Updated 07-2018

TRADE

Page 2 of 177 Updated 07-2018

ace REPORTS DATA DICTIONARY – TRADE

The ACE Reports Data Dictionary is a reference guide designed to enhance the understanding of ACE Reports by clearly

categorizing and defining data universes and data objects available to system users. It is meant to assist users in

identifying data sets and/or specific objects that best fulfill a particular business need and to encourage overall use of

the reporting tool. The dictionary is a living document that will evolve as reports capabilities change and as new data

universes are added. Each update will be marked with the month and year of issuance to allow for quick and easy

identification of the most recently published document.

This version of the ACE Reports Data Dictionary contains detailed information on data that can be accessed by users in

the Trade community and focuses on data universes deployed since 2015.

The following features have been integrated into the dictionary to enable users to navigate the document and quickly

access relevant content:

1. Linked Table of Contents – Enables users to quickly locate a particular reporting area in the electronic

version of this document by simply clicking on the desired section title listed in the table of contents

2. Built-In Search Feature – Enables the user to search for a word or phrase (e.g., a specific data object) within

the electronic version of this document by pressing Ctrl + F on the keyboard

Due to the length of the dictionary, it is recommended that users take advantage of these features by working with this

reference document in electronic format.

Page 3 of 177 Updated 07-2018

ace REPORTS DATA DICTIONARY – TRADE

Table of Contents

Data Universe Descriptions ..................................................................................................................................................... 4

Cargo Release

Cargo Release ...................................................................................................................................................................... 5

PGA Message Set – Cargo .................................................................................................................................................. 21

Entry Summary

ADCVD ............................................................................................................................................................................... 43

Entry Summary .................................................................................................................................................................. 69

Liquidation ....................................................................................................................................................................... 105

Protest ............................................................................................................................................................................. 114

Reconciliation .................................................................................................................................................................. 123

Statements ...................................................................................................................................................................... 144

Export

Trade Export .................................................................................................................................................................... 152

Reference

Harmonized Tariff Schedule ............................................................................................................................................ 166

Miscellaneous

Date Objects .................................................................................................................................................................... 174

Training .......................................................................................................................................................................... 1736

Page 4 of 177 Updated 07-2018

ace REPORTS DATA DICTIONARY – TRADE

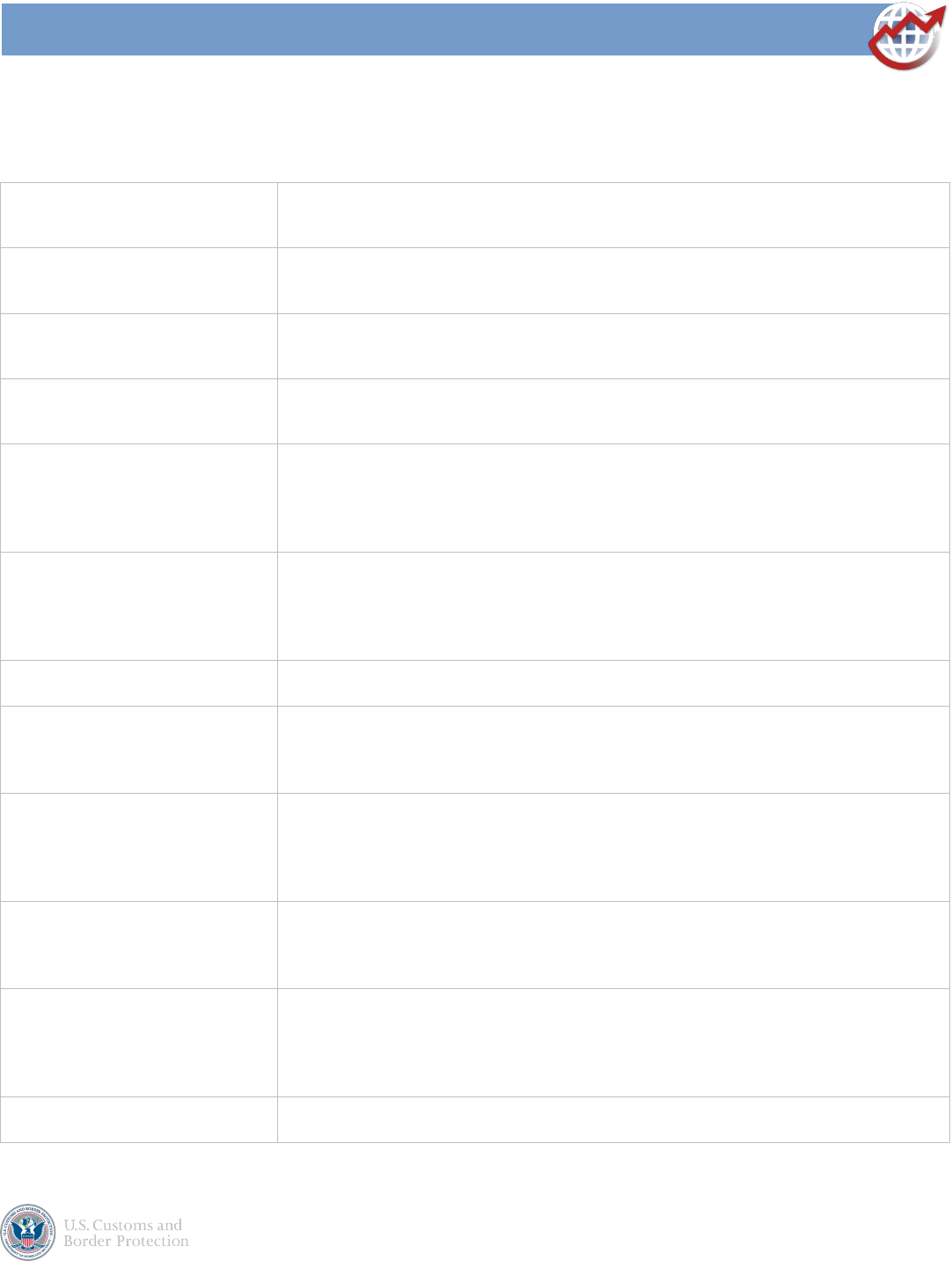

Data Universe Descriptions

A data universe is the interfacing layer between the user and the database. It is a business representation of the data

warehouse that defines the relationship between select data tables and allows the user to interact with data without

knowing all of the complexities of the database.

The following table outlines data universes created since 2015 that are available to Trade users for creating custom ad

hoc reports and/or modifying existing public standard reports in ACE Reports.

Category

Universe

Description

Cargo Release

Cargo Release

This universe contains data on cargo release entries filed in ACE and ACS. Data elements

include, but are not limited to: entry header, entry line, entry tariff, and select entry-

related manifest information.

Available to: CBP, PGAs, Brokers, Importers

Cargo Release

PGA Message Set

- Cargo

This universe contains data on cargo release entry lines filed with Partner Government

Agency (PGA) message set data. Data elements include, but are not limited to: entry

header, entry line, entry tariff, and select PGA message set information.

Available to: CBP, PGAs, Brokers, Importers

Entry Summary

ADCVD

This universe contains data on Antidumping/Countervailing Duty (AD/CVD) data for any

line filed in ACE or ACS that contains an antidumping or countervailing duty case number.

Available to: CBP, select PGAs, Brokers, Importers

Entry Summary

Entry Summary

The Entry Summary universe contains data elements pertaining to 7501 entry summary

filings, which have been standardized to include both ACS and ACE filed entry summaries.

Data elements include information captured at the entry summary header, line, and tariff

level.

Available to: CBP, Brokers, Importers

Entry Summary

Liquidation

The Liquidation universe contains data elements related to the liquidation records that

occur on 7501 entry summary filings. This universe is separate from the main entry

summary universe to account for the fact that multiple liquidations can occur on the

same entry summary.

Available to: CBP, Brokers, Importers

Entry Summary

Protest

This universe contains data on protests filed in ACE and ACS along with select entry

summary information for entries that are associated to a protest. Data elements include,

but are not limited to: protest header, protest activities, protest attachments, and select

entry summary information.

Available to: CBP, Protest Filers

Entry Summary

Reconciliation

The Reconciliation universe contains data elements pertaining to type 09 reconciliation

entry summaries as well as their underlying 01, 02, and 06 entry summaries.

Available to: CBP, Brokers, Importers

Page 5 of 177 Updated 07-2018

ace REPORTS DATA DICTIONARY – TRADE

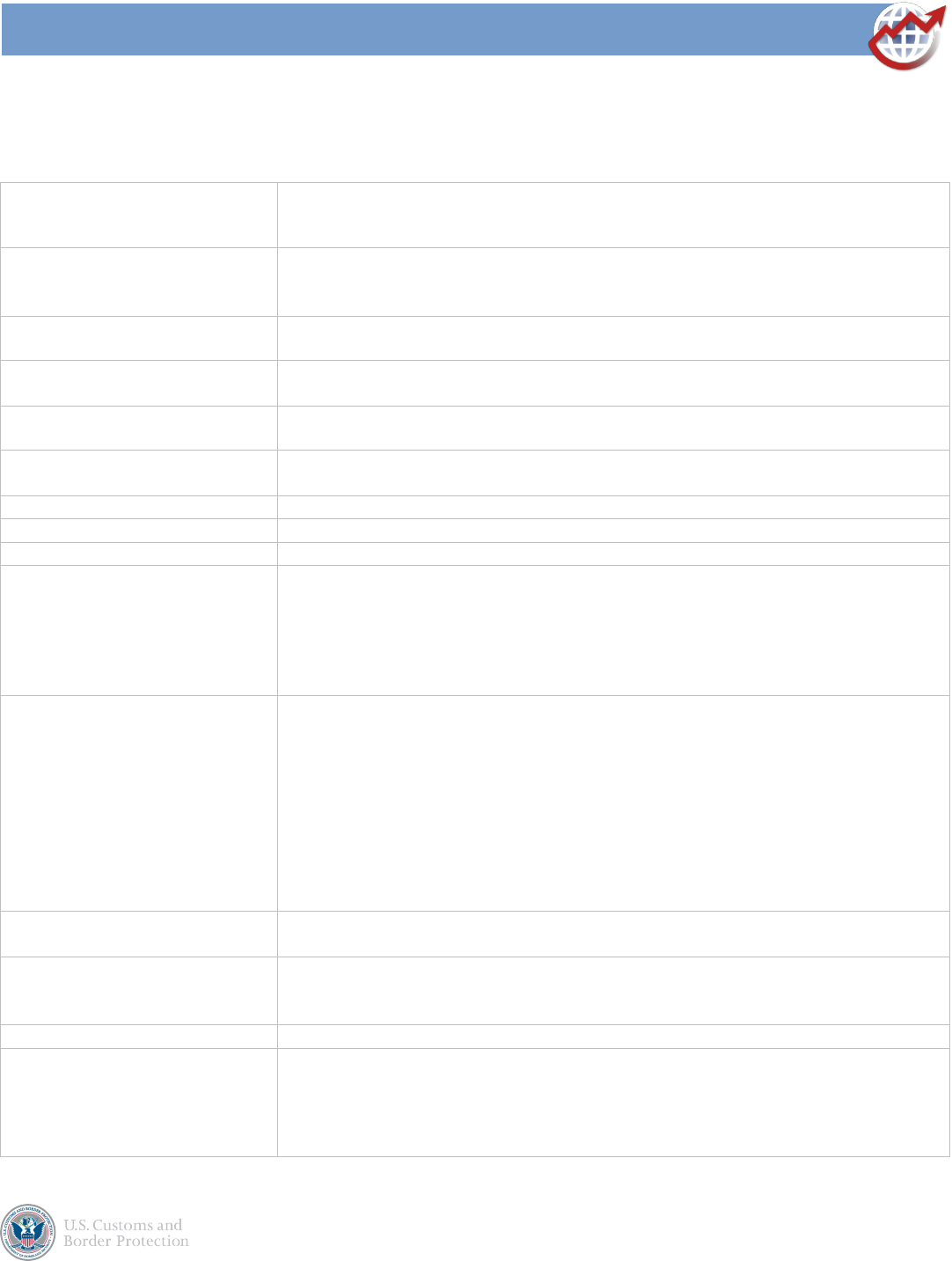

Category

Universe

Description

Entry Summary

Statements

The Statements universe contains data elements found in the ACE Statements

application, which captures data at four different levels of detail: monthly statements,

daily statements, entry summaries associated to daily statements, and the accounting

class code/user fee details for each entry summary associated to a daily statement.

Available to: CBP, Brokers, Importers

Export

Trade Export

This trade-specific universe allows United States Principal Parties in Interest (USPPIs) and

filers to retrieve Electronic Export Information (EEI) filing data on exports in the

Automated Export System (AES). It contains a U.S. Census Bureau approved set of data

elements which include, but are not limited to: EEI header, commodity line, party, vehicle,

equipment, and Directorate of Defense Trade Controls (DDTC) license information.

Available to: CBP, Exporters

Reference

Harmonized

Tariff Schedule

The Harmonized Tariff Schedule (HTS) contains data elements related to the master

Harmonized Tariff Schedule record. Each HTS record is uniquely identified by an HTS

number, and a beginning/end effective date range.

Available to: CBP, Brokers, Importers

Miscellaneous

Date Objects

These date-related objects that can be used in conjunction with the other data universes

to apply certain time restrictions on reports that a user wishes to generate. It should be

noted that this group of data objects do not comprise a data universe independent from

the other universes in this data dictionary.

Available to: CBP, PGAs, Brokers, Carriers, Exporters, Importers, Protest Filers, Sureties

Miscellaneous

Training

This universe is a virtual sandbox that contains a selection of non-personally identifiable

entry header and entry line information. The intent of the universe is to allow users to

familiarize themselves with the SAP BusinessObjects Web Intelligence application in a

smaller, more controlled environment. Data elements include: select entry header, entry

line, and entry tariff information.

Available to: CBP, PGAs, Brokers, Carriers, Exporters, Importers, Protest Filers, Sureties

Page 6 of 177 Updated 07-2018

ace REPORTS DATA DICTIONARY – TRADE

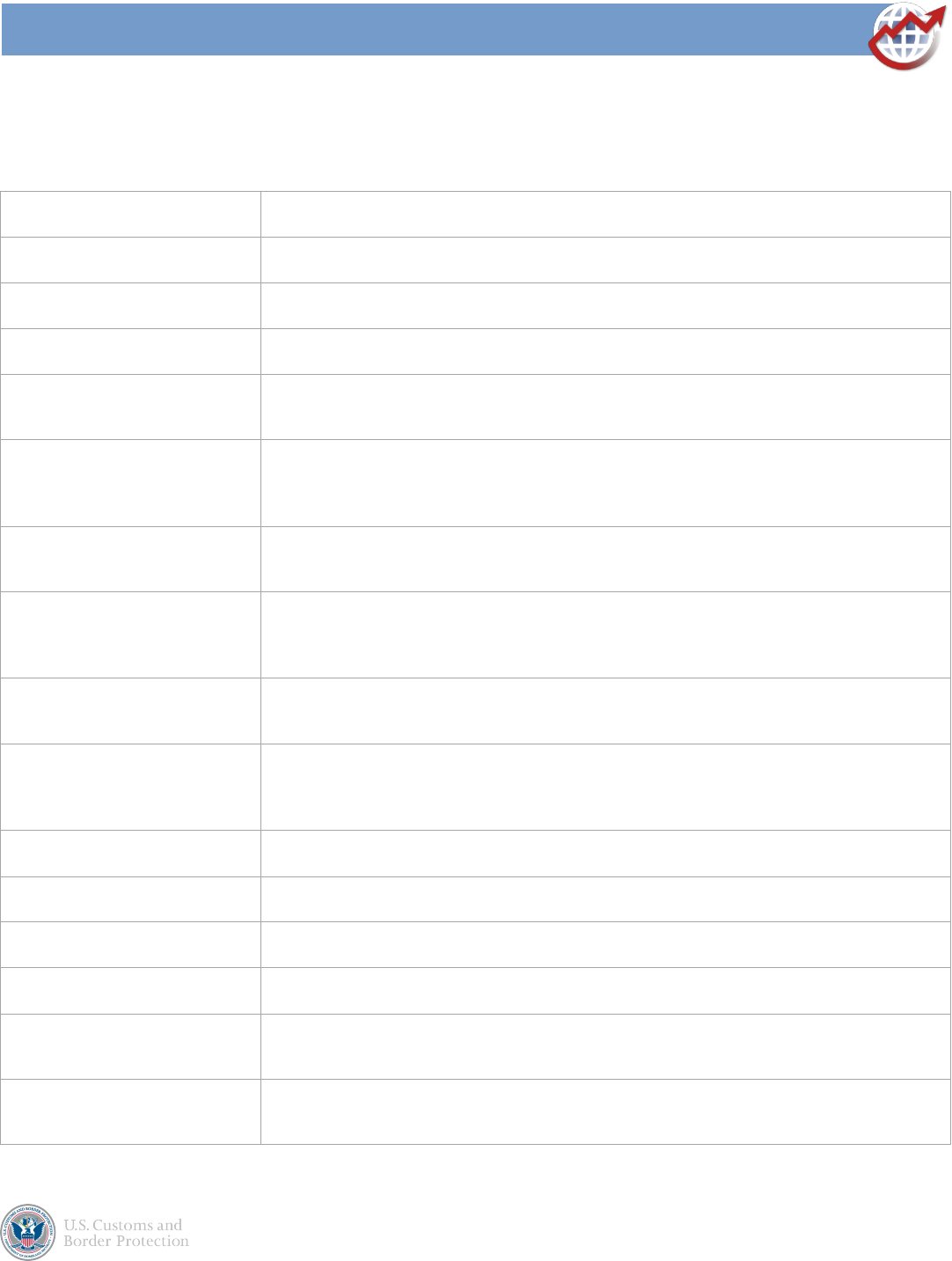

Cargo Release

The following table lists all data objects that are available in the Cargo Release data universe. These objects can be used

to modify existing Cargo Release reports or to create custom ad hoc reports.

Cargo Release Data Objects

Object Name

Object Description

ACE Entry Status

The description indicating the status of a cargo release entry filed in ACE. Possible values

include: "Admissible," "Bill Hold," "Cancelled," "Document Required," "Intensive,"

"Pending," and "Released."

ACE Entry Status Code

A 1 character code indicating the status of a cargo release entry filed in ACE. Possible values

include: "A" indicating Admissible, "B" indicating Bill Hold, "C" indicating Cancelled, "D"

indicating Document Required, "I" indicating Intensive, "P" indicating Pending, and "R"

indicating Released.

Actual Arrival Date - BETA

The month, day, and year (MM/DD/YYYY) when the conveyance transporting the

merchandise from the foreign destination arrived within the limits of the U.S. port with the

intent to unload. Note: This object should not be used. It is currently being tested to

validate accuracy.

Agency Code

The commonly known Partner Government Agency (PGA) code. Possible values include, but

are not limited to: "FSIS" indicating U.S. Department of Agriculture, Food Safety and

Inspection Service, "NHTSA" indicating U.S. Department of Transportation, National

Highway Traffic Safety Administration, and "DCMA" indicating U.S. Department of Defense,

Defense Contract Management Agency.

Agency Name

The full name of the Partner Government Agency (PGA).

Bill Number

The alphanumeric code issued by a carrier for a particular shipment being transmitted from

a shipper to a consignee.

Bond Number

The unique 9 character alphanumeric identifier assigned by CBP to the posted bond after

the bond has been approved by an authorized CBP official.

Bond Type

The description indicating the type of bond coverage required for the payment of duties,

fees, and taxes. Possible values include: "Continuous," "Single Transaction," and "No Bond

Required."

Bond Type Code

A 1 digit code that signifies the type of bond coverage required for the payment of duties,

fees, and taxes. Possible values include: "0" indicating no bond required, "8" indicating

continuous, and "9" indicating single transaction.

Broker Mailing Address Line 1

The first line of the address associated with the broker's mailing address. The mailing

address is used to specify the location where CBP should send written correspondence. This

may or may not be the same as the physical address where broker business is conducted.

Broker Mailing Address Line 2

The second line of the address associated with the broker's mailing address. The mailing

address is used to specify the location where CBP should send written correspondence. This

may or may not be the same as the physical address where broker business is conducted.

Broker Mailing Address Line 3

The third line of the address associated with the broker's mailing address. The mailing

address is used to specify the location where CBP should send written correspondence. This

may or may not be the same as the physical address where broker business is conducted.

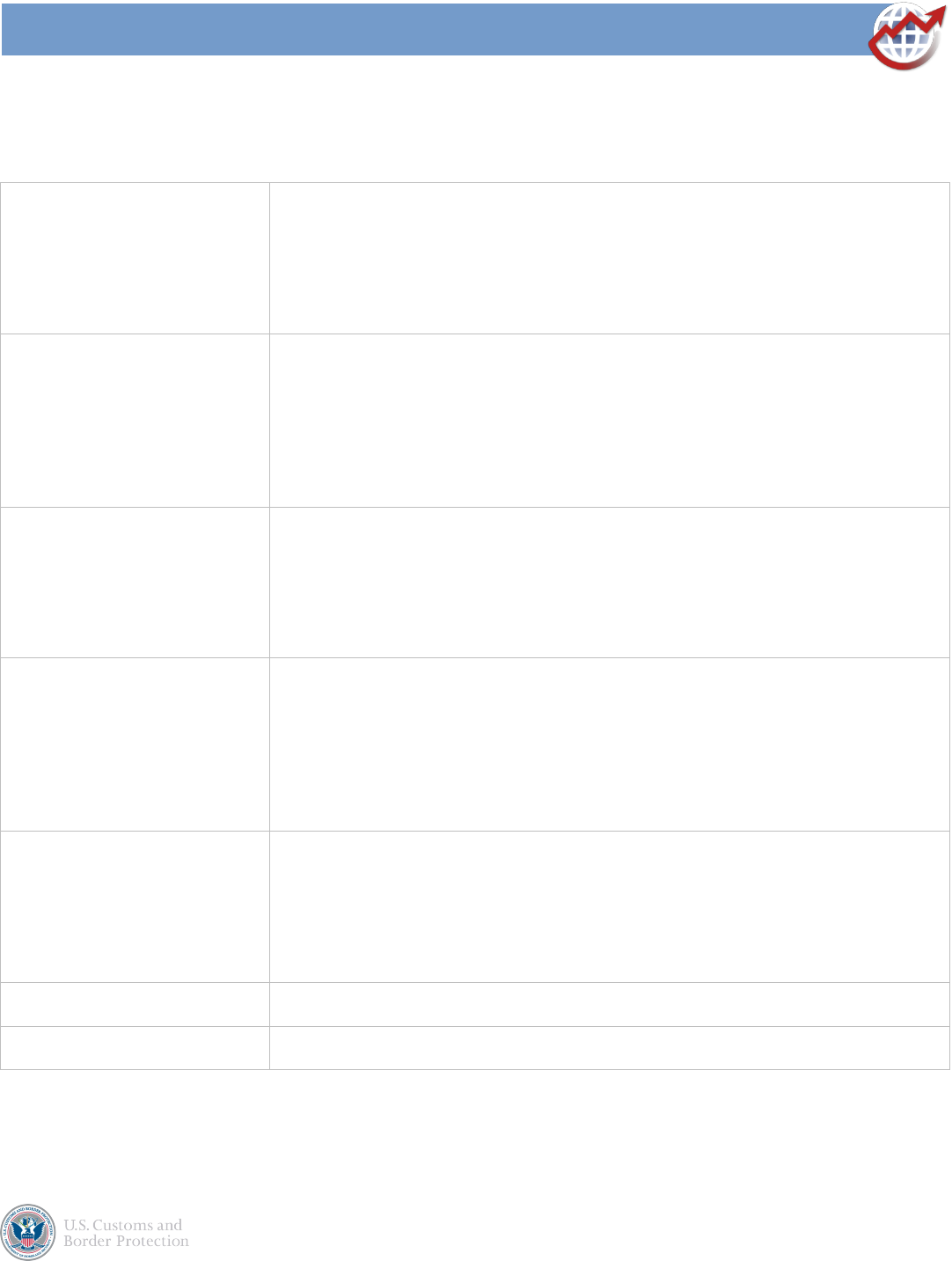

Page 7 of 177 Updated 07-2018

ace REPORTS DATA DICTIONARY – TRADE

Cargo Release Data Objects

Object Name

Object Description

Broker Mailing Building Number

The alphanumeric value that represents the building number associated with the mailing

address of the broker's organization. The mailing address is used to specify the location

where CBP should send written correspondence. This may or may not be the same as the

physical address where broker business is conducted.

Broker Mailing City

The city associated with the broker's mailing address. The mailing address is used to specify

the location where CBP should send written correspondence. This may or may not be the

same as the physical address where broker business is conducted.

Broker Mailing Country Code

The 2 character abbreviation, as defined by the International Organization for

Standardization (ISO), used to identify the country associated with the broker's mailing

address. The mailing address is used to specify the location where CBP should send written

correspondence. This may or may not be the same as the physical address where broker

business is conducted. Possible values include, but are not limited to: "TV" indicating

TUVALU, "TW" indicating CHINA(TAIWAN), "TZ" indicating TANZANIA, "UA" indicating

UKRAINE, "UG" indicating UGANDA, "UM" indicating UNITED STATES OUTLYING ISLANDS,

and "US" indicating USA.

Broker Mailing Floor Number

The alphanumeric value that represents the floor number associated with the mailing

address of the broker's organization. The mailing address is used to specify the place CBP

should send written correspondence. This may or may not be the same as the physical

address where broker business is conducted.

Broker Mailing House Number

The alphanumeric value that identifies the street location of the broker's mailing address.

The mailing address is used to specify the place CBP should send written correspondence.

This may or may not be the same as the physical address where broker business is

conducted.

Broker Mailing Phone Extension

The calling extension associated with the phone number for the broker's mailing address.

The mailing address is used to specify the place CBP should send written correspondence.

This may or may not be the same as the physical address where broker business is

conducted.

Broker Mailing Phone Number

The phone number associated with the broker's mailing address. The mailing address is

used to specify the place CBP should send written correspondence. This may or may not be

the same as the physical address where broker business is conducted.

Broker Mailing PO Box Number

The post office (PO) box number associated with the broker's mailing address. The mailing

address is used to specify the place CBP should send written correspondence. This may or

may not be the same as the physical address where broker business is conducted.

Broker Mailing State Code

The 2 character abbreviation used to identify the state associated with the broker's mailing

address. The mailing address is used to specify the place CBP should send written

correspondence. This may or may not be the same as the physical address where broker

business is conducted. Possible values include, but are not limited to: "MA" indicating

Massachusetts, "CA" indicating California, and "NY" indicating New York.

Broker Mailing Suite/Apartment

Number

The alphanumeric value that represents the suite or apartment number associated with the

broker's mailing address. The mailing address is used to specify the place CBP should send

written correspondence. This may or may not be the same as the physical address where

broker business is conducted.

Broker Mailing Zip Code

The postal code associated with the broker's mailing address. The mailing address is used to

specify the place CBP should send written correspondence. This may or may not be the

same as the physical address where broker business is conducted.

Page 8 of 177 Updated 07-2018

ace REPORTS DATA DICTIONARY – TRADE

Cargo Release Data Objects

Object Name

Object Description

Broker Physical Address Line 1

The first line of the address associated with the broker's physical address. The physical

address is where the broker conducts business. This may or may not be the same as the

mailing address used by CBP for written correspondence.

Broker Physical Address Line 2

The second line of the address associated with the broker's physical address. The physical

address is where the broker conducts business. This may or may not be the same as the

mailing address used by CBP for written correspondence.

Broker Physical Address Line 3

The third line of the address associated with the broker's physical address. The physical

address is where the broker conducts business. This may or may not be the same as the

mailing address used by CBP for written correspondence.

Broker Physical Building Number

The alphanumeric value that represents the building number associated with the broker's

physical address. The physical address is where the broker conducts business. This may or

may not be the same as the mailing address used by CBP for written correspondence.

Broker Physical City

The city associated with the broker's physical address. The physical address is where the

broker conducts business. This may or may not be the same as the mailing address used by

CBP for written correspondence.

Broker Physical Country Code

The 2 character abbreviation, as defined by the International Organization for

Standardization (ISO), used to identify the country associated with the broker's physical

address. The physical address may or may not be the same as the location used by CBP for

written correspondence. Possible values include, but are not limited to: "TV" indicating

TUVALU, "TW" indicating CHINA (TAIWAN), "TZ" indicating TANZANIA, "UA" indicating

UKRAINE, "UG" indicating UGANDA, "UM" indicating UNITED STATES OUTLYING ISLANDS,

and "US" indicating USA.

Broker Physical Floor Number

The alphanumeric value that represents the floor number associated with the broker's

physical address. The physical address is where the broker conducts business. This may or

may not be the same as the mailing address used by CBP for written correspondence.

Broker Physical House Number

The alphanumeric value that identifies the street location of the broker's physical address.

The physical address is where the broker conducts business. This may or may not be the

same as the mailing address used by CBP for written correspondence.

Broker Physical Phone Extension

The calling extension associated with the phone number for the broker's physical address.

The physical address is where the broker conducts business. This may or may not be the

same as the mailing address used by CBP for written correspondence.

Broker Physical Phone Number

The phone number associated with the broker's physical address. The physical address is

where the broker conducts business. This may or may not be the same as the mailing

address used by CBP for written correspondence.

Broker Physical PO Box Number

The post office (PO) box number associated with the broker's physical address. The physical

address is where the broker conducts business. This may or may not be the same as the

mailing address used by CBP for written correspondence.

Broker Physical State Code

The 2 character abbreviation used to identify the state associated with the broker's physical

address. The physical address is where the broker conducts business. This may or may not

be the same as the mailing address used by CBP for written correspondence. Possible values

include, but are not limited to: "MA" indicating Massachusetts, "CA" indicating California,

and "NY" indicating New York.

Broker Physical Suite/Apartment

Number

The alphanumeric value that represents the suite or apartment number associated with the

broker's physical address. The physical address is where the broker conducts business. This

may or may not be the same as the mailing address used by CBP for written

correspondence.

Page 9 of 177 Updated 07-2018

ace REPORTS DATA DICTIONARY – TRADE

Cargo Release Data Objects

Object Name

Object Description

Broker Physical Zip Code

The postal code associated with the broker's physical address. The physical address is where

the broker conducts business. This may or may not be the same as the mailing address used

by CBP for written correspondence.

Carrier Name

The proper name belonging to a carrier.

Carrier SCAC/IATA Code

The carrier ID, which is either the Standard Carrier Alpha Code (SCAC) or the International

Air Transport Association (IATA) code. For vessel, rail, or truck shipments, the SCAC is used;

for air shipments the IATA code is used.

Consignee Mailing Address Line 1

The first line of the address associated with the consignee's mailing address. The mailing

address is used to specify the location where CBP should send written correspondence. This

may or may not be the same as the physical address where consignee business is

conducted.

Consignee Mailing Address Line 2

The second line of the address associated with the consignee's mailing address. The mailing

address is used to specify the location where CBP should send written correspondence. This

may or may not be the same as the physical address where consignee business is

conducted.

Consignee Mailing Address Line 3

The third line of the address associated with the consignee's mailing address. The mailing

address is used to specify the location where CBP should send written correspondence. This

may or may not be the same as the physical address where consignee business is

conducted.

Consignee Mailing Building

Number

The alphanumeric value that represents the building number associated with the mailing

address of the consignee's organization. The mailing address is used to specify the location

where CBP should send written correspondence. This may or may not be the same as the

physical address where consignee business is conducted.

Consignee Mailing City

The city associated with the consignee's mailing address. The mailing address is used to

specify the location where CBP should send written correspondence. This may or may not

be the same as the physical address where consignee business is conducted.

Consignee Mailing Country Code

The 2 character abbreviation, as defined by the International Organization for

Standardization (ISO), used to identify the country associated with the consignee's mailing

address. The mailing address is used to specify the location where CBP should send written

correspondence. This may or may not be the same as the physical address where consignee

business is conducted. Possible values include, but are not limited to: "TV" indicating

TUVALU, "TW" indicating CHINA (TAIWAN), "TZ" indicating TANZANIA, "UA" indicating

UKRAINE, "UG" indicating UGANDA, "UM" indicating UNITED STATES OUTLYING ISLANDS,

and "US" indicating USA.

Consignee Mailing Floor Number

The alphanumeric value that represents the floor number associated with the mailing

address of the consignee's organization. The mailing address is used to specify the place CBP

should send written correspondence. This may or may not be the same as the physical

address where consignee business is conducted.

Consignee Mailing House Number

The alphanumeric value that identifies the street location of the consignee's mailing

address. The mailing address is used to specify the place CBP should send written

correspondence. This may or may not be the same as the physical address where consignee

business is conducted.

Consignee Mailing Phone

Extension

The calling extension associated with the phone number for the consignee's mailing

address. The mailing address is used to specify the place CBP should send written

correspondence. This may or may not be the same as the physical address where consignee

business is conducted.

Page 10 of 177 Updated 07-2018

ace REPORTS DATA DICTIONARY – TRADE

Cargo Release Data Objects

Object Name

Object Description

Consignee Mailing Phone Number

The phone number associated with the consignee's mailing address. The mailing address is

used to specify the place CBP should send written correspondence. This may or may not be

the same as the physical address where consignee business is conducted.

Consignee Mailing PO Box Number

The post office (PO) box number associated with the consignee's mailing address. The

mailing address is used to specify the place CBP should send written correspondence. This

may or may not be the same as the physical address where consignee business is

conducted.

Consignee Mailing State Code

The 2 character abbreviation used to identify the state associated with the consignee's

mailing address. The mailing address is used to specify the place CBP should send written

correspondence. This may or may not be the same as the physical address where importer

business is conducted. Possible values include, but are not limited to: "MA" indicating

Massachusetts, "CA" indicating California, and "NY" indicating New York.

Consignee Mailing

Suite/Apartment Number

The alphanumeric value that represents the suite or apartment number associated with the

consignee's mailing address. The mailing address is used to specify the place CBP should

send written correspondence. This may or may not be the same as the physical address

where consignee business is conducted.

Consignee Mailing Zip Code

The postal code associated with the consignee's mailing address. The mailing address is

used to specify the place CBP should send written correspondence. This may or may not be

the same as the physical address where consignee business is conducted.

Consignee Name

The proper name of the U.S. party or other entity to whom the overseas shipper sold the

imported merchandise.

Consignee Number

The identification number of the U.S. party or other entity to whom the overseas shipper

sold the imported merchandise.

Consignee Physical Address Line 1

The first line of the address associated with the consignee's physical address. The physical

address is where the consignee conducts business. This may or may not be the same as the

mailing address used by CBP for written correspondence.

Consignee Physical Address Line 2

The second line of the address associated with the consignee's physical address. The

physical address is where the consignee conducts business. This may or may not be the

same as the mailing address used by CBP for written correspondence.

Consignee Physical Address Line 3

The third line of the address associated with the consignee's physical address. The physical

address is where the consignee conducts business. This may or may not be the same as the

mailing address used by CBP for written correspondence.

Consignee Physical Building

Number

The alphanumeric value that represents the building number associated with the

consignee's physical address. The physical address is where the consignee conducts

business. This may or may not be the same as the mailing address used by CBP for written

correspondence.

Consignee Physical City

The city associated with the consignee's physical address. The physical address is where the

consignee conducts business. This may or may not be the same as the mailing address used

by CBP for written correspondence.

Consignee Physical Country Code

The 2 character abbreviation, as defined by the International Organization for

Standardization (ISO), used to identify the country associated with the consignee's physical

address. The physical address may or may not be the same as the location used by CBP for

written correspondence. Possible values include, but are not limited to: "TV" indicating

TUVALU, "TW" indicating CHINA (TAIWAN), "TZ" indicating TANZANIA, "UA" indicating

UKRAINE, "UG" indicating UGANDA, "UM" indicating UNITED STATES OUTLYING ISLANDS,

and "US" indicating USA.

Page 11 of 177 Updated 07-2018

ace REPORTS DATA DICTIONARY – TRADE

Cargo Release Data Objects

Object Name

Object Description

Consignee Physical Floor Number

The alphanumeric value that represents the floor number associated with the consignee's

physical address. The physical address is where the consignee conducts business. This may

or may not be the same as the mailing address used by CBP for written correspondence.

Consignee Physical House Number

The alphanumeric value that identifies the street location of the consignee's physical

address. The physical address is where the consignee conducts business. This may or may

not be the same as the mailing address used by CBP for written correspondence.

Consignee Physical Phone

Extension

The calling extension associated with the phone number for the consignee's physical

address. The physical address is where the consignee conducts business. This may or may

not be the same as the mailing address used by CBP for written correspondence.

Consignee Physical Phone Number

The phone number associated with the consignee's physical address. The physical address is

where the consignee conducts business. This may or may not be the same as the mailing

address used by CBP for written correspondence.

Consignee Physical PO Box

Number

The post office (PO) box number associated with the consignee's physical address. The

physical address is where the consignee conducts business. This may or may not be the

same as the mailing address used by CBP for written correspondence.

Consignee Physical State Code

The 2 character abbreviation used to identify the state associated with the consignee's

physical address. The physical address is where the consignee conducts business. This may

or may not be the same as the mailing address used by CBP for written correspondence.

Possible values include, but are not limited to: "MA" indicating Massachusetts, "CA"

indicating California, and "NY" indicating New York.

Consignee Physical

Suite/Apartment Number

The alphanumeric value that represents the suite or apartment number associated with the

consignee's physical address. The physical address is where the consignee conducts

business. This may or may not be the same as the mailing address used by CBP for written

correspondence.

Consignee Physical Zip Code

The postal code associated with the consignee's physical address. The physical address is

where the consignee conducts business. This may or may not be the same as the mailing

address used by CBP for written correspondence.

Container Number

The unique alphanumeric identifier assigned to each unit of a carriers’ equipment. The

identifier is constructed of a 4 character Standard Carrier Alpha Code (SCAC), a 1 to 15 digit

serial number and in some instances a 1 digit check digit. Note: This object should only be

used to perform a specific query. If used to run an open ended query the user will

experience significant performance implications.

Conveyance Name

The name of the conveyance used to transport merchandise from the foreign location to the

United States. For ocean shipments, this will return the vessel name. For air, truck, and rail

shipments, this will return the carrier name.

Country of Origin Code

The 2 character International Organization for Standardization (ISO) code indicating the

country of origin (COO) related to a specific entry line. The country of origin is the country of

manufacture, production, and/or growth of an article. Possible values include, but are not

limited to: "CN" indicating China, "AR" indicating Argentina, and "BE" indicating Belgium.

Country of Origin Code and Name

A concatenated field indicating the Country of Origin Code and Country of Origin Name. The

Country of Origin Code is the 2 character International Organization for Standardization

(ISO) code indicating the country of origin (COO) related to a specific entry line. The country

of origin is the country of manufacture, production, and/or growth of an article. The

Country of Origin Name is the full name of the country of origin (COO) on an entry line.

Possible values include, but are not limited to: "CN - China," "AR - Argentina," and "BE -

Belgium."

Page 12 of 177 Updated 07-2018

ace REPORTS DATA DICTIONARY – TRADE

Cargo Release Data Objects

Object Name

Object Description

Country of Origin Name

The full name of the country of origin (COO) on an entry line. Possible values include, but

are not limited to: "China," "Argentina," and "Belgium."

Designated Exam Site

The district and the port a filer has selected to make entry at and where a CBP examination

will occur, if applicable. This location differs from the location where the freight is unladen.

Possible values include, but are not limited to: "LOS ANGELES, CA," "OTAY MESA,"

"PHOENIX, AZ," "SEATTLE, WA," and "NEW YORK/NEWARK AREA." Note: The option to

select a designated exam site is only available for entries submitted via remote location

filing (RLF).

Designated Exam Site Code

The 4 digit code that represents the district and port a filer has selected to make entry at

and where a CBP examination will occur, if applicable. This location differs from the location

where the freight is unladen. The district code is the first two characters and the port code

is the last two characters. Possible values include, but are not limited to: "2704" indicating

LOS ANGELES, CA, "2506" indicating OTAY MESA, "2605" indicating PHOENIX, AZ, "3001"

indicating SEATTLE, WA, and "4601" indicating NEW YORK/NEWARK AREA. Note: The option

to select a designated exam site is only available for entries submitted via remote location

filing (RLF).

Entry Date

The month, day, and year (MM/DD/YYYY) that cargo makes legal entry into the United

States. This is normally the date of cargo release, but it can also be the date of entry or

entry summary filing for merchandise subject to immediate delivery requirements or quota

merchandise.

Entry Date - Year (Fiscal)

The fiscal year (YYYY) in which a cargo release entry date occurs. The CBP fiscal year begins

on October 1 and ends on September 30.

Entry Date - Year Month

(Calendar)

The calendar year and month (YYYY - MM) in which a cargo release entry date occurs. A

calendar year begins in January (calendar month 01) and ends in December (calendar month

12).

Entry Date within Last 12 Months

A filter that can be added to a report query filter, which will enable a saved report to always

return data with an entry date within 12 months of today’s date. This eliminates the need to

filter by specific dates each time a saved report is run. Note: This is a filter, not a date

object.

Entry Date within Last 13 Months

A filter that can be added to a report query filter, which will enable a saved report to always

return data with an entry date within 13 months of today’s date. This eliminates the need to

filter by specific dates each time a saved report is run. Note: This is a filter, not a date

object.

Entry Date within Last 2 Years

A filter that can be added to a report query filter, which will enable a saved report to always

return data with an entry date within 2 years of today’s date. This eliminates the need to

filter by specific dates each time a saved report is run. Note: This is a filter, not a date

object.

Entry Date within Last 3 Years

A filter that can be added to a report query filter, which will enable a saved report to always

return data with an entry date within 3 years of today’s date. This eliminates the need to

filter by specific dates each time a saved report is run. Note: This is a filter, not a date

object.

Entry Date within Last 4 Years

A filter that can be added to a report query filter, which will enable a saved report to always

return data with an entry date within 4 years of today’s date. This eliminates the need to

filter by specific dates each time a saved report is run. Note: This is a filter, not a date

object.

Page 13 of 177 Updated 07-2018

ace REPORTS DATA DICTIONARY – TRADE

Cargo Release Data Objects

Object Name

Object Description

Entry Date within Last 5 Years

A filter that can be added to a report query filter, which will enable a saved report to always

return data with an entry date within 5 years of today’s date. This eliminates the need to

filter by specific dates each time a saved report is run. Note: This is a filter, not a date

object.

Entry Election Code

A 1 character code indicating whether the presentation date or the date of arrival was used

as the entry date as listed on the entry header. If neither the presentation date nor the date

of arrival is elected, CBP determines the appropriate entry date by established procedures.

Entry Filing Date - Year (Fiscal)

The fiscal year (YYYY) in which the entry record was created in the transaction system.

Entry Filing Date - Year Month

(Calendar)

The calendar year and month (YYYY - MM) in which the entry record was created in the

transaction system.

Entry Filing Date within Last 4

Years

A filter that can be added to a report query filter, which will enable a saved report to always

return data with an entry filing date within 4 years of today’s date. This eliminates the need

to filter by specific dates each time a saved report is run. Note: This is a filter, not a date

object.

Entry Line Number

The number that identifies the line on an entry that the data correlates to.

Entry Line Sequence Number

The number that identifies the specific sequence on an entry line that the data correlates to.

Note: The sequence number can range from 0 to 9.

Entry Line Value

The value of the merchandise imported on the entry line. Note: This amount is reported in

whole U.S. dollars.

Entry Number

A unique 11 character alphanumeric identifier assigned by an entry filer to each entry

transaction. The first 3 positions identify the filer. The next 7 positions are the number

assigned to the entry by the filer. The last position is a check digit.

Entry Presentation Date

The month, day, and year (MM/DD/YYYY) when the entry is filed with CBP.

Entry Status

The description indicating the status of a cargo release entry filed in ACE or ACS. This object

is derived based on values in the “ACE Entry Status Code” and “Selectivity Type Code”

objects. Possible values include, but are not limited to: "Admissible," "Intensive,"

"Released," "Not Released," "Cancelled," and "Not Cancelled." Note: This will reflect that

status that is displayed in the Cargo Release Application UI.

Entry Summary Date

The month, day, and year (MM/DD/YYYY) that the entry summary is filed with CBP. For

timely filing, this date must be within ten working days after release of the merchandise.

Entry Type Code

A 2 digit code indicating the type of entry being filed. Possible values include, but are not

limited to: "01" indicating Consumption - Free and Dutiable, "03" indicating Consumption -

Antidumping (AD)/Countervailing Duty (CVD), and "11" indicating Informal.

Entry Type Code and Description

A concatenated field indicating the Entry Type Code followed by the Entry Type Long

Description. The Entry Type Code is a 2 digit code indicating the type of entry being filed.

The Entry Type Long Description is the description indicating the type of entry being filed.

Possible values include, but are not limited to: "01 - Consumption - Free and Dutiable," "03 -

Consumption - Antidumping (AD)/Countervailing Duty (CVD)," and "11 - Informal."

Entry Type Long Description

The description indicating the type of entry being filed. Possible values include, but are not

limited to: "Consumption - Free and Dutiable," "Consumption - Antidumping

(AD)/Countervailing Duty (CVD)," and "Informal."

Estimated Arrival Date - BETA

The month, day, and year (MM/DD/YYYY) on which the conveyance transporting the

merchandise from the foreign country is estimated to arrive within the limits of the U.S.

port with the intent to unload. Note: This object should not be used. It is currently being

tested to validate accuracy.

Page 14 of 177 Updated 07-2018

ace REPORTS DATA DICTIONARY – TRADE

Cargo Release Data Objects

Object Name

Object Description

Expedited Release Indicator

A 1 character code indicating that the cargo referenced in a particular entry has been

released via an expedited entry program. The current expedited entry programs are Free

and Secure Trade (FAST), Border Release Advance Screening and Selectivity (BRASS) and

Line Release. Possible values are: "Y" indicating Yes and "N" indicating No.

Expedited Release Type

A written description indicating which expedited entry program was used to release cargo

for a particular entry. Possible values are: "FAST" indicating Free and Secure Trade, "BRASS"

indicating Border Release Advance Screening and Selectivity, and "Line Release."

Field Office Name

The name of the field office associated with each port of entry. Formerly known as the

Customs Management Centers (CMCs). Possible values include, but are not limited to:

"ATLANTA," "LOS ANGELES," "BUFFALO," and "NEW ORLEANS."

Filer Code

The unique 3 character alphanumeric identifier for the legal entity qualified by CBP to file

entries.

Filer Name

The trade entity name associated with the 3 character alphanumeric identifier for the legal

entity qualified by CBP to file entries.

First-Time Commodity Indicator

An indicator which identifies if the commodity declared on an entry line is being imported

for the first time. Possible values are: "Y" indicating Yes.

First-Time Country Indicator

An indicator which identifies if the commodity declared on declared on an entry line is being

imported from the country declared on the entry line for the first time. Possible values are:

"Y" indicating Yes.

First-Time Manufacturer Indicator

An indicator which identifies if the commodity declared on an entry line is being imported

from the manufacturer declared on the entry line for the first time. Possible values are: "Y"

indicating Yes.

Foreign Trade Zone ID

The identification number of the foreign trade zone where merchandise is physically

located.

HTS Description

The description of the merchandise associated with the 6 to 10 digit Harmonized Tariff

Schedule (HTS) number. The HTS is a comprehensive listing of sequential numbers that

identifies commodities in a standard format.

HTS Long Description

The long description of the merchandise associated with the 6 to 10 digit Harmonized Tariff

Schedule (HTS) number. The HTS is a comprehensive listing of sequential numbers that

identifies commodities in a standard format.

HTS Number - First 2

The first 2 digits of the 10 digit Harmonized Tariff Schedule (HTS) number.

HTS Number - First 4

The first 4 digits of the 10 digit Harmonized Tariff Schedule (HTS) number.

HTS Number - First 6

The first 6 digits of the 10 digit Harmonized Tariff Schedule (HTS) number.

HTS Number - First 8

The first 8 digits of the 10 digit Harmonized Tariff Schedule (HTS) number.

HTS Number - Full

The full 10 digit Harmonized Tariff Schedule (HTS) number.

HTS Short Description

The short description of the merchandise associated with the 6 to 10 digit Harmonized Tariff

Schedule (HTS) number. The HTS is a comprehensive listing of sequential numbers that

identifies commodities in a standard format.

Immediate Transportation Date

The month, day, and year (MM/DD/YYYY) when merchandise will be transported from the

first port of arrival to another location for final disposition.

Importer Mailing Address Line 1

The first line of the address associated with the importer's mailing address. The mailing

address is used to specify the location where CBP should send written correspondence. This

may or may not be the same as the physical address where importer business is conducted.

Page 15 of 177 Updated 07-2018

ace REPORTS DATA DICTIONARY – TRADE

Cargo Release Data Objects

Object Name

Object Description

Importer Mailing Address Line 2

The second line of the address associated with the importer's mailing address. The mailing

address is used to specify the location where CBP should send written correspondence. This

may or may not be the same as the physical address where importer business is conducted.

Importer Mailing Address Line 3

The third line of the address associated with the importer's mailing address. The mailing

address is used to specify the location where CBP should send written correspondence. This

may or may not be the same as the physical address where importer business is conducted.

Importer Mailing Building Number

The alphanumeric value that represents the building number associated with the importer's

mailing address. The mailing address is used to specify the location where CBP should send

written correspondence. This may or may not be the same as the physical address where

importer business is conducted.

Importer Mailing City

The city associated with the importer's mailing address. The mailing address is used to

specify the location where CBP should send written correspondence. This may or may not

be the same as the physical address where importer business is conducted.

Importer Mailing Country Code

The 2 character abbreviation, as defined by the International Organization for

Standardization (ISO), used to identify the country associated with the importer's mailing

address. The mailing address is used to specify the location where CBP should send written

correspondence. This may or may not be the same as the physical address where importer

business is conducted. Possible values include, but are not limited to: "TV" indicating

TUVALU, "TW" indicating CHINA (TAIWAN), "TZ" indicating TANZANIA, "UA" indicating

UKRAINE, "UG" indicating UGANDA, "UM" indicating UNITED STATES OUTLYING ISLANDS,

and "US" indicating USA.

Importer Mailing Floor Number

The alphanumeric value that represents the floor number associated with the importer's

mailing address. The mailing address is used to specify the place CBP should send written

correspondence. This may or may not be the same as the physical address where importer

business is conducted.

Importer Mailing House Number

The alphanumeric value that identifies the street location of the importer's mailing address.

The mailing address is used to specify the place CBP should send written correspondence.

This may or may not be the same as the physical address where importer business is

conducted.

Importer Mailing Phone Extension

The calling extension associated with the phone number for the importer's mailing address.

The mailing address is used to specify the place CBP should send written correspondence.

This may or may not be the same as the physical address where importer business is

conducted.

Importer Mailing Phone Number

The phone number associated with the importer's mailing address. The mailing address is

used to specify the place CBP should send written correspondence. This may or may not be

the same as the physical address where importer business is conducted.

Importer Mailing PO Box Number

The post office (PO) box number associated with the importer's mailing address. The mailing

address is used to specify the place CBP should send written correspondence. This may or

may not be the same as the physical address where importer business is conducted.

Importer Mailing State Code

The 2 character abbreviation used to identify the state associated with the importer's

mailing address. The mailing address is used to specify the place CBP should send written

correspondence. This may or may not be the same as the physical address where importer

business is conducted. Possible values include, but are not limited to: "MA" indicating

Massachusetts, "CA" indicating California, and "NY" indicating New York.

Page 16 of 177 Updated 07-2018

ace REPORTS DATA DICTIONARY – TRADE

Cargo Release Data Objects

Object Name

Object Description

Importer Mailing Suite/Apartment

Number

The alphanumeric value that represents the suite or apartment number associated with the

importer's mailing address. The mailing address is used to specify the place CBP should send

written correspondence. This may or may not be the same as the physical address where

importer business is conducted.

Importer Mailing Zip Code

The postal code associated with the importer's mailing address. The mailing address is used

to specify the place CBP should send written correspondence. This may or may not be the

same as the physical address where importer business is conducted.

Importer Name

The name of the entity importing the goods into the United States.

Importer Number

The unique importer of record (IR) number associated with each entry. Typically this

consists of the taxpayer ID number and a 2 digit suffix but it is also possible that the IR

number identifies an individual via their Social Security Number (SSN) in the format of NNN-

NN-NNNN. The IR number may also be a CBP-assigned number that consists of six digits, a "-

", followed by five digits. This is typically assigned to importers located outside of the United

States that do not have a taxpayer ID.

Importer Physical Address Line 1

The first line of the address associated with the importer's physical address. The physical

address is where the importer conducts business. This may or may not be the same as the

mailing address used by CBP for written correspondence.

Importer Physical Address Line 2

The second line of the address associated with the importer's physical address. The physical

address is where the importer conducts business. This may or may not be the same as the

mailing address used by CBP for written correspondence.

Importer Physical Address Line 3

The third line of the address associated with the importer's physical address. The physical

address is where the importer conducts business. This may or may not be the same as the

mailing address used by CBP for written correspondence.

Importer Physical Building Number

The alphanumeric value that represents the building number associated with the importer's

physical address. The physical address is where the importer conducts business. This may or

may not be the same as the mailing address used by CBP for written correspondence.

Importer Physical City

The city associated with the importer's physical address. The physical address is where the

importer conducts business. This may or may not be the same as the mailing address used

by CBP for written correspondence.

Importer Physical Country Code

The 2 character abbreviation, as defined by the International Organization for

Standardization (ISO), used to identify the country associated with the importer's physical

address. The physical address may or may not be the same as the location used by CBP for

written correspondence. Possible values include, but are not limited to: "TV" indicating

TUVALU, "TW" indicating CHINA (TAIWAN), "TZ" indicating TANZANIA, "UA" indicating

UKRAINE, "UG" indicating UGANDA, "UM" indicating UNITED STATES OUTLYING ISLANDS,

and "US" indicating USA.

Importer Physical Floor Number

The alphanumeric value that represents the floor number associated with the importer's

physical address. The physical address is where the importer conducts business. This may or

may not be the same as the mailing address used by CBP for written correspondence.

Importer Physical House Number

The alphanumeric value that identifies the street location of the importer's physical address.

The physical address is where the importer conducts business. This may or may not be the

same as the mailing address used by CBP for written correspondence.

Importer Physical Phone Extension

The calling extension associated with the phone number for the importer's physical address.

The physical address is where the importer conducts business. This may or may not be the

same as the mailing address used by CBP for written correspondence.

Page 17 of 177 Updated 07-2018

ace REPORTS DATA DICTIONARY – TRADE

Cargo Release Data Objects

Object Name

Object Description

Importer Physical Phone Number

The phone number associated with the importer's physical address. The physical address is

where the importer conducts business. This may or may not be the same as the mailing

address used by CBP for written correspondence.

Importer Physical PO Box Number

The post office (PO) box number associated with the importer's physical address. The

physical address is where the importer conducts business. This may or may not be the same

as the mailing address used by CBP for written correspondence.

Importer Physical State Code

The 2 character abbreviation used to identify the state associated with the importer's

physical address. The physical address is where the importer conducts business. This may or

may not be the same as the mailing address used by CBP for written correspondence.

Possible values include, but are not limited to: "MA" indicating Massachusetts, "CA"

indicating California, and "NY" indicating New York.

Importer Physical Suite/Apartment

Number

The alphanumeric value that represents the suite or apartment number associated with the

importer's physical address. The physical address is where the importer conducts business.

This may or may not be the same as the mailing address used by CBP for written

correspondence.

Importer Physical Zip Code

The postal code associated with the importer's physical address. The physical address is

where the importer conducts business. This may or may not be the same as the mailing

address used by CBP for written correspondence.

Inbond Entry Type Code

A 2 digit code indicating the entry type associated with a particular shipment that is being

transported under bond. Possible values include, but are not limited to: "36" indicating

WAREHOUSE WITHDRAWAL FOR IE, "37" indicating WAREHOUSE WITHDRAWAL FOR T AND

E, "67" indicating FOREIGN TRADE ZONE WITHDRAWAL FOR IE, "68" indicating FOREIGN

TRADE ZONE WITHDRAWAL FOR T AND E, and "70" indicating MERCHANDISE NOT SHIPPED

INBOND. Note: This object should only be used to perform a specific query. If used to run an

open ended query the user will experience significant performance implications.

Inbond Number

A unique 9 to 11 position code that identifies the movement of a particular shipment that is

being transported under bond. Note: This object should only be used to perform a specific

query. If used to run an open ended query the user will experience significant performance

implications.

Industry Name

The industry grouping of an imported product based on the Harmonized Tariff Schedule

(HTS) number associated with an entry line. Possible values include, but are not limited to:

"Electronics," "Base Metals," and "Machinery." Note: Industry names currently align with

the Centers of Excellence and Expertise (CEEs); however, groupings are based solely on tariff

ranges and are not intended to reflect actual team assignment or workload statistics for a

particular CEE.

Location of Goods FIRMS Code

The 4 digit alphanumeric Facilities Information and Resources Management System (FIRMS)

code that identifies the facility where the imported goods are physically located. FIRMS

codes represent locations where CBP work is performed on a regular basis and can be inside

or outside ports of entry.

Location of Goods Port Code

The 4 digit code that represents the district and port associated with the Facilities

Information and Resources Management System (FIRMS) code. The district code is the first

two characters and the port code is the last two characters. Possible values include, but are

not limited to: "2704" indicating LOS ANGELES, CA, "2506" indicating OTAY MESA, "2605"

indicating PHOENIX, AZ, "3001" indicating SEATTLE, WA, and "4601" indicating NEW

YORK/NEWARK AREA.

Manufacturer Address Line 1

The first line of the manufacturer's address.

Page 18 of 177 Updated 07-2018

ace REPORTS DATA DICTIONARY – TRADE

Cargo Release Data Objects

Object Name

Object Description

Manufacturer Address Line 2

The second line of the manufacturer's address.

Manufacturer City

The city associated with the manufacturer's address.

Manufacturer Code

The unique alphanumeric code that identifies the manufacturer of goods on the entry line.

If the manufacturer ID (MID) code is not available or found, this field is left null. An MID can

be up to 15 characters in length and is comprised of 5 different pieces to make the complete

MID string. Follows the format: "OOAAABBB1111CCC" Position 1-2: "OO" indicating the

country in 2 characters. Corresponds to the ISO code for the country. Position 3-5 & 6-8:

"AAA" and "BBB" indicating the Manufacturer Name, up to 3 characters each from the first

two words of the company name. There will be no third piece if the name is one word.

Position 9-12: "1111" indicating the Address Line with Street Name and/or Box Number, up

to 4 characters, and is the largest number on the address line. Position 13-15: "CCC"

indicating the City, up to 3 characters. The first 3 letters from the city name.

Manufacturer Country

The full name of the country associated with the manufacturer's address. Possible values

include, but are not limited to: "TUVALU," "CHINA (TAIWAN)," "TANZANIA," "UKRAINE,"

"UGANDA," "UNITED STATES OUTLYING ISLANDS," and "USA."

Manufacturer Country Code

The 2 character abbreviation, as defined by the International Organization for

Standardization (ISO), used to identify the country associated with the manufacturer's

address. Possible values include, but are not limited to: "TV" indicating TUVALU, "TW"

indicating CHINA (TAIWAN), "TZ" indicating TANZANIA, "UA" indicating UKRAINE, "UG"

indicating UGANDA, "UM" indicating UNITED STATES OUTLYING ISLANDS, and "US"

indicating USA.

Manufacturer Name

The proper name identifying the manufacturer of goods on the entry line as it appears in

the ACE MID information screen.

Manufacturer State Code

The 2 character abbreviation used to identify the state associated with the manufacturer's

address. Possible values include, but are not limited to: "MA" indicating Massachusetts,

"CA" indicating California, and "NY" indicating New York.

Manufacturer Zip Code

The postal code associated with the manufacturer's address.

Message Set Agencies

The 3 character code that identifies the Partner Government Agency (PGA) for which PGA

Message Set data was transmitted on a particular entry line and sequence. Possible values

include, but are not limited to: "FSI" indicating U.S. Department of Agriculture, Food Safety

and Inspection Service, "NHT" indicating U.S. Department of Transportation, National

Highway Traffic Safety Administration, and "DCM" indicating U.S. Department of Defense,

Defense Contract Management Agency. Note: Valid codes can be found in ACE ABI CATAIR

Appendix V. More than one PGA can be listed for a particular entry line and sequence.

Message Set Indicator (Entry Line)

A 1 character code indicating if a particular entry line and sequence contain PGA Message

Set data. Possible values are: "Y" for Yes and "N" for No.

Mode of Transportation

The description indicating the mode of transportation by which the merchandise is

exported. Possible values include, but are not limited to: "Vessel (Containerized)," "Rail

(Non-Containerized)," "Rail (Containerized)," "Truck (Non-Containerized)," and "Truck

(Containerized)."

Mode of Transportation Code

The 2 digit code that represents the mode of transportation used to move merchandise

from the country of export to the port of unlading in the United States. Possible values

include, but are not limited to: "11" indicating Vessel (Containerized), "20" indicating Rail

(Non-Containerized), "31" indicating Truck (Containerized), and "50" indicating Mail.

Page 19 of 177 Updated 07-2018

ace REPORTS DATA DICTIONARY – TRADE

Cargo Release Data Objects

Object Name

Object Description

Mode of Transportation Code and

Description

A concatenated field indicating the Mode of Transportation Code followed by the Mode of

Transportation. The Mode of Transportation Code is the 2 digit code that represents the

mode of transportation used to move merchandise from the country of export to the port of

unlading in the United States. The Mode of Transportation is the description of the 2 digit

code. Possible values include, but are not limited to: "11 - Vessel (Containerized)," "20 - Rail

(Non-Containerized)," "31 - Truck (Containerized)," and "50 - Mail."

North/South Border Indicator

An indicator which identifies if a port is located at a northern or southern land border.

Possible values are: "NORTH" and "SOUTH".

Number of Agencies by HTS

A measure used in summary reporting that counts the number of Partner Government

Agencies (PGAs) that regulate a particular Harmonized Tariff Schedule (HTS) number.

Number of Days Since Entry Filed

A measure used in summary reporting that counts the number of days since the cargo

release entry was created.

Number of Days Since Entry Filed

Range

A measure used in summary reporting that counts the number of days since the entry was

created and displays the range it falls within. Possible values are: "<20" indicating the cargo

release entry was created less than 20 days ago , "20-30" indicating the cargo release entry

was created 20 to 30 days ago , ">30" indicating the cargo release entry was created more

than 30 days ago.

Number of Entries

A measure used in summary reporting that counts the number of entries related to a

specific object.

Number of Entry Lines

A measure used in summary reporting that counts the number of entry lines related to a

specific object.

Number of Filers

A measure used in summary reporting that counts the number of filers related to a specific

object.

Number of HTS on Entry Lines

A measure used in summary reporting that counts the number of unique HTS numbers

regulated by a particular agency that are declared at time of entry. For example, if this

object were combined with "Agency Code" it would indicate the number of unique HTS

numbers that the agency regulates, which were declared at the time of entry.

Number of Importers

A measure used in summary reporting that counts the number of importers related to a

specific object.

Number of Message Set Entry

Lines

A measure used in summary reporting that counts the number of entry lines and sequences

containing PGA message set date.

Number of Ports of Entry

A measure used in summary reporting that counts the number of ports of entry related to a

specific object.

Number of Regulated HTS

Numbers

A measure used in summary reporting that counts the number of HTS numbers regulated by

a Partner Government Agency (PGA).

Port of Entry Code

The 4 digit code that represents the district and port where the merchandise entered. The

district code is the first two characters and the port code is the last two characters. Possible

values include, but are not limited to: "2704" indicating LOS ANGELES, CA, "2506" indicating

OTAY MESA, "2605" indicating PHOENIX, AZ, "3001" indicating SEATTLE, WA, and "4601"

indicating NEW YORK/NEWARK AREA.

Page 20 of 177 Updated 07-2018

ace REPORTS DATA DICTIONARY – TRADE

Cargo Release Data Objects

Object Name

Object Description

Port of Entry Code and Name

A concatenated field indicating the Port of Entry Code followed by the Port of Entry. The

Port of Entry Code is the 4 digit code that represents the district and port where the

merchandise entered. The district code is the first two characters and the port code is the

last two characters. The Port of Entry is the name of the district and the port where the

merchandise entered. Possible values include, but are not limited to: "2704 - LOS ANGELES,

CA," "2506 - OTAY MESA," "2605 - PHOENIX, AZ," "3001 - SEATTLE, WA," and "4601 - NEW

YORK/NEWARK AREA."

Port of Entry Name

The district and the port where the merchandise entered. Possible values include, but are

not limited to: "LOS ANGELES, CA," "OTAY MESA," "PHOENIX, AZ," "SEATTLE, WA," and

"NEW YORK/NEWARK AREA."

Port of Unlading Code

A 4 digit code that represents the district and port at which goods are unloaded from the

means of transport having been used for their carriage. The district code is the first two

characters and the port code is the last two characters.

Port of Unlading Name

The name of the district and port at which goods are unloaded from the means of transport

having been used for their carriage. The district code is the first two characters and the port

code is the last two characters.

Regulated HTS Description

The description of the merchandise associated with the 6 to 10 digit Harmonized Tariff

Schedule (HTS) number that is regulated by a particular Partner Government Agency (PGA).

The HTS is a comprehensive listing of sequential numbers that identifies commodities in a

standard format.

Regulated HTS Number

The Harmonized Tariff Schedule (HTS) number identified in the memorandum of

understanding (MOU) as being regulated by the Partner Government Agency (PGA).

Release Date

The month, day, and year (MM/DD/YYYY) that the imported merchandise is released by U.S.

Customs and Border Protection and allowed to enter the commerce of the United States.

Surety Code

The 3 digit identifier assigned by CBP to the entity that ensures the duties, taxes, fees and

other charges associated with international trade transactions are covered in the event the

importer defaults on payment to the government.

Surety Name

The proper name of the entity that ensures the duties, taxes, fees and other charges

associated with international trade transactions are covered in the event the importer

defaults on payment to the government.

System of Release

A 3 character code indicating which CBP system was used to release the entry. Possible

values are: "ACE" indicating the Automated Commercial Environment and "ACS" indicating

the Automated Commercial System. Note: This object populates what is reflected for "Entry

System" in the PGA Data Processing User Interface entry details.

Today

A dynamic date object that can be added to a report query filter, derived using the current

system date and time as a reference point to bring in data that corresponds to the current

day. Date objects are intended to be used when scheduling recurring reports, by eliminating

the need to filter by specific dates each time a saved report is run. Note: These objects can

be utilized by selecting the "Define Filter Type" button for any query filter that corresponds

to a date, and choosing "Object from this query."

Voyage/Flight/Trip Number

The unique number assigned by the carrier to each voyage (if by ocean vessel), flight (if by

air) or trip (if by truck or rail) made to the United States.

Page 21 of 177 Updated 07-2018

ace REPORTS DATA DICTIONARY – TRADE

PGA Message Set – Cargo

The following table lists all data objects that are available in the PGA Message Set – Cargo data universe. These objects

can be used to modify existing PGA Message Set – Cargo reports or to create custom ad hoc reports.

PGA Message Set – Cargo Data Objects

Object Name

Object Description

ACE Entry Status

The description indicating the status of a cargo release entry filed in ACE. Possible values

include: "Admissible," "Bill Hold," "Cancelled," "Document Required," "Intensive," "Pending,"

and "Released."

ACE Entry Status Code

A 1 character code indicating the status of a cargo release entry filed in ACE. Possible values

include: "A" indicating Admissible, "B" indicating Bill Hold, "C" indicating Cancelled, "D"

indicating Document Required, "I" indicating Intensive, "P" indicating Pending, and "R"

indicating Released.

Actual Arrival Date

The month, day, and year (MM/DD/YYYY) when the conveyance transporting the

merchandise from the foreign destination arrived within the limits of the U.S. port with the

intent to unload. Note: This object should not be used. It is currently being tested to validate

accuracy.

Actual Temperature

The reported temperature. Note: Reported to 2 decimal places.

Additional Information

The free-form text description of the additional information being provided in relation to the

Additional Information Qualifier Code.

Additional Information Qualifier

Code

A code indicating the type of additional information provided. Possible values include, but are

not limited to: "AD1" indicating Entity Address 1 Overflow, "AD2" indicating Entity Address 2

Overflow, and "ENA" indicating Entity Name Overflow. Note: Valid codes can be found in ACE

ABI CATAIR Appendix PGA.

Affirmation of Compliance Code

A code used to affirm compliance with FDA requirements. If the merchandise is subject to

BTA, this field is used to report the appropriate affirmation of compliance information not

reported elsewhere. Note: Valid codes can be found in ACE ABI CATAIR Appendix PGA.

Affirmation of Compliance

Description

The free-form text description of the information required by the PGA in relation to the

Affirmation of Compliance Code.

Agency Code

The commonly known Partner Government Agency (PGA) code. Possible values include, but

are not limited to: "FSIS" indicating U.S. Department of Agriculture, Food Safety and

Inspection Service, "NHTSA" indicating U.S. Department of Transportation, National Highway

Traffic Safety Administration, and "DCMA" indicating U.S. Department of Defense, Defense

Contract Management Agency.

Agency Name

The full name of the Partner Government Agency (PGA).

Agency Name

The full name of the Partner Government Agency (PGA).

Bill Number

The alphanumeric code issued by a carrier for a particular shipment being transmitted from a

shipper to a consignee.

Bond Number

The unique 9 character alphanumeric identifier assigned by CBP to the posted bond after the

bond has been approved by an authorized CBP official.

Bond Type

The description indicating the type of bond coverage required for the payment of duties,

fees, and taxes. Possible values include: "Continuous," "Single Transaction," and "No Bond

Required."

Page 22 of 177 Updated 07-2018

ace REPORTS DATA DICTIONARY – TRADE

PGA Message Set – Cargo Data Objects

Object Name

Object Description

Bond Type Code

A 1 digit code that signifies the type of bond coverage required for the payment of duties,

fees, and taxes. Possible values include: "0" indicating no bond required, "8" indicating

continuous, and "9" indicating single transaction.

Broker Mailing Address Line 1

The first line of the address associated with the broker's mailing address. The mailing address

is used to specify the location where CBP should send written correspondence. This may or

may not be the same as the physical address where broker business is conducted.

Broker Mailing Address Line 2

The second line of the address associated with the broker's mailing address. The mailing

address is used to specify the location where CBP should send written correspondence. This

may or may not be the same as the physical address where broker business is conducted.

Broker Mailing Address Line 3

The third line of the address associated with the broker's mailing address. The mailing

address is used to specify the location where CBP should send written correspondence. This

may or may not be the same as the physical address where broker business is conducted.

Broker Mailing Building Number

The alphanumeric value that represents the building number associated with the mailing

address of the broker's organization. The mailing address is used to specify the location

where CBP should send written correspondence. This may or may not be the same as the

physical address where broker business is conducted.

Broker Mailing City

The city associated with the broker's mailing address. The mailing address is used to specify

the location where CBP should send written correspondence. This may or may not be the

same as the physical address where broker business is conducted.

Broker Mailing Country Code

The 2 character abbreviation, as defined by the International Organization for

Standardization (ISO), used to identify the country associated with the broker's mailing

address. The mailing address is used to specify the location where CBP should send written

correspondence. This may or may not be the same as the physical address where broker

business is conducted. Possible values include, but are not limited to: "TV" indicating

TUVALU, "TW" indicating CHINA (TAIWAN), "TZ" indicating TANZANIA, "UA" indicating

UKRAINE, "UG" indicating UGANDA, "UM" indicating UNITED STATES OUTLYING ISLANDS, and

"US" indicating USA.

Broker Mailing Floor Number

The alphanumeric value that represents the floor number associated with the mailing

address of the broker's organization. The mailing address is used to specify the place CBP

should send written correspondence. This may or may not be the same as the physical

address where broker business is conducted.

Broker Mailing House Number

The alphanumeric value that identifies the street location of the broker's mailing address.