1

COMMITTEE ON WAYS AND MEANS,

U.S. HOUSE OF REPRESENTATIVES,

WASHINGTON, D.C.

INTERVIEW OF: GARY A. SHAPLEY, JR.

Friday, May 26, 2023

Washington, D.C.

The interview in the above matter was held in 5480 O'Neill House Office Building,

commencing at 9:33 a.m.

2

Appearances:

For the COMMITTEE ON WAYS AND MEANS:

, MAJORITY COUNSEL

, MAJORITY COUNSEL

, MAJORITY COUNSEL

, MAJORITY STAFF

, MAJORITY STAFF

, MAJORITY COUNSEL

, MINORITY COUNSEL

, MINORITY COUNSEL

, MINORITY COUNSEL

For GARY A. SHAPLEY, JR.:

MARK D. LYTLE,

PARTNER,

NIXON PEABODY LLP

TRISTAN LEAVITT,

PRESIDENT,

EMPOWER OVERSIGHT

3

MAJORITY COUNSEL 1. Good morning. This is a transcribed interview of

Internal Revenue Service Criminal Supervisory Special Agent Gary Shapley.

Chairman Jason Smith has requested this interview following a letter sent to the

committee through counsel on April 19th, 2023, indicating Mr. Shapley's desire to make

protected whistleblower disclosures to Congress.

This interview is being conducted as part of the committee's oversight of the

Internal Revenue Code and the Internal Revenue Service.

Would the witness please state your name for the record?

Mr. Shapley. Gary Shapley.

MAJORITY COUNSEL 1. Could counsel for the witness please state your names

for the record?

Mr. Lytle. Mark Lytle.

Mr. Leavitt. Tristan Leavitt.

MAJORITY COUNSEL 1. On behalf of the committee, I want to thank you for

appearing here today to answer our questions and for coming forward to make these

disclosures to Congress.

My name is . I'm an attorney on Chairman Smith's Ways and Means

Committee staff.

I'll now have everyone else from the committee who is here at the table introduce

themselves as well.

MAJORITY COUNSEL 2. with the majority staff.

MAJORITY COUNSEL 3. , majority staff.

MAJORITY STAFF. , majority staff.

MAJORITY COUNSEL 4. , majority staff.

MAJORITY STAFF. , majority staff.

4

MINORITY COUNSEL 1. , minority staff.

MINORITY COUNSEL 2. , minority staff.

MINORITY COUNSEL 3. , minority.

MAJORITY COUNSEL 1. Thank you.

I'd like to now go over the ground rules and guidelines we'll follow during today's

interview.

Because you have come forward as a whistleblower and seek to make disclosures

to Congress, we will first give you an opportunity to make an opening statement.

Following your statement, the questioning will proceed in rounds. The majority

will ask questions first for one hour, and then the minority will have an opportunity to ask

questions for an equal period of time if they choose. We will alternate back and forth

until there are no more questions and the interview is over.

Typically, we take a short break at the end of each hour, but if you would like to

take a break apart from that, please just let us know.

As you can see, there is an official court reporter taking down everything we say to

make a written record, so we ask that you give verbal responses to all questions.

Do you understand?

Mr. Shapley. Yes, I do.

MAJORITY COUNSEL 1. So the court reporter can take down a clear record, we

will do our best to limit the number of people directing questions at you during any given

hour to just those people on staff whose turn it is.

Please try and speak clearly so the court reporter can understand and so everyone

at the end of the table can hear you. It is important that we don't talk over one another

or interrupt each other if we can help it, and that goes for everyone present at today's

interview.

5

We want you to answer our questions in the most complete, truthful manner as

possible, so we will take our time. If you have any questions or if you do not understand

one of our questions, please let us know.

Our questions will cover a wide range of topics, so if you need clarification on any

point, just say so. If you honestly don't know the answer to a question or do not

remember, it is best not to guess. Please give us your best recollection.

It is okay to tell us if you learned the information from someone else. Just

indicate how you came to know the information. If there are things you don't know or

can't remember, just say so and please inform us who, to the best of your knowledge,

might be able to provide a more complete answer to the question.

If you need to confer with counsel, we can go off the record and stop the clock

until you are prepared to respond.

You should also understand that, by law, you're required to answer questions

from Congress truthfully.

Do you understand?

Mr. Shapley. Yes, I do.

MAJORITY COUNSEL 1. This also applies to questions posed by congressional

staff in an interview.

Do you understand?

Mr. Shapley. Yes, I do.

MAJORITY COUNSEL 1. Witnesses that knowingly provide false testimony could

be subject to criminal prosecution for perjury or making a false statement under 18 U.S.C.

1001.

Do you understand?

Mr. Shapley. Yes, I do.

6

MAJORITY COUNSEL 1. Is there any reason you are unable to provide truthful

answer to today's questions?

Mr. Shapley. There is not.

MAJORITY COUNSEL 1. Finally, I'd like to note the information discussed here

today is confidential. As an IRS agent, I know you understand the significance of our tax

privacy laws. Chairman Smith takes our tax privacy laws extremely seriously, and we

have worked diligently to make sure that you can provide your disclosures to Congress in

a legal manner and with the assistance of counsel.

As I'm sure you know, 26 U.S.C. Section 6103 makes tax returns and return

information confidential, subject to specific authorizations or exceptions in the statute.

The statute anticipates and provides for whistleblowers like yourself to come

forward and share information with Congress under Section 6103(f)(5).

Specifically, that statute permits a person with access to returns or return

information to disclose it to a committee referred to in subsection (f)(1) or any individual

authorized to receive or inspect information under paragraph (4)(A) if the whistleblower

believes such return or return information may relate to possible misconduct,

maladministration, or taxpayer abuse.

In your position at the IRS, do you or did you have access to return or return

information covered by Section 6103 of the Internal Revenue Code?

Mr. Shapley. Yes.

MAJORITY COUNSEL 1. Have you had access to return information that you

believe may relate to possible misconduct, maladministration, or taxpayer abuse?

Mr. Shapley. Yes.

MAJORITY COUNSEL 1. Do you wish to disclose such information to the

committee today?

7

Mr. Shapley. Yes, I do.

MAJORITY COUNSEL 1. In addition to Section 6103(f)(5), the chairman of the

committee on Ways and Means has authority under Section 6103(f)(4)(A) to designate

agents to receive and inspect returns and return information.

To facilitate the disclosures you wish to make here today, Chairman Smith has

designated the individuals in this room for the purposes of receiving the information you

wish to share. The chairman considers this entire interview and the resulting transcript

as protected confidential information under Section 6103.

That means that this interview can only proceed so long as everyone in the room

is properly designated to receive the information. The chairman has designated the

court reporter and the related individuals that provide transcription services to the House

of Representatives.

I'd like to remind the witness and everyone in the room that 26 U.S.C. Section

7213 makes it unlawful to make any disclosure of returns or return information not

authorized by Section 6103. Unauthorized disclosure of such information can be a

felony punishable by fine or imprisonment.

Given the statutory protection for this type of information, we ask that you not

speak about what we discuss in this interview to individuals not designated to receive

such information.

For the same reason, the marked exhibits that we use today will remain with the

court reporter so that they can go in the official transcript, and any copies of those

exhibits will be returned to us when we wrap up.

We also understand that you have alleged that you have been retaliated against

for seeking to blow the whistle inside your agency and to Congress. We will discuss that

issue in more detail, but I will note that Chairman Smith values whistleblowers and knows

8

that whistleblowers take significant risks when disclosing wrongdoing. That is why there

are legal protections in place for whistleblowers making disclosures to Congress, such as

the protections in 5 U.S.C. Section 2302(b)(8)(C), which your counsel identified in your

initial letter to the committee.

At a hearing before the Ways and Means Committee on April 27th, 2023,

Chairman Smith asked IRS Commissioner Werfel to commit that there will be no

retaliation against whistleblowers. The IRS Commissioner replied, quote, "I can say

without hesitation, any hesitation, there will be no retaliation for anyone making an

allegation," end quote.

Since that time, you have shared additional information with the committee

regarding allegations of retaliation. This is very troubling, particularly given

Commissioner Werfel's testimony before the committee. We will discuss your

allegations in greater detail today.

That is the end of my preamble. Is there anything my colleagues from the

minority would like to add?

MINORITY COUNSEL 1. Thanks, .

Thank you very much for appearing before us today. I personally am very happy

that you were able to share with us some information in advance, because I think that

helped us get prepared for this meeting today. I look forward to hearing what you have

to say. Thank you for coming in.

MAJORITY COUNSEL 1. And with that, we invite you to begin with an opening

statement, after which we will begin questioning.

Mr. Shapley. So thank you for having me here today.

My name is Gary Shapley. I am a supervisory special agent with the Internal

Revenue Service Criminal Investigation. I have been an IRS agent since July 2009, and

9

have served as a supervisory special agent or acting assistant special agent in charge since

April 2018.

I grew up in a little town in upstate New York and never thought that I would be in

this position I am today. I was taught to be proud of this country that had afforded me

so many opportunities and to always do the right thing -- the right thing, a simple

philosophy that has me sitting here today. There is no reward for me for becoming a

whistleblower. The only win for me is to not be fired or arrested or retaliated against.

Before October of 2022, I had received the highest awards available to me in my

agency and multiple awards from DOJ. In October 2022, I was a senior leader, assistant

special agent in charge of the Chicago Field Office, and received the highest performance

rating available that year as an outstanding.

I was planning to transition to a new position in headquarters for an international

collaboration of foreign tax organizations that I was picked to help set up and operated

since 2018. I have led, planned, and executed undercover operations and/or search

warrants in over a dozen countries. I have investigated and managed some of the

largest cases in U.S. history and of the history of the agency, recovering over $3.5 billion

for the United States Government.

Since October 2022, IRS CI has taken every opportunity to retaliate against me and

my team.

I was passed over for a promotion for which I was clearly most qualified.

The special agent in charge and assistant special agent in charge of the

Washington, D.C. Field Office have sent threats to the field office, suppressing additional

potential whistleblowers from coming forward.

Even after IRS CI senior leadership had been made aware on a recurring basis that

the Delaware U.S. Attorney's Office and the Department of Justice was acting improperly,

10

they acquiesced to a DOJ request to remove the entire team from the Hunter Biden

investigation, a team that had been investigating it for over 5 years. Passing the buck

and deferring to others was a common theme with IRS CI leadership during this

investigation.

After you hear my testimony, I believe you will understand why my conscience

would not be silenced. My oath of office would have been unfulfilled if I did nothing. I

went from a senior leader to a pariah, and the only thing that happened in between was

that I blew the whistle.

I am blowing the whistle because the Delaware U.S. Attorney's Office, Department

of Justice Tax, and Department of Justice provided preferential treatment and unchecked

conflicts of interest in an important and high-profile investigation of the President's son,

Hunter Biden.

The mission of IRS CI is to investigate potential criminal violations of Internal

Revenue Code and related financial crimes in a manner that fosters confidence in the

Code and compliance with the law.

That mission can only be met by treating every taxpayer we encounter the same.

The normal process must be followed. If search warrants or witness interviews or

document requests that include the actual subjects' names are not allowed, for example,

that is simply a deviation from the normal process that provided preferential treatment,

in this case to Hunter Biden.

The case agent on this case is one of the best agents in the entire agency.

Without his knowledge and persistence, DOJ would have prevented the investigative

team from collecting enough evidence to make an informed assessment, which ultimately

included even DOJ agreeing on the recommended criminal charges.

I am alleging, with evidence, that DOJ provided preferential treatment,

11

slow-walked the investigation, did nothing to avoid obvious conflicts of interest in this

investigation.

I have absolutely no political activities in my past. I vote in the general election

and recently voted in the midterms because of an interest in the process for my children,

who I took to witness one of the pillars of this Nation, the right to vote.

I have never given a dollar to any campaign, never attended a campaign event at

any level of government, never had a campaign sign on my car, lawn, et cetera. I do not

own and have never owned a tee shirt or hat with any election topic. I vote for the

candidate, not the party. I have voted for Presidents with both an R and/or a D in front

of their names.

I speak on this topic so I can try to head off time that might be spent on it. In the

end, a fact is a fact, regardless of the political affiliation of the person who brought it to

you.

I am hoping the whistleblower process will allow me to give this protected

disclosure and leave it to you to make your determinations based on what my testimony

and the documents say about the investigation.

I respect this institution and have faith that the issues I raise will be considered

appropriately. I beg of you to protect me from the coming retaliatory storm. You are

my only hope, and your actions send a message to all those out there that see

wrongdoing but are terrified to bring it to light.

In this country, we believe in the rule of law, and that applies to everyone. There

is not a two-track justice system depending on who you are and who you're connected to.

But the criminal tax investigation of Hunter Biden, led by the United States

Attorney's Office for the District of Delaware, has been handled differently than any

investigation I've ever been a part of for the past 14 years of my IRS service.

12

Some of the decisions seem to be influenced by politics. But whatever the

motivations, at every stage decisions were made that had the effect of benefiting the

subject of the investigation. These decisions included slow-walking investigative steps,

not allowing enforcement actions to be executed, limiting investigators' line of

questioning for witnesses, misleading investigators on charging authority, delaying any

and all actions months before elections to ensure the investigation did not go overt well

before policy memorandum mandated the pause. These are just only a few examples.

The investigation into Hunter Biden, code name Sportsman, was first opened in

November 2018 as an offshoot of an investigation the IRS was conducting into a

foreign-based amateur online pornography platform. Special Agent

developed the investigative lead and was assigned to be the original case agent.

In October 2019, the FBI became aware that a repair shop had a laptop allegedly

belonging to Hunter Biden and that the laptop might contain evidence of a crime. The

FBI verified its authenticity in November of 2019 by matching the device number against

Hunter Biden's Apple iCloud ID.

When the FBI took possession of the device in December 2019, they notified the

IRS that it likely contained evidence of tax crimes. Thus, Special Agent drafted an

affidavit for a Title 26 search warrant, which a magistrate judge approved that month.

In January 2020, I became the supervisor of the Sportsman case. The group,

known as the International Tax and Financial Crimes group, or the ITFC, is comprised of 12

elite agents who were selected based on their experience and performance in the area of

complex high-dollar international tax investigations.

The IRS direct investigative team, including the co-case agent, case agent, and me,

were working closely with the FBI and the Delaware U.S. Attorney's Office and

Department of Justice Tax in biweekly prosecution team meetings, or pros meetings.

13

Yet, it soon became clear to me this case was being handled differently than any I'd seen

before.

As early as March 6th, 2020, I sent a sensitive case report up through my chain of

command at IRS reporting that by mid-March the IRS would be ready to seek approval for

physical search warrants in California, Arkansas, New York, and Washington, D.C.

Special Agent drafted an April 1st, 2020, affidavit establishing probable

cause for these physical search warrants. We also planned to conduct approximately 15

contemporaneous interviews at that time.

Yet, after former Vice President Joseph Biden became the presumptive

Democratic nominee for President in early April 2020, career DOJ officials dragged their

feet on the IRS taking these investigative steps.

By June 2020, those same career officials were already delaying overt investigative

actions. This was well before the typical 60- to 90-day period when DOJ would

historically stand down before an election. It was apparent that DOJ was purposely

slow-walking investigative actions in this matter.

On a June 16th, 2020, call Special Agent and I had with our chain of

command up to the Director of Field Operations, I pointed out that if normal procedures

had been followed we already would have executed search warrants, conducted

interviews, and served document requests. Nevertheless, my IRS chain of command

decided we would defer to DOJ.

Thus, I became the highest-ranking IRS CI leader to participate in our prosecution

team calls, be up to date on specific case strategies, to discuss the investigation with DOJ

and the Delaware U.S. Attorney's Office, and to address concerns as they arose.

From around October 2020 through October 2022, I was the IRS CI manager who

interacted directly with the United States Attorney, David Weiss, and individuals at DOJ

14

Tax Division the most.

Even after investigative steps were denied, enforcement operations were rejected

by DOJ, leading to the election in November 2020, we continued to obtain further leads in

the Sportsman's case and prepared for when we could go overt.

For example, in August 2020, we got the results back from an iCloud search

warrant. Unlike the laptop, these came to the investigative team from a third-party

record keeper and included a set of messages. The messages included material we

clearly needed to follow up on.

Nevertheless, prosecutors denied investigators' requests to develop a strategy to

look into the messages and denied investigators' suggestion to obtain location

information to see where the texts were sent from.

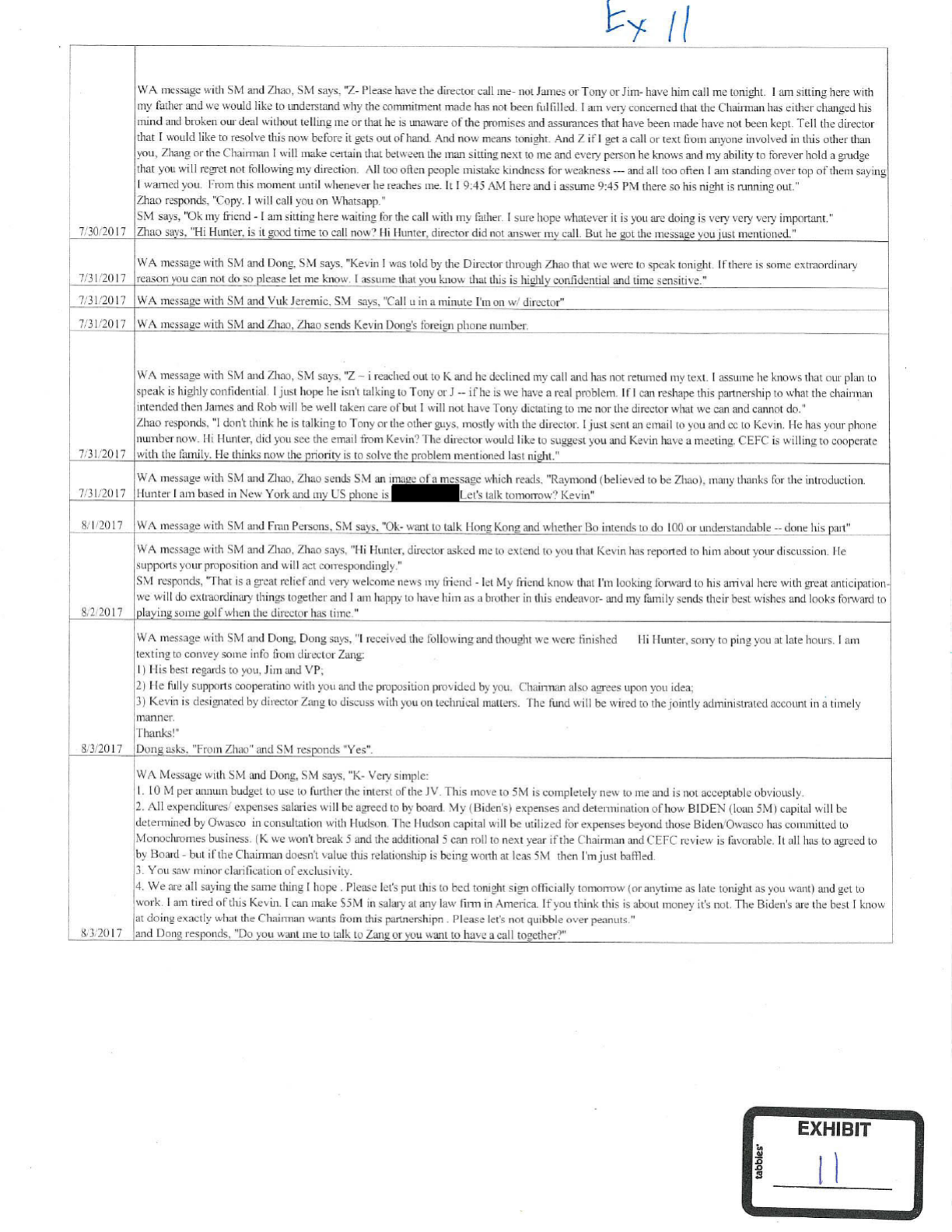

For example, we obtained a July 30th, 2017, WhatsApp message from Hunter

Biden to Henry Zhao, where Hunter Biden wrote: "I am sitting here with my father and

we would like to understand why the commitment made has not been fulfilled. Tell the

director that I would like to resolve this now before it gets out of hand, and now means

tonight. And, Z, if I get a call or text from anyone involved in this other than you, Zhang,

or the chairman, I will make certain that between the man sitting next to me and every

person he knows and my ability to forever hold a grudge that you will regret not following

my direction. I am sitting here waiting for the call with my father."

Communications like these made it clear we needed to search the guest house at

the Bidens' Delaware residence where Hunter Biden stayed for a time.

In a September 3rd, 2023 [2020], pros meeting, the Assistant United States

Attorney, Lesley Wolf, told us there was more than enough probable cause for the

physical search warrant there, but the question was whether the juice was worth the

squeeze. She continued that optics were a driving factor in the decision on whether to

15

execute a search warrant. She said a lot of evidence in our investigation would be found

in the guest house of former Vice President Biden, but said there is no way we will get

that approved.

The prosecutors even wanted to remove Hunter Biden's name from electronic

search warrants, 2703(d) orders, and document requests. Special Agent said on

the call he felt uncomfortable with removing the subject's name from those documents

just based on what might or might not be approved, as that seemed unethical. But his

concerns were ignored.

And Department of Justice Tax Line Attorney Jack Morgan said, doing it without

Hunter Biden's name would probably still get us, in quote, "most" of the data we sought.

I have never been part of an investigation where only getting most of the data was

considered sufficient.

On September 3rd, 2020, the slow-walking of process continued when AUSA Wolf

stated that a search warrant for the emails for Blue Star Strategies was being sat on by

OEO. That's the Department of Justice Office -- actually, I'm sorry. I don't know what it

means, the acronym.

She indicated it would likely not get approved. This was a significant blow to the

Foreign Agents Registration Act piece of the investigation.

On September 4th, 2020, Deputy Attorney General Donoghue issued a cease and

desist of all overt investigative activities due to the coming election. AUSA Wolf made

several odd statements, to include that DOJ was under fire and it was self-inflicted. She

stated that DOJ needed to repair their reputation.

At the next pros meeting, on September 21st, 2020, the FBI tried to dictate that

we only do five of the planned interviews so FBI management could reevaluate if they

wanted to continue assisting. Special Agent told them it seems inappropriate for

16

them to dictate in an IRS investigation who should be interviewed.

Later that day, I learned the FBI case agent in Delaware had only recently moved

back to his hometown of Wilmington with his wife and family and was concerned about

the consequences for him and his family if they conducted these sensitive interviews and

executed a search warrant of the President Biden guest house.

On October 19th, 2020, I emailed Assistant United States Attorney Wolf: "We

need to talk about the computer. It appears the FBI is making certain representations

about the device, and the only reason we know what is on the device is because of the

IRS CI affiant search warrant that allowed access to the documents. If Durham also

executed a search warrant on a device, we need to know so that my leadership is

informed. My management has to be looped into whatever the FBI is doing with the

laptop. It is IRS CI's responsibility to know what is happening. Let me know when I can

be briefed on this issue."

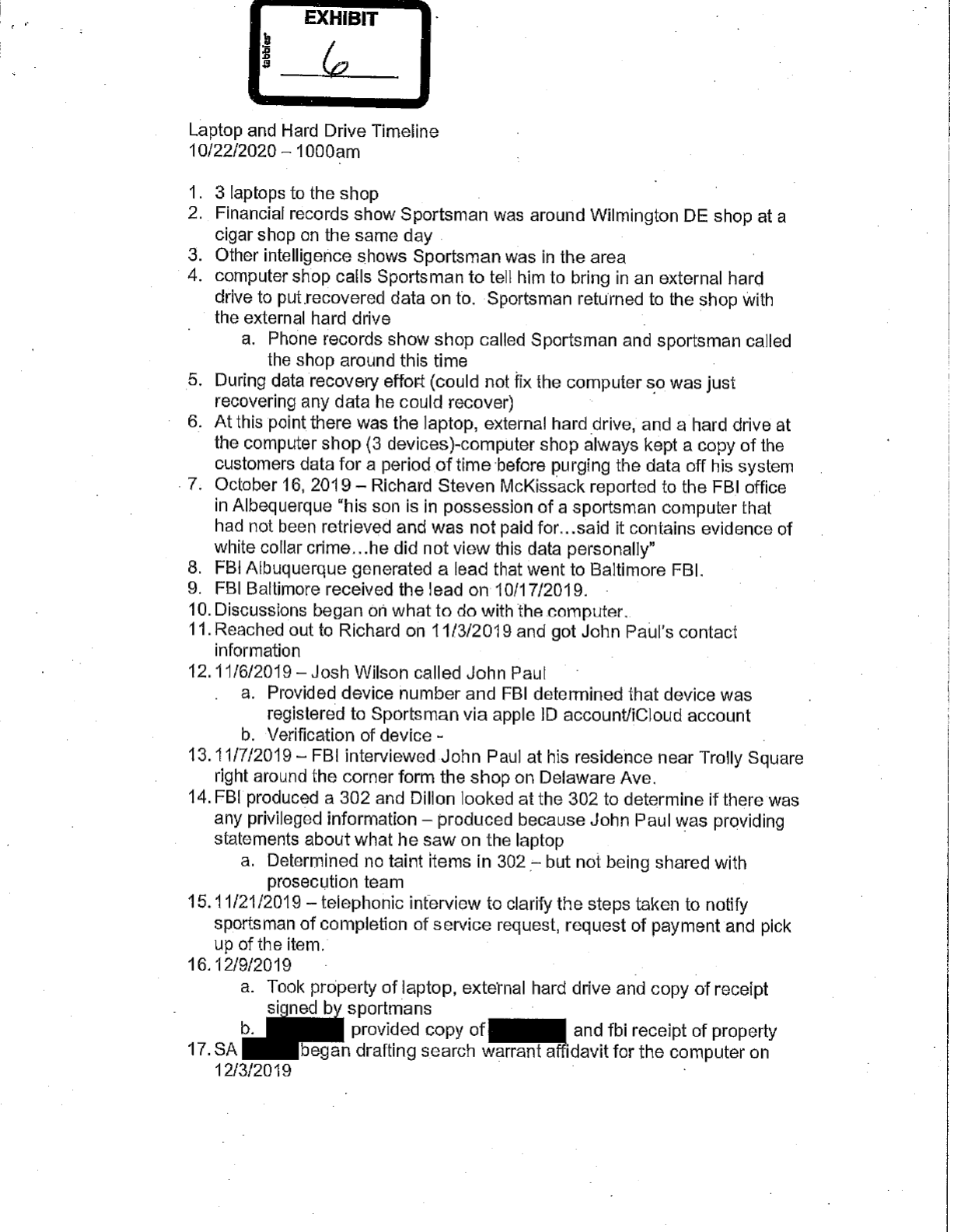

My email led to a special meeting on October 22nd, 2020, with the prosecution

team and the FBI's computer analysis team to discuss Hunter Biden's laptop. We once

again objected that we still had not been given access to the laptop.

Special Agent asked about the full filter reviewed copy of the contents of

the devices. He stated he had not been provided with the data. AUSA Lesley Wolf

stated that she would not have seen it because, for a variety of reasons, prosecutors

decided to keep it from the investigators. This decision is unprecedented in my

experience.

Investigators assigned to this investigation were obstructed from seeing all the

available evidence. It is unknown if all the evidence in the laptop was reviewed by

agents or by prosecutors.

Based on guidance provided by the prosecutors on a recurring basis to not look

17

into anything related to President Biden, there is no way of knowing if evidence of other

criminal activity existed concerning Hunter Biden or President Biden.

AUSA Wolf acknowledged that there was no reason to believe that any data was

manipulated on devices by any third party. She further supported this belief by

mentioning that they corroborated the data with other sources of information received.

Also on an October 22nd, 2020, pros team call, AUSA Wolf stated that United

States Attorney David Weiss had reviewed the affidavit for search warrant of Hunter

Biden's residence and agreed that probable cause had been achieved.

Even though the legal requirements were met and the investigative team knew

evidence would be in these locations, AUSA Wolf stated that they would not allow a

physical search warrant on Hunter Biden.

The case agent and I raised the issue to IRS CI leadership on a continued basis, to

include in a June 16th, 2020, meeting with the Director of Field Operations, where I

stated: "DOJ Tax has made a concerted effort to drag their feet concerning conducting

search warrants and interviewing key witnesses in an effort to push those actions to a

timeframe where they can invoke the Department of Justice rule of thumb concerning

affecting elections." No follow-up questions were asked and no action was taken by IRS

CI senior leadership.

Because the 2020 election was contested, our original plan to go overt on or

around November 17th was delayed. DOJ pushed back against the day of action date

because they did not want to approach Hunter Biden while he was in Delaware,

potentially collocated with President Biden.

United States Attorney Weiss stated on November 10th, 2020, that he had to

delay the day of action because it was a contested election. He also stated that because

there was no leak in the investigation to date, therefore not public at the time, that the

18

primary focus was to protect the integrity of the investigation, which meant to keep it

concealed from the public.

We began preparing for what we called our day of action on December 8th, 2020.

That included document requests and approximately 12 interviews around the country.

The search warrant had been rejected by DOJ, and we included a possibility of a potential

consent search of Hunter Biden's residence, which was a Hail Mary.

On December 3rd, 2020, we had around a 12-hour long meeting at the United

States Attorney's Office in Delaware with the prosecution team. United States Attorney

Weiss came in at the beginning of the meeting and jubilantly congratulated the

investigative team for keeping the investigation a "secret," quote.

Weiss was in and out for the rest of the meeting, but it went downhill from there.

We shared with prosecutors our outline to interview Hunter Biden's associate, Rob

Walker. Among other things, we wanted to question Walker about an email that said:

"Ten held by H for the big guy." We had obvious questions like who was H, who the big

guy was, and why this percentage was to be held separately with the association hidden.

But AUSA Wolf interjected and said she did not want to ask about the big guy and

stated she did not want to ask questions about "dad." When multiple people in the

room spoke up and objected that we had to ask, she responded, there's no specific

criminality to that line of questioning.

This upset the FBI too. And as I'll explain in a moment, the IRS and FBI agents

conducting this interview tried to skirt AUSA Wolf's direction.

Hunter Biden was assigned Secret Service protection on or around our December

3rd meeting. So we developed a plan for the FBI Los Angeles special agent in charge to

reach out at 8 a.m. on December 8th to the Secret Service Los Angeles special agent in

charge and tell them that we would be coming to the residence to seek an interview with

19

Hunter Biden and that it was part of an official investigation.

However, the night before, December 7th, 2020, I was informed that FBI

headquarters had notified Secret Service headquarters and the transition team about the

planned actions the following day. This essentially tipped off a group of people very

close to President Biden and Hunter Biden and gave this group an opportunity to obstruct

the approach on the witnesses.

The next morning, when I saw my FBI counterpart, Supervisory Special Agent Joe

Gordon, he was clearly dejected about how our plan had been interfered with. FBI SSA

Gordon memorialized the new plan in an email the morning of December 8th, 2020, that

stated the subject and the Secret Service protectees would be given the phone numbers

of the FBI SSA Joe Gordon and I and the subject would call us if he wanted to speak with

us.

SSA Gordon and I waited in the car outside of Hunter Biden's California residence

waiting for a phone call. It was no surprise that the phone call SSA Gordon received was

from his ASAC Alfred Watson, who informed us that Hunter Biden would contact us

through his attorneys.

We received a telephone call later that morning from Hunter Biden's attorneys,

who said he would accept service for any document requests, but we couldn't talk to his

client. The public news of our investigation hit the press the next day.

I can't know for certain whether FBI's advance notice played a role or not, but of

the 12 interviews we hoped to conduct on our day of action, we only got one substantive

interview. It was with Rob Walker in Arkansas, and it was exactly the sort of interview

we expected to have if the FBI hadn't tipped off Secret Service and the transition team.

In the interview, the FBI agent tried to get Rob Walker to talk about the "ten held

by H" email while not directly contradicting AUSA Wolf's direction not to ask about the,

20

quote, "big guy." The FBI agent said, this is a quote: "The famous email that Tony was

pointing out like the equity split, can you tell me your opinion of that, when it's going

through like, you know, ten B dot-dot-dot held by H?"

Walker answered: "I think that maybe James was wishful thinking or maybe he

was just projecting that, you know, if this was a good relationship and this was something

that was going to happen, the VP was never going to run, just protecting that, you know,

maybe at some point he would be a piece of it, but he was more just, you know -- it looks

terrible, but it's not. I certainly never was thinking at any time the VP was a part of

anything we were doing."

And yet it was clearly valuable for the investigators to ask about Hunter Biden's

dad, as Walker went on to describe an instance in which the former Vice President

showed up at a CEFC meeting.

Walker said: "We were at the Four Seasons and we were having lunch and he

stopped in, just said hello to everybody. I don't even think he drank water. I think

Hunter Biden said, 'I may be trying to start a company or try to do something with these

guys and could you?' And I think he was like, if I'm around and he'd show up."

The FBI agent asked: "So you definitely got the feeling that that was

orchestrated by Hunter Biden to have like an appearance by his dad at that meeting just

to kind of bolster your chances at making a deal work out?"

Walker answered: "Sure."

The FBI agent continued: "Any times when he was in office, or did you hear

Hunter Biden say that he was setting up a meeting with his dad with them while dad was

still in office?"

Walker answered: "Yes."

And, inexplicably, the FBI agent changed the subject.

21

On December 10th, 2020, the prosecutorial team met again to discuss the next

steps. One piece of information that came out of the day of action was that Hunter

Biden vacated the Washington, D.C., office of Owasco. His documents all went into a

storage unit in northern Virginia. The IRS prepared an affidavit in support of a search

warrant for the unit, but AUSA Wolf once again objected.

My special agent in charge and I scheduled a call with United States Attorney

Weiss on December 14th just to talk about that specific issue. United States Attorney

Weiss agreed that if the storage unit wasn't accessed for 30 days we could execute a

search warrant on it.

No sooner had we gotten off the call then we heard AUSA Wolf had simply

reached out to Hunter Biden's defense counsel and told him about the storage unit, once

again ruining our chance to get to evidence before being destroyed, manipulated, or

concealed.

My special agent in charge at the time emailed that she would be informing the

director of field operations and the deputy chief of IRS CI of her, quote, "frustration with

the United States Attorney's Office not allowing us to go forward with a search warrant."

To this day, I have no way of knowing if the documents from that unit were among

those ultimately provided to our team.

This was the second search warrant where prosecutors agreed that probable

cause was achieved, but would not allow the investigators to execute a search warrant, a

clear indication of preferential treatment of Hunter Biden.

In a briefing that I requested to make to Director of Field Operations Batdorf and

SAC Waldon on March 2nd, 2021, investigators mentioned the possibility of blowing the

whistle on how DOJ was handling this case. My special agent in charge disengaged and

was minimally involved moving forward.

22

This same sort of unprecedented behavior continued through 2021. For

example, as I wrote to my chain of command on a May 3rd, 2021, memo: "This

investigation has been hampered and slowed by claims of potential election meddling.

Through interviews and review of evidence obtained, it appears there may be campaign

finance criminal violations. AUSA Wolf stated on the last prosecution team meeting that

she did not want any of the agents to look into the allegation. She cited a need to focus

on the 2014 tax year, that we could not yet prove an allegation beyond a reasonable

doubt, and that she does not want to include their Public Integrity Unit because they

would take authority away from her. We do not agree with her obstruction on this

matter," end quote.

After we shared on August 18th, 2021, and multiple times thereafter about

interviews we had planned, on September 9th, 2021, AUSA Wolf emailed us: "I do not

think you are going to be able to do these interviews as planned." She told us they

would require approval from the Tax Division.

These delays extended through September and into October. Then the United

States Attorney's Office raised other objections. Part of what we examined were

charges made with Hunter Biden's card that might conceivably have been done by his

children. However, on October 21st, 2021, AUSA Wolf told us it will get us into hot

water if we interview the President's grandchildren.

As a result of this behavior, I went to my Director of Field Operations in November

2021 to express how poorly DOJ was handling this case. Despite these obstacles, around

this time Special Agent began drafting the Special Agent Report, or SAR, which is a

document in which IRS recommends what charges should be brought.

A[nother] troubling issue occurred with IRS criminal tax attorneys, commonly

known as CT counsel, related to their review of the SAR [that recommended] charging

23

Hunter Biden that laid out the evidence for each element of each violation.

The CT Counsel Line Attorney Christine Steinbrunner worked with the case agent

to get questions answered and to understand the case and the evidence. She indicated

to the case agent that she was going to concur with all the recommended charges in the

SAR.

On February 9th, 2022, a CT counsel attorney at the national office reached out to

the co-case agent and told her that Ms. Steinbrunner had sent it forward with concur for

all charges and that the five members of the review team at the national office concurred

with the line attorney.

It then went to CT senior leadership Rick Lunger and Elizabeth Hadden, and

direction was given to the line attorney, Ms. Steinbrunner, to change it to a nonconcur for

all charges.

I informed SAC Waldon, and he telephoned Ms. Steinbrunner's supervisor,

Veena Luthra. Ms. Luthra stated it had always been a nonconcur. I then

communicated with SAC Waldon that CT was misrepresenting the facts.

On February 11th, 2022, CT counsel issued the memorandum nonconcurring with

all counts. In a documented exchange with Ms. Steinbrunner, the case agent told her:

"Did you know that they were saying that it's always been a nonconcur?"

Ms. Steinbrunner responded: "What? No, I sent them a yellow light."

I have no idea why Ms. Luthra would provide false information about this topic.

Since CT counsel's opinion is only advisory, on February 25th, 2022, the IRS sent

the SAR to the Delaware U.S. Attorney's Office -- I'm sorry, that's incorrect. They sent it

to the Department of Justice Tax Division.

AUSA Wolf supported charging Hunter Biden for tax evasion and false return in

2014, 2018, and 2019, and failure to file or pay for 2015, 2016, and 2017. It is my

24

understanding that the Tax Division then authored a 90-plus-page memo that

recommended prosecution.

The proper venue for a tax case is where the subject resides or where the return is

prepared or filed. That meant the proper venue for the years we were looking into

would either be Washington, D.C., or California, not Delaware.

In March 2022, DOJ's Tax Division presented its prosecution memo to the United

States Attorney's Office for the District of Columbia, which had venue over the 2014 and

2015 tax years. The case agent and I requested to be part of the presentation to the

D.C. U.S. Attorney's Office, but were denied.

Department of Justice Tax Division Mark Daly telephoned the case agent and

stated that the First Assistant at the D.C. U.S. Attorney's Office was optimistic and had

stated she would assign an AUSA to assist.

Just a couple days later, Mark Daly called the case agent back and told him that

the President Biden appointee to the United States Attorney for the District of Columbia,

Matthew Graves, personally reviewed the report and did not support it. We in the IRS

didn't realize at the time that meant there was no ability to charge there.

Attorney General Merrick Garland appeared before the Senate Appropriations

Committee on April 26th, 2022. Senator Bill Hagerty asked him how the American

people could be confident that the administration was conducting a serious investigation

into the President's own son.

Garland testified: "Because we put the investigation in the hands of a Trump

appointee from the previous administration, who is the United States Attorney for the

District of Delaware, and because you have me as the Attorney General, who is

committed to the independence of the Justice Department from any influence from the

White House in criminal matters."

25

Garland said: "The Hunter Biden investigation is being run by and supervised by

the United States Attorney for the District of Delaware. He is in charge of that

investigation. There will not be interference of any political or improper kind."

We knew that President Biden-appointed U.S. Attorney Matthew Graves did not

support the investigation, but DOJ and United States Attorney Weiss allowed us to

believe that he had some special authority to charge.

From March 2022 through October 7th, 2022, I was under the impression that,

based on AG Garland's testimony before Congress and statements by U.S. Attorney Weiss

and prosecutors, that they were still deciding whether to charge 2014 and 2015 tax

violations.

However, I would later be told by United States Attorney Weiss that the D.C. U.S.

Attorney would not allow U.S. Attorney Weiss to charge those years in his district. This

resulted in United States Attorney Weiss requesting special counsel authority from Main

DOJ to charge in the District of Columbia. I don't know if he asked before or after the

Attorney General's April 26th, 2022, statement, but Weiss said his request for that

authority was denied and that he was told to follow DOJ's process.

That process meant no charges would ever be brought in the District of Columbia,

where the statute of limitations on the 2014 and '15 charges would eventually expire.

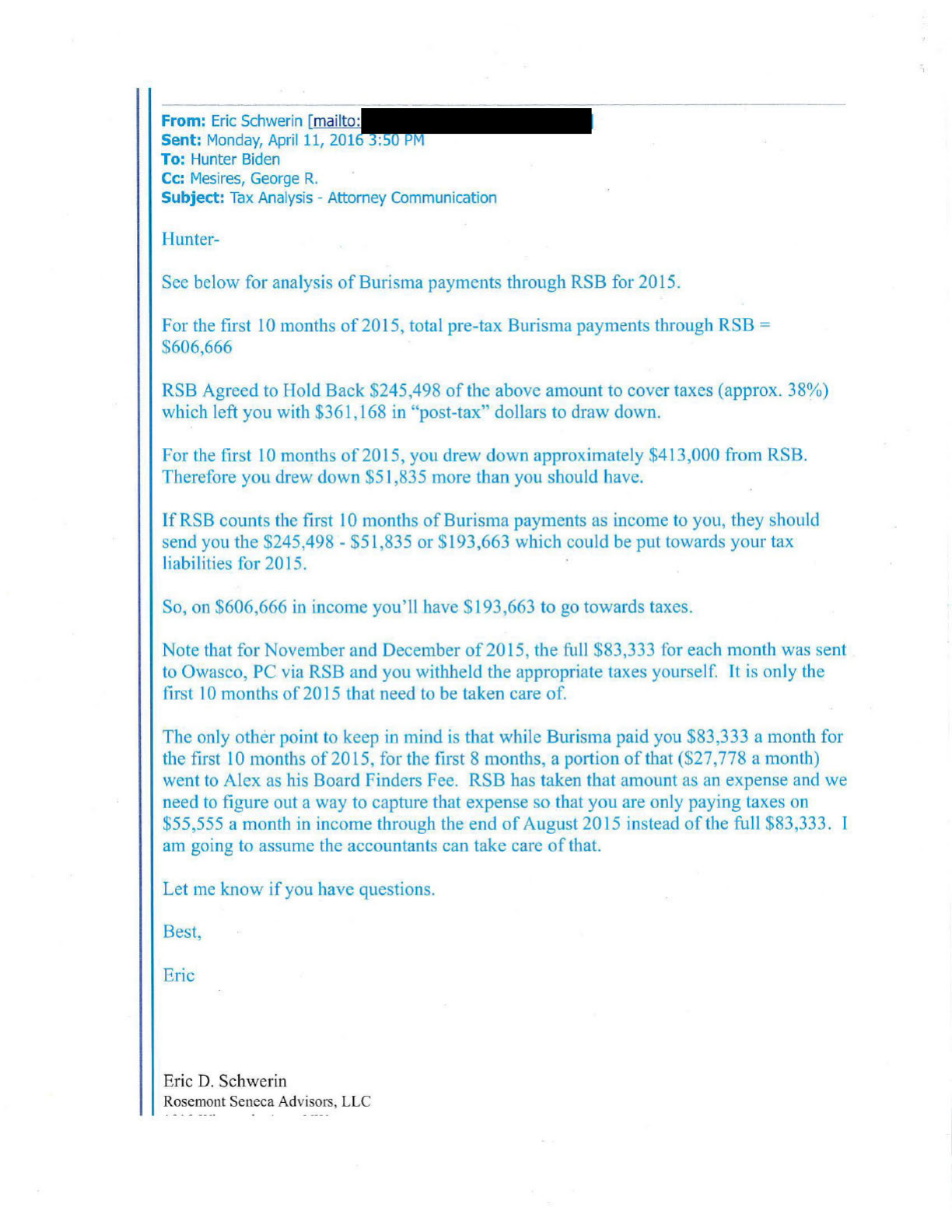

The years in question included foreign income from Burisma and a scheme to evade his

income taxes through a partnership with a convicted felon. There were also potential

FARA issues relating to 2014 and 2015. The purposeful exclusion of the 2014 and 2015

years sanitized the most substantive criminal conduct and concealed material facts.

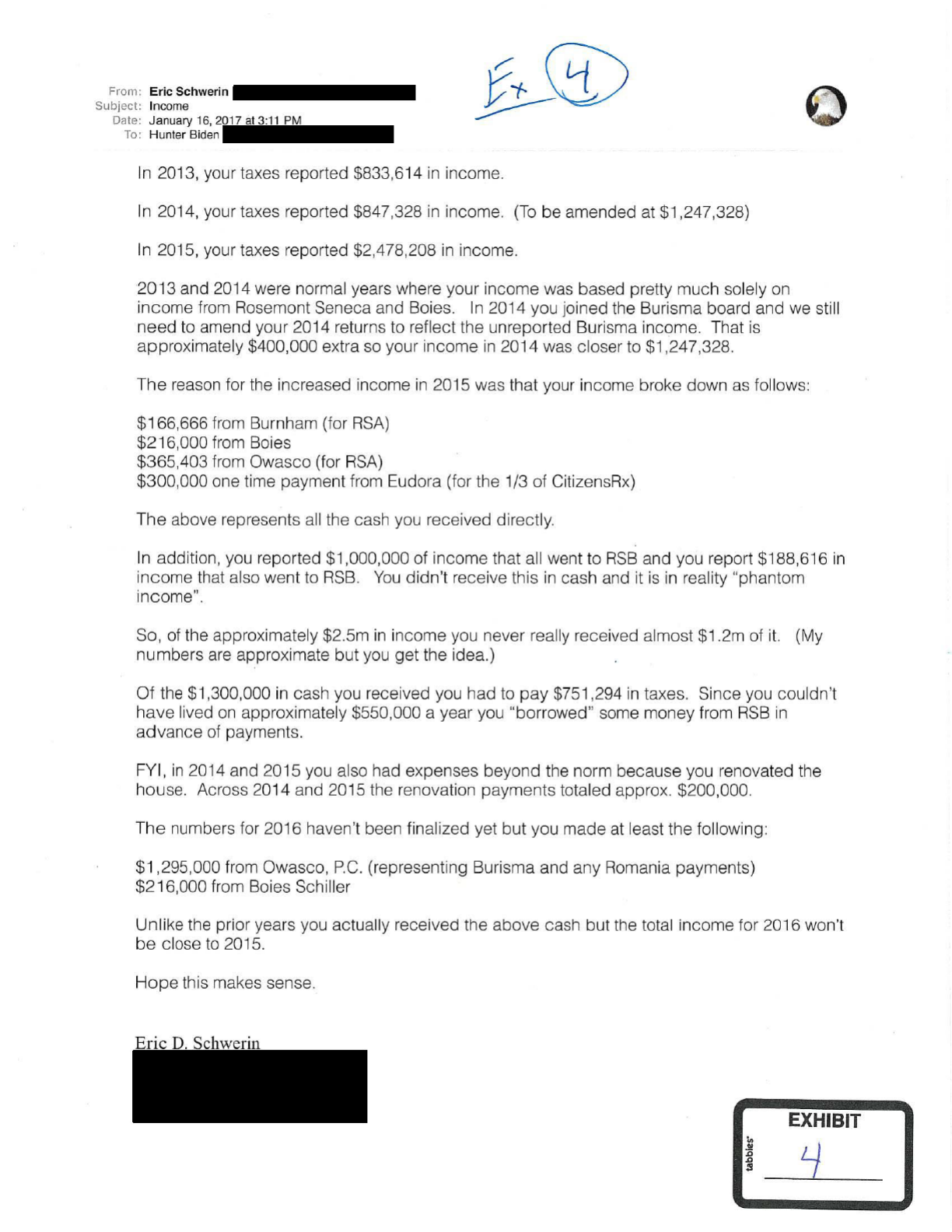

Hunter Biden still has not reported approximately $400,000 in income from

Burisma and has not paid the tax due and owing of around $125,000 even after being told

multiple times by his partner, Eric Schwerin, that he had to amend his 2014 return to

26

report that income.

To make matters worse, defense counsel was willing to sign statute of limitations

extensions for 2014 and 2015 and had done so several times. Because United States

Attorney Weiss had no ability to charge 2014 and 2015, DOJ allowed the statute of

limitations to expire. There is no mechanism available to collect the tax owed by Hunter

Biden for 2014 other than in a voluntary fashion.

In the first week of May 2022, I received a call from FBI Supervisory Special Agent

Joe Gordon. Gordon was preparing a briefing for FBI leadership. He told me that his

field office thought they should push for this case to be given to a special counsel and

said, quote: "My leadership is wondering why your leadership isn't asking for a special

counsel in this investigation."

I relayed that information to my Director of Field Operations, who simply

responded: "I wouldn't even know how to go about that."

But since we didn't know D.C., District of Columbia, had refused to bring charges

and that United States Attorney Weiss had no authority to overrule them, we believed at

that time that the case could still be prosecuted.

It is common practice for DOJ to ask for the case agents' communications in

discovery, as they might have to testify in court. However, it's much more unusual to

ask for management communications, because it is simply not discoverable.

In March of 2022, DOJ requested of the IRS and FBI all management-level emails

and documents on this case. I didn't produce my emails, but I provided them with my

sensitive case reports and memorandums that included contemporaneous

documentation of DOJ's continued unethical conduct.

Much of that information was being provided up my chain of command for over 2

years on how I thought their handling of the case was unethical. I didn't hear anything

27

back about this at the time, leading me to believe no one read the discovery I provided.

In our July 29th, 2022, prosecution team call, AUSA Wolf told us that United States

Attorney Weiss indicated that the end of September would be his goal to charge the 2014

and 2015 years, because they did not want to get any closer to a midterm election. She

also said: "The X factor on timing will include any delay defense counsel has requested."

Two weeks later, I learned how defense counsel felt about the case when

prosecutors told us on a pros team call that Chris Clark, Hunter Biden's counsel from

Latham and Watkins, told them that if they charge Hunter Biden, they would be

committing "career suicide," end quote.

Around this time, there began to be discussions of the fact that the remaining tax

years, 2016, '17, '18 and '19, needed to be brought in the Central District of California.

There was no explanation as to why, after being declined in D.C. for 2014 and 2015, that

it took until mid-September 2022 to present the case to the Central District of California

United States Attorney's Office.

Prosecutors stated that they presented the case to the Central District of

California in mid-September. That happened to correspond with the confirmation of the

President Biden appointee to the United States Attorney, Martin Estrada. The case

agent and I asked to participate in that presentation, but it was denied.

On a September 22nd, 2022, pros team call, AUSA Wolf announced we wouldn't

be taking any actions until after the midterm elections, asking: Why would we shoot

ourselves in the foot by charging before the election? This was decided even though

DOJ's Public Integrity Section had provided instruction that there did not need to be a

cease and desist on investigative actions due to the upcoming midterms. It still

appeared that decisions were being made to conceal from the public the results of the

investigation.

28

The next meeting was in person on October 7th, 2022, and it took place in the

Delaware U.S. Attorney's Office. This meeting included only senior-level managers from

IRS CI, FBI, and the Delaware U.S. Attorney's Office. This ended up being my red-line

meeting in our investigation for me.

United States Attorney Weiss was present for the meeting. He surprised us by

telling us on the charges, quote: "I'm not the deciding official on whether charges are

filed," unquote.

He then shocked us with the earth-shattering news that the Biden-appointed D.C.

U.S. Attorney Matthew Graves would not allow him to charge in his district.

To add to the surprise, U.S. Attorney Weiss stated that he subsequently asked for

special counsel authority from Main DOJ at that time and was denied that authority.

Instead, he was told to follow the process, which was known to send U.S. Attorney

Weiss through another President Biden-appointed U.S. Attorney.

This was troubling, because he stated that, if California does not support charging,

he has no authority to charge in California. Because it had been denied, he informed us

the government would not be bringing charges against Hunter Biden for the 2014-2015

tax years, for which the statute of limitations were set to expire in one month.

All of our years of effort getting to the bottom of the massive amounts of foreign

money Hunter Biden received from Burisma and others during that period would be for

nothing.

Weiss also told us that if the new United States Attorney for the Central District of

California declined to support charging for the 2016 through 2019 years, he would have

to request special counsel authority again from the Deputy Attorney General and/or the

Attorney General.

I couldn't understand why the IRS wasn't told in the summer of 2022 that D.C. had

29

already declined charges. Everyone in that meeting seemed shellshocked, and I felt

misled by the Delaware United States Attorney's Office.

At this point, I expressed to United States Attorney Weiss several concerns with

how this case had been handled from the beginning. The meeting was very contentious

and ended quite awkwardly. It would be the last in-person meeting I had with United

States Attorney Weiss.

We had one more call 10 days later on October 17th, 2022. United States

Attorney Weiss wasn't on this call. In response to questions about more subpoena

requests, we were told there was no grand jury any longer to issue subpoena requests

out of.

When we asked when the Central District of California might make its decision on

the case, DOJ Tax Mark Daly responded, quote: "I'm not the boss of them."

After this call, DOJ either stopped scheduling prosecution team meetings or else

just stopped inviting the IRS to them.

Disclosing our concerns to United States Attorney Weiss produced other problems

too. In May, I had produced all my sensitive case reports for enforcement to date.

And now suddenly 5 months later, on October 24th, 2022, DOJ started asking for all those

reports since May.

They also renewed the request for all my emails on the case, saying they needed

to ensure they were aware of any exculpatory or impeachment effort in the case. But

their extraordinary request looked to us just like a fishing expedition to know what we'd

been saying about their unethical handling of the case.

On November 7th, 2022, the FBI special agent on the case, Mike Dzielak, called me

to tell me the United States Attorney's Office had requested both management- and

senior management-level documents from the FBI related to the investigation. He said

30

that had never happened before and that he was shocked at the request. The FBI

refused to provide any further discovery to the Delaware U.S. Attorney's Office.

I also shared with my leadership how inappropriate the whole situation was. On

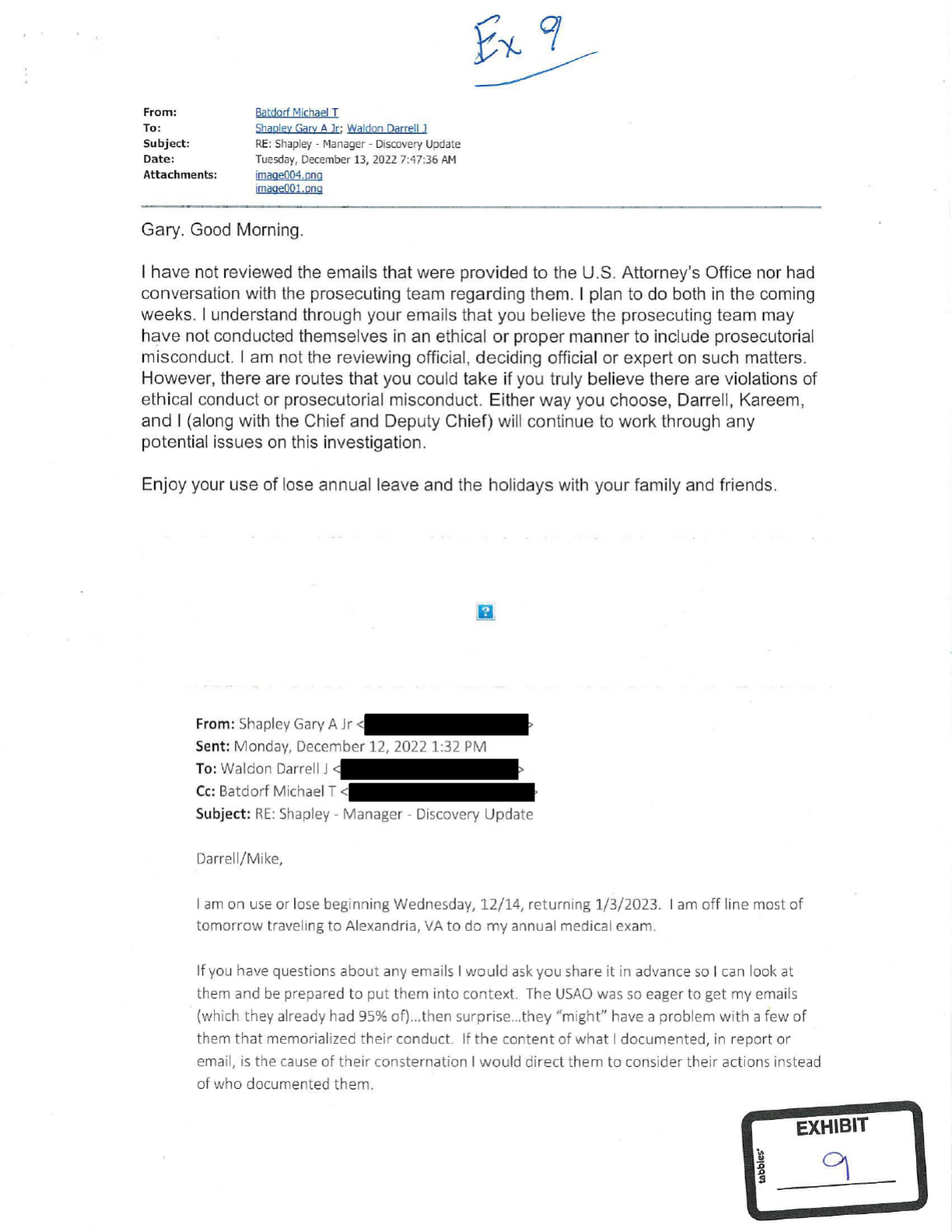

December 12th, 2022, I emailed – “the United States Attorney's Office was so eager to

get my emails, which they already had 95 percent of, then surprise they might have a

problem with a few of them that memorialized their conduct. If the content of what I

documented in report or email is the cause of their consternation, I would direct them to

consider their actions instead of who documented them.

I documented issues that I would normally have addressed as they occurred,

because the United States Attorney's Office and Department of Justice Tax continued

visceral reactions to any dissenting opinions or ideas. Every single day was a battle to do

our jobs.

I continually reported these issues up to IRS CI leadership beginning in the

summer of 2020. Now, because they realize I documented their conduct, they separate

me out, cease all communication, and are now attempting to salvage their own conduct

by attacking mine. This is an attempt by the U.S. Attorney's Office to tarnish my good

standing and position with IRS CI, and I expect IRS CI leadership to understand that.

As recent as the October 7th meeting, the Delaware U.S. Attorney's Office had

nothing but good things to say about me and the team. Then they finally read discovery

items which were provided 6 months previous that are actually not discoverable, and

they are beginning to defend their own unethical actions.

I have called into question the conduct of the United States Attorneys and DOJ Tax

on this investigation on a recurring basis and am prepared to present these issues.

For over a year, I've had trouble sleeping and wake all hours of night thinking

about this. After some time, I realized it was because I subconsciously knew they were

31

not doing the right thing, but I could not fathom concluding that the United States

Attorney's Office or DOJ Tax were in the wrong.

After I wrapped my mind around the fact that they were not infallible, I started to

sleep better. My choice was to turn a blind eye to their malfeasance and not sleep or to

put myself in the crosshairs by doing the right thing. My conscience chose the latter.

I hope IRS CI applauds the incredibly difficult position I have been put into instead

of entertaining United States Attorney's Office attacks. If they bring up something

legitimate, I am sure we can address it, because it was not intentional. Everything I do is

with the goal of furthering IRS CI's mission, protecting the fairness of our tax system, and

representing IRS CI with honor.”

In January of this year, I learned United States Attorney Estrada had declined to

bring the charges in the Central District of California. For all intents and purposes, the

case was dead, with the exception of one gun charge that could be brought in Delaware.

And yet, when Senator Chuck Grassley asked Attorney General Garland about the

case on March 1st, 2023, Garland testified, quote: "The United States Attorney had

been advised that he has full authority to make those referrals you're talking about or to

bring cases in other districts if he needs to do that. He has been advised that he should

get anything he needs. I have not heard anything from that office that suggests they are

not able to do anything that the U.S. Attorney wants them to do."

I don't have any firsthand information into why Garland said that, but to all of us

who have been in the October 7th meeting with Weiss, this was clearly false testimony.

On March 16th, 2023, DOJ Tax Mark Daly was overheard on his telephone by one

of my agents. Mark Daly was talking to DOJ Tax Attorney Jack Morgan. Mr. Daly stated

that they would give United States Attorney Weiss the approvals required if he wanted

them, but that he had no idea where he planned to charge Hunter Biden.

32

This indicates that after the Central District of California declined to allow charges

to be brought there, the only route to United States Attorney Weiss was to request

special counsel authority. It appears that this case was not moving forward until

Senator Grassley asked pointed questions that held AG Garland accountable.

After my attorney sent the first letter to Congress on April 19th, I started to hear

rumblings that DOJ was picking the case back up again. I don't believe that would have

happened were it not for me blowing the whistle.

However, on Monday, May 15th, my special agent in charge called me and told

me that DOJ had requested an entirely new team from the IRS and that none of the 12

agents in my group would be able to work the case. This seems like clear retaliation for

me making my disclosures.

What's worse, after Special Agent emailed the Commissioner to point out

the human cost of the IRS simply implementing DOJ's retaliatory direction, my assistant

special agent in charge threatened him with leaking (6)(E) material.

And my special agent in charge sent me and other supervisors an email at the

same time that said we had to stay within our chain of command. I interpreted this as a

clear warning to me and anyone else who might be thinking of blowing the whistle.

I did not choose to sit here before you today. I was compelled by my conscience

when decision after decision has been made to deviate from our normal investigative

processes. I believe Congress needs to know this information. I trust you'll do the

right thing, because we have nothing if I can't trust this body.

MAJORITY COUNSEL 1. Thank you very much for your thorough opening

statement.

The time is 10:24. We'll start the clock with majority questions.

To start, I'd like to mark this document as exhibit 1.

33

[Shapley Exhibit No. 1

Was marked for identification.]

34

EXAMINATION

BY MAJORITY COUNSEL 1:

Q Do you recognize this document?

A Yes, I do.

Q What is it?

A This is the April 19th, 2023, letter sent to the chairs and ranking members

identified here by my attorneys Mark Lytle and -- oh, it's just from Mark Lytle.

Q And this is the initial reason why we're here today?

A This initiated what's happening, yes.

Q Okay. I'd like to talk a little bit about your background.

You mentioned, I believe, that you started at the IRS in 2009. Is that correct?

A Yes, that's correct.

Q And what is your educational background?

A I have an accounting and business degree from the University of Maryland,

and I have a master's in business administration from the University of Baltimore.

Q And before you joined the IRS, what did you do for employment?

A I was in the Office of Inspector General with the National Security Agency.

Q And when did you begin in that position?

A 2007.

Q Did you hold any other positions prior to that?

A Internships and stuff like that.

Q What was your motivation for joining the IRS?

A I always planned on going into law enforcement and I really had a desire to

serve. And that was why I went with the accounting degree and business degree and I

35

got my MBA, was for the purpose of getting that special agent job with the Federal

Government.

Q And you talked through sort of your history at the IRS during your opening

statement. Can you briefly summarize your roles and responsibilities in your current

position?

A Yes. So I oversee 12 agents. They are handpicked. They sit all across the

country. We work all high-dollar, complex, international cases. We work foreign

financial institutions. We do undercover operations and search warrants and all that

stuff in other countries and in this country.

And I'm responsible for reviewing all enforcement actions and recommendation

reports and case initiations and so on and so forth. That's like my main job as the

supervisory special agent of ITFC.

I'm also a representative in the Joint Chiefs of Global Tax Enforcement, working I

guess directly under the Chief of IRS CI. And it works with four other partner countries

in trying to collaborate and attack tax noncompliance on a global scale and share

information where we can legally.

Q And who do you directly report to?

A My current report is Assistant Special Agent in Charge Lola Watson.

BY MAJORITY COUNSEL 2:

Q Where does she sit?

A Washington, D.C.

Q She sits in Washington. And your office is in Baltimore?

A Yeah. I either sit in D.C. or Baltimore. I kind of split time.

Q Okay.

BY MAJORITY COUNSEL 1:

36

Q In the typical situation in the criminal tax investigation, what is your

understanding of the leadership and management structure at the Tax Division at the

Department of Justice?

A Well, with most of our cases, because they're complex and high-dollar and

they usually align with the very top priorities in the agency, we usually have Department

of Justice Tax attorneys that assist on the cases with us.

That's not typical for small cases, normal cases. But in our cases and in this

particular case, from the very beginning there were two Department of Justice Tax

Division attorneys working side by side with us the entire time. So they worked as

prosecutors alongside the AUSAs in Delaware.

And then ultimately what happens is the prosecution recommendation report that

is produced by Criminal Investigation gets sent to DOJ Tax. And they absorb that report,

and they usually put out a memo either approving, providing discretion, or declining.

And in the normal course, it's usually a pretty quick turnaround, 30 days, 45 days.

Q You mentioned two prosecutors in this case at DOJ Tax. Who are those

two individuals?

A At the beginning, it was Jason Poole and Mark Daly. And Mark Daly was

definitely the lead. Jason Poole took a different position at some point and Jack Morgan

took his spot.

Q And did those individuals sit in Washington, D.C.?

A I know Mark Daly does. I'm pretty sure -- yeah, Jack Morgan does as well,

yes, yes.

Q In the course of this investigation, did you interact with anyone else at the

DOJ Tax Division?

A I interacted with Jason Poole a lot, but in his new role, because he became

37

the chief of the Northern Division of the Department of Justice's Tax Division, and I had to

call him on several occasions concerning issues we were having.

MAJORITY COUNSEL 2. On this case?

Mr. Shapley. Yes.

MAJORITY COUNSEL 1. Okay. And in a typical case, what is IRS CI's relationship

with any given U.S. Attorney's Office?

Mr. Shapley. I'm sorry, can I add to my last question there?

MAJORITY COUNSEL 1. Please.

Mr. Shapley. So I also interacted with Stuart Goldberg, who I think is a Deputy

Assistant Attorney General, I think is his title, on a few occasions.

MAJORITY COUNSEL 2. And he's the head of the Tax Division?

Mr. Shapley. I believe he's the head of the Civil Tax Division and the head of the

Criminal is different, but there is not currently a person who's been confirmed there, I

believe.

Usually Stuart Goldberg would not be the person overseeing the criminal tax stuff.

It usually would go to the personal -- the Criminal Division.

MAJORITY COUNSEL 2. Is it fair to say he was the senior-most official in the Tax

Division?

Mr. Shapley. Yes. That's fair, yes.

BY MAJORITY COUNSEL 1:

Q On this investigation?

A That's correct.

Q Okay. What in a typical case would be IRS CI's relationship with the U.S.

Attorney's Office?

A On a case, we would talk strategy. We would go and get the evidence,

38

bring the evidence to them. We would be requesting to do, get certain document

requests from them.

There are things like search warrants and undercover operations that all go

through the United States Attorney's Office prosecutors. And generally, the way it

works is the agents go out and they get the information, and they have to be proactive in

doing so. And they bring that information to the prosecutor, and we kind of go forward

from there.

Q In your opening statement, you described prosecution team meetings. In

this case, individuals from which organizations participated in those meetings?

39

[10:32 a.m.]

Mr. Shapley. Sure, yeah. The prosecution team is the United States Attorney's

Office for Delaware, Department of Justice Tax Division.

At some point in time, a Department of Justice National Security Division attorney

came on.

MAJORITY COUNSEL 2. Who was that?

Mr. Shapley. McKenzie. Brian McKenzie.

And then it was FBI. And that was usually from the SSA to the case agents, and

there was around four or five of them.

BY MAJORITY COUNSEL 1:

Q Sorry. What's SSA?

A I'm sorry. Supervisory special agent, SSA.

And then it was IRS. And it was me, , and the co-case agent, Christine

Puglisi. And there was also an IRS CI agent out of the Philadelphia Field Office that was

working some ancillary issues, Anthony LoPiccolo, who would also participate in those.

And United States Attorney Weiss would be on those, but it wasn't scheduled.

He'd be on some -- pop in, pop out, that type of thing.

Q And is the structure of that prosecution team typical for a case of this size

and profile?

A It was -- we met more often, I think, because there were so many moving

parts. I wouldn't say that it's typical to have a prosecution team meeting every 2 weeks

in other cases. But it was just a way to get everybody at one spot at one time to have

the conversations.

Q And how did this specific investigation begin?

40

A So Special Agent was working on another case, and during that

case he found some reports that had some individuals' names in it. And it was basically

a case development tool he was using, and he looked at those and was seeing if he can

initiate criminal investigations on that list of people, and Hunter Biden was one of the

people on that list.

Q And from that stage, how does an investigation open? What's the process

around that?

A So the agent can write a PI evaluation report, and they send it to my level,

the SSA, supervisory special agent. And if it's a Title 26 case, it can just be approved and

put on our system.

Now, under a PI, it's kind of unique at IRS CI. There are only a few techniques

you can use, and it does [not] include third-party contacts and stuff like that.

So there's a whole other effort to make a subject criminal investigation, and that's

a more involved form, called the 9131, and it has a bunch of attachments. And really it's

an analysis of all the steps taken in the primary investigative phase.

And that 9131, in this case, if it's -- it goes forward to Department of Justice

Tax Division for approval and -- yeah, yeah. I'm sorry.

Generally. If it's generally like a 9131, if it's going to be a grand jury

investigation, request a grand jury investigation, generally a 9131 goes to Department of

Justice Tax Division, who approves it, and you're allowed to participate in that grand jury.

Q When a matter develops in this way, is there interaction on the civil side

related to civil audits? Are audits opened in connection with this process?

A Audits aren't opened in partner with a criminal investigation. Part of the

primary investigative phase, as one of the things you would do, you would request all the

information from IDRS, our internal system. That would include checks for audits and

41

things like that in the past, but there would be no request to initiate any civil activity.

It's actually the exact opposite. A form is issued that says -- the title of the form

is Suspend Civil Activity, and the subject's identifiers are included.

Q So in your opening statement you discussed tax years 2014 through 2019 for

this particular taxpayer. Do you know whether there are any issues related to 2020 or

2021?

A No. We never included that as part of the investigation.

We did get the returns, but we didn't.

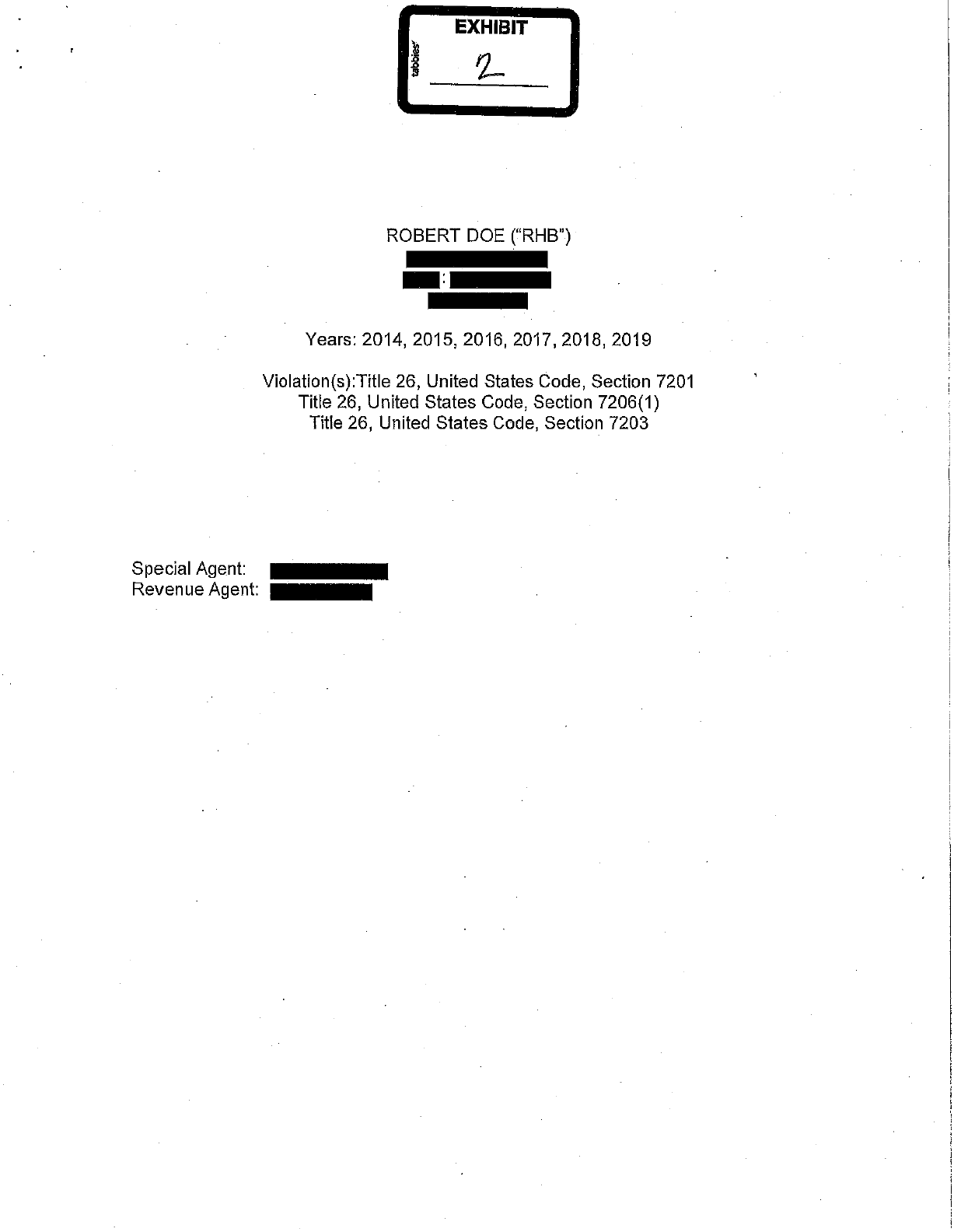

[Shapley Exhibit No. 2

Was marked for identification.]

42

BY MAJORITY COUNSEL 1:

Q Okay. I'd like to talk now a little bit about the specific tax years at issue.

The document being handed to you is marked as exhibit 2.

Are you familiar with this document?

A Yes, I am.

Q What is it?

A This is the special agent report.

Q And who is the subject of this report?

A Yeah. To clarify the last response, it's an excerpt from the special agent

report.

Q And who is the subject of this report?

A So it says Robert Doe. That was the name that was put into our internal

system to attempt to keep anyone from revealing the name, and "RHB" stands for Robert

Hunter Biden.

Q And turning to the second page of the document, this excerpt includes the

"Conclusions and Recommendations" section. Can you describe the conclusions and

recommendations made in this report?

A Yes, I can. The report includes itemized elements of each violation for each

year up above it that I couldn't provide because of grand jury (6)(e) material.

This recommended felony tax evasion charges, that's 7201, is tax evasion, and

7206(1) is a false tax return, also a felony, for the tax years 2014, 2018, and 2019. And

for Title 26 7203, which is a failure to file or pay, that is a misdemeanor charge for '15,

'16, '17, '18, and '19.

Also under that is a paragraph that is common when we work directly with

43

Department of Justice Tax Division and AUSA so closely. We usually would give a

statement saying what they wanted as well at that time.

This report was reviewed extensively with Mark Daly, and also a lot with AUSA

Lesley Wolf, and each of them agreed with the recommendations as posed in this report.

Q Okay. And when was this document finalized and signed?

A It was, I believe, January 27th of 2022.

BY MAJORITY COUNSEL 2:

Q And can you just walk us through the process for this document? This is an

IRS document?

A It is, yeah.

Q And it is sent to who?

A Yeah. This document is a very robust document that includes everything

that we do. Internally it would go to CT counsel for their review. They provide a

memo, concur or nonconcur. It's just advisory. We don't have to follow what they say.

Q Did they concur?

A They nonconcurred.

Q They did not concur?

A Yeah. There was a portion in my opening statement that described that

event where the line attorney concurred with all charges and then it went to the national

office to review on sensitive case.

The panel at the national office agreed with the line attorney that it was concur.

And when it went up to their top two people at the CT counsel, they sent it back to the

line attorney and told her to change it to nonconcur.

Q Okay.

A So I'm not even sure. That could happen on occasion. What was

44

incredibly outside the norm here was that they usually tell us, and we ask them to tell us

if anything is going to be a nonconcur. And all along they were saying it's a concur, it's a

concur -- with all charges. It was green for 2018, yellow for other years, which is all in

the concur range.

And when we got the nonconcur, I went to my special agent in charge who called

the line attorney's supervisor and she said, it's always been nonconcur.

And then it was really incredible that that statement was made, and maybe only

IRS CI geeks care about that. But then we communicate in an instant message that's

captured with the line attorney saying, "They are telling us that this has always been a

nonconcur," and she's like, "What, no, no. It was a concur when I sent it up."

So for some reason, that got miscommunicated.

Q Was any feedback provided as to why?

A There's a robust document that was created by CT counsel -- I spent time

rebutting it, but there was nothing that we hadn't considered in the investigative team

with the prosecution team for the 3-plus years we'd been investigating.

Yeah, and this advisory. Yeah, it is, I would say, 90-plus percent of everything

that I do in my international tax group is nonconcur by CT counsel, and we ignore what

they say.

So then this report goes, after that, to the Department of Justice Tax Division.

It's transmitted to them. And that's when they take it and they review it. And usually

it's approve, discretion, or declined in a normal course. But we sent it to them on

February 25th of 2022, and I have yet to see an approval, discretion, or declination.

Q And what's the U.S. Attorney's Office in Delaware's role with this particular

document?

A So it's just to help advise them. After DOJ Tax, if they approve a charge,

45

then that's DOJ Tax saying that you have to charge it. And if the United States

Attorney's Office, they can say, "We don't want to charge it here," but DOJ Tax then has

to go and charge it. They have the authority to do so.

Q So did the U.S. Attorney's Office in Delaware concur with this?

A They would never have [to as part of the process, but] they did when it was

written, right? They were on board with all the charges when it was written. But there

would never be an official time where we requested their concur or nonconcur.

Q So did they review it before you submitted it to DOJ?

A Oh, yes, yes.

Q Okay.

A Yes.

Q And they had an opportunity to make suggestions or --

A Yes.

Q -- tell you to tweak things?

A Yes.

Q And they didn't.

A Well, we did, but --

Q The final document though --

A Yeah.

Q -- they concurred.

A The final document was a compilation of everyone's understanding of what

the evidence said and what should be charged.

Just a little bit more about this document. I mean, this document is around – it’s

incredibly robust. So I think it was around 85 pages, just the report, and it goes through

the theory of investigation. And then it goes, like I said, into each year and each

46

element.

And it's each piece of evidence in each element, and it's cited to evidence. So

this report, in reality, crashes my computer every time it comes up because it includes all

the evidence attached to it. It's like 8-, 9-, 10,000 pages of evidence and documents.

It's an incredibly robust document.

[Shapley Exhibit No. 3

Was marked for identification.]

47

BY MAJORITY COUNSEL 1:

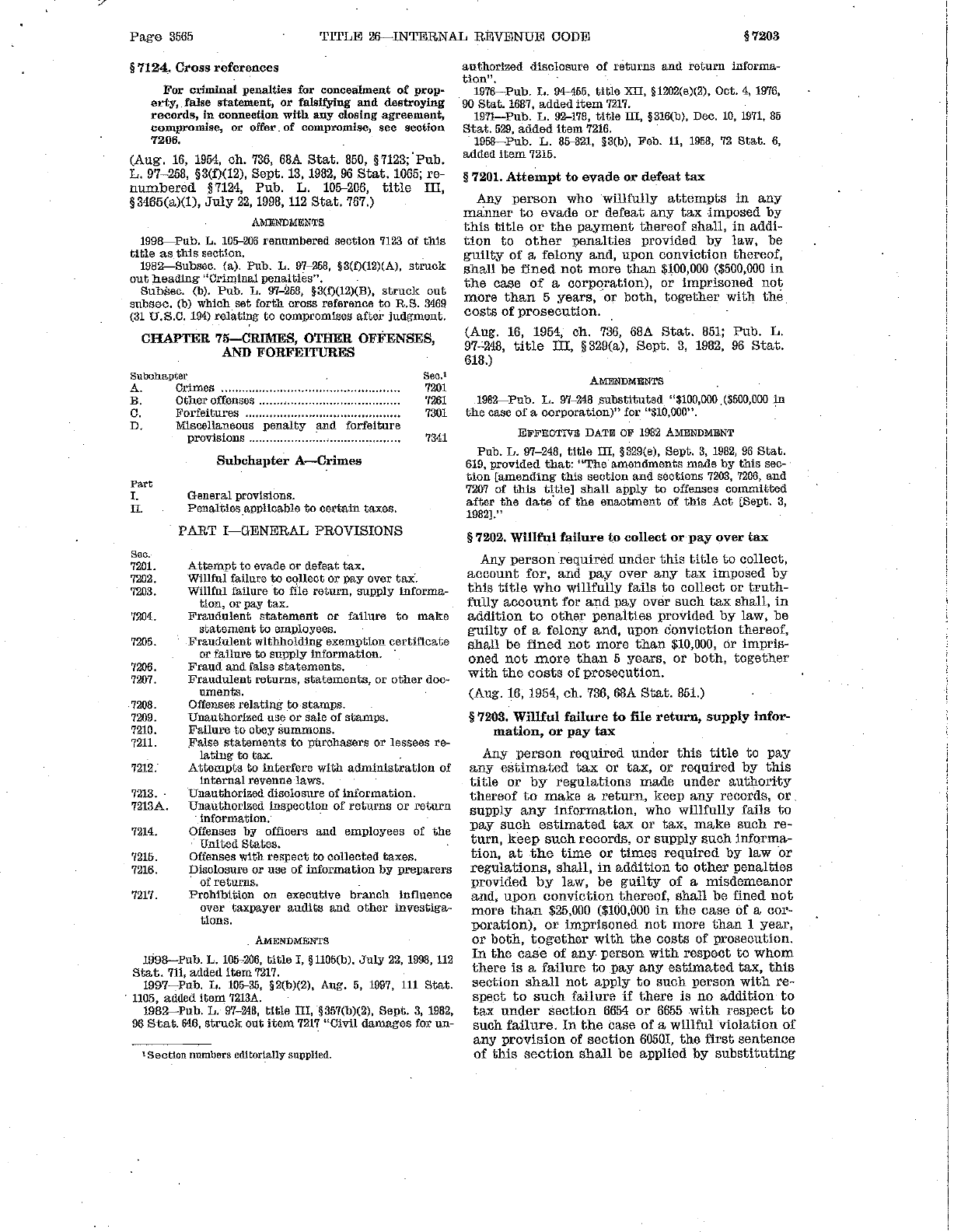

Q Okay. The document just handed to you is being marked exhibit 3. I’ll

give you a moment to look it over.

A Oh, okay, yes. Okay.

Q So this document contains the relevant statutory citations included in the

special agent report document you just looked at, and I'd like to walk through each of the

relevant statutes briefly.

A Okay.

Q 26 U.S.C. 7201 covers attempt to evade or defeat tax. Is that correct?

A That is.

Q What are the elements of a 7201 offense?

A So the elements are affirmative acts of evasion. They are that there's a tax

due and owing and -- I'm not used to reading it in this setting, so I'm sorry. So it's willful

attempts in any manner to evade or defeat any tax imposed by this title or the payment

thereof. There has to be tax due and owing. And the willfulness is a voluntary,

intentional violation of a known legal duty. And those are the elements.

Q And what is the statute of limitations for this offense?

A It's 6 -- this says 5 years. Did that just change? It was 6 years -- 6 years

from the date. Yeah. This says 5 years.

MINORITY COUNSEL 2. No, that's the prison sentence.

Mr. Shapley. Oh, thank you very much.

Yeah, the statute of limitations is 6 years from when the return is filed or of an

affirmative act of evasion that could occur after the filing of the tax returns.

BY MAJORITY COUNSEL 1:

48

Q Okay. And based on the conclusion in your report, the elements for that

offense were met in tax years 2014, 2018, and 2019. Is that correct?

A That's correct.

Q Okay. 26 U.S.C. 7203 covers willful failure to file, to supply information, or

pay tax. Is that correct?

A It is.

Q And what are the elements of a 7203 offense?

A So that's that you had a requirement to file and that you had the knowledge

that you did have to file, is how I know it. I mean, would you --

Q That's okay, you don't need to read the whole thing.

BY MAJORITY COUNSEL 2:

Q Yeah, we're just giving you the statute. And this isn't a pop quiz.

A Yeah, sorry, yeah.

Q We're just trying to understand what the elements of these crimes are --

A Yeah.

Q -- what the statute of limitations is and so forth. And since this is not a pop

quiz, we just thought we would provide this as a resource.

A Yeah. I never see it in this format.

BY MAJORITY COUNSEL 1:

Q Understood.

And what's the statute of limitations for this?

A It's 6 years.

Q And based on this report, elements for that offense were met in 2015, 2016,

2017, 2018, and 2019. Is that correct?

A That's correct, yes.

49

Q And same exercise, 26 U.S.C. 7206 (1) covers fraud or false statement. Is

that correct?

A It is.