Lectures in Labor Econom ics

Daron Acemoglu

David Autor

Con tents

P art 1. In troduction to Hum an Capital In vestments 1

Chapter 1. The Basic Theory of H um an Capital 3

1. General Issues 3

2. Uses of Human Capital 4

3. Sources of Hum an Capital Differences 6

4. Human Capital In vestmen ts and The Separation Theorem 8

5. Schooling Investments and Returns to Education 11

6. A Simple Tw o-P eriod Model of Schooling Investmen ts and Some Evidence 13

7. Eviden ce on Hum an C apital Inv estm ents and Credit Con straints 16

8. The Ben-Porath Model 20

9. Selection and Wages– T he One-Facto r Model 26

Chapter 2. Hu m an Capital and Signaling 35

1. The Basic Model of Labor Mark et Signaling 35

2. Generalizations 39

3. Evidence on Labor Market Signaling 44

Chapter 3. Externalities and P eer Effects 47

1. Theory 47

2. Eviden ce 51

3. School Qualit y 54

4. Peer Group Effects 55

P art 2. Incen tives, Agency and Efficiency Wages 69

Chapter 4. Mor al Hazard: Basic Models 71

1. The Baseline Model of Incentiv e-Insu ra nce Trade off 72

2. Incen tiv es without Asymm etric Information 74

3. Incen tiv es-Insurance Trade-off 76

4. The Form of Perform an ce Contracts 80

5. The Use of Information: Sufficient Statistics 82

Chap ter 5. Mo ral Hazard with Limited Liability, Mu ltitask ing, Career

Concerns, and Applications 85

1. Limited Lia bility 85

iii

Lectures in Labor Economics

2. Linear Con tracts 89

3. Eviden ce 94

4. Multitask ing 96

5. Relative P erfo rm a n ce Evaluation 99

6. Tournaments 100

7. Application: CEO P ay 106

8. The Basic Model of Career Concerns 108

9. Career Con cern s Over Multip le Periods 114

10. Career Co ncern s and Multita sking: Application to Teac h ing 115

11. Moral Hazard and Optimal Unemploym en t Insurance 128

Chapter 6. Holdups, Incomplete Con tracts and In v estments 137

1. In vestment s in the Absence of Binding Contracts 137

2. Incomplete Contracts and the Internal Organization of the Firm 141

Chapter 7. Efficiency Wa ge Models 145

1. The Shapiro-Stiglitz Model 145

2. Other Solutions to Incentive Problems 151

3. Eviden ce on Efficiency Wages 151

4. Efficiency Wages, Monitoring and Corporate Structure 154

Part 3. Inv e stment in Post-Schooling Skills 163

Chap ter 8. The Theory of Training Inv estm ents 165

1. General Vs. Specific Training 165

2. The Becke r Model of Training 166

3. Market Failures Due to Con tractual Problems 169

4. Training in Imperfect Labor Mark ets 170

5. General Equilibrium with Imperfect Labor Markets 177

Chap ter 9. Firm -SpecificSkillsandLearning 189

1. The Evidence On Firm-Specific Ren ts and Interpretation 189

2. In vestment in Firm-Specific Skills 194

3. A Simple M odel of Labor Mar ket Learnin g and Mo bility 203

P art 4. Search and Unemployment 211

Chapter 10. Th e Partial Equilibrium Model 213

1. Basic Model 213

2. Unemplo ymen t with Sequential Search 218

3. Aside on Riskiness and Mean Preserving Spreads 21 9

4. Back to the Basic Partial Equilibriu m Sear ch Model 221

5. P aradoxes of Search 223

iv

Lectures in Labor Economics

Chapter 11. Ba sic Equilibrium Searc h Fram ework 229

1. Motivation 229

2. The Basic Search Model 229

3. Efficiency of Search Equ ilibriu m 239

4. Endogenous Job Destruction 242

5. A Tw o -Sector Searc h M odel 247

Chapter 12. Com position of Jobs 253

1. Endogenous Composition of Jobs with Homogeneous Work ers 253

2. Endogenous Composition of Jobs with Heterogeneous Work ers 267

Chapter 13. Wage Posting and Directed Searc h 273

1. Inefficiency of Search Equilibria with In vestments 273

2. The Basic Model of Directed Search 279

3. Risk Aversion in Searc h Equilibr ium 287

v

Part 1

Introd uc tion to Hu m an Cap ital

In vestmen ts

CHAPTER 1

The Basic Theory of Human Capital

1. General Issues

One of the most importan t ideas in labor economics is to think of the set of

marketable skills of wo rkers as a form of capital in whic h w orkers make a variety

of investments. This perspective is im portant in understanding both investmen t

incen tives, and the structure of w a ges and earnings.

Loosely speaking, h uman capital corresponds to any stock of kno wledge or c har-

acteristics the work er has (either innate or acquired) that contribu tes to his or her

“productivity”. This definition is broad, and this has both advan tages and disad-

vantages. The advantages are clear: it enables us to think of not only the years

of schooling, but also of a variety of other c haracteristics as part of h um an capital

in vestments. These inclu de sc hool quality, training, attitudes tow a rds work, etc. Us-

ing this type of reasoning, w e can m ak e some progress towards understanding some

of the differ en ces in earnings across wo rkers that are not accounted by sch ooling

differences alone.

The disadvantages are also related. A t some lev el, we can push this notion of

h u ma n capital too far, and think of every difference in remu nera tion that we observe

in the labor market as due to hum an capital. For example, if I am paid less than

another Ph.D ., that m ust be because I hav e lo wer “skills” in some other dimension

that’s not being measu red by my years of schooling–this is the famous (or infamo us)

unob serv ed heterogeneity issue. The presumption that all pa y differences are related

to skills (even if these skills are unobserv e d to the econom ists in the standard data

sets) is not a bad place to start when w e want to impose a conceptual structure on

3

Lectures in Labor Economics

empirical w a ge distributions, but there are many notable exceptions, som e of which

will be discussed later. Here it is useful to mention three:

(1) Compensating differentials: a wo rker may be paid less in money, because

he is receiving part of his compensation in terms of other (hard-to-observe)

c h aracteristics of the job, whic h m ay include lo wer effort requiremen ts, more

pleasant w ork ing conditions, better amenities etc.

(2) Labor mark et imperfections: t wo work ers with the same h um a n capital may

be paid different wa ges because jobs differ in terms of their productivity and

pa y, and one of them ended up matc hing with the high productivity job,

while the other has matched with the low productivit y one.

(3) Taste-based discrimination: employers may pay a lo wer wage to a w orker

because of the work er’s gender or race due to their prejudices.

In interpreting wage differences, and therefore in thinking of h um an capital in-

v e stm ents and the incen tives for in vestmen t, it is importan t to strike the righ t bal-

ance between assigning earning differences to unobserved heterogeneit y, compensat-

ing w a ge differentials and labor market imperfections.

2. Uses of Human Capital

The standard approach in labor economics views human capital as a set of

skills/characteristics that increase a w orker’s productivity. Th is is a useful start-

ing place, and for most practical purposes quite sufficient. Nevertheless, it ma y be

useful to distinguish between some complem entary/alternativ e ways of thinking of

human capital. Here is a possible classification:

(1) The Bec ker view: h u ma n capital is directly useful in the production process.

More explicitly, human capital increases a w orker’s productivity in all tasks,

though possibly differentially in different tasks, organizations, and situa-

tions. In this view, although the role of human capital in the production

process ma y be quite complex, there is a sense in wh ich we can think of it as

represented (representa ble) b y a unidimensional object, suc h as the stock

4

Lectures in Labor Economics

of kno w le dg e or skills, h, and this stock is directly part of the production

function.

(2) The Gardener view: according to this view, we should not think of hum an

capital as unidimensional, since there are many man y dimensions or types

of skills. A simple ver sion of this approach wo uld emphasize mental vs.

physical abilities as different skills. Let us dub this the Garden er view af-

ter the work by the social psychologist Howard Gardener, who con tributed

to the dev elop m e nt of multiple-intelligences theory, in particular emphasiz-

ing how man y geniuses/fam ous personalities were v ery “unskilled” in some

other dimen sion s.

(3) The Schultz/Nelson-Phelps view: h uman capital is view ed mostly as the

capacity to adapt. According to this appro ach, human cap ital is especially

useful in dealing with “disequilibrium” situations, or mor e generally, with

situation s in which there is a c ha ng ing enviro nmen t, and w orkers hav e to

adapt to this.

(4) The Bowles-Gintis view: “h um an capital” is the capacit y to wor k in or-

ganizatio n s, obey orders, in short, adapt to life in a hierarchic al/c apitalist

society. Accord ing to th is view, the main role o f schools is to instill in

individuals the “correct” ideology and approach towards life.

(5) The Spence view: observable measures of hu ma n capital are more a signal of

ability than cha racter istics independen tly useful in the production process.

Despite their differen ces, the first three views are quite similar, in that “h uman

capital” will be valued in th e mark et because it in creases firms’ profits. This is

straightforward in the Beck er and Sc hultz views, but also similar in the Garden er

view. In fact, in man y applications, labor econo m ists’ view of hu m an capital w o u ld

be a mixture of these th ree appro aches. Even th e Bowles-Gin tis view h as very similar

implicatio ns. Here, firms would pa y higher wages to educated w orkers because these

workerswillbemoreusefultothefirm as they will obey orders better and will be

more reliable members of the firm ’s hierarc hy. The Spence view is different from

5

Lectures in Labor Economics

the others, howev er, in that observable measures of human capital m ay be rewarded

because they are signals about some other characteristics of work er s. We will discuss

different implications of these views below .

3. Sources of Human Capital Differences

It is useful to think of the possible sources of h u ma n capital differences before

discussing the incentiv es to inv est in h uman capital:

(1) Innate ability: work ers can ha ve different amounts of skills/human capital

becauseofinnatedifferences. Researc h in biology/ social biology has docu-

mented that there is some componen t of IQ which is genetic in origin (there

is a heated debate about the exact importance of this component, and some

econom ists hav e also tak en part in this). The relevance of this observation

for labor eco nom ics is tw ofold: (i) there is likely to be heterog eneity in

h u m an capital ev en when individuals have access to the same investment

opportunities and the same economic constrain ts; (ii) in empirical appli-

cations, we have to find a way of dealing with this source of differences

in h u man capital, especially when it’s like ly to be correlated with other

variables of interest.

(2) Sc hooling: this has been the focus of muc h research, since it is the most

easily observable component of h um a n capital in vestments. It has to be

borne in mind, however, that the R

2

of earnings regressions that contr ol for

schooling is relatively small, suggesting that sc hooling differences account

for a relatively small fraction of the differen ces in earnings. Ther efore,

there is much more to hu m an capital than sc h ooling. Nev ertheless, the

analysis of sc h ooling is lik ely to be v er y informative if we presume that

thesameforcesthataffect schooling in vestments are also likely to affect

non-schooling in vestments. So we can infer from the patterns of sc h ooling

inv estm ents what may be happening to non-sc h ooling inv estm ents, which

are more difficult to observ e.

6

Lectures in Labor Economics

(3) Sc hool qualit y and non-sc h ooling inv estmen ts: a pair of iden tica l tw ins who

grew up in the same en vironment un til the age of 6, and then completed

the same y ear s of schooling may nevertheless have differen t amoun ts of

h u m an capital. This could be because they attended differen t sc hools with

varying qualities, but it could also be the case ev en if they w ent to the same

sc h ool. In this latter case, for one reason or another, they may ha ve c hosen

to make different in vestmen ts in other components of their h um an capital

(one ma y ha ve w or ked harder, or studied especially for some subjects, or

because of a variet y of choices/ circumstances, one ma y ha ve become more

assertiv e, better at communicating, etc.). M any economists believ e that

these “unobserved” skills are v er y importan t in unders tan ding the structu re

of w ages (and the changes in the structure of w ages). The problem is that we

do not have good data on these components of hu m an capital. Nev ertheless,

we will see different w ays of inferring what’s happening to these dimensions

of hum an capital below .

(4) Training: this is the component of hum an capital that w orkers acquire after

sc h ooling, often associated with some set of skills useful for a particular

industry, or useful with a particular set of tec h n olog ies. A t some lev el,

training is very similar to sc hooling in that the w orker, at least to some

degree, con tr ols ho w mu ch to in vest. Bu t it is also m uch more complex,

since it is difficu lt for a w o r ker to make training in vestments by himself.

The firm also needs to inv est in the training of the w orkers, and often ends

up bearing a large fraction of the costs of these training in vestments. The

role of the firmisevengreateroncewetakeintoaccountthattraininghas

asignificant “matching” componen t in the sense that it is most useful for

theworkertoinvestinasetofspecific tech nologies that the firm will be

using in the future. So training is often a joint in vestment b y firm s and

workers, com plicating the analysis.

7

Lectures in Labor Economics

(5) Pre-labor market influen ces: there is increasing recognition among econo-

miststhatpeergroupeffects to whic h individuals are exposed before they

join the labor market may also affect their hu m a n capital significantly. A t

some level, the analysis of these pre-labor mark e t influences may be “so-

ciological”. But it also has an elemen t of investmen t. For example, an

altruistic parent deciding where to liv e is also deciding whether her off-

spring will be exposed to good or less good pre-labor market influences.

Ther efor e, some of the same issues that arise in thinking about the theory

of schooling and training will apply in this context too.

4. Hum an Capital In vestments and The Separation Theorem

Let us start with the partial equilibrium schooling decisions and establish a

simple general result, sometimes referred to as a “separation theorem” for human

capital in vestmen ts. We set up the basic model in con tinuous time for simplicity.

Consid er the schooling decision of a single individu al facing exogenously giv en

prices for h u m a n capital. Througho ut, we assume that there are perfect capital

markets. The separatio n theorem referred to in the title of this section will show

that, with perfect capital markets, schooling decisions will maximize the net presen t

discoun ted value of the individual. More specifica lly, consider an individual with an

instantaneous utilit y function u (c) that satisfies the standard neoclassical assump-

tions. In particular, it is strictly increasing and strictly concav e. Suppose that the

individual has a planning horizon of T (w h ere T = ∞ is allo wed), discounts the

future at the rate ρ>0 and faces a constan t flo w rate of death equal to ν ≥ 0.

Standard arguments imply that the objective function of this individual at time

t =0is

(1.1) max

Z

T

0

exp (− (ρ + ν) t) u (c (t)) dt.

Supposethatthisindividualisbornwithsomehumancapitalh (0) ≥ 0.Suppose

also that his human capital ev o lves o ver time according to the differential equation

(1.2)

˙

h (t)=G (t, h (t) ,s(t)) ,

8

Lectures in Labor Economics

where s (t) ∈ [0, 1] is the fraction of time that the individual spends for in v estmen ts

in schooling, and G : R

2

+

× [0, 1] → R

+

determines how hum an capital evolv es as a

function of time, the individual’s stock of h uman capital and schooling decisions. In

addition, we can impose a further restriction on schooling decisions, for example,

(1.3) s (t) ∈ S (t) ,

where S (t) ⊂ [0, 1] and ma y be useful to model constraints of the form s (t) ∈ {0, 1},

which wou ld correspond to the restriction that schooling must be full-time (or other

suc h restrictions on h um a n capital in vestments).

The individual is assumed to face an exogenous sequence of wage per unit of

h u m an capital giv en by [w (t)]

T

t=0

, so that his labor earnings at time t are

W (t)=w (t)[1− s (t)] [h (t)+ω (t)] ,

where 1 − s (t) is the fraction of time spen t supplying labor to the market and ω (t)

is non-human capital labor that the individual may be supplying to the mark et at

time t. The sequence of non-hu man capital labor that the individual can supply to

the mark et, [ω (t)]

T

t=0

,isexogenous. Thisformulationassumesthattheonlymargin

of choice is between mark et w o rk and sc hooling (i.e., there is no leisure).

Finally, let us assume that the individual faces a constant (flow)interestrate

equal to r on his savings. Using the equation for labor earnings, the lifetime budget

constraint of the individ ual can be written as

(1.4)

Z

T

0

exp (−rt) c (t) dt ≤

Z

T

0

exp (−rt) w (t)[1− s (t)] [h (t)+ω (t)] dt.

The Separa tion Theo rem , which is the subject of this section, can be stated as

follows:

Theorem 1.1. (Separation Theor em ) Suppose that the instantaneous utility

function u (·) is strictly increasing. Then the sequenc e

h

ˆc (t) , ˆs (t) ,

ˆ

h (t)

i

T

t=0

is a

solution to the maximization of (1.1) subje ct to (1.2), (1.3) and (1.4) if and only if

h

ˆs (t) ,

ˆ

h (t)

i

T

t=0

maximizes

(1.5)

Z

T

0

exp (−rt) w (t)[1− s (t)] [h (t)+ω (t)] dt

9

Lectures in Labor Economics

subject to (1.2) and (1.3), and [ˆc (t)]

T

t=0

maximizes (1.1) subje ct to (1.4) given

h

ˆs (t) ,

ˆ

h (t)

i

T

t=0

. That is, human capital accumulation and supply decisions can be

separated from consump tio n decisions.

Proof. To prove the “only if” part, suppose that

h

ˆs (t) ,

ˆ

h (t)

i

T

t=0

does not max-

imize (1.5), but there exists ˆc (t) suc h that

h

ˆc (t) , ˆs (t) ,

ˆ

h (t)

i

T

t=0

is a solution to

(1.1). Let the value of (1.5) generated by

h

ˆs (t) ,

ˆ

h (t)

i

T

t=0

be denoted Y .Since

h

ˆs (t) ,

ˆ

h (t)

i

T

t=0

doesnotmaximize(1.5),thereexists[s (t) ,h(t)]

T

t=0

reaching a value

of (1.5), Y

0

>Y. Consider the sequence [c (t) ,s(t) ,h(t)]

T

t=0

,wherec (t)=ˆc (t)+ε.

By the hypothesis that

h

ˆc (t) , ˆs (t) ,

ˆ

h (t)

i

T

t=0

is a solution to (1.1), the budget con-

straint (1.4) implies

Z

T

0

exp (−rt)ˆc (t) dt ≤ Y .

Let ε>0 and consider c (t)=ˆc (t)+ε for all t.Wehavethat

Z

T

0

exp (−rt) c (t) dt =

Z

T

0

exp (−rt)ˆc (t) dt +

[1 − exp (−rT)]

r

ε.

≤ Y +

[1 − exp (−rT)]

r

ε.

Since Y

0

>Y,forε sufficien tly small,

R

T

0

exp (−rt) c (t) dt ≤ Y

0

and th us [c (t) ,s(t) ,h(t)]

T

t=0

is feasible. Since u (·) is strictly increasing, [c (t) ,s(t) ,h(t)]

T

t=0

is strictly preferred

to

h

ˆc (t) , ˆs (t) ,

ˆ

h (t)

i

T

t=0

, leading to a contra diction and proving the “only if” part.

The proof of the “if” part is similar. Suppose that

h

ˆs (t) ,

ˆ

h (t)

i

T

t=0

maximizes

(1.5). Let the maximum value be denoted b y Y . Consider the maximization of (1.1)

subject to the constrain t that

R

T

0

exp (−rt) c (t) dt ≤ Y .Let[ˆc (t)]

T

t=0

be a solution.

This implies that if [c

0

(t)]

T

t=0

is a sequence that is strictly preferred to [ˆc (t)]

T

t=0

,then

R

T

0

exp (−rt) c

0

(t) dt > Y . Thisimpliesthat

h

ˆc (t) , ˆs (t) ,

ˆ

h (t)

i

T

t=0

must be a solution

to the original problem, because any other [s (t) ,h(t)]

T

t=0

leads to a value of (1.5)

Y

0

≤ Y ,andif[c

0

(t)]

T

t=0

is strictly preferred to [ˆc (t)]

T

t=0

,then

R

T

0

exp (−rt) c

0

(t) dt >

Y ≥ Y

0

for any Y

0

associated with any feasible [s (t) ,h(t)]

T

t=0

. ¤

10

Lectures in Labor Economics

The in tu ition for this theorem is straightforward: in the presence of perfect capi-

tal markets, the best human capital accum ulatio n decisions are those that maxim ize

the lifetime budget set of the individ u al. It can be shown that this theorem does

not hold when there are imperfect capital markets. Moreov er, this theorem also

fails to hold when leisure is an argumen t of the utility function of the individual.

Nevertheless, it is a very useful benchmarkas a starting poin t of our analysis.

5. Schooling Investmen ts and Returns to Education

We now tur n to the simplest model of schooling decision s in partial equilibrium ,

which will illustrate the ma in tradeoffs in hum an capital in vestmen ts. The model

presented here is a v ersion of Mincer’s (1974) seminal con trib ution. This model also

enables a simple mapping from the theory of human capital inv estmen ts to the large

empirical literature on returns to sch ooling.

Let us first assume that T = ∞, whic h will simplify the expressions. The flow

rate of death, ν, is positiv e, so that individu als ha ve finite expected liv es. Suppose

that (1.2) and (1.3) are suc h that the individual has to spend an interval S with

s (t)=1–i.e., in full-tim e schooling, and s (t)=0thereafter. A t the end of the

sc hooling interval, the individual will ha ve a schooling level of

h (S)=η (S) ,

where η (·) is an increasing, contin u ou sly differen tiable and concave function. For

t ∈ [S, ∞), human capital accum ulates over time (as the individual w orks) according

to the differen tial equation

(1.6)

˙

h (t)=g

h

h (t) ,

for some g

h

≥ 0. Suppose also that wages gro w exponentially,

(1.7) ˙w (t)=g

w

w (t) ,

with boundary condition w (0) > 0.

Suppose that

g

w

+ g

h

<r+ ν,

11

Lectures in Labor Economics

so that the net presen t discounted value of the individua l is finite. No w using

Theo rem 1.1, the optimal sch ooling decision m ust be a solution to the following

maximization problem

(1.8) max

S

Z

∞

S

exp (− (r + ν) t) w (t) h (t) dt.

Now using (1.6) and (1.7), this is equivalent to:

(1.9) max

S

η (S) w (0) exp (− (r + ν − g

w

) S)

r + ν − g

h

− g

w

.

Since η (S) is concav e, the objectiv e function in (1.9) is strictly concave. There-

fore, the unique solution to this problem is characterized b y the first-order condition

(1.10)

η

0

(S

∗

)

η (S

∗

)

= r + ν − g

w

.

Equation (1.10) sho w s that higher in terest rates and higher values of ν (cor-

responding to shorter planning horizons) reduce h u m an capital in vestments, while

higher values of g

w

increase the value of hum an capital and thus encourage further

inve stm e nts.

In tegratin g both sides of this equation with respect to S,weobtain

(1.11) ln η (S

∗

)=constant +(r + ν − g

w

) S

∗

.

Now note that the w age earnings of the w orker of age τ ≥ S

∗

in the labor market

at time t will be given by

W (S, t)=exp(g

w

t)exp(g

h

(t − S)) η (S) .

Taking logs and using equation (1.11) implies that the earnings of the work er will

be given by

ln W (S

∗

,t)= constant +(r + ν − g

w

) S

∗

+ g

w

t + g

h

(t − S

∗

) ,

where t − S can be thought of as w orker experience (time after sch ooling). If we

make a cross-sectional compariso n across w orkers, the time trend term g

w

t ,will

also go in to the constan t, so that w e obtain the canonical Mincer equation where,

in the cross section, log w age earnings are proportional to schooling and experience.

12

Lectures in Labor Economics

Written differently, we have the follow ing cross-sectional equation

(1.12) ln W

j

= constant + γ

s

S

j

+ γ

e

experience,

where j refers to individual j. Note ho wev er that we have not introduced an y source

of heterogeneity that can generate different leve ls of sc hooling across individuals.

Nevertheless, equation (1.12) is important, since it is the typ ical empirical model

for the relationship between wages and schooling estimated in labor economics.

The econom ic insight provided by this equation is quite important; it suggests

that the functional form of the Mincerian w age equation is not just a mere co-

incidence, but has economic conten t: the opportunity cost of one more y ear of

sc hooling is foregone earnings. T his implies that the benefit has to be commen-

surate with these foregone earnings, thus should lead to a proportional increase in

earnings in the future. In particular, this proportional increase should be at the rate

(r + ν − g

w

).

Em pirical w ork using equations of the form (1.12) leads to estimates for γ in

the range of 0.06 to 0.10. Equation (1.12) suggests that these returns to sch ooling

are not unreasonab le. For example, w e can think of the annu al in terest rate r as

approximately 0.10, ν as corresponding to 0.02 that gives an expected life of 50

y ears, and g

w

corresponding to the rate of wage growth holding the h um a n capital

level of the individual constant, which should be approximately about 2%. Th us

we should expect an estimate of γ around 0.10, whic h is consistent with the upper

range of the empirica l estimates.

6. A Simp le Two-Period M odel of Schooling Inv estments and Some

Evidence

Let us no w step bac k and illustrate these ideas using a t wo-period model and then

use this model to look at some further evidence. In period 1 an individual (parent)

works, consum es c,savess, decides whether to send their offsprin g to sc hool, e =0

or 1, and then dies at the end of the period. Utility of house hold i is given as:

13

Lectures in Labor Economics

(1.13) ln c

i

+lnˆc

i

where ˆc is the consump tion of the offspring. There is heterogeneity among children,

sothecostofeducation,θ

i

varies with i. In the second period skilled individuals

(those with education) receive a wage w

s

and an unskilled work er receives w

u

.

First, consider the case in which there are no credit mark et problems, so parents

canborrowonbehalfoftheirchildren,andwhentheydoso,theypaythesame

in terest rate, r, as the rate they w ould obtain by sa ving. Then, the decision problem

of the parent with income y

i

is to maximize (1.13) with respect to e

i

, c

i

and ˆc

i

,

subject to the budget constrain t:

c

i

+

ˆc

i

1+r

≤

w

u

1+r

+ e

i

w

s

− w

u

1+r

+ y

i

− e

i

θ

i

Note that e

i

does not appear in the objective function, so the education decision will

be mad e simply to m axim ize the budget set of the consu m er. This is the essen ce of

the Separation Theorem, Theorem 1.1 above. In particular, here paren ts will choose

to educate their offsp ring only if

(1.14) θ

i

≤

w

s

− w

u

1+r

Oneimportantfeatureofthisdecisionruleisthatagreaterskillpremiumas

captured b y w

s

− w

u

will encour age schooling, while the high er interest rate, r,will

discourage sc hooling (since schooling is a form of inv estm ent with upfron t costs and

delayed benefits).

In practice, this solution may be difficult to achiev e for a variety of reasons.

First, there is the usual list of informational/contractual problems, creating credit

constraints or transaction costs that in troduce a wedge bet ween borro wing and lend-

ing rates (or ev en make borrow ing impossible for some groups). Second, in man y

cases, it is the paren ts who make part of the in vestment decisions for their children,

so the above solution involves parents borrow ing to finance both the education

expenses and also part of their o wn current consumption. These loans are then

supposed to be paid bac k b y their children . With the above setup, this arrangement

14

Lectures in Labor Economics

works since parents are fully altruistic. Howev er, if there are non-altruistic parents,

this will create obvious problem s.

Therefo re, in many situations credit problems might be importan t. No w imagine

the same setup, but also assume that parents cannot ha v e negativ e savings, which

is a simple and sev ere form of credit ma rket problem s. This m odifies the constr aint

set as follows

c

i

≤ y

i

− e

i

θ

i

− s

i

s

i

≥ 0

ˆc

i

≤ w

u

+ e

i

(w

s

− w

u

)+(1+r) s

Firstnotethatforaparentwithy

i

− e

i

θ

i

>w

s

, the constrain t of nonnegative

sa ving s is not binding, so the same solution as before will apply. Therefor e, credit

constraints will only affect parents who needed to borrow to finance their children’s

education.

To characterize the solution to this problem , let us look at the utilities from

inv esting ing and not investing in education of a parent. Also to sim plify the discus-

sion let us focus on parents who w ould not choose positiv e sa vings, that is, those

paren ts with (1 + r) y

i

≤ w

u

. The utilities from investing and not inve sting in

education are given, respectively, b y U(e =1| y

i

,θ

i

)=ln(y

i

− θ

i

)+lnw

s

,and

U(e =0| y

i

,θ

i

)=lny

i

+lnw

u

. Comparison of these two expressions implies that

paren ts with

θ

i

≤ y

i

w

s

− w

u

w

s

will invest in education. It is then straightforward to verify that:

(1) This condition is more restrictiv e than (1.14) above, since (1 + r) y

i

≤ w

u

<

w

s

.

(2) As income increases, there will be more in vestmen t in education, which

con tra sts with the non-credit-constrain ed case.

15

Lectures in Labor Economics

One interestin g implication of the setup with credit constraints is that the skill

premium, w

s

− w

u

, still has a positive effect on human capital inv estm ents. Ho w -

ever, in more general models with credit constrain ts, the conclusions may be more

n u an ced. For example, if w

s

− w

u

increases because the unskilled w age, w

u

, falls,

this ma y reduce the income level of man y of the households that are marginal for

the education decision, th us discourage in vestment in education.

7. Evidence on Hum an Capital In vestmen ts and Credit Constraints

This finding, that income only matters for education inv estm ents in the presence

of credit constrain ts, motivates investigations of whether there are significan t differ-

ences in the educational attainment of c hildren from different paren tal bac kgrounds

as a test of the im portance of credit constrain ts on education decisions. In addition,

the em p irical relationship between family income and educa tion is interesting in its

own right.

A t ypica l regression would be along the lines of

schooling=con trols + α · log paren tal income

which leads to positiv e estimates of α, consisten t with credit constraints. The prob-

lem is that there are at least t wo alternative explanations for wh y w e ma y be esti-

matin g a positive α:

(1) Children’s educa tion m ay also be a consumption good, so rich parents will

“consume” more of this good as well as other goods. If this is the case,

the positive relationsh i p between family inco me and educa tion is not ev-

idence in fa vor of credit constraints, since the “separation theorem” does

not apply when the decision is not a pure investment (en ter s directly in

the utilit y function ). Nevertheless, the implic ations for labor economics are

quite simila r: ric her par ents will inve st mo re in their c hildre n’s educa tion.

(2) The second issue is more problema tic. The distribution of costs and bene-

fits of education differ across families, and are lik ely to be correlated with

incom e. That is, the param eter θ

i

in terms of the model above will be

16

Lectures in Labor Economics

correlated with y

i

, so a regression of sc hooling on incom e will, at least in

part, capture the direct effect of differen t costs and benefits of education.

One line of attack to deal with this problem has been to include other char-

acteristics that could pro xy for the costs and benefits of education, or attitudes

to ward education. The in teresting finding here is that when parents’ education is

also included in the regressio n, the role of incom e is substantially reduced.

Does this mean that credit mark et problems are not important for education?

Does it mean that parents’ incom e does not have a direct affect on education? Not

necessarily. In particular, there are t wo reasons for why suc h an interpretation may

not be w arranted.

(1) First, paren ts’ income may affect the quality rather than the quan tity of

educa tion . This may be particula rly importan t in the U.S. con text wher e

the choice of the neighborhood in which the family live s appears to have

amajoreffect on the qualit y of schooling. This implies that in the United

States high income parents ma y be “buying” more human capital for their

c h ild ren , not by sending them to sc h ool for longer, but by providing them

with better sc h ooling.

(2) P a rental income is often measured with error, and has a significant tran-

sitory component, so parental education ma y be a m uch better pro xy for

permanen t income than income observations in these data sets. There-

fore, even when incom e matters for education, all its effect my load on the

parental education variable.

Neither problem is easy to deal with, but there are possible a venues. First, we

could look at the incomes of ch ildre n rather than their sc h ooling as the outcom e

variable. To the extent that incom e reflects skills (broadly defined), it will incorpo-

rate unobserved dimensions of human capital, including sc hool quality. This takes

us to the literature on in terge neratio nal mob ility. The typ ical regression here is

(1.15) log c hild incom e = controls + α · log paren tal income

17

Lectures in Labor Economics

Regressions of this sort wer e first investigated b y Becker and Tomes. They found

relatively small coefficien ts, typ ica lly in the neighborhood of 0.3 (while others, for

example Behrman and Taubman estimated coefficients as low as 0.2). This me ans

that if your paren ts are twice as rich as my parents, you will typ ically ha ve about

30 to 40 percen t higher income than me. With this degree of in tergeneratio nal de-

pendence, differences in initial conditions will soon disappear. In fact, your ch ildren

will be typic ally about 10 percent (α

2

percen t) richer than m y children. So this

find ing im plie s that we are living in a relatively “egalitarian” society.

To see this more clearly, consider the following simple model:

ln y

t

= μ + α ln y

t−1

+ ε

t

where y

t

istheincomeoft-th generation, and ε

t

is serially independent disturbanc e

term with variance σ

2

ε

. Then the long-term variance of log income is:

(1.16) σ

2

y

=

σ

2

ε

1 − α

2

Using the estimate of 0.3 for α, equation (1.16) implies that the long-term variance of

log income will be approximately 10 percent higher than σ

2

ε

, so the long-run income

distribution will basically reflect transitory shocks to dynasties’ incomes and skills,

and not inherited differences.

Returnin g to the in terp reta tion of α in equation (1.15), also note that a degree

of persistence in the neigh borhood of 0.3 is not v ery differentfromwhatwemight

expect to result sim ply from the inheritance of IQ between parents and c hildren , or

from the children ’s adoption of cultural values fa voring education from their parents.

As a result, these estimates suggest that there is a relatively small effect of paren ts

incom e on ch ildren ’s human capital.

This work has been criticized, ho wever, because there are certain simple biases,

stacking the cards against finding large estimates of the coefficien t α.First,mea-

surement error will bias the coefficient α towards zero. Second, in typical panel data

sets, we observ e children at an early stage of their life cycles, where differences in

earningsmaybelessthanatlater stages, again biasing α do w nw ard. Third, income

18

Lectures in Labor Economics

mob ility may be v ery nonlinear, with a lot of mobilit y amo ng middle income fami-

lies, but very little at the tails. Work b y Solon and Zim m e rm a n has dealt with the

first two problems. They find that con t rolling for these issues increases the degree of

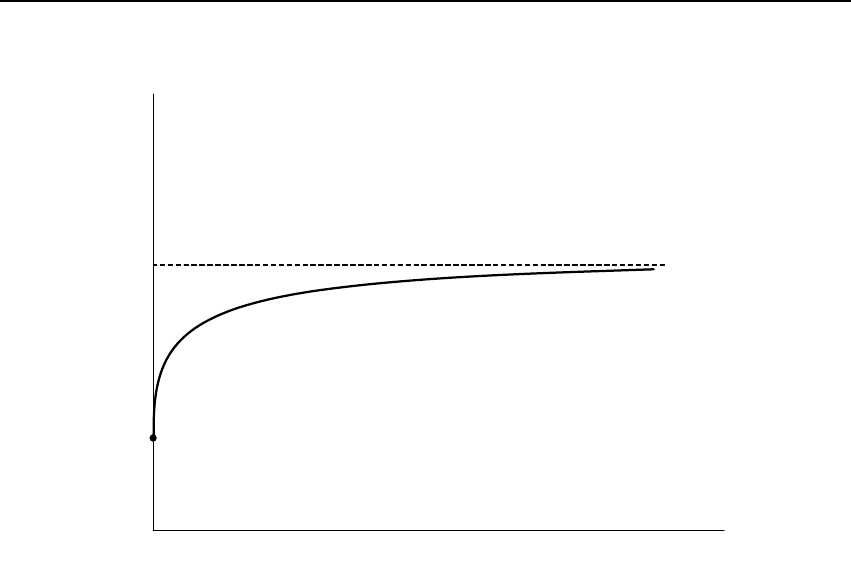

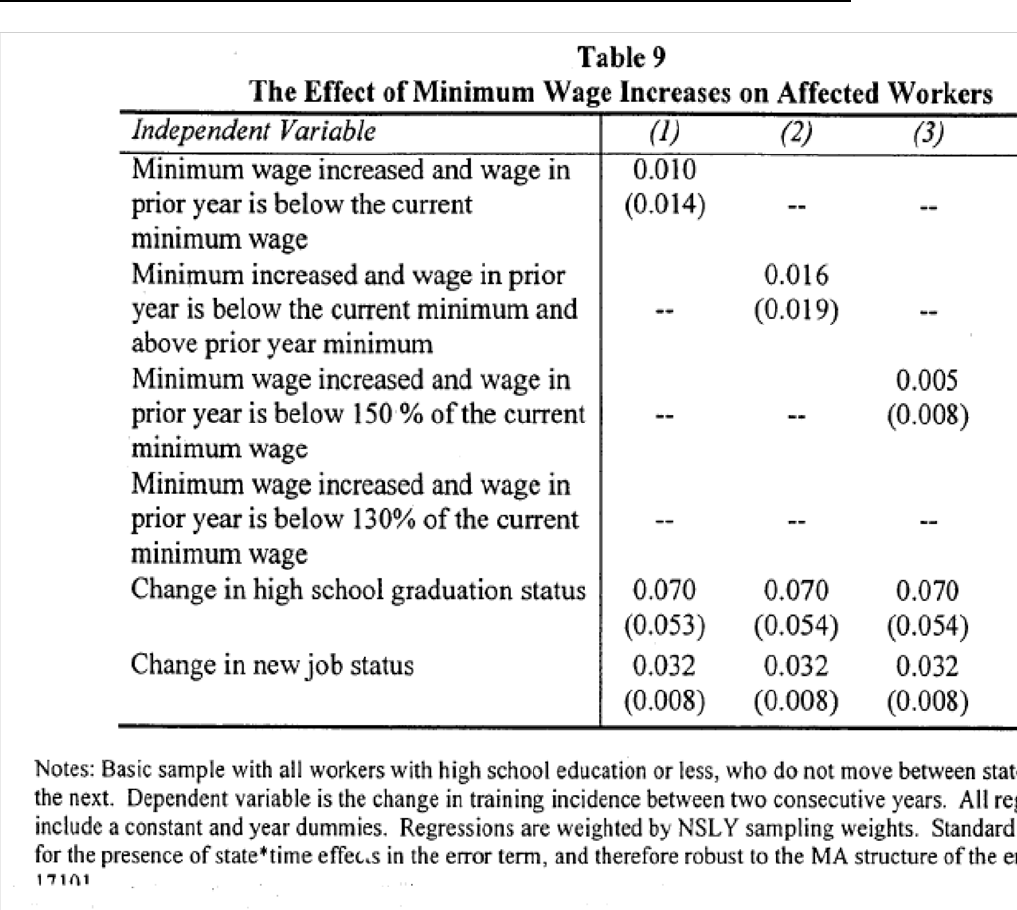

persistence substantially to about 0.45 or ev en 0.55. The next figur e sho w s Solon’s

baseline estimates.

Figure 1.1

A paper by Cooper, Durlauf and Johnson, in turn, finds that there is mu c h more

persistence at the top and the bottom of income distribution than at the middle.

That the differen ce between 0.3 and 0.55 is in fact substan tial can be seen b y

looking at the implication s of using α =0.55 in (1.16). Now the long-run income

distribution will be substan tially more disperse than the transitory shocks. More

specifica lly, we will hav e σ

2

y

≈ 1.45 · σ

2

ε

.

To deal with the second empirical issue, one needs a source of exogenous variation

in incomes to implem e nt an IV strategy. There are no perfect candid ates, but som e

imperfect ones exist. One possibility, pursued in Ace m oglu and Pischke (2001), is

to exploit changes in the income distribution that have tak en place o ver the past 30

19

Lectures in Labor Economics

y ears to get a source of exogenous variation in household income. The basic idea

is that the rank of a family in the income distribution is a good pro x y for parental

h u m an capital, and conditional on that rank, the income gap has widened o ver the

past 20 years. Moreo v er, this has happened differentially across states. On e can

exploit this source of variation by estima ting regression of the form

(1.17) s

iqjt

= δ

q

+ δ

j

+ δ

t

+ β

q

ln y

iqjt

+ ε

iqjt

,

where q denotes income quartile, j denotes region, and t denotes time. s

iqjt

is

education of individual i in income quartile q region j time t.Withnoeffect of

income on education, β

q

’s should be zero. With credit constraints, w e migh t expect

low e r quartiles to hav e positiv e β’s. Acem oglu and Pisc h ke report versions of this

equation using data aggregated to income quartile, regio n and time cells. The

estimates of β are ty p ica lly positive and significant, as sho w n in the next two tables.

Ho wever, the evidence does not indicate that the β’s are higher for low e r income

quartiles, which suggests that there m ay be more to the relationship between income

and education than simple credit constrain ts. Potential determinants of the rela-

tionship between income and education have already been discussed extensiv ely in

the literature, but we still do not ha ve a satisfactory understanding of why paren tal

income may affectchildren’seducationaloutcomes(andtowhatextentitdoesso).

8. The Ben-Porath Model

The baseline Ben-P o rath model enrich es the models w e ha ve seen so far by al-

lowing h u m an capital investments and non-trivial labor supply decisions through ou t

the lifetime of the individual. It also acts as a bridge to models of inv estmen t in

h u m an capital on-the-job, whic h we will discuss below .

Let s (t) ∈ [0, 1] for all t ≥ 0. Together with the Mincer equation (1.12) above,

the Ben-Porath model is the basis of muc h of labor economics. Here it is sufficien t

to consider a simple version of this model where the hum an capital accumulation

equation, (1.2), takes the form

(1.18)

˙

h (t)=φ (s (t) h (t)) − δ

h

h (t) ,

20

Lectures in Labor Economics

Figure 1.2

where δ

h

> 0 captures “depreciation of hu ma n capital,” for example because new

mac hines and tec hniques are being in troduced, eroding the existing h uman capital

of the w o rker. The individual starts with an initial value of h um an capital h (0) >

0. The function φ : R

+

→ R

+

is strictly increasing, continuously differentiable

and strictly concav e. Furtherm o re, we simplify the analysis by assuming that this

function satisfies the Inada-type conditions,

lim

x→0

φ

0

(x)=∞ and lim

x→h(0)

φ

0

(x)=0.

21

Lectures in Labor Economics

The latter condition makes sure that we do not have to impose additional constrain ts

to ensure s (t) ∈ [0, 1]..

Let us also suppose that there is no non-human capital componen t of labor, so

that ω (t)=0for all t,thatT = ∞, and that there is a flow rate of death ν>0.

Finally, we assume that the w age per unit of hu ma n capital is constant at w and

the in ter est rate is constant and equal to r. We also norm alize w =1without loss

of any generality.

Again using Theorem 1.1, h uman capital investments can be determined as a

solution to the followin g problem

max

Z

∞

0

exp (− (r + ν)) (1 − s (t)) h (t) dt

subject to (1.18).

This problem can then be solved b y setting up the current-value Hamilto nia n,

which in this case takes the form

H (h, s, μ)=(1− s (t)) h (t)+μ (t)(φ (s (t) h (t)) − δ

h

h (t)) ,

where w e used H to denote the Hamiltonian to a void confusion with h u m a n capital.

The necessary conditio ns for an optimal solution to this problem are

H

s

(h, s, μ)=−h (t)+μ (t) h (t) φ

0

(s (t) h (t)) = 0

H

h

(h, s, μ)=(1− s (t)) + μ (t)(s (t) φ

0

(s (t) h (t)) − δ

h

)

=(r + ν) μ (t) − ˙μ (t)

lim

t→∞

exp (− (r + ν) t) μ (t) h (t)=0.

To solv e for the optimal path of human capital in vestments, let us adopt the

following transform ation of variables:

x (t) ≡ s (t) h (t) .

Instead of s (t) (or μ (t))andh (t),wewillstudythedynamicsoftheoptimalpath

in x (t) and h (t).

The first necessary condition then implies that

(1.19) 1=μ (t) φ

0

(x (t)) ,

22

Lectures in Labor Economics

while the second necessary condition can be expressed as

˙μ (t)

μ (t)

= r + ν + δ

h

− s (t) φ

0

(x (t)) −

1 − s (t)

μ (t)

.

Substitu ting for μ (t) from (1.19), and simplify in g, we obtain

(1.20)

˙μ (t)

μ (t)

= r + ν + δ

h

− φ

0

(x (t)) .

The steady-state (stationary) solution of this optimal control problem in volves

˙μ (t)=0and

˙

h (t)=0, and thus implies that

(1.21) x

∗

= φ

0−1

(r + ν + δ

h

) ,

where φ

0−1

(·) is the in verse function of φ

0

(·) (whic h exists and is strictly decreasing

since φ (·) is strictly concave). This equation sho w s that x

∗

≡ s

∗

h

∗

will be higher

when the in terest rate is low, when the life expectancy of the individual is high, and

when the rate of depreciation of h u m an capital is lo w.

To determine s

∗

and h

∗

separately, we set

˙

h (t)=0in the h u m a n capital accu-

mulation equation (1.18), whic h gives

h

∗

=

φ (x

∗

)

δ

h

=

φ

¡

φ

0−1

(r + ν + δ

h

)

¢

δ

h

.(1.22)

Since φ

0−1

(·) is strictly decreasing and φ (·) is strictly increasing, this equation im-

plies that the steady-state solution for the hu m an capital stock is uniquely deter-

mined and is decreasing in r, ν and δ

h

.

More interesting than the stationar y (steady-state) solution to the optimization

problem is the time path of h uman capital inv estm ents in this model. To derive

this, differentiate (1.19) with respect to time to obtain

˙μ (t)

μ (t)

= ε

φ

0

(x)

˙x (t)

x (t)

,

where

ε

φ

0

(x)=−

xφ

00

(x)

φ

0

(x)

> 0

23

Lectures in Labor Economics

is the elasticit y of the funct ion φ

0

(·) and is positive since φ

0

(·) is strictly decreasing

(thus φ

00

(·) < 0). Combining this equation with (1.20), we obtain

(1.23)

˙x (t)

x (t)

=

1

ε

φ

0

(x (t))

(r + ν + δ

h

− φ

0

(x (t))) .

Figure 1.4 plots (1.18) and (1.23) in the h-x space. Th e upward-sloping curv e

corresponds to the locus for

˙

h (t)=0, while (1.23) can only be zero at x

∗

,thusthe

locus for ˙x (t)=0corresponds to the horizontal line in the figure. The arrows of

motion are also plotted in this phase diag ram and make it clear that the steady-state

solution (h

∗

,x

∗

) is globally saddle-path stable, with the stable arm coinciding with

the horizon ta l line for ˙x (t)=0.Startingwithh (0) ∈ (0,h

∗

), s (0) jumps to the level

necessary to ensure s (0) h (0) = x

∗

.Fromthenon,h (t) increases and s (t) decreases

so as to keep s (t) h (t)=x

∗

. Therefore, the pattern of hu man capital in vestments

implied by the Ben-P orath model is one of high in vestment at the beginning of an

individua l’s life followed by lower investments later on.

In our simplified version of the Ben-P orath model this all happens smoothly.

In the original Ben-Porath model, whic h inv olves the use of other inputs in the

production of human capital and finite horizons, the constrain t for s (t) ≤ 1 t y pically

binds early on in the life of the individual, and the interval during which s (t)=1

can be interpreted as full-time schooling. After full-time sc hooling, the individual

starts w o rking (i.e., s (t) < 1). But even on-the-job, the individual con tinues to

accumulate h uman capital (i.e., s (t) > 0), which can be in terp reted as spending

time in training programs or allocating some of his time on the job to learning rather

than production. Moreov er, because the horizon is finite, if the Inada conditions

were relaxed, the individual could prefer to stop investing in human capital at some

point. As a result, the time path of human capital generated b y the standard Ben-

P orath model ma y be h ump-shaped, with a possibly declining portion at the end.

Instead, the path of h uman capital (and the earning poten tial of the individual) in

thecurrentmodelisalwaysincreasingasshowninFigure1.5.

The importance of the Ben-Porath model is twofold. First, it emph asizes that

schooling is not the only way in whic h individua ls can in vest in h u m a n capital

24

Lectures in Labor Economics

and there is a con tinuity between schooling investments and other in vestmen ts in

human capital. Second, it suggests that in societies wher e sc h ooling inv estm e nts are

high w e ma y also expect higher levels of on-the-job investmen ts in h um an capital.

Thus there may be systematic mismeasurem ent of the amount or the quality h uman

capital across societies.

This model also provides us with a useful wa y of thinking of the lifecycle of the

individual, which starts with higher in vestmen ts in sc hooling, and then there is a

period of “full-time” w or k (where s (t) is high ), but this is still accomp an ied b y

in v estment in human capital and thus increasing earnings. The increase in earnings

tak es place at a slo wer rate as the individual ages. There is also som e evidence that

earnings may start falling at the very end of w orkers’ careers, though this does not

happen in the simplified version of the model presen ted here (how w ou ld you modify

it to mak e sure that earnings may fall in equilibrium ? ).

The a vailable evidence is consisten t with the broad patterns suggested by the

model. Nevertheless, this evidence comes from cross-sectional age-experience pro-

files, so it has to be interpreted with some caution (in particular, the decline at the

very end of an individua l’s life cycle that is found in some studies may be due to

“selection,” as the higher-abilit y workers retire earlier).

P erhaps more w orrisome for this interpretation is the fact that the increase in

earnings may reflect not the accumulation of h um an capital due to in vestment, but

either:

(1) simple age effects; individuals become mo re productive as they get older.

Or

(2) simple experience effects: individuals becom e more productiv e as they get

more experienced–this is independent of whether they choose to in vest or

not.

It is difficult to distinguish between the Ben-Porath model and the second ex-

planation. But there is some evidence that could be useful to distinguish bet ween

age effects vs. experience effects (automatic or due to in vestment).

25

Lectures in Labor Economics

Josh Angrist’s paper on Vietnam v eterans basically sho w s that w o rkers who

served in the Vietnam War lost the experience premium associated with the yea rs

they serv ed in the w ar. This is sho w n in the next figure.

Presuming that serving in the war has no productivit y effects, this evidence

suggests that m uch of the age-earnings profiles are due to experience not simply due

to age. Nev ertheless, this evidence is consistent both with direct experience effects

on w orker productivity, and also a Ben P orath type explanation where w orkers

are purposefully in vesting in their hu m a n capital while working, and experience is

proxying for these in vestments.

9. Selection and Wages–The One-Factor Model

Issues of selection bias arise often in the analysis of education, migration, labor

supply, and sectoral choice decisions. This section illustrates the basic issues of selec-

tion using a single-index model, wher e eac h individual possesses a one-dimen sional

skill. Richer models, such as the famous Roy model of selection, incorporate multi-

dimensional skills. While models with multi-dimensional skills mak e a range of

additional predictions, the major implica tions of selection for interpreting wage dif-

ferences across different groups can be derived using the single-index model.

Suppose that individuals are distinguished by an unobserv ed type, z,whichis

assumed to be distributed uniformly bet ween 0 and 1. Individuals decide whether

to obtain education, whic h costs c. The wage of an individual of type z when he

has no education is

w

0

(z)=z

and when he obtains education, it is

(1.24) w

1

(z)=α

0

+ α

1

z,

where α

0

> 0 and α

1

> 1. α

0

is the main effect of education on earnings, whic h

applies irrespectiv e of ability, whereas α

1

interacts with ability. The assump tion

that α

1

> 1 implies that education is comp lemen ta ry to ability, and will ensure that

high-ability individuals are “positively selected” into education.

26

Lectures in Labor Economics

Individuals make their sc hooling choices to maximize income. It is straightfor-

w ard to see that all individuals of type z ≥ z

∗

will obtain education, wher e

z

∗

≡

c − α

0

α

1

− 1

,

which, to mak e the analysis interesting, w e assume lies bet ween 0 and 1. Figure 1.7

gives the w age distribution in this economy.

Now let us look at mean wages b y education group. By standard arguments,

these are

¯w

0

=

c − α

0

2(α

1

− 1)

¯w

1

= α

0

+ α

1

α

1

− 1+c − α

0

2(α

1

− 1)

It is clear that ¯w

1

− ¯w

0

>α

0

, so the wage gap bet ween educated and uneduca ted

groups is greater than the main effect of education in equation (1.24)–since α

1

−1 >

0.Thisreflects two components. First, the return to education is not α

0

, but it is

α

0

+ α

1

· z for individual z. Therefore, for a group of mean ability ¯z, the return to

education is

w

1

(¯z) − w

0

(¯z)=α

0

+(α

1

− 1) ¯z,

which we can simply think of as the return to education evaluated at the mean

ability of the group.

But there is one more component in ¯w

1

− ¯w

0

, whic h results from the fact that

the average ability of the two groups is not the same, and the earning differences

resulting from this ability gap are being coun ted as part of the returns to educa-

tion. In fact, since α

1

− 1 > 0, high-ab ility individuals are selected into education

increasing the wag e differential. To see this, rewrite the observed wa ge differential

as follo w s

¯w

1

− ¯w

0

= α

0

+(α

1

− 1)

∙

c − α

0

2(α

1

− 1)

¸

+

α

1

2

Here, the first two terms give the return to education evaluated at the mean abilit y

of the uneducated group. This would be the answ er to the counter-factual question

of how much the earnings of the uneducated group w ould increase if they were to

obtain education. The third term is the additional effect that results from the fact

27

Lectures in Labor Economics

that the t wo groups do not have the same ability level. It is therefore the selection

effect. Alternatively, we could ha ve written

¯w

1

− ¯w

0

= α

0

+(α

1

− 1)

∙

α

1

− 1+c − α

0

2(α

1

− 1)

¸

+

1

2

,

where no w the first two terms give the return to education evaluated at the mean

abilit y of the educated group, whic h is greater than the return to education evaluated

at the mean ability lev el of the uneducated group. So the selection effect is somewhat

smaller, but still positiv e.

This example illustrates ho w looking at observed averages, witho ut taking selec-

tion into account, may give mislead ing results, and also provides a simple example

of how to think of decisions in the presence of this ty pe of heterogeneity.

It is also interesting to note that if α

1

< 1, we w ould have negative selection in to

education, and observed returns to education w ould be less than the true returns.

Thecaseofα

1

< 1 appears less plausib le, but may arise if high abilit y individuals

do not need to obtain education to perform certain tasks.

28

Lectures in Labor Economics

Figure 1.3

29

Lectures in Labor Economics

h(t)

0

h(t)=0

h*

x*

x(t)

x(t)=0

h(0)

x’’(0)

x’(0)

Figure 1.4. Steady state and equilibrium dyn amics in the simp lified

BenPorathmodel.

30

Lectures in Labor Economics

h(t)

t

0

h*

h(0)

Figure 1.5. Time path of h u m a n capital investments in the simpli-

fied Ben Porath model.

31

Lectures in Labor Economics

Figure 1.6

32

Lectures in Labor Economics

Figure 1.7. Selection in the One-Factor Model.

33

CHAPTER 2

Human Cap ital an d Signaling

1. The Basic Model of Labor Market Signaling

The models w e hav e discussed so far are broadly in the tradition of Bec ker’s

approach to human capital. Human capital is viewed as an input in the production

process. Th e leading alternative is to view education purely as a signal. C o nsid er

the follo wing simple model to illustrate the issues.

There are two t y pes of workers, high ability and lo w abilit y. The fraction of

high abilit y workers in the population is λ. Workers kno w their ow n abilit y, but

employers do not observ e this directly. H igh abilit y work ers alwa ys produce y

H

,

while low abilit y workers produce y

L

. In addition, work er s can obtain education.

The cost of obtaining education is c

H

for high ab ility workers and c

L

for low ability

work ers. The crucial assumptio n is that c

L

>c

H

, that is, education is more costly

for lo w ability workers. This is often referred to as the “single-crossing” assumption,

since it mak es sure that in the space of educa tion and wa ges, the indifference curves

of high and low t ypes intersect only once. For future reference, let us denote the

decision to obtain education b y e =1.

For simplicity, we assume that education does not increase the productivity of

either type of w orker. Once wo rkers obtain their education, there is competition

among a large n umber of risk-neutral firm s, so w orkers will be paid their expected

productivity. More specifically,thetimingofeventsisasfollows:

• Each work er finds out their ability.

• Each wor ker c hooses education, e =0or e =1.

• A large number of firm s observ e the education decision of each worker (but

not their abilit y) and compete a la Bertrand to hire these w o rkers.

35

Lectures in Labor Economics

Clearly, this environm ent corresponds to a dynamic game of incomplete informa-

tion, since individuals kno w their ability, but firms do not. In natural equilibrium

concept in this case is the P erfect Ba yesian Equilibrium. Recall that a P e rfe ct

Bay e sian Equilibrium consists of a strategy profile σ (designating a strategy for

each player) and a brief profile μ (designating the beliefs of eac h pla yer at eac h

information set) such that σ is sequentially rational for each play e r giv en μ (so that

each pla yer pla ys the best response in eac h information set given their beliefs) and

μ is deriv ed from σ using Ba yes’s rule whenev er possible. W hile Perfect Bayesian

Equilibria are straigh tforward to ch aracterize and often reasonable, in incomplete

informat ion games where playe rs with private information move before those with-

out this information, there may also exist Perfect Ba yesian Equilibria with certain

undesirable chara cteristics. We ma y therefore wish to strengthen this notion of

equilibrium (see belo w ).

In general, there can be t wo types of equilibria in this game.

(1) Separating, where high and lo w ability workers ch oose different lev els of

sc h ooling, and as a result, in equilibrium, employers can infer worker abilit y

from education (whic h is a straightforward application of Bay esia n updat-

ing).

(2) P ooling, where high and lo w ability work ers c hoose the same level of edu-

cation.

In addition, there can be semi-separating equilibria, where some education levels

are chosen by more than one type.

1.1 . A sepa rating eq u ilibrium. Let us start b y characterizing a possible sep-

arating equilibrium , which illustrates ho w education can be valued, even though it

has no directly productive role.

Suppose that w e hav e

(2.1) y

H

− c

H

>y

L

>y

H

− c

L

36

Lectures in Labor Economics

This is clearly possible since c

H

<c

L

. Then the following is an equilibriu m: all high

ability workers obtain educatio n, and all low abilit y wo rkers c hoose no educatio n.

Wages (conditional on education) are:

w (e =1)=y

H

and w (e =0)=y

L

Notice that these wages are conditioned on education, and not directly on abilit y,

since ability is not observed b y employers. Let us now c h eck that all parties are

pla y ing best responses. First consider firms. Giv en the strategies of w orkers (to

obtain education for high ability and not to obtain education for low abilit y ), a

work er with education has productivity y

H

while a w or ker with no educatio n has

productivity y

L

.Sonofirm can c hange its behavior and increase its profits.

W hat about workers? If a high ability work er deviates to no education, he will

obtain w (e =0)=y

L

, whereas he’s currently getting w (e =1)−c

H

= y

H

−c

H

>y

L

.

If a lo w ability worker deviates to obtaining education, the market w ill perceive him

as a high ability work er , and pa y him the higher w age w (e =1)=y

H

.Butfrom

(2.1), we have that y

H

− c

L

<y

L

, so this deviation is not profita ble for a lo w abilit y

worker, proving that the separating allocation is indeed an equilib rium.

In this equilib riu m, education is valued simply because it is a signal about ability.

Edu cation can be a signal about ability because of the single-crossing property. This

can be easily verified b y considering the case in wh ich c

L

≤ c

H

. Then w e could never

hav e condition (2.1) hold, so it would not be possible to convince high abilit y w or kers

to obtain education, while deterring low ability workers from doing so.

Notice also that if the game was one of perfect information, that is, the w orker

t ype were publicly observ ed, there could never be education investmen ts here. This

is an extreme result, due to the assumption that education has no productivity

benefits. But it illustrates the forces at wo rk.

1.2. Pooling equilibri a in signa lin g games. How ever, the separating equi-

librium is not the only one. Consid er the following allocation: both lo w and high

37

Lectures in Labor Economics

abilit y workers do not obtain education, and the w a ge structure is

w (e =1)=(1− λ) y

L

+ λy

H

and w (e =0)=(1− λ) y

L

+ λy

H

It is straigh tfo rward to ch eck that no worker has an y incen tive to obtain edu-

cation (giv en that education is costly, and there are no rewards to obtaining it).

Since all workers choose no education, the expected productivity of a w orker with

no education is (1 − λ) y

L

+λy

H

,sofirms are playing best responses. (In Nash Equi-

librium and Perfect Bayesian Equilibrium, what they do in response to a deviation

b y a w ork er who obtains education is not important, since this does not happen

along the equilibrium path).

W hat is happening here is that the market does not view education as a good

signal, so a wo rker who “deviates” and obtains education is viewe d as an average-

abilit y work er, not as a high-ability w orker.

W ha t we hav e just described is a P erfe ct Bayesian Eq uilibrium. But is it reason-

able? The answer is no. This equilibrium is being supported by the belief that the

work er who gets edu cation is no better than a worker who does not. But education

is more costly for low abilit y w or kers, so they should be less likely to deviate to

obtaining education. There are man y refinem ents in game theory whic h basically

try to restrict beliefs in informa tion sets that are not reached along the equilibrium

path, ensuring that “unreasonable” beliefs, such as those that think a deviation to

obtainin g educat ion is more likely from a low ab ility w o rker, are ruled out.

Perhaps the simplest is The Intuitive Criterion in troduced by Cho and Kreps.

The underlying idea is as follow s. If there exists a type who will nev e r benefit

from taking a particular deviation, then the uninformed parties (here the firms)

should deduce that this deviation is v er y unlikely to come from this ty pe. This

falls within the category of “forw ar d induction” where rather than solving the game

simply bac kwards, we think about what ty pe of inferences will others derive from a

deviation.

38

Lectures in Labor Economics

To illustrate the main idea, let us simplify the discussion by sligh tly strength en ing

condition (2.1) to

(2.2) y

H

− c

H

> (1 − λ) y

L

+ λy

H

and y

L

>y

H

− c

L

.

Now tak e the pooling equilibriu m above. Consider a deviation to e =1.Thereis

no circumstance under which the low type would benefitfromthisdeviation,since

by assumption (2.2) we ha ve y

L

>y

H

− c

L

, and the most a w orker could ev er get is

y

H

, and the low abilit y w orker is now getting (1 − λ) y

L

+ λy

H

. Therefore, firm s can

deduce that the deviation to e =1must be coming from the high type, and offer

him a w age of y

H

. Then (2.2) also ensures that this deviation is profitable for the

high t ypes, breaking the pooling equilibrium .

The reason wh y this refinem ent is referred to as “The Intuitive Criterion” is

that it can be supported by a relatively in tuitive “speech” b y the deviator along the

follow ing lines: “y ou have to deduce that I must be the high type deviating to e =1,

since lo w ty pes w ould never ever consider such a deviation, whereas I w ould find

it profitable if I could convince you that I am indeed the high t ype).” You should

bear in mind that this speech is used simp ly as a loose and intu itive description of

the reasoning underlying this equilibrium refinement. In practice there are no such

speec hes, because the possibility of making suc h speec hes has not been modeled as

part of the game. Nev erth eless, this heuristic device gives the basic idea.

The overall conclusion is that as long as the separating condition is satisfied,

we expect the equ ilibrium of this economy to involve a separating allocation, whe re

education is valued as a signal.

2. Generalizations

It is straightforward to generalize this equilib rium concept to a situation in whic h

education has a productiv e role as well as a signaling role. Then the story would be

one where education is valued for more than its productiv e effect, because it is also

associated with higher ability.

39

Lectures in Labor Economics

Figure 2.1

Letmegivethebasicideahere. Imaginethateducationiscontinuouse ∈ [0, ∞).

And the cost functions for the high and low t ypes are c

H

(e) and c

L

(e),whichare

both strictly increasing and con vex, with c

H

(0) = c

L

(0) = 0. The single crossing

property is that

c

0

H

(e) <c

0

L

(e) for all e ∈ [0, ∞),

that is, the marginal cost of investing in a given unit of education is alw ays higher

for the low type. Figure 3.1 shows these cost functions.

Moreover, suppose that the output of the t wo ty pes as a function of their edu-

cations are y

H

(e) and y

L

(e),with

y

H

(e) >y

L

(e) for all e.

Figure 2.2 shows the first-best, whic h would arise in the absence of incomplete

informat ion.

40

Lectures in Labor Economics

Figure 2.2. The first best allocation with complete information.

In particular, as the figure shows, the firstbestinvolveseffort levels (e

∗

l

,e

∗

h

) suc h

that

(2.3) y

0

L

(e

∗

l

)=c

0

L

(e

∗

l

)

and

(2.4) y

0

H

(e

∗

h

)=c

0

H

(e

∗

h

) .

W ith incomplete informa tion , there are again many equilibria, some separating,

some pooling and some semi-separating. But applying a stronger form of the In-

tuitive Cr iterion reasoning, we will pic k the Riley equilibrium of this game, whic h

is a particular separating equilibrium . It is c ha racterize d as follows. We first find

the most preferred education level for the lo w type in the perfect inform a tion case,

which coincides with the first best e

∗

l

determin ed in (2.3). Then w e can write the

41

Lectures in Labor Economics

incen tive compatibilit y constrain t for the lo w t ype, suc h that when the market ex-

pects lo w types to obtain education e

∗

l

,thelowtypedoesnottrytomimicthehigh

t ype; in other words, the lo w t ype agen t should not prefer to choose the education

level the market expects from the high type, e, and receive the wage associated with

this level of educ ation. This incentive com patib ility constraint is straightforw a rd to

write once w e not e tha t in the wage level that lo w ty pe w or kers will obtain is exactly

y

L

(e

∗

l

) in this case, since w e are looking at the separating equilibr ium. Thus the

incentive compatibility constraint is simply

(2.5) y

L

(e

∗

l

) − c

L

(e

∗

l

) ≥ w (e) − c

L

(e) for all e,

where w (e) is the w age rate paid for a worker with education e.Sincee

∗

l

is the first-

best effort lev el for the lo w type w orker, if we had w (e)=y

L

(e),thisconstraint

wouldalwaysbesatisfied. Howev er, since the market can not tell low and high type

work ers apart, b y choosing a different level of education, a lo w type worker ma y be

able to “mimic” and high type w o rker and th us w e will t y p ically hav e w (e) ≥ y

L

(e)

when e ≥ e

∗

l

, with a strict inequalit y for some values of education . Therefore, the

separatin g (Riley) equilib riu m must satisfy (2.5) for the equilibrium wage function

w (e).

To ma ke further progress, no te tha t in a separating equ ilib rium , there will exist

some level of education, sa y e

h

, that will be chosen by high type workers. Then,

Bertran d competition among firms, with the reasoning similar to that in the previous

section, implies that w (e

h

)=y

H

(e

h

). Therefore, if a low type worker deviates to

this level of effort,themarketwilltakehimtobeahightypeworkerandpayhim

the w a ge y

H

(e

h

). Now take this education level e

h

to be suc h that the incen tive

compatibility constraint, (2.5), holds as an equalit y, that is,

(2.6) y

L

(e

∗

l

) − c

L

(e

∗

l

)=y

H

(e

h

) − c

L

(e

h

) .

Then the Riley equilibriu m is suc h that low t y pes c hoose e

∗

l

andobtainthewage

w (e

∗

l

)=y

L

(e

∗

l

), and high types choose e

h

and obtain the w age w (e

h

)=y

H

(e

h

).

That high types are happ y to do this follow s imm edia tely from the single-crossing

42

Lectures in Labor Economics

Figure 2.3. The Riley equilibrium.

property, since

y

H

(e

h

) − c

H

(e

h

)=y

H

(e

h

) − c

L

(e

h

) − (c

H

(e

h

) − c

L

(e

h

))

>y

H

(e

h

) − c

L

(e

h

) − (c

H

(e

∗

l

) − c

L

(e

∗

l

))

= y

L

(e

∗

l

) − c

L

(e

∗

l

) − (c

H

(e

∗

l

) − c

L

(e

∗

l

))

= y

L

(e

∗

l

) − c

H

(e

∗

l

) ,

43

Lectures in Labor Economics

where the first line is in troduced by adding and subtracting c

L

(e

h

). The second line

follows from single crossing, since c

H

(e

h

) − c

L

(e

h

) <c

H

(e

∗

l

) − c

L

(e

∗

l

) in vie w of the

fact that e

∗

l

<e

h