*Net Employment Outlook results range from +100% to –100%

Executive

Summary

In the latest edition of the

ManpowerGroup Employment

Outlook Survey, 40,374 employers

from 42 countries were asked

about their third quarter hiring

intentions, AI adoption journey, and

challenges faced along the way.

22% Global Net Employment Outlook:

Calculated by subtracting employers planning reductions vs.

those planning to hire.* Unchanged since the previous quarter

but weakening when compared to the same time last year by -6%.

More than half (55%) of employers expect to increase

headcount due to AI and ML over the next two years and nearly one in

four believe there will be no impact.

Highest Global Hiring Demand:

Information

Technology (IT)

Finance and

Real Estate

Nearly half of companies (48%) said they

have already adopted AI, an increase of 13% year-over-year, though

employers reveal that AI optimism varies by seniority.

Healthcare and

Life Sciences

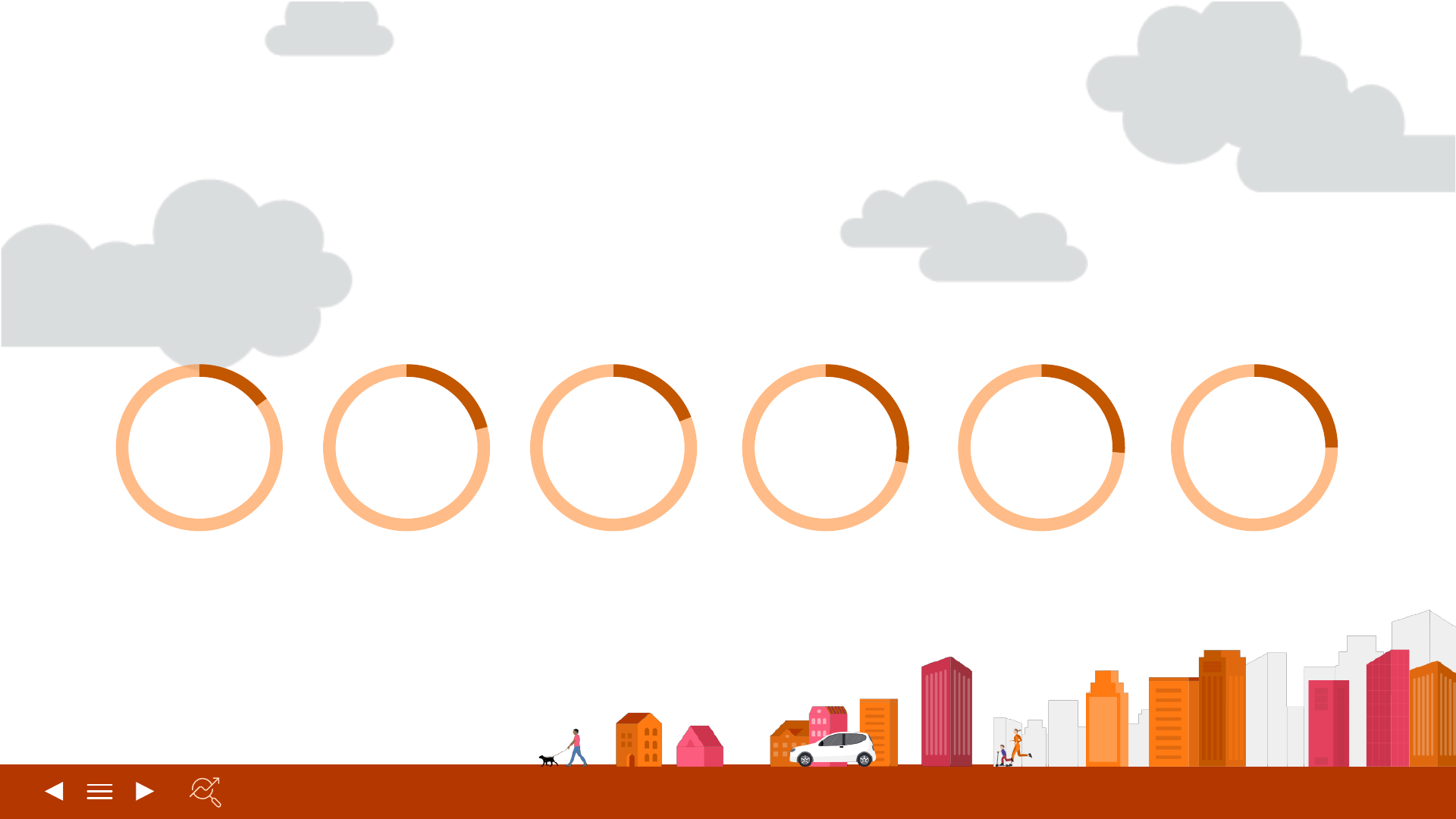

Q3 Employment Outlooks

Q3 2024 | 5

Global Employment

Outlook for Q3 2024

Used internationally as a bellwether of labor

market trends, the Net Employment Outlook

(NEO) — calculated by subtracting the

percentage of employers who anticipate

reductions to staffing levels from those

who plan to hire — continues at 22%.

Global Net

Employment

Outlook

22%

of employers anticipate

an increase in hiring

anticipate a decrease

report no change

are unsure

42%

20%

35%

3%

Q3 Employment Outlooks

Q3 2024 | 7

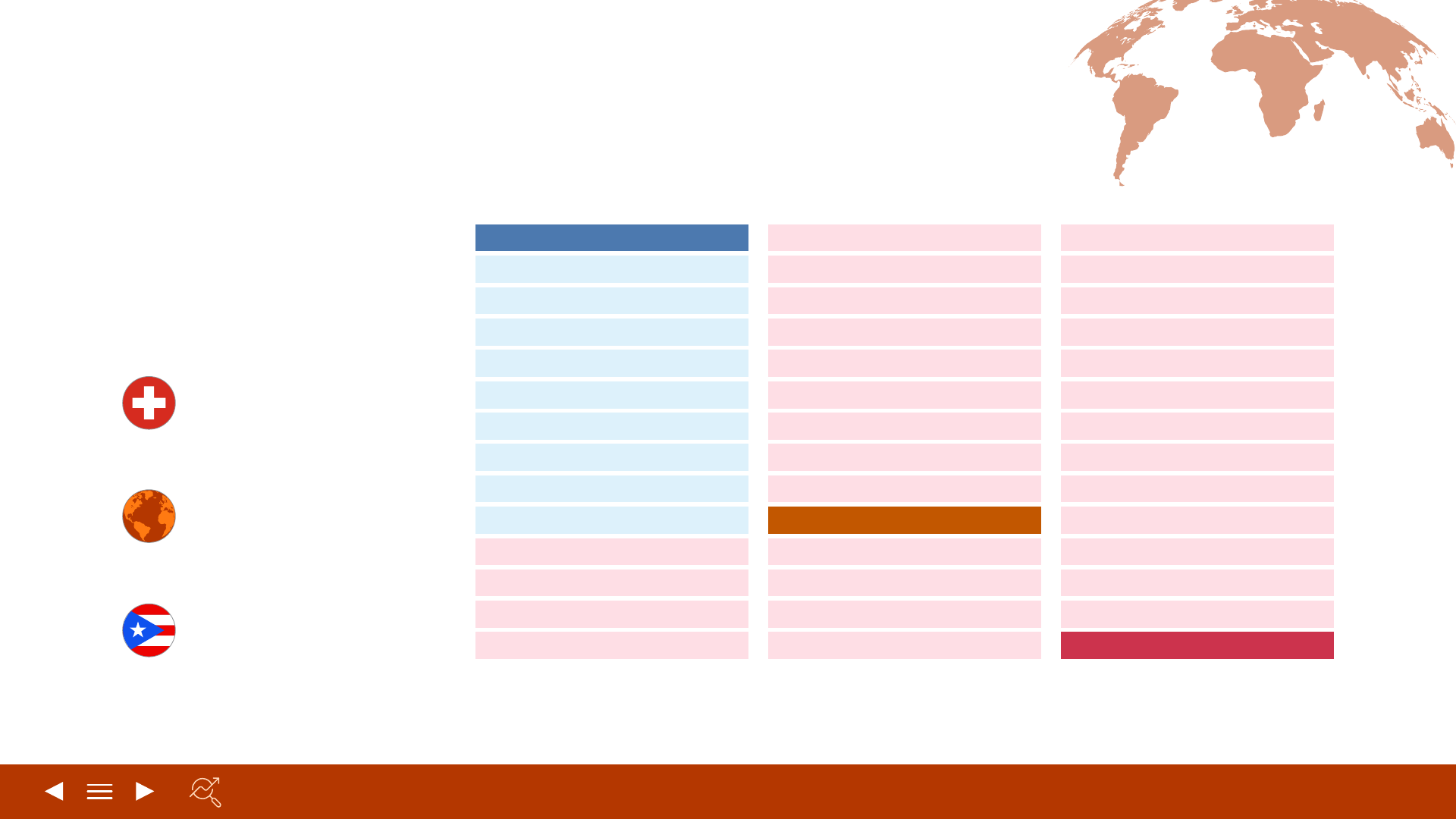

Hiring Expectations for July through September by Country

Seasonally Adjusted

Net Employment

Outlooks (NEO)

35% Costa Rica

Strongest NEO

22% Global

Average NEO

3%

Argentina and Romania

Weakest NEO

Switzerland 34%

Guatemala 32%

Mexico 32%

South Africa 31%

India 30%

U.S. 30%

China 28%

The Netherlands 28%

Brazil 27%

Belgium 25%

Peru 25%

France 24%

Canada 23%

Costa Rica 35%

Germany 23%

Ireland 23%

Finland 22%

Norway 22%

Austria 20%

Colombia 20%

Singapore

20%

U.K. 20%

Panama 19%

Portugal 18%

Taiwan 18%

Türkiye 17%

Italy 16%

Australia 15%

Spain 15%

Hungary 14%

Poland 14%

Sweden 13%

Japan 12%

Greece 10%

Puerto Rico 8%

Hong Kong 8%

Czech Republic 8%

Chile* 7%

Israel 4%

Argentina

3%

Romania

3%

Slovakia 15%

*Chile joined the program in Q2 2024. There is currently no historical data, and the data has not been seasonally adjusted.

Q3 Employment Outlooks

Q3 2024 | 8

Year-Over-Year Changes by Country

Austria +6%

Italy +6%

Slovakia +5%

Taiwan +3%

Belgium +2%

France +2%

Poland +2%

Hungary +1%

Argentina +0%

Finland -1%

Japan -1%

Guatemala -3%

Ireland -3%

Switzerland +7%

Mexico -4%

Norway -4%

Spain -5%

U.S. -5%

Brazil

-6%

Colombia -6%

India -6%

Germany -6%

Global Average

-6%

Greece -6%

Sweden -6%

Türkiye -6%

Canada -7%

South Africa -3%

Costa Rica -8%

Czech Republic -8%

Portugal -9%

U.K. -9%

The Netherlands -11%

Israel -12%

Romania -13%

Panama -14%

Singapore -14%

Peru -16%

Australia -22%

Hong Kong -25%

Puerto Rico -27%

China -7%

Seasonally Adjusted

Changes to NEO

Since Q3 2023

+7%Switzerland

Most Strengthened Outlook

-27% Puerto Rico

Most Weakened Outlook

-6% Global

Global Average

*Chile joined the program in Q2 2024. There is currently no historical data, and the data has not been seasonally adjusted.

Q3 Employment Outlooks

Q3 2024 | 9

Most Significant Outlook

Improvements for Q3

Employers in 9 countries

report a stronger hiring

Outlook compared with

the same period last year,

weakening in 31, and

remaining unchanged in 1.

Switzerland

+7%

Austria

+6%

Italy

+6%

Quarter-Over-Quarter Improvements

Year-Over-Year Improvements

Italy

+7%

Portugal

+7%

Slovakia

+5%

Brazil

+9%

Q3 Employment Outlooks

Q3 2024 | 11

Global Employment Outlooks Across Key Industry Sectors

Businesses in the Information Technology (IT) industry reported the strongest Outlook for the seventh

consecutive quarter but declined 5% versus Q2 2024.

29%

27%

27%

24%

21%

21%

16%

11%

9%

Consumer

Goods and

Services

*Includes: Government or Public Service; Not for Profit/NGO/Charity/Religious organization; Other Industry; Other Transport, Logistics and Automobiles Sub-Industry; Educational Institutions; Agriculture and Fishing

Information

Technology

Financials and

Real Estate

Healthcare

and Life

Sciences

Industrials and

Materials

Energy and

Utilities

Communication

Services

Transport,

Logistics and

Automotive

Other*/None

of the Above

Q3 Employment Outlooks

Q3 2024 | 12

Employment Outlooks Across

Europe, the Middle East, and Africa

Hiring expectations remain the lowest in Europe, the Middle

East, and Africa (18%), but strengthened by +2% since Q2 2024

and weakened -3% year-over-year.

Outlooks vary across the region with employers most keen to hire in

Switzerland (34%), South Africa (31%), and The Netherlands (28%).

Weakest Outlooks are in Romania (3%) and Israel (4%).

The strongest hiring intentions globally for the Energy & Utilities

(66%) industry vertical are reported by employers in Switzerland,

Transport and Logistics & Automotive (50%) and Industrials &

Materials (47%) in Ireland.

Strongest Hiring Intentions

Weakest Hiring Intentions

Switzerland

34%

South Africa

31%

The Netherlands

28%

Romania

3%

Israel

4%

Q3 Employment Outlooks

Q3 2024 | 13

Strongest Hiring Intentions

Weakest Hiring Intentions

India

30%

China

28%

Hong Kong

8%

Japan

12%

Employment Outlooks

Across The Asia-Pacific

Hiring managers across the Asia-Pacific

countries anticipate the second strongest regional

Outlook (23%), a decline from both the previous quarter

(-4%) and when compared to the same time last year (-8%).

India (30%) and China (28%) continue to report the strongest

Outlooks in the region.

The most cautious Outlooks were reported by employers in

Hong Kong (8%) and Japan (12%).

Q3 Employment Outlooks

Q3 2024 | 14

Employment Outlooks

Across the Americas

Employers from all 12 countries surveyed across

North, Central, and South America reported positive

employment Outlooks for Q3, though hiring intentions have

decreased in 4 countries quarter-over-quarter and in 10

compared to this time last year.

Employers in Costa Rica (35%), Guatemala (32%), and Mexico

(32%) reported the strongest hiring intentions across the regions for

Q3.

The strongest Outlooks globally for both the Consumer Goods &

Services (54%) industry verticals are reported by employers in

Guatemala, Communication Services (44%) in Mexico, Financials &

Real Estate (54%) and Healthcare & Life Sciences (46%) in Costa

Rica, and Information Technology (50%) in the U.S.

Strongest Hiring Intentions

*Chile joined the program in Q2 2024. There is currently no historical data, and the data has not been

seasonally adjusted.

Argentina

3%

Chile*

7%

Costa Rica

35%

Guatemala

32%

Weakest Hiring Intentions

Mexico

32%

Workforce Trends

Q3 2024 | 16

Navigating AI Adoption

Nearly half (48%) of companies said they have already adopted AI, including generative conversational AI. This is a

13% increase when compared to employers’ responses one year ago (35%).

14%

17%

17%

18%

24%

29%

31%

30%

21%

22%

21%

21%

Generative Conversational AI

Machine Learning (ML)

Virtual Reality

Artificial Intelligence (AI)

Next 12 monthsEarly adopter Current adopter

Next 12 monthsEarly adopter Current adopter

Next 12 monthsEarly adopter Current adopter

Next 12 monthsEarly adopter Current adopter

Workforce Trends

Q3 2024 | 17

Employers reveal that AI optimism varies by seniority. With a 12-point-gap

between senior leadership and frontline workers, leaders can seize the opportunity

to clearly communicate the positive influence that AI will bring to their workload.

Diverging Sentiments Emerge on AI

Impact to Work

57%

Factory floor

and frontline

workers

68%

Office

workers

67%

Middle

managers and

supervisors

69%

Senior

leadership

Factory floor and

frontline workers are

least optimistic about AI

Workforce Trends

Q3 2024 | 18

AI Optimism

Varies by Seniority

and Region

Most of the workforce (65%) at all

seniority levels believe AI will have a

positive impact on the future of work.

However, the level of optimism varies

based on the region and seniority of the

employees. While office professionals in

the South and Central Americas are the

most optimistic (76%) about the positive

impact of AI, less frontline workers (54%)

in Europe share this view.

Middle managers and supervisors

Office workers

Factory floor and frontline workers

Senior leadership

66%

67%

59%

68%

Middle managers and supervisors

Office workers

Factory floor and frontline workers

Senior leadership

74%

76%

66%

73%

Middle managers and supervisors

Office workers

Factory floor and frontline workers

Senior leadership

65%

66%

54%

67%

Middle managers and supervisors

Office workers

Factory floor and frontline workers

Senior leadership

68%

68%

56%

69%

North

America

South and

Central America

EMEA

Asia-

Pacific

66%

67%

59%

68%

74%

76%

66%

73%

65%

66%

54%

67%

68%

68%

56%

69%

Workforce Trends

Q3 2024 | 19

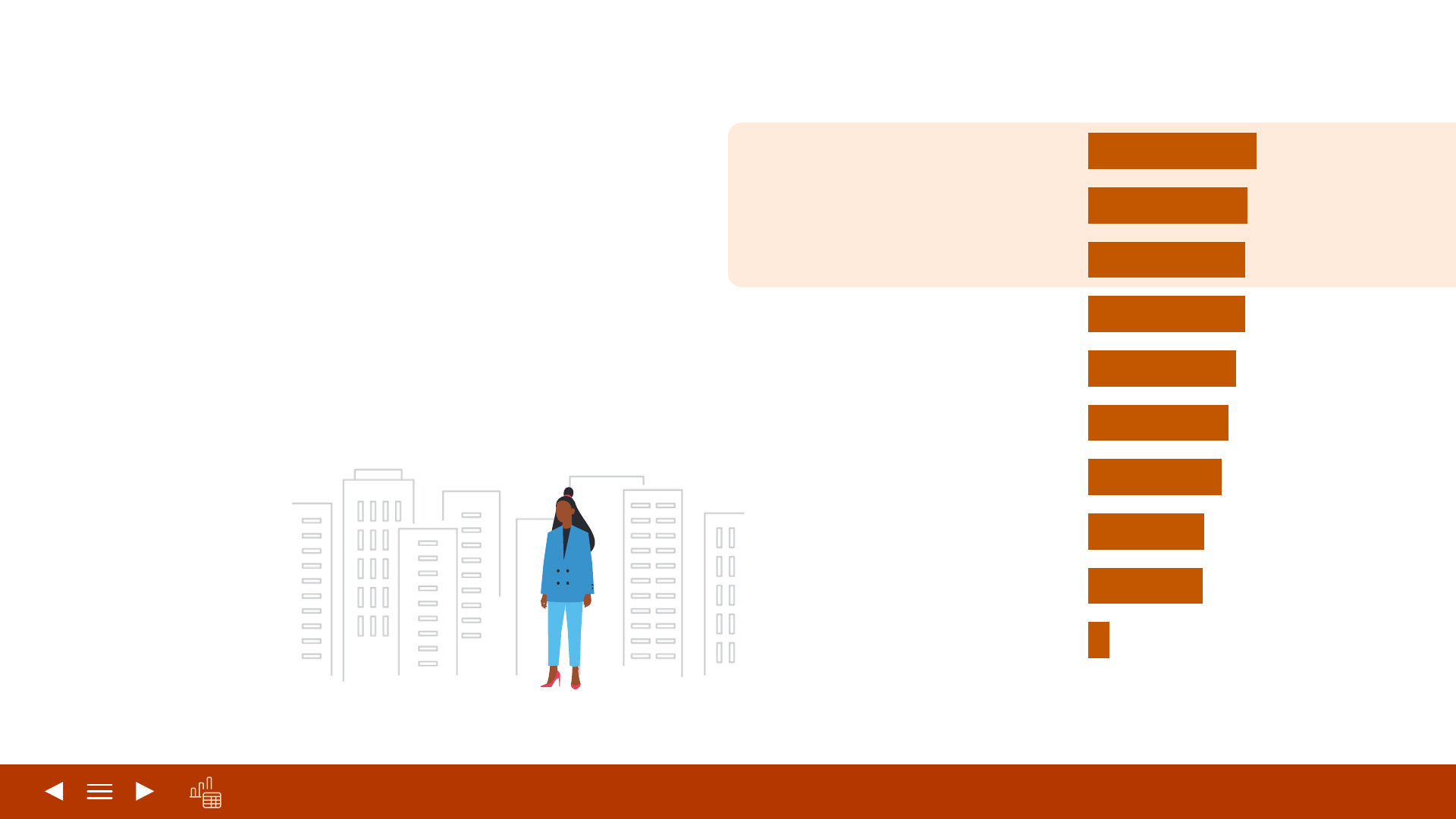

Employers Reveal that Nearly

All Organizations Encounter AI

Adoption Challenges

Most common ones relating to cost, privacy, and lack

of AI skills.

31%

33%

High cost of

investment

Concerns about

privacy &

regulations

Workers don’t

have the skills to

use AI effectively

31%

33%

31%

31%

26%

26%

24%

22%

22%

18%

4%

High cost of investment

Concerns about

privacy & regulations

Workers don’t have the

skills to use AI effectively

Lack of appropriate

AI tools & platforms

Workers are resistant to change

Implementing AI effectively

is too complex

Our organization’s data is not

structured enough to use AI

Identifying relevant use cases

Leaders are resistant to change

None of the above

Workforce Trends

Q3 2024 | 20

78%

Information

Technology

78%

Financials and

Real Estate

72%

70%

70%

64%

63%

62%

61%

59%

Overall business performance

Required employee training

Onboarding process

Recruiting process

Employee engagement

ESG initiative performance

Upskilling & reskilling

of existing employees

Diversity, Equity, Inclusion, &

Belonging (DEIB) initiatives

Employers Begin Identifying

Future Impacts From AI

When asked to predict the future impact of AI and

ML at their organization, employers globally found

consensus across industries and regions that

these tools will have a positive impact on

business performance, especially in the IT and

Financials and Real Estate industries. They were

nearly equally optimistic about the effect on

upskilling, reskilling, and training employees.

Workforce Trends

Q3 2024 | 21

Increase

headcount

No impact to

headcount

Decrease

headcount

Global Average 55% 24% 18%

Communication Services 59% 23% 16%

Consumer Goods & Services 52% 25% 20%

Energy & Utilities 63% 22% 14%

Financials & Real Estate 57% 21% 19%

Healthcare & Life Sciences 51% 26% 18%

Industrials & Materials 55% 24% 17%

Information Technology 60% 22% 17%

Transport, Logistics & Automotive

58% 22% 17%

Projected Impact

of AI and ML on

Headcount by

Industry

Over half of companies expect to

increase headcount due to AI and

ML over the next two years.

Nearly one in four believe there will

be no impact and less than one in

five anticipate staffing decreases.

Workforce Trends

Q3 2024 | 22

Engaging the Next

Generation of Workers

Employee engagement and motivation,

expectations around work-life balance, and

career advancement are the top three

challenges employers are facing with newer

workers (less than 10 years in the workforce).

34%

32%

32%

31%

30%

28%

27%

23%

23%

4%

Employee engagement & motivation

Work-life balance expectations

Career advancement expectations

Compensation expectations

Workplace technology expectations

(e.g., generative AI)

Recruiting & retention

Lacking skills to perform their role

Different communication preferences

than more experienced workers

Need for manager supervision

Our organization has no challenges with

those newer to the workforce

Employee

engagement and

motivation is the

top challenge

employers face

with new workers

Workforce Trends

Q3 2024 | 23

76%

75%

73%

73%

73%

73%

72%

71%

70%

68%

67%

Improving technology tools

Emphasis on overall well-being

Flexibility in work hours

Increased compensation &

financial stability

Increased transparency around internal

career development options

Increased focus on purpose & values

Improved onboarding experience

Formal leadership coaching

& mentoring programs

Flexibility in remote work options

Increased investment on

sustainability initiatives

Increased investment on Diversity, Equity,

Inclusion, & Belonging (DEIB) initiatives

Employers globally have found that

improving technology tools and

emphasizing well-being are the top

two drivers in boosting engagement and

productivity of their newer workforce.

Improving Tech

Tools Points to

Promising Results

82%

in Central and

South America

Improving

technology

tools

Outlooks by Industry Vertical

Q3 2024 | 25

A majority (73%) of Communication Services

organizations report difficulty finding the

skilled talent they need.*

The global NEO for the Communications

Services industry is 11%. This figure decreased

5% from the previous quarter and 11% when

compared to the same period last year.

* The 2024 Global Talent Shortage, ManpowerGroup

Communication

Services

Reported

Talent Shortage

73%

Global Net

Employment Outlook

11%

Outlooks by Industry Vertical

Q3 2024 | 26

A majority (76%) of Consumer Goods and

Services employers report difficulty finding the

skilled talent they need.*

The global NEO for Consumer Goods and

Services employers is 21%. This figure

increased 3% from the previous quarter and

is down 3% year-over-year.

* The 2024 Global Talent Shortage, ManpowerGroup

Consumer Goods

and Services

Reported

Talent Shortage

76%

Global Net

Employment Outlook

21%

Outlooks by Industry Vertical

Q3 2024 | 27

A majority (71%) of Energy and Utilities

employers report difficulty finding the skilled

talent they need.*

The global NEO for Energy and Utilities

employers is 9%. This figure decreased 9%

from the previous quarter and 25% when

compared to the same period last year.

* The 2024 Global Talent Shortage, ManpowerGroup

Energy and Utilities

Reported

Talent Shortage

71%

Global Net

Employment Outlook

9%

Outlooks by Industry Vertical

Q3 2024 | 28

A majority (72%) of Financials and Real Estate

employers report difficulty finding the skilled

talent they need.*

The global NEO for Financials and Real Estate

employers is 27%. This figure decreased 2%

from the previous quarter and 4% when

compared to the same period last year.

* The 2024 Global Talent Shortage, ManpowerGroup

Financials and

Real Estate

Reported

Talent Shortage

72%

Global Net

Employment Outlook

27%

Outlooks by Industry Vertical

Q3 2024 | 29

A majority (77%) of Healthcare and Life

Sciences employers report difficulty

finding the skilled talent they need.*

The global NEO for Healthcare and Life

Science employers is 27%. This figure

increased 1% from the previous quarter

and remains unchanged year-over-year.

* The 2024 Global Talent Shortage, ManpowerGroup

Healthcare

and Life Sciences

Reported

Talent Shortage

77%

Global Net

Employment Outlook

27%

Outlooks by Industry Vertical

Q3 2024 | 30

A majority (75%) of Industrials and Materials

employers report difficulty finding the skilled

talent they need.*

The global NEO for Industrials and Materials

employers is 24%. This figure increased 2%

from the previous quarter and is down 4%

when compared to the same period last year.

* The 2024 Global Talent Shortage, ManpowerGroup

Industrials and

Materials

Reported

Talent Shortage

75%

Global Net

Employment Outlook

24%

Outlooks by Industry Vertical

Q3 2024 | 31

A majority (76%) of IT employers report

difficulty finding the skilled talent they need.*

The global NEO for IT employers is 29%.

This figure decreased 5% from the previous

quarter and 10% when compared to the

same period last year.

* The 2024 Global Talent Shortage, ManpowerGroup

Information

Technology (IT)

Reported

Talent Shortage

76%

Global Net

Employment Outlook

29%

Outlooks by Industry Vertical

Q3 2024 | 32

A majority (76%) of Transport, Logistics and

Automotive employers report difficulty finding

the skilled talent they need.*

The global NEO for Transport, Logistics and

Automotive employers is 21%. This figure

increased 5% from the previous quarter and

is down 7% year-over-year.

* The 2024 Global Talent Shortage, ManpowerGroup

Transport, Logistics

and Automotive

Reported

Talent Shortage

76%

Global Net

Employment Outlook

21%

About the Survey

Q3 2024 | 34

Forward-Looking Statements:

This report contains forward-looking statements,

including statements regarding labor demand in

certain regions, countries and industries, economic

uncertainty and the use and impact of AI . Actual

events or results may differ materially from those

contained in the forward-looking statements, due to

risks, uncertainties and assumptions. These factors

include those found in the Company's reports filed

with the U.S. Securities and Exchange Commission

(SEC), including the information under the heading

"Risk Factors" in its Annual Report on Form 10-K for

the year ended December 31, 2023,

whose information is incorporated herein by

reference. ManpowerGroup disclaims any obligation

to update any forward-looking or other statements in

this release, except as required by law.

Unique: It is unparalleled in its size, scope, longevity and area of focus. The Survey is the most extensive, forward-looking employment

survey in the world, asking employers to forecast employment over the next quarter. In contrast, other surveys and studies focus on

retrospective data to report on what occurred in the past.

Independent: The Survey is conducted with a representative sample of employers from throughout the countries and territories in

which it is conducted. The survey participants are not derived from ManpowerGroup’s customer base.

Robust: The Survey is based on interviews with 40,374 public and private employers across 42 countries and territories to measure

anticipated employment trends each quarter. This sample allows for analysis to be performed across specific sectors and regions to provide

more detailed information.

Focused: For more than six decades, the Survey has derived all its information from a single question: “How do you anticipate total

employment at your location to change in the three months to the end of September 2024 as compared to the current quarter?”

Survey Methodology: The methodology used to collect NEO data has been digitized in 42 markets for the Q3 2024 report.

Survey responses were collected from April 1-30, 2024. Both, the question asked and the respondent profile remain unchanged. The size

of the organization and sector are standardized across all countries and territories to allow international comparisons.

About the Survey

The ManpowerGroup Employment Outlook Survey is the most comprehensive, forward-looking employment

survey of its kind, used globally as a key economic indicator. The Net Employment Outlook is derived from the

percentage of employers anticipating an increase in hiring activity and subtracting from it the percentage of employers

expecting a decrease. Running since 1962, various factors underpin its success:

About the Survey

Q3 2024 | 35

Frequently Asked Questions

What does Net Employment Outlook mean?

The Net Employment Outlook (NEO) is derived by taking the percentage of employers

anticipating an increase in hiring activity and subtracting from this the percentage of

employers that expect to see a decrease in employment at their location in the next quarter.

A positive NEO figure means that, on balance, more employers expect to add to their

headcount in the following three months than those who intend to reduce staff.

What does Seasonal Adjustment mean? Why is it used in the

ManpowerGroup Employment Outlook Survey?

Seasonal adjustment is a statistical process that allows the Survey data to be presented

without the impact of hiring fluctuations that normally occur through the course of the year –

typically due to various external factors, such as changes in weather, traditional production

cycles and public holidays. Seasonal adjustment has the effect of flattening peaks and

smoothing troughs in the data to better illustrate underlying employment trends and provide a

more accurate representation of the Survey results.

How are companies selected for

the Survey?

Employers are selected based on the types of companies

and organizations they represent. We want to ensure that our

panel is representative of each participating country’s national

labor market, so each country’s panel is built in proportion to

that country’s overall distribution of industry sectors and

organization sizes.

Who do you interview in each company?

The person we select to interview will be someone with a good

overview of staffing levels and hiring intentions within their

organization. Normally, this will be the head of human resources

(HR) or an HR manager. In smaller organizations, however, that

person may be a general manager or even the CEO.