DOD COST ESTIMATING GUIDE

Version 1.0

OFFICE OF THE SECRETARY OF DEFENSE

Cost Assessment and Program Evaluation

December 2020

2

FOREWORD

In an environment of growing threats, competing priorities, and fiscal pressures, the Department of

Defense (DoD) must spend the DoD budget on the right things, in the right amounts, at the right time.

DoD cost analysts play a critical role in this by producing cost estimates that support the planning,

programming, budgeting, acquisition, and requirements generation processes. The cost estimating

community of ~1500 government analysts supports an annual budget of more than $700 billion, with

160 major weapons systems and information systems, countless smaller acquisition programs, and

ongoing generation of requirements for future capabilities. Cost estimating is a unique skill set that

combines the best of science and art into a single role. The work relies on sound mathematical and

analytical skills, while also requiring critical thinking, communication, and nuance. Cost estimators have

a depth and breadth of knowledge that is unrivaled in many other career fields.

Every cost estimate is unique, but the overarching process for producing a credible, high-quality

estimate is not. With the help of cost estimating stakeholders from across the national security

community, this guide takes the reader through the steps of the cost estimating process and introduces

topics and concepts that are important for every DoD cost estimator to understand. Special thanks to all

of the organizations that helped CAPE to prepare this guide: DASA-CE, DON estimating community,

AFCAA, MDA, NRO, NPS, AFIT, DAU, GAO, and NASA. The input provided by these stakeholders is

invaluable to the finished product.

The guide provides an overview of important cost estimating topics, and then points the reader to other

resources for detailed theory and explanation, mathematical mechanics, and training opportunities.

Version 1 of this DoD Cost Estimating Guide reflects the current policies and practices as of March 15,

2020. CAPE will endeavor to update the guide as necessary to remain current as these policies and

practices inevitably will evolve in the future.

“No one can predict the future” is an often-used cliché, and yet this is what the DoD asks its cost

estimating community to do every day, albeit in a highly structured and disciplined way. Whether a new

cost estimator or seasoned analyst, this guide will assist with projects and analyses so that the cost

estimating community will continue to provide leaders and decision makers with relevant assessments

and sound recommendations.

3

TABLE OF CONTENTS

1.0 PURPOSE, POLICY, PROPERTIES, AND DEFINITIONS ............................................................... 7

Purpose of the Department of Defense (DoD) Cost Estimating Guide ............................................... 7

Cost Estimating and Analysis Policy .................................................................................................... 7

1.2.1 Cost Estimating and Analysis Statutes ......................................................................................... 7

1.2.2 Cost Estimating and Analysis DoDDs ........................................................................................... 9

1.2.3 Cost Estimating and Analysis DoDIs ........................................................................................... 10

Cost Estimate Program Category, Studies, and Types ...................................................................... 11

1.3.1 Program Category/Events Requiring a Cost Estimate ............................................................... 11

1.3.2 Studies ........................................................................................................................................ 12

1.3.3 Cost Estimate Type .................................................................................................................... 13

Properties of a Good Cost Estimate .................................................................................................. 14

Definitions ......................................................................................................................................... 15

1.5.1 Cost Analysis vs. Cost Estimating ............................................................................................... 15

1.5.2 Work Breakdown Structure and Estimate Structure ................................................................. 15

1.5.3 Inflation vs. Escalation ............................................................................................................... 16

1.5.4 Cost vs. Price .............................................................................................................................. 17

1.5.5 Direct vs. Indirect ....................................................................................................................... 17

1.5.6 Cost Model vs. Cost Estimate .................................................................................................... 17

1.5.7 Cost Contributors vs. Cost Drivers ............................................................................................. 17

1.5.8 Risk/Opportunity, and Uncertainty ........................................................................................... 18

Cost Estimating and Analysis Policy References ............................................................................... 18

Cost Estimating and Analysis Policy Training .................................................................................... 18

2.0 THE COST ESTIMATING PROCESS ........................................................................................... 20

DoD Cost Estimating Process ............................................................................................................ 20

2.1.1 Policy .......................................................................................................................................... 21

2.1.2 Program Definition ..................................................................................................................... 21

2.1.3 Cost Estimate Basis .................................................................................................................... 21

2.1.4 Data ............................................................................................................................................ 21

2.1.5 Methods ..................................................................................................................................... 21

2.1.6 Model ......................................................................................................................................... 21

2.1.7 Initial Results and Iterate as Necessary ..................................................................................... 22

2.1.8 Final Results and Documentation .............................................................................................. 22

2.1.9 Next Analysis .............................................................................................................................. 22

Component Guidance Documents .................................................................................................... 22

Cost Estimating Process References ................................................................................................. 23

Cost Estimating Process Training ...................................................................................................... 23

3.0 PROGRAM DEFINITION .......................................................................................................... 25

Establish a Program Definition .......................................................................................................... 25

3.1.1 Cost Analysis Requirements Description (CARD) ....................................................................... 27

3.1.2 Understanding the Program and Contract WBS ........................................................................ 27

3.1.3 Program WBS, Contract WBS, O&S CES and the Estimate Structure ........................................ 28

Start Building a Cost Model ............................................................................................................... 29

Program Definition References ......................................................................................................... 29

Program Definition Training .............................................................................................................. 30

4.0 COST ESTIMATE BASIS ............................................................................................................ 31

Cost Estimate Plan............................................................................................................................. 31

4

4.1.1 Establishing the Purpose and Scope .......................................................................................... 33

4.1.2 Define the Estimate Structure ................................................................................................... 33

4.1.3 Creating a Cost Estimate Schedule ............................................................................................ 33

Framing Assumptions, Ground Rules, and Cost Estimate Assumptions ........................................... 34

4.2.1 Framing Assumptions ................................................................................................................ 34

4.2.2 Ground Rules ............................................................................................................................. 35

4.2.3 Cost Estimate Assumptions ....................................................................................................... 35

Documentation of the Cost Estimate Basis ....................................................................................... 36

Cost Estimate Basis References ........................................................................................................ 36

Cost Estimate Basis Training ............................................................................................................. 37

5.0 IDENTIFY, COLLECT, VALIDATE, NORMALIZE, AND ANALYZE DATA ..................................... 38

Characterizing Data ........................................................................................................................... 38

Data Types ......................................................................................................................................... 39

5.2.1 Cost Data .................................................................................................................................... 39

5.2.2 Programmatic Data .................................................................................................................... 40

5.2.3 Performance and Technical Data ............................................................................................... 40

5.2.4 Schedule Data ............................................................................................................................ 40

Data Sensitive to Duration or Quantity ............................................................................................. 41

Identify Data ...................................................................................................................................... 41

5.4.1 Data Repositories ....................................................................................................................... 42

5.4.2 Deliverables and Reports ........................................................................................................... 44

Collect, Validate, Normalize, and Analyze Data ................................................................................ 48

5.5.1 Data Collection Plan ................................................................................................................... 48

5.5.2 Collecting Data ........................................................................................................................... 49

5.5.3 Validate Data .............................................................................................................................. 51

5.5.4 Normalize Data .......................................................................................................................... 51

5.5.5 Analyze Data .............................................................................................................................. 52

Data References ................................................................................................................................ 53

Data Training ..................................................................................................................................... 53

6.0 SELECT COST/SCHEDULE ESTIMATING METHODS ................................................................ 55

Basic Estimating Methods ................................................................................................................. 55

6.1.1 Analogy Estimating Method ...................................................................................................... 55

6.1.2 Build-up Estimating Method ...................................................................................................... 56

6.1.3 Extrapolation from Actuals Method .......................................................................................... 57

6.1.4 Parametric Estimating Method .................................................................................................. 57

6.1.5 Comparing Basic Estimating Methods ....................................................................................... 58

Other Estimating Methods ................................................................................................................ 60

Additional Considerations ................................................................................................................. 61

6.3.1 Correlation ................................................................................................................................. 61

6.3.2 Cost Improvement Curve ........................................................................................................... 62

6.3.3 Linear Without Intercept ........................................................................................................... 64

6.3.4 Outliers ....................................................................................................................................... 64

Introduction to Estimating Method Uncertainty .............................................................................. 64

Estimating Methods References ....................................................................................................... 65

Estimating Methods Training ............................................................................................................ 66

7.0 BUILD COST ESTIMATE MODEL .............................................................................................. 68

Anatomy of a Cost Estimate Model .................................................................................................. 68

5

7.1.1 Characteristics to Simplify the Cost Estimate Model ................................................................. 69

7.1.2 Phasing ....................................................................................................................................... 70

7.1.3 Sunk Cost.................................................................................................................................... 72

7.1.4 Cost Modeling Tools .................................................................................................................. 73

7.1.5 Multiple Cost Models for One Program ..................................................................................... 73

7.1.6 Common Cost Metrics ............................................................................................................... 74

Develop and Interpret the Baseline Cost Estimate ........................................................................... 75

7.2.1 Develop the Baseline Cost Estimate .......................................................................................... 75

7.2.2 Interpreting the Baseline Cost Estimate Results ........................................................................ 75

Review the Initial Results .................................................................................................................. 78

7.3.1 Crosschecks ................................................................................................................................ 78

7.3.2 Sensitivity Analysis ..................................................................................................................... 79

7.3.3 What-If Analysis ......................................................................................................................... 80

Addressing Risk/Opportunity, and Uncertainty ................................................................................ 80

7.4.1 Risk/Opportunity ....................................................................................................................... 81

7.4.2 Uncertainty ................................................................................................................................ 82

Iterate as Necessary .......................................................................................................................... 83

Build Cost Model References ............................................................................................................ 83

Build Cost Estimate Model Training .................................................................................................. 84

8.0 FINAL RESULTS AND DOCUMENTATION ............................................................................... 85

Documentation Contents .................................................................................................................. 85

Generate Final Documentation Report ............................................................................................. 86

Present and Defend Results .............................................................................................................. 88

8.3.1 Sand Chart .................................................................................................................................. 88

8.3.2 Pareto Chart ............................................................................................................................... 90

8.3.3 Tornado Charts .......................................................................................................................... 90

8.3.4 Cost Element Chart .................................................................................................................... 92

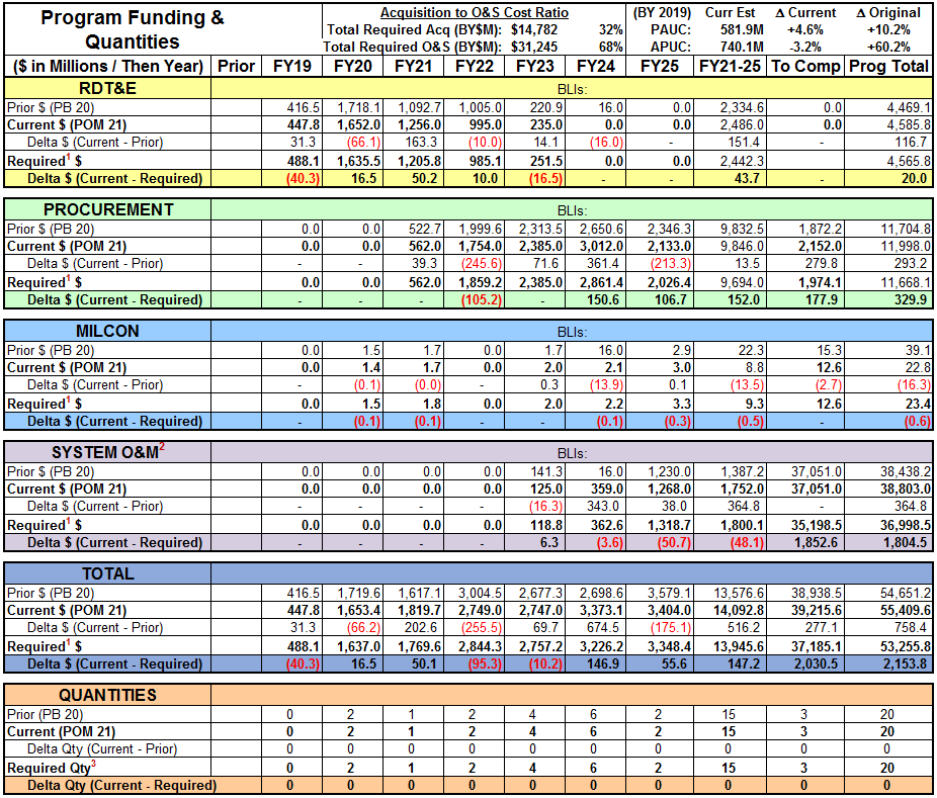

8.3.5 Program Funding and Quantities Chart ..................................................................................... 93

8.3.6 S-Curve ....................................................................................................................................... 94

GAO Cost Assessment Checklist ........................................................................................................ 95

Lessons Learned ................................................................................................................................ 95

Documentation and Results References ........................................................................................... 96

Documentation and Results Training ................................................................................................ 97

9.0 NEXT ANALYSIS ....................................................................................................................... 98

APPENDIX ..................................................................................................................................... 99

APPENDIX A ACRONYMS ............................................................................................................ 100

APPENDIX B SAMPLE COST ESTIMATING FLOWCHARTS .......................................................... 107

B.1 Government Accountability Office ................................................................................................. 107

B.2 CAPE ................................................................................................................................................ 107

B.3 Department of the Army ................................................................................................................. 108

B.4 Department of the Navy ................................................................................................................. 108

B.5 Department of the Air Force ........................................................................................................... 109

B.6 Joint Space Cost Council (JSCC) ....................................................................................................... 111

B.7 NASA ............................................................................................................................................... 111

APPENDIX C SAMPLE QUESTIONS TO GET STARTED ................................................................. 112

C.1 Sample Kickoff Meeting Questions ................................................................................................. 112

C.2 Sample Program Definition Questions ............................................................................................ 112

6

APPENDIX D DEPARTMENT OF THE AIR FORCE COST ESTIMATE DOCUMENTATION CHECKLIST

FOR ACAT I, II, AND III COST ESTIMATES ................................................................................... 114

D.1 Introduction .................................................................................................................................... 114

D.2 Body ................................................................................................................................................ 114

D.3 Additional checklist considerations identify whether: ................................................................... 115

APPENDIX E SAMPLE SME INTERVIEW FORM ........................................................................... 116

APPENDIX F SAMPLE ASSESSMENTS OF ESTIMATING METHOD APPLICATION ....................... 117

APPENDIX G GAO BEST PRACTICE LIST ...................................................................................... 119

FIGURES

Figure 1: DoD Cost Estimating Process ........................................................................................................................ 20

Figure 2: Estimating Method Applicability .................................................................................................................. 60

Figure 3: Notional Correlation Matrix Example ........................................................................................................... 62

Figure 4: Notional Major Capability Acquisition Budget Profile vs. a Notional MTA Program Schedule .................... 72

Figure 5: Total Ownership Cost Composition .............................................................................................................. 74

Figure 6: Point Estimate Location Within a Range of Possible Outcomes ................................................................... 76

Figure 7: Sand Chart (Layered) (notional) .................................................................................................................... 89

Figure 8: Sand Chart (Stacked Bar) (notional) ............................................................................................................. 89

Figure 9: Pareto Chart (notional) ................................................................................................................................. 90

Figure 10: Tornado for Cost Drivers Chart (notional) .................................................................................................. 91

Figure 11: Tornado for Cost Contributors Chart (notional) ......................................................................................... 92

Figure 12: O&S Cost Element Chart (notional) ............................................................................................................ 92

Figure 13: Program Funding and Quantities (Spruill) Chart (notional) ........................................................................ 94

Figure 14: S-Curve Example (notional) ........................................................................................................................ 95

Figure 15: GAO Cost Estimating Process .................................................................................................................... 107

Figure 16: CAPE Recommended Analytic Approach for O&S Cost Estimate ............................................................. 107

Figure 17: Department of the Army Cost Estimating Process ................................................................................... 108

Figure 18: DON Cost Estimating Process Flow ........................................................................................................... 108

Figure 19: NAVAIR Life-Cycle Cost Estimating Process Flow (Sep 2019) ................................................................... 109

Figure 20: AF Basic Cost Estimating Process .............................................................................................................. 109

Figure 21: AF Cost Estimating Overview .................................................................................................................... 110

Figure 22: Joint Space Cost Council (JSCC) Cost Estimating Process.......................................................................... 111

Figure 23: NASA Cost Estimating Process .................................................................................................................. 111

Figure 24: Example SME Documentation (Provided by the Missile Defense Agency, 2019) ..................................... 116

Figure 25: AFCAA: Selection of Methods ................................................................................................................... 117

Figure 26: Missile Defense Agency: Selection of Methods ........................................................................................ 117

Figure 27: NASA: Use of Cost Estimating Methodologies by Phase .......................................................................... 118

TABLES

Table 1: Key Inflation/Escalation Terms ...................................................................................................................... 16

Table 2: Information to Include in a Cost Estimate Plan ............................................................................................. 32

Table 3: Data Types and Generic Sources (not exhaustive) ......................................................................................... 41

Table 4: CADE Data ...................................................................................................................................................... 43

Table 5: DoD-level Data Repositories .......................................................................................................................... 44

Table 6: Potential Data Available in Required Acquisition Documents ....................................................................... 45

Table 7: Potential Data Available in Identified Government Data Sources ................................................................. 47

Table 8: Industry Data Sources to Consider ................................................................................................................. 48

Table 9: Summary of Advantages and Disadvantages of Basic Estimating Methods .................................................. 59

Table 10: Common Cost Estimate Documentation Organization ................................................................................ 87

7

1.0 PURPOSE, POLICY, PROPERTIES, AND DEFINITIONS

Purpose of the Department of Defense (DoD) Cost Estimating Guide

This guide provides consolidated information on the DoD cost estimating process and points the reader

to additional references and training for specific estimating topics. It does not replace DoD Component

guides and training materials. It does make direct references to existing cost estimating or guidance

documents that describe processes, methods, and procedures specific to that environment. This guide:

• applies to all types of cost analyses performed within the DoD,

• bridges the gap between the DoD Directives/Instructions (DoDDs/DoDIs) and the

Component/ Agency-level guidance/resources,

• focuses on major defense acquisition programs (MDAPs), but also applies to acquisition

category (ACAT) II and smaller programs, business system programs, services acquisition

programs, and other estimates including Middle Tier of Acquisition (MTA

1

) programs and

Nunn-McCurdy requirements, and

• provides a starting point for new analysts across DoD and a resource for seasoned analysts.

Cost Estimating and Analysis Policy

The United States Congress conferred primary DoD acquisition program cost estimation and cost

analysis responsibility to the Office of the Secretary of Defense (OSD) Cost Assessment and Program

Evaluation (CAPE). This responsibility includes the authority to establish DoD policy through DoDIs.

Therefore, the Director of CAPE (DCAPE) has prescribed policies and procedures for the conduct of cost

estimation and cost analysis, to include Independent Cost Estimates (ICEs), Analysis of Alternatives

(AoA), multiyear procurements

2

(MYP), data collection, etc. The following sections discuss the laws and

policies that govern cost estimating requirements.

1.2.1 Cost Estimating and Analysis Statutes

The United States Congress passes cost estimating and analysis statutes and incorporates them into

various titles and sections of the United States Code (USC). There are also four fiscal laws that govern

how the government spends money and indirectly impact cost estimating. The primary statutes and the

associated directives that establish policy relevant to cost estimating are discussed below.

Four primary fiscal laws relevant to cost estimating are:

• 10 USC Code Sec 114, “Annual authorization of appropriations”: Identifies appropriations

for military spending. Analysts must understand the military appropriations in order to

partition a cost estimate into the proper budget categories.

• Antideficiency Act: Creates various laws for expenditures, obligations, and voluntary

service, which are necessary for analysts to understand. These laws include:

o 31 USC Sec 1341(a)(1)(A) – prohibits authorizing expenditures in excess of the amount

appropriated,

o 31 USC Sec 1341(a)(1)(B) – prohibits spending of funds prior to funds being

appropriated,

o 31 USC Sec 1342 – prohibits voluntary service to the government, and

o 31 USC Sec 1517(a) – prohibits expenditures in excess of apportionment amounts.

1

MTA programs are a result of the 2016 National Defense Authorization Act (NDAA) in Section 804.

2

See 10 USC Section (Sec) 2306b “Multiyear contracts: acquisition of property”.

8

• 31 USC Sec 1301, “Application”: Requires that appropriated funds be applied only to the

objects for which the appropriations were made. This Appropriations statute, commonly

known as the “Misappropriation Act”, contains language about limitations placed on the

use of appropriated funds, which might become an issue during the cost estimating

process.

• 31 USC Sec 1502, “Balances available”: Requires appropriated funds be used only for

goods and services for which a need arises during the period of that appropriation’s

availability for obligation. Known as the “Bona Fide Need” rule, this law contributes to an

analyst’s understanding of obligation requirements.

Other laws directly applicable to cost estimating and analysis include:

• 10 USC Sec 2306b, “Multiyear contracts: acquisition of property”: Establishes the criteria

for entering into multiyear contracts. Includes requirements for a preliminary (prior to

authorization) and final (prior to contract award) CAPE savings forecast. DoD submits the

final savings forecast to Congress, and the contract may not be awarded until 30 days after

that submission.

• 10 USC Sec 2334, “Independent cost estimation and cost analysis”: Includes the Weapon

Systems Acquisition Reform Act of 2009 (Public Law 111-23) which established the DCAPE

statutory authority for independent cost estimation and cost analysis including providing

realistic acquisition cost estimates, conducting/approving MDAP cost estimates, reviewing

Component cost estimates (CCE), analyses, and records, discussing cost estimate risks, and

establishing data collection guidelines. Additionally, 10 USC Sec 2334 provides the

authority for DCAPE to issue cost estimating policy, procedures, and guidance. The

implementing directive for 10 USC Sec 2334 is DoDD 5105.84, “Director of CAPE”.

• 10 USC Sec 2337a, “Assessment, management, and control of operating and support costs

for major weapon systems”: Establishes, in conjunction with 10 USC Sec 2334(g), the

DCAPE authority to collect cost data. 10 USC 2334(g) is specific to acquisition data while 10

USC Sec 2337a(c) provides DCAPE statutory authority to retain Operating and Support

(O&S) data along with the responsibility to establish a database to collect O&S estimates,

documentation, and costs. The DoD published DoDD 5105.84, “Director of Cost

Assessment and Program Evaluation (DCAPE)” on May 11, 2012, before 10 USC Sec 2337a

became law. The next revision to DoDD 5105.84 will capture the content of 10 USC 2337a.

• 10 USC Sec 2366a, “Major defense acquisition programs: determination required before

Milestone A approval”: Defines the responsibilities, determination, and submissions

required for an MDAP to receive Milestone A approval. As part of the determination prior

to granting Milestone A approval, the DCAPE must concur, for the submitted program cost

estimate, that the level of resources required to develop, procure, and sustain the program

is sufficient for successful program execution. Additionally, within 15 calendar days of

granting Milestone A approval, the program Milestone Decision Authority (MDA) is required

to submit the program cost and schedule estimates, as well as the ICE, to the congressional

defense committees. This statute also defines a requirement for an AoA.

• 10 USC Sec 2366b, “Major defense acquisition programs: certification required before

Milestone B approval”: Defines the certifications, determinations, submissions, and

applicable waivers for an MDAP to receive Milestone B approval. As part of the

determination prior to granting Milestone B approval, the DCAPE must concur, for the

submitted program cost estimate, that reasonable cost and schedule estimates have been

developed to execute the program product development and production plan.

Additionally, within 15 calendar days of granting Milestone B approval, the program MDA is

9

required to submit the program cost and schedule estimates, as well as the ICE, to the

congressional defense committees. This statute also requires the completion of an AoA.

• 10 USC Sec 2366c, “Major defense acquisition programs: submissions to Congress on

Milestone C”: Defines the Congressional submissions required after Milestone C approval.

Within calendar 15 days of granting Milestone C approval, the program MDA is required to

submit a brief summary of the dollar values estimated for the program acquisition unit cost

(PAUC), average procurement unit cost (APUC), the total life-cycle cost, the planned dates

for initial operational test and evaluation (IOT&E) and initial operational capability (IOC),

and the ICE to the congressional defense committees.

• 10 USC Sec 2430, “Major defense acquisition program defined”: Defines an MDAP and

designates the MDA for such programs as the relevant Service Acquisition Executive, unless

otherwise designated by the Secretary of Defense. This definition and designation has a

significant impact on the level of cost estimating detail and documentation required at

milestone decision reviews. This law excludes rapid prototyping/rapid fielding programs

defined as MTA programs in the 2016 NDAA and some defense business systems (DBS)

from the definition of MDAP.

• 10 USC Sec 2433, “Unit Cost Reports”: Establishes the terms procurement program,

significant cost growth threshold, and critical cost growth threshold and their relationship

to the PAUC and APUC for an MDAP or any designated major subprogram. These

relationships form the basis for a Nunn-McCurdy breach that analysts should understand.

• 10 USC Sec 2441, “Sustainment reviews”: Establishes a statutory requirement for ongoing

reviews during system sustainment, which includes an ICE and other cost related analyses

of major weapon systems.

1.2.2 Cost Estimating and Analysis DoDDs

A DoDD is a broad policy document containing what is required by statute, the President, or the

Secretary of Defense to initiate, govern, or regulate actions or conduct by the DoD Components within

their specific areas of responsibilities. DoDDs establish or describe policy, programs, and organizations;

define missions; provide authority; and assign responsibilities. DoDDs directly applicable to cost

estimating and analysis include:

• DoDD 5000.01, “The Defense Acquisition System” (2018): Establishes the management

process by which the DoD provides effective, affordable, and timely systems to the users. It

addresses topics such as acquisition program accountability for cost, schedule, and

performance reporting, reducing cost, cost and affordability, total ownership costs, cost

realism, and the most cost-effective solution over the system life cycle. Cost estimating and

cost analysis play extremely important roles in acquiring new capabilities for the warfighter.

• DoDD 5105.84, “Director of Cost Assessment and Program Evaluation (DCAPE)” (2012):

Assigns the responsibilities, functions, relationships, and authorities of the DCAPE. DCAPE

responsibilities include acquisition support, resource planning, analysis and advice, annual

reports to Congress, and other duties as assigned by the Secretary or Deputy Secretary of

Defense. Acquisition support contains DCAPE responsibilities for cost analysis, AoAs, and

analytic competency.

• DoDD 5134.01, “Under Secretary of Defense for Acquisition, Technology, and Logistics

(USD(AT&L))” (2008): Assigns the responsibilities, functions, relationships, and authorities

of the USD(AT&L). The 2017 NDAA separated the USD(AT&L) into the Undersecretary of

Defense for Research and Engineering (USD(R&E)) and the Undersecretary of Defense for

Acquisition and Sustainment (USD(A&S)). While policies are still under revision for the

10

duties of these two organizations, their collective impact upon cost estimating including

acquisition and sustainment process improvements and research, technology, and

engineering improvements can lead to changes in a cost estimate.

• DoDD 5144.02, “DoD Chief Information Officer (CIO)” (2017): Assigns the responsibilities,

functions, relationships, and authorities of the DoD CIO. This directive establishes top-level

guidance that contributes to information system cost estimating requirements.

The brief summary of these statutes and directives highlight the many requirements placed upon DCAPE

in directing and establishing the DoD cost estimating policies and procedures which are further

conveyed via DoDIs.

1.2.3 Cost Estimating and Analysis DoDIs

DoDIs implement the policy or prescribe the manner for carrying out the policy, operating a program or

activity, and assigning responsibilities. DoDIs directly applicable to cost estimating and analysis include:

• DoDI 5000.02, “Operation of the Adaptive Acquisition Framework” (2020): Prescribes

procedures for managing acquisition programs and assigns program management

responsibilities. Describes the purpose and characteristics of six acquisition pathways.

Each of the pathways has associated cost estimating requirements. These requirements

are further described in the DoDI 5000.73.

• DoDI 5000.02T, “Operation of the Defense Acquisition System” (2020): Provides the

detailed procedures that guide the operation of the Defense Acquisition System and is the

implementation instruction for DoDD 5000.01. It addresses cost estimating requirements

at a very high level within the context of the acquisition process. It also states that DCAPE

establishes procedural guidance for the collection of cost data on acquisition programs.

This policy is a transition document and its Table 1 outlines new policy documents that are

in development.

• DoDI 5000.73, “Cost Analysis Guidance and Procedures” (2020): Establishes policy, assigns

responsibilities, and provides procedures for the conduct of cost estimation and analysis in

the DoD. This is the implementing instruction for DoDD 5105.84. It is the primary

instruction on cost estimating and cost analysis across the DoD and its Components. This

instruction instantiates cost estimating requirements for many types of cost analysis.

• DoDI 5000.74, “Defense Acquisition of Services” (2020): Establishes policy, assigns

responsibilities, and provides direction for the acquisition of contracted services. This is the

implementation instruction for DoDD 5134.01. It assigns responsibility to DCAPE for

policies and procedures associated with cost estimating and cost analysis for the acquisition

of contracted services.

• DoDI 5000.75, “Business Systems Requirements and Acquisition” (2020): Establishes

policy for the use of the business capability acquisition cycle (BCAC) for business systems

requirements and acquisition. This is the implementation instruction under DoDD 5134.01,

DoDD 5000.01, and DoDD 5144.02. It assigns responsibility to DCAPE for policies and

procedures associated with data collection, cost estimating, and cost analysis for the

acquisition of business systems. (The DoDI 5000.75 supersedes DoDI 5000.02T for all

business system acquisition programs that are not designated as an MDAP.)

• DoDI 5000.80, "Operation of the Middle Tier of Acquisition (MTA)" (2019): Establishes

policy, assigns responsibilities, and prescribes procedures for rapid prototyping and rapid

fielding as defined in Section 804 of Public Law 114-92. This is an implementation

instruction under DoDD 5134.01. It assigns responsibility to DCAPE for advising the

USD(A&S) on schedule, resource allocation, affordability, systems analysis, cost estimation,

11

and the performance implications of proposed MTA programs. Additionally, DCAPE is to

establish policies and prescribe procedures for the collection of cost data and cost

estimates for MTA programs.

• DoDI 5000.81, "Urgent Capability Acquisition" (2019): Establishes policy, assigns

responsibilities, and provides procedures for acquisition programs that fulfill urgent

operational needs and quick reaction capabilities. This instruction does not include any

specific responsibilities for DCAPE. However, an acquisition program must meet specific

cost and schedule criteria in order to utilize the Urgent Capability Acquisition pathway.

• DoDI 7041.03, “Economic Analysis for Decision Making” (2017): Establishes policy, assigns

responsibilities, and provides procedures for conducting cost-effective economic analyses

(EA). These analyses evaluate the costs and benefits of any government decision to initiate,

renew, or expand program or project alternatives under the Office of Management and

Budget (OMB) Circular No A-94, “Guidelines and Discount Rates for Benefit-Cost Analysis of

Federal Programs.” DoDI 7041.03 is an implementing instruction under DoDD 5105.84. It is

applicable to decisions regarding the use of real property, acquisition of information

systems, and the acquisition of weapon systems and weapons systems support. With

respect to the acquisition of weapons system and weapons systems support, analytic

studies and Business Case Analysis (BCA) may also be considered EAs if they deal with cost

and effectiveness considerations.

Analysts can find the latest versions of DoDDs/DoDIs under DoD Issuance/Directives and DoD Issuance/

Instructions at: https://www.esd.whs.mil/DD/DoD-Issuances/. These DoDIs are not the end of the policy

and guidance chain. DoD Manuals (DoDM), specifically the DoDM 5000.04 Cost and Software Data

Reporting (CSDR) Manual, and the many guides and manuals referenced throughout this document

directly relate to the statutes, directives, and instructions already mentioned. All of these documents

work together to address how the DoD accomplishes cost estimating.

Cost Estimate Program Category, Studies, and Types

The purpose and scope of a cost estimate are a function of program category, events, and type. These

program categories, events, and types help define the amount of detail, the timeline, the approval

process, and other requirements for the specified cost estimate.

1.3.1 Program Category/Events Requiring a Cost Estimate

While 10 USC Sec 2430(d)(1) gives MDA authority to the Component Acquisition Executives (CAEs) for

most MDAPs, DoDI 5000.02T identifies the USD(AT&L) as the Defense Acquisition Executive (DAE) and

MDA for the remaining MDAPs. MDAPs at the DAE level are usually very high dollar value or of special

interest to the Secretary of Defense. DoDI 5000.02T, Enclosure 1, Table 2 also identifies the CAE as the

MDA for ACAT II and III programs and provides definitions for each ACAT level. In some cases, the CAEs

delegate approval authority for lower level ACAT programs to Program Executive Officers (PEOs).

Therefore, the analyst should consult Component level guidance for any recent changes to the MDA

since the MDA is responsible for approving the cost estimates required for the following:

• ACAT I – IV programs: ACAT I – III programs are described in Enclosure 1, Table 2 of DoDI

5000.02T, and ACAT IV programs are Component specific (usually limited to the

Department of the Navy (DON)). The MDA for ACAT I programs will review an ICE and/or

Component Cost Position (CCP) and approve the most appropriate estimate for the

program at milestone reviews. The MDA for ACAT II – IV will review a CCE and/or program

office estimate (POE) for the specified program at milestone reviews. An ACAT program will

have multiple reviews over its life cycle.

12

• Business System Categories (BCAT) I – III: Table 1 of DoDI 5000.75 describes these non-

ACAT DBS categories where the associated cost estimates are reviewed/approved by the

MDA at authority to proceed (ATP) decision points, which are milestone-like events. A

BCAT will have multiple ATP decision points over its life cycle.

• Service Acquisition Categories (S-CATs) I – IV: These service acquisitions are described in

Table 1 of DoDI 5000.74 where the particular S-CAT level is determined by an independent

government cost estimate (IGCE). Following the initial review, there are no milestones or

decision points within a service acquisition, but there may be other reviews if contract

performance becomes a concern.

• MTA Program: The funding levels for these non-ACAT programs, which may surpass MDAP

thresholds, determines the type of cost estimate(s) required. The expected five-year or less

timeline to finish requires at least one MDA cost estimate review process and possibly more

depending on program cost and schedule performance. MTA Rapid Prototyping programs

require a cost estimate specific to the cost of the rapid prototyping. MTA Rapid Fielding

programs require a full life-cycle cost estimate.

• Nunn-McCurdy Breach: Congress made the Nunn-McCurdy Act permanent in 1983 via 10

USC Sec 2433 by defining significant and critical breaches

3

for MDAPs to curtail growth in

weapon systems programs. In addition to several certifications from across the acquisition

entities, a Nunn-McCurdy critical breach requires the CAPE to develop an ICE on the revised

program on a reduced timeline and present it to the MDA

1.3.2 Studies

There are acquisition studies containing cost estimates that require decision authority (possibly the

MDA) approval. The program office reviews and approves the cost estimates in these study documents.

Depending on the ACAT, BCAT, or S-CAT level, approval by the Component/DoD may also be required.

These include:

• AoA: A technical and cost assessment to objectively evaluate different potential courses of

action. In DoDD 5105.84, DCAPE requires that an AoA consider trade-offs among life-cycle

costs. While this is an ACAT I requirement, the Components have implemented similar

requirements on lower ACAT programs.

• EA: A systematic approach to identifying, analyzing, and comparing costs and benefits of

alternative courses of action. In DoDI 7041.03, DCAPE establishes the requirement for cost

and benefit analysis to support acquisition decisions. These decisions involve selecting the

best alternative from multiple criteria, including life-cycle costs in net present value

4

(NPV)

terms. Analytic studies and BCAs including cost and effectiveness considerations for the

acquisition of weapons systems and weapons systems support are types of EA.

• BCA: Used to determine if a new approach should be undertaken. DoDI 5000.02T includes

various requirements for BCAs associated with earned value management (EVM), Milestone

B approval, a product support (PS) BCA as part of the life-cycle sustainment plan, and cloud

computing services. The DoD has issued BCA guidebooks (e.g., PS BCA) and templates (e.g.,

3

When MDAPs experience cost growth of 15% percent from their current baseline or 30% percent from their

original baseline, they are in a “significant” Nunn-McCurdy Unit Cost Breach. Similarly, a 25% current or 50%

original baseline growth results in a “critical” Nunn-McCurdy Unit Cost Breach. These breaches are based on

growth to the PAUC or the APUC.

4

NPV analysis account for the time-value of money based on the assertion that dollars received in the future are

worth less than dollars in available today. The OMB promulgates Circular-94 “Guidelines and Discount Rates For

Benefit-Cost Analysis Of Federal Programs” annually.

13

Information Technology (IT) BCA)). Components have also issued guidance for BCAs. In all

cases, the requirement to include cost estimates in the BCA exists. The BCA addresses the

question: Should I invest or not? A PS BCA guidebook can be found at:

https://www.dau.edu/tools/t/Product-Support-Business-Case-Analysis-(BCA)-Guidebook.

• Source Selection/Proposal Evaluation: The source selection criteria issued by the Director

of Defense Pricing and Contracting (DPC) requires that the program manager

5

develop an

IGCE prior to the release of the final request for proposal (RFP) in order to help evaluate

proposal cost reasonableness and realism.

While there are other analytic studies concerning cost and effectiveness considerations that require cost

estimates, these are the major types. The Components have issued specific guidance for the types of

analysis they require. For example, Air Force Instruction (AFI) 65-501, “Economic Analysis” states that

implementing the EA approach is applicable to a variety of comparative analyses including EA, lease vs.

buy decisions, BCA, PS BCA, cost benefit analysis, and AoAs and then proceeds to provide guidance on

the implementation of these comparative analyses. The DON, alternatively, has separate EA and BCA

templates. The analyst must be familiar with the respective Component requirements for cost

estimates in these types of studies.

1.3.3 Cost Estimate Type

Regardless of the type of analysis it supports, every estimate should be realistic, defendable,

comprehensive, and well documented. The cost estimate type is a function of the program category,

events, its purpose, and the organization responsible for its development. The following are broad cost

estimate types:

• ICE: A life-cycle cost estimate

6

is statutorily required for all MDAPs during acquisition and

sustainment decision reviews and other significant out-of-cycle reviews such as Critical

Nunn-McCurdy breaches. For an MDAP in the acquisition process, the CAPE produces an

ICE or reviews and approves the ICE if produced by a Component. For non-MDAP

programs, the Component Cost Agency performs the ICE.

• DoD CCP: The CCP is the outcome of the reconciliation between the CCE and the POE,

except for the DON. It serves as the program official cost position from that Component.

For the DON, the POE serves as its official cost position, in the absence of a CCP.

• DoD CCE: A life-cycle cost estimate developed by one of the Components typically

developed by the Component Cost Agency.

• POE: A cost estimate developed by the program office and used as a tool for life-cycle cost

management throughout the life of the program. A program updates its POE as required to

capture actual incurred costs to date and refined estimating methods. The program

manager uses the POE to inform the acquisition and O&S management processes. The POE

is a consideration during the creation of the CCP.

• Cost Capability Analysis (CCA): An estimate typically developed by the program office to

support the program manager in the delivery of cost-effective solutions through deliberate

trade-off analysis between operational capability and affordability.

• IGCE: Pertains mostly to services acquisitions, specifically contracts, as mentioned in DoDI

5000.74. It provides a government developed cost estimate of an individual contract. The

5

This guide does not use the acronym PM. Program manager is spelled out to avoid confusion with the term

project manager.

6

A life-cycle cost estimate is the estimated cost of developing, producing, deploying, maintaining, operating and

disposing of a system over its entire lifespan.

14

analyst conducts an IGCE to check the reasonableness of a contractor’s cost proposal and to

make sure that the offered prices are within the budget range for a particular program. The

IGCE may assist in cost realism analysis

7

.

• Should Cost Estimate

8

(SCE): A management tool associated with the OSD Better Buying

Power initiative to control and reduce cost throughout the lifecycle, often referred to as a

Should Cost Initiative. The objective is to proactively target cost reduction through process

and productivity improvements. Over time, the SCE has evolved in intent and purpose and

therefore the reader is encouraged to seek out the relevant Component definitions and

policies for this type of cost estimate.

• Sufficiency Review: A review to ensure a program or cost estimate has sufficient

information for a formal milestone review. These reviews are typically component specific.

For example, the Air Force Life Cycle Management Center conducts program sufficiency

reviews “culminating in a final outbrief of the results of those assessments to obtain

approval of a program baseline

9

” and there is a sufficiency review checklist for cost

estimates scoring documentation, reasonableness and relevance, completeness and

consistency, and risk.

Properties of a Good Cost Estimate

10

Regardless of the type of cost estimate produced, the analyst can expect leaders and other analysts to

assess it against how well it:

• predicts, analyzes, and evaluates system cost and schedule resources,

• facilitates decision making, and

• assists program managers with program control planning and execution.

Due to the wide variety of cost estimate purposes and types, it is impossible to build a one-size-fits-all

cost estimate evaluation metric. However, the following are fundamental characteristics of any good

cost estimate:

• It is realistic, comprehensive, believable, and all-inclusive.

• It can be audited via traceability in the work breakdown structure (WBS), source data, and

cost model.

• It contains clear and concise definitions.

• It can be replicated by other estimators via well-defined documentation.

• It identifies and substantiates the costs of program resources (e.g., time, materiel,

manpower).

• It discloses any excluded costs along with the rationale.

7

The 2018 Independent Government Cost Estimate (IGCE) Handbook for Services Acquisition defines cost

reasonableness and cost realism.

8

“Joint Memorandum on Savings Related to “Should Cost”” signed by USD(AT&L) and USD Comptroller/Chief

Financial Officer (C/CFO) April 22, 2011

9

2016 Air Force Life Cycle Management Center (AFLCMC) Internal Process Guide to Conduct Program Sufficiency

Reviews (PSR)

10

Inspired by the Department of the Air Force Cost Analysis Agency (AFCAA), Cost Analysis Handbook, 2008,

Chapter 1, “Properties of a Good Estimate”, pg.1-20 and Government Accountability Office (GAO), Cost Estimating

and Assessment Guide, 2009, Chapter 1, “The Characteristics of Credible Cost Estimates and a Reliable Process for

Creating Them”, pg. 5

15

• It results in a specific mathematical answer, but that answer is framed within the context of

risks/opportunities and uncertainty.

• It includes comparisons to previous cost estimates and the available (or expected) budget.

• It addresses key stakeholder requirements including tables and charts that support

decision-making.

• It is structured to be easily modified to provide answers for unplanned program changes.

• It has been independently reviewed.

• It is completed on time.

These properties are not a complete list, but analysts should consider them individually and in total

when developing a cost estimate of any type.

Definitions

This section provides key definitions that are particularly important to the ensuing content in this guide

and discussions with other analysts. A comprehensive list of acronyms used throughout this document

is found in Appendix A Acronyms. The Defense Acquisition University (DAU) maintains a comprehensive

glossary of Defense acquisition acronyms and terms (

https://www.dau.edu/glossary/Pages/Glossary.aspx).

1.5.1 Cost Analysis vs. Cost Estimating

CAPE policies are consistent in distinguishing between cost analysis and cost estimating. Cost analysis

encompasses the entire range of activities in the cost estimating process. Cost analysis includes

activities such as sensitivity and what if analysis that are performed on the results of a cost estimate.

(See Sections 7.3.2 for sensitivity and 7.3.3 for what-if analysis.) Cost estimating itself is a blend of art

and science to develop a realistic cost forecast of proposed products or services. In this guide, cost

analysis refers to any effort performed in the support of generating a cost estimate and its

documentation. For example, assessing the benefit of a MYP (rather than annual procurement) is a cost

analysis activity with various results, some of which the analyst incorporates into the cost estimate.

1.5.2 Work Breakdown Structure and Estimate Structure

The 2018 military standard Work Breakdown Structures for Defense Materiel Items (MIL-STD-881D)

describes WBS” as a consistent and visible framework for product-oriented materiel items and contracts

within a defense program. Analysts use MIL-STD-881 WBSs as the basis for acquisition cost estimates.

The 2014 CAPE O&S Cost-Estimating Guide defines an O&S CES that categorizes and defines cost

elements covering the full range of O&S costs that could occur in any defense system. This guide uses

the following terms:

• Program WBS: Refers to a WBS that describes the program and is based on the current

version of MIL-STD-881 inclusive of all government costs.

• Contract WBS: Refers to the agreed-to contract reporting level and includes any

discretionary extensions to lower-levels for reporting. It should be closely aligned with the

program WBS.

• O&S CES: Refers to the CES as defined in the 2014 CAPE O&S Cost-Estimating Guide.

• Estimate Structure: Refers to a program WBS and/or O&S CES that has been expanded

and/or rearranged to support the required cost estimate.

See Section 3.1.2 for a more extensive discussion on the program and contract WBS.

16

1.5.3 Inflation vs. Escalation

Inflation is the rise in an economy-wide average (general) price level over time; there is only one rate of

inflation that applies to all goods and services in the US economy. Escalation is the change in price (to

include inflation) of particular goods and services in specific sectors of the economy. Escalation has two

components: inflation and real price change (RPC). RPC is the portion of escalation unexplained by

inflation such as market-specific supply and demand.

11

To account for inflation and escalation, cost can be expressed in a number of different ways, each

suitable for a specific purpose. Table 1 displays terms that the cost community uses to characterize or

modify cost to the proper context.

The 2017 CAPE Inflation and Escalation Best Practices For Cost Analysis: Analyst Handbook contains

more information on calculations associated with the terms in Table 1.

Table 1: Key Inflation/Escalation Terms

Term

Definition

Inflation Index

A series of multipliers that measure the percentage

change in the general price level over time, relative to a

particular year. Costs normalized using an inflation index

are Constant Year (CY) dollars.

Escalation Index

A series of multipliers that measure the percentage

change in price for particular goods and services over

time, relative to a particular year. Costs normalized

using an escalation index are Constant Price (CP) dollars.

Fiscal Year (FY) Dollars

Costs expressed in terms of a particular government FY.

CY

12

Dollars

Cost normalized for inflation only (not normalized for

RPC) to a specific FY.

CP Dollars

Cost normalized for escalation, including both inflation

and RPC.

Base Year (BY) Dollars

Equivalent to CY dollars for specific point-of-reference

year, often selected for a program’s formal reporting

documents to maintain a constant basis of comparison.

Outlay Profile

In percentage terms, the rate at which a budget is spent

over time (years).

Then Year (TY) Dollars

Costs that include an outlay profile

13

to cover escalation

as obligations are expended over a multiyear period.

Primarily used for budgeting purposes (e.g., Total

Obligation Authority (TOA)).

11

See the 2017 CAPE DoD Inflation and Escalation Best Practices for Cost Analysis for authoritative details on

inflation, escalation, and other terms that characterize cost,

12

CY can also be the acronym for “current year” or “calendar year”. CY refers to “constant year” in this guide.

13

Some appropriations are required to be obligated within one year fully expended by the second year (e.g., O&S).

Others are spent over a period of up to seven years (e.g., shipbuilding). The outlay profile specifies the percent

spent in each year.

17

1.5.4 Cost vs. Price

Cost is the expense incurred for a product or service. Price represents the amount of money the

government intends to pay for that product or service. The difference between cost and price is fee

(commonly referred to as profit). Calculating fee is a function of contract type, and there are many

variations. A comparison of major contract types is found at:

https://www.acq.osd.mil/dpap/ccap/cc/jcchb/Files/Topical/Contract_Type_Comparison_Table/resources/contract

_type_table.docx

1.5.5 Direct vs. Indirect

Direct costs are costs attributable to a single product and generally categorized as labor, material, and

other direct cost (ODC). ODC includes items or services, such as tooling or consulting, that are neither

material nor direct labor but are attributable to a single product.

Indirect costs are service or expense costs that benefit multiple products such as utilities and facilities

and are therefore difficult to allocate to a single effort. Companies typically prorate these costs across

multiple contracts. An analyst may allocate indirect costs to different efforts based on relative direct

cost.

1.5.6 Cost Model vs. Cost Estimate

The cost model is what the analyst builds and utilizes to characterize the behavior of the program and

produce a credible cost estimate. The cost estimate is a product of the cost model and the cost

projection of the subject program, given a set of cost model inputs. Section 2.1.6 describes the basic

elements of a cost model.

1.5.7 Cost Contributors vs. Cost Drivers

The question “What is driving the program cost?” elicits different answers depending on who is

answering the question. For some, the answer is the element(s) of the estimate structure that

contribute the most to the total cost of interest. For others it is the programmatic, technical,

performance, or schedule element that has the greatest impact on the total cost of interest. These

concepts can be summarized as:

• Program cost contributors: The element(s) of the estimate structure (generally at a level

lower than acquisition or O&S) that contribute the greatest cost to the program. Finding

data to support elements of the estimate structure that contribute only a small fraction to

the total cost are not as important as those that contribute significantly more to the total

cost interest. For example, CAPE O&S CES 2.1.1 Energy (Fuel, Petroleum, Oil and

Lubricants, Electricity) may be a high cost contributor to the overall O&S estimate.

• Program cost drivers: The inputs (hours, labor rates, quantities, weight, power, etc.) to

cost estimate methods that have the most influence on the total cost of interest. Using the

same 2.1.1 Energy example, either the price of a gallon of fuel or the fuel consumption rate

of the system is likely to drive the total fuel cost.

The notion of contributors and drivers applies to not only their influence on the point estimate

14

but

also their influence on cost or schedule risk/opportunity and uncertainty. A review of similar programs

14

This guide does not use the acronym PE. Point estimate is spelled out to avoid confusion with the budgeting

term program element.

18

and the benefit of subject matter expert (SME) guidance helps to identify potential program cost

contributors and drivers and, in turn, may influence the data collection focus.

1.5.8 Risk/Opportunity, and Uncertainty

A risk is a potential future event or condition that may have a negative effect on cost, schedule, and/or

performance. An opportunity is a potential future event or condition that may have a positive effect on

cost, schedule, and/or performance

15

. Risk/opportunities have three characteristics: a triggering event

or condition, the probability that event or condition will occur, and the consequence of the event or

condition should it occur.

Analysts often use the terms risk and uncertainty interchangeably. In fact, they are distinct from one

another. Uncertainty is the indefiniteness of the outcome of a situation

16

. Uncertainty captures the

entire range of possible positive and negative outcomes associated with a given value or calculated

result. In a cost estimating model, an analyst generally addresses uncertainty first. The analyst then

addresses risks/opportunities if and only if the uncertainty assessment has not already captured them.

Cost Estimating and Analysis Policy References

• CAPE, Operating and Support Cost-Estimating Guide, 2014, para. 5, “Overview of Life-Cycle

Costs” pg. 2-1

• Naval Center for Cost Analysis (NCCA)/ AFCAA, Software Development Cost Estimating

Handbook, 2008, Chapter 2.1 “The Defense Acquisition System”, pg. 2-1

• Department of the Army, Cost Analysis Manual, 2020, Chap 2 “Cost Analysis References”,

pg. 8

• AFCAA, AFI 65-508, 2018, Chapter 1 “Overview, Roles, And Responsibilities” pg. 4

• Missile Defense Agency

17

, Cost Handbook, 2012, Chap 1 “Missile Defense Agency Cost

Estimating Process Overview” pg.7

• GAO, Cost Estimating and Assessment Guide, 2009, Chapter 2 “Why Government Programs

Need Cost Estimates and the Challenges in Developing Theme” pg. 15

• National Aeronautics and Space Administration (NASA), Cost Estimating Handbook, 2015,

para. 1.2 “The NASA Acquisition and Management Processes”, pg. 1

Cost Estimating and Analysis Policy Training

The DAU Cost Estimating certification program for members of the Defense Acquisition Workforce offers

training relevant to cost estimating policy. Additional information on each course may be found in the

DAU iCatalog (

https://icatalog.dau.edu/).

• Business, Cost Estimating, Financial Management (BCF) 130 Fundamentals of Cost Analysis,

Lesson 2

• BCF 216 Applied Operating and Support Cost Analysis, Lesson 2

• BCF 250 Applied Software Cost Estimating, Lesson 4

• BCF 331 Advanced Concepts in Cost Analysis, Lesson 1

15

DoD, Risk, Issue, and Opportunity Management Guide for Defense Acquisition Programs, 2017, para. 1.1,

“Purpose”, pg. 3

16

NCCA, Joint Agency Cost Schedule Risk and Uncertainty Handbook (JA CSRUH), 2014, para. 1.2.2 “The Difference

Between Risk, Opportunity, and Uncertainty”, pg. 2

17

Missile Defense Agency is spelled out to avoid confusion with Milestone Decision Authority (MDA).

19

• Continuous Learning, Business (CLB) 009 Planning, Programming, Budgeting, and Execution

and Budget Exhibits (focuses on explaining the Planning, Programming, Budgeting and

Execution (PPBE) process, including the relationship of each phase to the systems acquisition

process)

• CLB 011 Budget Policy (focuses on appropriations and the funding policies associated with

each appropriation)

• CLB 014 Acquisition Reporting Concepts and Policy Requirements (introduces terms,

policies, and requirements)

• CLB 039 Cost Estimation Terminology (defines key cost estimating terms that are often

confused in cost estimating)

The International Cost Estimating and Analysis Association (ICEAA) publishes the Cost Estimating Body of

Knowledge (CEBoK). The follow modules are relevant to cost estimating policy:

• CEBoK v1.2, 2013, Module 1 “Cost Estimating Basics”

• CEBoK v1.2, 2013, Module 2 “Cost Estimating Techniques”

• CEBoK v1.2, 2013, Module 4 “Inflation”

• CEBoK v1.2, 2013, Module 14 “Contract Pricing”

The following course numbers starting with FMF refer to the course number assigned by the Financial

Management (FM) Certification process. Information on these courses (including eligibility

requirements) can be found in the FM myLearn system:

https://fmonline.ousdc.osd.mil/FMmyLearn/Default.aspx.

• FMF 1546 Business Case Analysis

• FMF 1558 DoD FM 101 - Fiscal Law

• FMF 4069 Budget Concepts, Policies, and Principles

• FMF 6599 DoD Basic Fundamentals and Operations of Budget

• FMF 1559 DoD FM 101 - Acquisition & Contracting

• FMF 1560 DoD FM 101 - Cost Analysis

• FMF 4050 Business Case Analysis - Mini-Course

• FMF 1551 QMT 490 - Current Topics in Cost Estimating

20

2.0 THE COST ESTIMATING PROCESS

This chapter provides an overview of the cost estimating process, and subsequent chapters provide

more detail on each step in the process. The analyst should always tailor the process to his/her specific

estimate or project.

DoD Cost Estimating Process

Analysts can have very different opinions on how best to arrive at a realistic cost estimate because the

number of viable paths to get there and the hurdles to surmount can appear endless. Over the course

of several years, the GAO worked diligently with dozens of national and international experts, both

government and industry, to develop a consensus on a clearly defined cost estimating process and to

document the best practices supporting that process. The result was the 2009 GAO Cost Estimating and

Assessment Guide. The GAO guide includes a process of 12 steps, which, if followed correctly, should

result in reliable cost estimates. It is common for DoD Components to reference this flow chart directly

or to provide a modified version adapted to their environment.

In deference to the many organizations that have developed flow charts to suit their unique

requirements (several of them can be found in Appendix B), Figure 1 defines a generalized cost

estimating process for DoD. This DoD version captures all of the steps in the GAO process and most of

the elements from Component guides, handbooks, and manuals. (See Appendix B.1 for the GAO

process.) The graphic in Figure 1 provides the framework for the discussions in this guide and gives the

reader a comprehensive overview of a DoD-centric process.

Figure 1: DoD Cost Estimating Process

21

Key features of Figure 1 include:

• Policy and the program definition tend to be products produced by authorities other than

the analyst, although it is important to have analysts participate in these efforts.

• The process recognizes the effort related to Data as fundamental to the success of any cost

estimate and often the most time/effort intensive activity. Figure 1 emphasizes that data is

at the center of the other steps in the process.

• The steps in the process are necessarily overlapping and iterative. It is common to be

performing parts of two or more steps simultaneously, and at any point, returning to

previous steps. A precise and repeatable serial flow for every cost estimating circumstance

simply does not exist.

The remainder of this section introduces the key iterative steps of the DoD cost estimating process.

2.1.1 Policy

The statutes, policies and guidance summarized in Chapter 1.0 identify the requirements for various

types of cost estimates, cost data collection, and other cost estimating related processes.

2.1.2 Program Definition

The program definition is a detailed description of a DoD program for use in preparing a cost estimate.

The primary elements, including the Cost Analysis Requirements Description (CARD), baseline system,

and program WBS, are examined in detail in Chapter 3.0.

2.1.3 Cost Estimate Basis

The analyst is responsible for clearly documenting the purpose and scope (including level of detail) of

the estimate. In particular, this step includes the framing assumptions, ground rules, and assumptions

(e.g., CY to express costs, life-cycle phases to be estimated, level of detail, need for what-if analysis, and