Financial Analysis of

United States Postal Service

Financial Results and 10-K Statement

Fiscal Year 2023

June 17, 2024

Postal Regulatory Commission

Submitted 06/17/2024 02:52 PM

Filing ID: 129348

Accepted 6/17/2024

Financial Analysis Report FY 2023

i

Table of Contents

Chapter I. Overview .................................................................................................................................................................. 1

Volume Declines and Cost Increases Result in Continued Losses—Key Findings ....................................................... 1

Purpose of This Report ....................................................................................................................................................................... 4

Chapter II. Postal Service Financial Status ....................................................................................................................... 5

Introduction ................................................................................................................................................................................................. 5

Analysis of Income Statements ........................................................................................................................................................... 6

Market Dominant Revenue Compared to Prior Year ........................................................................................................... 9

Competitive Product Revenue Compared to Prior Year .................................................................................................. 10

Expense Analysis as Compared to Prior Year ....................................................................................................................... 11

Personnel Expenses .................................................................................................................................................................... 12

Non-Personnel Expenses ......................................................................................................................................................... 19

Comparison of Postal Service Actual Results to Operating Plan .................................................................................. 20

Financial Ratio Analysis .................................................................................................................................................................. 23

Operating Ratio............................................................................................................................................................................. 24

Return on Assets .......................................................................................................................................................................... 25

Analysis of Balance Sheets .................................................................................................................................................................. 27

Assets ...................................................................................................................................................................................................... 30

Liabilities ......................................................................................................................................................................................... 32

Balance Sheet Trend Analysis ...................................................................................................................................................... 33

Debt Ratio ....................................................................................................................................................................................... 33

Current Ratio ................................................................................................................................................................................. 35

Cash Ratio ....................................................................................................................................................................................... 36

Analysis of Statements of Cash Flows ............................................................................................................................................ 37

Cash Flow Ratio Analysis ............................................................................................................................................................... 38

Chapter III. Volume, Revenue, and Cost Trends .......................................................................................................... 41

Overview ..................................................................................................................................................................................................... 41

Overall Volume, Revenue, and Cost Trends ................................................................................................................................. 41

Market Dominant Products ........................................................................................................................................................... 42

Market Dominant Volume ............................................................................................................................................................. 44

Market Dominant Revenue ........................................................................................................................................................... 45

Competitive Products and Services ........................................................................................................................................... 46

Market Dominant Volume, Revenue, and Cost Trends by Class ......................................................................................... 49

First-Class Mail ................................................................................................................................................................................... 49

First-Class Mail Letters Compared with FY 2022 .......................................................................................................... 49

Trends in First-Class Mail Letters ........................................................................................................................................ 51

First-Class Mail Flats Compared with FY 2022 .............................................................................................................. 56

Trends in First-Class Mail Flats ............................................................................................................................................. 57

Financial Analysis Report FY 2023

ii

Other First-Class Mail Compared with FY 2022 ............................................................................................................ 60

USPS Marketing Mail ........................................................................................................................................................................ 61

USPS Marketing Mail Letters Compared with FY 2022 .............................................................................................. 61

Trends in USPS Marketing Mail Letters ............................................................................................................................. 62

USPS Marketing Mail Flats Compared with FY 2022 ................................................................................................... 65

Trends in USPS Marketing Mail Flats .................................................................................................................................. 66

Periodicals ............................................................................................................................................................................................ 69

Periodicals Compared With FY 2022 .................................................................................................................................. 69

Trends in Periodicals ................................................................................................................................................................. 70

Package Services ................................................................................................................................................................................ 73

Market Dominant Special Services ............................................................................................................................................ 75

Competitive Volume, Revenue, and Cost by Product .............................................................................................................. 77

Trends in Competitive Products ................................................................................................................................................. 79

Chapter IV. Cost and Profit Analysis ................................................................................................................................ 82

Introduction ............................................................................................................................................................................................... 82

Analysis of Inflationary Impact on Financial Condition ......................................................................................................... 82

Revenue from CPI Rate Authority .............................................................................................................................................. 85

Contribution Margin Income Statement ....................................................................................................................................... 85

Analysis of Cost Segments ............................................................................................................................................................. 93

Analysis of Employee Labor Cost ..................................................................................................................................................... 95

Appendix A .............................................................................................................................................................................................. 106

Appendix B: Total Factor Productivity ....................................................................................................................................... 107

Financial Analysis Report FY 2023

1

Chapter I. Overview

Volume Declines and Cost Increases Result in

Continued Losses—Key Findings

The Postal Service’s financial position worsened in FY 2023. The organization recorded a

net loss from operations of $2.3 billion, compared to a net loss of $473 million in FY 2022.

1

The increase of $1.8 billion in the FY 2023 net operating loss is the result of a $2.1 billion

increase in operating expenses. The increase in operating expenses occurred despite total

mail volume decreasing by 8.7 percent, including a 2.0 percent decrease in the volume of

Competitive products. The disconnect between workload and costs also resulted in a 4.0

percent decrease in Total Factor Productivity (TFP), the largest decrease in the measure of

the Postal Service’s efficiency since it was first calculated in 1965. The volume decreases

kept operating revenue essentially unchanged from FY 2022 even as prices for Market

Dominant products increased by more than 15 percent between the last month of FY 2022

and the end of FY 2023.

When Non-Operating Expenses (NOEs) are included,

2

the net operating loss of $2.3 billion

becomes a net loss of $6.5 billion. This is a deterioration of $5.5 billion

3

compared to FY

2022. Figure I-1 shows net income (loss) and net operating income (loss) results for the

period FY 2014 – FY 2023.

01

United Stated Postal Service Form 10-K FY 2022, November 10, 2022, at 19 (Postal Service FY 2022 Form 10-K) . Net income or loss from

operations is also referred to as net operating income (loss). The Commission’s calculation of net operating income (loss) differs from the

controllable net income (loss) reported in Postal Service Form 10-K. The Postal Service excludes the difference in the normal cost of Retiree

Health Benefits from its controllable income (loss) because it is the result of actuarial changes.

02

NOEs include all non-cash workers’ compensation costs, accruals to retirement accounts, and one-time adjustments, such as the one time

PSRA adjustment to RHBF unfunded liabilities and normal costs.

03

Excluding the one-time removal of the Retiree Health Benefits (RHB) liability.

Financial Analysis Report FY 2023

2

Figure I-1

Postal Service Net Income Trends

Source: Postal Service FY 2023 Form 10-K; Postal Service FY 2022 Form 10-K; United States Postal Service, Form 10-K FY 2021, November 10,

2021; United States Postal Service, Form 10-K FY 2020, November 13, 2020; United States Postal Service, Form 10-K FY 2019, November 14,

2019; United States Postal Service, Form 10-K FY 2018, November 16, 2018; United States Postal Service, Form 10-K FY 2017, November 14,

2017; United States Postal Service, Form 10-K FY 2016, November 28, 2016; United States Postal Service, Form 10-K FY 2015, November 13,

2015; United States Postal Service, Form 10-K FY 2014, December 5, 2014; (Collectively Postal Service Form 10-K, FY 2014-FY 2023)

As seen in Figure I-1, the Postal Service has not produced an operating profit in the last 7

fiscal years, and it has not had a positive net income since FY 2006. Even when excluding

NOEs, the Postal Service had posted a net operating income for only three of the last 10

years, FY 2014 through FY 2016, when the exigent price increase was in effect.

4

These continuing losses have negatively affected the Postal Service's financial position,

creating a substantial gap between the Postal Service’s assets and liabilities. At the end of

FY 2023, the Postal Service recorded total assets of $45.3 billion and total liabilities of

$68.4 billion.

The financial sustainability of the Postal Service is adversely impacted by insufficient

current assets to cover current liabilities.

04

From January 2014 to April 2016, an exigent price surcharge allowed the Postal Service to recover $4.6 billion in net revenue above its price

cap due to volume declines attributable to the Great Recession.

Financial Analysis Report FY 2023

3

At the end of FY 2023:

• The Postal Service’s net loss was $6.5 billion.

o The net deficit was $23.1 billion, consisting of an accumulated deficit of $39.2

billion offset by capital contributions of $16.1 billion.

• The highest growth in capital assets since the start of the Postal Accountability and

Enhancement Act (PAEA)5.

• The Postal Service’s cash and cash equivalents total, including restricted cash and

short-term investments, was $18.4 billion, a decrease of $2.2 billion compared to the

previous year.

o The remaining available borrowing authority from the PAEA-mandated debt

ceiling of $15 billion was $2 billion.

o The cash ratio was 0.50, a decrease of 0.14 compared to the prior year. The

FY 2023 cash ratio was also higher than the 10-year average of 0.22.

• The Postal Service’s operating revenue was $78.4 billion, which was $0.2 billion

lower than the previous year.

o In FY 2023, revenue from Competitive products increased slightly by $0.2

billion.

o Market Dominant revenue decreased by $0.4 billion in FY 2023 despite price

increases above the rate of inflation for all Market Dominant mail classes,

resulting from volume decreases in USPS Marketing Mail.

• FY 2023 was the first full year under the enactment of the Postal Service Reform Act

of 2022

6

(PSRA). Total operating expenses stood at $81.2 billion, which were $2.1

billion higher in FY 2023 than the prior year, and $0.8 billion more than the

Integrated Financial Plan due to higher-than-expected compensation.

• Rising inflation has contributed to increases in compensation and retirement benefit

expenses. Compensation and benefits were $0.9 billion higher than expected

primarily from the inflationary effects on Cost of Living Adjustments (COLAs).

• Personnel-related expenses made up 69.3 percent of total expenses.

o Total workhours and overtime hours decreased by 28 million and 27 million

hours respectively.

o Total postal employees increased by a net of approximately 4,300. Since FY

2020 the non-career workforce has declined by approximately 33,600

employees while the career workforce has increased by 29,000 employees.

05

Postal Accountability and Enhancement Act (PAEA), Pub. L. 109-435, 120 Stat. 3198 (2006).

06

Postal Service Reform Act (PSRA), Pub. L. 117-108, 136 Stat. 1127 (2022).

Financial Analysis Report FY 2023

4

Purpose of This Report

This report provides an in-depth analysis of the Postal Service’s financial performance

primarily using information reported in its Fiscal Year(FY) 2023 Form 10-K

7

measured

against its FY 2022 and its FY 2023 Integrated Financial Plan (IFP).

8

Additionally, data filed

with the FY 2023 Annual Compliance Report (ACR)

9

, such as the Cost and Revenue Analysis

report (CRA), the Cost Segments and Components (CSC) report, and the Revenue, Pieces, and

Weight (RPW) report, are utilized in developing this report.

This chapter provides a summary of the Commission’s findings.

Chapter 2 analyzes the Postal Service’s overall financial status, with a focus on key figures

in the Income Statement, Balance Sheet, and Cash Flow Statement. The Commission

evaluates relationships between the essential components of the Postal Service’s financial

statements to understand the Postal Service’s profitability, stability, and long-term

viability.

Chapter 3 describes the calculation of attributable and institutional cost and examines the

overall trends for Market Dominant and Competitive products and services. It includes

comparisons of volume, revenue, and cost between FY 2022 and FY 2023, as well as trend

analyses that highlight changes in volume, revenue, and cost that have occurred over time.

Chapter 4 disaggregates broad categories of costs into segments categorized by function

and includes a discussion of labor costs and workhours. The Commission also develops a

contribution margin income statement that facilitates analysis of the relationships between

revenue, attributable costs, institutional costs, and overall net income or loss. This year, the

Commission also analyzes the effects of recent high inflation on the costs and revenue of

the Postal Service and finds that although inflation has significantly increased costs,

revenue generated from CPI-based rate authority has offset most of these increases over

the past two years.

07

United Stated Postal Service, Form 10-K FY 2023, November 14, 2023 (Postal Service FY 2023 Form 10-K)

08

The Integrated Financial Plan is a Postal Service report that includes the operating plan, capital investment plan, and financing plan for the

fiscal year. This document is required to be filed as a periodic report pursuant to the 39 C.F.R. § 3050; United States Postal Service, Integrated

Financial Plan, Fiscal Year 2022, November 18, 2021 (Postal Service FY 2022 IFP); United States Postal Service, Integrated Financial Plan, Fiscal

Year 2023, November 29, 2022 (Postal Service FY 2023 IFP)

09

Docket No. ACR2023, United States Postal Service FY 2023 Annual Compliance Report, December 29, 2023 (FY 2023 ACR)

Financial Analysis Report FY 2023

5

Chapter II. Postal Service Financial Status

Introduction

The Commission evaluates the relationships of the essential components of the Postal

Service’s financial statements to analyze the Postal Service’s profitability, stability, and

long-term viability.

The Commission’s analysis, primarily based upon the Postal Service’s Form 10-K financial

statements, provides a basis for comparing FY 2022 and FY 2023. The Commission also

incorporates select key financial data from various relevant periods to support this

analysis.

The Postal Service’s Form 10-K report consists of:

• Income Statements, which measure the Postal Service’s financial performance

(profit and loss) over the fiscal year.

• Balance Sheets, which summarize the Postal Service’s assets and liabilities held at

the end of the fiscal year.

• Statements of Changes in Net Deficiency, which combine the accumulated net deficit

from operations and initial capital contributions.

• Statements of Cash Flows, which measure the Postal Service’s inflows and outflows

of cash during the fiscal year.

This chapter is divided into the following sections:

Analysis of Income Statements: This section reviews overall income and expenses and

compares actual revenue and expenses with those forecasted for the current year and

reported during the prior fiscal year. It also includes an analysis of key financial ratios that

help the Commission further assess the Postal Service’s profitability.

Analysis of Balance Sheets: This section begins with a summary of the Postal Service’s

assets and liabilities at the end of the fiscal year. The section also discusses changes in net

deficiency, which occur because Postal Service liabilities exceed its assets. The remainder

of the section provides a financial ratio analysis to assess both the short-term and long-

term stability of the Postal Service.

Analysis of Statements of Cash Flows: This section analyzes the Postal Service’s inflows and

outflows of cash and debt during the year.

Financial Analysis Report FY 2023

6

Analysis of Income Statements

To facilitate a detailed financial analysis of the Postal Service’s Income Statements, the

Commission separately identifies elements of reported operating revenue and operating

expenses. Net operating revenue includes mail and services revenue, miscellaneous item

revenue, and government appropriations revenue.

10

Net operating expense is calculated as

total expenses minus accruals for certain unfunded retirement liabilities and the non-cash

adjustments to the workers’ compensation liability.

11

The PAEA established the Retiree Health Benefit Fund (RHBF) to fund the long-term retiree

health benefits for postal employees, retirees, and their survivors. From FY 2007 through

FY 2016, the PAEA required the Postal Service to make specified annual payments into the

RHBF. The Postal Service defaulted on its annual payments from FY 2012 through FY 2017,

leaving a $33.9 billion unfunded balance in the RHBF. In addition, the Postal Service

defaulted on $18.8 billion of retiree health benefit normal cost payments from FY 2017

through FY 2021.

12

In April 2022, the PSRA cancelled the outstanding retiree health benefit

liability along with the FY 2022 retiree health benefit normal costs resulting in a $57 billion

adjustment.

In addition, the PSRA requires OPM to establish the Postal Service Health Benefits Program

within the existing Federal Employees Health Benefits program (FEHB), under which OPM

may contract with carriers to offer health benefit plans for Postal Service employees and

retirees. It also requires future retirees to enroll in Medicare.

13

These changes were

reflected on the FY 2022 Statement of Operations as a $57 billion non-cash adjustment to

total net income and on the Balance Sheet as a reversal to current liabilities. For analysis

purposes, the Commission excluded the $57 billion adjustment when appropriate in order

to accurately compare with FY 2023 financial results.

FY 2023 was the first full fiscal year under the enactment of the PSRA. The Postal Service is

still required to make annual amortization payments for unfunded Federal Employees

Retirement System (FERS) and Civil Service Retirement System (CSRS) liabilities. The PAEA

010

In FY 2023, $77 billion (97 percent) of total Postal Service revenue came from the sale of postage and mail services. Miscellaneous revenue

includes adjustments and revenue for miscellaneous items. The Postal Service also received a small governmental appropriation for providing

free mail for the blind and overseas voting and a few other programs.

11

These adjustments and expenses are properly recognized as accrual entries on the Postal Service’s Income Statements and are disaggregated

by the Commission to provide an in-depth analysis of the financial results for FY 2023. The Postal Service considers these expenses non-

controllable.

12

Beginning in FY 2017, the Postal Service’s share of healthcare premiums for retired employees was paid from the RHBF. The Postal Service

was required to make annual contributions to the RHBF for the normal costs of retiree health benefits.

13

Postal Service FY 2023 Form 10-K at 69.

Financial Analysis Report FY 2023

7

suspended the Postal Service’s contributions for CSRS until after FY 2016. Beginning in FY

2017, OPM annually revalues the CSRS liability and assesses installment payments in order

to liquidate the unfunded liability by FY 2043. In FY 2023, the Postal Service did not pay its

annual installment of $3 billion. Postal Service FY 2023 Form 10-K at 58. As of September

30, 2023, the Postal Service had a total of $13.8 billion in unpaid CSRS liabilities for years

FY 2017 through FY 2023. Id. at 38.

The FERS is a fully funded defined benefit plan. Beginning in FY 2013, the Postal Service is

required to make annual amortization payments as calculated by OPM. OPM calculates

these payments annually to liquidate the unfunded liability over a 30-year period on a

rolling basis. In FY 2023, the Postal Service paid $0.6 billion of the total $2.3 FERS

obligation, leaving $1.5 billion outstanding. Id. At 58. Since FY 2013, the Postal Service has

accumulated a total of $8.8 billion of unpaid FERS liabilities. Id. at 38.

Disaggregating the expenses in the Income Statement highlights the Postal Service’s

income with and without these statutorily required payments and the non-cash

adjustments to the workers’ compensation liability.

14

Table II-1 illustrates the

Commission’s disaggregated version of the Income Statements.

14

For FY 2022 results, the Commission also separately states the one-time PSRA adjustment to retiree health benefits.

Financial Analysis Report FY 2023

8

Table II-1

Analysis of Postal Service Income Statements, FY 2022 and FY 2023 ($ in Millions)

Decrease in revenue and expense is denoted by (). Increase in net loss is denoted by ().

N

umbers may not add across due to rounding.

Source: Docket No. ACR2023, Library Reference USPS-FY23-5, December 29, 2023( USPS-FY23-5); Docket No. ACR2022, Library Reference USPS-

FY22-5, December 29, 2022(USPS-FY22-5); United States Postal Service, USPS Preliminary Financial Information (Unaudited), September 2023,

November 14, 2023, FY 2023 Plan data from file "2023.11.14 September FY2023 Monthly Financial Report to the PRC.pdf”, (Postal Service

September 2023 PFI).

Net operating loss occurs when

the costs of running a business

are not covered by revenue.

Sustained net operating losses

can indicate deterioration of the

business. The Postal Service’s FY

2023 net operating loss is $1.8 billion more than the FY 2022 net operating loss,

representing an increase in operating losses and a decrease in profitability. The primary

reason for the deterioration is an increase in operating expenses of $2.1 billion in FY

2023.

15

This increase was largely caused by increases in compensation and other expenses,

partially offset by the decline in purchased transportation. Contributing factors were wage

increases (which include inflationary impacts on COLAs, increases in FERS and CSRS

unfunded expenses, increases in vehicle maintenance service, increases in information

15

The Commission excludes the $57 billion PSRA adjustment when comparing FY 2023 operating expenses to the prior year. When the $57

billion PSRA adjustment is included, FY 2022 operating expenses equal $79.6 billion.

IN FY 2023, THE POSTAL SERVICE’S LOSS

INCREASED BY $1.8 BILLION COMPARED TO FY

2022, REPRESENTING A FURTHER DECREASE IN

PROFITABILITY.

Financial Analysis Report FY 2023

9

technology for system upgrades, and facility rent increases. Postal Service FY 2023 Form

10-K at 23, 36.

Operating revenue decreased by approximately $0.2 billion compared to FY 2022.

Competitive revenue increased by $0.2 billion to partially offset the Market Dominant

revenue decline of $0.4 billion. The decrease in revenue was driven primarily by volume

declines in USPS Marketing Mail.

Market Dominant Revenue Compared to Prior Year

The discussion in this section summarizes the overall revenue by class for Market

Dominant products. Chapter 3 disaggregates revenue by class and product. Table II-2

compares FY 2023 with FY 2022 revenue by class.

Table II-2

Revenue by Market Dominant Class,

16

FY 2022 and FY 2023 ($ in Millions)

Decrease in revenue is denoted by ().

Numbers may not add across due to rounding.

Source: Docket No. ACR2023, Library Reference PRC-LR-ACR2023-1, March 28, 2024 (PRC-LR-ACR2023-1); Docket No. ACR2022, Library

Reference PRC-LR-ACR2022-1, March 29, 2023 (PRC-LR-ACR2022-1); Docket No. ACR2023, Library Reference USPS-FY23-42, December 29,

2023.(USPS-FY23-42)

Market Dominant mail and services revenue decreased by 0.7 percent from the prior

year.

17

As shown in Table II-2, USPS Marketing Mail (5.7%) and Periodicals (3.8%) declined

when compared to SPLY. Partially offsetting those declines were revenue increases in First-

Class Mail (2.3%) and Package Services (4%).

Changes in revenue per piece resulting from rate increases, volume changes, and migration

between classes, products, and rate categories (known as mail mix fluctuations) affect total

16

Other Market Dominant revenue includes appropriations, miscellaneous item revenue, and revenue foregone.

17

Total Market Dominant Mail includes Other Revenue which includes appropriations, mail in transit, and other miscellaneous items.

Financial Analysis Report FY 2023

10

revenue. Figure II-1 isolates the change in Market Dominant revenue due to mail volume

changes, mail mix, and average revenue per piece for each year since FY 2016. For overall

Market Dominant products, decreases in volume partially offsets increases in revenue per

piece and revenue increases from mail mix fluctuations.

Figure II-1

Change in Market Dominant Revenue Due to Changes in Mail Volume, Mail Mix,

and Average Revenue per Piece, FY 2017-FY 2023 ($ in Millions)

Source: PRC derived from Docket No. ACR2017, Library Reference USPS-FY17-42, December 29, 2017; Docket No. ACR2018, Library Reference

USPS-FY18-42, December 28, 2018; Docket No. ACR2019, Library Reference USPS-FY19-42, December 27, 2019; Docket No. ACR2020, Library

Reference USPS-FY20-43, December 29, 2020; Library Reference USPS-FY21-43, December 29, 2021; Docket No. ACR2022, Library Reference

USPS-FY22-43, December 29, 2022; Docket No. ACR2023, Library Reference USPS-FY23-43, December 29, 2023 (collectively, Postal Service RPW

Report, FY 2016–FY 2022).

Competitive Product Revenue Compared to Prior Year

Total revenue from Competitive products increased by $0.2 billion or 0.7 percent

compared to FY 2022 resulting from January 2023 rate increases and a time-limited price

increase in effect during the first quarter (peak season) of FY 2023.

18

Table II-3 compares

revenue for Competitive products between FY 2022 and FY 2023.

18

Postal Service FY 2023 Form 10-K at 22.

Financial Analysis Report FY 2023

11

Table II-3

Competitive Product Revenue, FY 2022 and FY 2023 ($ in Millions)

a

Total Ground consists of Parcel Select, Parcel Return & USPS Ground Advantage

Decrease in revenue denoted by ().

Numbers may not add across due to rounding.

Source: PRC-LR-ACR2023-1; PRC-LR-ACR2022-1.

Expense Analysis as Compared to Prior Year

As noted earlier, for purposes of

analyzing the Postal Service’s

financial position, the Commission

differentiates between operating and

total expenses. As shown in Table II-

4, in FY 2023, total expenses

increased by $5.8 billion (7.3 percent), while operating expenses increased by

approximately $2.1 billion (2.6 percent). The increase in operating expenses was the result

of increases in salaries and benefits, supplies and services, information technology, and

other expenses.

TOTAL EXPENSES INCREASED BY $5.8

BILLION (7.3%), WHILE OPERATING

EXPENSES INCREASED BY

APPROXIMATELY $2.1 BILLION (2.6%).

Financial Analysis Report FY 2023

12

Table II-4

Total Expenses, FY 2022 and FY 2023 ($ in Millions)

19

Decrease in expenses is denoted by (). NMF denotes not meaningful.

Numbers may not add across due to rounding.

Source: September 2023 PFI, file"2023.11.14 September FY2023 Monthly Financial Report to+ the PRC.pdf”; September 2022 PFI Report

(unaudited), file "2022.11.10. Sept FY2022 Monthly Fin Rep.pdf," November 11, 2022.

PERSONNEL EXPENSES

The majority of Postal Service expenses are personnel related. In FY 2023, operating

personnel expenses which exclude the non-cash adjustment to workers’ compensation and

amortization costs of unfunded retirement liabilities,

made up 69.3 percent of total expenses.

20

Including

the non-cash adjustments, labor costs account for 74.2

percent of total expenses.

Table II-5 shows that total personnel operating expenses for FY 2023 increased by $1.9

billion from FY 2022, resulting from increases in salaries, retirement, and employee health

benefits. When systemwide personnel expenses were included, total personnel expenses

increased by $5.6 billion. The net non-cash increase in the workers’ compensation

liability

21

and other non-operating retirement expenses all increased from FY 2022.

19

The PSRA adjustment of RHB Unfunded Liability is excluded from the calculation of percentage of total costs.

20

Subtotal personnel expenses ($59.2 billion) as a percentage of total operating expenses ($85.4 billion).

21

Workers’ compensation expense consists of cash payments, miscellaneous expenses, and the net increase (decrease) in the workers’

compensation liability.

LABOR COSTS ACCOUNT FOR

74.2 PERCENT OF POSTAL

SERVICE’S TOTAL EXPENSES.

Financial Analysis Report FY 2023

13

Table II-5

Breakdown of Total Personnel Expenses, FY 2022 and FY 2023 ($ in Millions)

Decrease in expenses is denoted by (). NMF denotes not meaningful figures.

Numbers may not add across due to rounding.

Source: PRC derived from United States Postal Service, National Trial Balance and Statement of Revenue Expenses, September 2023, November

14, 2023 (Postal Service National Trial Balance September 2023); Postal Service National Trial Balance September 2022, November 14, 2022.

Total compensation is comprised of

salaries for employees (full-time career,

part-time career, and non-career),

overtime and leave pay, and performance

or arbitration awards. There are several

cost drivers for compensation, including

contractual pay increases, inflation used to

calculate semi-annual COLAs, the number

of overtime workhours, and the composition of the workforce. The total compensation in

FY 2023 increased by approximately $0.9 billion compared to FY 2022 primarily due to

contractual wage increases partially offset by a decline in workhours. Collective bargaining

agreements include provisions for mandatory COLAs linked to the Consumer Price Index

for Urban Wage Earners and Clerical Workers (CPI-W). Beginning in FY 2021 COLAs

increases have been larger than the historical increases over the past decade. Postal Service

FY 2023 Form 10-K at 13. Overtime hours declined by approximately 27 million while

straight time hours declined by 1 million. Id. at 24. Impacts of inflation on FY 2023 postal

finances are discussed further in Chapter 4.

Figure II-2 illustrates the change in overtime workhours by craft. Overtime hours

decreased for all crafts except for postmasters, supervisors, rural carriers, vehicle

maintenance, and headquarters. According to the Postal Service, total overtime workhours

THE TOTAL COMPENSATION IN FY

2023 INCREASED BY APPROXIMATELY

$0.9 BILLION COMPARED TO FY 2022

PRIMARILY DUE TO CONTRACTUAL

WAGE INCREASES PARTIALLY OFFSET

BY A DECLINE IN WORKHOURS.

Financial Analysis Report FY 2023

14

decreased by approximately 16 million hours resulting in part from lower First-Class mail

and Shipping and Packages volume. Id.

Figure II-2

Change in Overtime Workhours, FY 2022 and FY 2023

22

Source: PRC derived from United States Postal Service, National Payroll Hours Summary Report, Pay Period 20, 2023, September 29, 2023 (2023

National Payroll Hours Summary PP20); United Stated Postal Service, National Payroll Hours Summary Report, Pay Period 20, 2022, October 4,

2022 (2022 National Payroll Hours Summary PP20). (Collectively National Payroll Hours Summary PP20 2022-2023)

The Postal Service’s workforce is comprised of career (full-time and part-time) and non-

career employees, including Postal Support Employees (PSE), City Carrier Assistants (CCA),

Mailhandler Assistants (MHA), and Other Non-Career Employees. Table II-6 shows the

number of employees by type for FY 2021-FY 2023.

22

“Other” includes Postmasters, Professional and Administrative, Vehicle Operators, and Headquarters.

Financial Analysis Report FY 2023

15

Table II-6

Postal Service Employee Complement, FY 2021–FY 2023

Decrease in amounts is denoted by ().

Numbers may not add across due to rounding.

Source: United States Postal Service, On-Roll and Paid Employee Statistics, Pay Period 20, 2023, September 29, 2023; United States Postal

Service, On-Roll and Paid Employee Statistics), Pay Period 20, 2022, September 29, 2023; United States Postal Service, On-Roll and Paid

Employee Statistics, Pay Period 20, 2021, September 29, 2021 (Collectively Postal Service ORPES PP 20 2021-2023)

In FY 2023, the Postal Service’s total workforce increased by 4,346 employees. Increases in

career employees (8,332) were partially offset by declines in non-career workforce

employees (4,000).

23

Postal Service FY 2023 Form 10-K at 24.

In March 2022, the Postal Service reached an agreement with the National Rural Letter

Carriers Association (NRLCA),

24

which covers a 3-year period from May 2021 to May 2024.

The contract covers 132,000 rural letter carriers and includes a 1.3 percent general wage

increase for November 2023 and COLAs increases for January 2023 and July 2023.

25

In February 2022, the Postal Service reached a final agreement with the American Postal

Workers Union, AFL-CIO (APWU), that expires in September 2024. The contract covers

over 200,000 Postal employees and includes general wage increases for November 2022

and COLAs increases in March and September of each year. The contract will also convert

PSEs to career status depending on the size of their respective post offices.

26

23

Other non-career positions include casuals, non-bargaining temporary positions, rural carrier substitutes, postmaster relief and postal

support employees.

24

Postal Service FY 2022 Form 10-K at 75.

25

National Rural Letter Carrier Association, Agreement between the United States Postal Service and the National Rural Letter Carriers’

Association 2021-2024 (2022), Handbook EL-902 - Agreement between the United States Postal Service and the National Rural Letter Carriers’

Association (ncrlca.org)

26

American Postal Workers Union, AFL-CIO,2021-2024 Tentative Collective Bargaining Agreement, February 28, 2022,

https://apwu.org/contracts/2021-2024-apwuusps-collective-bargaining-agreement.

Financial Analysis Report FY 2023

16

In March 2023, the Postal Service

finalized its negotiations with the

National Postal Mail Handlers

Union, AFL-CIO (NPMHU), on a

new collective bargaining

agreement. The new contract will expire in September 2025 and includes six COLAs

payments during the term of the agreement and general wage increases of 1.3 percent.

27

During FY 2023, total workhours decreased by approximately 28 million. This was the

second year in a row that workhours decreased.

28

Figure II-3 illustrates the change in total

workhours since FY 2007.

Figure II-3

Change in Total Workhours, FY 2007–FY 2023

Source: Postal Service Form 10-K, FY 2014–FY 2023; United States Postal Service, Form 10-K FY 2013, November 15, 2013; United States Postal

Service, Form 10-K FY 2012, November 15, 2012; United States Postal Service, Form 10-K FY 2011, September 30, 2011; United States Postal

Service, Form 10-K FY 2010, September 30, 2010; United States Postal Service, Form 10-K FY 2009, September 30, 2009; United States Postal

Service, Form 10-K FY 2008, September 30, 2008; United States Postal Service, Form 10-K FY 2007, November 20, 2007 (Collectively Postal

Service Form 10-K FY 2007-FY 2023)

27

National Postal Mail Handlers Union, 2022-2025 NPMHU National Agreement, March 13, 2023,

https://m.npmhu.org/media/news/body/2022-2025-NPMHU-National-Agreement-2.pdf.

28

Postal Service FY 2023 Form 10-K at 24.

(120.0)

(100.0)

(80.0)

(60.0)

(40.0)

(

20.0)

0.0

20.0

40.0

FY 2007

FY

2008

FY 2009

FY

2010

FY 2011

FY 2012

FY 2013

FY 2014

FY 2015

FY 2016

FY 2017

FY 2018

FY 2019

FY 2020

FY 2021

FY 2022

FY 2023

Change in Number of Workhours (in Millions)

Fiscal Year

DURING FY 2023, TOTAL WORKHOURS

DECREASED BY APPROXIMATELY 28 MILLION.

THIS WAS THE SECOND YEAR IN A ROW THAT

WORKHOURS DECREASED.

Financial Analysis Report FY 2023

17

An analysis of workhours by function shows that in FY 2023, workhours decreased in Mail

Processing (8.6 percent ), Customer Service (3.9 percent), City Delivery (1.1 percent ), and

Rural Delivery (0.7 percent ). Workhours increased in Plant & Equipment (1.6%), Vehicle

Maintenance (2.2 percent ), and Other (1.8 percent ).

29

Table II-7

Workhours by Function (Thousands of Workhours), FY 2021–FY 2023

Decrease in amounts is denoted by ().

Numbers may not add across due to rounding.

Source: Docket No. ACR2023, Library Reference USPS-FY23-7, December 29, 2023 (USPS-FY23-7); Docket No. ACR2022, Library Reference USPS-

FY22-7, December 29, 2022 (USPS-FY22-7); Docket No. ACR2021, Library Reference USPS-FY21-7, December 29, 2021 (USPS-FY21-7).

The Postal Service defines productive hourly wage rates as the labor costs per work hour

by cost segment/craft.

30

This metric reflects the effect of wage levels, the composition of

workers, overtime, pay premiums, and leave usage on hourly labor costs. Table II-8 shows

the productive hourly wage rates.

31

The productive hourly wage rate for all categories

increased compared to the prior year.

29

The “Other” category represents Operations Support, Finance, Human Resources, Administration, Training, and Rehabilitation workhours.

30

Docket No. ACR2023, Library Reference USPS-FY23-17, December 29, 2023, PDF file “USPS-FY23-17.pdf,” at 1(USPS-FY23-17).

31

The productive hourly wage rate is a measure of total compensation and benefits costs per hour worked. Compensation includes overtime,

annual, sick, or holiday pay and any other hourly pay premiums.

Financial Analysis Report FY 2023

18

Table II-8

Productive Hourly Wage Rates ($ per Workhour), FY 2021–FY 2023

Decrease in amounts is denoted by ().

Numbers may not add across due to rounding.

Source: USPS-FY23-7; USPS-FY22-7; USPS-FY21-7.

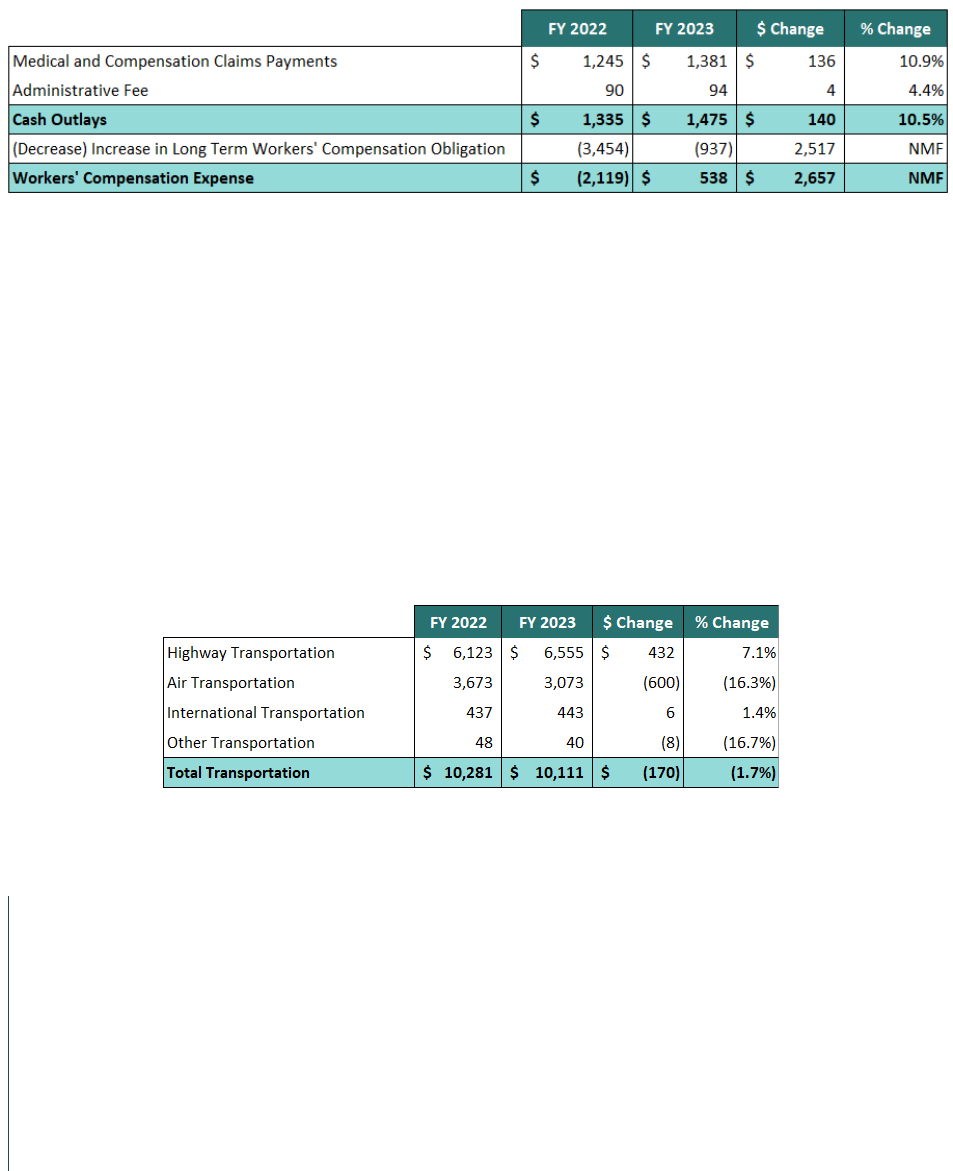

Workers’ compensation expenses increased by $2.7 billion in FY 2023. Workers’

compensation expenses consist of a cash payment and a non-cash change in long-term

workers’ compensation liability. The cash payment is paid to the U.S. Department of Labor

for the current year’s cost of medical and compensation benefits and an administrative

fee.

32

The non-cash change in long-term workers’ compensation expenses includes

actuarial revaluations of existing cases and new cases, initial costs of new cases for the

year, and any changes in the discount rate used to estimate the amount of current funds

needed to settle all claims in the current year. These factors cause the non-cash portion of

workers’ compensation to fluctuate year to year. In FY 2023, the non-cash component of

long-term workers’ compensation expenses increased by $2.5 billion compared to the prior

year. Table II-9 disaggregates components factoring into the workers’ compensation

expense for the past 2 years.

32

The workers’ compensation program is administered by the Department of Labor which makes all decisions regarding injured workers’

eligibility for benefits. The Postal Service reimburses the DOL for all workers’ compensation benefits paid on behalf of its employees, plus an

administrative fee. Postal Service FY 2023 Form 10-K at 33.

Financial Analysis Report FY 2023

19

Table II-9

Components of Workers’ Compensation Expense, FY 2022 and FY 2023 ($ in Millions)

Decrease in expenses is denoted by ().

Numbers may not add across due to rounding.

NMF = Not Meaningful Figure

Source: PRC derived from Postal Service FY 2023 Form 10-K at 34, 70.

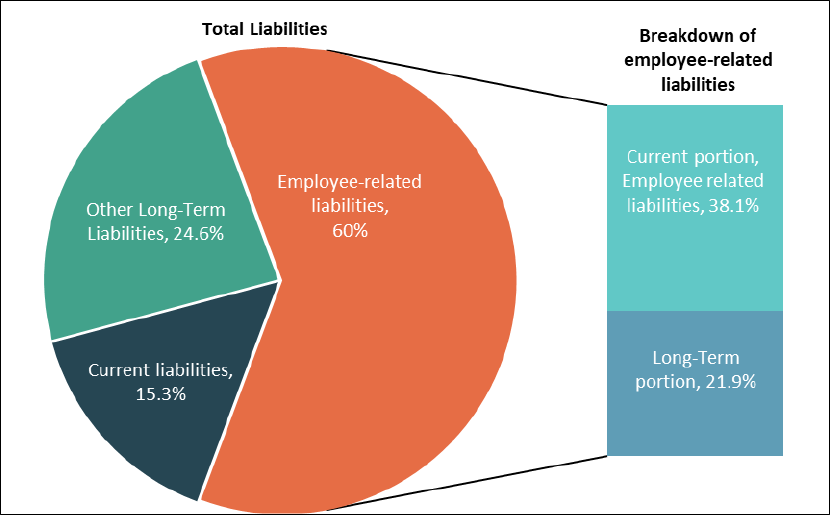

NON-PERSONNEL EXPENSES

Transportation is the largest non-personnel expense. It accounts for 11.8 percent of total

expenses. Table II-10 shows transportation expenses by category.

Table II-10

Transportation Expenses by Category, FY 2022 and FY 2023 ($ in Millions)

Decrease in expenses is denoted by ().

Numbers may not add across due to rounding.

Source: PRC derived from Postal Service FY 2023 Form 10-K at 34-35.

Total purchased transportation expenses

decreased for the first time since FY 2016, by

1.7 percent from FY 2022. Highway

transportation increased by 7.1 percent

compared to last year. Postal Service FY 2023

Form 10-K at 35. Air transportation expenses

decreased by 16.3 percent compared to last

year resulting from a shift in package volume

AIR TRANSPORTATION EXPENSES

DECREASED BY 16.3%

COMPARED TO LAST YEAR

RESULTING FROM A SHIFT IN

PACKAGE VOLUME FROM AIR TO

HIGHWAY TRANSPORTATION AS

PART OF THE DELIVERING FOR

AMERICA PLAN.

Financial Analysis Report FY 2023

20

from air to highway transportation as part of the Delivering for America plan. Id. at 35.

Table II-11 shows all other non-personnel-related expenses increased by $0.3 billion in FY

2023 resulting from higher vehicle maintenance for an aging vehicle fleet, increases in

supplies and services, higher information technology costs associated with system

upgrades, and increasing facility rents and utilities. Id.

Table II-11

Other Non-Personnel Expenses, FY 2022 and FY 2023 ($ in Millions)

Decrease in expenses is denoted by ().

Numbers may not add across due to rounding.

Source: PRC derived from Postal Service FY 2023 Form 10-K at 35.

Comparison of Postal Service Actual Results to Operating Plan

Each year the Postal Service develops an integrated financial plan that includes forecasts of

volume, revenue, and expenses for the following year. This section compares the Postal

Service’s forecasts with actual results. The Postal Service’s FY 2023 Operating Plan, as

outlined in its 2023 Integrated Financial Plan (IFP), projected a net loss of $4.5 billion in FY

2023.

33

The actual total net loss of $6.5 billion was $1.9 billion more than the Postal Service

estimated. Total revenue was $1.8 billion less than planned. Total operating expenses were

$0.9 billion more than planned, resulting primarily from higher than expected

compensation. Table II-12 compares actual FY 2023 results with the estimated results in

the Operating Plan.

33

United States Postal Service, Revised Integrated Financial Plan, Fiscal Year 2023, December 1, 2022, at 1 (Postal Service FY 2023 IFP); USPS

Preliminary Financial Information (unaudited), September 2023, November 14, 2023 (September 2023 Revised PFI). Excluding the retiree

health benefit prefunding adjustment.

Financial Analysis Report FY 2023

21

Table II-12

Actual and Operating Plan Income Statements, FY 2023 ($ in Billions)

Decrease in revenue and expense is denoted by (). Increase in net loss is denoted by ().

Numbers may not add across due to rounding.

Source: Postal Service September 2023 PFI, file “2023.11.14+September+FY2023+Monthly+Financial+Report+to+the+PRC.pdf”.

As seen in Table II-13, total revenue was $1.9 billion less than anticipated. First-Class Mail,

USPS Marketing Mail, Periodicals and Competitive and Other Parcels

34

were less than

projected while Other Mail revenues were more than projected.

Table II-13

Actual and Operating Plan Revenue by Categories Shown in IFP,

35

FY 2023 ($ in Billions)

36

Decrease in revenue is denoted by ().

Numbers may not add across due to rounding.

Source: United States Postal Service, Integrated Financial Plan FY 2024, November 11, 2023, at 2 (Postal Service FY

2024 IFP); Postal Service FY 2023 IFP at 3.

34

Competitive and Other Parcels mail includes Competitive packages and Market Dominant Package Service mail.

35

The Postal Service FY 2023 IFP isolates volume from International and Parcels from the other categories. See Postal Service FY 2022 IFP at 3.

36

“Other” includes special services and other miscellaneous revenue including Federal Interagency Agreements, Appropriations and Investment

Income. The Commission includes other miscellaneous revenue for comparison to the Postal Service’s IFP report which includes all sources of

revenue in its FY 2023 estimates.

Financial Analysis Report FY 2023

22

Total volume was less than expected, primarily due to lower-than-expected volume in

First-Class Mail and USPS Marketing Mail. Table II-14 compares volumes for FY 2023 with

the volume projected in the Operating Plan.

Table II-14

Actual and Operating Plan Volume by Categories Shown in IFP,

37

FY 2023 ($ in Billions)

Decrease is denoted by ().

Numbers may not add due to rounding.

Source: Postal Service September 2023 PFI at 2; Postal Service FY 2023 IFP at 3.

Total operating expenses were $0.8 billion more than anticipated as a result of higher than

anticipated compensation and benefits and transportation. Compensation and benefits

were $0.9 billion higher resulting from inflationary effects on COLAs. Postal Service FY

2023 Form 10-K at 23. Salaries and benefits were expected to increase by $1.2 billion in FY

2023; actual salaries and benefits were $1.7 billion higher despite a decline in workhours

of approximately 28 million.

The increase in salaries and benefits costs was the result of higher than expected inflation

linked to CPI-W. Actual and projected COLAs increases, beginning in FY 2021, have been

larger than the historical increases over the past decade. Id. at 13.

Excluding the non-cash workers’ compensation adjustment,

38

non-operating expenses

were $0.1 billion more than expected resulting from inflationary impacts on the actuarially

determined liabilities and an increase in FERS normal costs due to the changing workforce

composition. Postal Service FY 2023 Form 10-K at 25.

37

The Postal Service FY 2023 IFP isolates revenue and volume from International and Parcels from the other categories. See Postal Service FY

2023 IFP at 3.

38

The Postal Service excludes the non-cash adjustment to workers’ compensation from plan because it is dependent on actuarial assumptions,

interest rates, and other factors outside of Postal Service management’s control. See Postal Service FY 2023 IFP at 1.

Financial Analysis Report FY 2023

23

Total non-personnel expenses were $0.1 billion less than projected from the result of

higher than anticipated transportation and other expenses.

Table II-15

Actual and Operating Plan Expenses, FY 2023 ($ in Billions)

Decrease in amounts is denoted by ().

Numbers may not add across due to rounding.

Source: Postal Service September 2023 PFI Report at 3; Postal Service FY 2023 IFP at 1.

Financial Ratio Analysis

Financial ratios assist in interpreting accounting information. The Commission calculated

key financial ratios to facilitate its analysis of the Postal Service’s financial performance

between FY 2006 and FY 2023. These ratios provide a concise and systematic way to

organize financial data into meaningful information. The historic accounting information

used in ratio analysis is not adjusted for inflation in order to maintain consistency with

Generally Accepted Accounting Principles (GAAP) and comparability over time and also

because some postal expenses, such as labor, retirement, and workers’ compensation are

impacted by cost indexes other than inflation.

Financial Analysis Report FY 2023

24

OPERATING RATIO

The operating ratio measures how well an organization can control operating expenses

while generating revenue. The Commission measures this by comparing the Postal

Service’s total operating expenses to its total operating revenue. An operating ratio greater

than 1.0 indicates a net operating loss, and a ratio less than 1.0 indicates a net operating

profit.

39

In the period reflected in Figure II-4, the Postal Service had a net operating profit

in FY 2006 through FY 2008 and FY 2014 through FY 2016. An operating ratio below 1

indicates an operating profit and an improvement in the Postal Service’s ability to reduce

its operating expenses while generating

revenue. In FY 2020, operating revenue

and operating expenses were the highest

in more than a decade. In FY 2021 and FY

2022, the operating ratio declined as

operating revenue grew at a higher rate

than operating expenses. In FY 2023 the

operating ratio increased to 1.04 as

revenue declined and operating expenses

increased. In FY 2023 operating revenue declined by 0.3 percent while operating expenses

increased by 2.6 percent. Rising inflation has contributed to increases in compensation and

retirement benefit expenses while also causing volatility in supplies and services, fuel and

energy costs.

39

The Commission calculates the operating ratio by dividing total operating expenses by total operating revenue.

RISING INFLATION HAS

CONTRIBUTED TO INCREASES IN

COMPENSATION AND

RETIREMENT BENEFIT EXPENSES,

WHILE ALSO CAUSING VOLATILITY

IN SUPPLIES AND SERVICES, FUEL

AND ENERGY COSTS.

Financial Analysis Report FY 2023

25

Figure II-4

Operating Ratio Trend FY 2006–FY 2023

Source: PRC derived from Postal Service Form 10-K, FY 2007–FY 2023; United States Postal Service, FY 2006 United States Postal Service

Annual Report, September 30,2006 (Postal Service FY 2006 Annual Report).

RETURN ON ASSETS

The return on assets ratio is a measure of how efficiently an organization uses its assets to

generate profits. It compares total assets to net income (loss) for each year. A negative

return on assets indicates net losses and/or low capital investment. Figure II-5 shows the

Postal Service’s return on assets since FY 2006.

0.90

0.92

0.94

0

.96

0.98

1

.00

1

.02

1.04

1.06

Operang Rao

Fiscal Year

Operang Rao

Threshold

Financial Analysis Report FY 2023

26

Figure II-5

Return on Assets Trend FY 2006–FY 2023

Source: PRC derived from Postal Service FY 2006 Annual Report; Postal Service Form 10-K, FY 2007–FY 2023.

The Postal Service’s total assets are cash and cash equivalents; receivables; and property,

plant, and equipment. At the end of FY 2023, the Postal Service had a negative return on

assets ratio of 0.14,

40

a decline compared to the prior year’s ratio of negative 0.02.

Increasing capital investments in property, plant and equipment were offset by cash

declines. The increase in FY 2023 total net loss was the result of declining revenue and an

increase in operating expenses. The total net loss of $6.5 billion for FY 2023 was primarily

the result of compensation increases including the non-cash component of workers’

compensation, which increased by $2.5 billion compared to the prior year. The increase

was driven by a significant increase in discount rates in FY 2023. An increase of 1 percent

in interest rates can increase the workers’ compensation liability by $1.2 billion. Postal

Service FY 2023 Form 10-K at 43.

FY 2006 was the last year that showed a positive ratio. This was during the Postal

Reorganization Act regime when revenue was required to cover costs (break-even). From

FY 2007 through FY 2010, the percentage change in year-to-year net losses was greater

40

For analysis purposes the Commission excludes the one-time non-cash adjustment to retiree health benefit unfunded liability accruals ($57

billion).

(0.80)

(0.70)

(0

.60)

(0.50)

(0

.40)

(0

.30)

(0.20)

(0

.10)

0.00

0

.10

FY 2006

FY 2007

FY 2008

FY 2009

FY 2010

FY 2011

FY 2012

FY 2013

FY 2014

FY 2015

FY 2016

FY 2017

FY 2018

FY 2019

FY 2020

FY 2021

FY 2022

FY 2023

Return on Assets Rao

Fiscal Year

Financial Analysis Report FY 2023

27

than the percentage change in year-to-year total assets, resulting in increasingly negative

ratios. During this period, the Postal Service began using available debt to invest in capital

and fund its operations. From FY 2006 through FY 2011, the Postal Service used $13 billion

of its $15 billion allowable debt.

41

The sharp decline in FY 2012 was largely the result of

two retiree health benefits prefunding payments totaling $11.1 billion. The improvement in

FY 2014 through FY 2016 was primarily the result of revenue generated from the exigent

surcharge

42

and improving cash balances resulting from defaults on annual RHB

prefunding payments. The improvement in FY 2017 resulted from lower retirement-

related health benefit expenses compared to the statutory prefunding of the RHB and a

decrease in non-cash workers’ compensation expenses from higher discount rates.

Analysis of Balance Sheets

This section analyzes the Postal Service’s financial situation and use of resources based on

data from Balance Sheets prepared according to GAAP. The analysis compares two points

in time, September 30, 2023 (FY 2023) and September 30, 2022 (FY 2022). Table II-16

compares certain categories in the Postal Service’s asset and liability structure for FY 2023

with FY 2022.

41

Postal Service Form 10-K, Balance Sheet, FY 2007–FY 2010.

42

See Docket No. R2013-11, Order Granting Exigent Price Increase, December 24, 2013 (Order No. 1926).

Financial Analysis Report FY 2023

28

Table II-16

Structure of Assets and Liabilities, FY 2022 and FY 2023 ($ in Millions)

Decrease in amounts is denoted by ().

Numbers may not add across due to rounding.

Source: Postal Service FY 2023 Form 10-K at 47.

At the end of FY 2023, total assets decreased by $0.9 billion compared to the prior period,

driven by declines in available cash partially offset by an increase in short-term

investments.

43

Current assets are the sum of cash and cash equivalents, receivables and

supplies, and prepayments, easily converted to cash for financing operations. Noncurrent

assets, mainly buildings and equipment (capital assets), are more difficult to convert to

cash in the short term.

Liabilities at the end of FY 2023 totaled $68.4 billion, 53.4 percent of which were current

liabilities. Current liabilities are obligations that will come due within 1 year, while

noncurrent liabilities are long-term financial obligations. The Postal Service is required to

make payments for amortization of unfunded CSRS and FERS liabilities. The Postal Service

continued to accrue these unpaid retirement expenses, which totaled approximately $22.7

billion at the end of FY 2023. This obligation is 62.2 percent of current liabilities.

Additionally, at the end of FY 2023, the Postal Service had $1 billion more in short-term

43

The Postal Service invested excess cash not immediately necessary for operations in the amount of $8.8 billion and restricted cash in the

amount of $3.2 billion in Treasury bills of various maturities ranging between six months to one year. Postal Service FY 2023 Form 10-K at 62.

Financial Analysis Report FY 2023

29

debt compared to FY 2022. Long-term liabilities consist mainly of workers’ compensation

liability ($12.5 billion) and the total debt owed to the Federal Financing Bank ($12 billion).

On the Balance Sheets, net deficiency represents the difference between total assets and

total liabilities. This indicates whether assets were financed by borrowing (liability) or by

capital contributions and accumulated earnings from prior years. Net deficiency occurs

when liabilities are greater than assets.

At the end of FY 2023, the Postal Service recorded a $23.1 billion net deficit consisting of an

accumulated deficit of $39.2 billion offset by capital contributions of $16.1 billion. The

accumulated deficit is the result of multiple years of net losses, beginning in FY 2007, offset

by FY 2022 net income of $56 billion driven by PSRA adjustments. The $16.1 billion in

capital contributions consists of a beginning balance of $13.1 billion

44

and the $3.0 billion

in funds the Postal Service received in FY 2022 as part of the Inflation Reduction Act of

2022.

Figure II-6 shows the mix of the Postal Service’s asset and liability structure as of

September 30, 2023. The shortage of current assets (44.4 percent of total assets) to cover

current liabilities (53.4 percent of total liabilities) adversely affects the Postal Service’s

financial condition. In FY 2023, the Postal Service did not have a sufficient amount of

current assets to pay for current liabilities. Non-current assets comprise 55.6 percent of

total assets, while non-current liabilities only comprise 46.6 percent of total liabilities.

44

Total capital contributions of the U.S. government were $3.1 billion as of September 30, 2014, consisting of the beginning transfer of assets

from the former Post Office Department (POD) ($1.7 billion), cash contributions between 1972 and 1982 ($1.3 billion), and the contribution

of approximately 6,500 fuel efficient vehicles during FY 2009 and FY 2010 ($53 and $49 million), respectively.

Financial Analysis Report FY 2023

30

Figure II-6

Comparison of Postal Service’s FY 2023 Current and Noncurrent Assets and Liabilities

Source: PRC derived from Postal Service FY 2023 Form 10-K at 46.

Working capital is the difference between current assets and current liabilities. Negative

working capital indicates an excess of current liabilities over current assets. In FY 2023, the

Postal Service’s working capital was negative $16.4 billion.

Assets

Since 2008, Postal Service capital investments have not kept pace with depreciation and

amortization. Aging capital assets and the continued restrictions on capital investment

resulted in a depreciation expense in excess of investments from FY 2008 to FY 2019; fixed

assets declined by $9.2 billion over that period. The Postal Service reduced its capital

expenditures from an annual average of approximately $1.5 billion in FY 2009 through FY

2011 to an annual average of approximately $850 million in FY 2012 through FY 2015, a

reduction of approximately 43 percent. From FY 2015 through FY 2019, capital

expenditures to upgrade facilities, equipment, and the vehicle fleet increased to an annual

average of approximately $1.4 billion. In FY 2020 and FY 2021 capital assets grew at an

average rate of 1.4 percent.

0

5

10

15

20

25

30

35

40

Assets Liabilies

$ In Billions

Current Noncurrent

Financial Analysis Report FY 2023

31

Figure II-7

Percent Change in Capital Assets, FY 2006 - FY 2023

Source: PRC derived from Postal Service Form 10-K, FY 2006–FY 2023.

FY 2023 recorded its highest positive growth

in capital assets. The Postal Service recorded a

7.3 percent growth in capital, compared to the

2.5 percent in FY 2022. The Postal Service

purchased $3 billion in property and

equipment, offset by the total property, plant,

and equipment depreciation of $1.8 billion.

In September 2022, the Postal Service received $3.0 billion under the Inflation Reduction

Act of which $1.3 billion is available for the purchase of zero-emission vehicles with the

additional $1.7 billion available for the purchase and installation of infrastructure to

support those vehicles. Id. at 56.

FY 2023 RECORDED ITS HIGHEST

POSITIVE GROWTH IN CAPITAL

ASSETS. THE POSTAL SERVICE

RECORDED A 7.3% GROWTH IN

CAPITAL, COMPARED TO THE 2.5%

IN FY 2022.

Financial Analysis Report FY 2023

32

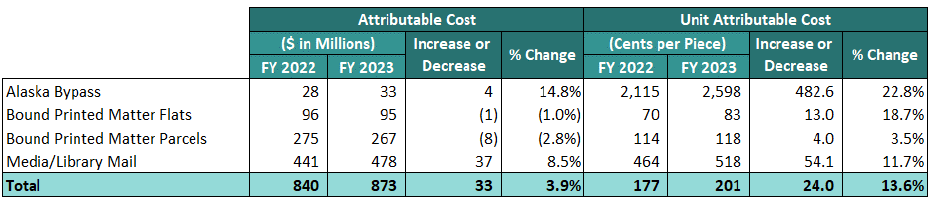

LIABILITIES

In FY 2023, total liabilities increased by $5.7 billion, resulting from increases in retirement

benefit liabilities and short-term debt.

The long-term portion of workers’ compensation decreased by $0.9 billion in FY 2023. This

actuarial adjustment is highly sensitive to discount and inflation rates and to new and

existing claims. Figure II-8 shows the current breakdown of the Postal Service’s liabilities

as of September 30, 2023.

Figure II-8

Postal Service Liabilities Structure, September 30, 2023

Source: PRC derived from Postal Service FY 2023 Form 10-K at 47.

In addition to the liabilities recorded on the Postal Service’s Balance Sheets, there are other

liabilities not recognized in the Postal Service’s financial statements. These liabilities are

controlled and administered by OPM and relate to the assets and liabilities attributed to the

Civil Service Retirement and Disability Fund (CSRDF). See 5 U.S.C. § 8909a. The CSRDF

provides pension benefits to retired and disabled Federal employees, including Postal

Service employees covered by CSRS and FERS. Id. § 8348.

Financial Analysis Report FY 2023

33

In addition, the PAEA requires the Postal Service to report certain disclosures provided by

OPM regarding the funded status of the CSRDF, specifically for postal employees, reported

on the Postal Service Form 10-K statements.

Balance Sheet Trend Analysis

To facilitate its analysis, the Commission applies key financial ratios to the Postal Service’s

Balance Sheet to further assess the current and historical financial stability of the Postal

Service. Table II-17 summarizes the key balance sheet ratios used in this analysis.

Table II-17

Postal Service Balance Sheet Ratios FY 2022 and FY 2023

Source: PRC derived from Postal Service FY 2023 Form 10-K.

DEBT RATIO

Debt ratio is the percentage of total liabilities an entity has on its balance sheet to its total

assets. The higher the ratio, the greater the risk that the entity’s debt level may impede its

ability to respond to challenges and opportunities effectively. Figure II-9 reflects the Postal

Service’s debt ratio trend since FY 2006.

Financial Analysis Report FY 2023

34

Figure II-9

Debt Ratio, FY 2006–FY 2023

Source: PRC derived from Postal Service FY 2006 Annual Report; Postal Service Form 10-K, FY 2007–FY 2023.

The ratio is generally a conservative measurement because the liabilities are carried at

estimated amounts of expected cash outflows. At the same time, some assets may be

understated because no adjustments have been made to restate for fair value. For example,

land or a fully depreciated building or equipment may have a higher fair market value than

its book value. As it pertains to the Postal Service, the debt ratio provides information

about the increasing amount of the

Postal Service’s liabilities relative to

its small asset base.

At the end of FY 2023, the debt ratio

increased to 1.51 from the 1.36 debt

ratio for FY 2022, the lowest the ratio

has been since FY 2008. The increase is primarily the result of a larger increase in total

liabilities than total assets. Retirement benefits and total debt owed to the Federal

Financing Bank are the primary drivers in increasing liabilities. While investments in

property, plant, and equipment were offset by declines in cash. The Postal Service’s FY

2023 debt ratio was lower than the average 10-year debt ratio of 2.28. This ratio is

indicative of the Postal Service’s insufficient resources to pay down its liabilities.

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

4.0

Debt Rao

Fiscal Year

Debt Ra o

Average FY

2006-FY 2023

AT THE END OF FY 2023, THE DEBT

RATIO INCREASED TO 1.51 FROM

THE 1.36 DEBT RATIO FOR FY 2022,

THE LOWEST THE RATIO HAS BEEN

SINCE FY 2008.

Financial Analysis Report FY 2023

35

CURRENT RATIO

The current ratio indicates the degree to which current assets meet current liabilities. The

higher the current ratio, the more likely an entity can pay its current liabilities because it

has a larger proportion of current assets relative to its current liabilities. Figure II-10

highlights the fluctuations in the current ratio since FY 2006.

Figure II-10

Current Ratio, FY 2006–FY 2023

Source: PRC derived from Postal Service Form 10-K, FY 2006–FY 2023.

At the end of FY 2023, the Postal Service had a current ratio of 0.55, a decrease of 0.14 from

the end of FY 2022. This is higher than the Postal Service’s 10-year average of 0.29.

The decrease in the ratio resulted from an increase in current liabilities compared to a

decline in current assets. Current liabilities increased by $4.4 billion (13.7 percent) due to

increases in CSRS and FERS unfunded liabilities. Retiree benefits are significantly impacted

by wage inflation, health benefit premium increases, retirement and workers’

compensation programs. Postal Service FY 2023 Form 10-K at 15.

The reduction of statutory prefunding payments in FY 2009 resulted in a higher current

ratio. A combination of increasing current liabilities and increasing cash has helped keep

the current ratio relatively flat. It has increased in the last 3 years resulting from increases

Financial Analysis Report FY 2023

36

in cash in years FY 2020 and FY 2021 and the reduction in current liabilities in FY 2022.

45

CASH RATIO

The cash ratio compares total liquid assets to its current liabilities. The ratio measures an

entity’s ability to pay current liabilities with available cash or cash equivalents. Figure II-11

illustrates the cash ratio from FY 2006 through FY 2022.

Figure II-11

Cash Ratio, FY 2006–FY 2023

Source: PRC derived from Postal Service FY 2006 Annual Report; Postal Service Form 10-K, FY 2007–FY 2023.

The Postal Service had a cash ratio of 0.50 at the end of FY 2023. This is a decrease

compared to the prior year’s cash ratio of 0.64. The FY 2023 cash ratio is also higher than

the 10-year average of 0.22. This is the result of a decrease in cash and cash equivalents

including short-term investments.

46

In FY 2008 and FY 2009, the Postal Service’s cash

balances increased by $533 million and $2.7 billion, respectively, which increased the cash

ratio. During FY 2011 through FY 2019, the Postal Service’s cash balance gradually

increased along with its current liabilities. During the years FY 2020 and FY 2021, gradual

cash increases helped improve the cash ratio.

45

The reduction in FY 2022 current liabilities was the result of PSRA adjustments to remove the accumulated retiree health benefit liability.

46

The Postal Service invested excess cash in the amount of $8.8 billion in highly liquid short-term investments issued by the U.S. Treasury.

Postal Service FY 2023 Form 10-K at 56.

Financial Analysis Report FY 2023

37

Analysis of Statements of Cash Flows

At the end of FY 2023, the Postal Service’s total cash and cash equivalents, excluding $1

billion in restricted cash, were $8.1 billion. Cash and cash equivalents excluding restricted

cash and short term investments were $11.6 billion lower than at the end of FY 2022. At

the end of FY 2023, the Postal Service had $2 billion in available borrowing authority

remaining from the PAEA-mandated debt ceiling of $15 billion. Table II-18 compares the

Postal Service’s cash flows from FY 2014 to FY 2023.

Table II-18

Postal Service Statements of Cash Flows, FY 2014–FY 2023 ($ in Millions)

47

Numbers may not add across due to rounding.

Source: PRC derived from Postal Service Form 10-K FY 2014–FY 2023.

Table II-19 illustrates the current liquidity position of the Postal Service. The Postal

Service’s liquidity is limited to cash and cash equivalents (excluding restricted cash) and

available borrowing authority. As of September 30, 2023, the Postal Service had $2 billion

in remaining borrowing capacity but is limited to a $3 billion annual borrowing cap. Postal

Service FY 2023 Form 10-K at 64.

47

The purchases and redemptions of investments and restricted investments in FY 2023 are investments of excess cash not immediately

necessary for operations in Treasury bills of various short-term maturities. Postal Service FY 2023 Form 10-K at 62.

Financial Analysis Report FY 2023

38

Table II-19

Total Postal Service Liquidity (in $ Millions) End of FY 2022 Compared to FY 2023

Source: Postal Service FY 2023 Form 10-K at 47.

Cash Flow Ratio Analysis

Cash flow ratios are applied in the Commission’s analysis to illustrate the Postal Service's

financial solvency. The asset efficiency ratio, current liability ratio, and long-term debt ratio

are all helpful indicators of the Postal Service’s current and historical ability to pay down

debt and remain financially solvent.

Table II-20

Cash Flow Ratios, FY 2022 and FY 2023

Source: PRC derived from Postal Service FY 2023 Form 10-K.