United States

Department of

Agriculture

Rural Business-

CgccyE&ive

FIBS

Research

Report 154

USDA

=a

Analysis of

Financial Statements:

Local Farm Supply,

Marketing Cooperatives

This report analyzes the balance sheets and income statements of local farm supply

and marketing cooperatives, comparing 1995 and 1994 and trends over the past 10

years. The data in this report represent four cooperative sizes and types. Common

size income statements and balance sheets are used to compare different cooperative

sizes and types. Trends for major balance sheet and income statement items and ratio

analysis are used to compare and contrast cooperatives by size and type.

Key words: Cooperatives, balance sheet, income statement, farm supply, marketing,

sales, and financial ratios.

Analysis of Financial Statements:

Local Farm Supply, Marketing Cooperatives

E. Eldon Eversull and Beverly L.

Rotan

Rural Business-Cooperative Service

U.S. Department of Agriculture

FIBS

Research Report 154

March 1997

Price: Domestic-S4.50;

Foreign-$500

Preface

This report studied the financial statements of local cooperatives, comparing 1995,

1994, and the past 10 years. Trends of major balance sheet and income statement

items as well as financial ratios are presented for four cooperative sizes and types. The

information provides cooperative managers and boards of directors with a basis to

compare their cooperatives’ historical performance with representative cooperative

data.

The authors thank the cooperatives that provided their financial statements to

RBS-Cooperative Service (CS) and made this report possible. Special thanks to CS

staffers David S. Chesnick and Charles A. Kraenzle for reviewing the initial draft.

Contents

Highlights . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

..~i

Profile of Respondent Cooperatives

.....................................

.l

Balance Sheet Definitions

.............................................

.3

Analysis of the Balance Sheet

.........................................

.4

Description of the Income Statement

....................................

.9

Analysis of the Income Statement

.....................................

.l

1

Financial Ratio Analysis

.............................................

.17

Summary and Conclusions

...........................................

.22

Bibliography

.....................................................

..2 3

Appendix..........................................................2

4

ii

Highlights

Financial statements of 1,610 local farm supply and marketing cooperatives were used

for this report. The statements of 432 cooperatives were used to compare 1995 to

1994, while 1,610 cooperatives were used to look at trends over the past 10 years.

Cooperatives were divided into four groups based on their mix of net sales between

supplies sold and farm products marketed. They were also divided into four size cate-

gories, based on their total sales volume.

Average net income increased 14 percent from 1994 to 1995. In 1995, average net

sales for all cooperatives studied was $12.2 million, up 8 percent from 1994. More than

36 percent of the cooperatives studied were small cooperatives-sales of less than

!§5

million.

Cooperatives not only were important to their member/patrons, but also were an impor-

tant asset to their rural communities. They were probably one of the community’s larg-

er employers, employing an average 21 full-time and 9 part-time employees with an

average annual payroll of $707,000.

Petroleum products and fertilizer were the two principal farm supplies sold. Marketing

activities (mainly grains and oilseeds) provided more than 54 percent of sales for these

cooperatives.

Average total assets grew 17 percent between 1994 and 1995, fueled by large increas-

es in inventories. To finance the growth in assets (mainly inventories), total liabilities

grew 31 percent while owner equities increased 5 percent.

Interest expenses, although less than 1 percent of net sales, increased 42 percent

largely due to increased short-term debt used to finance inventory buildup. Local sav-

ings was down 24 percent, but with an increase of 37 percent in patronage refunds

received, net income for these cooperatives was up 14 percent.

Financial ratio analysis was used to look at 1 O-year trends for the 1,610 cooperatives

in the data base. The financial ratio analysis revealed these findings:

l

The current ratio (current assets/current liabilities) was fairly steady around 1.5

between 1988 and 1994, with a slight downturn in 1995. The quick ratio (current

assets-inventory/current liabilities) mimicked the current ratio’s trend.

. Total debt-to-asset ratio was 0.25 in 1995, higher than most recent years but lower

than the high of 0.3 in 1985.

l

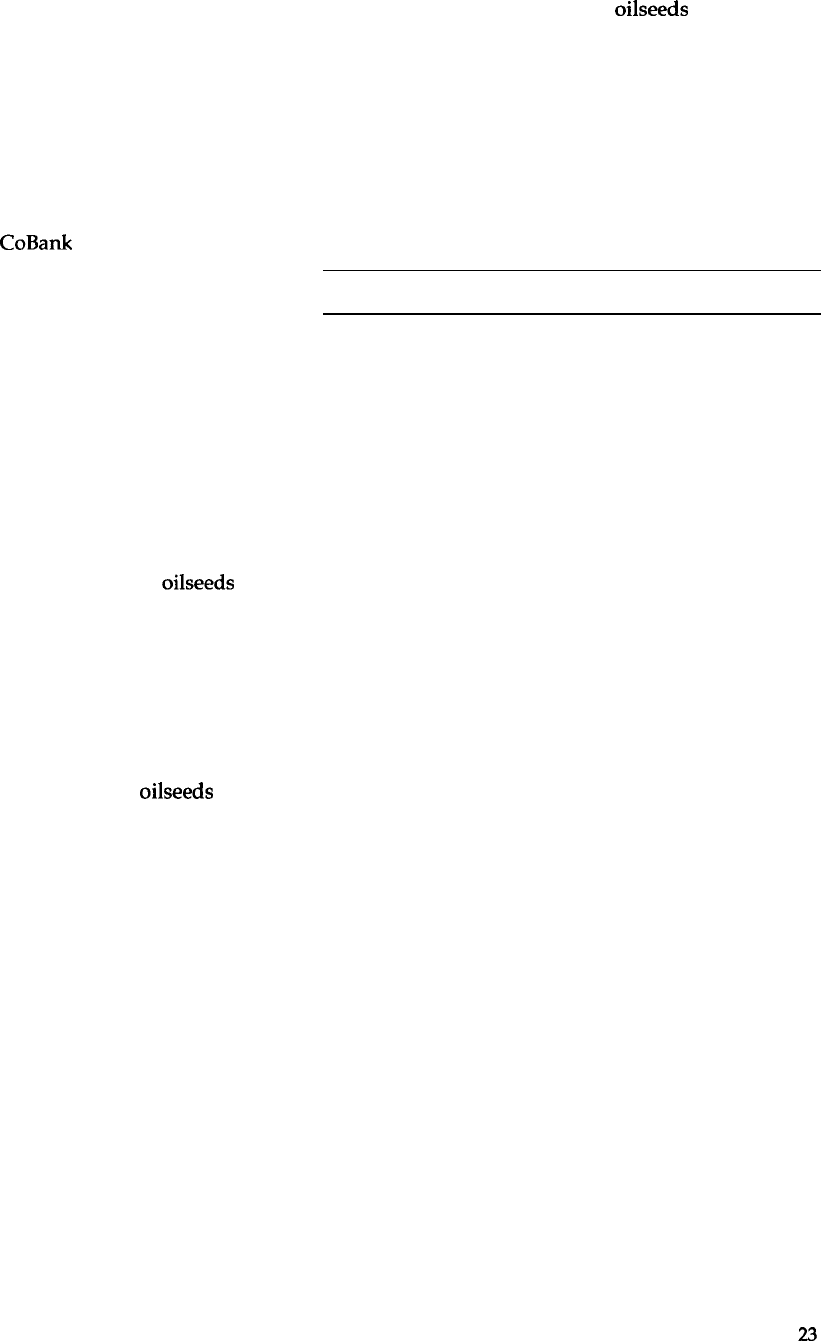

The fixed-asset-turnover ratio, a measure of asset utilization, has averaged at least

9.1 for the past 3 years

(

i.e., net sales were 9.1 times property, plant, and equipment

levels).

l

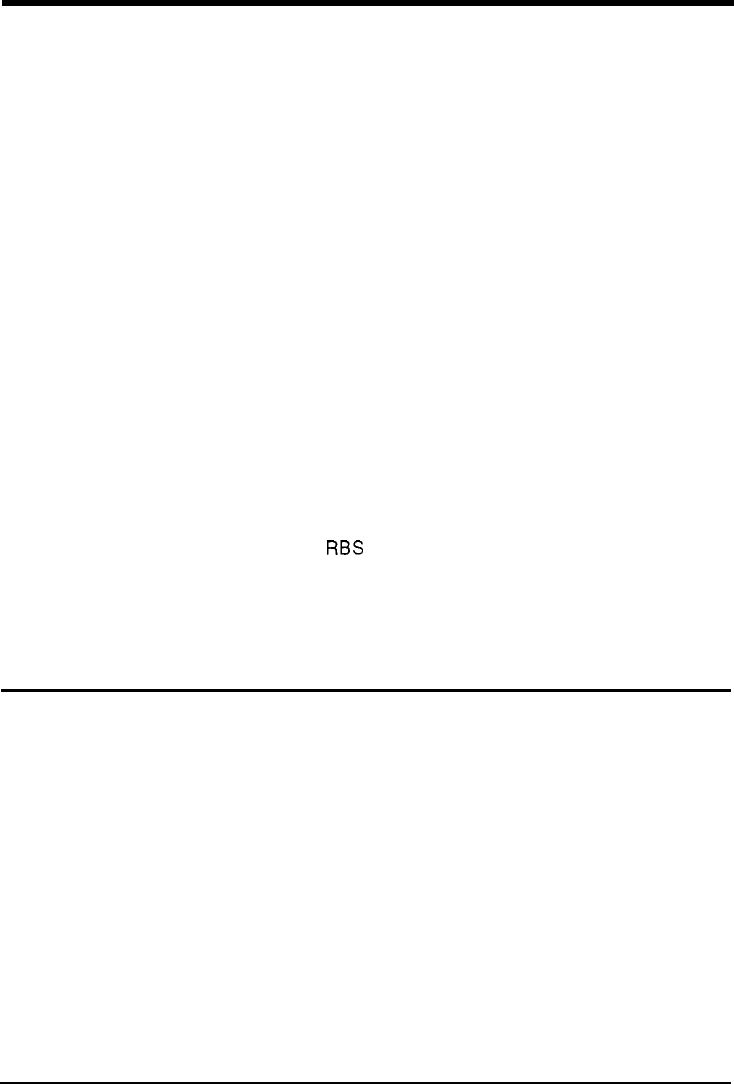

Return on total assets measures the rate of return on total investments. At 8 percent,

this measure was down slightly from 1994.

l

Return on allocated equity before taxes has grown dramatically in the decade from 5

percent to 14 percent.

.

.

.

111

Analysis of Financial Statements:

Local Farm Supply, Marketing Cooperatives

E. Eldon Eversull and Beverly L.

Rotan

Rural Business-Cooperative Service

U.S. Department of Agriculture

L

ocal

agricultural cooperatives play a vital role in

providing goods and services to their patrons

and the rural community. This report analyzes

their financial statements for comparative purposes for

cooperative managers, directors, and members. Ratio

analysis and trends will be discussed. The presentation

is sub-divided into four cooperative sizes and types to

make the information more useful.

The 432 local cooperatives had farm supply sales

(petroleum, fertilizer, feed, etc.) that averaged $5.6 mil-

lion in 1995 while marketing sales (corn, wheat, soy-

beans, etc.) averaged $6.6 million. Income from ser-

vices (product delivery, fertilizer application, grains

and

oilseeds

hauling and storage, etc.) averaged SO.4

million per year.

These cooperatives were not only important to,

their member/patrons, but also an important asset to

their rural communities. The cooperatives paid an

average of $43,000 in annual property taxes. They were

also a large employer in their communities, averaging

21 full-time and 9 part-time employees with an aver-

age annual payroll of $707,000.

Cooperative annual reports generally contain the

balance sheet and a statement of operations. More

detailed reports may contain a statement of changes in

patrons’ equity and a statement of cash-flows along

with explanations detailing various aspects of the

financial statements. The manager and the president of

the board of directors may also provide a statement on

the cooperative’s past year operating results and

future plans. This study focuses on the balance sheet,

income statement, and financial ratios derived from

these statements.

Profile of Respondent Cooperatives

Staff of the Cooperative Services

(CS)

program in

USDA’s Rural Business-Cooperative Service annually

survey farmer cooperatives. Data from this survey are

used in this study. To be included, a cooperative had to

sell some farm supplies. No cooperative that exclusive-

ly markets members’ products was included. In addi-

tion to selling farm supplies, the cooperative also had

to provide an annual report that had a detailed income

statement.

There are 1,610 cooperatives in the CS Farm

Supply and Services

(FSS)

database. This report focus-

es on 432 cooperatives that provided information in

both 1995 and 1994 when comparing those years and

on all 1,610 cooperatives when looking at long-term

trends (1985 through 1993

‘)

in the financial ratio

analysis section. To obtain a more complete under-

standing of the local cooperatives’ business, informa-

tion in this report is divided into a cross section of four

sizes and four types.

Cooperative Size

Cooperatives were grouped into four sizes by

sales volume, using actual figures. No attempt was

made to deflate these values. Sales groupings used in

this report were the same as in prior reports (see

CS-

RR 134 and RR 138) and, for the 432 cooperatives, sizes

and types used are summarized in table 1.

1

The data in the FSS database does not include 1991. It was omitted

in an effort to disseminate information in a more timely fashion.

At the time, it was thought that information from 1991 would be

included in the future, but as that information became less and less

current, it is less likely to become part of the database.

1

In classifying by total sales alone, product mix

was ignored. For example, a cooperative with $10 mil-

lion in sales that exclusively marketed grains and

oilseeds could be considered small relative to most

grains and oilseeds marketing organizations. But, a

strictly farm supply cooperative with sales of $10 mil-

lion, however, was quite substantial.

Cooperative Type

To account for differences in operations and ori-

entation based on product mix, cooperatives were

grouped into one of four descriptive categories: 1)

farm supply; 2) mixed farm supply; 3) mixed market-

ing; and 4) marketing. These descriptions were chosen

to represent business operations of these cooperatives

as closely as possible and their definitions summarized

in table 1.

This report focuses on cooperatives handling

farm supplies-42 percent in 1995 sold only farm sup-

plies; 16 percent were mixed; 24 percent were mixed

marketing; and 18 percent were marketing (table 2). Of

Table

r-Size and type definitions used for respondent

cooperatives

Cooperative size Definition

Number

Small up to $5 million in total sales

156

Medium

$5 million to $10 million

103

Large

$10 million to $20 million

96

Super $20 million and more

75

Cooperative type

Farm supply total net sales from farm supplies’

161

Mixed farm supply from 50 to 99 percent

70

Mixed marketing from 25 to 49 percent

103

Marketing less than 25 percent

78

1

The definition of farm supply cooperatives differs from prior reports.

These cooperatives now have 100 percent farm supply sales

instead of 90 to 100 percent.

the respondents, 36 percent were small; 24 percent,

medium; 23 percent, large; and 17 percent, super. Both

types of marketing cooperatives tended to be larger

while the farm supply cooperatives were most often

small. Most respondents were small farm supply coop-

eratives.

The first part of this report focuses on the 432

cooperatives that provided information in both 1995

and 1994. In the financial ratio analysis sections, data

between the years were not completely comparable in

that the same cooperatives did not respond to the CS

survey every year. Information in the FSS database

was not randomly selected and may not be statistically

valid to draw industry-wide conclusions. However,

the samples are large and represent a cross section of

cooperatives selling farm supplies and marketing

grains and oilseeds throughout the United States.

The information in this report also goes beyond

432 cooperatives and rural communities. These coop-

eratives operated 643 branches and had a significant

business impact on 1,075 rural communities in terms

of taxes and employment (table

3).

Super cooperatives

that averaged almost five branch outlets impacted

more rural communities. Marketing cooperatives had

an average of two branch outlets.

Sales Mix

The respondent cooperatives had five major farm

supply and two marketing categories (table 4).

Petroleum was the dominant production supply item

sold by small and medium cooperatives. Sales of small

cooperatives, the most numerous, averaged $2.8 mil-

lion in 1995. Farm production supplies represented the

bulk (86 percent) of their sales. As cooperatives grew

in size, the importance of farm supplies declined (64

percent for medium-sized cooperatives, 52 percent for

large, and 32 percent for super).

Table

z-Respondent cooperatives by size and type

Cooperative size

Cooperative type

Small Medium

Large

Super

Total

Number

Percenf

Farm supply

122

37

19 3

41.90

Mixed farm supply

14

23

22

11

16.20

Mixed marketing

12

28

33 30

23.84

Marketing

a

15

24

31

18.06

Percent of total

36.11

23.84 22.69

17.36

100.00

Sales of mixed farm supply cooperatives aver-

aged $12 million with $5 million in farm supply sales.

Petroleum was the most important farm supply item

sold, with feed a close second.

Average sales of marketing and mixed marketing

cooperatives were $22 million and $18 million, respec-

tively, and much larger than both categories of farm

supply cooperatives. As defined, marketing made up

the majority of their sales. Feed, fertilizer, and crop

protectants were the most important farm supplies

sold for both types of marketing cooperatives.

Balance Sheet Definitions

Balance sheet assets represent what the coopera-

tive owns and are usually listed in decreasing order of

their liquidity--the time it would take to convert them

to cash. Liabilities, or what the cooperative owes to

others, are usually presented in a similar decreasing

order. Equity represents members’ investment in their

cooperative.

Current assets- These are the most liquid assets on

the cooperative balance sheet. Cash and cash equivalents

represent monies either in the bank, in short-term

investments, or on hand at the cooperative. Accounts

receivable is money due the cooperative (i.e., a credit

sale due from the customer in 90 days). Inventories are

products the cooperative has purchased from patrons

to market and supplies the cooperative hopes to sell to

patrons. Prepaid expenses are those paid up-front and

then expensed as period costs throughout the fiscal

year (i.e., taxes or insurance).

Investments in other cooperatives-

represent equity

held in regional cooperatives through whom local

cooperatives market products or purchase supplies

and equity in the Bank for Cooperatives or CoBank,

their lending source. These investments are purchased

Table

z+-Average

and total number of branches

Cooperative

type

Average

Farm supply

.92

Mixed farm supply

1.79

Mixed marketing

1.78

Marketing

2.33

All

1.43

Total

55

122

178

177

643

Cooperative size

Average Total

Small

.36

55

Medium

.95

96

Large

1.59

153

Super

4.52

339

Table

&Average farm supplies sold and products marketed as a percent of

tOtSI

Saks,

and change from 1994

to 1995

Item

1995

1994

change, 1994

to 1995

Percent

Farm supplies sold:

Feed

9.22

10.17

1.48

Seed

.90

.98

3.05

Fertilizer

10.45

10.44

12.10

Crop protectants

7.42

7.87

5.52

Petroleum products

12.64

13.20

7.23

Other

4.91

5.29

3.04

Total

45.54

47.95

6.33

Products marketed:

Grains and oilseeds

53.79

52.05

25.59

Other

.67

-

-

Total

54.46

52.05

9.10

Total sales

100.00

100.00

11.96

Based on sales of:

$12,203,699 $10,900,239

3

equity as well as equity (patronage) paid back to the

cooperative based on use. The more sales through or

purchases from the regional cooperative or borrowing

from the bank, the larger the investment. Other assets

are usually past due accounts receivable not yet con-

sidered as bad debt losses.

Property, plant, and equipment- are the fixed assets

of the cooperative (i.e., grain bins, office equipment,

warehouse, gas station).

Accumulated depreciation

is the

sum of all the year’s depreciation expenses taken on

the assets. Net

property, plant,

and equipment

(PPQE)

is

the book value of the fixed assets-their cost minus

accumulated depreciation.

Total assets- are what the cooperative owns-current

assets, plus investments, plus net fixed assets equal

total assets.

Current liabilities- are obligations the cooperative

must pay within the next year.

Accounts payable

is

money owed, usually to suppliers (sometimes classi-

fied as accounts payable-trade accounts).

Accrued

expenses

and

accrued taxes

are unpaid expenses. They

often include unpaid salaries and benefits earned by

employees. Accrued taxes often include property and

sales taxes that have been incurred but not yet paid.

Other liabilities

in this study are most often accounts

payable-grains and

oilseeds

delivered and sold to the

cooperative by its patrons who have not yet been paid.

Retired equity

represents allocated equity that the board

has approved to revolve to members but not yet paid

as of the closing date of the books. This equity accu-

mulated from past sales to or purchases from

patrons-usually revolved to members on a set sched-

ule (often 7 or more years later).

Patronage refunds and

dividends

are monies declared but not yet paid to mem-

bers for current use of the cooperative and for invest-

ing in preferred stock.

Cooperatives are required to pay at least 20 per-

cent of their refunds in cash, with the rest becoming

allocated equity to be revolved to the members at a

later date. The refunds are based on cents per product

(weight or bushel) sold and/or on a percent of the dol-

lars of farm supplies purchased. The refunds are deter-

mined by the board of directors. Dividends paid on

preferred stock ownership are based on a set percent

return on the investment.

Current portion of

Zong-term

debt

and

seasonal short-term debt

are the final current lia-

bilities. They are money owed (principal) for borrow-

ing money and for leases. Long-term debt typically is

used to finance long-term assets, while short-term debt

is usually used for operating or seasonal loans.

Long-term

debt-

includes notes, bonds, mortgages,

and leases not due within the current year.

Member equities- are member and patron invest-

ments in the cooperative. The two main types are allo-

cated and unallocated.

Allocated equity

is assigned to

members in one of two forms. Each member has one

share and one vote. The other form includes

noncash

allocated certificates which are member investments in

the cooperative based on use.

Allocated equity could be classified as stock if the

cooperative was incorporated or certificates of owner-

ship if not incorporated. In most cases, cooperative

stock or ownership certificates are not generally traded

between members and, if sold, require board approval.

Unallocated equity

is the retained earnings of the cooper-

ative and often thought of as

nonmember-nonpatron-

age business but can also be based on member business.

Analysis of the Balance Sheet

The balance sheet of a local cooperative states its

financial position at the end of an operating period-a

1Zmonth fiscal year. The balance sheet represents the

cooperative’s assets, liabilities, member equity, and

their relationship to each other. This report analyzes

the balance sheets of 432 local cooperatives to provide

examples of typical levels for assets, liabilities, and

member equities for different sizes and types.

Table 5 compares common size balance sheets for

all respondents for 1995 and 1994. Appendix tables l-4

show common size balance sheets by size and type for

1995. In a common size balance sheet, each account is

listed as a percentage of total assets. The dollar

amount of total assets the balance sheets represent is

listed at the bottom of the table. By cooperative size,

total assets increased from $1.5 million for small coop-

eratives to $16.2 million for super-size cooperatives

(table 7). By cooperative type, total assets were $2.7

million for farm supply,

$6.2

million for mixed farm

supply, $7.8 million for mixed marketing, and $9 mil-

lion for marketing (table

8).

Current Assets

Looking first at current assets, cash and cash

equivalents as a percent of total assets decreased as

cooperative size increased. For small cooperatives,

cash was 7.4 percent of total assets. But, this dropped to

From 1994 to 1995, current assets increased by 24

1.9 percent for super cooperatives. Farm supply cooper-

percent. Most of this growth occurred in inventories,

atives

held the most cash by type (5.3 percent), followed

principally grains and oilseeds inventories. Overall,

by mixed farm supply cooperatives (2.8 percent).

these inventories increased 51 percent and farm sup-

Table

&Common size balance sheet and change in accounts, 1994 to 1995

1995

1994 Percentage change

Assets

Current assets

Cash

and

cash equivalents

Accounts

receivable

Inventories--grains and

oilseeds

-farm supplies

Prepaid expenses

Other current assets

Percent

3.12 4.69 (22.33)

10.95 11.89 7.22

22.36

17.23

51.23

11.83 11.52 19.70

0.92

1.21

(11.42)

7.41

6.48

33.18

Total current assets

Investments and other assets

investments-other cooperatives

-Bank for Cooperatives

56.59

53.02 24.37

16.79 18.42

6.18

1.43

1.18

40.98

-total

18.22

19.61

6.28

Other assets

.96 .88

27.28

Total investments

8

other assets

Property, plant, and equipment

At cost

Less accumulated depreciation

19.18

20.49

9.10

64.14

68.69

8.79

39.91

42.20

10.21

Net

PP&E

24.23

26.49

6.54

Total assets

100.00 100.00 16.52

Liabilities and owner

equities

Current liabilities

Current portion of long-term debt

Notes payable-seasonal

Accounts payable

Patrons credit balances

&

other liabilities

Accrued taxes

Accrued expenses

Patronage refunds (cash)

3.23

3.46 8.75

16.45 11.15

71.68

5.21

6.48

(8.20)

14.64

12.94

31.83

.64 .73

3.55

1.52

1.50 17.85

1.21

1.23 15.46

Total current liabilities

42.91

37.48 33.39

Long-term debt

6.82

6.84

16.31

Total liabilities

49.73

44.32 30.76

Owner equities

Allocated equity

Unallocated equity

37.03 41.76

3.30

13.24 13.92

10.83

Total owner equities

Total liabilities and owner equities

Based on total assets of:

50.27

55.68

5.18

100.00 100.00

16.52

!$5,630,189

$4,832,085

5

plies nearly 20 percent. By size, farm supply invento-

ries increased about 10 percent more for large and

super cooperatives and by type, about 5 percent more

for both farm supply cooperatives. Grains and oilseeds

inventories increased more than 55 percent for medi-

um and super cooperatives. By type, they increased

more than 50 percent for all but farm supply coopera-

tives.

There were also regional differences in inventory

buildup. By looking at 103 cooperatives that had their

grains and oilseeds inventories increase more than 50

percent, 65 cooperatives were in Iowa, Minnesota, or

Nebraska. In dollar terms, inventory increased $178

million, with $128 million in these three States. Part of

this buildup was due to low grains and oilseeds prices

the prior year and farmers holding back sales.

But a grain railcar shortage in the upper Midwest

also forced some cooperatives to resort to outdoor

storage on the ground (with increased grain prices and

especially corn prices, inventories of grains and

oilseeds can be expected to be much lower in

FY

96).

Interest expenses in the three States increased by $7

million, in part to finance these inventories. Local sav-

ings fell $10 million and 30 cooperatives had losses in

local income. Net income was up 16 percent for these

cooperatives due to patronage refunds, so that only

nine experienced losses.

Accounts receivable in this study were farm sup-

ply trade accounts, not grains and oilseeds trade

receivables. Farm supply and grains and oilseeds trade

receivables (“other” current assets) were separated to

allow ratio analysis in a future section of this study.

Accounts receivable for farm supply sales increased 7

percent, growing at about the same rate as the increase

in farm supply sales.

The age of accounts receivable refers to how long

ago the sale that started this receivable was made.

Most cooperatives have credit sales with discounts

offered to promote prompt payment. Terms might be 2

percent-10 days, net 30 days (no discount). Discounts

might be offered on all farm supply sales or on certain

products. The terms and what products had discounts

were not known, but 96 cooperatives listed their dis-

count on sales, and it was 1.22 percent on total farm

supply sales.

The age of accounts receivable is known for 54

cooperatives for both years (table 6). Fifty-five percent

were current. Another 14 percent were from 31 to 60

days old. The largest difference between the 2 years

was nearly 12 percent of receivables were more than 6

months old compared with 8 percent in 1994.

Table

6

Age

of

SCCOUM

receivable,

1995

and

1994

Accounts receivable age

1995

1994

Percent

Current, 0 to 30 days

55.02 53.15

31 to 60 days

14.26 14.77

61 to 90 days

8.69 10.55

91 to 120 days

1.96

4.70

121 to 180 days 3.10 3.72

Greater than 6 months

11.63 7.70

Accounts written off this

period 5.34

5.41

Based on accounts receivable of:

$26,284,134

$24,160,885

Investments and Other Assets

About 1.4 percent of cooperative’s total assets

was invested in the Bank for Cooperatives or CoBank.

Larger cooperatives and both types of marketing coop-

eratives had comparable investments. Meanwhile,

investments in other cooperatives dropped from a high

of 26 percent for small cooperatives to 13 percent for

super cooperatives. Across types, marketing coopera-

tives had less invested than farm supply cooperatives.

Other assets often included overdue accounts receiv-

able and were generally less than 2 percent of total

assets for all cooperative sizes and types (except large

farm supply cooperatives, 4.2 percent).

Property, Plant, and Equipment

Net property, plant, and equipment

(PP&E)

as a

percent of total assets tended to be between 22 percent

and 26 percent for all cooperative sizes. Net PP&E

increased 6.5 percent from 1994. Cooperatives that

handled grains and oilseeds had higher dollar

amounts of PP&E, probably due to extensive grains

and oilseeds storage and handling facilities and, also,

because these cooperatives were larger than farm sup-

ply cooperatives. But, both farm supply cooperatives

had growth in net

W&E

of at least 9 percent while

both marketing cooperatives were less than 5.5 per-

cent.

Current Liabilities

Current liabilities grew 33 percent between 1994

and 1995. The largest increase was in notes payable-

seasonal used to finance current operations, and usual-

ly used for inventories, They grew from 11.2 percent of

total assets to 16.5 percent. Farm supply cooperatives

had a negligible change while mixed farm supply,

mixed marketing, and marketing cooperatives all were

up 5 percent.

Table

7%Common

size balance sheets by cooperative size, 1995

Small Medium

Large Super

Assets

Current assets

Cash and cash equivalents

Accounts receivable

Inventories-grains and

oilseeds

-farm supplies

Prepaid expenses

Other current assets

7.41

13.10

3.29

20.23

2.15

3.93

Percent of

fofal

assets

4.59 3.03

14.05 11.96

11.38 18.46

14.11

12.68

64

63

5.07 6.54

1.93

9.07

31.21

9.15

.77

9.21

Total current assets

Investments and other assets

Investments-other cooperatives

--Bank for Cooperatives

50.11 50.04

53.50 61.34

26.20

22.51

17.95

12.72

.37

1.39

1.41

1.65

-total

26.57 23.90

19.36 14.37

Other assets

1.15

1.40 1.50

.53

Total investments

&

other assets

Property, plant, and equipment

At cost

Less accumulated depreciation

27.72

25.30 20.86

14.90

60.87

67.77

71.20

60.07

38.70

43.11

45.57

36.30

Net

PP&E

22.17 24.66 25.64 23.76

Total assets

100.00 100.00 100.00 100.00

Liabilities and owner equities

Current liabilities

Current portion of long-term debt

Notes payable-seasonal

Accounts payable

Patrons

credii

balances

&

other liabilities

Accrued taxes

Accrued expenses

Patronage refunds (cash)

Total current liabilities

Long-term debt

Total liabilities

27.86 37.73

47.11

58.76

Owner equities

Allocated equity

Unallocated equity

1.76 3.05

4.11

3.12

6.35 9.29 13.09

22.19

6.38

5.88 6.09

4.35

6.19 9.13 12.94

18.74

.44

.55 .65

.71

1.30 1.42 1.65

1.52

1.31

1.38

1.31

1.10

23.73 30.70 39.84 51.73

4.13 7.03

7.27

7.03

53.64 45.70 39.58 30.02

18.50 16.57

13.31

11.22

Total owner equities

72.14

62.27 52.89

41.24

Total liabilities and owner equities

Based on total assets of:

100.00 100.00 100.00

100.00

$1,460,910

$3,558,985 $8,316,485 $16,249,985

7

Table

s-Common

Size

balance sheets by cooperative type, 1995

Farm supply Mixed farm supply

Mixed marketing

Marketing

Assets

Current assets

Cash and cash equivalents

Accounts receivable

Inventories-grains and oifseeds

-farm supplies

Prepaid expenses

Other current assets

Total current assets

Percent of total assets

5.34

2.78

2.66

2.30

13.59 15.15

10.41

7.09

0.00 16.32

27.53

35.66

23.11 12.33

9.79

6.16

2.05

.65

.68

.57

2.69

3.85

8.64

11.51

46.78

51.08

59.71

63.29

Investments and other assets

Investments-other cooperatives

-Bank for Cooperatives

25.47

19.77

14.66 11.30

.72

1.39 1.67

1.69

-total

26.19

21.16

16.33 12.99

Other assets

2.12

1.31

.36

.63

Total investments

&

other assets

Property, plant, and equipment

At cost

Less accumulated depreciation

Net

PP&E

28.31

22.47

16.69 13.62

58.84

68.75

69.64

58.78

33.93

42.30 46.04

35.69

24.91

26.45

23.60 23.09

Total assets

100.00

100.00 100.00 100.00

Liabilities and owner equities

Current liabilities

Current portion of long-term debt

Notes payable-seasonal

Accounts payable

Patrons credit balances

&

other liabilities

Accrued taxes

Accrued expenses

Patronage refunds (cash)

2.00 3.14

3.36

4.00

6.79 15.67

18.91

20.90

7.66 6.34

4.35

3.78

5.27

7.06 16.47

23.78

.51

.55

.76 .67

1.86

1.88 1.54

1.03

1.62

1.51

1.23 0.74

Total current liabilities

Long-term debt

Total liabilities

Owner equities

Allocated equity

Unallocated equity

Total owner equities

Total liabilities and owner equities

Based on assets of:

25.71

36.15

46.62

54.90

7.42

7.81

5.97 6.77

33.13 43.96

52.59 61.67

52.05 45.05

32.67 26.52

14.82

10.99

14.74

11.81

66.87

56.04 47.41

38.33

100.00 100.00

100.00 100.00

$2,731,412

$6,180,969

$7,762,383 $9,046,959

8

Patrons’ credit balances and other liabilities grew

by 32 percent, mostly due to the inclusion of payables

due on grains and oilseeds trading and other market-

ing activities.

Accrued expenses and patronage refunds were

the only other current liabilities that grew in double

digits. Accrued expenses grew by 17.7 percent and

were a slightly larger percentage of total assets for

larger cooperatives and for both types of farm supply

cooperatives. Cash patronage refunds and dividends

grew by 15.5 percent, but was less than 2 percent of

total assets for all sizes and types of cooperatives.

Long-term Debt

Long-term debt increased by 16.3 percent from

1994 to 1995. As a percent of total assets it generally

increased with cooperative size, but interestingly,

tended to be higher for both types of farm supply

cooperatives. By type as a percent of total assets, long-

term debt ranged from 6 percent to 7.8 percent with

the farm supply cooperatives at the high end, about a

percentage point higher than the marketing coopera-

tives. Twenty-nine percent of the cooperatives had no

long-term debt. About half were small farm supply

cooperatives and combined together, farm supply

cooperatives made up more than half.

Nearly 66 percent of the cooperatives provided

information that broke out four main sources of their

$500 million total debt (short- and long-term com-

bined)-Bank

for Cooperatives and CoBank, commer-

cial banks, debentures or notes, and other.

A regional cooperative was most often the source

in the “other” category. The local cooperative often

purchases its farm supplies and markets its grains and

oilseeds through a regional cooperative, which

becomes a source of debt capital. The debt may be

short-term operating capital or long-term investment

capital.

Bank for Cooperatives and CoBank were the

most frequent source of debt capital (59 percent).

Others were regional cooperatives (32 percent), deben-

tures or notes (5 percent), and commercial banks (4

percent). Most sources, except debentures and notes,

extend lines of credit. Only 90 cooperatives reported

their lines of credit for both years, but in total it

increased by $20 million to $308 million in 1995. Of

this line of credit, the unused portion fell by $20 mil-

lion to $166 million in 1995.

Member Equities

Member equities to total assets represent the per-

cent of the cooperative’s assets owned by the mem-

bers, with creditors claiming the rest. Over all sizes

and types of cooperatives, members averaged 50.3 per-

cent ownership of the cooperative, down from 55.7

percent in 1994.

Members of small cooperatives had the highest

percentage of ownership (72.1 percent) while members

of super-size cooperatives had the lowest (41.2 per-

cent). By cooperative type, members of mixed farm

supply cooperatives owned at least 56 percent of their

cooperatives’ assets while farm supply cooperatives’

members owned more than 66 percent. Both types of

marketing cooperatives had lower member owner-

ship-38.3 percent for marketing and 47.4 percent for

mixed marketing cooperatives.

Member equities consisted of both allocated (pre-

ferred, common, and other kinds of ownership certifi-

cates) and unallocated equity. Allocated equity as a

percentage of total assets was highest for small cooper-

atives at 53.6 percent and more than 45 percent for

both farm supply cooperatives.

Unallocated equity averaged more than 13 per-

cent of total assets for all sizes and types, but fell as

cooperative size increased. By type, unallocated equity

was around 15 percent of total assets for farm supply

and mixed marketing cooperatives and around 11 per-

cent to 12 percent for mixed farm supply and market-

ing cooperatives.

Description of Income Statement

The income statement shows the results of opera-

tions for the past year and usually includes both the

current and prior year. It lists all sources of revenue

and expenses. The statement measures the profitability

of the cooperative for a given period of time. Although

it does not show timing of cash-flows, the statement

best describes the status of the business.

In the analysis of income statements, net sales

were set at 100 percent to find out the proportion that

a single item represented in a total group or subgroup.

Because the income statement variables were

expressed as a percent of net sales, comparisons were

possible between different sizes and types of opera-

tions. Thus, the statement used in this report became

known as a “common size” income statement. This

statement was provided for the average cooperative

respondent in table 9. The first item listed on the

income statement net sales was the primary source of

revenue-farm supplies sold and products marketed.

Cost of goods sold (COGS) was the amount a

cooperative paid for the products it sold and market-

9

Table

9-hICOI?W

Statt?t?Wnt

and change in

SCCOUntS,

19%

t0

1995

1995 1994

Percent change

Net sales

Cost of goods sold

Gross margin

Service and other income

Gross revenue

Operating expenses

Employee:

Salaries and wages

Payroll taxes

Employee insurance

Pension expense

Total

Administrative:

Professional services

Office supplies (includes postage)

Telephone, markets

Meetings and travel

Donations

Dues and subscriptions

Directors’ fees and expense

Annual meetings expense

Total

General:

Advertising and promotion

Delivery (auto

&

truck) expense

Insurance

Property

&

Business taxes

Other taxes and licenses

Rent and lease expense

Plant supplies

&

repairs

Repairs and maintenance

Utilities (includes dryer expense)

Miscellaneous expenses

Other expenses

Total

Depreciation

Interest expense

Bad debts

Total expenses

Local savings

Patronage refunds received

Savings before income taxes

Less income taxes

Net income

Based on sales of:

100.00

90.06

9.94

3.98

13.92

Percent

of

net

sales

100.00

89.87

10.13

3.79

13.92

7.82

8.05

5.83

13.26

7.85

4.69

4.36

15.97

.37

.36

9.31

.49

.50

6.78

.14

.14

12.94

5.69

5.36

7.16

.16

.13

34.45

.16

.16

7.72

.09

.09

7.18

.07

.07

7.52

.Ol

.Ol

9.92

.03

.03

15.51

.03

.03

6.26

.02

.02

3.93

57

.54

13.66

.16

.16

8.81

.68

.63

16.27

.49

.51

2.83

.33

.34

3.55

.15

.17

(4.96)

.20

.20

9.28

.22

.20

21.74

.68

.65

12.85

.49

.51

3.08

.12

.ll

17.21

.32

.39

(14.35)

3.84

3.87

18.00

1.53

1.54

7.33

.89

.68

42.42

.ll

.lO

17.16

12.63

12.09

12.65

1.29

1.83

(23.98)

1.41

1.11

36.55

2.70

2.94

(1.03)

.31

.68

(51 .Ol)

2.39

2.26

14.01

$12,187,025

$11,302,965

10

ed-cost to the cooperative for the supplies sold and

payments to farmers for products marketed. Net sales

less COGS represented the gross margin on sales.

Service and other income came mainly from pro-

viding services to cooperative patrons. Service includ-

ed delivery, chemical and fertilizer application, grain

drying, and storage. Although substantial for some

cooperatives, service income was not considered a pri-

mary source of revenue.

Operating expenses were those incurred in the

course of conducting normal business. They were usu-

ally classified by function like employee, administra-

tive, general, and depreciation, interest, and bad debts.

Local savings resulted from operations before

taxes and patronage refunds from other cooperatives.

Patronage refunds were based on volume of business

conducted with another cooperative and were depen-

dent on the other cooperative’s net income. Usually,

this income was allocated equity and not actual cash

coming into the respondent cooperatives.

Net income was the end result of operations for

that year. Distribution of net income was not part of

the income statement. The board of directors decides

how to distribute net income or allocate a net loss.

Analysis of the Income Statement

The income statement displays the net results of

cooperative operations. Because most managers’ per-

formance is judged by net income, members attach

great importance to the income statement. In the fol-

lowing sections, the underling values of the income

statement are studied. Table 9 presents a common size

income statement for 432 cooperatives and the change

between 1994 and 1995. Appendix tables 5 to 8 show

common size income statements by size and type for

1995.

Net Sales

The first item of the income statement analyzed

in this report was net sales. It was determined by sub-

tracting sales discounts and returns and allowances

from gross sales. The average net sales for the 432

cooperatives in 1995 was $12.2 million, up

$0.9

million

or 7.8 percent from 1994. Net sales by cooperative size

are presented in table 10, and by type in table 11. All

sizes and types of cooperatives experienced a growth

in net sales from 1994. If assets from tables 7 and 8 are

compared to net sales in tables 10 and 11, sales for all

types (except marketing) and sizes are about twice the

level of assets.

Cost of Goods Sold

Cost of goods sold (COGS) represented the

largest single component of expenses, usually

expressed as a percent of net sales. For this study,

COGS includes the beginning inventory plus purchas-

es and freight costs, minus purchase returns and

allowances, purchase discounts, and ending inventory.

So, for these cooperatives, COGS was the purchase

price of the farm supplies sold or products marketed.

Table 11 shows COGS as a percent of net sales for the

different types of cooperatives. Both types of market-

ing cooperatives had a relatively high COGS when

compared with farm supply cooperatives, which was

to be expected because they were generally marketing

grains and oilseeds for their patrons with only a few

cents per bushel margin. There was negligible change

in COGS by cooperative size and type between the 2

years.

Gross Margins

Gross margins were the excess of net sales over

the cost of goods sold. The gross margin averaged 9.9

percent for all cooperatives, down from 10.1 percent in

1994. The gross margin or gross margin percentage is a

very important operating ratio. A small change in the

gross margin has a tremendous impact on local sav-

ings. A cooperative manager must maintain a gross

margin near industry averages. Thus, least cost sources

of supplies need to be developed and marketing coop-

eratives must pay market rates on the products they

purchase.

Cooperatives are often characterized as business-

es that provide goods and services “at cost.” However,

a cooperative cannot operate at cost on a day-to-day

basis. Therefore, unless a cooperative has an adequate

gross margin, it can neither be profitable nor afford to

finance essential future-directed discretionary expen-

ditures such as expansion and advertising.

Because by definition, gross margin equals net

sales less cost of goods sold, those cooperatives with

higher COGS had lower gross margins. COGS were

higher for marketing and larger cooperatives, so gross

margins as a percent of net sales were highest for farm

supply and small cooperatives. Farm supply coopera-

tives-16.7 percent-had the highest gross margin.

Although both types of farm supply cooperatives had

less business volume than those that performed mar-

keting activities, their gross margin percentage was

from 6 to 10 percentage points higher. Small coopera-

tives, mostly selling farm supplies, had the highest

gross margin by size (15.6 percent).

11

Table

w-Abbreviated income statement as a percent of net sales for cooperatives by size, 1995

Small

Medium

Large

Super

Percent of net

sa/es

Net sales

100.00 100.00 100.00 100.00

Cost of goods sold

64.36 67.66

89.08 91.98

Gross margin

15.64 12.34 10.92

a.02

Service and other income

3.63 4.16 4.07 3.94

Gross revenue

19.27 16.50 14.99 11.96

Expenses

Employee

1

9.23 7.22 6.52

4.58

Administrative

*

1.10 .79 .59 -44

General

3

4.35 3.78 3.56 3.35

Depreciation

2.11 1.97 1.74 1.46

Interest

.68 .a2 .90

1.03

Bad debts

.23 .24

.ia

.06

Total

expenses

17.70 14.82 13.49 10.92

Local savings

1.57

1.68 1.50

1.04

Patronage refunds received

2.36

1 .a4

1.49

1.12

Savings before income taxes

3.93 3.52 2.99 2.16

Less income taxes

.24 .42 .49

.20

Net income

3.69 3.10 2.50

1.96

Based on total sales of:

$2,599,834 $7,010,685

$13,819,360 !§37,104,303

t

Employee expenses include salaries and wages, payroll taxes, employee insurance, unemployment compensation, and pension expense.

2

Administrative costs include professional services, office supplies, telephone, meetings and travel, donations, dues and subscriptions,

directors’ fees and expense, and annual meetings.

3

General expenses include advertising and promotion, delivery (auto and truck), insurance, property, business and other taxes and licenses,

rent and lease expenses, plant supplies and repairs, repairs and maintenance, utilities, miscellaneous, and other.

Gross margins vary not only by cooperative, but

also by farm supply sold or product marketed.

Cooperatives, like other businesses, have different

margins for different products. For 100 cooperatives

that provided their individual product gross margins,

these margins are shown in table 12. Margins vary due

to product type and competition. For instance, fertiliz-

er sold by the truckload has a different margin than a

sale of a single bag. The services offered in conjunction

with a sale (e.g., fertilizer spread on the field by a

cooperative truck) have an impact on margin. Margins

are also subject to competition. The gross margin dis-

cussed in the first paragraph of this section is a blend-

12

ed margin, made up of the margins of all products the

cooperative sold, services rendered, and products mar-

keted.

The highest weighted (by volume) gross margin

for the five main farm supplies was for fertilizer with a

gross margin of almost 19 percent. The maximum mar-

gin on fertilizer of 46 percent was for a small amount,

probably a speciality fertilizer sold by the bag. Feed

and petroleum margins were both around 17 percent.

The margin of -302 percent on seed looks incorrect and

needs further explanation. This margin was from a

cooperative with more than

$6

million in grains and

oilseeds sales that sold $1,500 of seed for

$400.

The

Table

I

l-Abbreviated income statement as a percent of net sales for cooperatives by type, 1995

Farm supply Mixed farm supply Mixed marketing Marketing

Percent of net sales

Net sales

100.00 100.00 100.00 100.00

Cost of goods sold

83.32 85.06 91.82 94.02

Gross margin

16.68 14.94 8.18 5.98

Service and other income 3.81

4.99 4.03 3.55

Gross revenue

20.49 19.93

12.21

9.53

Expenses

Employee

l

9.63 8.89 4.85 3.36

Administrative

2

1.02

.91

.44 .33

General 4.67 5.15

2.91

2.87

Depreciation

2.23 2.24

1.54

1.20

Interest .85 1.09 .95 .94

Bad debts .19 -22 .12 .05

Total

expenses

18.59 18.50

10.81

8.75

Local savings

1.90 1.43 1.40

.78

Patronage refunds received

2.39

1.99

1.15

.91

Savings before income taxes

4.29 3.42 2.55

1.69

Less income taxes .23 .20 .49

.21

Net income

4.06 3.22 2.06 1.48

Based on sales of:

!$4,930,596

$11,534,034 $18,014,033 $21,917,039

1

Employee expenses include salaries and wages, payroll taxes, employee insurance, unemployment compensation, and pension expense.

*

Administrative costs include professional services, office supplies, telephone, meetings and travel, donations, dues and subscriptions,

directors’ fees and expense, and annual meetings.

3

General expenses include advertising and promotion, delivery (auto and truck), insurance, property, business and other taxes and licenses,

rent and lease expenses, plant supplies and repairs, repairs and maintenance, utilities, miscellaneous, and other.

seed may have been damaged, stolen, or sold for a

loss, but for whatever the reason, it was a very small

loss on minimal sales,

If the gross margin is extremely low, it may mean

that the cooperative is in a very competitive market.

For example, the two cooperatives with the lowest

margins were located in close proximity and of course,

in head-to-head competition. On further analysis, both

cooperatives have been profitable over the past 5 years

and have increased sales. They have even discussed

merger, but membership has resisted this change. In

this one instance, their low margins may be equated to

low product prices-something that their members

have noted by increasing their purchases from both

cooperatives.

Grains and oilseeds were the only products mar-

keted where gross margins were known. Grains and

oilseeds margins were low, only around 4 percent.

Around 10 cooperatives reported high grains and

oilseeds margins of 18 and 19 percent. These high mar-

gins were all at mixed farm supply cooperatives that

had feed sales. It is suspected that the high margins

resulted from the grain and oilseed content in livestock

feeds sold rather than the commodities themselves.

Service and Other Income

Service and other income, for the most part, con-

sisted of trucking services (both delivery of purchases

to patrons and transfer of their products to market),

custom application of fertilizers and crop protectants,

and drying and storing of grains and oilseeds. Local

13

Table

12--Gross

margin on farm supplies sold and grains and

oilsaeds

marketed,

1995

Weighted

Number of

margin Maximum

Minimum

observations

Percent

Number

Feed 16.53

28.76 2.38

a4

Seed 14.59

64.09

(301 a4)

78

Fertilizer

18.61

45.88 4.14 88

Crop protectants

13.86

24.96 2.66

a4

Petroleum products

16.46

41.23 2.45 55

Tires, batteries,

&

auto accessories 21.04 29.68

1.77

43

Machinery

13.88 19.24 11.09 4

Building materials 21.20

69.51

9.95

16

Food

23.44 33.00

11.71 7

Other farm supplies

19.50

48.35

(10.08)

90

Grains and

oilseeds 4.16

18.81

.27 62

cooperatives provided many other services to their

patrons, but these were the primary ones of the

respondent cooperatives. This income averaged

between 3.6 percent and 5 percent of net sales for all

sizes and types of cooperatives.

Other income was derived from non-operating

sources such as interest and finance charges. This

income included interest on cash equivalents and

interest charged on credit sales.

Other income also came from the sale of property,

plant, and equipment, rentals, and extraordinary

items. Sometimes property, plant, and equipment was

sold to generate income, but usually it was the sale of

a fully depreciated asset where the market value was

greater than the book value. In some cases, disposal of

a fully depreciated asset may mean a loss to the coop-

erative. Rental income from unused facilities or equip-

ment provided income flows. Extraordinary items

might be either a gain or a loss. A gain could result

from a fire loss where the insurance settlement was

greater than the book value of the asset. A loss might

be from flood damage for which the cooperative had

no coverage.

Operating Expenses

Operating expenses were divided into four main

categories-employee; administrative; general; and

depreciation, interest, and bad debts. Employee

expenses, of course, were related to labor costs.

Administrative expenses included a variety of over-

head costs associated with a cooperative and indirectly

related to revenue production. General expenses were

those directly related to revenue production, The bulk

were in employee, general, and depreciation categories.

14

Employee Expenses

Employee expenses included salaries, wages, and

benefits (payroll taxes, employee insurance, unem-

ployment compensation, and pension expense) and

averaged 5.7 percent of net sales for all respondent

cooperatives. Employee expenses, up 7.2 percent from

1994, represented the smallest increase of all the major

expense categories.

As a percent of net sales, employee expenses

decreased as cooperative size increased. This expense

decreased from 9.2 percent of net sales for small coop-

eratives to 4.6 percent for super cooperatives. By type,

employee expenses as a percent of net sales were 9.6

percent for farm supply cooperatives and 3.4 percent

for marketing cooperatives.

About 62 percent of the cooperatives (268) pro-

vided employee numbers and expenses (table 13).

These expenses were for all employees. To equate part-

time to full-time employees for purposes of this study,

four part-time employees were considered as one full-

time equivalent employee.3 Based on that calculation,

the expense for a single employee averaged $30,119 for

an average 19 employees, up 4 percent from 1994. By

size, they ranged from $26,982 for small to $33,010 for

super cooperatives and by type from $27,611 for those

selling only farm supplies to $33,481 for mixed market-

ing cooperatives. Small cooperatives averaged 8 actual

full-time employees (excludes part-time), medium, 16;

3

Based on previous research conducted by CS economist David E.

Cummins.

Table

wCalculated

salaries (using both full- and part-time employee expenses) and actual number of

full-

time employees, 1995

Small

Medium

Large

Super

All

Farm supply salaries

number of employees

$26,349

9

$31,151

21

$28,391

44

$30,600

42

$27,611

14

Mixed farm supply salaries

28,144

31,452 32,324

33,394

31,596

number of employees

9 18 34

59

28

Mixed marketing salaries

31,568 31,704 34,832

34,106

33,481

number of employees

6

11

20

50 25

Marketing salaries

29,634 29,268

32,443

31,864 31,213

number of employees

4

6

11

39 19

All salaries

26,982

31,039 32,634 33,010

30,119

number of employees 8 16

24

47

19

Table

I.+Board member

SalarieS

Cooperative type Salaries

Cooperative size

Salaries

Farm supply

$576

Mixed farm supply

1,087

Mixed marketing

559

Marketing

739

Average of all

684

Small

$364

Medium

639

Large

870

Super

1,306

large, 24; and super, 47. Farm supply cooperatives

averaged 14 employees, mixed farm supply, 28; mixed

marketing, 25; and marketing, 19.

Cooperatives with a significant proportion of

their sales as farm supplies tended to be more labor

intensive. Operating a feed mill or service station,

applying chemicals and fertilizers, and selling hard-

ware required the use of several employees. For

instance, a small farm supply cooperative had 9 full-

time employees while a small marketing cooperative

used fewer employees-often only a manager, book-

keeper, and two others.

Administrative Expenses

Administrative expenses were indirectly related

to generating income. Managers usually had more con-

trol over administrative expenses than any other cost.

In years when revenues were down, managers could

reduce expenses in this area more easily than in other

categories. Administrative costs include professional

services, donations, dues and subscriptions, directors’

fees and expenses, annual meetings, meetings and

travel, office supplies, and telephone and market infor-

mation.

Professional services (such as legal, accounting,

and computer) and office supplies both comprised 0.16

percent of net sales-the largest administrative

expense. In total, administrative expenses were less

than 0.6 percent of net sales. These expenses fell from a

high of 1.1 percent for small cooperatives to 0.44 per-

cent for super cooperatives. As cooperative size

increased, the highest administrative expense, profes-

sional services, fell as the cooperative relied more on

its own employees to perform these tasks rather than

purchase the services.

Although directors’ fees and expenses were a

small part of total costs, director compensation was

important to many cooperatives to get farmers to sacri-

fice time normally spent on their own operations to

devote several hours of service each month to guiding

their cooperative. Table 14 shows the number of direc-

tors and their compensation for 282 cooperatives in

1995. Board expenses seemed rather modest, averaging

$684

per director. The average board had seven direc-

tors. By size, small cooperatives paid directors the

least ($364) and super paid the most ($1,306). By type,

mixed farm supply cooperatives paid the most at

$1,087 per director.

15

General Expenses

General expenses were usually fixed in the short

run and associated with income production. These

expenses included advertising and promotion, deliv-

ery (auto and truck), general insurance, property, busi-

ness and other taxes and licenses, rent and lease

expenses, plant supplies and repairs, repairs and main-

tenance, utilities (including dryer expenses), miscella-

neous, and other. Most of these expenses (with the

exception of advertising and promotion) were not

under direct management control.

General expenses averaged 3.8 percent of net

sales in 1995, Repairs and maintenance and delivery

expenses at 0.68 percent of net sales were the largest in

the general category, followed by insurance and utili-

ties, both at 0.49. By cooperative size, general expenses

were 4.4 for small cooperatives and 3.4 for super coop-

eratives. By cooperative type, these expenses were

around 5 percent of net sales for farm supply coopera-

tives and around 3 for marketing cooperatives.

Depreciation, Interest, and Bad Debts

Depreciation expense averaged 1.5 percent of net

sales; interest, 0.9 percent; and bad debts, 0.1 percent.

By cooperative size, depreciation expense as a percent

of net sales was 2.1 percent for small cooperatives and

1.5 percent for super cooperatives. By cooperative

type, depreciation expense was 2.2 percent of net sales

for farm supply cooperatives, 1.5 percent for mixed

marketing, and 1.2 percent for marketing cooperatives.

As discussed earlier, interest expenses, especially

for short-term borrowing increased dramatically, going

from 0.7 percent of net sales in 1994 to 0.9 percent in

1995. Interest expenses were lowest among small coop-

eratives at 0.7, but grew to more than 1 percent for

super cooperatives. By type, interest expenses were

about 0.9 percent for all cooperatives except mixed

farm supply which was highest at 1.1 percent.

Bad debts as a percent of net sales fell as coopera-

tive size increased-O.2 for small cooperatives and 0.1

for super cooperatives. By cooperative type, bad debts

were 0.2 for both farm supply cooperatives and

around 0.1 for both marketing cooperatives.

Local Savings

Local savings or local income was generated from

own operations (before taxes and patronage refunds

from other cooperatives). Local savings as a percent of

net sales was highest for small cooperatives (1.6 per-

cent) and lowest for super cooperatives (1 percent). By

type, local savings was the highest for farm supply

cooperatives (1.9 percent) and the lowest for market-

ing cooperatives (0.8 percent). Small cooperatives, and

especially farm supply cooperatives, had higher local

savings than larger marketing cooperatives.

About 24 percent of the cooperatives in this study

had losses. While small cooperatives have higher

returns on net sales, 50 or one-third of them lost

money. Table 15 shows losses by size and type. Thirty

percent of the mixed farm supply cooperatives lost

money. Most likely to lose money were small mixed

farm supply cooperatives (57 percent).

Patronage Refunds Received

Patronage refunds received or income from other

cooperatives resulted from locals doing business with

other cooperatives, generally regionals, or cooperative

banks such as CoBank or the Bank for Cooperatives.

The patronage refund from regionals was based

on business volume and consisted of cash refunds and

equity stock. The equity stock was usually revolved

back to the local cooperative on a set schedule. Many

respondent cooperatives also borrowed funds from

CoBank and the Bank for Cooperatives and received

both cash and noncash patronage income. The noncash

Table

k-Respondent cooperatives that had losses

Cooperative type

Farm supply

Mixed farm supply

Mixed marketing

Marketing

Average

16

Small

28.69

57.14

25.00

50.00

32.05

Cooperative size

Medium

Large

Pefcerrf

10.81

10.53

26.09 18.18

21.43 24.24

26.67 29.17

19.42 21.43

Super

33.33

27.27

6.67

16.13

14.67

Average

23.20

30.00

18.45

25.64

23.61

patronage from CoBank or the Bank for Cooperatives

was from investing in the bank which was usually

required in proportion to the funds borrowed.

Patronage refunds reflect the volume of business

with regional cooperatives, CoBank or the Bank for

Cooperatives. The dollar amount of patronage refunds

between 1994 and 1995 was up 37 percent, suggesting

1995 must have been a good year for regional coopera-

tives, CoBank, or the Bank for Cooperatives. Patronage

refunds received were 2.4 percent of net sales for small

cooperatives and 1.1 percent for super cooperatives. By

cooperative type, patronage refunds received as a per-

cent of net sales were higher for farm supply coopera-

tives than for marketing cooperatives.

Patronage refunds were an important source of

revenues. They allowed 71 (out of 102) cooperatives

that had local losses to have net income.

Income Taxes

Cooperatives paid income taxes on earnings not

allocated to members (retained earnings) and on divi-

dend payments. The decision as to what amounts of

income that were allocated to retained earnings and to

members was made by the board of directors. The

treatment of nonmember business has an impact on

retained earnings because the cooperative could allo-

cate the earnings to nonmembers or retain the income.

In terms of net sales, income tax paid was 0.3 percent

of net sales in 1995.

Income tax paid by cooperatives varied by size

and type. Small cooperatives paid income taxes equal

to 0.2 percent of their net sales, medium, 0.4; large, 0.5;

and super, 0.2. All cooperatives except mixed market-

ing

(

0.5 percent) paid 0.2 percent of their net sales in

income taxes.

Net Income

Net income is the term used here for profits on

cooperative income statements. Net income as a per-

Table

w-Distribution of net income before taxes

Item

1995 1994

Percent

Non-cash patronage allocations 52.91 54.43

Cash patronage refunds

22.42

22.51

Retained earnings

17.17

16.97

Taxes

7.35

5.96

Dividends

-15

.14

cent of net sales decreased by cooperative size. For

small cooperatives it was 3.7 percent of net sales,

medium, 3.1 percent; large, 2.5 percent; and super, 2

percent. By cooperative type, farm supply had returns

of 4.1 percent on net sales, mixed farm supply had 3.2

percent, mixed marketing cooperatives, 2.1 percent,

and marketing cooperatives, 1.5 percent.

Net income (before taxes) was generally distrib-

uted five ways-non-cash patronage allocations, cash

patronage refunds, retained earnings, income taxes,

and dividends on patron’s equity (table 16). Nearly 53

percent of net income before taxes was held as non-

cash patronage allocations by the 287 cooperatives that

provided income allocations. Cash patronage refunds

were 22 percent. All distributions of income were basi-

cally unchanged from 1994. Only 9 of the 287 coopera-

tives reported dividends on preferred stock. The effec-

tive interest paid was 3.22 percent.

Financial Ratio Analvsis

Looking beyond levels of assets, liabilities, mem-

ber equities, sales, and expenses, cooperative man-

agers and boards of directors need comparative mea-

sures to evaluate their cooperative’s financial

performance.

Standard ratios were used in this report, includ-

ing financial ratio analysis that allow performance

comparisons between years and different cooperatives.

No single financial indicator will provide enough

information to determine a cooperative’s financial

health. Therefore, ratios must be carefully interpreted.

It is important to look at a group of financial ratios

over a period of time, evaluate other cooperatives with

similar sales and functions, and/or compare perfor-

mance with other cooperatives in the same geographi-

cal area.

Ratios used in this study were often chosen

because of their comparability with prior studies.

Therefore, most figures show ratios for the 11-year

period for all 1,610 cooperatives. Data for 1994 and

1995 reflect information gathered from the same 432

cooperatives that reported for both years.

Performance ratios measure various levels of

cooperative operations and generally have both a

financial and operational impact. Four categories were

used-liquidity, leverage, activity, and profitability.

Many factors underlie each ratio and examining one

ratio may not help pinpoint problems.

Net income before taxes:

Number of cooperatives:

$101,171,588

$94,112,032

287

330

17

Liquidity Ratios

Liquidity ratios, such as current and quick, mea-

sure the cooperative’s ability to meet short-term oblig-

ations. They focus on the cooperative’s ability to

remain solvent. The current ratio is current assets

divided by current liabilities. However, this ratio does

not consider the degree of liquidity of each of the com-

ponents of current assets. In other words, if the current

assets of a cooperative were mainly cash, they would

be much more liquid than if comprised of mainly

inventory.

If the ratio is less than 1, current liabilities exceed

current assets and the cooperative’s liquidity is threat-

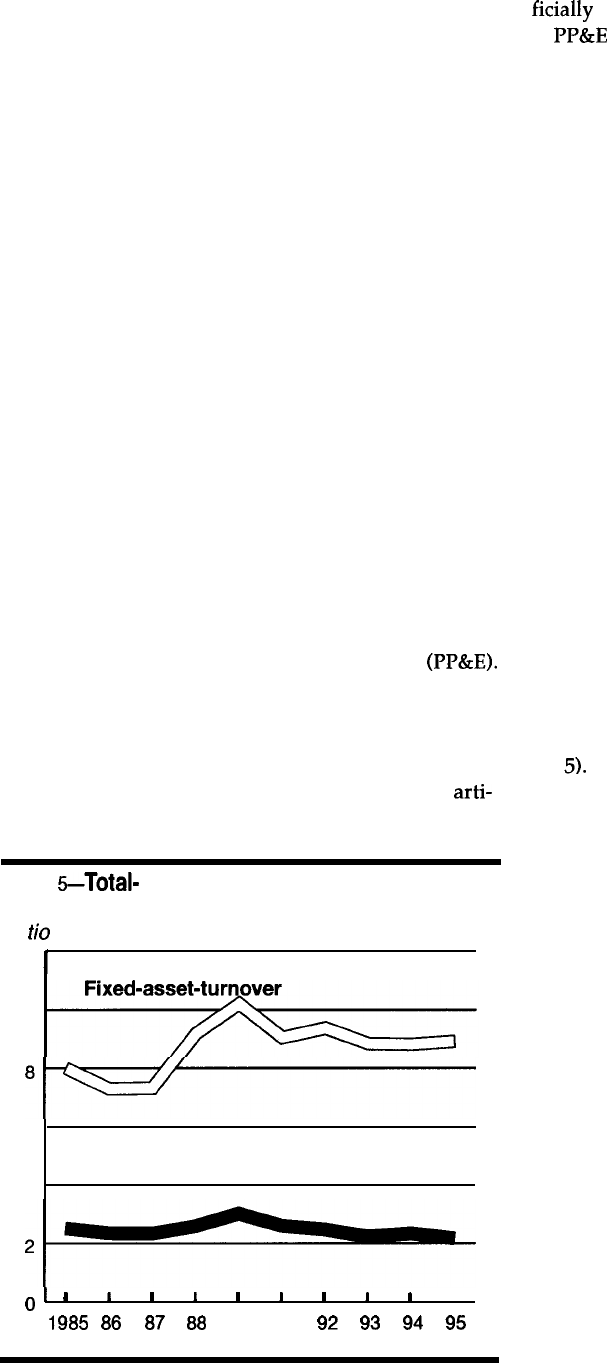

Figure

i-Current and Quick Ratios

Ratio

21

4-=-

Quick

0

’

I

I I I I

I

I

I

I

1985

86

87

88 89

90

92

93 94 95

ened. Improvements in this ratio can be achieved by

selling additional capital stock, borrowing additional

long-term debt, or disposing of unproductive fixed

assets and retaining proceeds. Current liabilities may

also be reduced by retaining a greater portion of allo-

cated savings (reducing the cash portion).

A high current ratio is a favorable condition

financially because it indicates the ability to pay cur-

rent liabilities from the conversion of current assets

into cash. Operationally, this same high ratio tends to

increase operating freedom and reduce the probability

of bill-paying difficulty from writedowns of accounts

receivable or inventory.

Figure 1 shows the current and quick ratios for the

surveyed cooperatives. The current ratio was relatively

constant for 3 years before it took a slight downturn in

1995. The total current assets increased 24 percent

while total current liabilities increased 33 percent.

From 1994 to 1995, grains and oilseeds and farm sup-

ply inventories and dividends on equity were the only

elements of current liabilities that grew. Higher grain

and oilseed inventories are probably causing the

32-

percent increase in patron credit balances and other

liabilities (which contains grain trade payables).

The current ratio fell as cooperative size increased.

The ratio was highest for small cooperatives (2.11) and

fell to 1.19 for super cooperatives (table 17). By cooper-

ative type, the ratio was 1.15 for marketing coopera-

tives and 1.82 for farm supply cooperatives (table 18).

Quick ratio is current assets minus inventories,

divided by current liabilities. Inventories are exclud-

ed-the least liquid of all current assets. All elements

of this ratio have increased. Financially, a high ratio

Table

w-Financial

SnalySiS

ratios

by

COOperatiVe

Sk?,

1995

Ratio

Liquidity

Current

Quick

Leverage

Debts-to-assets

Debt-to-equity

Times-interest-earned

Activity

Total-asset-turnover

Fixed-asset-turnover

Profitability

Gross profit margin

Return on total assets

before interest

&

taxes

Return on allocated equity

Small

Medium

Large Super

2.11 1.63 1.34

1.19

1.12 .80 .56

-41

.12

.19

.24 .32

.06

.ll

.14

.17

6.80 5.26 4.33 3.10

1.78 1.97 2.19 2.28

8.03 7.99 8.53

9.61

15.64 12.34 10.92 8.02

8.20 8.54

8.51

7.29

12.23 13.34 13.83 14.92

18

allows little dependence on the salability of inventory

to meet current obligations. Operationally, the results

are the same as with current ratio.

The quick ratio mimicked the movement of the

current ratio. Small cooperatives (1.12) had the highest

ratio and it decreased as size increased to 0.41 for

super cooperatives (table 17). The quick ratio ranged

from a low of 0.39 for marketing cooperatives to a high

of 0.92 for farm supply cooperatives. This ratio was

highest in 1986 and lowest in 1995 (figure 1).

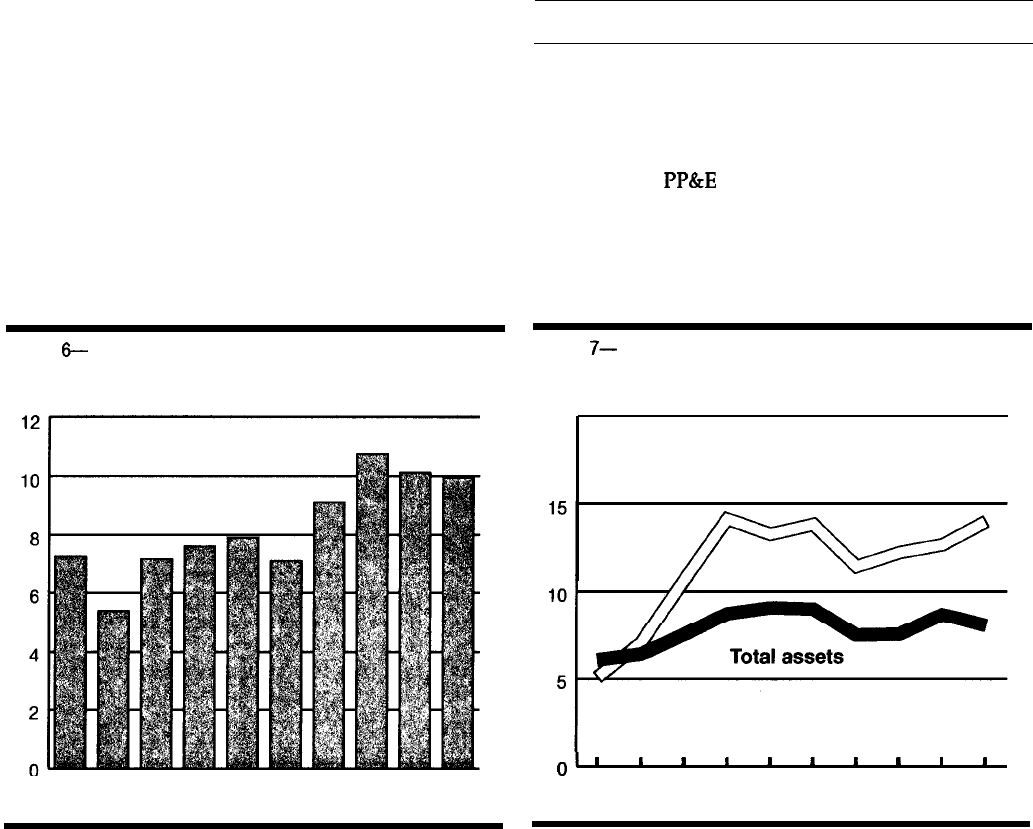

Figure

z-Total

Debt-To-Asset Ratio

Percent

0.35

0.25

0.20

0.15

0.10

0.05

n

”