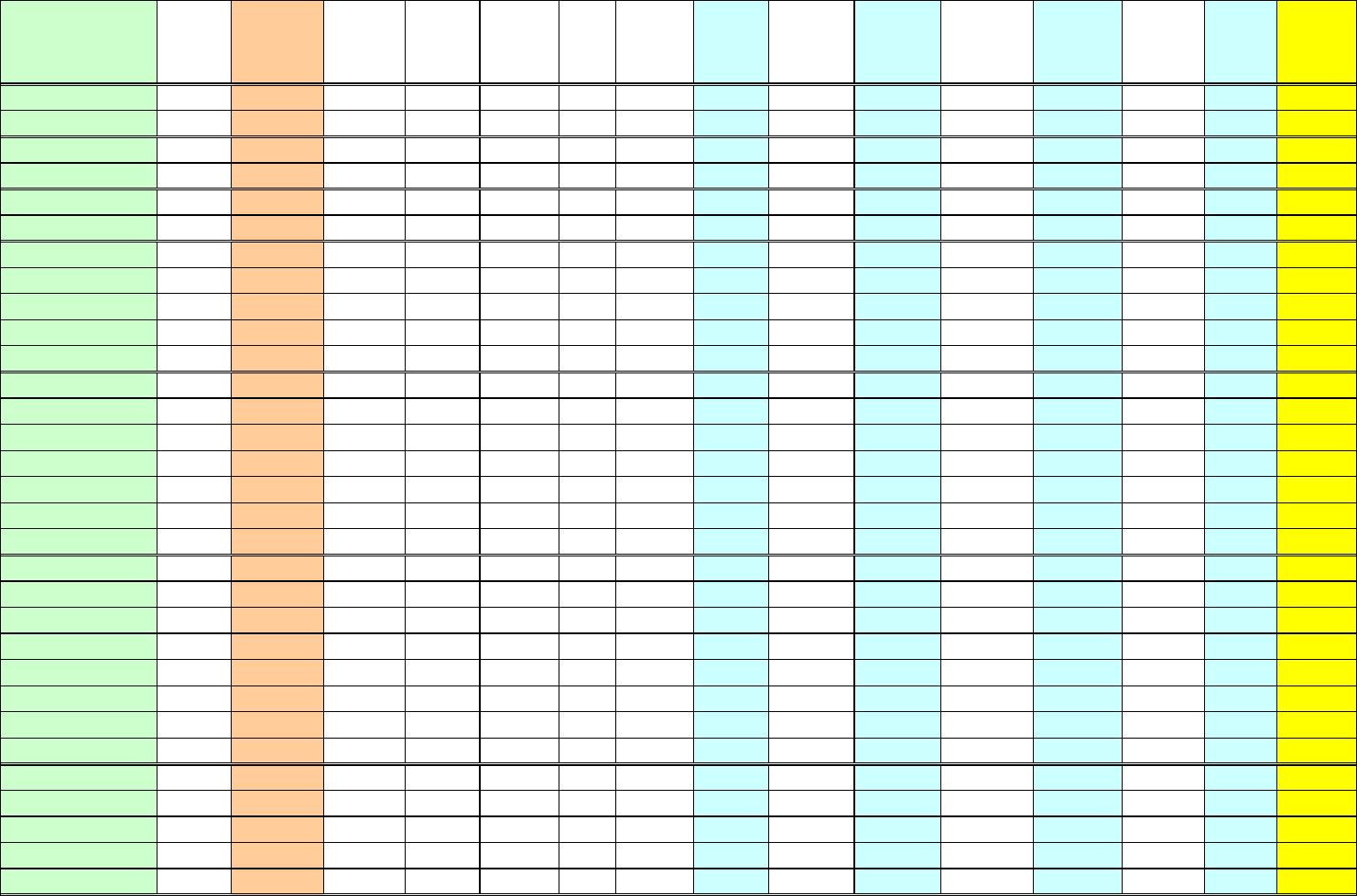

MUNICIPALITY

House

Full

Market

Value

2020

Equalization

Rate

2020

Assessed

Value

2020

Basic

STAR

Exemption

Amount

2020

Maximum

Basic STAR

Savings

STAR

Cap

Applies

2020-2021

School

Tax

Rate

School

2021 County

Tax

Rate

County

(includes

Service Tax

& Library)

2020 City/

2021 Town

Tax Rate

(includes

Highway)

City/Town

(includes

Highway)

2020-2021

Village

Tax

Rate

Village

Total

Tax

BUFFALO $150,000 90.00% $135,000 $22,510

Buffalo SD $252 N

4.746466

$533.93 5.040571 $680.48 5.238570 $707.21 $1,921.62

LACKAWANNA $150,000 100.00% $150,000 $35,040

Lackawanna SD $335 Y

12.830127

$1,589.52 4.685937 $702.89

17.151989

$2,572.80 $4,865.21

CITY OF TONAWANDA $150,000 92.00% $138,000 $28,500

Tonawanda City SD $473 N

16.307099

$1,785.63 5.227177 $721.35 18.548018 $2,559.63 $5,066.61

ALDEN $150,000 81.60% $122,400 $26,400

Alden SD $501 N 18.167651 $1,744.09 5.747414 $703.48 1.765009 $216.04 $2,663.61

Akron SD $442 N 16.506841 $1,584.66 5.747414 $703.48 1.765009 $216.04 $2,504.18

Vlg Alden

Alden SD $501 N 18.167651 $1,744.09 5.747414 $703.48 1.744284 $213.50 6.477461 $792.84 $3,453.91

AMHERST $150,000 91.00% $136,500 $28,500

Amherst SD $588 Y 20.718879 $2,240.13 4.969032 $678.27 4.303619 $587.44 $3,505.84

Sweet Home SD $397 Y 14.028790 $1,517.93 4.969032 $678.27 4.303619 $587.44 $2,783.64

Clarence SD $408 N 14.098981 $1,522.69 4.969032 $678.27 4.303619 $587.44 $2,788.40

Williamsville SD $504 N 17.583635 $1,899.03 4.969032 $678.27 4.303619 $587.44 $3,164.74

Vlg Williamsville

Williamsville SD $504 N 17.583635 $1,899.03 4.969032 $678.27 5.778056 $788.70 4.955500 $676.43 $4,042.43

AURORA $150,000 30.25% $45,375 $9,750

East Aurora SD $447 Y 45.992160 $1,639.89 14.837499 $673.25 7.809404 $354.35 $2,667.49

Holland SD $389 Y 40.860327 $1,465.04 14.837499 $673.25 7.809404 $354.35 $2,492.64

Iroquois SD $451 N 45.804705 $1,631.79 14.837499 $673.25 7.809404 $354.35 $2,659.39

Orchard Park SD $538 Y 56.970026 $2,047.01 14.837499 $673.25 7.809404 $354.35 $3,074.61

Springville-Griffith SD $500 N 51.101924 $1,820.51 14.837499 $673.25 7.809404 $354.35 $2,848.11

Vlg East Aurora

East Aurora SD $447 Y 45.992160 $1,639.89 14.837499 $673.25 3.630005 $164.71 19.056109 $864.67 $3,342.52

BOSTON $150,000 78.00% $117,000 $23,700

Hamburg SD $566 N 22.231069 $2,074.16 5.864761 $686.18 1.775183 $207.70 $2,968.04

Springville-Griffith SD $512 N 19.818375 $1,849.05 5.864761 $686.18 1.775183 $207.70 $2,742.93

Orchard Park SD $551 N 22.094145 $2,061.38 5.864761 $686.18 1.775183 $207.70 $2,955.26

Eden SD $557 N 21.830902 $2,036.82 5.864761 $686.18 1.775183 $207.70 $2,930.70

2020-2021 Real Property Tax Comparison

Page 1

MUNICIPALITY

House

Full

Market

Value

2020

Equalization

Rate

2020

Assessed

Value

2020

Basic

STAR

Exemption

Amount

2020

Maximum

Basic STAR

Savings

STAR

Cap

Applies

2020-2021

School

Tax

Rate

School

2021 County

Tax

Rate

County

(includes

Service Tax

& Library)

2020 City/

2021 Town

Tax Rate

(includes

Highway)

City/Town

(includes

Highway)

2020-2021

Village

Tax

Rate

Village

Total

Tax

2020-2021 Real Property Tax Comparison

BRANT $150,000 73.00% $109,500 $22,800

Lake Shore SD $466 N 19.696844 $1,707.72 6.318103 $691.83 4.027040 $440.96 $2,840.51

North Collins SD $510 N 20.710799 $1,795.63 6.318103 $691.83 4.027040 $440.96 $2,928.42

Silver Creek SD $503 Y 22.495742 $1,960.28 6.318103 $691.83 4.027040 $440.96 $3,093.07

Vlg Farnham

Lake Shore SD $466 N 19.696844 $1,707.72 6.318103 $691.83 4.027040 $440.96 10.150000 $1,111.43 $3,951.94

CHEEKTOWAGA $150,000 83.00% $124,500 $25,500

Cheektowaga SD $504 N 19.169125 $1,897.74 5.601493 $697.39 10.073724 $1,254.18 $3,849.31

Maryvale SD $527 N 20.048786 $1,984.83 5.601493 $697.39 10.073724 $1,254.18 $3,936.40

Cleve-Hill SD . $768 N 28.760250 $2,847.26 5.601493 $697.39 10.073724 $1,254.18 $4,798.83

Cheektowaga-Sloan SD $922 N 33.223031 $3,289.08 5.601493 $697.39 10.073724 $1,254.18 $5,240.65

Depew SD $606 N 21.759189 $2,154.16 5.601493 $697.39 10.073724 $1,254.18 $4,105.73

Lancaster SD $454 N 17.112941 $1,694.18 5.601493 $697.39 10.073724 $1,254.18 $3,645.75

Williamsville SD $513 N 19.224949 $1,903.27 5.601493 $697.39 10.073724 $1,254.18 $3,854.84

West Seneca SD $533 N 19.841547 $1,964.31 5.601493 $697.39 10.073724 $1,254.18 $3,915.88

Vlg Depew

Depew SD $606 N 21.759189 $2,154.16 5.601493 $697.39 8.107342 $1,009.36 12.570781 $1,565.06 $5,425.97

Cheektowaga SD $504 N 19.169125 $1,897.74 5.601493 $697.39 8.107342 $1,009.36 12.570781 $1,565.06 $5,169.55

Maryvale SD $527 N 20.048786 $1,984.83 5.601493 $697.39 8.107342 $1,009.36 12.570781 $1,565.06 $5,256.64

Lancaster SD $454 N 17.112941 $1,694.18 5.601493 $697.39 8.107342 $1,009.36 12.570781 $1,565.06 $4,965.99

Vlg Sloan

Cheektowaga-Sloan SD $922 N 33.223031 $3,289.08 5.601493 $697.39 9.133122 $1,137.07 10.956080 $1,364.03 $6,487.57

Vlg Williamsville

Williamsville SD $513 N 19.224949 $1,903.27 5.601493 $697.39 9.132740 $1,137.03 5.538500 $689.54 $4,427.23

CLARENCE $150,000 92.00% $138,000 $30,000

Clarence SD $412 Y 13.945813 $1,512.52 4.860808 $670.79 1.856715 $256.23 $2,439.54

Akron SD $414 Y 14.640851 $1,606.44 4.860808 $670.79 1.856715 $256.23 $2,533.46

Williamsville SD $493 Y 17.354857 $1,901.97 4.860808 $670.79 1.856715 $256.23 $2,828.99

COLDEN $150,000 35.00% $52,500 $11,100

Springville-Griffith SD $512 N 44.166663 $1,828.50 13.006667 $682.85 5.122301 $268.92 $2,780.27

Holland SD $394 N 35.451518 $1,467.69 13.006667 $682.85 5.122301 $268.92 $2,419.46

East Aurora SD $440 Y 39.750367 $1,646.89 13.006667 $682.85 5.122301 $268.92 $2,598.66

Page 2

MUNICIPALITY

House

Full

Market

Value

2020

Equalization

Rate

2020

Assessed

Value

2020

Basic

STAR

Exemption

Amount

2020

Maximum

Basic STAR

Savings

STAR

Cap

Applies

2020-2021

School

Tax

Rate

School

2021 County

Tax

Rate

County

(includes

Service Tax

& Library)

2020 City/

2021 Town

Tax Rate

(includes

Highway)

City/Town

(includes

Highway)

2020-2021

Village

Tax

Rate

Village

Total

Tax

2020-2021 Real Property Tax Comparison

COLLINS $150,000 52.00% $78,000 $16,200

Springville-Griffith SD $490 N 29.727562 $1,837.16 9.095779 $709.47 4.681251 $365.14 $2,911.77

Gowanda SD $375 N 22.290086 $1,377.53 9.095779 $709.47 4.681251 $365.14 $2,452.14

North Collins SD $497 N 29.074775 $1,796.82 9.095779 $709.47 4.681251 $365.14 $2,871.43

Vlg Gowanda

Gowanda SD $375 N 22.290086 $1,377.53 9.095779 $709.47 3.956902 $308.64 21.010000 $1,638.78 $4,034.42

CONCORD $150,000 36.00% $54,000 $12,000

Springville-Griffith SD $500 Y 42.939811 $1,818.75 12.695285 $685.55 5.030137 $271.63 $2,775.93

Eden SD $544 Y 47.300286 $2,010.22 12.695285 $685.55 5.030137 $271.63 $2,967.40

North Collins SD $505 N 41.996899 $1,763.87 12.695285 $685.55 5.030137 $271.63 $2,721.05

Holland SD $389 Y 32.767391 $1,380.44 12.695285 $685.55 5.030137 $271.63 $2,337.62

Vlg Springville

Springville-Griffith SD $500 Y 42.939811 $1,818.75 12.695285 $685.55 3.497299 $188.85 17.995010 $971.73 $3,664.88

EDEN $150,000 53.00% $79,500 $17,100

Eden SD $556 N 32.128497 $2,004.82 8.627143 $685.86 6.825834 $542.65 $3,233.33

Frontier SD $422 Y 24.878391 $1,555.83 8.627143 $685.86 6.825834 $542.65 $2,784.34

Hamburg SD $551 Y 32.717422 $2,050.04 8.627143 $685.86 6.825834 $542.65 $3,278.55

Lake Shore SD $469 N 27.129615 $1,692.89 8.627143 $685.86 6.825834 $542.65 $2,921.40

North Collins SD $515 N 28.526184 $1,780.03 8.627143 $685.86 6.825834 $542.65 $3,008.54

ELMA $150,000 3.67% $5,505 $1,230

Iroquois SD $458 Y 378.901702 $1,627.85 122.971936 $676.96 5.937718 $32.69 $2,337.50

Lancaster SD $422 Y 392.320641 $1,737.73 122.971936 $676.96 5.937718 $32.69 $2,447.38

East Aurora SD $433 Y 379.090696 $1,653.89 122.971936 $676.96 5.937718 $32.69 $2,363.54

Orchard Park SD $527 Y 469.575824 $2,058.01 122.971936 $676.96 5.937718 $32.69 $2,767.66

EVANS $150,000 77.00% $115,500 $24,600

Lake Shore SD $474 N 18.673631 $1,697.43 6.019001 $695.19 10.360327 $1,196.62 $3,589.24

North Collins SD $505 N 19.634915 $1,784.81 6.019001 $695.19 10.360327 $1,196.62 $3,676.62

Eden SD $544 Y 22.114420 $2,010.22 6.019001 $695.19 10.360327 $1,196.62 $3,902.03

Vlg Angola

Lake Shore SD $474 N 18.673631 $1,697.43 6.019001 $695.19 9.625716 $1,111.77 7.180000 $829.29 $4,333.68

GRAND ISLAND $150,000 85.00% $127,500 $26,400

Grand Island SD $548 N 19.777864 $1,999.54 5.457747 $695.86 2.970806 $378.78 $3,074.18

Page 3

MUNICIPALITY

House

Full

Market

Value

2020

Equalization

Rate

2020

Assessed

Value

2020

Basic

STAR

Exemption

Amount

2020

Maximum

Basic STAR

Savings

STAR

Cap

Applies

2020-2021

School

Tax

Rate

School

2021 County

Tax

Rate

County

(includes

Service Tax

& Library)

2020 City/

2021 Town

Tax Rate

(includes

Highway)

City/Town

(includes

Highway)

2020-2021

Village

Tax

Rate

Village

Total

Tax

2020-2021 Real Property Tax Comparison

HAMBURG $150,000 44.50% $66,750 $14,100

Frontier SD $434 N 29.621483 $1,559.57 10.304110 $687.80 11.296039 $754.01 $3,001.38

Hamburg SD $566 N 38.966818 $2,051.60 10.304110 $687.80 11.296039 $754.01 $3,493.41

Orchard Park SD $557 N 38.726815 $2,038.97 10.304110 $687.80 11.296039 $754.01 $3,480.78

West Seneca SD $526 N 37.007352 $1,948.44 10.304110 $687.80 11.296039 $754.01 $3,390.25

Vlg Blasdell

Frontier SD $434 N 29.621483 $1,559.57 10.304110 $687.80 5.178768 $345.68 21.200000 $1,415.10 $4,008.15

Vlg Hamburg

Frontier SD $434 N 29.621483 $1,559.57 10.304110 $687.80 5.178768 $345.68 21.695250 $1,448.16 $4,041.21

Hamburg SD $566 N 38.966818 $2,051.60 10.304110 $687.80 5.178768 $345.68 21.695250 $1,448.16 $4,533.24

HOLLAND $150,000 75.00% $112,500 $24,000

Holland SD $389 Y 16.277314 $1,442.20 6.116965 $688.16 5.837205 $656.69 $2,787.05

Pioneer SD $348 Y 14.719379 $1,307.93 6.116965 $688.16 5.837205 $656.69 $2,652.78

LANCASTER $150,000 100.00% $150,000 $30,000

Alden SD $506 N 14.824803 $1,778.98 4.537853 $680.68 4.676744 $701.51 $3,161.17

Clarence SD $426 N 12.830340 $1,539.64 4.537853 $680.68 4.676744 $701.51 $2,921.83

Iroquois SD $474 N 14.106234 $1,692.75 4.537853 $680.68 4.676744 $701.51 $3,074.94

Depew SD $633 N 18.060127 $2,167.22 4.537853 $680.68 4.676744 $701.51 $3,549.41

Lancaster SD $473 N 14.147622 $1,697.71 4.537853 $680.68 4.676744 $701.51 $3,079.90

Vlg Lancaster

Depew SD $633 N 18.060127 $2,167.22 4.537853 $680.68 3.278672 $491.80 10.503515 $1,575.53 $4,915.23

Lancaster SD $473 N 14.147622 $1,697.71 4.537853 $680.68 3.278672 $491.80 10.503515 $1,575.53 $4,445.72

Vlg Depew

Depew SD $633 N 18.060127 $2,167.22 4.537853 $680.68 2.072691 $310.90 13.876836 $2,081.53 $5,240.33

Lancaster SD $473 N 14.147622 $1,697.71 4.537853 $680.68 2.072691 $310.90 13.876836 $2,081.53 $4,770.82

MARILLA $150,000 34.00% $51,000 $11,400

Alden SD $469 Y 43.602362 $1,754.72 13.320194 $679.33 0.653253 $33.32 $2,467.37

Iroquois SD $455 Y 40.958569 $1,633.89 13.320194 $679.33 0.653253 $33.32 $2,346.54

NEWSTEAD $150,000 100.00% $150,000 $31,930

Alden SD $491 N 14.824803 $1,750.36 4.630643 $694.60 1.843428 $276.51 $2,721.47

Akron SD $434 N 13.469583 $1,590.35 4.630643 $694.60 1.843428 $276.51 $2,561.46

Clarence SD $421 N 12.830073 $1,514.85 4.630643 $694.60 1.843428 $276.51 $2,485.96

Vlg Akron

Akron SD $434 N 13.469583 $1,590.35 4.630643 $694.60 1.354425 $203.16 7.418900 $1,112.84 $3,600.95

Page 4

MUNICIPALITY

House

Full

Market

Value

2020

Equalization

Rate

2020

Assessed

Value

2020

Basic

STAR

Exemption

Amount

2020

Maximum

Basic STAR

Savings

STAR

Cap

Applies

2020-2021

School

Tax

Rate

School

2021 County

Tax

Rate

County

(includes

Service Tax

& Library)

2020 City/

2021 Town

Tax Rate

(includes

Highway)

City/Town

(includes

Highway)

2020-2021

Village

Tax

Rate

Village

Total

Tax

2020-2021 Real Property Tax Comparison

NORTH COLLINS $150,000 71.00% $106,500 $24,000

Eden SD $537 Y 23.983244 $2,017.22 6.482485 $690.38 6.186322 $658.84 $3,366.44

Gowanda SD $375 Y 16.325133 $1,363.63 6.482485 $690.38 6.186322 $658.84 $2,712.85

North Collins SD $497 Y 21.294202 $1,770.83 6.482485 $690.38 6.186322 $658.84 $3,120.05

Vlg North Collins

North Collins SD $497 Y 21.294202 $1,770.83 6.482485 $690.38 3.218144 $342.73 13.230000 $1,409.00 $4,212.94

ORCHARD PARK $150,000 46.50% $69,750 $14,550

Hamburg SD $554 N 37.290825 $2,058.45 9.684906 $675.52 7.771520 $542.06 $3,276.03

Orchard Park SD $549 N 37.061146 $2,045.78 9.684906 $675.52 7.771520 $542.06 $3,263.36

West Seneca SD $515 Y 35.415638 $1,955.24 9.684906 $675.52 7.771520 $542.06 $3,172.82

Vlg Orchard Park

Orchard Park SD $549 N 37.061146 $2,045.78 9.684906 $675.52 8.143131 $567.98 4.340000 $302.72 $3,592.00

SARDINIA $150,000 48.00% $72,000 $15,300

Springville-Griffith SD $497 N 32.204859 $1,826.02 9.577454 $689.58 0.000000 $0.00 $2,515.60

Holland SD $394 N 24.428113 $1,385.07 9.577454 $689.58 0.000000 $0.00 $2,074.65

Pioneer SD $362 N 22.999494 $1,304.07 9.577454 $689.58 0.000000 $0.00 $1,993.65

TONAWANDA $150,000 33.00% $49,500 $10,500

Sweet Home SD $417 N 38.942769 $1,518.77 14.113034 $698.60 17.561074 $869.27 $3,086.64

Ken-Ton SD $573 N 53.151278 $2,072.90 14.113034 $698.60 17.561074 $869.27 $3,640.77

Vlg Kenmore

Ken-Ton SD $573 N 53.151278 $2,072.90 14.113034 $698.60 6.716214 $332.45 32.877400 $1,627.43 $4,731.38

WALES $150,000 36.00% $54,000 $12,000

Attica SD $462 Y 41.389793 $1,773.05 12.670656 $684.22 0.669455 $36.15 $2,493.42

Holland SD $389 N 31.963987 $1,342.49 12.670656 $684.22 0.669455 $36.15 $2,062.86

Iroquois SD $452 Y 38.605536 $1,632.70 12.670656 $684.22 0.669455 $36.15 $2,353.07

WEST SENECA $150,000 36.00% $54,000 $11,100

Cheektowaga-Sloan SD $888 N 76.597543 $3,286.03 12.870886 $695.03 21.888533 $1,181.98 $5,163.04

Orchard Park SD $546 N 47.870646 $2,053.65 12.870886 $695.03 21.888533 $1,181.98 $3,930.66

West Seneca SD $521 N 45.746342 $1,962.52 12.870886 $695.03 21.888533 $1,181.98 $3,839.53

Page 5