BY ORDER OF THE SECRETARY

OF THE AIR FORCE

AIR FORCE MANUAL 34-209

2 OCTOBER 2019

Services

NONAPPROPRIATED FUND

FINANCIAL MANAGEMENT

AND ACCOUNTING

COMPLIANCE WITH THIS PUBLICATION IS MANDATORY

ACCESSIBILITY: Publications and forms are available on the e-Publishing web site at

www.e-Publishing.af.mil for downloading or ordering

RELEASABILITY: There are no releasability restrictions on this publication

OPR: AF/A1SR

Supersedes: AFI34-209, 10 January 2005;

AFMAN34-214, 14 February 2006;

AFMAN34-215, 9 February 2016

Certified by: SAF/MR

Pages: 152

This publication implements Air Force Policy Directive (AFPD) 34-1, Air Force Services. It

assigns responsibilities and explains financial management and accounting procedures for all

nonappropriated fund instrumentalities (NAFI). It has been developed in collaboration between

the Deputy Chief of Staff for Manpower, Personnel and Services (AF/A1), the Chief of the Air

Force Reserve (AF/RE) and the Director of the Air National Guard (NGB/CF), and applies to all

active duty Regular Air Force members, members of the Air Force Reserve, members of the Air

National Guard on collocated installations and when in Title 10 status, and Department of Defense

Contractors. Ensure all records created as a result of processes prescribed in this publication are

maintained in accordance with Air Force Manual (AFMAN) 33-363, Management of Records, and

disposed of in accordance with the Air Force Records Disposition Schedule located in the Air

Force Records Information Management System (AFRIMS). Refer recommended changes and

questions about this publication to the Office of Primary Responsibility (OPR) using the AF Form

847, Recommendation for Change of Publication; route AF Forms 847 from the field through the

major command (MAJCOM) functional managers. This publication may be supplemented at any

level, but all Supplements must be routed to the OPR of this publication for coordination prior to

certification and approval. The authorities to waive wing/unit level requirements in this

publication are identified with a Tier (“T-0, T-1, T-2, T-3”) number following the compliance

statement. See AFI33-360, Publications and Forms Management, for a description of the

authorities associated with the Tier numbers. Submit requests for waivers through the chain of

command to the appropriate Tier waiver approval authority, or alternately, to the requestor’s

2 AFMAN34-209 2 OCTOBER 2019

command for non-tiered compliance items. The use of the name or mark of any specific

manufacturer, commercial product, commodity, or service in this publication does not imply

endorsement by the Air Force.

This Manual requires the collection and or maintenance of information protected by the Privacy

Act of 1974 authorized by 10 USC. and 5 USC. The applicable SORNs, F065 AF SVA A, Non-

appropriated Fund Instrumentalities (NAFIs) Financial System, F065 AF SVA B, Non-

appropriated Fund (NAF) Insurance and Employee Benefit System Files, F065 AF SVA D, Non-

appropriated Funds Standard Payroll System, F034 AF AFSVC B, Non-Appropriated Fund

(NAF) Civilian Personnel Records, F034 AF SVA E, Check Cashing Privilege Files, F034 AFPC

B, Air Force Morale and Welfare Membership Programs are available at

https://dpcld.defense.gov/Privacy/SORNs/.

SUMMARY OF CHANGES

This publication has been substantially revised and needs to be completely reviewed. It reflects

organizational changes with the standups of the Force Support Squadron (FSS) and Air Force

Installation and Mission Support Center (AFIMSC) as well as changes to responsible offices,

points of contact, and roles and responsibilities. This revision updates the Air Force Morale,

Welfare, and Recreation (MWR) Logistics property, asset, and vehicle management program and

administrative changes due to updates to AFI23-101, Air Force Materiel Management. In

addition, this revision rescinds AFMAN34-214, Procedures for Nonappropriated Funds Financial

Management and Accounting, and AFMAN34-215, Procedures for the Cash Management and

Investment Program, and incorporates the guidance from those publications herein

Chapter 1— PRINCIPLES, STANDARDS, AND REQUIREMENTS 15

1.1. Accounting Entity. ................................................................................................ 15

1.2. General Accounting Policies. ................................................................................ 15

1.3. Accrual Method of Accounting. ........................................................................... 16

1.4. Summarizing Accounting Transactions. ............................................................... 16

1.5. Authorized Changes. ............................................................................................. 17

1.6. General Ledger Maintenance. ............................................................................... 17

1.7. Fund Equity. .......................................................................................................... 20

1.8. Transfers of Equity. .............................................................................................. 22

1.9. Grants. ................................................................................................................... 23

1.10. Extraordinary Items. ............................................................................................. 23

1.11. Financial Statements. ............................................................................................ 23

1.12. Requests for Technical Assistance or Waiver. ...................................................... 24

AFMAN34-209 2 OCTOBER 2019 3

1.13. Forms. ................................................................................................................... 24

1.14. Financial Management Training. .......................................................................... 24

1.15. Management Fee Agreements. .............................................................................. 24

1.16. Community Commons. ......................................................................................... 25

1.17. Training Aids (TAs). ............................................................................................. 25

1.18. Financial Analysis. ................................................................................................ 25

1.19. Disposition of Records. ......................................................................................... 25

Chapter 2— NONAPPROPRIATED FUND ACCOUNTING ROLES,

RESPONSABILITES AND STANDARDS 26

2.1. Directorate of Services (AF/A1S). .......................................................................... 26

2.2. Air Force Services Center, Commander (AFSVC/CC) or Executive Director. ...... 26

2.3. Air Force Services Center, Directorate of Financial Management and

Comptroller (AFSVC/FM). ..................................................................................... 26

2.4. Air Force Services Center, Shared Services Center (AFSVC/SSC). ...................... 27

2.5. Air Force Services Center, Directorate of Installation Support (AFSVC/SVI). ... 27

2.6. Air Force Installation and Mission Support Center Nonappropriated Fund

Financial Analysts .................................................................................................... 27

2.7. Installation Commander. ......................................................................................... 27

2.8. FSS Commander or Director. ................................................................................. 27

2.9. Resource Management Flight Chief. ...................................................................... 28

2.10. Nonappropriated Fund Accounting Office Standards. .......................................... 28

2.11. Nonappropriated Fund Accounting Office Relation to Other Type Funds. .......... 28

2.12. Nonappropriated Fund Accounting Office Funding Support. ............................... 29

2.13. Changes of Custodian and Activity Managers. ..................................................... 29

2.14. Life-of-the-Fund File. ........................................................................................... 30

Chapter 3— BUDGET PROCEDURES 32

3.1. Nonappropriated Fund Budget Program. ............................................................. 32

3.2. Nonappropriated Fund Budget Preparation Timeframe. ...................................... 32

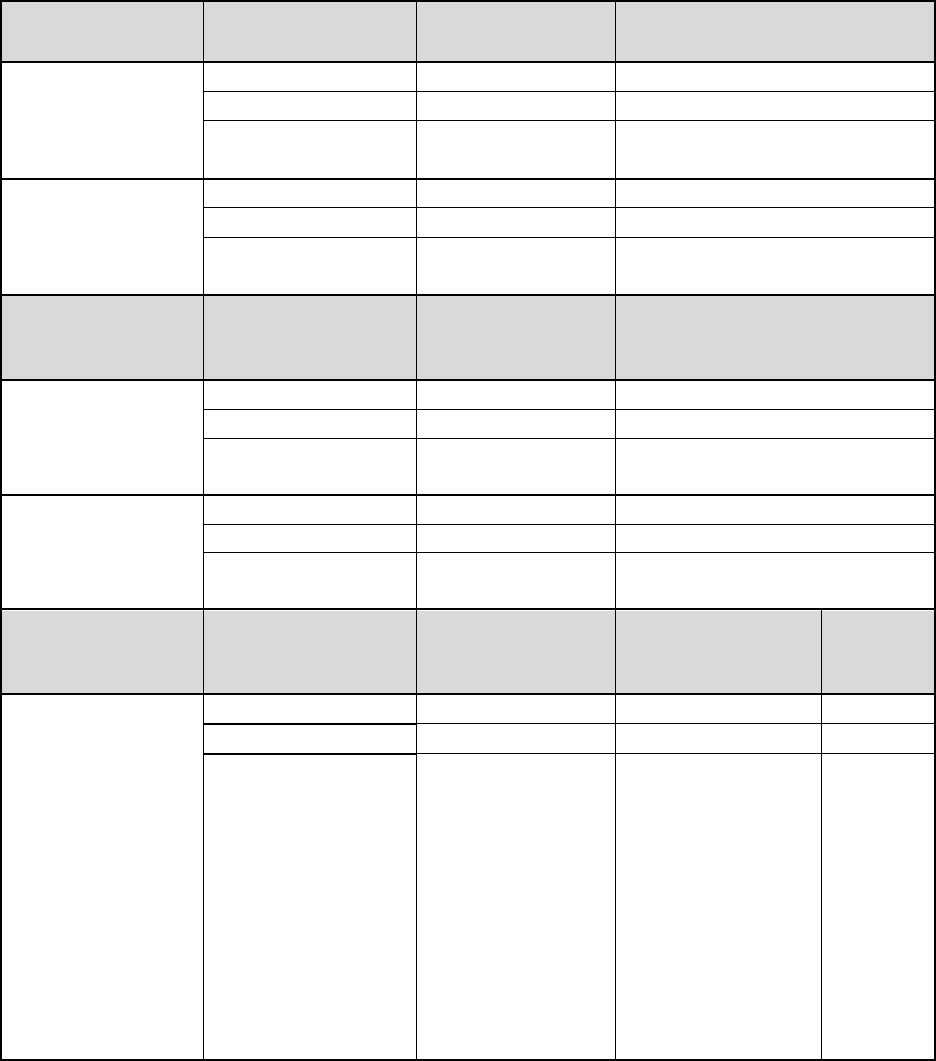

Figure 3.1. Suggested Nonappropriated Fund Budgeting Actions Schedule. ........................... 32

3.3. Preparing Nonappropriated Fund Income and Expense Budget. ......................... 33

4 AFMAN34-209 2 OCTOBER 2019

3.4. Prepare the Nonappropriated Fund Requirements Budget (NRB). ....................... 34

3.5. Preparation of the Nonappropriated Fund Cash Flow Budget. ............................ 36

3.6. The Appropriated Fund Budget. ........................................................................... 36

3.7. Nonappropriated Fund Vehicle Budget Exhibit. ................................................... 37

Figure 3.2. Sample Nonappropriated Fund Vehicle Budget Exhibit. ........................................ 38

3.8. The Lodging Budget. ............................................................................................ 38

3.9. Review and Approval Nonappropriated Fund Budgets. ....................................... 38

3.10. Budget Training. ................................................................................................... 39

Chapter 4— PROPERTY 40

4.1. Capitalization of Assets: ......................................................................................... 40

4.2. Recording Fixed Assets. ....................................................................................... 41

4.3. Acquisition of Fixed Assets. ................................................................................. 41

4.4. Acquisition of Expendable Items. ......................................................................... 45

4.5. Leases...................................................................................................................... 47

4.6. Fixed Assets-Appropriated Fund Titled. ............................................................... 50

4.7. Horses. .................................................................................................................. 50

4.8. General Services Administration Seized Property or Defense Logistics Agency

Disposition Services (formerly Defense Reutilization and Marketing Office). ..... 50

4.9. Repair of Fixed Assets. ......................................................................................... 51

4.10. Depreciation. ......................................................................................................... 51

4.11. Trade-in of Assets. ................................................................................................ 52

4.12. Disposition of Assets. ........................................................................................... 52

4.13. Nonappropriated Fund Fixed Assets Inventory. .................................................. 52

4.14. Insurance Claims. .................................................................................................. 53

4.15. Nonappropriated Fund Labor Costs Incurred During Self-Help Renovation

Projects: ................................................................................................................... 53

4.16. Aero Clubs. ........................................................................................................... 55

4.17. Grants. ................................................................................................................... 55

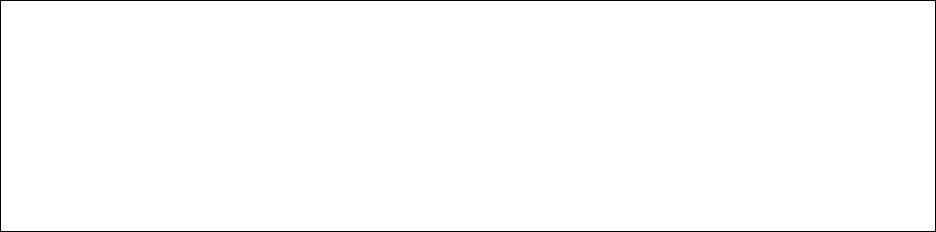

Table 4.1. Criteria for Capitalizing Purchases. ........................................................................ 56

AFMAN34-209 2 OCTOBER 2019 5

Table 4.2. Depreciation/Amortization Rate Schedules. ........................................................... 57

Chapter 5— REVENUE TRANSACTIONS AND PROMOTIONAL PROCESSING 61

5.1. Revenue Processing. ............................................................................................. 61

5.2. Individual Cashier’s Reports and Consolidated Cost Center Reports. ................. 61

5.3. Deposit Slips. ........................................................................................................ 62

5.4. Credit Card Deposits. ............................................................................................ 62

5.5. Bank Fees and Charges. ........................................................................................ 63

5.6. Special Function Gratuities. .................................................................................. 63

5.7. Accountability Using Point of Sale System. ......................................................... 63

5.8. Unearned Income. ................................................................................................. 63

5.9. Cash Refunds. ....................................................................................................... 64

5.10. Credit Card Refunds. ............................................................................................ 64

5.11. Returned Checks. .................................................................................................. 64

5.12. Promotions. ........................................................................................................... 65

5.13. Cash Overages and Shortages. .............................................................................. 65

5.14. Petty Cash Purchases From Change Funds/Receipts. ........................................... 65

5.15. Monte Carlo Night. ............................................................................................... 65

5.16. Interest. ................................................................................................................. 65

5.17. Army and Air Force Exchange Service (AAFES) Support. ................................. 65

5.18. Operating Subsidies. ............................................................................................. 65

5.19. Foreign Currency. ................................................................................................. 66

5.20. Commercial Sponsorship Program. ...................................................................... 66

5.21. Randolph Sheppard Act-Vending Facility Program for the Blind. ....................... 66

5.22. Gaming Machines. ................................................................................................ 67

5.23. Advertising Revenue. ............................................................................................ 67

5.24. Discounted Revenue. ............................................................................................ 67

5.25. Coupons. ............................................................................................................... 67

5.26. Gift Certificates and FSS Gift Cards. ................................................................... 67

5.27. Members First Discounts. ..................................................................................... 68

6 AFMAN34-209 2 OCTOBER 2019

5.28. Commercial Credit Authority. .............................................................................. 68

5.29. Merchant Agreement Authority. ........................................................................... 68

5.30. Cash Transfers from Centrally Funded Programs. ................................................ 69

5.31. Operating Grants. .................................................................................................. 69

5.32. Non-operating Grants. .......................................................................................... 69

5.33. Purchases Made with Grant Funds. ...................................................................... 69

5.34. Aero Club Liability and Hull Insurance Premiums. ............................................. 69

5.35. Asset and General Liability Insurance. ................................................................. 71

5.36. Lodging Assessment Processing. ............................................................................ 71

5.37. Gaming Machine Assessments. ............................................................................ 72

Chapter 6— ACCOUNTS RECEIVABLE 73

6.1. Customer Purchases of Merchandise and Services. .............................................. 73

6.2. Payment Method for Merchandise and Services..................................................... 73

6.3. Authorized Use of an In-House Account Receivable System. ............................ 73

6.4. Unauthorized Use of an In-House Account Receivable System. .......................... 74

6.5. Finance Charges. ................................................................................................... 74

6.6. Late Payment Charge. ........................................................................................... 74

6.7. Payment Method for Merchandise and Services. .................................................. 74

6.8. Temporary Lodging Facility (TLF). ..................................................................... 74

6.9. Visiting Quarters (Visiting Quarters). ................................................................... 74

6.10. Other Credit Provisions. ....................................................................................... 74

6.11. Agency Accounts. ................................................................................................. 74

6.12. Collection Actions. ............................................................................................... 74

6.13. Balancing Account Receivable Subsidiary. .......................................................... 75

6.14. Late Payments and Finance Charges. ................................................................... 75

6.15. Allowance for Uncollectible Accounts. ................................................................ 75

6.16. Account Receivable Operating Instruction. .......................................................... 75

6.17. Account Receivable Aging and Reporting. .......................................................... 75

6.18. Special Functions. ................................................................................................. 76

AFMAN34-209 2 OCTOBER 2019 7

6.19. Collection Actions. ............................................................................................... 76

6.20. Military Pay Order. ............................................................................................... 76

6.21. Write-off of Uncollectible Accounts. ................................................................... 76

6.22. Payment on Accounts Previously Written Off as Uncollectible. .......................... 76

6.23. Processing Debtor Payments at Base. ................................................................... 77

6.24. Bad Debt Write-Off Procedures. ........................................................................... 77

6.25. Credit Card Charges. ............................................................................................. 77

Chapter 7— PURCHASE AND CONTROL OF MERCHANDISE 78

7.1. Purchase and Control of Merchandise. ................................................................. 78

7.2. Advance Payment Conditions and Authority. ....................................................... 79

7.3. Overseas Shipments. ............................................................................................. 80

7.4. Partial Shipments. ................................................................................................. 80

7.5. Value Added Tax. ................................................................................................. 80

7.6. Stock Records. ...................................................................................................... 80

7.7. Stock Levels and Reorder Points. ......................................................................... 80

7.8. Stock Numbers and Standard Units of Measure. .................................................. 81

7.9. Nonappropriated Fund Transfer Between Cost Centers (Transfer Between Cost

Centers). ................................................................................................................. 81

7.10. Spoilage, Breakage and Out-Dated Material. ....................................................... 81

7.11. The activity absorbs spoilage, breakage, outdated material, customer complaint,

or reject items that cost less than $100 in cost of goods. ......................................... 81

7.12. Commodities. ........................................................................................................ 82

7.13. Central Vendor Payment. ...................................................................................... 82

7.14. Consigned Merchandise. ....................................................................................... 82

7.15. Receiving Reports. ................................................................................................ 82

Chapter 8— ACCOUNTS PAYABLE PROCESSING 84

8.1. Establishment of Accounts Payable. ..................................................................... 84

8.2. Documents and Entries. ........................................................................................ 84

8.3. Payable Suspense File. .......................................................................................... 84

8 AFMAN34-209 2 OCTOBER 2019

8.4. Vendor Invoices. ................................................................................................... 85

8.5. Proof of Shipment. ................................................................................................ 85

8.6. Discounts. ............................................................................................................. 85

8.7. Delivery Costs. ...................................................................................................... 85

8.8. Documentation Required for Payment. ................................................................. 85

8.9. Filing Paid Documents. ......................................................................................... 85

8.10. Approval Authority. .............................................................................................. 86

8.11. Blanket Purchase Agreement. ............................................................................... 86

8.12. Centralized Payment of Consolidated Purchases. ................................................. 86

8.13. Prompt Payment Act Requirements. ..................................................................... 86

8.14. Ratification. ........................................................................................................... 86

8.15. Electronic Fund Transfer (EFT) Public Law 104-134, Debt Collection

Improvement Act. .................................................................................................. 86

8.16. Filing The IRS Form 1099-MISC. ........................................................................ 87

8.17. Nonappropriated Fund Travel. .............................................................................. 88

8.18. Purchasing Card. ................................................................................................... 88

Chapter 9— INVENTORY 89

9.1. Inventory Maintenance. ........................................................................................ 89

9.2. Monitoring Inventory Levels. ............................................................................... 90

9.3. Inventory Schedule and Frequency. ...................................................................... 91

9.4. Change of Activity Managers. ................................................................................ 91

9.5. Change of Custodian. ............................................................................................ 92

9.6. Free Items or Donations. ....................................................................................... 92

9.7. Nonappropriated Fund Accounting Office Inventory Procedures. ....................... 92

9.8. Bingo Payout Procedures. ....................................................................................... 92

9.9. Resale Inventory Transfer Between Cost Center. ................................................... 92

Chapter 10— CHILD DEVELOPMENT 93

10.1. United States Department of Agriculture (USDA) Child and Adult Care Food

Program. ................................................................................................................. 93

AFMAN34-209 2 OCTOBER 2019 9

10.2. Subsidy Payments to Family Child Care Expanded Child Care Providers. .......... 94

10.3. Air Force Aid Society. .......................................................................................... 95

10.4. Providing Child Care Services to Volunteers. ...................................................... 96

Chapter 11— REPORTS 97

11.1. MWR Personnel Strength and Benefit Programs Report. ..................................... 97

11.2. Appropriated Fund Support to MWR Activities. .................................................. 97

11.3. Tax Reports. .......................................................................................................... 97

11.4. Certification of Financial Statements. ................................................................... 97

11.5. Certification of Cash Management and Investment Program Accounts. .............. 97

11.6. Nonappropriated Fund Financial Statements. ........................................................ 97

Chapter 12— TRAVEL AND PCS MOVES 98

12.1. Travel. ................................................................................................................... 98

12.2. Permanent Change of Station (PCS) Moves. ........................................................ 98

Chapter 13— PAYROLL 100

13.1. Basis for Entitlements. .......................................................................................... 100

13.2. Air Force Services Financial Management System. ............................................. 100

13.3. Direct Deposit. ...................................................................................................... 101

13.4. Manual Pay Preparation. ....................................................................................... 101

13.5. Payroll Adjustment Worksheet. ............................................................................ 102

13.6. Final Pay. .............................................................................................................. 102

13.7. Loans to Employees. ............................................................................................. 102

13.8. Payroll Interface to the General Ledger. ............................................................... 102

13.9. Adjustments to Payroll Accruals. ......................................................................... 102

13.10. Unclaimed Wages. ................................................................................................ 102

13.11. Individual Pay Record. ......................................................................................... 103

13.12. Annual and Sick Leave. ........................................................................................ 103

13.13. The activity retains OPM Form 71 ......................................................................... 104

13.14. Leave Balance Insufficient to Cover Leave Requested. ....................................... 104

13.15. Advance Annual and Sick Leave. ......................................................................... 104

10 AFMAN34-209 2 OCTOBER 2019

13.16. Transfer of Annual and Sick Leave. ..................................................................... 104

13.17. Transfer of Annual Leave Under Portability. ....................................................... 105

13.18. Military Leave. ...................................................................................................... 105

13.19. Military Furlough. ................................................................................................. 106

13.20. Court Leave. .......................................................................................................... 106

13.21. Discounted Meals Furnished to Employees. ......................................................... 107

13.22. Employee Awards. ................................................................................................ 107

13.23. Severance Benefits. ............................................................................................... 107

13.24. Separation Allowances. ......................................................................................... 109

13.25. Labor Transfers. .................................................................................................... 110

13.26. Tip Reporting. ....................................................................................................... 110

13.27. Tip Allocation. ...................................................................................................... 111

13.28. Service Charges. ................................................................................................... 112

13.29. Other Authorized Deductions. .............................................................................. 112

13.30. Supporting Statement for Voluntary Deductions. ................................................. 113

13.31. Priority of Deductions. .......................................................................................... 113

13.32. Withholding Allowance Certificate. ..................................................................... 113

13.33. Earned Income Credit. ........................................................................................... 114

13.34. Tax Tables and Tax Periods. ................................................................................. 114

13.35. Methods of Withholding. ...................................................................................... 114

13.36. Adjustments to Withheld Income Taxes: ................................................................ 115

13.37. Tax Payments and Returns. ................................................................................... 115

13.38. Federal Payroll Taxes. .......................................................................................... 116

13.39. Compensation Subject to Federal Taxes. .............................................................. 117

13.40. Quarterly and Annual Reports. ............................................................................. 118

13.41. Group Health and Life Insurance Arrearages. ...................................................... 119

13.42. Workers' Compensation Program. ........................................................................ 119

13.43. Unemployment Compensation. ............................................................................. 120

13.44. Payroll Processing After a Natural Disaster. ........................................................ 120

AFMAN34-209 2 OCTOBER 2019 11

13.45. Employee Debt. .................................................................................................... 120

Chapter 14— CASH MANAGEMENT AND INVESTMENT PROGRAM (CMIP) 122

14.1. Applicability. ......................................................................................................... 122

14.2. CMIP System Overview: ........................................................................................ 122

14.3. Participation In CMIP. .......................................................................................... 123

14.4. Overdraft CMIP Accounts. ................................................................................... 124

14.5. AFSVC/FM or Installation Resource Management Flight Chief will send a

message to AFSVC/FMTB and the Shared Service Center informing them of the

corrective action taken for the overdraft NAFI's account. ....................................... 124

14.6. AFSVC/FM determines whether an assessment of pecuniary liability is

appropriate according to AFMAN34-202, Protecting Nonappropriated Fund

Assets. ...................................................................................................................... 124

14.7. Any Cash Transfer reported through the CMIP system which would cause a

NAFI to go into an overdraft status will be identified during processing and

rejected. .................................................................................................................. 124

14.8. Field Banks. .......................................................................................................... 124

14.9. Field Bank Account Ownership. ........................................................................... 124

14.10. Cash Back Arrangements. ..................................................................................... 125

14.11. Concentration Banks. ............................................................................................ 125

14.12. Merchant Agreements. .......................................................................................... 125

14.13. NAFI Account Numbers. ...................................................................................... 125

14.14. Daily Statements. .................................................................................................. 125

14.15. Payment of Interest. .............................................................................................. 125

14.16. Posting of CMIP Interest Earned. ......................................................................... 125

14.17. Consolidation or Establishment of NAFIs. ........................................................... 126

14.18. Dissolution of a NAFI. .......................................................................................... 126

14.19. MBF Closures/Changes. ....................................................................................... 126

14.20. Opening Field Bank Accounts. ............................................................................. 126

14.21. Closing Field Bank Accounts. .............................................................................. 126

14.22. Ordering Deposit Slips. ......................................................................................... 127

14.23. US Dollar Deposit Reporting. ............................................................................... 127

12 AFMAN34-209 2 OCTOBER 2019

14.24. US Dollar Checks Drawn on Foreign Banks. ....................................................... 127

14.25. AF Form 1877, Nonappropriated Fund Central Cashier Control Log. ................. 127

14.26. Foreign Currency (FC) Deposit Reporting. .......................................................... 128

14.27. Credit Card Deposit Reporting. ............................................................................ 128

14.28. Off-Base Deposit Reporting. ................................................................................ 128

14.29. Returned Checks. .................................................................................................. 128

14.30. Debit/Credit Memo Corrections. .......................................................................... 128

14.31. General Information Concerning Checks. ............................................................ 128

14.32. All check types have an 8-digit check number for CMIP reporting purposes. ..... 128

14.33. Signature Requirements on Checks. ..................................................................... 129

14.34. Signature Changes. ............................................................................................... 130

14.35. Check Numbering. ................................................................................................ 130

14.36. Reporting US Dollar General Checks. .................................................................. 130

14.37. Reporting US Dollar Void Checks. ...................................................................... 130

14.38. Stop Payment Action, US Dollar Checks. ............................................................ 130

14.39. Foreign Currency. ................................................................................................. 131

14.40. Reporting Foreign Currency Checks. ................................................................... 131

14.41. Reporting Foreign Currency Void Checks. .......................................................... 131

14.42. Stop Payment Action, Foreign Currency Checks. ................................................ 131

14.43. Corrections to Check Issue and Void Transactions Reported. .............................. 132

14.44. Foreign Currency Accommodation Sales. ............................................................ 132

14.45. Dollar Transfers. ................................................................................................... 132

14.46. Air Force Lodging Fund (AFLF). ......................................................................... 133

14.47. General Information on Remittances. ................................................................... 133

14.48. Recording Remittances. ........................................................................................ 133

14.49. Remittance Processing. ......................................................................................... 133

14.50. Automated Reimbursements. ................................................................................ 133

14.51. Property and Liability. .......................................................................................... 134

14.52. Aircraft Hull Insurance Assessments. ................................................................... 134

AFMAN34-209 2 OCTOBER 2019 13

14.53. Aircraft Liability Insurance Assessments. ............................................................ 134

14.54. Temporary Lodging Facility (TLF) Assessment. ................................................. 134

14.55. General Information on Reporting. ....................................................................... 134

14.56. Timing of Transmissions. ..................................................................................... 134

14.57. Dating of Transactions. ......................................................................................... 134

14.58. End-of-Month and Holiday Reporting. ................................................................. 134

14.59. Banking Files. ....................................................................................................... 135

14.60. Deposit Validations. .............................................................................................. 135

14.61. Deposit Validation Products and Their Use. ......................................................... 135

14.62. Foreign Currency (FC) Deposit Validation (Overseas Only). .............................. 136

14.63. Deposit Validation Reconciliation. ....................................................................... 136

14.64. Transfer between NAFIs. ...................................................................................... 136

14.65. Cash Control Summary Report. ............................................................................ 136

14.66. Outstanding Check Reports. ................................................................................. 137

14.67. Verification of Outstanding Check Reports. ......................................................... 137

14.68. End-of-Month CMIP Account Verification. ......................................................... 137

14.69. Adjustments of CMIP Accounts Due to Unreconciled Variances. ....................... 137

14.70. Programs. .............................................................................................................. 137

14.71. Severance (SEV) Participation. ............................................................................ 137

14.72. Severance Account Numbers. ............................................................................... 137

14.73. Severance Statements. .......................................................................................... 137

14.74. Severance End-of-Month Products. ...................................................................... 138

14.75. Severance Payment of Interest. ............................................................................. 138

14.76. Severance Deposits. .............................................................................................. 138

14.77. Severance Withdrawals. ........................................................................................ 138

14.78. Severance Account Minimum Balances. .............................................................. 138

14.79. Emergency Notifications. ..................................................................................... 138

14.80. Disposition of Currency and Coin. ....................................................................... 138

14.81. Blank Check Stocks. ............................................................................................. 138

14 AFMAN34-209 2 OCTOBER 2019

Attachment 1— GLOSSARY OF REFERENCES AND SUPPORTING INFORMATION 139

Attachment 2— MEMORANDUM RECEIPT CUSTODIAN REPLACEMENT OR

ALTERNATE CUSTODIAN CHANGE 148

Attachment 3— MEMORANDUM RECEIPT/ASSUMPTION OF DUTIES – ACTIVITY

MANAGER 150

Attachment 4— EXPLANATION OF AMOUNTS ENTERED ON BANK VERSUS BASE

VARIANCE REPORT ISSUED BY AFSVC/FMTB 151

Attachment 5— EXPLANATION OF DATA TO BE REPORTED ON AF FORM 1736 152

AFMAN34-209 2 OCTOBER 2019 15

Chapter 1

PRINCIPLES, STANDARDS, AND REQUIREMENTS

1.1. Accounting Entity. Each Nonappropriated Fund Instrumentality (NAFI), established

according to AFMAN34-201, Use of Nonappropriated Funds, is a separate entity for accounting

purposes. Asset, liability and equity accounts must be maintained separately for each

Nonappropriated Fund Instrumentality (NAFI). (T-0)

1.2. General Accounting Policies. Nonappropriated Fund financial statements are prepared

according to the following general accounting policies.

1.2.1. Nonappropriated Fund financial statements will be prepared in accordance with

Generally Accepted Accounting Principles and in accordance with accounting standards set

forth by the Financial Accounting Standards Board. (T-0) The exception is where the

Department of Defense (DoD) 7000.14R Financial Management Regulations (FMRS),

Volume 13, Nonappropriated Funds Policy, or Department of Defense Instruction 1015.15,

Establishment, Management, and Control of Nonappropriated Fund Instrumentalities, and

Financial Management of Supporting Resources mandates an alternate accounting treatment.

1.2.2. Assets. Assets are economic resources obtained or controlled by Nonappropriated

Fund Instrumentalities as a result of past transactions or events. The Nonappropriated Fund

Accounting Office classifies assets on financial statements as either current or noncurrent

items.

1.2.3. Current Assets. Classify those items of cash and other assets or resources the

Nonappropriated Fund Instrumentality can reasonably expect to convert to cash or to consume

during the normal operating cycle (12 months for Air Force Nonappropriated Funds) as current

assets. These include cash and cash equivalents, short-term investments, accounts receivable,

inventories and prepaid expenses.

1.2.4. Noncurrent Assets. Classify assets the Nonappropriated Fund Instrumentality will not

convert to cash or consume during the next 12 months as noncurrent assets. These include

land, buildings, leasehold improvements, furniture, equipment, bulk purchases of expendable

equipment, long-term investments, long-term receivables and long-term prepaid expenses.

1.2.5. Liabilities. Liabilities are obligations to transfer assets, provide services, or otherwise

expend assets to satisfy responsibilities resulting from past or current transactions. The

Nonappropriated Fund Accounting Office classifies liabilities as either current or noncurrent.

1.2.6. Current Liabilities. These are debts and obligations the Nonappropriated Fund

Instrumentality can expect to cover use existing current assets or the creation of other current

liabilities during the next 12 months. These include accounts payable, loans payable and

accrued liabilities.

1.2.7. Noncurrent Liabilities. Classify those liabilities the Nonappropriated Fund

Instrumentality does not expect to liquidate during the next 12 months as noncurrent. These

include the long-term portion of loans payable and long-term accrued liabilities.

1.2.8. Fund Equity. Fund equity consists of capital invested in the Nonappropriated Fund

Instrumentality plus the profit or minus the loss resulting from operations since its inception.

16 AFMAN34-209 2 OCTOBER 2019

1.3. Accrual Method of Accounting. All Nonappropriated Fund financial statements and

accounting records are prepared using the accrual method of accounting. Income received prior

to being earned is recorded as unearned income until earned. Income earned, but not received, is

recorded as both income and an accounts receivable until collected. Expenses incurred but not

paid are recorded as a liability and expensed. Expenses paid but not incurred are recorded as a

pre-paid expense until consumed. Accruals will be made as required to record capital expenses,

bulk purchases, etc. An exception to the requirement for accrual accounting is as follows:

1.3.1. Isolated Unit Funds (IUFs). Isolated Unit Funds maintain accounting records on a

cash basis if total revenue is less than $40,000 per year.

1.3.2. Income and Expenses. Income and expenses are recorded in the Nonappropriated

Fund Instrumentality and activities program and cost center where they are incurred. Do not

record identifiable activity operating expenses in any other activity or cost center unless

specifically provided for in this or other AFI. Income and expenses are recorded in the proper

income and expense general ledger account code. Entries are always made showing a complete

auditable trail of debits and credits; never use a net amount to make a correction.

1.3.3. Overhead Expenses. Expenses properly charged to overhead cost centers, e.g., fund

administration, human resources, Nonappropriated Fund Accounting Office, etc., are not

allocated to activities. The Shared Service Center fees calculated for accounting and payroll,

Human Resource (HR) support, and systematically posted transactions by the Shared Service

Center, are chargeable to the applicable memorandum of agreement cost center. This provision

is only for memorandum of agreement cost centers; do not transfer these fees or other overhead

expenses; (example unidentifiable administrative costs), or to the cost center level, within the

same Nonappropriated Fund Instrumentality. (T-0)

1.3.4. Transfers of Merchandise, Supplies or Labor. Transfers between activities within

the same Nonappropriated Fund Instrumentality or other AF NAFI are made at cost.

1.3.5. Contingencies. Contingencies are existing conditions, situations or circumstances

involving uncertainty as to potential gain or loss. The NAFI ultimately resolves contingencies

when one or more future events occur or fail to occur. The Resource Management Flight Chief

works with the Force Support Squadron commander or director to determine the amount of the

loss contingency. The Nonappropriated Fund Accounting Office posts accruals for loss

contingencies where the outcome is probable and the amount can be reasonably estimated. Do

not record gain contingencies in the financial statements. Describe the loss contingency and

all pertinent details in a footnote to the financial statement.

1.4. Summarizing Accounting Transactions. Accounting transactions are grouped and

summarized in the Air Force Services Financial Management System (AFSFMS) using a standard

accounting string. The Air Force Services Center, Financial Management and Comptroller

Directorate (AFSVC/FM), must approve in advance, changes or additions to the accounting string.

(T-1). A complete list of the segments for an accounting string and their definitions is available

on the Services Installation Support Portal. The accounting string is composed of the following

segments:

1.4.1. Major Command (MAJCOM) Code. The segment consists of three letters to

designate the MAJCOM, e.g., “ATC” for Air Education and Training Command or “SPC” for

Air Force Space Command.

AFMAN34-209 2 OCTOBER 2019 17

1.4.2. Activity Code. This segment consists of five digits to designate the specific

installation and activity making the transaction, e.g., 50315 for the Joint Base San Antonio

Randolph Golf Course.

1.4.3. Fund Code. This segment consists of three digits (e.g. 015) to designate the

Nonappropriated Fund Instrumentality, e.g., Altus MWR Fund or Altus Lodging Fund.

1.4.4. Program Code. This segment consists of four digits and identifies the program.

Generally an activity will only have one program but could have more than one, e.g., Golf with

an Activity Code “50315” could house program code 0119 or program code Other Revenue

Generating, 0123, etc.

1.4.5. Cost Center Code. This segment consists of four digits and identifies a segment of

an activity and program such as 0301 for Golf Course Operations or 0303 for Golf Pro Shop,

etc.

1.4.6. General Ledger Account Code. This segment consists of seven digits; the first three

digits identify the general account or account type. The last four digits break down the

transactions within the same general account, e.g., general ledger account code 720000 Supply

Expense. General ledger account code 7010000 Nonappropriated Fund payroll is regular

hours, general ledger account code 7010005 is overtime hours.

1.5. Authorized Changes. Directorate of Financial Management and Comptroller approves, in

advance, requests to combine history balances of individual accounts or cost centers. Installations

submit requests through the AFSVC/SVI.

1.6. General Ledger Maintenance. The Shared Service Center maintains the general ledger

and prepares the income and expense statement and balance sheet for each Nonappropriated Fund

Instrumentality. The Nonappropriated Fund Accounting Office prepares the statement of cash

flow. All AF NAFIs are accounted for within the AFSFMS and maintained by the SSC.

Transactions are posted to the general ledger each business day. The installation Resource

Management Flight Chief is responsible for the accuracy of financial statements and ensuring they

are prepared in accordance with guidance in this AFMAN. (T-1).

1.6.1. Subsidiary Records. Activities, NAF AO and SSC each maintain certain subsidiary

records on all balance sheet accounts for each Nonappropriated Fund Instrumentality.

Subsidiary records should be automated, where possible. The subsidiary records should be

reconciled to the general ledger control accounts before finalizing the monthly financial

statement. The exception to this is if a Force Support Activity maintains the subsidiary records.

1.6.1.1. During the end of month reconciliation, the activity must make the subsidiary

available for review by the Resource Management Flight Chief and the Nonappropriated

Fund Accounting Office when requested. (T-1) Activity maintained subsidiary records

must be reconciled at a minimum quarterly or monthly as designated by the Resource

Management Flight Chief and NAF AO. (T-1)

18 AFMAN34-209 2 OCTOBER 2019

1.6.1.2. The SSC and NAF AO each have assigned subsidiary responsibilities of accounts

according to the base subsidiary determination publication provided on the Services

Installation Support Portal. The frequency of subsidiary certification is included as part of

the definition of the applicable general ledger account code. The SSC will provide the

Resource Management Flight Chief of the Nonappropriated Fund Accounting Office a

certification of the subsidiary reconciliation for the accounts the Shared Service Center is

responsible to maintain as detailed in the base subsidiary determination publication. (T-1)

1.6.1.3. Each subsidiary record must contain complete information to identify validity of

the account balance (i.e., transaction date, amount, document number, description and

customer name, date of event). (T-0) The Resource Management Flight Chief will ensure

FSS activities and FSS employees are reconciling and resolving discrepancies associated

with their assigned subsidiary accounts. (T-2) Each activity or individual must provide a

certification to the Resource Management Flight Chief for his or her assigned subsidiary

general ledger control account at the frequency designated by the Resource Management

Flight Chief and the Nonappropriated Fund Accounting Office, at a minimum quarterly.

(T-1) The certification must list any discrepancies (i.e. reconciling items) in the accounts

to include differences between the subsidiary total and the general ledger, the actions taken

or resolutions, and an estimated completion date. (T-1) The Resource Management Flight

Chief, after reviewing to ensure the subsidiaries are accurate and complete, uses these

certifications as backup documentation for the monthly certification letter signed by the

Resource Management Flight Chief. Retain these certifications with the end-of-month

supporting documentation. (T-0)

1.6.1.4. A monthly general ledger detail listing is not a subsidiary of an account. It only

provides transaction detail for an accounting period. A subsidiary provides detailed

information on each transaction making up the total amount of the account balance. The

balance may consist of items from several accounting periods, not just the current period.

1.6.1.5. The Resource Management Flight Chief will document activities allowed to

maintain subsidiary accounts. (T-1)

1.6.1.6. The Resource Management Flight Chief or Nonappropriated Fund Accounting

Office will assist activity managers in the proper maintenance and reconciliation of

subsidiaries specific to their activity. (T-2) Examples of such subsidiaries include special

functions, unearned income or prepaid expenses.

1.6.1.7. If any subsidiary records are not in balance to the general ledger accounts, the

Resource Management Flight Chief must annotate the financial statement and certify with

the out-of-balance condition (see paragraph 1.10.1 on footnoting financial statements).

(T-1)

1.6.1.8. The Resource Management Flight Chief must ensure the provisions

ofAFMAN34-202, Protecting Nonappropriated Fund Assets, are followed when

subsidiary discrepancy resolution results in losses to the Nonappropriated Fund

Instrumentality. (T-1)

AFMAN34-209 2 OCTOBER 2019 19

1.6.1.9. Adjusting Entries. The Nonappropriated Fund Accounting Office, Shared

Service Center and FSS activities prepare the necessary general ledger adjustment forms

according to the monthly financial statement-closing schedule published by the Shared

Service Center. The Resource Management Flight Chief should establish and use a local

checklist for all required adjusting entries.

1.6.1.9.1. Document and explain adjustments to the general ledger on the general

ledger adjustment forms. The NAF AO will retain the general ledger adjustment forms

with all back-up documentation. (T-1) Dispose of records in accordance with IAW

paragraph 1.19 Some adjustments may be made by the Shared Service Center, but the

installation remains responsible for the financial statements.

1.6.1.9.2. The Shared Service Center will notify installations when general ledger

adjustment forms, including descriptions, are made to an installation’s general ledger.

(T-1) The SSC will receive guidance from AFSVC/FM as to the treatment of all the

general ledger entries. AFSVC/FM will ensure compliance with generally accepted

accounting Principles, applicable Financial Analyst issuances, DoD 7000.14-R,

Department of Defense Financial Management Regulations (FMR), Volume 13,

Nonappropriated Funds Policy and DoDI 1015.15, Procedures for Establishment,

Management, and Control of Nonappropriated Fund Instrumentalities and Financial

Management of Supporting Resources. (T-0) The Shared Service Center, with

guidance from AFSVC/FM will make changes to erroneous general ledger entries,

improper use of general ledger account codes or improper accounting treatment. The

installation will be notified in these situations. (T-1)

1.6.1.10. Finalizing the Financial Statement. The Resource Management Flight Chief

and Nonappropriated Fund Accounting Office will document and make available to all

activity managers and applicable staff an end of month and end of year activity closing

timeline. (T-2) The Resource Management Flight Chief should ensure all FSS personnel

understand what is required in preparing and closing the financial statements. The

Resource Management Flight Chief will provide training and ensure proper source

document submission is understood by all necessary FSS personnel. (T-2) For example;

correcting entries, transfer between cost centers for labor/supplies/inventory are all

properly submitted to the Nonappropriated Fund Accounting Office and the Shared Service

Center if needed.

1.6.1.10.1. All transactions returned for errors must be resolved according to the

closing schedule. (T-1)

1.6.1.10.2. The Nonappropriated Fund Accounting Office, Resource Management

Flight Chief, Nonappropriated Fund Financial Analyst, each flight chief and activity

manager review the preliminary financial statements for accuracy prior to monthly

financial statements being issued. (T-2)

1.6.1.10.3. Make the review of the preliminary financial statement a priority in order

not to delay the financial reporting process.

20 AFMAN34-209 2 OCTOBER 2019

1.7. Fund Equity. The Resource Management Flight Chief will only allow authorized

transactions into and out of the equity general ledger account codes. (T-0) These transactions

include net income; net losses; approved prior year adjustments; and entries associated with the

establishment, disestablishment, distribution, or redistribution of capital transferred equity, which

includes capital from another Nonappropriated Fund Instrumentality (capital includes cash and

physical assets. These transfers to Nonappropriated Fund Instrumentalities can be from the Air

Force or another DoD entity.

1.7.1. All accounts in the equity section must be reviewed by the Resource Management Flight

Chief prior to closing end of month and especially at end of year. (T-1) The RMFC can run

and review the Extended Fund Equity Balancing Report from the Air Force Services Financial

Management System (AFSFMS) to ensure all equity accounts are accurate. All errors and

other entries to equity accounts must be resolved prior to financial statement preparation and

charged to the proper general ledger account code. (T-0)

1.7.2. Prior-Period Equity Adjustments (PPEA). Prior-period equity adjustments are

items of income or expense, related to the correction of errors in the financial statements from

a prior fiscal year. If approved by the approval authority the correcting entry is accounted for

as adjustments to equity, and excluded from the determination of net income or Net Income

Adjusted for Depreciation for the current period. Errors in financial statements resulting from

mathematical mistakes in the application of accounting principles or oversight or misuse of

facts existing at the time the financial statements were prepared may qualify for prior-period

fund equity adjustments.

1.7.2.1. Only requests considered material to the Nonappropriated Fund Instrumentality

will be considered for adjustment. Materiality is typically defined as greater than one

percent (1%) of the assets in the consolidated balance sheet.

1.7.2.1.1. The Resource Management Flight Chief submits the fully coordinated

installation request for prior-period fund equity adjustment to AFSVC/SVI, who in-

turn forwards to AFSVC/FM for review and upward coordination for approval, if

proper criteria for consideration are met.

1.7.2.1.2. Requests may be signed by the installation Resource Management Flight

Chief or designated fund custodian. The package must show coordination with the

base comptroller office, Nonappropriated Fund Financial Analyst, Force Support

Squadron Commander or Director and indicate Nonappropriated Fund Council

awareness. (T-1) Any adjustment resulting in an actual loss of assets (fixed or cash)

must have documented installation commander coordination. (T-1)

1.7.2.1.3. Prior-Period Equity Adjustment requests must also include a timeline of

events, all supporting documentation, justification for qualification as a prior-period

equity adjustment, and specify the adjustment requested to include all affected general

ledger account codes and amounts. (T-1) When determining if a package should be

submitted, contact AFSVC/SVI or Financial Management Office for guidance.

1.7.2.1.4. If required by AFMAN34-202, Protecting Nonappropriated Fund Assets

requests for approval must include results of investigation of loss or a statement why

an investigation is not required.

AFMAN34-209 2 OCTOBER 2019 21

1.7.2.2. AFSVC/SVI provides a copy to Air Force Installation and Mission Support Center

Nonappropriated Fund Financial Analyst. Requests may be disapproved at any level in the

coordination process for prior period equity adjustments when they do not meet all the

criteria.

1.7.2.3. AFSVC/FM will review, coordinate and staff to higher headquarters. While

requests may be disapproved at any level in the coordination process, only SAF/FMCEB

has the authority to approve prior-period fund equity adjustments.

1.7.2.4. The NAF Accounting Office records the transaction only after SAF/FMCEB

grants written approval.

1.7.2.5. Disapproved amounts will be recorded in general ledger account code 9460000,

disapproved prior-period equity adjustments.

1.7.2.6. Make no adjustments to accounting records until written approval is received. (T-

1)

1.7.2.7. The installation Resource Management Flight Chief will be notified by

AFSVA/FM when the approved adjustment has been made in general ledger account code

2830000, prior-year adjustments. (T-1) The Nonappropriated Fund Accounting Office

footnotes the financial statements explaining the circumstances of the adjustment and the

effect.

1.7.2.8. Individuals completing comparative analysis should adjust prior-period

statements. The NAF AO will maintain a copy of the approval letter in the Life of Fund

file. (T-1)

1.7.2.9. Do not treat the following corrections and adjustments as prior-period fund equity

adjustments:

1.7.2.9.1. The result of the use of estimates in the accounting process. (T-1)

1.7.2.9.2. Changes in estimates resulting from new information. (T-1)

1.7.2.9.3. Subsequent developments and adjustments based on better insight or

improved judgment. (T-1)

1.7.2.10. Examples of transactions that generally accepted accounting principles does not

consider as prior-period fund equity adjustments include, but are not limited to:

1.7.2.10.1. Amounts considered immaterial in the determination of net income and net

income adjusted for depreciation.

1.7.2.10.2. Changes in the estimated lives of property or equipment that affect the

computed amounts of depreciation.

1.7.2.10.3. The undepreciated value of property or equipment no longer used due to

facility renovation or replacement.

1.7.2.10.4. Pay and severance benefit increases that apply to wages earned in a prior

year if they could have been reasonably estimated in a prior year or the increase

resulting from events occurring after the close of the affected prior FY.

1.7.2.10.5. Gains or losses resulting from changes in foreign currency exchange rates.

22 AFMAN34-209 2 OCTOBER 2019

1.7.2.10.6. Amounts held in construction-in-progress for a terminated and

uncompleted project. Example: design funds utilized but the project was cancelled.

1.8. Transfers of Equity. When transfers of cash or other assets are made between

Nonappropriated Fund Instrumentalities, except for the purchase of assets and payments for

services rendered, they are recorded as transfers of equity. Certain Air Force Services Center

programs may require alternative accounting treatments. Air Force Services Center Financial

Services Division (AFSVC/FMA) will provide specific accounting instructions for those

programs. These instructions are delivered electronically at the time of program execution. These

instructions are then posted to the Services Installation Support Portal for download.

1.8.1. Reserved Fund Equity. A reserve of fund equity accounting entry must be made for

goods and services on order but not yet received and for budgeted and approved fixed assets,

facility improvements and quantity (bulk) expendable purchases which are going to be

executed in the future, normally the next 12 months. (T-1) However, for a larger installation

funded project this period may exceed 12 months. Exclude centralized lodging purchases

made by the Air Force Lodging Fund; these projects are recorded on the Air Force Lodging

Fund books, not the installations. When the project(s) is complete, the project(s) will be

transferred to the installation and the corresponding entries to the installation lodging records

will be made at that time.

1.8.1.1. Reserved Equity-Current Purchases. At the end of each accounting period,

adjust this account to reflect the total value of all outstanding orders not received. Include

outstanding orders from all obligation documents, such as outstanding purchase orders,

blanket purchase agreement orders, and purchase requests for supplies, inventory and

services, including fixed assets, facility improvements, and quantity (bulk) expendables on

order. Use general ledger account code 2730000, Outstanding Orders to account for

reserved equity–current purchases. Installations must also account for outstanding orders

that are MAJCOM, AF, or MOA funded under the appropriate general ledger account

codes (e.g. general ledger account codes 274XXXX or 275XXXX).

1.8.1.2. Reserved Equity-Capital Requirements. During the month of September each

FY, close the current dollar amount in the reserved equity to fund equity-prior year and set

up the dollar amount for the next fiscal year. As of 30 September, this account should

always reflect the current and future 11 periods of proposed capital requirements. At the

end of the period adjust this account for those items executed on or no longer needed

(disapproved) and ensure the balance includes a total of 12 periods of future capital

requirements, this end of period balance will be the beginning balance for the next period.

The Nonappropriated Fund Accounting Office submits a general ledger adjustment forms

to the Shared Service Center to make necessary adjustments. Use general ledger account

code 2760001, Current Fiscal Year Capital Requirements to account for the 12 periods of

future capital requirements. Installations must also account for capital requirements

approved in the long-range capital requirements budget beyond the current fiscal year using

general ledger account codes 2760002, Next Fiscal Year Budgeted Capital Requirements

and 2760003, Out-Year Capital Requirements (3-5 years).

1.8.1.3. Reserved Equity-Quantity (Bulk) Expendable Equipment. Follow the same

process as detailed in paragraph 1.8.1.2.

AFMAN34-209 2 OCTOBER 2019 23

1.8.2. Equity Accounts. After a completed end of year closeout, the Shared Service Center

will prepare and post in the first period of the new fiscal year to roll specific equity accounts

to retained earnings; general ledger account code 2900000, Fund Equity Prior Years.

Installations prepare general ledger adjustment forms to post to the 2900000 as the offsetting

entry for outstanding orders and capital requirements detailed in paragraph 1.8.1.2. and

paragraph 1.8.1.3

1.9. Grants. See AFMAN34-201, paragraph 5.12, for guidance on acceptance and usage of

grants. Contact AFSVC/FM for specific accounting guidance and controls. Only use general

ledger account code 8330000, Special Grants Operating, when specifically directed by

AFSVC/FM accounting instructions. Additional accounting guidance for grants is provided in

paragraphs 5.31 and 5.32.

1.10. Extraordinary Items. The Resource Management Flight Chief submits requests to record

any transaction as an extraordinary gain or loss to AFSVC/SVI through their local Force Support

Squadron leadership, with coordination by the installation Nonappropriated Fund Financial

Analyst. AFSVC/SVI will review the package to ensure documentation is complete and provide

Air Force Installation and Mission Support Center Nonappropriated Fund Financial Analysts with

a copy. AFSVC/FM will review the package and if sufficient forward to AF/A1S and then

SAF/FMCEB for approval. Disapproval of requests may at any level in the coordination process.

Request for approval must include all supporting documentation, justification for qualification as

an extraordinary item and, the specific entries requested to include general ledger account codes

and amounts. (T-1) If disapproved, use the proper general ledger account code as the normal

situation would dictate. If SAF/FMCEB approves the request, the Resource Management Flight

Chief must account for extraordinary items under general ledger account code 9610000,

Extraordinary Items, and must attach a footnote to the financial statements with an explanation of

the cause of the transactions and its effect on current operations. (T-1)

1.11. Financial Statements. Financial statements are available to all authorized users from the

AFSFMS report website, https://ssc.afsv.net/, and may be downloaded and printed as required.

The financial statements consist of the income and expense statement, balance sheet, cash flow

statement, and notes to the financial statements. Cash flow statements are prepared at the

installation. Financial statements are used to assess each operation's current performance and for

critical decision-making at all levels of your installation and Force Support Squadron leadership.

1.10.1. The Resource Management Flight Chief is responsible for preparing footnotes to the

financial statements. Refer to training aid, TA-AFSFMS-59, Attaching Financial Statement

Footnotes to 6i Report, available on the Services Installation Support Portal, for instructions

on how to footnote financial statements using the Resource Management Flight Chief footnote

template. Footnotes are an integral part of the financial statements and must be provided to

Force Support Squadron management and other installation-level users of the financial

statements. (T-1)

24 AFMAN34-209 2 OCTOBER 2019

1.12. Requests for Technical Assistance or Waiver. Submit requests for clarification or

interpretation of this manual to AFSVC/SVI. Submit each request for waiver, except those waivers

authorized and granted locally according to guidance in the applicable Air Force Instruction (AFI)

to AFSVC/SVI. The installation commander must approve waivers granted according to the

AFMAN through the custodian, Force Support Squadron commander or director, as applicable.

Requests for certain waivers concerning Civilian Welfare Funds, Fisher House Funds or Mission

Essential Feeding Funds submitted through AFSVC/FM for consideration and approval by the

appropriate Board Central Fund custodian. In all waiver requests, outline the problem, identify

the specific requirement to be waived, recommend an alternative and furnish complete

justification. Review waivers at least annually or when conditions and circumstances change.

1.13. Forms. Force Support Squadron may use automated formats of AF and Nonappropriated

Fund forms. AFSVC/FM will recommend changes to Air Force forms following the approved Air

Force publication process.

1.14. Financial Management Training. The Fund Custodian (normally the Resource

Management Flight Chief) conducts (or obtains) financial management training as required. The

Resource Management Flight Chief must ensure Nonappropriated Fund Accounting Office staff,

and activity personnel as required, are trained on specific job-related duties and responsibilities

and applicable regulatory references and other published training materials (such as program

training aids, and other training-related guidance dealing with Nonappropriated Fund accounting

issues). (T-1) The Resource Management Flight Chief documents all financial management

training.

1.15. Management Fee Agreements. Management services provided in support of activities

(other than where the manager is assigned) must be based on the actual time spent in the activity.

The activity receiving management services processes a transfer of labor between the applicable

cost centers.

1.15.1. Each pay period, Nonappropriated Fund activity managers document the actual hours

spent providing management services to other activities. Provide this documentation to the

serviced activities so they can prepare the labor transfer. Include the cost center where the

manager is originally assigned, number of hours worked in other activities, and the receiving

activity where the manager performed the work.

1.15.1.1. As an alternative to tracking hours by pay period, the Force Support Squadron

commander or director may establish a distribution formula based on actual time spent

during a 30-day period. This distribution formula must be validated annually and changed

as conditions or situations vary.

1.15.1.2. Keep the documentation supporting the formula in the Life-of-the-Fund file.

1.15.2. The activity manager prepares the general ledger adjustment forms for the transfer and

the appropriate supporting documentation is provided to the Nonappropriated Fund

Accounting Office so the appropriate personnel can approve the general ledger adjustment

forms for the Shared Service Center to post in the accounting system. The activity managers

or designees need to review financial statements and general ledger detail listing to ensure

personnel expense is accurate and transactions have posted.

AFMAN34-209 2 OCTOBER 2019 25

1.15.3. Nonappropriated Fund activity managers may not transfer more than 40% of their total

salary plus benefits to any individual activity in any month. The installation commander must

approve distribution formulas that allot more than 40% of total salaries to a single activity other