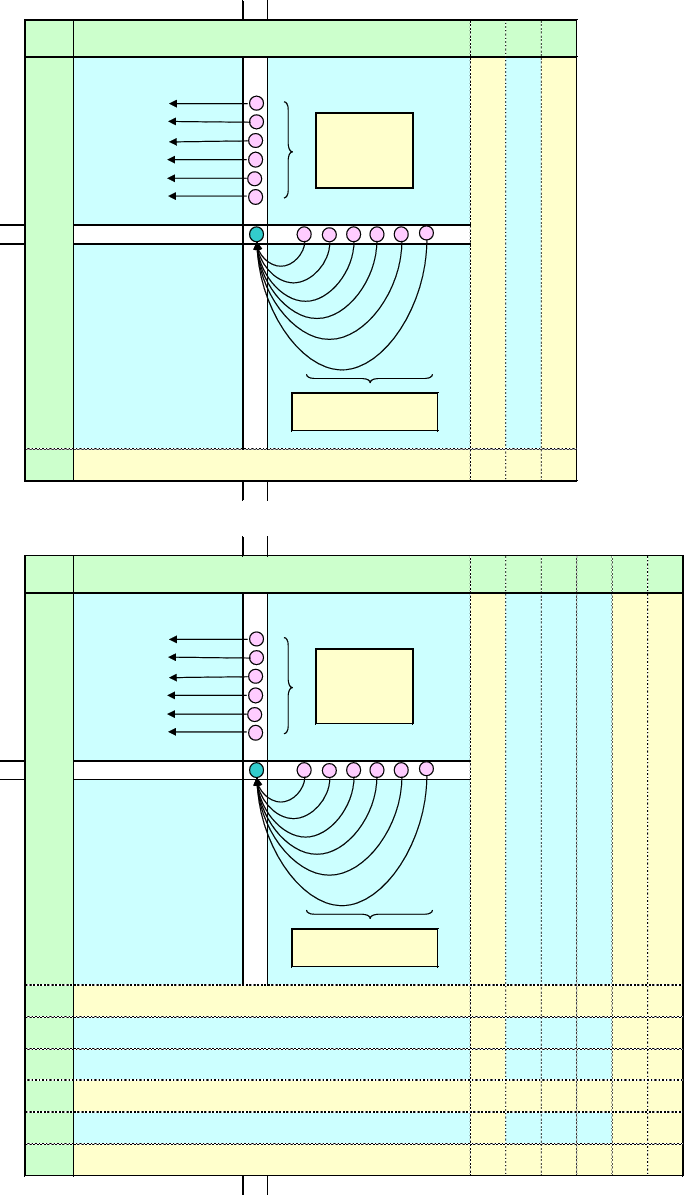

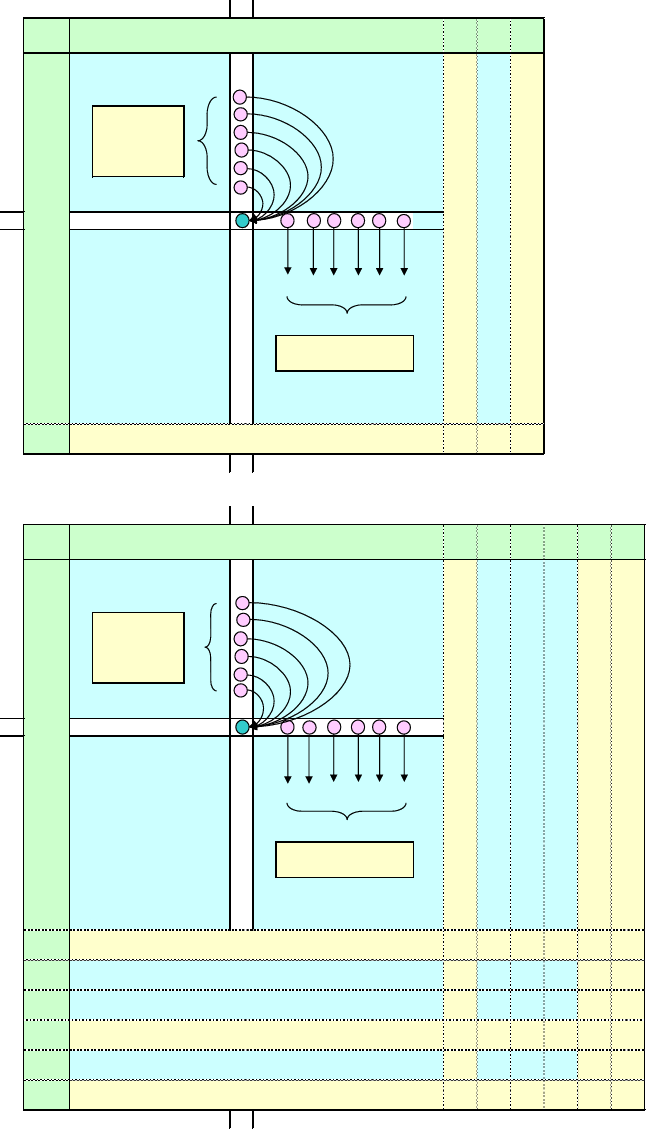

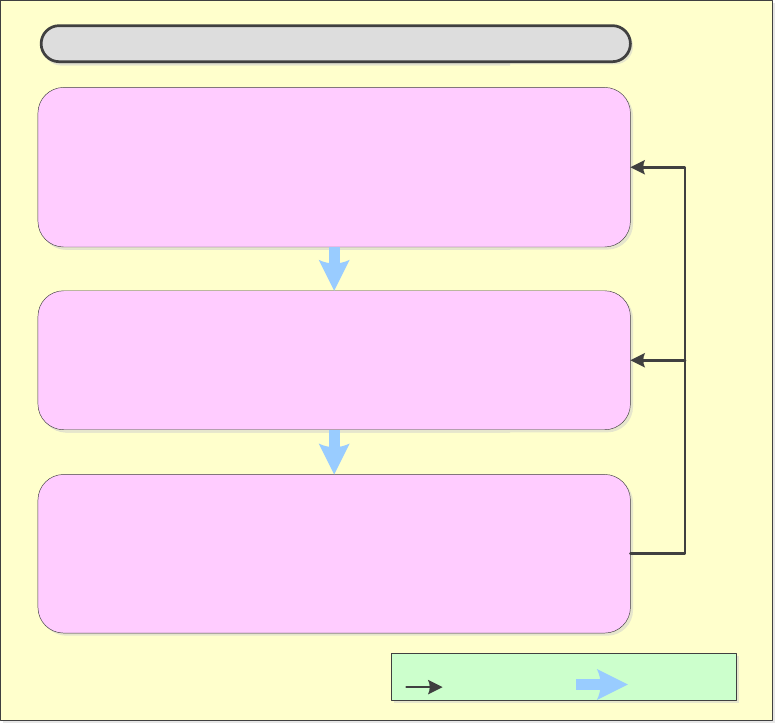

Figure 2.2 Schematic overview of the compilation of SUTs and IOTs: H-Approach .................. 30

Figure 2.3 System of national accounts in matrix form ................................................................ 41

Figure 2.4 Overview of SUTs and IOTs as part of the SNA compilation .................................... 59

Figure 3.1 Phases of the GSBPM ................................................................................................. 72

Figure 3.2 Simplified business processing model for compiling SUTs, IOTs, and PSUTs ......... 74

Handbook on Supply and Use Tables and Input-Output Tables with Extensions and Applications

xi

Figure 3.3 Structure of the SUTs and the links covered in this Handbook .................................. 77

Figure 3.4 Compilation of SUTs and IOTs in current prices and in volume terms ...................... 79

Figure 3.5 Evolution of compiling SUTs and IOTs in the first three years .................................. 80

Figure 3.6 First year of compilation ............................................................................................. 82

Figure 3.7 Second year of compilation ......................................................................................... 84

Figure 4.1 Overview of SUTs and IOTs as part of the SNA compilation .................................. 123

Figure 5.1 Link between valuation matrices in the supply table and the use table..................... 135

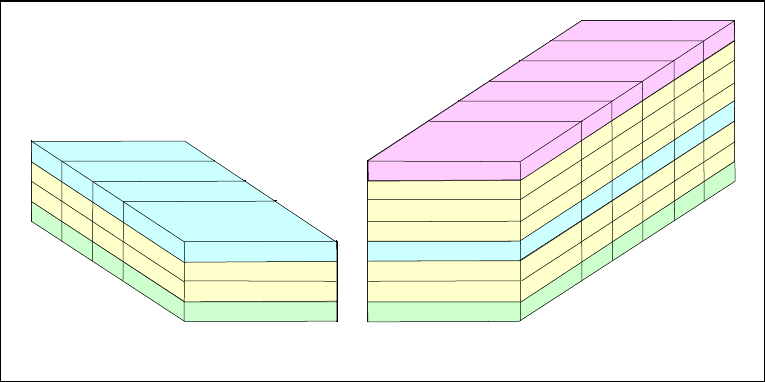

Figure 6.1 Three-dimensional view of SUTs .............................................................................. 162

Figure 7.1 Schematic representation of the valuation matrices in the SUTs .............................. 210

Figure 7.2 Alternative distribution channels of goods ................................................................ 227

Figure 9.1 Overview of the compilation schematic layout linking SUTs in current prices and in

volume terms ............................................................................................................................... 274

Figure 9.2 Link between SUTs in current prices and in volume terms ...................................... 278

Figure 10.1 Links between the industry accounts and the institutional sector accounts ............ 304

Figure 10.2 Link between the SUTs and institutional sector accounts ....................................... 309

Figure 11.1 Simplified SUTs system .......................................................................................... 321

Figure 11.2 Six-pack ................................................................................................................... 325

Figure 11.3 Overview of the SUTs balancing framework for simultaneous balancing.............. 333

Figure 11.4 Sources of feedback loops emanating from the balancing process ......................... 342

Figure 12.1 Transformation of SUTs into IOTs ......................................................................... 372

Figure 12.2 Basic transformation models ................................................................................... 378

Figure 13.1 Physical flows of natural inputs, products and residuals ......................................... 431

Figure 13.2 Overview of the compilation system for PSUTs ..................................................... 446

Figure 13.3 Key feedback loops in producing and balancing the PSUTs and environmental

extended IOTs ............................................................................................................................. 449

Figure 13.4 Danish SUTs framework extended with physical flows ......................................... 456

Figure 13.5 From source data to PSUTs ..................................................................................... 458

Figure 14.1 Quarterly GDP production (output) aggregate: data availability and estimation in the

United Kingdom.......................................................................................................................... 470

Figure 14.2 Quarterly GDP expenditure components: data availability and estimation in the United

Kingdom ..................................................................................................................................... 471

Figure 15.1 Release calendar covering SUTs, IOTs and national accounts: Statistics Denmark

..................................................................................................................................................... 490

Figure 15.2 Measuring United Kingdom GDP and SUTs: revision policy ................................ 491

Figure 17.1 Schematic representation of multi-country SUTs (three-country case) .................. 523

Figure 17.2 Schematic representation of multi-country IOTs (three country case) ................... 524

Figure 17.3 System of multi-country SUTs and its conceptual correspondence to a national SUTs

framework ................................................................................................................................... 532

Figure 17.4 Splitting the import matrix by country of origin ..................................................... 535

Figure 17.5 Converting valuation scheme .................................................................................. 536

Handbook on Supply and Use Tables and Input-Output Tables with Extensions and Applications

xii

Figure 17.6 Formation of the export vector to rest of the world................................................. 538

Figure 17.7 Transformation to multi-country IOTs .................................................................... 540

Figure 21.1: Illustration of a database for the product-flow method used in smaller countries . 649

Figure 21.2 Supply and use table ................................................................................................ 670

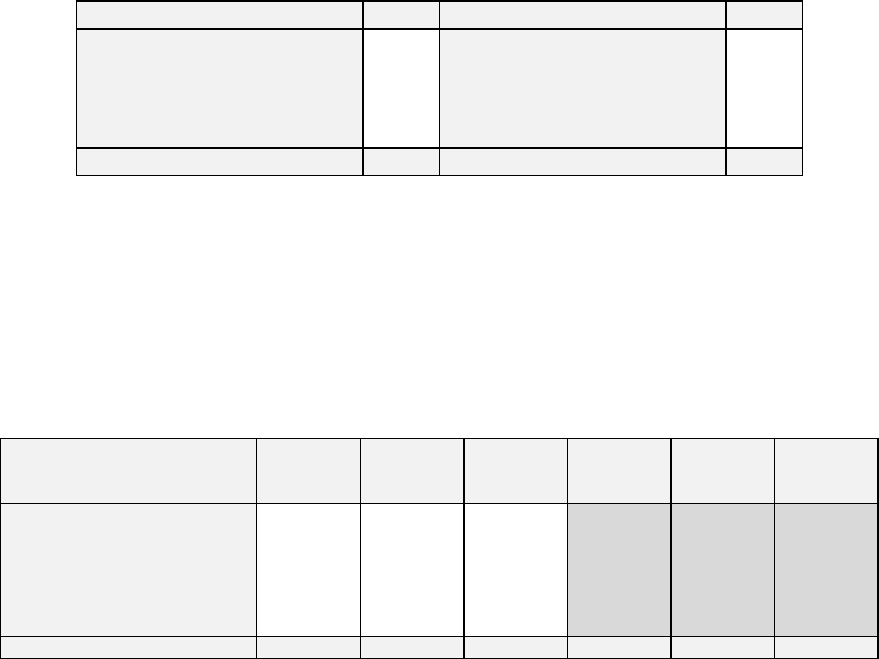

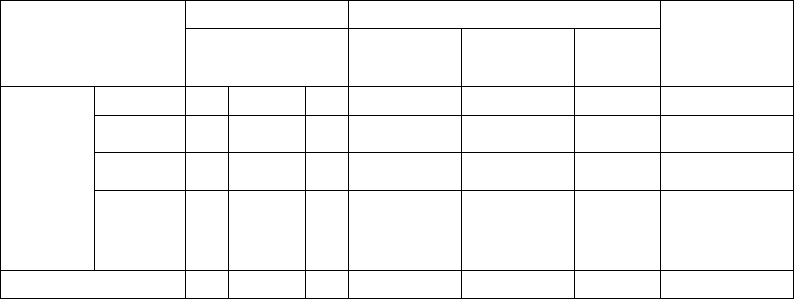

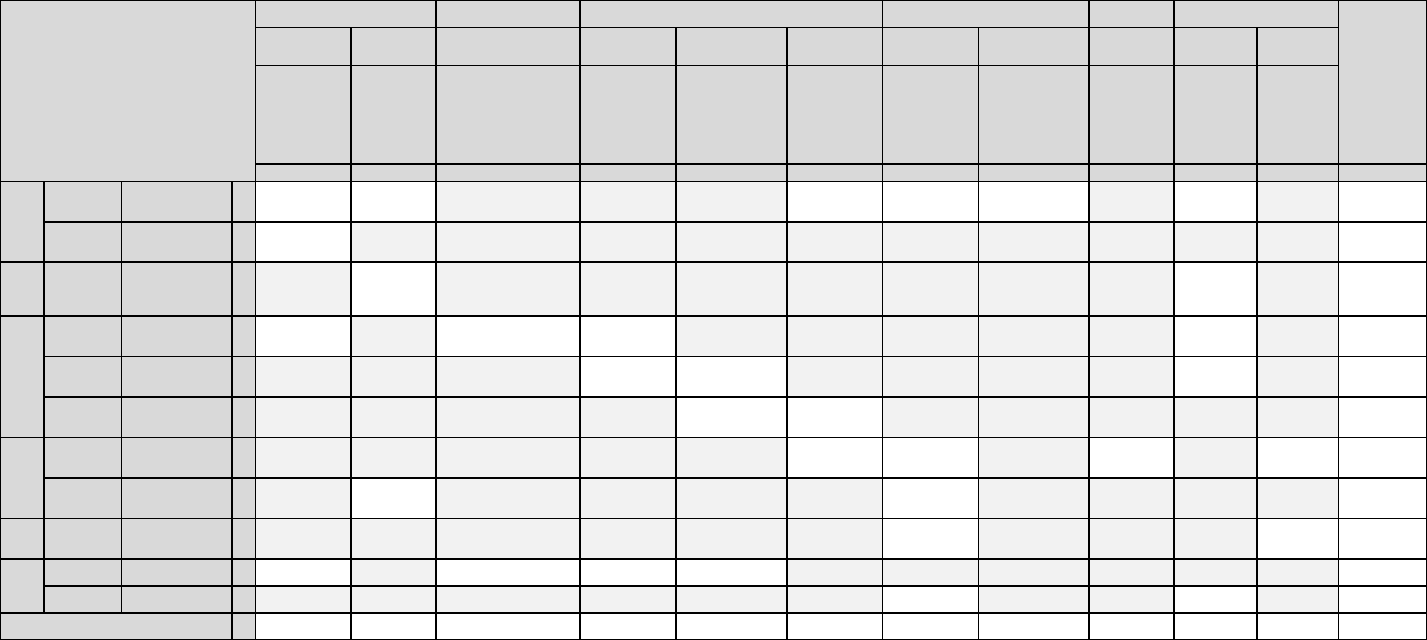

Table 2.1: Simplified structure of the supply table ....................................................................... 24

Table 2.2: Simplified structure of the use table ............................................................................ 24

Table 2.3: Supply and use tables framework ................................................................................ 25

Table 2.4 Schematic view of the physical supply table ................................................................ 34

Table 2.5 Schematic view of the physical use table ..................................................................... 34

Table 2.6 Simplified IOT (product by product) ............................................................................ 36

Table 2.7 Links between the use table and functional classifications .......................................... 51

Table 2.8 Simplified table linking the SUTs to the institutional sector accounts ......................... 65

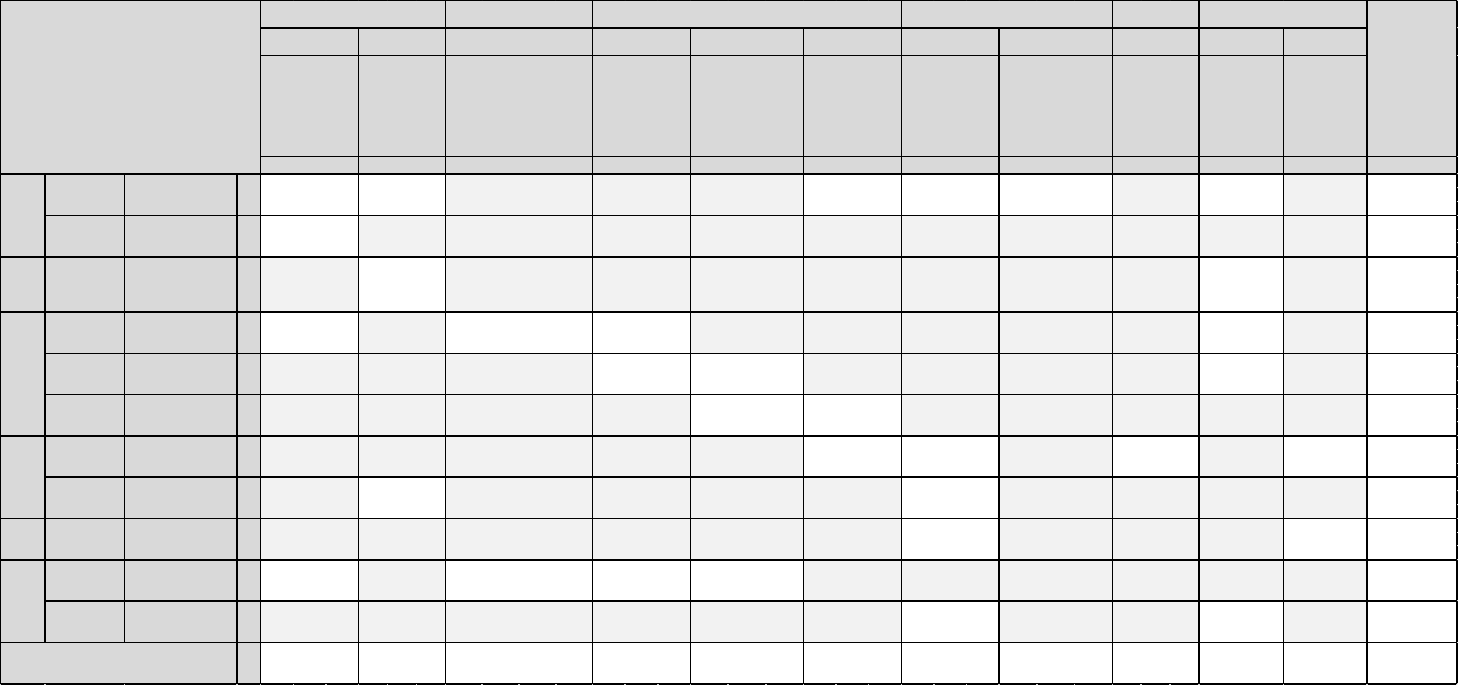

Table 4.1 Examples of the size of published and internal working level SUTs and IOTs ......... 107

Table 5.1 Numerical example of a supply table at basic prices .................................................. 132

Table 5.2 Supply table at basic prices, including a transformation into purchasers’ prices ....... 133

Table 5.3 Data adjustment for external trade of goods and services .......................................... 148

Table 5.4 CIF and FOB adjustment row ..................................................................................... 149

Table 6.1 Use table at purchasers’ prices.................................................................................... 158

Table 6.2 Intermediate consumption of selected inputs into “Manufacture of rubber and plastic

products” ..................................................................................................................................... 169

Table 6.3 Sample product balance for "Gelatine and gelatine derivatives"................................ 170

Table 6.4 Categories of final consumption expenditure ............................................................. 173

Table 6.5 Table linking final expenditures by purpose (COICOP) and product (CPC) ............. 175

Table 6.6 Final consumption expenditure of households (by COICOP headings) ..................... 176

Table 6.7 Table linking final consumption expenditures of NPISHs by purpose (COPNI) and by

product (CPC) ............................................................................................................................. 180

Table 6.8 Table linking final consumption expenditure of general government by COFOG and

CPC ............................................................................................................................................. 182

Table 6.9 Categories of gross capital formation ......................................................................... 183

Table 6.10 Table linking gross fixed capital formation by industries, assets and products ....... 185

Table 6.11 Gross fixed capital formation by investing industry ................................................. 187

Table 6.12 Table linking change in inventories industries, assets and products ........................ 192

Table 7.1 Supply table at basic prices, including a transformation into purchasers’ prices ....... 212

Table 7.2 Use table at purchasers’ prices.................................................................................... 213

Table 7.3 Use-side valuation matrices ........................................................................................ 214

Table 7.4 Use table at basic prices .............................................................................................. 216

Table 7.5 Trade turnover and trade margins for wholesale and retail trade margins ................. 224

Table 8.1 Structure of the imports use table ............................................................................... 251

Table 8.2 Numerical example of the imports use table .............................................................. 251

Handbook on Supply and Use Tables and Input-Output Tables with Extensions and Applications

xiii

Table 8.3 Structure of the domestic use table ............................................................................. 252

Table 8.4 Numerical example of a domestic use table ............................................................... 252

Table 8.5 Example of an input table for imports at basic prices ................................................. 253

Table 8.6 Input-output table for domestic output at basic prices ................................................ 254

Table 8.7 Input-output table for domestic output at basic prices, net exports with adjustment items

..................................................................................................................................................... 255

Table 8.8 Processing within the country ..................................................................................... 261

Table 8.9 Goods sent abroad for processing ............................................................................... 262

Table 8.10 Industry 1 – Alternative input structures .................................................................. 264

Table 9.1 Supply table in current prices and in volume terms .................................................... 280

Table 9.2 Use table in current prices and in volume terms ......................................................... 281

Table 9.3 Gross domestic product in current prices and in volume terms .................................. 283

Table 10.1 Summary of institutional sectors and subsectors ...................................................... 306

Table 10.2 Main features of the SUT approach and the institutional sector approach ............... 307

Table 10.3 Numerical example showing the table linking the SUTs and institutional sector

accounts....................................................................................................................................... 310

Table 10.4 Goods and services for the whole economy ............................................................. 312

Table 10.5 Production account for the whole economy ............................................................. 313

Table 10.6 Link between GDP and industry GVA ..................................................................... 313

Table 10.7 Generation of income account for the whole economy ............................................ 314

Table 12.1 Product-by-product IOT at basic prices .................................................................... 370

Table 12.2 Numerical example of rectangular SUTs for the transformation ............................. 375

Table 12.3 Numerical example of square SUTs for the transformation ..................................... 376

Table 12.4 Transformation matrix for the product technology assumption ............................... 386

Table 12.5 Product-by-product IOTs based on product technology ........................................... 387

Table 12.6 Transformation matrix for industry technology assumption .................................... 388

Table 12.7 Product-by-product IOTs based on industry technology .......................................... 388

Table 12.8 Matrix for hybrid technology .................................................................................... 389

Table 12.9 Transformation matrix for hybrid technology assumption ....................................... 390

Table 12.10 IOTs based on the hybrid technology assumption .................................................. 390

Table 12.11 Transformation matrix for the fixed industry sales structure assumption ............. 391

Table 12.12 IOTs based on the fixed industry sales structure assumption ................................. 392

Table 12.13 Transformation matrix for the fixed product sales structure assumption for rectangular

SUTs ........................................................................................................................................... 394

Table 12.14 IOTs based on the fixed product sales structure assumption derived from rectangular

SUTs ........................................................................................................................................... 394

Table 12.15 Transformation matrix for the fixed product sales structure assumption for square

SUTs ........................................................................................................................................... 395

Table 12.16 IOTs based on the fixed product sales structure assumption for square SUTs....... 396

Handbook on Supply and Use Tables and Input-Output Tables with Extensions and Applications

xiv

Table 12.17 Absolute deviation of IOTs based on rectangular SUTs less IOTs based on square

SUTs for Model D ...................................................................................................................... 397

Table 12.18 Alternative presentations of product-by-product IOTs ........................................... 399

Table 12.19 Empirical example of product-by-product IOTs .................................................... 402

Table 12.20 Empirical example of industry-by-industry IOTs ................................................... 404

Table 13.1 General PSUT ........................................................................................................... 432

Table 13.2 Classes of natural input ............................................................................................. 434

Table 13.3 Typical components for groups of residuals ............................................................. 436

Table 13.4 List of individual components of SEEA physical PSUTs ........................................ 443

Table 13.5 Common national data sources and links to SEEA component accounts ................. 443

Table 13.6 Single region IOT with environmental data ............................................................. 450

Table 13.7 Single region IOT in hybrid units ............................................................................. 452

Table 13.8 Industry-by -industry IOTs (upper block of Table 13.6) .......................................... 453

Table 13.9 Environmental data by industry (lower block of Table 13.6) ................................... 453

Table 13.10 PSUTs in Denmark ................................................................................................. 460

Table 13.11 SUTs for the Netherlands, 2010 ............................................................................. 462

Table 13.12 PSUTs for the Netherlands, 2010 ........................................................................... 463

Table 14.1 Balancing supply and use of products ...................................................................... 477

Table 16.1 SUTs framework for interregional SUTs.................................................................. 507

Table 16.2 Interregional and international trade flows by province and territory, 2010 ........... 510

Table 17.1 Adjustment targets for national tables of selected countries in the Asian international

input-output table for the year 2000............................................................................................ 530

Table 18.1 Categorization of methods ........................................................................................ 561

Table 19.1 Structure of a social accounting matrix .................................................................... 594

Table 19.2 Numerical example of a social accounting matrix .................................................... 595

Table 19.3 Extended IOT with satellite systems ........................................................................ 599

Table 20.1 IOT at basic prices .................................................................................................... 605

Table 20.2 Input coefficients of IOTs ......................................................................................... 610

Table 20.3 Output coefficients of IOTs ...................................................................................... 612

Table 20.4 Input coefficients for domestic intermediate consumption ....................................... 613

Table 20.5 Leontief matrix ......................................................................................................... 614

Table 20.6 Leontief inverse ........................................................................................................ 615

Table 20.7 Quantity input-output model based on monetary data .............................................. 616

Table 20.8 Price input-output model based on monetary data .................................................... 619

Table 20.9 Emission model......................................................................................................... 625

Table 20.10 Input indicators for production activities per unit of output ................................... 628

Table 20.11 Output multipliers (Leontief inverse) ..................................................................... 629

Table 20.12 Multipliers for products .......................................................................................... 632

Table 20.13 Input content of final use by category .................................................................... 635

Table 20.14 Backward linkages .................................................................................................. 637

Handbook on Supply and Use Tables and Input-Output Tables with Extensions and Applications

xv

Table 20.15 Forward linkages..................................................................................................... 637

Table 20.16 Forward and backward linkages ............................................................................. 638

Table 20.17 Normalized forward and backward linkages .......................................................... 638

Table 21.1 Historical benchmark exercises ................................................................................ 664

Table 21.2 Annual business surveys ........................................................................................... 666

Table 21.3 Administrative records .............................................................................................. 667

Table 21.4 SUTs for tobacco products, year 2008, current prices .............................................. 672

Table 21.5 SUT for cleaning and toiletry products, year 2008, current prices ........................... 672

Table 21.6 IOTs for domestic output at basic prices, 2008 ........................................................ 673

Handbook on Supply and Use Tables and Input-Output Tables with Extensions and Applications

xvi

Handbook on Supply and Use Tables and Input-Output Tables with Extensions and Applications

xvii

Abbreviations

AIIOT

Asian International Input-Output Tables

ANZSIC

Australian and New Zealand Standard Industrial Classification

ARIMA

autoregressive integrated moving average

BEC

classification by broad economic categories

BPM

Balance of Payments and International Investment Position Manual

BTDIxE

Bilateral Trade Database by Industry and End-Use

CH

4

methane

CIF

cost, insurance and freight

CO

2

carbon dioxide

COFOG

Classification of the Functions of Government

COICOP

Classification of the Purposes of Non-profit Institutions Serving Households

COPNI

Classification of the Purposes of Non-profit Institutions Serving Households

COPP

Classification of the Outlays of Producers According to Purpose

CPA

Classification of Products by Activity

CPC

Central Product Classification

CPI

consumer price index

CRAS

cell-corrected RAS method

CREEA

compiling and refining of economic and environmental accounts

CSPI

corporate services price index

EBOPS

Extended Balance of Payments Services Classification

ECE

Economic Commission for Europe

Handbook on Supply and Use Tables and Input-Output Tables with Extensions and Applications

xviii

EE-IOT

environmentally extended input-output tables

EPI

export price index

ERETES

equilibre ressources-emplois et tableau entrées-sorties

ESA

European system of accounts

EU

European Union

FAO

Food and Agriculture Organization of the United Nations

FBS

finance and business services

FI

fixed industry

FIGARO

full international and global accounts for research in input-output

analysis

FISIM

financial intermediation services indirectly measured

FOB

free on board

FP

fixed product

GDP

gross domestic product

GENESIS

online databank of the Federal Statistical Office of Germany

GNI

gross national income

GRAS

generalized RAS

GSBPM

Generic Statistical Business Process Model

GTAP

global trade analysis project

GTAP-MRIO

multi-region input–output table based on the global trade analysis project

database

GVA

gross value added

HS

Harmonized Commodity Description and Coding System

ICIO

inter-country input-output

ICPIs

intermediate consumption price indices

Handbook on Supply and Use Tables and Input-Output Tables with Extensions and Applications

xix

ICT

information and communications technology

ILO

International Labour Organization

IMF

International Monetary Fund

IMTS

International Merchandise Trade Statistics: Concepts and Definitions

INSEE

Institut national de la statistique et des études économiques

IOTs

input-output tables

IPCC

Intergovernmental Panel on Climate Change

IPIs

import price indices

ISIC

International Standard Industrial Classification of All Economic Activities

KLEMS

Integrated Industry-Level Production Account

KRAS

Konfliktfreies RAS

MPS

Material Product System

MRIO

multi-region input-output

N

2

O

nitrous oxide

NACE

Statistical Classification of Economic Activities in the European Community

NAICS

North American Industry Classification System

NMVOC

non-methane volatile organic compounds

NOx

mono-nitrogen oxides

NPISH

non-profit institution serving households

OECD

Organization for Economic Cooperation and Development

PIOT

physical input-output tables

PPP

purchasing power parities

PSUT

physical supply and use table

PYPs

previous years’ prices

R&D

research and development

Handbook on Supply and Use Tables and Input-Output Tables with Extensions and Applications

xx

RAS

ranking and scaling data reconciliation method

RPI

retail prices index

SAM

social accounting matrix

SDMX

Statistical Data and Metadata Exchange

SEEA

System of Environmental and Economic Accounts

SESAME

system of economic and social accounting matrices and extensions

SITC

Standard International Trade Classification

SNA

System of National Accounts

SO2

sulphur dioxide

SUT-Euro

Euro method for SUTs

SUTs

supply and use tables

TEC

trade by enterprise characteristics data

TiVA

trade in value added

TLS

taxes less subsidies on products

TRAS

three-stage RAS

TTM

trade and transport margins

UNSD

United Nations Statistics Division

UNWTO

World Tourism Organization

VAT

value added taxes

WCO

World Customs Organization

WIOD

World Input-Output Database

WPI

wholesale price index

WTO

World Trade Organization

Handbook on Supply and Use Tables and Input-Output Tables with Extensions and Applications

1

Part one

Handbook on Supply and Use Tables and Input-Output Tables with Extensions and Applications

2

Handbook on Supply and Use Tables and Input-Output Tables with Extensions and Applications

3

Chapter 1. Introduction

A. Background

1.1. The supply and use tables (SUTs) are an integral part of the System of National Accounts

2008 (2008 SNA) forming the central framework for the compilation of a single and coherent

estimate of gross domestic product (GDP) integrating all the components of production, income

and expenditure approaches, and providing key links to other parts of the SNA framework.

1.2. In their simplest form, the SUTs describe how products (goods and services) are brought

into an economy (either as a result of domestic production or imports from other countries) in the

supply table, and how those same products (intermediate consumption; final consumption by

household, non-profit institutions serving households, and general government; gross capital

formation; and exports) are used in the use table.

1.3. The SUTs also provide the link between components of gross value added (GVA), industry

inputs and outputs. Although typically they show only the industry dimension, SUTs can also be

formulated to show the role of different institutional sectors (for example, non-financial

corporations, government, and others) providing an important linking mechanism to the different

accounts of the SNA framework (the goods and services account, production account, generation

of income account and the capital account).

1.4. Importantly, and by design, these interlinkages facilitate data confrontation and the

examination of the consistency of data on goods and services obtained from different statistical

sources, such as business surveys, household surveys and administrative data within a single

detailed framework. As such, they provide a powerful mechanism for feedback on the quality and

coherency of primary data sources.

1.5. The SUTs do not just provide a framework to ensure the best quality estimates of GDP and

its components: they are also an important analytical resource in their own right, showing the

interaction between producers and consumers. When measured in volume terms, the SUTs provide

the basis for a rich stream of analyses, notably in the field of structural analysis, and in particular

productivity, where in recent years SUTs have been widely accepted as an important tool for

Handbook on Supply and Use Tables and Input-Output Tables with Extensions and Applications

4

KLEMS-type

2

productivity measures. Just as important is their growing use as the basis for

deriving the input-output tables (IOTs).

1.6. In many respects, the IOTs, which show the links between final uses and intermediate uses

of goods and services defined according to industry outputs (industry-by-industry tables) or

according to product outputs (product-by-product tables) predate the SUTs. The IOTs also show

separately the consumption of domestically produced and imported goods and services. The

widespread availability of SUTs has meant, however, that the SUTs form the starting point for

constructing IOTs and, in turn, an entire swathe of related analytical products and indicators, such

as the Leontief inverse and other type of analyses, including output multipliers, employment

multipliers, and others.

1.7. The SUTs and IOTs are compiled by many countries in the course of producing their core

national accounts, thereby improving the coherency and consistency of their national account

estimates. The ability to readily create IOTs from SUTs (as shown in chapter 12) has helped to

reinforce the momentum behind the evolution, role and use of SUTs.

1.8. SUTs and IOTs have received much attention in recent years. This is because their

analytical properties allow for a much wider set of analyses, not only of the national economy and

the regions within a nation but also of the interlinkages between economies at the global level and

also of environmental impacts.

1.9. Further momentum has been generated for the role of SUTs and IOTs in step with the

rapidly growing impact of globalization and the international fragmentation of production. For a

full understanding of international interdependencies and their impact on important policy areas,

such as trade, competitiveness and sustainable development, there is increasing need to view

production and consumption through a global value chain lens. In other words, multi-country and

regional SUTs and IOTs have become essential tools to inform policy and policymakers. Over the

past five years, a number of efforts have been made by the international statistics community to

meet these needs, such as the trade in value added database prepared by the Organization for

Economic Cooperation and Development (OECD) and the World Trade Organization (WTO), and

other comparable databases such as the World Input-Output Database (WIOD) and the Handbook

on Accounting for Global Value Chains prepared by the Expert Group on International Trade and

Economic Globalization Statistics.

1.10. Given these developments and, in particular, the heightened importance of SUTs and IOTs,

the timing of the present Handbook is important and highly relevant. The present chapter provides

a general introduction to the various issues considered in greater detail in the various chapters that

follow. Section B of this introductory chapter provides a general overview of the roles and uses of

2

KLEMS is an industry-level growth and productivity research project, based on the analysis of capital (K), labour

(L), energy (E), materials (M) and service (S) inputs.

Handbook on Supply and Use Tables and Input-Output Tables with Extensions and Applications

5

SUTs and IOTs. Section C covers the SNA and its links to SUTs and IOTs. Section D covers the

objectives of the Handbook and its new features compared to previous manuals on the subject.

Lastly, section E briefly outlines the structure and content of the Handbook.

B. Uses of SUTs and IOTs

1.11. The uses of SUTs and IOTs are multiple and their statistical and analytical importance has

increased with time and in response to new and emerging issues, such as globalization and

sustainable development, with its three pillars of social, economic and environmental

development. Where possible, the analytical uses of SUTs and IOTs are presented below in

parallel. As SUTs form the basis for the compilation of IOTs, the uses of the two types of tables

are treated in the same way in this section.

1.12. As mentioned above, the SUTs combine in a single framework the three approaches to

measuring GDP, namely, the production approach, the income approach and the expenditure

approach. All three approaches are based on sets of data with various levels of detail and a range

of different sources. Combining the data in a single statistical framework compels compilers to

use harmonized and unique classifications of producers, users and income receivers, together with

harmonized and unique classifications and definitions of products and income categories. Under

these conditions, corresponding data can be related and compared in an organized manner.

Combining the three data sets provides an opportunity to analyse the causes of discrepancies, make

necessary adjustments and fill data gaps when necessary.

1.13. An important objective of national accounts is to estimate year-to-year and quarter-to-

quarter changes in a number of macroeconomic variables. When dealing with production, use and