Economic Governance and EMU Scrutiny Unit (EGOV)

Directorate-General for Internal Policies

PE 755.707 - November2003

EN

Comparing Fed and

ECB monetary policies

Subtitle (optional)

IN-DEPTH ANALYSIS

Requested by the ECON committee

Monetary Dialogue Papers, November 2023

External

author:

Karl WHELAN

External author:

Karl WHELAN

IPOL | Economic Governance and EMU Scrutiny Unit (EGOV)

2 PE 755.707

Comparing Fed and ECB monetary policies

PE 755.707 3

Comparing Fed and ECB

monetary policies

Abstract

The European Central Bank and Federal Reserve have taken

similar approaches to tightening monetary policy to tackle high

inflation. However, relative to the US, euro area inflation has been

driven more by supply shocks and less by strong demand. The

euro area economy is also weakening while the US economy is

still growing solidly. Markets expect the Fed to ease more than

the ECB in 2024 but falling inflation and a weak euro area

economy may see the opposite occur.

This document was provided by the Economic Governance and

EMU Scrutiny Unit at the request of the Committee on Economic

and Monetary Affairs (ECON) ahead of the Monetary Dialogue

with the ECB President on 27 November 2023.

IPOL | Economic Governance and EMU Scrutiny Unit (EGOV)

4 PE 755.707

This document was requested by the European Parliament's Committee on Economic and Monetary

Affairs.

AUTHORS

Karl WHELAN, University College Dublin

ADMINISTRATOR RESPONSIBLE

Giacomo LOI

Drazen RAKIC

Maja SABOL

EDITORIAL ASSISTANT

Adriana HECSER

LINGUISTIC VERSIONS

Original: EN

ABOUT THE EDITOR

The Economic Governance and EMU Scrutiny Unit provides in-house and external expertise to support

EP committees and other parliamentary bodies in shaping legislation and exercising democratic

scrutiny over EU internal policies.

To contact Economic Governance and EMU Scrutiny Unit or to subscribe to its newsletter please write

to:

Economic Governance and EMU Scrutiny Unit

European Parliament

B-1047 Brussels

E-mail: [email protected]

Manuscript completed in November 2023

© European Union, 2023

This document was prepared as part of a series on “Comparative analysis of monetary policy and

inflation dynamics in the euro area and the United States”, available on the internet at:

https://www.europarl.europa.eu/committees/en/econ/econ-policies/monetary-dialogue

DISCLAIMER AND COPYRIGHT

The opinions expressed in this document are the sole responsibility of the authors and do not

necessarily represent the official position of the European Parliament.

Reproduction and translation for non-commercial purposes are authorised, provided the source is

acknowledged and the European Parliament is given prior notice and sent a copy.

Comparing Fed and ECB monetary policies

PE 755.707 5

CONTENTS

LIST OF ABBREVIATIONS 6

LIST OF FIGURES 7

LIST OF TABLES 7

EXECUTIVE SUMMARY 8

INTRODUCTION 9

ECONOMIC DEVELOPMENTS IN THE US AND THE EURO AREA 10

2.1. Inflation 10

2.2. Other economic indicators 17

PROFITS AND WAGES 20

OUTLOOK FOR POLICY 26

REFERENCES 29

IPOL | Economic Governance and EMU Scrutiny Unit (EGOV)

6 PE 755.707

LIST OF ABBREVIATIONS

CPI

Consumer price index

ECB

European Central Bank

GDP

Gross domestic product

HICP

IMF

Harmonised index of consumer prices

International Monetary Fund

NFC

Nonfinancial corporation

TLTRO

Targeted longer-term refinancing operations

Comparing Fed and ECB monetary policies

PE 755.707 7

LIST OF FIGURES

Figure 1: Year-over-year price inflation for the US CPI (red) and euro area HICP (blue), in % 11

Figure 2: Consumer energy prices (indexed to equal 1 in December 2020) in the US (red) and euro

area (blue) 11

Figure 3: IMF estimates of structural budget balance as a share of GDP in the US (red) and euro area

(blue) 12

Figure 4: Natural gas prices for consumers (indexed to equal 100 in December 2020) in the US (red)

and euro area (blue) 12

Figure 5: Year-over-year food price inflation for consumers in the US (red) and euro area (blue), in % 13

Figure 6: Year-over-year core consumer price inflation (excluding food and energy) for the US CPI

(red) and euro area HICP (blue), in % 15

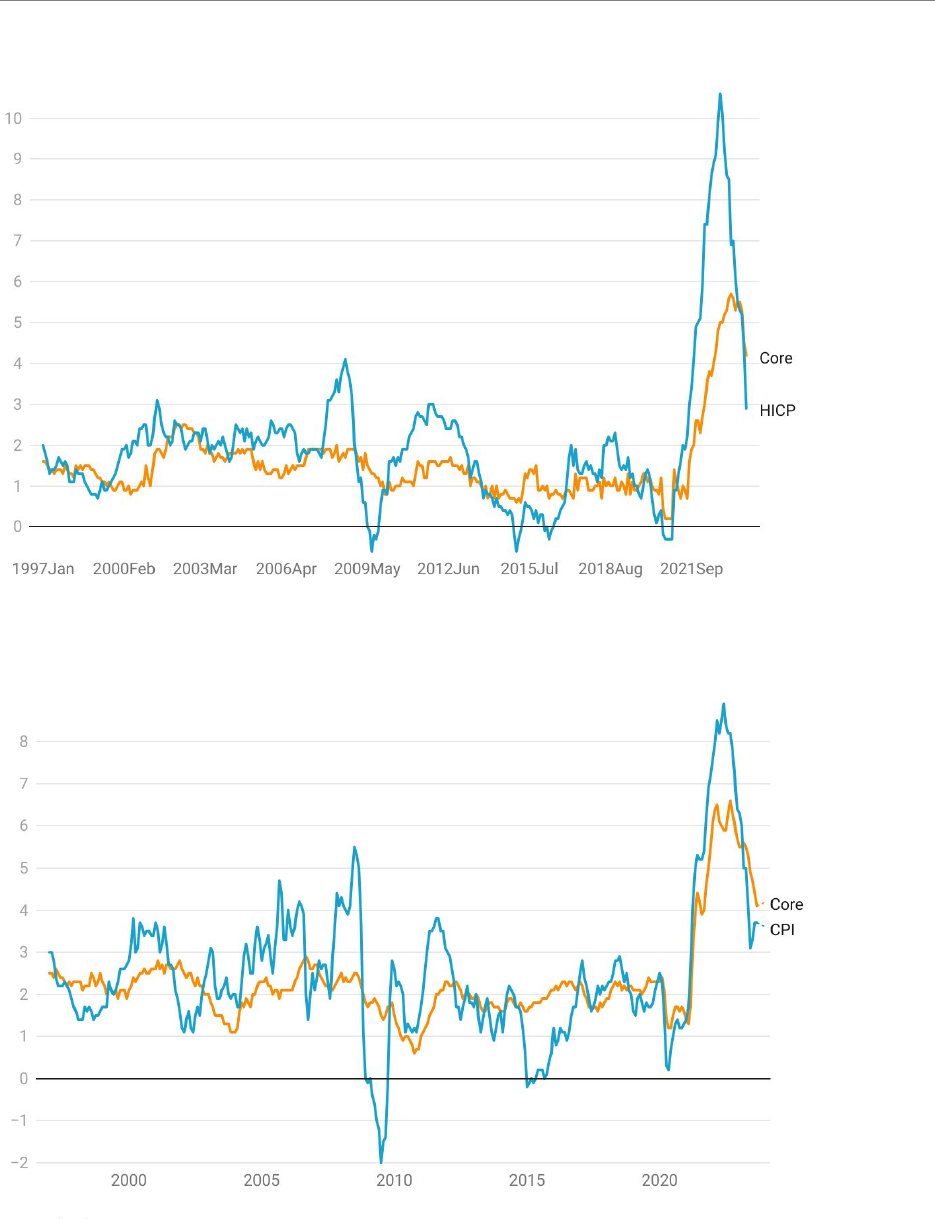

Figure 7: Year-over-year euro area HICP inflation (blue) and year-over-year core HICP inflation

(excluding food and energy) (orange), in % 16

Figure 8: Year-over-year US CPI inflation (blue) and year-over-year core CPI inflation (excluding food

and energy) (orange) 16

Figure 9: Year-over-year GDP growth in the US (red) and euro area (blue), in % 18

Figure 10: Euro area monthly data on year-over-year growth in total loans to households and to

nonfinancial corporations (NFCs), in % 19

Figure 11: US quarterly year-over-year growth in total loans to households and to nonfinancial

corporations (NFCs), in % 19

Figure 12: Quarterly data for shares of income generated by US nonfinancial corporations expressed

as a share of the sector’s gross value added 21

Figure 13: Quarterly data for shares of income generated by US non-financial corporations expressed

as a share of the sector’s gross value added 21

Figure 14: Annual growth rate of hourly wages in the US and the euro area, in % 24

Figure 15: Indeed wage tracker, measure of annual percentage salary increases (3-month average) for

the US and euro area 24

Figure 16: Average inflation expectations from the ECB’s Survey of Professional Forecasters, in % 25

Figure 17: Key policy rates for the Federal Reserve and ECB 27

Figure 18: Balance sheet reduction for the Federal Reserve and ECB 28

LIST OF TABLES

Table 1: Coefficients from a regression of HICP inflation on HICP inflation from 12 months earlier and

core inflation from 12 months earlier 15

Table 2: Haskel’s decomposition of 2022 consumer price inflation in the US, UK and euro area 22

IPOL | Economic Governance and EMU Scrutiny Unit (EGOV)

8 PE 755.707

EXECUTIVE SUMMARY

• The European Central Bank (ECB) and Federal Reserve (Fed) have taken similar approaches

over the past 18 months to tightening monetary policy to tackle high inflation. Since early

2022, the Fed has raised its policy rate by 5.25% and the ECB has raised its key deposit facility rate

by 4.5%.

• This similar response has occurred despite some important differences in the factors driving

inflation in the two economies. Relative to the US, euro area inflation has been driven more by

supply shocks. In particular, euro area inflation in 2022 was largely fuelled by the food and energy

price increases triggered by Russian invasion of Ukraine.

• Aggregate demand has been weaker in the euro area than the US, partly reflecting

differences in fiscal policies. US fiscal policy has been highly expansionary this year, reflecting tax

cuts and spending commitments in President Biden’s Inflation Reduction Act and Creating Helpful

Incentives to Produce Semiconductors (CHIPS) and Science Act.

• The surge in food and energy prices triggered by the Russian invasion of Ukraine has been a

significant “terms of trade” effect for the euro area economy. This has raised inflation and

reduced real incomes. In contrast, the US is now a net exporter of energy so this shock did not have

such a negative impact.

• Euro area inflation was 2.9% in October (according to the Eurostat flash estimate) so it is

getting close the ECB’s target. “Core” inflation (excluding food and energy prices) was 4.2%. Core

inflation is sometimes interpreted as the “underlying” inflation rate but this paper provides some

arguments for why this is not always the case. In the presence of a large supply shock, core inflation

can be a lagging rather than a leading indicator.

• There is evidence that higher profit margins for firms have played a role in generating high

inflation in the euro area over the past year. However, the size of this effect is a lot smaller than

the impact of the “terms of trade” shock. Also, focusing on the mechanical determinants of higher

prices (how much of these lead to higher profits and how much pay for higher wages) can miss the

underlying supply and demand factors that drive inflation.

• The euro area economy is weakening while the US economy is still growing steadily.

According to Eurostat preliminary flash estimate, year-over-year growth in the euro area in the third

quarter was basically 0%, while it was 3% in the US. The euro area economy is likely to enter

recession this quarter.

• Wage growth in the euro area is relatively high but it is still lower than inflation and there is

evidence that salary growth is falling. Further declines in inflation and a weakening labour

market due to the economic slowdown also point towards slowing wage inflation.

• Markets expect the Fed to ease more than the ECB in 2024 but a weak euro area economy

and falling inflation may see the opposite occur.

Comparing Fed and ECB monetary policies

PE 755.707 9

INTRODUCTION

The surge in inflation around the world since the easing of the pandemic in 2021 has seen all major

central banks implement monetary tightening with the aim of bringing inflation back to moderate

levels. While the timings of their policy decisions have been somewhat different, the overall patterns

of tightening introduced by the Fed and the ECB has been similar. Starting in March 2022, the Fed

raised the mid-range of its target for the federal funds rate from 0.13% to its current value of 5.38%.

The ECB raised its deposit facility rate from minus 0.5% to 0% in July 2022 and has since raised it further

to its current level of 4%.

In this paper, we will look at the factors that have driven these decisions and discuss the prognosis for

future policy rates for both the Fed and the ECB. The principal theme of the paper is that despite some

similarities in the path of inflation and in the policy response across the two cases, there are some

important differences in the forces driving inflation and in the current situation faced by the two central

banks.

While both the US and the euro area experienced negative supply shocks, the supply shocks due to the

Russian invasion of Ukraine have had a larger impact in raising inflation via higher food and energy

prices in the euro area than in the US. In contrast, as we will discuss below, highly aggressive fiscal

policy in the US has contributed to a much stronger path for aggregate demand in the US than in the

euro area. The US economy continues to expand at a steady rate, with third quarter real GDP up 2.9%

from a year earlier while the euro area economy in the third quarter was only 0.1% larger than a year

earlier and the most recent quarter showed a small contraction of 0.1%.

The ECB’s October Survey of Monetary Analysts showed its sample of experts predicting that the ECB

will not cut interest rates until the third quarter of next year and that the deposit facility rate will be

3.25% at the end of 2024, an easing of 75 basis points. The Fed’s September Survey of Market

Participants showed an expectation that the Fed will start cutting policy rates in the first quarter of next

year and that its mid-range target policy rate will be 3.88% at the end of next year, an easing of 150

basis points.

1

I argue in this paper that the likely errors in these scenarios lie with anticipating too much easing from

the Fed and too little easing from the ECB. With the US economy still growing at a steady pace, the Fed

may not see inflation cooling as much as it is currently hoping for and further rate rises may be required.

In contrast, falling inflation and a weakening economy may push the ECB to cut policy rates relatively

soon.

The paper is structured as follows. Section 2 presents evidence on how inflation has behaved in the US

and the euro area since 2020, discussing the role of supply and demand factors. Section 3 provides a

discussion of the contribution of wage inflation and firms’ operating surpluses to inflation and repeats

some evidence from a recent paper by Haskel (2023) on the impact of these factors as well as terms of

trade effects on inflation in the euro area. Section 4 concludes with an assessment of the recent policy

approach of the ECB and a discussion of the prospects for policy over the next year.

1

The Fed survey is available at https://www.newyorkfed.org/medialibrary/media/markets/survey/2023/sep-2023-smp-

results.pdf. The ECB survey is available at

https://www.ecb.europa.eu/stats/ecb_surveys/sma/shared/pdf/ecb.smar231030_october.en.pdf

IPOL | Economic Governance and EMU Scrutiny Unit (EGOV)

10 PE 755.707

ECONOMIC DEVELOPMENTS IN THE US AND THE EURO AREA

This section discusses economic developments in the US and euro area economies. We will first discuss

the recent behaviour of inflation and then describe the economic conditions likely to influence its

future path.

2.1. Inflation

Figure 1 shows headline consumer price inflation for the US and the euro area. The chart shows some

clear similarities in the recent behaviour of inflation: In both cases, inflation slumped to close to or

below zero during the initial phases of the COVID-19pandemic, then began to increase during 2021,

reaching peaks close to 10% in 2022 before easing more recently. These common elements hide some

important differences in the underlying driving forces.

Inflation started to rise during 2021 as successful vaccine rollouts and rising immunity began to reduce

the impact of the pandemic on the economy. Energy prices, which had slumped during early stages of

the COVID-19 pandemic, began to rise and with demand for services still weakened by sporadic

lockdowns, goods prices began to increase globally (see Figure 2). The US saw a faster increase in

inflation than the euro area, due in part to a less-focused approach to government supports which saw

a much larger fiscal stimulus to the economy than in Europe, including three different rounds of

stimulus cheques sent to households. Figure 3 shows the International Monetary Fund (IMF)’s

estimates of the structural budget balance in the areas. The IMF estimate the structural budget deficit

in the US increased by 5.4% of GDP between 2019 and 2021 while the change in this measure for the

euro area was 3% of GDP.

In January 2022, a month prior to the Russian invasion of Ukraine, “headline” inflation for the euro area’s

Harmonised Index of Consumer Prices (HICP) was 5.1% but “core” inflation (excluding food and energy

prices) was only 2.3%. So at that point, inflation in the euro area was largely above target because of

global issues. In contrast, in January 2022, headline CPI inflation in the US was 7.6% and core CPI

inflation was 6.1%, so US inflation problems clearly went beyond the global supply and demand factors

influencing energy and food prices.

The Russian invasion of Ukraine then had a much greater effect on inflation in the euro area than in the

US. Headline euro area inflation jumped to 7.4% in March 2022 and moved up to a peak of 10.6% in

October 2022, going higher than the peak rate in the US. The key drivers were higher food and energy

prices. Figure 3 shows that prior to the Russian invasion, energy prices in the US and euro area had

increased by similar amounts but after the invasion, they spiked much higher in Europe than in the US.

This was primarily driven by higher prices for natural gas: Figure 4 shows that natural gas prices in the

euro area peaked at about 120% higher than their December 2022 level, compared with a 60% peak

increase in the US.

Furthermore, Figure 5 shows that food price inflation also spiked higher in Europe after the Russian

invasion of Ukraine, jumping from 3.5% in January 2022 to a peak of 15.5% in March 2023. The effects

of the war-related supply shocks are now easing and headline inflation in the euro area in October was

2.9% compared with 3.7% for the most recently available reading for the US CPI inflation rate from

September 2023.

Comparing Fed and ECB monetary policies

PE 755.707 11

Figure 1: Year-over-year price inflation for the US CPI (red) and euro area HICP (blue), in %

Source: Author’s calculations based on data from ECB Data Portal and the Federal Reserve Bank of St. Louis’s FRED database.

Figure 2: Consumer energy prices (indexed to equal 1 in December 2020) in the US (red) and

euro area (blue)

Source: Author’s calculations based on data from ECB Data Portal and the Federal Reserve Bank of St. Louis’s FRED database.

IPOL | Economic Governance and EMU Scrutiny Unit (EGOV)

12 PE 755.707

Figure 3: IMF estimates of structural budget balance as a share of GDP in the US (red) and

euro area (blue)

Source: Author’s calculations based on data from the IMF World Economic Outlook Database.

Figure 4: Natural gas prices for consumers (indexed to equal 100 in December 2020) in the

US (red) and euro area (blue)

Source: Author’s calculations based on data from ECB Data Portal and the Federal Reserve Bank of St. Louis’s FRED database.

Comparing Fed and ECB monetary policies

PE 755.707 13

Figure 5: Year-over-year food price inflation for consumers in the US (red) and euro area

(blue), in %

Source: Author’s calculations based on data from ECB Data Portal and the Federal Reserve Bank of St. Louis’s FRED database.

As illustrated in Figure 1, inflation in both the US and euro area appears to have peaked, so central

banks are now focusing on how long it will take it to return to target. In these debates, discussion often

focuses on so-called “core” measure of inflation. This measure excludes food and energy prices because

they tend to be more volatile than other prices. One has to be careful in interpreting core inflation, for

a few reasons.

First, central banks with a responsibility for price stability such as the ECB are not charged with keeping

prices stable apart from food and energy. The price stability that matters for the public is for the full

basket of goods and services. So by this measure, the ECB is already very close to its price stability goal,

since headline inflation had fallen to 2.9% in October. Core inflation being well above the ECB’s target,

on its own, is irrelevant.

Second, removing food and energy prices does not give us a measure of inflation that is immune from

the influence of supply shocks. Energy is a key input for every sector and the Ukraine-related jump in

gas prices contributed to higher prices for services and manufactured goods in Europe. Food also plays

a prominent role in household budgets and thus high food price inflation places upwards pressure on

wages, which in turn influence other prices. These factors seem to be the most likely explanation for

why core inflation in the euro area increased after the Russian invasion of Ukraine, rising from 2.3% in

January 2022 to a high of 5.7% in March of this year (see Figure 6). Core inflation is now easing in both

the US and the euro area. Much of this likely reflects the indirect effect of falling energy prices and

falling food price inflation, though in the euro area it may also reflect the impact of a slowing economy.

Third, core inflation is sometimes considered to be a more useful measure of “underlying” inflation.

2

In

other words, core inflation is sometimes considered a better measure of what inflation is going to be

2

ECB officials often refer to measures of HICP inflation excluding various items as measures of “underlying inflation”. For

example, see slide 4 of this presentation by the ECB Executive Board member Philip Lane.

https://www.ecb.europa.eu/press/key/date/2023/html/ecb.sp231108~37a8ac4e2b.en.pdf

IPOL | Economic Governance and EMU Scrutiny Unit (EGOV)

14 PE 755.707

over the next year or two. At times, core inflation measures can perform this function reasonably well.

For example, Figure 1 shows that at various times after the global financial crisis, euro area HICP

inflation rose above the ECB’s 2% target but Figure 6 shows that core inflation never did. Each of the

times inflation rose above 2%, it was because of temporary jumps in food and energy prices which were

subsequently reversed. Does this mean that October’s core inflation reading of 4.2% is a better

indicator of what inflation is likely to be over the next year? Not necessarily.

Despite the example just given, there is little statistical basis for the idea that core inflation is necessarily

the best predictor of future inflation. For example, Table 1 below reports ordinary least squares

regression using data on HICP inflation since the introduction of the euro. The regression uses both

HICP inflation from 12 months earlier and core HICP inflation to predict current inflation. The table

shows that past headline inflation has been a statistically significant predictor of current inflation but

that core HICP inflation has not. Note also, however, that the fit of this linear regression is poor, with an

R-squared of 0.19. This means that the model does not do a particularly good job of fitting the data,

meaning inflation in the euro area has not been easy to predict on the basis of its own past values.

Also, when there is a large supply shock such as the Ukraine-related shock, it is likely that core inflation

represents a lagging indicator of inflation rather than a leading one. In both the US and the euro area,

core inflation measures rose slower than headline inflation and peaked later as “second-round” effects

of supply shocks on other prices took time to feed through. See Figures 7 and 8. In the euro area,

headline inflation peaked at 10.6% in October 2022 while core inflation peaked at 5.7% five months

later. It is likely that the fall in energy prices from their peak levels will take time to feed through into

lower core inflation. The latest readings for core inflation being higher than headline inflation isn’t

necessarily a sign that headline inflation is going to rise. It may just be a sign that core inflation is going

to fall further in the coming months.

3

3

The different possible arguments that can be used in relation to headline and core inflation can sometimes lead to people

adjusting the arguments they use in order to justify their preferred monetary policy stance. For example, after an inflation-

raising supply shock, you may see inflation “hawks” moving from first emphasising that headline inflation is the target rate

that central banks need to focus on but then switching later to emphasising that core inflation is measuring “underlying”

inflation when the supply shock has been reversed and headline inflation is lower than core. Similarly inflation “doves” may

make the opposite switch.

Comparing Fed and ECB monetary policies

PE 755.707 15

Figure 6: Year-over-year core consumer price inflation (excluding food and energy) for the

US CPI (red) and euro area HICP (blue), in %

Source: Author’s calculations based on data from ECB Data Portal and the Federal Reserve Bank of St. Louis’s FRED database.

Table 1: Coefficients from a regression of HICP inflation on HICP inflation from 12 months

earlier and core inflation from 12 months earlier

Explanatory variables Coefficients

Constant 1.37 (0.26)

HICP inflation (12 months earlier) 0.62 (0.12)

Core HICP inflation (12 months earlier) -0.29 (0.27)

R-squared 0.19

Source: Author’s own calculation based on Eurostat data.

Note: Sample is January 2000 to October 2023. Standard errors in brackets.

IPOL | Economic Governance and EMU Scrutiny Unit (EGOV)

16 PE 755.707

Figure 7: Year-over-year euro area HICP inflation (blue) and year-over-year core HICP

inflation (excluding food and energy) (orange), in %

Source: Author’s calculations based on data from ECB Data Portal.

Figure 8: Year-over-year US CPI inflation (blue) and year-over-year core CPI inflation

(excluding food and energy) (orange)

Source: Author’s calculations based on data from the Federal Reserve Bank of St. Louis’s FRED database.

Comparing Fed and ECB monetary policies

PE 755.707 17

2.2. Other economic indicators

Forecasting the economy is hard and inflation has historically been particularly difficult to forecast.

Some of the most important factors influencing the future path of inflation are innately unpredictable.

For example, a serious conflict in the Middle East could produce an even larger supply shock than the

ones just experienced. But, absent such a shock, the key influence on inflation over the next few years

is likely to be the state of the economy. Here again, there are some clear differences between the US

and the euro area.

The euro area economy has proved more resilient over the past year than I had anticipated. In the

September 2022 briefing paper, I wrote that the euro area was likely to enter recession in 2023 under

the pressure of higher energy prices and monetary tightening.

4

This didn’t happen as quickly as I

thought it would but the latest data show the euro area economy has flattened out over the past year

and now seems likely to enter recession this quarter.

5

(See Figure 9). Readings for leading indicators

that tend to forecast GDP, such as purchasing managers indices, are consistent with economic

contraction. Indeed, as Figure 9 shows, each of the previous times the euro area economy’s growth has

decelerated to zero, the result has been recessions lasting at least a few quarters.

In contrast, the US economy has continued to surprise people by performing well despite a substantial

monetary tightening from the Fed. The most recent data show real GDP in the third quarter up 3%

relative to a year earlier and the monthly payroll reports continue to show increases in employment.

There are some areas of weakness such as construction sector and the delayed effects of the Fed’s

interest rate increases may well tip the US economy into recession in the coming months but, as of

now, there is a definite risk that the strong economy results in US inflation remaining higher for longer

than the Fed is currently now anticipating, triggering further policy rate increases.

The contrast in economic performance between the US and the euro area likely has a number of

sources. First, US fiscal policy has been highly expansive in 2023. As shown in Figure 2, the IMF’s

estimate of the US structural budget balance increased from a deficit of 6.5% of GDP in 2022 to 8.8% of

GDP this year, implying an additional 2.3% of fiscal stimulus. This unusually procyclical fiscal policy

stems from the spending commitments in President Biden’s Inflation Reduction Act and CHIPS and

Science Act, both of which were passed in August 2022.

6

The Inflation Reduction Act has provided

substantial tax breaks to the private sector to encourage investment in green energy technologies and

the CHIPS and Science Act is providing subsidies for investments in the semiconductor sector. This has

lead to a boom in construction of manufacturing plants, which was up 60 % year on year in September.

7

In contrast, the IMF estimates the structural budget deficit for the euro area is effectively unchanged

this year at 2.7% of GDP, so European fiscal policy is not offsetting the contractionary impacts of fiscal

policy.

Second, the euro area is a net importer of energy while the US has become a net exporter of energy in

recent years. While US households have been hurt by higher energy prices, these higher prices are

benefiting firms and workers in the energy sector. In the language of economists, Europe has had a

large “terms of trade” shock because of an increase in the price of its imports relative to its exports.

4

Whelan (2022).

5

I should perhaps have factored in the legendary economist Rudi Dornbusch’s warning that “In economics, things take longer to happen

than you think they will, and then they happen faster than you thought they could.”

6

https://www.thetaxadviser.com/issues/2023/jun/what-the-inflation-reduction-and-chips-acts-could-mean-for-us-

importers.html

7

Data on this is available from the St. Louis Fed at https://fred.stlouisfed.org/series/TLMFGCONS

IPOL | Economic Governance and EMU Scrutiny Unit (EGOV)

18 PE 755.707

These kinds of shocks make people on average worse off, while the net impact on US real GDP of the

higher energy prices has been essentially neutral.

One common pattern having a negative influence on economic growth in both the US and Europe is

that monetary tightening is having its expected negative impact on the supply of credit. Figures 10 and

11 show year-over-year growth in total loans to households and to non-financial corporations for both

the euro area (Figure 10) and the US (Figure 11). Both countries show a sharp deceleration in the supply

of credit and the (slightly more recent) latest data for the euro area suggest we are likely to see year-

on-year declines in the credit supply to both firms and households over the next year, just as was seen

previously during the global financial crisis and the euro crisis.

With much of the impact of the ECB’s tighter policy still to be felt, the data suggest the state of the euro

economy is likely to be a drag on inflation over the coming year.

Figure 9: Year-over-year GDP growth in the US (red) and euro area (blue), in %

Source: Author’s calculations based on data from ECB Data Portal and the Federal Reserve Bank of St. Louis’s FRED database.

Comparing Fed and ECB monetary policies

PE 755.707 19

Figure 10: Euro area monthly data on year-over-year growth in total loans to households

and to nonfinancial corporations (NFCs), in %

:

Source: Author’s calculations based on data from the ECB Data Portal. Last observation is September 2023.

Figure 11: US quarterly year-over-year growth in total loans to households and to

nonfinancial corporations (NFCs), in %

Source: Author’s calculations based on data from the Federal Reserve Board’s Financial Accounts (Z1 release).

Last observation is 2023:Q2.

IPOL | Economic Governance and EMU Scrutiny Unit (EGOV)

20 PE 755.707

PROFITS AND WAGES

The fundamental causes of high global inflation have been some negative supply shocks and strong

aggregate demand due to stimulus from macroeconomic policies. However, commentary on recent

inflation has often focused, not on the fundamental causes, but on the mechanics of how inflation. In

other words, people focus on the higher profits and/or wages that emerge from higher prices and then

view these as the problem.

For example, a lot of commentary has focused on the idea of “greedflation”, i.e. that higher inflation

represents a surge in profits from corporations taking advantage of economic conditions to raise their

profit margins. “Greedflation” is not a particularly useful term. Corporations have always sought to

maximise their profits and it seems unlikely that there has been a sudden surge in the “greediness” of

corporate CEOs. However, as discussed in a widely-publicised paper by Weber and Wasner (2023),

profits of US non-financial corporations as a share of their value added have reached a multi-decade

high during this period of high inflation.

As noted, focusing on wages and profits might be not particularly useful way to understand what is

driving high inflation. However, while these explanations of inflation may be “mechanical”, it is still

worth documenting the mechanics.

Figure 12 presents information on the shares of income generated by US non-financial corporations.

The data are expressed as fractions of total gross value added generated by the corporations. The green

line shows the fraction of value added that was spent on compensation for employees. The blue line

shows the fraction of value added that went to the government in the form of production taxes and

the black line shows the remaining amount, labelled “gross operating surplus.” The red line is corporate

profits – this deducts depreciation and interest costs from gross operating surplus.

Figure 12 shows that there has been a spike in the profit share of gross value added since the start of

the COVID-19 pandemic. At first, this was triggered by a cut in production taxes but this higher level

has been sustained since then even as production tax rates returned to normal. If this increase was fully

due to higher prices that translated into higher revenues, then we would expect a similar-sized increase

in the income share of gross operating surplus but this share has increased by about half as much

relative to pre-pandemic levels. This suggests that as well as higher prices, other factors such interest

and depreciation costs have contributed to the multi-decade high for corporate profits as a share of

value added.

As of the most recent data, the shares of both gross operating surplus and employee compensation

are both relatively close in the most recent US data to their pre-COVID-19 levels. The compensation

share is relatively low by historical standards and the operating surplus share is relatively high but, as

Figure 12 shows, this reflects a pattern that emerged during the early 2000s and which prevailed during

a period of low inflation.

Figure 13 shows corresponding data for gross operating surplus and compensation shares for the total

euro area economy. The latest data, from 2023:Q2, show the compensation share of gross value added

(which spiked upwards in 2020) has returned to pre-pandemic levels while the gross operating surplus

share is a bit higher than prior to the pandemic. This suggests that, at least in a mechanical sense, higher

profit margins have had an impact on euro area inflation.

Comparing Fed and ECB monetary policies

PE 755.707 21

Figure 12: Quarterly data for shares of income generated by US nonfinancial corporations

expressed as a share of the sector’s gross value added

Source: Author’s calculations based on data Table 1.14 of the National Income and Product Accounts published by the US

Department of Commerce Bureau of Economic Analysis.

Figure 13: Quarterly data for shares of income generated by US non-financial corporations

expressed as a share of the sector’s gross value added

Source: Author’s calculations based on data from the ECB’s sectoral accounts obtained from the ECB Data Portal.

In a paper released earlier this year, Jonathan Haskel (2023) presented a useful way to summarise the

mechanical forces contributing to inflation. Haskel notes that nominal GDP is the product of real GDP

and the so-called GDP deflator price index. Nominal GDP can also be described as the sum of a number

of different components showing where the income earned by the sector ended up.

IPOL | Economic Governance and EMU Scrutiny Unit (EGOV)

22 PE 755.707

For example, nominal GDP can be written as:

Nominal GDP = Compensation + Operating Surplus + Production Taxes (1)

which means that all income earned is either paid to workers, or to the government in production taxes

with the rest left to firms.

Haskel (2023) notes that if we divided all elements of this equation by real GDP, we end up with an

identity explaining the GDP deflator. Taking percentage changes of both sides of this identity gives us

a mechanical decomposition of the sources of changes in this measure of the price level. However,

there is little reason to be interested in changes in the GDP deflator because it only measures the cost

of good produced within an area. What the public care about is the cost of the full basket of consumer

products, including imported goods. Haskel (2023) extends his decomposition to consumer prices,

including the impact of terms of trade effects as well as some other items. He then presented his

analysis decomposing inflation in 2022 for the US, the United Kingdom (UK) and the euro area. I have

repeated a table from his paper as Table 2 below.

Table 2: Haskel’s decomposition of 2022 consumer price inflation in the US, UK and euro

area

Source: Haskel (2023).

This table shows that labour costs contributed 1.6% to euro area annual inflation of 8.4% last year and

that capital costs (as measured by gross operating surplus) contributed 2.8%. Since total capital costs

are smaller than total labour costs (though not by much in the euro area), we would expect their

contribution to this decomposition in normal times to be lower than the contribution of labour costs.

This confirms that higher gross profit margins for firms has been an element of recent euro area

Comparing Fed and ECB monetary policies

PE 755.707 23

inflation, though Haskel notes that government energy subsidies likely played an important role in

shielding firm profits in 2022.

The single most important item, however, directly accounting for almost half of euro area inflation has

been the terms of trade effect due to higher food and energy costs. When we consider the likely impact

of higher food and energy prices on wage costs, it seems likely that food and energy costs have

accounted for most of the surge in inflation over the last year.

Of course, while some people worry about excessive profits, ECB officials are always concerned that

wages could rise by more than they expect, triggering a wage-price spiral. Figure 14 reports measures

of average hourly compensation for the US and the euro area. The figure shows that hourly wages in

the euro area have grown at a slower rate than inflation but the recent readings are perhaps

uncomfortably high. This will be an indicator the ECB will pay close attention to but it seems likely that

with headline inflation receding, wage inflation will also decline.

More reassuring is recent data from Indeed, a company that posts jobs on its website. Indeed publish a

“wage tracker” for the euro area and also for several individual countries including the US. They

calculate an average annual rate of change based on the salaries posted on their website, controlling

for change in the composition of jobs posted.

8

Figure 15 shows data from this measure for the US and

the euro area show that annualised salary increases in the euro area have been below the US since 2020

and appear to have peaked in late 2022.

Another re-assuring sign is that measures of near-term inflation expectations are declining. Figure 16

shows average inflation expectations for one year ahead, for two years ahead and for the longer-term

from the ECB’s Survey of Professional Forecasters.

9

The one-year and two-year forecasts are both

converging towards the ECB’s 2% inflation target while the long-term expectation has remained very

close to 2%. The ECB will hope these restrained expectations about inflation will be reflected in

upcoming wage deals, thus heading off a wage-price spiral.

8

The methodology underlying these data is described in Adrjan and Lydon (2022).

9

https://www.ecb.europa.eu/stats/ecb_surveys/survey_of_professional_forecasters/html/table_hist_hicp.en.html

IPOL | Economic Governance and EMU Scrutiny Unit (EGOV)

24 PE 755.707

Figure 14: Annual growth rate of hourly wages in the US and the euro area, in %

Source: Eurostat and US Bureau of Labor Statistics.

Notes: For the US, data is the annual percent change in nonfarm hourly compensation for all workers. For the euro area, data

is the annual percent change in Eurostat’s labour cost index.

Figure 15: Indeed wage tracker, measure of annual percentage salary increases (3-month

average) for the US and euro area

Source: Indeed. https://github.com/hiring-lab/indeed-wage-tracker.

Comparing Fed and ECB monetary policies

PE 755.707 25

Figure 16: Average inflation expectations from the ECB’s Survey of Professional Forecasters,

in %

Source: ECB.

IPOL | Economic Governance and EMU Scrutiny Unit (EGOV)

26 PE 755.707

OUTLOOK FOR POLICY

As noted already, the monetary policies of the Fed and the ECB have been relatively similar over the

past year and a half. Figure 17 shows that while the total increase in policy interest rates has been

slightly higher for the Fed than for the ECB (recalling that the ECB deposit rate began at minus 50 basis

points), the pattern of the increases have been relatively similar.

Beyond interest rates, Figure 18 shows that the ECB has reduced its balance sheet far more than the

Fed which may mean the total impact of its monetary tightening on the economy may be closer to the

Fed’s actions than the interest rate chart suggests. That said, the Eurosystem’s balance sheet reduction

has been due to banks repaying their various TLTRO loans, partly because the ECB reneged on its policy

of allowing banks to make “free money” from getting negative interest rate loans once this policy no

longer suited its goals. TLTROs were designed to influence the economy by increasing the supply of

credit to firms and households.

10

However, in an environment of tightening credit conditions due to

higher interest rates, it is not clear that reduced TLTRO borrowing from banks is having an important

additional effect on the supply of credit.

I have argued here that, despite the apparent similarities in the behaviour of inflation and in the

response of central banks, the factors underlying high inflation in the euro area have been

substantively different to those in the United States. Supply shocks have been more important in

driving euro area inflation and excessive aggregate demand has played a smaller role. The classic New

Keynesian recommendation is for central banks to raise interest rates more than one-for-one in

response to changes in inflation driven by aggregate demand but it is less clear that temporary

aggregate supply shocks require such an aggressive response.

11

Do these difference mean the ECB has tightened policy by too much? On balance I think the answer is

No.

The ECB had little choice other than to implement a substantial rise in policy rates. Failure to respond

seriously to the first big spike in inflation since the introduction of the euro would have damaged the

ECB’s credibility. The containment of inflation expectations that I have just documented has likely been

dependent on the strong message the ECB has sent with its policy response. In addition, a decision to

not raise interest rates in line with the Fed’s actions would have triggered a large depreciation of the

euro against the dollar, which would have further worsened the already serious problem with import

price inflation.

Where I think the difference in circumstances between the US and the euro area is more likely to matter

is in what happens from here onwards. As noted above and displayed in Figure 17, the Fed’s Survey of

Market Participants in September showed an expectation that it would start cutting policy rates in the

first quarter of next year and that it would ease rates by 150 basis points by the end of next year.

12

By

contrast, the ECB’s October Survey of Monetary Analysts showed its sample of experts predicting that

10

For example, in a 2019 speech, ECB executive board member Philip Lane discussed the impact of TLTROs as follows “The

upshot of cheaper bank funding is higher credit volumes and lower lending rates to the wider economy via the bank

lending channel” https://www.ecb.europa.eu/press/key/date/2019/html/ecb.sp190701~0c1fa3c8fc.en.html.

11

In a paper presented at the ECB’s Forum on Central Banking in Sintra in June, Bandera et al (2023) discuss the various ways

that supply shocks may produce a different response from central banks than supply shocks.

12

https://www.newyorkfed.org/medialibrary/media/markets/survey/2023/sep-2023-smp-results.pdf

Comparing Fed and ECB monetary policies

PE 755.707 27

the ECB will not cut interest rates until the third quarter of next year and that the deposit facility rate

will be 3.25% at the end of 2024, an easing of 75 basis points.

13

I suspect the opposite pattern is more likely. The current strength of the US economy may make taming

inflation more difficult than anticipated. For the euro area, the HICP for energy has moved up on

average in recent months, so energy price declines will probably stop subtracting from headline

inflation soon. There is also the risk that further supply shocks could trigger another surge in euro area

inflation. However, the current situation is that inflation is now relatively close to the ECB’s 2% target.

It may be that getting inflation from September’s 2.9% to the 2% target rate will represent a difficult

“last mile” as described in ECB Executive Board member Isabel Schnabel’s recent speech.

14

However,

our models for forecasting inflation are not generally good enough to allow us to make precise

predictions about how long it will take for inflation to fall by 0.9 percentage points. The last mile might

be slow or it might be fast.

What we can say now with some confidence is that the euro area economy appears to be heading for

recession and the full effects of monetary tightening have not yet been felt. This is likely to impact

inflation. Instead of euro area inflation remaining sluggishly high, there is a chance that it falls back to

and below the 2% target over the coming months. It now seems likely the ECB’s next policy move will

be to cut interest rates and it may come sooner than many expect.

Figure 17: Key policy rates for the Federal Reserve and ECB

Source: European Parliament, EGOV elaboration based on data from ECB and Federal Reserve.

13

https://www.ecb.europa.eu/stats/ecb_surveys/sma/shared/pdf/ecb.smar231030_october.en.pdf.

14

Schnabel (2023).

IPOL | Economic Governance and EMU Scrutiny Unit (EGOV)

28 PE 755.707

Figure 18: Balance sheet reduction for the Federal Reserve and ECB

Source: European Parliament, EGOV elaboration based on data from ECB and Federal Reserve.

Comparing Fed and ECB monetary policies

PE 755.707 29

REFERENCES

• Adrjan P. and R. Lydon (2022). “Wage Growth in Europe: Evidence from Job Ads”. Central Bank of

Ireland Economic Letters, Vol. 2022, No. 7.

https://www.centralbank.ie/docs/default-

source/publications/economic-letters/wage-growth-europe-evidence-job-ads.pdf

• Bandera, N., L. Barnes, M. Chavaz, S.Tenreyro and L. von dem Berge (2023). “Monetary policy in the

face of supply shocks: the role of inflation expectations”.

https://www.ecb.europa.eu/pub/conferences/ecbforum/shared/pdf/2023/Tenreyro_paper.pdf

• Haskel, J (2023). “What’s driving inflation: wages, profits, or energy prices?” Paper presented at the

Peterson Institute for International Economics, Washington DC.

https://www.bankofengland.co.uk/-/media/boe/files/speech/2023/may/whats-driving-inflation-

wages-profits-or-energy-prices-speech-by-jonathan-haskel.pdf

• Schnabel, I. (2023). The last mile.

https://www.ecb.europa.eu/press/key/date/2023/html/ecb.sp231102_1~4bb07ebef7.en.html

• Weber, I. and E. Wasner (2023). “Sellers’ inflation, profits and conflict: why can large firms hike prices

in an emergency?” Review of Keynesian Economics, Volume 11, pages 183-213.

https://www.researchgate.net/publication/370171854_Sellers'_inflation_profits_and_conflict_wh

y_can_large_firms_hike_prices_in_an_emergency/link/64431a81d749e4340e2b1572/download

• Whelan, K. (2022). Should the ECB be tightening faster?, ECON committee briefing paper.

https://www.europarl.europa.eu/cmsdata/253889/QA-09-22-494-EN-N.pdf

PE 755.707

IP/A/ECONMD/FWC/2020-002/C7/SC14

Print ISBN 978-92-848-1356-8 | doi:10.2861/ 943127 | QA- 05-23-417-EN-C

PDF ISBN 978-92-848-1357-5 | doi:10.2861/ 790628 | QA- 05-23-417-EN-N

The European Central Bank and Federal Reserve have taken similar approaches to tightening

monetary policy to tackle high inflation. However, relative to the US, euro area inflation has been

driven more by supply shocks and less by strong demand. The euro area economy is also weakening

while the US economy is still growing solidly. Markets expect the Fed to ease more than the ECB in

2024 but falling inflation and a weak euro area economy may see the opposite occur.

This document was provided by the Economic Governance and EMU Scrutiny Unit at the request of

t

he Committee on Economic and Monetary Affairs (ECON) ahead of the Monetary Dialogue with the

ECB President on 27 November 2023.