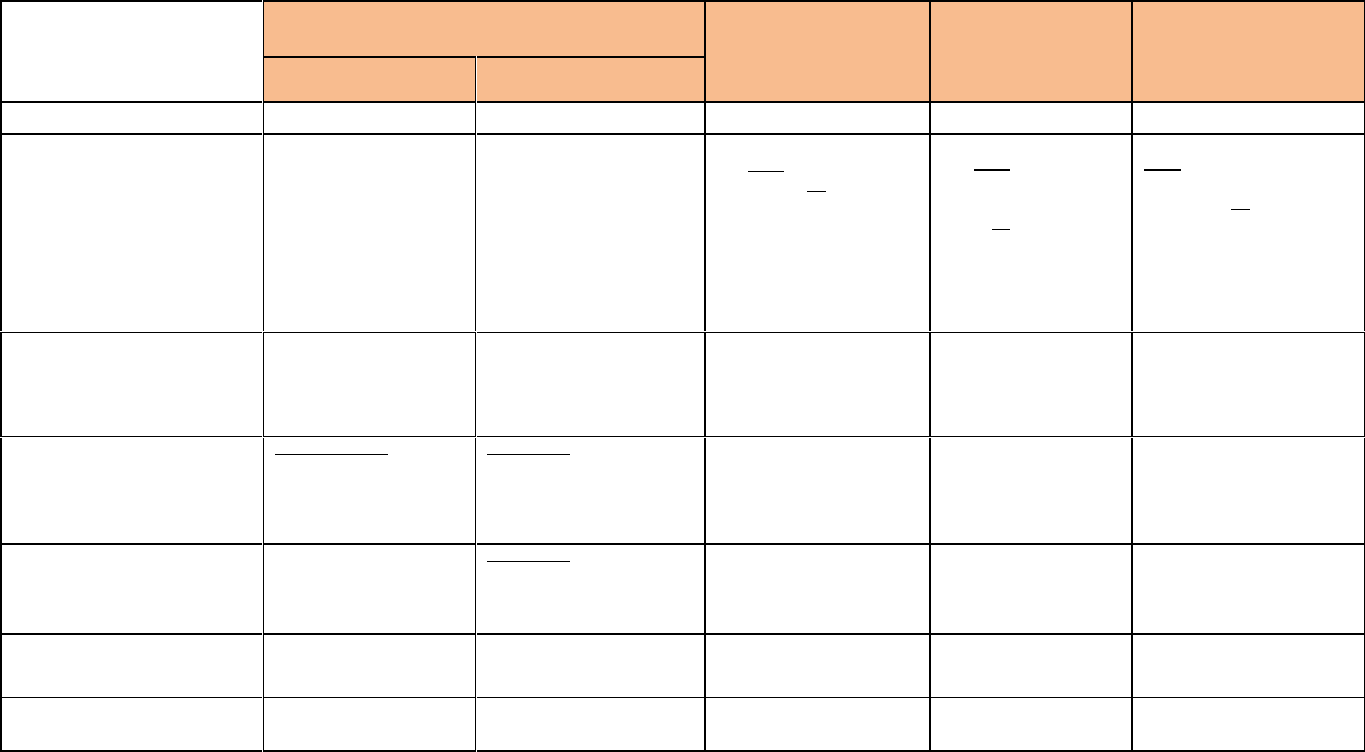

OPERATING ENGINEERS HEALTH & WELFARE FUND

BENEFIT PLANS SUMMARY COMPARISON FOR ACTIVES and EARLY RETIREES

Operating Engineers PPO Plan

Operating Engineers

Kaiser Permanente Plan

Operating Engineers

Anthem HMO Plan

Operating Engineers

Health Plan of Nevada

(Nevada Residents Only)

For Non-PPO

Providers

For PPO Providers

Employee Premium

None

None

None

None

None

Explanation of Plans and

Options Available to You

If you choose a

doctor who is not

contracted with Anthem

Blue Cross the Plan will

pay the following benefits

according to Plan rules

The treatment must be a

covered service

If you use Anthem Blue

Cross PPO providers, the

Plan will pay the following

benefits according to Plan

rules

Treatment must be rendered

by a PPO contract provider

and be a covered service

If you enroll in this plan

you must use Kaiser

facilities for all of your

medical care

If you enroll in this plan

you must choose a

participating medical

group where you must

go for all your medical

care

If you enroll in this plan, you

must choose a participating

medical group where you

must go for all your medical

care

Deductible

$500 per person per

calendar year; maximum

$1,500 per family

(Applicable to Most

Services)

$250 per person per

calendar year; maximum

$750 per family

(Applicable to Most

Services)

None

None

None

Annual Out-of-Pocket

Maximum | Medical and

¹Pediatric Dental & Vision

Out of Network

$6,000 per person;

$12,000 per family per

calendar year

In-Network

$3,000 per person;

$6,000 per family per

calendar year

$1,500 per person;

$3,000 for two or more

family members

$1,500 per person;

$3,000 for two family

members;

$4,500 for three or

more family members

$6,000 per person;

$12,000 per family

Annual Out-of-Pocket

Maximum | Rx

Not Applicable

In-Network

$3,600 per person;

$7,200 per family per

calendar year

Not Applicable

Not Applicable

Not Applicable

Calendar Year Maximum

None

None

None

None

None

Pre-Existing Condition

Limitations

None

None

None

None

None

1. Pediatric services are defined as services for an individualless than 19 years of age.

7/17

Rev.

OPERATING ENGINEERS HEALTH & WELFARE FUND

BENEFIT PLANS SUMMARY COMPARISON FOR ACTIVES and EARLY RETIREES

Operating Engineers PPO Plan

Operating

Operating

Operating Engineers

Health Plan of Nevada

(Nevada Residents Only)

Engineers

Kaiser Permanente

Plan

Engineers

Anthem HMO

Plan

For Non-PPO Providers

For PPO Providers

PROFESSIONAL SERVICES:

Office Visits

Plan pays a maximum of $15 per visit

Plan pays 90% of the contract

rate after a $20 co-pay per

visit

$25 co-pay per visit

$25 co-pay per visit

$5 co-pay per visit

Hospital Visits

Plan pays 70% of reasonable and

customary charges

Plan pays 90% of the contract

rate

$250 co-payper

admission

$250 co-pay per

admission

Inpatient - $300 co-pay per admission

Outpatient - $200 co-pay per surgery

Lab and X-Ray

Plan pays 70% of

reasonable and customary charges

Plan pays 90% of the contract

rate

$10 co-pay per

service

No charge

Lab - $5 co-pay per service

X-ray - $10 co-pay per service

Therapy -

Acupuncture, Chiropractic &

Physical Therapy

(Note: The combined 26 visit

limit on the FFS and PPO plans is

a combined limit. You do not

receive a separate benefit of 26

visits under each plan.)

Plan pays a maximum of $15 per visit

with a combined limit of 26 visits per

calendar year for Acupuncture and

Chiropractic care

Chiropractic - Plan pays 50% of

the contract rate

Acupuncture and Physical

Therapy- Plan pays 90% of

the contract rate after a $20

co-pay per visit

Acupuncture and Chiropractic

care have a combined limit of

26 visits per calendar year

$25 co-pay per visit

(See Kaiser’s

Summary of Benefits

for details)

$25 co-pay per visit

$5 co-pay per visit for Physical Therapy

and Chiropractic services

(see Health Plan of Nevada’s Summary

of Benefits for details)

Speech Therapy

Plan pays 70% of reasonable and

customary charges up to a maximum

of $15 per visit

Plan pays 90% of the contract

rate

$25 co-pay per visit

$25 co-pay per visit

$5 co-pay per visit

²Preventive Healthcare Services

Plan covers 70% of reasonable and

customary charges

No charge

No charge

No charge

No charge

Surgeon

Plan pays 70% of reasonable

and customary charges

Plan pays 90% of the contract

rate

No charge

No charge

$100 co-pay per surgery (hospital)

$50 co-pay per surgery (surgical

facility)

Assistant Surgeon

Plan pays 70% of reasonable and

customary charges for second

surgeon, assistant surgeon, second

assistant surgeon and physician

assistant

(Only if surgery

warrants an Assistant Surgeon)

Plan pays 90% of the contract

rate

(Only if surgery warrants an

Assistant Surgeon)

No charge

No charge

No charge

Anesthetist

Plan pays 70% of reasonable and

customary charges

Plan pays 90% of the contract

rate

No charge

$35 co-pay per

occurrence

$100 co-pay per surgery

Urgent Care Services

Plan pays 70% of reasonable and

customary charges

Plan pays 90% of the contract

rate

$25 co-pay per visit

$35 co-pay per visit

$20 co-pay per visit

2. Preventive Services Include: All preventiveservices and tests with an A or B rating from the U.S. Preventive Task Force are covered

(Additionaltests may be covered as required by law)

7/17

Rev.

OPERATING ENGINEERS HEALTH & WELFARE FUND

BENEFIT PLANS SUMMARY COMPARISON FOR ACTIVES and EARLY RETIREES

Operating Engineers PPO Plan

Operating Engineers

Kaiser Permanente Plan

Operating Engineers

Anthem HMO Plan

Operating Engineers

Health Plan of Nevada

(Nevada Residents Only)

For Non-PPO Providers

For PPO Providers

HOSPITAL SERVICES:

Inpatient Care –

Semi-Private Room and

Misc. Charges

Plan pays 70% of reasonable and

customary charges

Plan pays 90% of the

contract rate

$250 co-pay per admission

$250 co-pay per admission

$300 co-pay per admission

Outpatient Care –

Emergency RoomCare –

Non Emergency

Emergency RoomCare –

Emergency related

Ambulatory Surgical

Facility

Plan pays a maximum of $15

for Emergency Room visit;

70% of reasonable and

customary charges for Lab and

X-ray charges

Plan pays 90% of reasonable

and customary charges

Plan pays 70% of reasonable

and customary charges

Plan pays 90% of

the contract rate

Plan pays 90% of

the contract rate

Plan pays 90% of

the contract rate

$100 co-pay per visit;

waived if admitted

$100 co-pay per visit;

waived if admitted

$250 co-pay per

occurrence

$100 co-pay per visit;

waived if admitted

$100 co-pay per visit;

waived if admitted

$250 co-pay per occurrence

$150 co-pay per visit; waived

if admitted

$150 co-pay per visit; waived

if admitted

$50 co-pay per surgery

Inpatient Psychiatric

Care

Plan pays 70% of reasonable and

customary charges

(Benefits provided through

MHN)

Plan pays 90% of

the contract rate

(Benefits provided through

MHN)

$250 co-pay per admission

$250 co-pay per admission

$300 co-pay per admission

Inpatient Alcohol and

Substance Abuse Care

Plan pays 70% of reasonable and

customary charges

(Benefits provided through

MHN)

Plan pays 90% of

the contract rate

(Benefits provided through

MHN)

$250 co-pay per

admission for

detoxification

$100 co-pay per

admission for

transitional residential

recovery services

Maximum of 60 days

per calendar year, not to

exceed 120 days in any

5 year period

$250 co-pay per admission

for detoxification only

$300 co-pay per admission

Skilled Nursing Facility

Plan pays 80% of reasonable

and customary charges

with a 60-day maximum

per confinement

Plan pays 90% of the

contract rate with a 60-day

maximum per confinement

No charge

Maximum 100 days per

benefit period (2/1 - 1/31)

$250 co-pay per admission

Maximum of100 days per

calendar year

$300 co-pay per admission;

waived if admitted from an

acute care facility

Maximum of100 days per

calendar year

7/17

Rev.

OPERATING ENGINEERS HEALTH & WELFARE FUND

BENEFIT PLANS SUMMARY COMPARISON FOR ACTIVES and EARLY RETIREES

Operating Engineers PPO Plan

Operating Engineers

Kaiser Permanente Plan

Operating Engineers

Anthem HMO Plan

Operating Engineers

Health Plan of Nevada

(Nevada Residents Only)

For Non-PPO Providers

For PPO Providers

OTHER SERVICES:

Ambulance

(medically necessary)

Emergency Transport:

Plan pays 80% of

reasonable and customary

charges (Deductible waived)

Non-Emergency

Transport: Plan pays

70% of reasonable and

customary charges

(Deductible applies)

Transport Between

In- Network Hospitals:

Plan pays 100% of

reasonable and customary

charges (Deductible

waived)

Emergency Transport:

Plan pays 80% of the

contract rate

(Deductible waived)

Non-Emergency

Transport: Plan pays

80% of the contract rate

(Deductible applies)

Transport Between

In-Network Hospitals:

Plan pays 100% of the

contract rate

(Deductible waived)

$50 co-pay per trip

$50 co-pay per trip

$150 co-pay per trip

Hearing Aids

Plan pays 100% to a

maximum of $1,000 per

ear, once every 3 years

Plan pays 100% to a

maximum of $1,000 per

ear, once every 3 years

Not covered

Note: Coverage available

under the Fund’s PPO Plan

Not covered

Note: Coverage available

under the Fund’s PPO Plan

$0 co-pay

Durable Medical Equipment

Plan pays 70% of

reasonable and

customary charges, not to

exceed purchase price

Plan pays 90% of the

contract rate, not

to exceed purchase

price

No charge. Including

diabetic testing supplies

No charge

$0 co-pay; subject to

maximum benefit

Prosthetic Appliances

Plan pays 70% of

reasonable and customary

charges

Plan pays 90% of the

contract rate

No charge

No charge

$750 co-pay per device;

subject to maximum benefit

7/17

Rev.

OPERATING ENGINEERS HEALTH & WELFARE FUND

BENEFIT PLANS SUMMARY COMPARISON FOR ACTIVES and EARLY RETIREES

Operating Engineers PPO Plan

Operating Engineers

Kaiser Permanente Plan

Operating Engineers

Anthem HMO Plan

Operating Engineers

Health Plan of Nevada

(Nevada Residents Only)

PRESCRIPTION DRUGS:

Contract Prescription Card –

Walk-in (30 Day Supply)

At OptumRx Participating

Pharmacies

At participating pharmacies your co-pays are:

$10 for a generic drug

$25 for a preferred brand-name drug

$40 for a non-preferred brand-name drug

If there is a generic equivalent for the brand-name drug

you choose to purchase, you will pay the co-pay PLUS 50%

of the difference in price between the brand-name and

generic drug

Note: Maintenance type drugs can be filled in

90-day supplies through the OptumRx mail

order pharmacy or at OptumRx network retail

pharmacies (see below)

For generic drugs at Kaiser

pharmacies, you pay:

$10 for up to a 31 day supply

$20 for a 100 day supply

For brand-name drugs at a Kaiser

pharmacy, you pay:

$25 for up to a 31 day supply

$50 for a 100 day supply

At contract pharmacies you

pay:

$10 for a generic drug on the

Anthem Blue Cross

recommended drug list (RDL)

For a RDL brand-name drug

you pay $30

For a drug not listed on the

RDL you pay 50% of the

drug cost

At contract pharmacies you pay:

$7 for a Tier 1 drug

$30 for a Tier II drug with NO

generic equivalent

$50 for a Tier III drug

Contract Prescription Card –

Mail Order (90 Day Supply)

At the OptumRx Mail Order

Pharmacy

At the OptumRx Mail Order Pharmacy or OptumRx

Network Retail Pharmacies, your co-pays are:

$25 for a generic drug

$62.50 for a preferred brand-name drug

$100 for a non-preferred brand-name drug

If there is a generic equivalent to the brand-name drug you

choose to purchase, you will pay the co-pay PLUS 50% of the

difference in price between the brand-name and generic drug

For generic drugs you pay:

$10 for up to a 30 day supply

$20 for a 31-100 day supply

You pay twice the applicable

co-pay as outlined above

You pay 2.5 times the applicable

co-pay as outlined above

Fee-For-Service

Prescription Drug Plan

(Non-Participating Pharmacies)

Plan pays 80% of the reasonable and customary charge after

satisfaction of the out-of-network calendar year deductible.

You may obtain a maximum 60-day supply of any one drug. Once

you have obtained a 60-day supply, you must use a OptumRx

network pharmacy for additional refills. Continued purchases at

non-network pharmacies will be denied

Not applicable

Not applicable

Not applicable

4/19

Rev.

OPERATING ENGINEERS HEALTH & WELFARE FUND

BENEFIT PLANS SUMMARY COMPARISON FOR ACTIVES and EARLY RETIREES

Operating Engineers PPO Plan

Operating Engineers

United Concordia

Preferred - DPPO

Operating Engineers

United Concordia

Plus - DHMO

Operating Engineers

Delta Dental PMI - DHMO

For Non-PPO Providers

For PPO Providers

DENTAL/ORTHODONTIA

CARE:

Deductible

$25 per person, per

calendar year,

$75 per family per calendar

year

(Combined dental and

orthodontia deductible)

$25 per person, per

calendar year,

$75 per family per calendar

year

(Combined dental and

orthodontia deductible)

In Network

$25 per person per

calendar year,

$75 per family per

calendar year

Out of Network

$100 per person per

calendar year,

$300 per family per

calendar year

No deductible

No deductible

Dental Coverage

Plan pays 100% of the non-

contract fee schedule

(approximately 50% of

charges)

Any balance remaining is

patient co-pay

Adult Benefit Maximum

19 years of age and older:

$6,200 in any two (2)

consecutive year period,

per person*

Plan pays 100% of the

contract amount

Adult Benefit Maximum

19 years of age and older:

$6,200 in any two (2)

consecutive year period,

per person*

Plan pays 100% for

network dentists

Plan pays 50% for

non-network dentists

Calendar Year Benefit

Maximum

$3,000 per person per

calendar year in network,

$1,000 per person per

calendar year non network

Plan pays 100% of most

covered services

No maximum

Refer to the Plan Schedule

of Benefits (available from

the Fund Office) for

specific coverage and

co-pay amounts

No maximum

Orthodontia Coverage

Plan pays 50% of charges

up to a lifetime maximum

benefit of $3,000*

Coverage available to

dependent children only

Plan pays 50% of charges

up to $3,000*

Co-pay is also 50% of

charges up to $3,000*

Lifetime maximum benefit

of $3,000*

Coverage available to

dependent children only

Plan pays 50% of charges

up to lifetime maximum

$2,000 lifetime maximum

Coverage available to

dependent children only

Refer to the Plan Schedule

of Benefits (available from

the Fund Office) for specific

coverage and copay amounts

No calendar year maximum

Coverage available to

dependent children and

adults

Refer to the Plan Schedule of

Benefits (available from the

Fund Office) for specific

coverage and copay amounts

No Calendar Year maximum

Coverage available to

dependent children and

adults

Effective with dates of service on or after June 1, 2017

7/17 Rev.

OPERATING ENGINEERS HEALTH & WELFARE FUND

BENEFIT PLANS SUMMARY COMPARISON FOR ACTIVES and EARLY RETIREES

Operating Engineers PPO Plan

Operating Engineers

Kaiser Permanente Plan

Operating Engineers

Anthem HMO Plan

Operating Engineers

Health Plan of Nevada

(Nevada Residents Only)

VISION CARE:

Eye Examination

Through Vision Service Plan (VSP)

$15 deductible

Exam covered once every 12 months

$25 co-pay per visit

$25 co-pay per visit

Through Vision Service

Plan (VSP)

Eye Lenses / Frames

Through Vision Service Plan (VSP)

$25 deductible

Lenses covered once every 24 months

Frames covered once every 24 months

For the Member Only:

Extra pair of glasses or lenses once every 24 months for a

$65 co-pay

Through Vision Service

Plan (VSP)

$25 co-pay

Lenses covered once

every 24 months

Frames covered once

every 24 months

For the Member Only:

Extra pair of glasses or

lenses once every 24

months for a $65 co-pay

Through Vision Service

Plan (VSP)

$25 co-pay

Lenses covered once every

24 months

Frames covered once every

24 months

For the Member Only:

Extra pair of glasses or

lenses once every 24

months for a $65 co-pay

Through Vision Service

Plan (VSP)

$25 co-pay

Lenses covered once every

24 months

Frames covered once every

24 months

For the Member Only:

Extra pair of glasses or

lenses once every 24

months for a $65 co-pay

SPECIAL NOTES:

All Plans have limitations and exclusions.

Please refer to your Plan Booklet for complete details

All Plans have limitations

and exclusions.

Please refer to your Plan

Booklet for complete

details

All Plans have limitations

and exclusions.

Please refer to your Plan

Booklet for complete

details

All Plans have limitations

and exclusions.

Please refer to your Plan

Booklet for complete

details

7/17

Rev.