Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________________

FORM 10-Q

_______________________________________________

(Mark One)

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended October 28, 2023

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 1-37499

_______________________________________________

BARNES & NOBLE EDUCATION, INC.

(Exact Name of Registrant as Specified in Its Charter)

_______________________________________________

Delaware 46-0599018

(State or Other Jurisdiction of

Incorporation or Organization)

(I.R.S. Employer

Identification No.)

120 Mountain View Blvd., Basking Ridge, NJ 07920

(Address of Principal Executive Offices) (Zip Code)

(Registrant’s Telephone Number, Including Area Code): (908) 991-2665

Securities registered pursuant to Section 12(b) of the Act:

Title of Class Trading Symbol Name of Exchange on which registered

Common Stock, $0.01 par value per share BNED New York Stock Exchange

_______________________________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during

the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for

the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of

Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such

files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the

definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer x

Non-accelerated filer ¨ Smaller reporting company ¨

Emerging Growth Company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of December 1, 2023, 53,149,504 shares of Common Stock, par value $0.01 per share, were outstanding.

Table of Contents

BARNES & NOBLE EDUCATION, INC. AND SUBSIDIARIES

Fiscal Quarter Ended October 28, 2023

Index to Form 10-Q

Page No.

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements (Unaudited)

Condensed Consolidated Statements of Operations – For the 13 and 26 weeks ended October 28, 2023 and October 29, 2022 3

Condensed Consolidated Balance Sheets – As of October 28, 2023, October 29, 2022, and April 29, 2023 4

Condensed Consolidated Statements of Cash Flows – For the 26 weeks ended October 28, 2023 and October 29, 2022 5

Condensed Consolidated Statements of Equity – As of October 28, 2023 and October 29, 2022 7

Notes to Condensed Consolidated Financial Statements 8

Note 1. Organization 8

Note 2. Summary of Significant Accounting Policies 9

Note 3. Revenue 16

Note 4. Segment Reporting 17

Note 5. Equity and Earnings Per Share 20

Note 6. Fair Value Measurements 21

Note 7. Debt 22

Note 8. Leases 25

Note 9. Supplementary Information 27

Note 10. Long-Term Incentive Plan Compensation Expense 27

Note 11. Employee Benefit Plans 27

Note 12. Income Taxes 28

Note 13. Legal Proceedings 28

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations 29

Overview 29

Results of Operations 34

Non-GAAP Measures 45

Liquidity and Capital Resources 48

Item 3. Quantitative and Qualitative Disclosures About Market Risk 56

Item 4. Controls and Procedures 56

PART II - OTHER INFORMATION

Item 1. Legal Proceedings 57

Item 1A. Risk Factors 57

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds 57

Item 5. Other Information 57

Item 6. Exhibits 58

SIGNATURES 59

2

Table of Contents

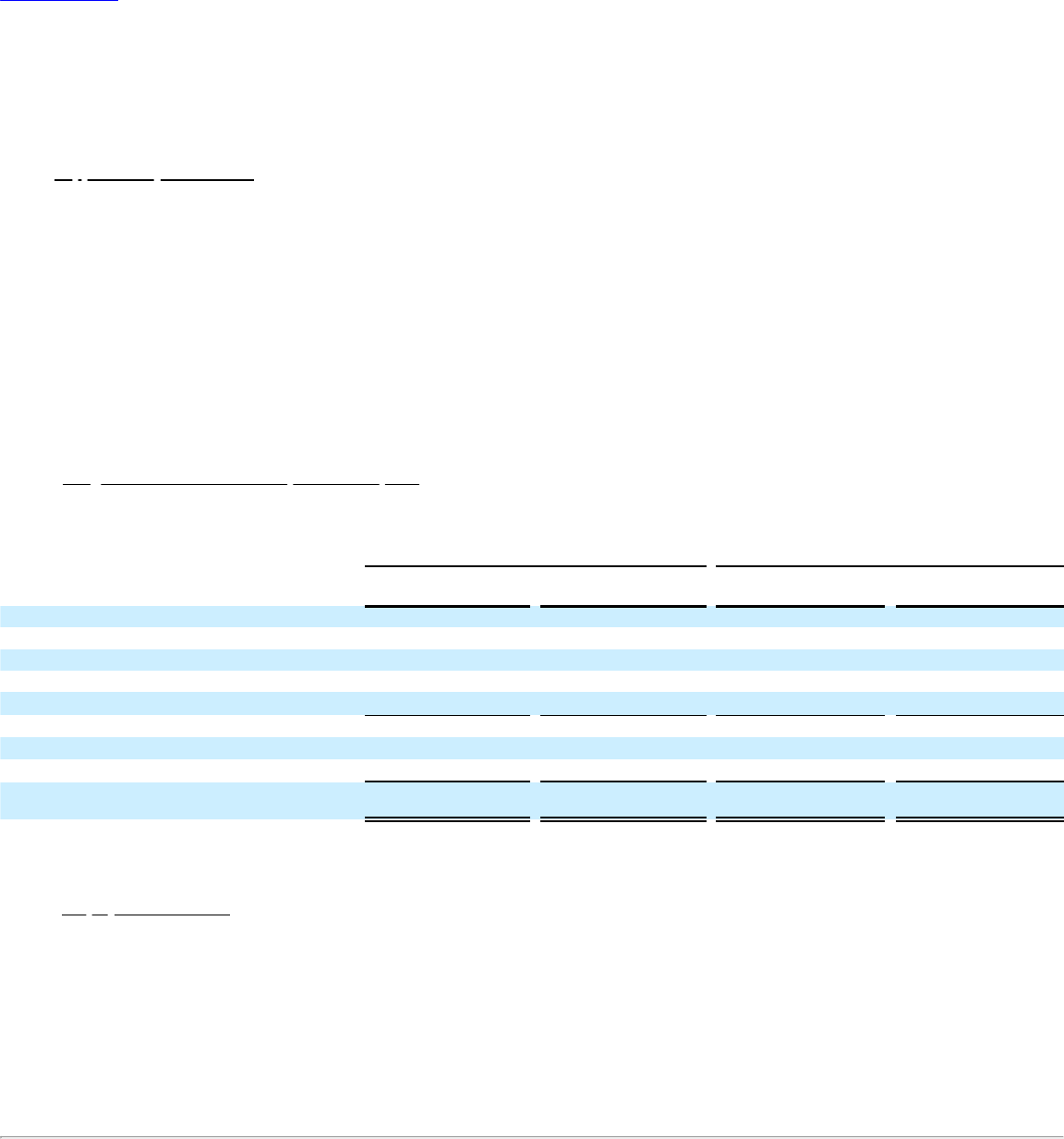

PART I - FINANCIAL INFORMATION

Item 1: Financial Statements

BARNES & NOBLE EDUCATION, INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Operations

(In thousands, except per share data)

(unaudited)

13 weeks ended 26 weeks ended

October 28,

2023

October 29,

2022

October 28,

2023

October 29,

2022

Sales:

Product sales and other $ 569,698 $ 567,299 $ 822,348 $ 811,061

Rental income 40,681 41,334 52,192 52,246

Total sales

610,379 608,633 874,540 863,307

Cost of sales (exclusive of depreciation and amortization

expense):

Product and other cost of sales 451,953 447,551 658,967 639,955

Rental cost of sales 22,184 22,941 28,697 29,206

Total cost of sales

474,137 470,492 687,664 669,161

Gross profit 136,242 138,141 186,876 194,146

Selling and administrative expenses

85,961 98,954 163,437 189,295

Depreciation and amortization expense 10,175 10,256 20,428 21,152

Restructuring and other charges 4,274 260 8,907 635

Operating income (loss)

35,832 28,671 (5,896) (16,936)

Interest expense, net 10,664 4,886 18,918 8,754

Income (loss) from continuing operations before income

taxes 25,168 23,785 (24,814) (25,690)

Income tax expense (benefit) 314 (383) 303 464

Income (loss) from continuing operations

$ 24,854 $ 24,168 $ (25,117) $ (26,154)

Loss from discontinued operations, net of tax of $0, $83,

$20, and $169, respectively

$ (674) $ (2,024) $ (1,091) $ (4,409)

Net income (loss)

$ 24,180 $ 22,144 $ (26,208) $ (30,563)

Earnings (loss) per share of common stock:

Basic:

Continuing operations $ 0.47 $ 0.46 $ (0.48) $ (0.50)

Discontinued operations $ (0.01) $ (0.04) $ (0.02) $ (0.08)

Total Basic Earnings per share $ 0.46 $ 0.42 $ (0.50) $ (0.58)

Weighted average common shares outstanding - Basic

52,791 52,438 52,716 52,305

Diluted:

Continuing operations $ 0.47 $ 0.46 $ (0.48) $ (0.50)

Discontinued operations $ (0.01) $ (0.04) $ (0.02) $ (0.08)

Total Diluted Earnings per share

$ 0.46 $ 0.42 $ (0.50) $ (0.58)

Weighted average common shares outstanding - Diluted

52,870 53,195 52,716 52,305

See accompanying notes to condensed consolidated financial statements.

3

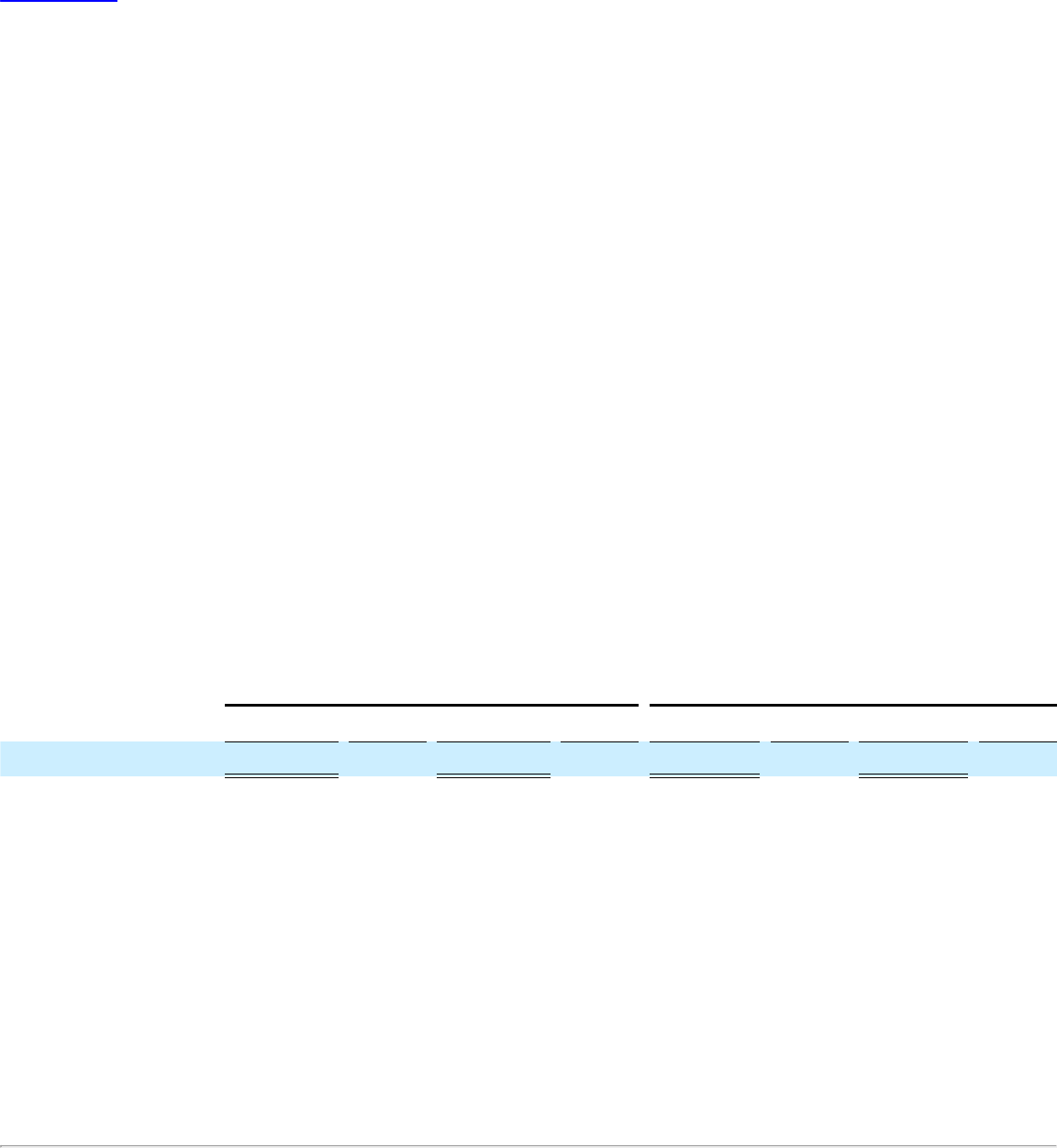

Table of Contents

BARNES & NOBLE EDUCATION, INC. AND SUBSIDIARIES

Condensed Consolidated Balance Sheets

(In thousands, except per share data)

October 28,

2023

October 29,

2022

April 29,

2023

(unaudited) (unaudited) (audited)

ASSETS

Current assets:

Cash and cash equivalents $ 15,008 $ 17,296 $ 14,219

Receivables, net 221,805 209,288 92,512

Merchandise inventories, net 364,292 371,570 322,979

Textbook rental inventories 51,840 49,355 30,349

Prepaid expenses and other current assets 63,410 51,520 49,512

Assets held for sale, current — 30,558 27,430

Total current assets

716,355 729,587 537,001

Property and equipment, net 61,403 75,475 68,153

Operating lease right-of-use assets 246,531 291,704 246,972

Intangible assets, net 104,026 120,533 110,632

Deferred tax assets, net — — 132

Other noncurrent assets 16,664 21,100 17,889

Total assets $ 1,144,979 $ 1,238,399 $ 980,779

LIABILITIES AND STOCKHOLDERS' EQUITY

Current liabilities:

Accounts payable $ 385,895 $ 326,007 $ 267,923

Accrued liabilities 112,075 113,628 85,759

Current operating lease liabilities 126,426 130,802 99,980

Liabilities held for sale — 5,243 8,423

Total current liabilities

624,396 575,680 462,085

Long-term deferred taxes, net 1,936 1,430 1,970

Long-term operating lease liabilities 160,185 190,758 184,754

Other long-term liabilities 18,625 19,622 19,068

Long-term borrowings 233,873 250,445 182,151

Total liabilities

1,039,015 1,037,935 850,028

Commitments and contingencies — — —

Stockholders' equity:

Preferred stock, $0.01 par value; authorized, 5,000 shares; 0 shares issued and 0 shares

outstanding — — —

Common stock, $0.01 par value; authorized, 200,000 shares; issued, 55,818, 55,132 and

55,140 shares, respectively; outstanding, 53,137, 52,599 and 52,604 shares,

respectively 558 551 551

Additional paid-in capital 747,518 744,339 745,932

Accumulated deficit (619,564) (522,057) (593,356)

Treasury stock, at cost (22,548) (22,369) (22,376)

Total stockholders' equity

105,964 200,464 130,751

Total liabilities and stockholders' equity

$ 1,144,979 $ 1,238,399 $ 980,779

See accompanying notes to condensed consolidated financial statements.

4

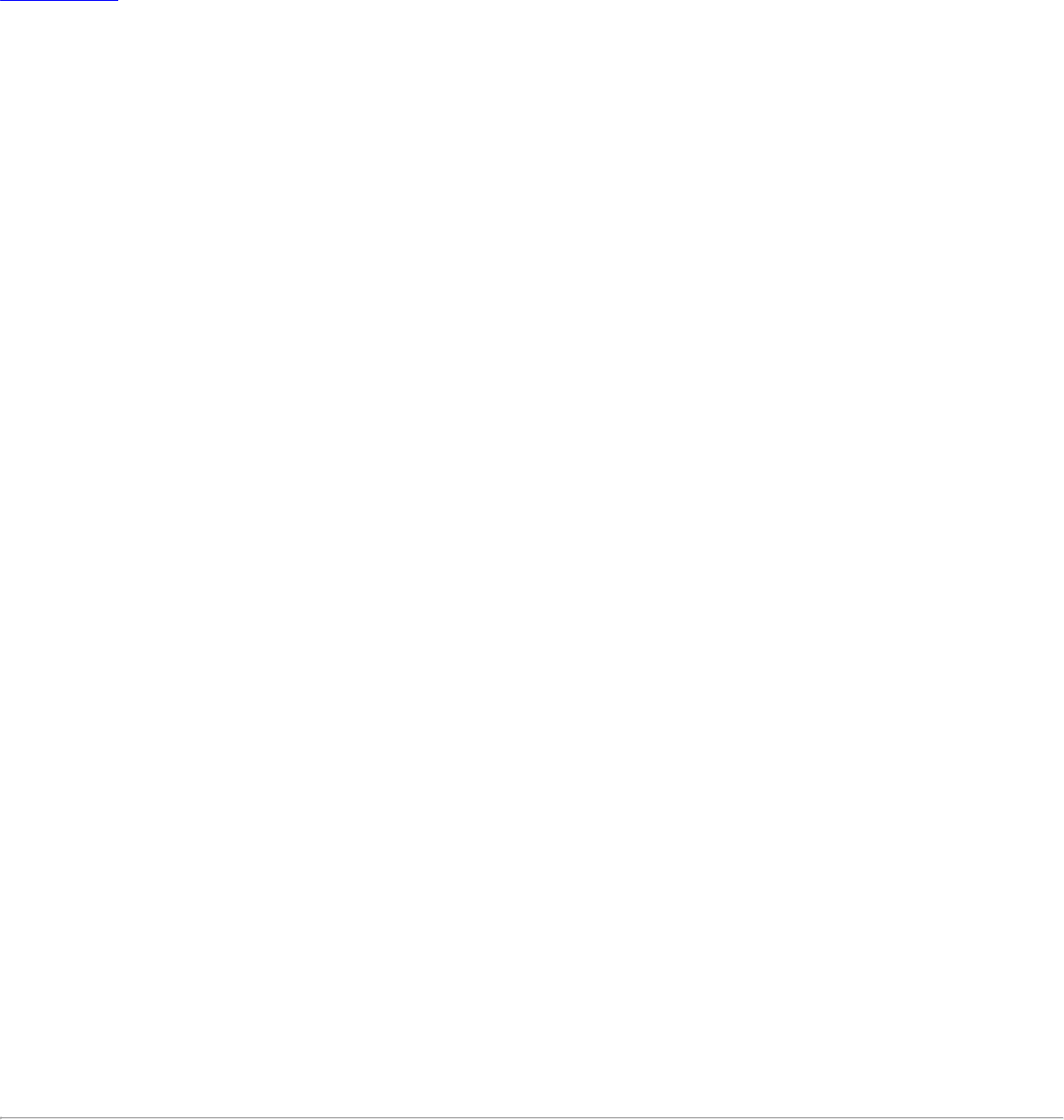

Table of Contents

BARNES & NOBLE EDUCATION, INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Cash Flows

(In thousands) (unaudited)

26 weeks ended

October 28,

2023

October 29,

2022

Cash flows from operating activities:

Net loss $ (26,208) $ (30,563)

Less: Loss from discontinued operations, net of tax (1,091) (4,409)

Loss from continuing operations

(25,117) (26,154)

Adjustments to reconcile net loss from continuing operations to net cash flows from operating activities from

continuing operations:

Depreciation and amortization expense 20,428 21,152

Content amortization expense — 26

Amortization of deferred financing costs 4,406 1,200

Deferred taxes 97 —

Stock-based compensation expense 1,756 3,066

Non-cash interest expense (paid-in-kind) 863 —

Changes in operating lease right-of-use assets and liabilities 1,826 (298)

Changes in other long-term assets and liabilities, net (2,311) 265

Changes in other operating assets and liabilities, net

Receivables, net (129,293) (73,287)

Merchandise inventories (41,313) (77,716)

Textbook rental inventories (21,491) (19,743)

Prepaid expenses and other current assets 2,756 13,149

Accounts payable and accrued liabilities 140,233 168,413

Changes in other operating assets and liabilities, net

(49,108) 10,816

Net cash flows (used in) provided by operating activities from continuing operations (47,160) 10,073

Net cash flows used in operating activities from discontinued operations (3,939) (703)

Net cash flow (used in) provided by operating activities $ (51,099) $ 9,370

Cash flows from investing activities:

Purchases of property and equipment $ (8,196) $ (16,823)

Net change in other noncurrent assets 78 255

Net cash flows used in investing activities from continuing operations

(8,118) (16,568)

Net cash flows provided by (used in) investing activities from discontinued operations 21,395 (3,750)

Net cash flow provided by (used in) investing activities

$ 13,277 $ (20,318)

Cash flows from financing activities:

Proceeds from borrowings $ 284,698 $ 348,200

Repayments of borrowings (233,970) (321,900)

Payment of deferred financing costs (9,381) (1,716)

Purchase of treasury shares (172) (857)

Net cash flows provided by financing activities from continuing operations

41,175 23,727

Net cash flows provided by financing activities from discontinued operations — —

Net cash flows provided by financing activities

$ 41,175 $ 23,727

Net increase in cash, cash equivalents and restricted cash

3,353 12,779

Cash, cash equivalents and restricted cash at beginning of period 31,988 21,036

5

Table of Contents

Cash, cash equivalents and restricted cash at end of period

35,341 33,815

Less: Cash, cash equivalents and restricted cash of discontinued operations at end of period — (929)

Cash, cash equivalents, and restricted cash of continuing operations at end of period

$ 35,341 $ 32,886

See accompanying notes to condensed consolidated financial statements.

6

Table of Contents

BARNES & NOBLE EDUCATION, INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Equity

(In thousands) (unaudited)

Additional

Common Stock

Paid-In Accumulated

Treasury Stock

Total

Shares Amount Capital Deficit Shares Amount Equity

Balance at April 30, 2022 54,234 $ 542 $ 740,838 $ (491,494) 2,188 $ (21,512) $ 228,374

Stock-based compensation expense 1,791 1,791

Vested equity awards 540 5 (5) —

Shares repurchased for tax withholdings for

vested stock awards 238 (612) (612)

Net loss

(52,707) (52,707)

Balance July 30, 2022

54,774 $ 547 $ 742,624 $ (544,201) 2,426 $ (22,124) $ 176,846

Stock-based compensation expense 1,719 1,719

Vested equity awards 357 4 (4) —

Shares repurchased for tax withholdings for

vested stock awards 107 (245) (245)

Net income 22,144 22,144

Balance October 29, 2022 55,131 $ 551 $ 744,339 $ (522,057) 2,533 $ (22,369) $ 200,464

Additional

Common Stock

Paid-In Accumulated

Treasury Stock

Total

Shares Amount Capital Deficit Shares Amount Equity

Balance at April 29, 2023 55,140 $ 551 $ 745,932 $ (593,356) 2,536 $ (22,376) $ 130,751

Stock-based compensation expense 794 794

Vested equity awards 179 2 (2) —

Shares repurchased for tax withholdings for

vested stock awards 78 (98) (98)

Net loss (50,388) (50,388)

Balance July 29, 2023

55,319 $ 553 $ 746,724 $ (643,744) 2,614 $ (22,474) $ 81,059

Stock-based compensation expense 799 799

Vested equity awards 499 5 (5) —

Shares repurchased for tax withholdings for

vested stock awards 67 (74) (74)

Net income 24,180 24,180

Balance October 28, 2023

55,818 $ 558 $ 747,518 $ (619,564) 2,681 $ (22,548) $ 105,964

See accompanying notes to condensed consolidated financial statements.

7

Table of Contents

BARNES & NOBLE EDUCATION, INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

For the 13 and 26 weeks ended October 28, 2023 and October 29, 2022

(Thousands of dollars, except share and per share data)

(unaudited)

Unless the context otherwise indicates, references in these Notes to the accompanying condensed consolidated financial statements to “we,” “us,” “our”

and “the Company” refer to Barnes & Noble Education or "BNED", Inc., a Delaware corporation. References to “Barnes & Noble College” refer to our

college bookstore business operated through our subsidiary Barnes & Noble College Booksellers, LLC. References to “MBS” refer to our virtual bookstore

and wholesale textbook distribution business operated through our subsidiary MBS Textbook Exchange, LLC.

This Form 10-Q should be read in conjunction with our Audited Consolidated Financial Statements and accompanying Notes to consolidated financial

statements in our Annual Report on Form 10-K for the fiscal year ended April 29, 2023, which includes consolidated financial statements for the Company as

of April 29, 2023, and April 30, 2022 and for each of the three fiscal years ended April 29, 2023, April 30, 2022 and May 1, 2021 ("Fiscal 2023," "Fiscal 2022"

and "Fiscal 2021", respectively) and the unaudited condensed consolidated financial statements in our Quarterly Report on Form 10-Q for the quarter ended

July 29, 2023.

Note 1. Organization

Description of Business

Barnes & Noble Education, Inc. (“BNED”) is one of the largest contract operators of physical and virtual bookstores for college and university campuses

and K-12 institutions across the United States. We are also one of the largest textbook wholesalers, inventory management hardware and software providers.

We operate 1,271 physical, virtual, and custom bookstores and serve more than 5.8 million students, delivering essential educational content, tools and general

merchandise within a dynamic omnichannel retail environment.

The strengths of our business include our ability to compete by developing new products and solutions to meet market needs, our large operating footprint

with direct access to students and faculty, our well-established, deep relationships with academic partners and stable, long-term contracts and our well-

recognized brands. We provide product and service offerings designed to address the most pressing issues in higher education, including equitable access,

enhanced convenience and improved affordability through innovative course material delivery models designed to drive improved student experiences and

outcomes. We offer our BNC First Day equitable and inclusive access programs, consisting of First Day Complete and First Day, which provide faculty

required course materials on or before the first day of class at a discounted rate, as compared to the total retail price for the same course materials if purchased

separately. The BNC First Day discounted price is offered as a course fee or included in tuition. During the 26 weeks ended October 28, 2023, BNC First Day

total revenue increased by $72,684, or 39%, to $261,021 compared to $188,337 during the prior year period.

We expect to continue to introduce scalable and advanced solutions focused largely on the student and customer experience, expand our e-commerce

capabilities and accelerate such capabilities through our merchandising and e-commerce service provider agreement with Fanatics Retail Group Fulfillment,

LLC, Inc. (“Fanatics”) and Fanatics Lids College, Inc. D/B/A "Lids" (“Lids”) (collectively referred to herein as the “F/L Relationship”), win new accounts, and

expand our revenue opportunities through strategic relationships. We expect gross general merchandise sales to increase over the long term, as our product

assortments continue to emphasize and reflect changing consumer trends, and we evolve our presentation concepts and merchandising of products in stores and

online, which we expect to be further enhanced and accelerated through the F/L Relationship. Through this relationship, Fanatics and Lids provide unparalleled

product assortment, e-commerce capabilities and powerful digital marketing tools on our behalf to drive increased value for customers and accelerate growth of

our logo general merchandise business.

The Barnes & Noble brand (licensed from our former parent) along with our subsidiary brands, BNC and MBS, are synonymous with innovation in

bookselling and campus retailing, and are widely recognized and respected brands in the United States. Our large college footprint, reputation, and credibility

in the marketplace not only support our marketing efforts to universities, students, and faculty, but are also important to our relationship with leading publishers

who rely on us as one of their primary distribution channels.

During the fourth quarter of Fiscal 2023, assets related to our DSS Segment met the criteria for classification as Assets Held for Sale and Discontinued

Operations and is no longer a reportable segment. We have two reportable segments: Retail and Wholesale. For additional information related to our strategies,

operations and segments, see Part I - Item 1. Business in our Annual Report on Form 10-K for the fiscal year ended April 29, 2023.

®

8

Table of Contents

BARNES & NOBLE EDUCATION, INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

For the 13 and 26 weeks ended October 28, 2023 and October 29, 2022

(Thousands of dollars, except share and per share data)

(unaudited)

BNC First Day Equitable and Inclusive Access Programs

We provide product and service offerings designed to address the most pressing issues in higher education, including equitable access, enhanced

convenience and improved affordability through innovative course material delivery models designed to drive improved student experiences and outcomes. We

offer our BNC First Day equitable and inclusive access programs, consisting of First Day Complete and First Day, which provide faculty required course

materials on or before the first day of class at a discounted rate, as compared to the total retail price for the same course materials if purchased separately. The

BNC First Day discounted price is offered as a course fee or included in tuition.

• First Day Complete is adopted by an institution and includes the majority of undergraduate classes (and on occasion graduate classes), providing

students both physical and digital materials. The First Day Complete model drives substantially greater unit sales and sell-through for the bookstore.

• First Day is adopted by a faculty member for a single course, and students receive primarily digital course materials through their school's learning

management system ("LMS").

Offering course materials through our equitable and inclusive access First Day Complete and First Day models is a key, and increasingly important

strategic initiative of ours to meet the market demands of substantially reduced pricing to students, as well as the opportunity to improve student outcomes,

while, at the same time, increasing our market share, revenue and relative gross profits of course material sales given the higher volumes of units sold in such

models as compared to historical sales models that rely on individual student marketing and sales. These programs have allowed us to reverse historical long-

term trends in course materials revenue declines, which have been observed at those schools where such programs have been adopted, and improve

predictability of our future results. We are moving quickly and decisively to accelerate our First Day Complete strategy. We plan to move many institutions to

First Day Complete in Fiscal 2024 and the majority of our schools by Fiscal 2025, with continued relative adoption of this model thereafter.

In the Fall of 2023, 157 campus stores are utilizing First Day Complete representing enrollment of nearly 800,000 undergraduate and post graduate

students (as reported by National Center for Education Statistics), an increase of approximately 47% compared to Fall of 2022. During the 26 weeks ended

October 28, 2023, First Day Complete sales increased by $55,455, or 52%, to $161,934 as compared to $106,479 in the prior year period. During the 26 weeks

ended October 28, 2023, First Day sales increased by $17,229, or 21%, to $99,087 as compared to $81,858 in the prior year period.

Relationship with Fanatics and Lids

In December 2020, we entered into the F/L Relationship. Under the related service provider agreements, we receive unparalleled product assortment, e-

commerce capabilities and powerful digital marketing tools to drive increased value for customers and accelerate growth of our general merchandise business.

Fanatics and Lids process consumer personal information on our behalf, subject to certain contractual obligations as our service providers, offering our campus

stores expanded product selection, a world-class online and mobile experience, and a progressive direct-to-consumer platform. Coupled with Lids, the leading

standalone brick and mortar retailer focused exclusively on licensed fan and alumni products, our campus stores have improved access to trend and sales

performance data on licensees, product styles, and design treatments.

We maintain our relationships with campus partners and remain responsible for staffing and managing the day-to-day operations of our campus bookstores.

We also work closely with our campus partners to ensure that each campus store maintains unique aspects of in-store merchandising, including localized

product assortments and specific styles and designs that reflect each campus’s brand. As our service provider, we leverage Fanatics’ e-commerce technology

and expertise on our behalf for the operational management of the emblematic merchandise and gift sections of our campus store websites. Lids manages in-

store assortment planning and merchandising of emblematic apparel, headwear, and gift products for our partner campus stores, and Lids owns the inventory it

manages, relieving us of the obligation to finance inventory purchases from working capital.

Note 2. Summary of Significant Accounting Policies

Basis of Presentation and Consolidation

Our condensed consolidated financial statements reflect our condensed consolidated financial position, results of operations and cash flows in conformity

with accounting principles generally accepted in the United States (“GAAP”). Net income (loss) is equal to comprehensive income (loss) on our condensed

consolidated statement of operations. In the opinion of the Company’s management, the accompanying unaudited condensed consolidated financial statements

of the Company contain all

®

®

9

Table of Contents

BARNES & NOBLE EDUCATION, INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

For the 13 and 26 weeks ended October 28, 2023 and October 29, 2022

(Thousands of dollars, except share and per share data)

(unaudited)

adjustments (consisting of only normal recurring adjustments) necessary to present fairly its consolidated financial position and the results of its operations and

cash flows for the periods reported. These consolidated financial statements are condensed and therefore do not include all of the information and footnotes

required by GAAP. All material intercompany accounts and transactions have been eliminated in consolidation.

Our fiscal year is comprised of 52 or 53 weeks, ending on the Saturday closest to the last day of April. Due to the seasonal nature of the business, the

results of operations for the 13 and 26 weeks ended October 28, 2023 are not indicative of the results expected for the 52 weeks ending April 27, 2024 ("Fiscal

2024").

Liquidity and Going Concern

The accompanying condensed consolidated financial statements are prepared in accordance with U.S. GAAP applicable to a going concern. This

presentation contemplates the realization of assets and the satisfaction of liabilities in the normal course of business and does not include any adjustments

relating to the recoverability and classification of recorded asset amounts or the amounts and classification of liabilities that might result from the outcome of

the uncertainties described below.

Pursuant to ASC 205-40, Presentation of Financial Statements — Going Concern (“ASC 205-40”), management must evaluate whether there are

conditions and events, considered in aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for one year after the

date that these condensed consolidated financial statements are issued. In accordance with ASC 205-40, management’s analysis can only include the potential

mitigating impact of management’s plans that have not been fully implemented as of the issuance date of these condensed consolidated financial statements if

(a) it is probable that management’s plans will be effectively implemented on a timely basis, and (b) it is probable that the plans, when implemented, will

alleviate the relevant conditions or events that raise substantial doubt about the Company’s ability to continue as a going concern.

Our primary sources of cash are net cash flows from operating activities, funds available under our Credit Agreement, Term Loan Agreement, and short-

term vendor financing. Our liquidity is highly dependent on the seasonal nature of our business, particularly with respect to course material sales, as sales are

generally highest in the second and third fiscal quarters, when college students generally purchase textbooks for the upcoming Fall and Spring semesters,

respectively. As of October 28, 2023, we had $35,341 of cash on hand, including $20,333 of restricted cash primarily related to segregated funds for

commission due to Lids for logo merchandise sales as per the merchandising service provider agreement.

Our business was significantly negatively impacted by the COVID-19 pandemic during the years ended April 30, 2022 and May 1, 2021, as many schools

adjusted their learning models and on-campus activities. Although most academic institutions have since reopened after the COVID-19 pandemic, the lingering

impacts of the pandemic have resulted in changes in customer behaviors, lower enrollments, and an evolving educational landscape which continued to impact

our financial results during the year ended April 29, 2023. Some institutions are still providing alternatives to traditional in-person instruction, including online

and hybrid learning options and significantly reduced classroom sizes. The impact of COVID-19 store closings, as well as lower earnings during the year ended

April 29, 2023, resulted in the loss of cash flows and increased borrowings that we would not otherwise have expected to incur.

We recognized Net Income from Continuing Operations of $24,854 and $24,168 for the 13 weeks ended October 28, 2023 and October 29, 2022,

respectively, and a Net Loss from Continuing Operations of $(25,117) and $(26,154) for the 26 weeks ended October 28, 2023 and October 29, 2022,

respectively, and we incurred a Net Loss from Continuing Operations of $(90,140), $(61,559), and $(133,569) for the years ended April 29, 2023, April 30,

2022, and May 1, 2021, respectively. Our Cash Flow (Used In) Provided by Operating Activities from Continuing Operations were $(47,160) and $10,073 for

the 26 weeks ended October 28, 2023 and October 29, 2022, respectively, and were $90,513, $(16,195), and $27,049, for the years ended April 29, 2023, April

30, 2022, and May 1, 2021, respectively. The tightening of our available credit commitments, including the elimination and repayment of our FILO Facility in

fiscal year 2023 of $40,000, had a significant impact on our liquidity during fiscal year 2023 and fiscal year 2024, including our ability to make timely vendor

payments and school commission payments.

Our losses and projected cash needs, combined with our current liquidity level, raised substantial doubt about our ability to continue as a going concern as

of the year ended April 29, 2023, which Management subsequently remediated by implementing a plan to improve the Company’s liquidity and successfully

alleviate substantial doubt including (1) raising additional liquidity and (2) taking additional operational restructuring actions.

10

Table of Contents

BARNES & NOBLE EDUCATION, INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

For the 13 and 26 weeks ended October 28, 2023 and October 29, 2022

(Thousands of dollars, except share and per share data)

(unaudited)

Debt amendments

On October 10, 2023, we amended our existing Credit Agreement to revise certain reporting requirements to the administrative agent and lenders under the

Credit Agreement. The amendment introduced a Specified Liquidity Transaction Fee of $3,800 that would become due and payable at the earlier to occur of (1)

January 31, 2024, to the extent a Specified Liquidity Transaction (as defined in the Credit Agreement) has not been consummated prior to such date (or such

later date that is up to thirty days thereafter to the extent agreed to in writing by the Administrative Agent in its sole discretion) or (b) an Event of Default under

the Credit Agreement.

On July 28, 2023, we amended our existing Credit Agreement to (i) extend the maturity date of the Credit Agreement to December 28, 2024, (ii) reduce

advance rates with respect to the borrowing base by 1000 basis points on September 2, 2024 (in lieu of the reductions previously contemplated for September

2023), (iii) subject to the conditions set forth in such amendment, add a CARES Act tax refund claim to the borrowing base, from April 1, 2024 through July

31, 2024, (iv) amend the financial maintenance covenant to require Availability (as defined in the Credit Agreement) at all times greater than the greater of (x)

10% of the Aggregate Loan Cap (as defined in the Credit Agreement) and (y) (A) $32,500 minus, subject to the conditions set forth in such amendment, (B) (a)

$7,500 for the period of April 1, 2024 through and including April 30, 2024, (b) $2,500 for the period of May 1, 2024 through and including May 31, 2024 and

(c) $0 at all other times, (v) add a minimum Consolidated EBITDA (as defined in the Credit Agreement) financial maintenance covenant, and (vi) amend

certain negative and affirmative covenants and add certain additional covenants, all as more particularly set forth in such amendment. The amendment also

requires that we appoint a Chief Restructuring Officer and that, by August 11, 2023, we (i) appoint two independent members to the board of directors of the

Company from prospective candidates that have been previously disclosed to the Administrative Agent and the Lenders and (ii) appoint a committee of the

board of directors of the Company to consist of three board members (two of whom will be the new independent directors), and as of the date of this filing, we

have satisfied such requirements. The committee’s responsibilities will include, among other things, to explore, consider, solicit expressions of interest or

proposals for, respond to any communications, inquiries or proposals regarding, and advise as to all strategic alternatives to effect a “Specified Liquidity

Transaction” (as defined in the Credit Agreement). There can be no guarantee or assurances that any such transaction or transactions be consummated. We must

pay (i) a fee of 0.50% of the outstanding principal amount of the commitments under the Credit Agreement March 2023 amendment (as defined in the Credit

Agreement) on the closing date (in lieu of the deferred fee previously contemplated in connection with the March 2023 amendment (as defined in the Credit

Agreement)) and (ii) a fee of 1.00% of the outstanding principal amount of the commitments under the Credit Agreement as of the closing date on the earlier to

occur of September 2, 2024 and an Event of Default (as defined in the Credit Agreement).

On July 28, 2023, we amended our Term Loan Agreement to (i) extend the maturity date of the Term Loan Agreement to April 7, 2025, (ii) allow for

interest to be paid in kind until September 2, 2024, (iii) amend the 1.50% anniversary fee to recur on June 7 of each year that the Term Loan Agreement

remains outstanding, with 2024 fee deferred to the earlier of September 2, 2024 and the Termination Date (as defined in the Term Loan Agreement) and (iv)

amend certain negative covenants and affirmative and add certain additional covenants. We must pay a fee of $50,000 to the lenders under the Term Loan

Agreement on the earlier of September 2, 2024 and the Termination Date (as defined in the Term Loan Agreement).

Operational restructuring plans

During Fiscal 2023, we implemented a significant cost reduction program designed to streamline our operations, maximize productivity and drive

profitability. We reduced our workforce, eliminated duplicate administrative headcounts at all levels, implemented improved system development processes to

reduce maintenance costs, reduced capital expenditures, and evaluated operating contractual obligations for cost savings. Over the last year, we have achieved

annualized savings of $30,000 to $35,000 from these cost savings initiatives. Additionally, during Fiscal 2024, Management's planned to implement further

cost savings measures, including reduction of gross capital expenditures, amounting to approximately $25,000, of which approximately $14,000 has been

achieved during the 26 weeks ended October 28, 2023. Management believes that these plans are within its control and will be focused on implementing as

outlined.

During the 13 weeks ended October 28, 2023, Net Income from Continuing Operations increased by $686 compared to the prior year period. Excluding

interest expense and restructuring and other charges Net Income from Continuing Operations improved by $10,478 during the 13 weeks ended October 28,

2023 compared to the prior year period. During the 26 weeks ended October 28, 2023, Net Loss from Continuing Operations decreased by $1,037 compared to

the prior year period. Excluding interest expense and restructuring and other charges Net Loss from Continuing Operations decreased by $19,473 during the 26

weeks ended October 28, 2023 compared to the prior year period. The improvements in Net Income from Continuing Operations during the 13 and 26 weeks

are primarily due to operational improvements and cost savings initiatives.

11

Table of Contents

BARNES & NOBLE EDUCATION, INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

For the 13 and 26 weeks ended October 28, 2023 and October 29, 2022

(Thousands of dollars, except share and per share data)

(unaudited)

Management believes that the expected impact on our liquidity and cash flows resulting from the debt amendments and the operational initiatives outlined

above are sufficient to enable the Company to meet its obligations for at least twelve months from the issuance date of these condensed consolidated financial

statements and to continue to alleviate the conditions that initially raised substantial doubt about the Company's ability to continue as a going concern.

Seasonality

Our business is highly seasonal. Our quarterly results also may fluctuate depending on the timing of the start of the various schools' semesters, as well as

shifts in our fiscal calendar dates. These shifts in timing may affect the comparability of our results across periods. Our retail business is highly seasonal, with

the major portion of sales and operating profit realized during the second and third fiscal quarters, when college students generally purchase and rent textbooks

for the upcoming semesters. Sales attributable to our wholesale business are generally highest in our first, second and third quarters, as it sells textbooks and

other course materials for retail distribution. See Revenue Recognition and Deferred Revenue discussion below.

Use of Estimates

In preparing financial statements in conformity with GAAP, we are required to make estimates and assumptions that affect the reported amounts in the

condensed consolidated financial statements and accompanying notes. Actual results could differ from those estimates.

Discontinued Operations

During the fourth quarter of Fiscal 2023, assets related to our Digital Student Solutions ("DSS") Segment met the criteria for classification as Assets Held

for Sale and Discontinued Operations and is no longer a reportable segment. Certain assets and liabilities associated with the DSS Segment are presented in our

condensed consolidated balance sheets as "Assets Held for Sale" and "Liabilities Held for Sale". The results of operations related to the DSS Segment are

included in the condensed consolidated statements of operations as "Loss from discontinued operations, net of tax." The cash flows of the DSS Segment are

also presented separately in our condensed consolidated statements of cash flows. All corresponding prior year periods presented in our financial statements

and related information in the accompanying notes have been reclassified to reflect the Asset Held for Sale and Discontinued Operations presentation.

On May 31, 2023, we completed the sale of these assets related to our DSS Segment for cash proceeds of $20,000, net of certain transaction fees,

severance costs, escrow, and other considerations. During the 26 weeks ended October 28, 2023, we recorded a Gain on Sale of Business of $3,068 in Loss

from Discontinued Operations, Net, related to the sale. Net cash proceeds from the sale were used for debt repayment and provided additional funds for

working capital needs under our Credit Facility. The following table summarizes the operating results of the discontinued operations for the periods indicated:

13 weeks ended 26 weeks ended

Dollars in thousands

October 28, 2023 October 29, 2022 October 28, 2023 October 29, 2022

Total sales

$ — $ 8,465 $ 2,784 $ 17,649

Cost of sales — 1,772 76 3,472

Gross profit

— 6,693 2,708 14,177

Selling and administrative expenses 643 8,131 2,924 16,277

Depreciation and amortization 3 503 3 2,140

Gain on sale of business — — (3,068) —

Impairment loss (non-cash) — — 610 —

Restructuring costs 10 — 3,297 —

Transaction costs 18 — 13 —

Operating loss (674) (1,941) (1,071) (4,240)

Income tax expense — 83 20 169

Loss from discontinued operations, net of tax $ (674) $ (2,024) $ (1,091) $ (4,409)

(a) Cost of sales and Gross margin for the DSS Segment includes amortization expense (non-cash) related to content development costs of $1,618 and $3,169 for the 13 and 26

weeks ended October 29, 2022, respectively.

(b) During the 26 weeks ended October 28, 2023, we recognized an impairment loss (non-cash) of $610 (both pre-tax and after-tax),

(a)

(a)

(b)

(c)

12

Table of Contents

BARNES & NOBLE EDUCATION, INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

For the 13 and 26 weeks ended October 28, 2023 and October 29, 2022

(Thousands of dollars, except share and per share data)

(unaudited)

comprised of $119 and $491 of property and equipment and operating lease right-of-use assets, respectively, on the condensed consolidated statement of operations as part

of discontinued operations.

(c) During the 26 weeks ended October 28, 2023, we recognized restructuring and other charges of $3,297 comprised of severance and other employee termination costs.

The following table summarizes the assets and liabilities of the Assets Held for Sale included in the condensed consolidated balance sheets:

As of

April 29, 2023 October 29, 2022

Cash and cash equivalents $ 1,057 $ 929

Receivables, net 480 721

Prepaid expenses and other current assets 901 2,421

Property and equipment, net 19,523 20,621

Intangible assets, net 402 954

Goodwill 4,700 4,700

Deferred tax assets, net 130 —

Other noncurrent assets 237 212

Assets held for sale $ 27,430 $ 30,558

Accounts payable $ 211 $ 161

Accrued liabilities 8,212 5,061

Other long-term liabilities — 20

Liabilities held for sale

$ 8,423 $ 5,242

Restricted Cash

As of October 28, 2023 and October 29, 2022, we had restricted cash of $20,333 and $15,590, respectively, comprised of $19,388 and $14,686,

respectively, in prepaid and other current assets in the condensed consolidated balance sheet related to segregated funds for commission due to Lids for logo

merchandise sales as per the Lids service provider merchandising agreement, and $945 and $904, respectively, in other noncurrent assets in the condensed

consolidated balance sheet related to amounts held in trust for future distributions related to employee benefit plans.

Merchandise Inventories

Merchandise inventories, which consist of finished goods, are stated at the lower of cost or market. Market value of our inventory, which is all purchased

finished goods, is determined based on its estimated net realizable value, which is generally the selling price less normally predictable costs of disposal and

transportation. Reserves for non-returnable inventory are based on our history of liquidating non-returnable inventory, which includes certain significant

assumptions, including markdowns, sales below cost, inventory aging and expected demand.

Cost is determined primarily by the retail inventory method for our Retail segment. Our textbook and trade book inventories, for Retail and Wholesale, are

valued using the LIFO method and the related reserve was not material to the recorded amount of our inventories. There were no LIFO adjustments in Fiscal

2023, Fiscal 2022 and Fiscal 2021.

For our physical bookstores, we also estimate and accrue shortage for the period between the last physical count of inventory and the balance sheet date.

Shortage rates are estimated and accrued based on historical rates and can be affected by changes in merchandise mix and changes in actual shortage trends.

The Retail Segment fulfillment order is directed first to our wholesale business before other sources of inventory are utilized. The products that we sell

originate from a wide variety of domestic and international vendors. After internal sourcing, the bookstore purchases textbooks from outside suppliers and

publishers.

13

Table of Contents

BARNES & NOBLE EDUCATION, INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

For the 13 and 26 weeks ended October 28, 2023 and October 29, 2022

(Thousands of dollars, except share and per share data)

(unaudited)

Textbook Rental Inventories

Physical textbooks out on rent are categorized as textbook rental inventories. At the time a rental transaction is consummated, the book is removed from

merchandise inventories and moved to textbook rental inventories at cost. The cost of the book is amortized down to its estimated residual value over the rental

period. The related amortization expense is included in cost of goods sold. At the end of the rental period, upon return, the book is removed from textbook

rental inventories and recorded in merchandise inventories at its amortized cost.

Leases

We recognize lease assets and lease liabilities on the condensed consolidated balance sheet for all operating lease arrangements based on the present value

of future lease payments as required by Accounting Standards Codification ("ASC") Topic 842, Leases. We do not recognize lease assets or lease liabilities for

short-term leases (i.e., those with a term of twelve months or less). We recognize lease expense on a straight-line basis over the lease term for contracts with

fixed lease payments, including those with fixed annual minimums, or over a rolling twelve-month period for leases where the annual guarantee resets at the

start of each contract year, in order to best reflect the pattern of usage of the underlying leased asset. For additional information, see Note 8. Leases.

Revenue Recognition and Deferred Revenue

Product sales and rentals

The majority of our revenue is derived from the sale of products through our bookstore locations, including virtual bookstores, and our bookstore affiliated

e-commerce websites, and contains a single performance obligation. Revenue from sales of our products is recognized at the point in time when control of the

products is transferred to our customers in an amount that reflects the consideration we expect to be entitled to in exchange for the products. For additional

information, see Note 3. Revenue.

Retail product revenue is recognized when the customer takes physical possession of our products, which occurs either at the point of sale for products

purchased at physical locations or upon receipt of our products by our customers for products ordered through our websites and virtual bookstores. Wholesale

product revenue is recognized upon shipment of physical textbooks at which point title passes and risk of loss is transferred to the customer. Additional revenue

is recognized for shipping charges billed to customers and shipping costs are accounted for as fulfillment costs within cost of goods sold.

Revenue from the sale of digital textbooks, which contains a single performance obligation, is recognized at the point of sale as product revenue in our

condensed consolidated financial statements. A software feature is embedded within the content of our digital textbooks, such that upon expiration of the term

the customer is no longer able to access the content. While the sale of the digital textbook allows the customer to access digital content for a fixed period of

time, once the digital content is delivered to the customer, our performance obligation is complete.

Revenue from the rental of physical textbooks is deferred and recognized over the rental period based on the passage of time commencing at the point of

sale, when control of the product transfers to the customer and is recognized as rental income in our condensed consolidated financial statements. Rental

periods are typically for a single semester and are always less than one year in duration. We offer a buyout option to allow the purchase of a rented physical

textbook at the end of the rental period if the customer desires to do so. We record the buyout purchase when the customer exercises and pays the buyout option

price which is determined at the time of the buyout. In these instances, we accelerate any remaining deferred rental revenue at the point of sale.

Revenue recognized for our BNC First Day offerings is consistent with our policies outlined above for product, digital and rental sales, net of an

anticipated opt-out or return provision. Given the growth of BNC First Day programs, the timing of cash collection from our school partners may shift to

periods subsequent to when the revenue is recognized. When a school adopts our BNC First Day equitable and inclusive access offerings, cash collection from

the school generally occurs after the institution's drop/add dates, which is later in the working capital cycle, particularly in our third quarter given the timing of

the Spring Term and our quarterly reporting period, as compared to direct-to-student point-of-sale transactions where cash is generally collected during the

point-of-sale transaction or within a few days from the credit card processor.

We estimate returns based on an analysis of historical experience. A provision for anticipated merchandise returns is provided through a reduction of sales

and cost of goods sold in the period that the related sales are recorded.

For sales and rentals involving third-party products, we evaluate whether we are acting as a principal or an agent. Our determination is based on our

evaluation of whether we control the specified goods or services prior to transferring them to the

14

Table of Contents

BARNES & NOBLE EDUCATION, INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

For the 13 and 26 weeks ended October 28, 2023 and October 29, 2022

(Thousands of dollars, except share and per share data)

(unaudited)

customer. There are significant judgments involved in determining whether we control the specified goods or services prior to transferring them to the customer

including whether we have the ability to direct the use of the good or service and obtain substantially all of the remaining benefits from the good or service. For

those transactions where we are the principal, we record revenue on a gross basis, and for those transactions where we are an agent to a third-party, we record

revenue on a net basis.

As contemplated by the F/L Relationship related merchandising agreement and e-commerce agreement, logo general merchandise sales are fulfilled by

Lids and Fanatics on our behalf and we recognize commission revenue earned for these sales on a net basis in our condensed consolidated financial statements.

We do not have gift card or customer loyalty programs. We do not treat any promotional offers as expenses. Sales tax collected from our customers is

excluded from reported revenues. Our payment terms are generally 30 days and do not extend beyond one year.

Service and other revenue

Service and other revenue is primarily derived from brand partnership marketing services which includes promotional activities and advertisements within

our physical bookstores and web properties performed on behalf of third-party customers, shipping and handling, and revenue from other programs.

Brand partnership marketing agreements often include multiple performance obligations which are individually negotiated with our customers. For these

arrangements that contain distinct performance obligations, we allocate the transaction price based on the relative standalone selling price method by

comparing the standalone selling price (“SSP”) of each distinct performance obligation to the total value of the contract. The revenue is recognized as each

performance obligation is satisfied, typically at a point in time for brand partnership marketing service and overtime for advertising efforts as measured based

upon the passage of time for contracts that are based on a stated period of time or the number of impressions delivered for contracts with a fixed number of

impressions.

Cost of Sales

Our cost of sales primarily includes costs such as merchandise costs, textbook rental amortization, content development cost amortization, warehouse costs

related to inventory management and order fulfillment, insurance, certain payroll costs, and management service agreement costs, including rent expense,

related to our college and university contracts and other facility related expenses.

Selling and Administrative Expenses

Our selling and administrative expenses consist primarily of store payroll and store operating expenses. Selling and administrative expenses also include

long-term incentive plan compensation expense and general office expenses, such as merchandising, procurement, field support, finance and accounting.

Shared-service costs such as human resources, legal, treasury, information technology, and various other corporate level expenses and other governance

functions, are not allocated to a specific reporting segment and are recorded in Corporate Services.

Income Taxes

The provision for income taxes includes federal, state and local income taxes currently payable and those deferred because of temporary differences

between the financial statement and tax basis of assets and liabilities. The deferred tax assets and liabilities are measured using the enacted tax rates and laws

that are expected to be in effect when the differences reverse. We regularly review deferred tax assets for recoverability and establish a valuation allowance, if

determined to be necessary.

Recent Accounting Pronouncements

In November 2023, the Financial Accounting Standards Board ("FASB") issued ASU 2023-07, Segment Reporting (Topic 280): Improvements to

Reportable Segment Disclosures to improve reportable segment disclosure requirements, primarily through enhanced disclosures about significant segment

expenses. This guidance will be effective for the Company for the annual report for the fiscal year ending April 26, 2025 and subsequent interim periods. Early

adoption is permitted and retrospective adoption is required for all prior periods presented. We are currently assessing this guidance and determining the impact

on our condensed consolidated financial statements.

15

Table of Contents

BARNES & NOBLE EDUCATION, INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

For the 13 and 26 weeks ended October 28, 2023 and October 29, 2022

(Thousands of dollars, except share and per share data)

(unaudited)

Note 3. Revenue

Revenue from sales of our products and services is recognized either at the point in time when control of the products is transferred to our customers or

over time as services are provided in an amount that reflects the consideration we expect to be entitled to in exchange for the products or services. See Note 2.

Summary of Significant Accounting Policies for additional information related to our revenue recognition policies and Note 4. Segment Reporting for a

description of each segment's product and service offerings.

Disaggregation of Revenue

The following table disaggregates the revenue associated with our major product and service offerings:

13 weeks ended 26 weeks ended

October 28, 2023 October 29, 2022 October 28, 2023 October 29, 2022

Retail

Course Materials Product Sales $ 435,370 $ 416,410 $ 573,906 $ 547,262

General Merchandise Product Sales 105,022 122,648 193,702 211,472

Service and Other Revenue 18,263 18,218 24,996 24,137

Retail Product and Other Sales sub-total 558,655 557,276 792,604 782,871

Course Materials Rental Income

40,681 41,334 52,192 52,246

Retail Total Sales $ 599,336 $ 598,610 $ 844,796 $ 835,117

Wholesale Sales $ 20,973 $ 21,120 $ 59,764 $ 58,203

Eliminations

$ (9,930) $ (11,097) $ (30,020) $ (30,013)

Total Sales

$ 610,379 $ 608,633 $ 874,540 $ 863,307

(a) Logo general merchandise sales for the Retail Segment are recognized on a net basis as commission revenue in the condensed consolidated financial

statements.

(b) Service and other revenue primarily relates to brand partnership marketing and other service revenues.

(c) The sales eliminations represent the elimination of Wholesale sales and fulfillment service fees to Retail and the elimination of Retail commissions earned

from Wholesale.

Contract Liabilities

Contract liabilities represent an obligation to transfer goods or services to a customer for which we have received consideration and consists of our

deferred revenue liability (deferred revenue). Deferred revenue consists of the following:

• advanced payments from customers related to textbook rental performance obligations, which are recognized ratably over the terms of the related rental

period;

• unsatisfied performance obligations associated with brand partnership marketing services, which are recognized when the contracted services are

provided to our brand partnership marketing customers; and

• unsatisfied performance obligations associated with the premium paid for the sale of treasury shares, which are expected to be recognized over the term

of the e-commerce and merchandising contracts for Fanatics and Lids, respectively.

(a)

(b)

(c)

16

Table of Contents

BARNES & NOBLE EDUCATION, INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

For the 13 and 26 weeks ended October 28, 2023 and October 29, 2022

(Thousands of dollars, except share and per share data)

(unaudited)

The following table presents changes in deferred revenue associated with our contract liabilities:

26 weeks ended

October 28, 2023 October 29, 2022

Deferred revenue at the beginning of period $ 15,356 $ 16,475

Additions to deferred revenue during the period 97,773 96,121

Reductions to deferred revenue for revenue recognized during the period

(71,164) (68,676)

Deferred revenue balance at the end of period:

$ 41,965 $ 43,920

Balance Sheet classification:

Accrued liabilities $ 38,105 $ 39,504

Other long-term liabilities 3,860 4,416

Deferred revenue balance at the end of period:

$ 41,965 $ 43,920

As of October 28, 2023, we expect to recognize $38,105 of the deferred revenue balance within the next 12 months.

Note 4. Segment Reporting

During the fourth quarter of Fiscal 2023, assets related to our DSS Segment met the criteria for classification as Assets Held for Sale and Discontinued

Operations and is no longer a reportable segment. For additional information, see Note 2. Summary of Significant Accounting Policies.

We have two reportable segments: Retail and Wholesale. Additionally, unallocated shared-service costs, which include various corporate level expenses

and other governance functions, are not allocated to a specific reporting segment and continue to be presented as “Corporate Services”.

We identify our segments in accordance with the way our business is managed (focusing on the financial information distributed) and the manner in which

our chief operating decision maker allocates resources and assesses financial performance. The following summarizes the two segments. For additional

information about each segment's operations, see Part I - Item 1. Business in our Annual Report on Form 10-K for the fiscal year ended April 29, 2023.

Retail Segment

The Retail Segment operates 1,271 college, university, and K-12 school bookstores, comprised of 717 physical bookstores and 554 virtual bookstores. Our

bookstores typically operate under agreements with the college, university, or K-12 schools to be the official bookstore and the exclusive seller of course

materials and supplies, including physical and digital products. The majority of the physical campus bookstores have school-branded e-commerce websites

which we operate independently or along with our merchant service providers, and which offer students access to affordable course materials and affinity

products, including emblematic apparel and gifts. The Retail Segment offers our BNC First Day equitable and inclusive access programs, consisting of First

Day Complete and First Day, which provide faculty required course materials on or before the first day of class at a discounted rate, as compared to the total

retail price for the same course materials if purchased separately. The BNC First Day discounted price is offered as a course fee or included in tuition.

Additionally, the Retail Segment offers a suite of digital content and services to colleges and universities, including a variety of open educational resource-

based courseware.

Wholesale Segment

The Wholesale Segment is comprised of our wholesale textbook business and is one of the largest textbook wholesalers in the country. The Wholesale

Segment centrally sources, sells, and distributes new and used textbooks to approximately 2,900 physical bookstores (including our Retail Segment's 717

physical bookstores) and sources and distributes new and used textbooks to our 554 virtual bookstores. Additionally, the Wholesale Segment sells hardware and

a software suite of applications that provides inventory management and point-of-sale solutions to approximately 330 college bookstores.

®

17

Table of Contents

BARNES & NOBLE EDUCATION, INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

For the 13 and 26 weeks ended October 28, 2023 and October 29, 2022

(Thousands of dollars, except share and per share data)

(unaudited)

Corporate Services represents unallocated shared-service costs which include corporate level expenses and other governance functions, including

executive functions, such as accounting, legal, treasury, information technology, and human resources.

Intercompany Eliminations

The eliminations are primarily related to the following intercompany activities:

• The sales eliminations represent the elimination of Wholesale sales and fulfillment service fees to Retail and the elimination of Retail commissions

earned from Wholesale, and

• These cost of sales eliminations represent (i) the recognition of intercompany profit for Retail inventory that was purchased from Wholesale in a prior

period that was subsequently sold to external customers during the current period and the elimination of Wholesale service fees charged for fulfillment

of inventory for virtual store sales, net of (ii) the elimination of intercompany profit for Wholesale inventory purchases by Retail that remain in ending

inventory at the end of the current period.

Our international operations are not material, and the majority of the revenue and total assets are within the United States.

18

Table of Contents

BARNES & NOBLE EDUCATION, INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

For the 13 and 26 weeks ended October 28, 2023 and October 29, 2022

(Thousands of dollars, except share and per share data)

(unaudited)

Summarized financial information for our reportable segments is reported below:

13 weeks ended 26 weeks ended

October 28, 2023 October 29, 2022 October 28, 2023 October 29, 2022

Sales

Retail $ 599,336 $ 598,610 $ 844,796 $ 835,117

Wholesale 20,973 21,120 59,764 58,203

Eliminations (9,930) (11,097) (30,020) (30,013)

Total Sales

$ 610,379 $ 608,633 $ 874,540 $ 863,307

Gross Profit

Retail $ 125,529 $ 129,502 $ 175,820 $ 183,495

Wholesale 6,090 5,455 11,884 12,354

Eliminations 4,623 3,184 (828) (1,703)

Total Gross Profit

$ 136,242 $ 138,141 $ 186,876 $ 194,146

Selling and Administrative Expenses

Retail $ 77,182 $ 90,086 $ 146,355 $ 169,090

Wholesale 3,492 3,867 6,880 7,998

Corporate Services 5,287 5,075 10,205 12,289

Eliminations — (74) (3) (82)

Total Selling and Administrative Expenses

$ 85,961 $ 98,954 $ 163,437 $ 189,295

Depreciation and Amortization

Retail $ 8,911 $ 8,869 $ 17,877 $ 18,398

Wholesale 1,254 1,370 2,531 2,719

Corporate Services 10 17 20 35

Total Depreciation and Amortization $ 10,175 $ 10,256 $ 20,428 $ 21,152

Restructuring and Other Charges

Retail $ 29 $ — $ 555 $ —

Wholesale — — 526 —

Corporate Services 4,245 260 7,826 635

Total Restructuring and Other Charges

$ 4,274 $ 260 $ 8,907 $ 635

Operating Income (Loss)

Retail $ 39,407 $ 30,547 $ 11,033 $ (3,993)

Wholesale 1,344 218 1,947 1,637

Corporate Services (9,542) (5,352) (18,051) (12,959)

Elimination 4,623 3,258 (825) (1,621)

Total Operating Income (Loss)

$ 35,832 $ 28,671 $ (5,896) $ (16,936)

Interest Expense, net $ 10,664 $ 4,886 $ 18,918 $ 8,754

Total Income (Loss) from Continuing Operations Before

Income Taxes

$ 25,168 $ 23,785 $ (24,814) $ (25,690)

19

Table of Contents

BARNES & NOBLE EDUCATION, INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

For the 13 and 26 weeks ended October 28, 2023 and October 29, 2022

(Thousands of dollars, except share and per share data)

(unaudited)

Note 5. Equity and Earnings Per Share

Equity

Share Repurchases

During the 13 and 26 weeks ended October 28, 2023, we did not repurchase shares of our Common Stock under the stock repurchase program and as of

October 28, 2023, approximately $26,669 remains available under the stock repurchase program.

During the 13 and 26 weeks ended October 28, 2023, we repurchased 66,852 and 144,750 shares of our Common Stock, respectively, outside of the stock

repurchase program in connection with employee tax withholding obligations for vested stock awards.

Earnings Per Share

Basic EPS is computed based upon the weighted average number of common shares outstanding for the year. Diluted EPS is computed based upon the

weighted average number of common shares outstanding for the year plus the dilutive effect of common stock equivalents using the treasury stock method and

the average market price of our common stock for the year. We include participating securities (unvested share-based payment awards that contain non-

forfeitable rights to dividends or dividend equivalents) in the computation of EPS pursuant to the two-class method. Our participating securities consist solely

of unvested restricted stock awards, which have contractual participation rights equivalent to those of stockholders of unrestricted common stock. The two-

class method of computing earnings per share is an allocation method that calculates earnings per share for common stock and participating securities. During

periods of net loss, no effect is given to the participating securities because they do not share in the losses of the Company. During the 13 weeks ended

October 28, 2023 and October 29, 2022, average shares of 3,149,756 and 3,153,516 were excluded from the diluted earnings per share calculation as their

inclusion would have been antidilutive, respectively. During the 26 weeks ended October 28, 2023 and October 29, 2022, average shares of 3,453,892 and

4,898,303 were excluded from the diluted earnings per share calculation as their inclusion would have been antidilutive, respectively. The following is a

reconciliation of the basic and diluted earnings per share calculation:

20

Table of Contents

BARNES & NOBLE EDUCATION, INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

For the 13 and 26 weeks ended October 28, 2023 and October 29, 2022

(Thousands of dollars, except share and per share data)

(unaudited)

13 weeks ended 26 weeks ended

(shares in thousands) October 28, 2023 October 29, 2022 October 28, 2023 October 29, 2022

Numerator for basic earnings per share:

Net income (loss) from continuing operations $ 24,854 $ 24,168 $ (25,117) $ (26,154)

Less allocation of earnings to participating securities (3) (11) — —

Net income (loss) from continuing operations available to common

shareholders $ 24,851 $ 24,157 $ (25,117) $ (26,154)

Loss from discontinued operations, net of tax (674) (2,024) (1,091) (4,409)

Net income (loss) available to common shareholders $ 24,177 $ 22,133 $ (26,208) $ (30,563)

Numerator for diluted earnings per share:

Net income (loss) from continuing operations $ 24,851 $ 24,157 $ (25,117) $ (26,154)

Allocation of earnings to participating securities 3 11 — —

Less diluted allocation of earnings to participating securities (3) (11) — —

Net income (loss) from continuing operations available to common

shareholders $ 24,851 $ 24,157 $ (25,117) $ (26,154)

Loss from discontinued operations, net of tax (674) (2,024) (1,091) (4,409)

Net income (loss) available to common shareholders

$ 24,177 $ 22,133 $ (26,208) $ (30,563)

Denominator for basic earnings per share:

Basic weighted average shares of Common Stock

52,791 52,438 52,716 52,305

Denominator for diluted earnings per share:

Basic weighted average shares of Common Stock 52,791 52,438 52,716 52,305

Average dilutive restricted stock units 74 141 — —

Average dilutive restricted shares 5 10 — —

Average dilutive stock options

— 606 — —

Diluted weighted average shares of Common Stock

52,870 53,195 52,716 52,305

Earnings (Loss) per share of Common Stock:

Basic

Continuing operations $ 0.47 $ 0.46 $ (0.48) $ (0.50)

Discontinuing operations (0.01) (0.04) (0.02) (0.08)

Total Basic Earnings per share

$ 0.46 $ 0.42 $ (0.50) $ (0.58)

Diluted

Continuing operations $ 0.47 $ 0.46 $ (0.48) $ (0.50)

Discontinuing operations (0.01) (0.04) (0.02) (0.08)

Total Diluted Earnings per share

$ 0.46 $ 0.42 $ (0.50) $ (0.58)

Note 6. Fair Value Measurements

In accordance with ASC No. 820, Fair Value Measurements and Disclosures, the fair value of an asset is considered to be the price at which the asset could

be sold in an orderly transaction between unrelated knowledgeable and willing parties. A liability’s fair value is defined as the amount that would be paid to

transfer the liability to a new obligor, not the amount that would be paid to settle the liability with the creditor. Assets and liabilities recorded at fair value are

measured using a three-tier fair value hierarchy, which prioritizes the inputs used in measuring fair value. These tiers include:

21

Table of Contents

BARNES & NOBLE EDUCATION, INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

For the 13 and 26 weeks ended October 28, 2023 and October 29, 2022

(Thousands of dollars, except share and per share data)

(unaudited)

Level 1—Observable inputs that reflect quoted prices in active markets

Level 2—Inputs other than quoted prices in active markets that are either directly or indirectly observable

Level 3—Unobservable inputs in which little or no market data exists, therefore requiring us to develop our own assumptions

Our financial instruments include cash and cash equivalents, receivables, accrued liabilities and accounts payable. The fair value of cash and cash

equivalents, receivables, accrued liabilities and accounts payable approximates their carrying values because of the short-term nature of these instruments,

which are all considered Level 1. The fair value of short-term and long-term debt approximates its carrying value.

Non-Financial Assets and Liabilities

Our non-financial assets include property and equipment, operating lease right-of-use assets, and intangible assets. Such assets are reported at their

carrying values and are not subject to recurring fair value measurements. We review our long-lived assets for impairment whenever events or changes in

circumstances indicate that the carrying amount of an asset may not be recoverable in accordance with ASC 360-10, Accounting for the Impairment or Disposal

of Long-Lived Assets.

Other Non-Financial Liabilities

We granted phantom share units as long-term incentive awards which are settled in cash based on the fair market value of a share of common stock of the

Company at each vesting date. The fair value of the liability for the cash-settled phantom share unit awards will be remeasured at the end of each reporting

period through settlement to reflect current risk-free rate and volatility assumptions. As of October 28, 2023, we recorded a liability of $32 (Level 2 input)

which is reflected in accrued liabilities on the condensed consolidated balance sheet. As of October 29, 2022, we recorded a liability of $1,398 (Level 2 input)

which is reflected in accrued liabilities ($1,318) and other long-term liabilities ($80) on the condensed consolidated balance sheet. For additional information,

see Note 10. Long-Term Incentive Plan Compensation Expense.

Note 7. Debt

As of

Maturity Date October 28, 2023 October 29, 2022

Credit Facility December 28, 2024 $ 204,881 $ 222,000

Term Loan April 7, 2025 30,863 30,000

sub-total 235,744 252,000

Less: Deferred financing costs

(1,871) (1,555)

Total debt

$ 233,873 $ 250,445

Balance Sheet classification:

Short-term borrowings $ — $ —

Long-term borrowings

233,873 250,445

Total debt

$ 233,873 $ 250,445

Credit Facility

We have a credit agreement (the “Credit Agreement”), amended from time to time including on October 10, 2023, July 28, 2023, May 24, 2023, March 8,

2023, March 31, 2021 and March 1, 2019, under which the lenders originally committed to provide us with a 5 year asset-backed revolving credit facility in an

aggregate committed principal amount of $400,000 (the “Credit Facility”) effective from the March 1, 2019 amendment. We had the option to request an

increase in commitments under the Credit Facility of up to $100,000, subject to certain restrictions. Proceeds from the Credit Facility are used for general

corporate purposes, including seasonal working capital needs. The agreement included an incremental first in, last out seasonal loan facility (the “FILO

Facility”) for a $100,000 maintaining the maximum availability under the Credit Agreement at $500,000. As of July 31, 2022, the FILO Facility was repaid and

eliminated according to its terms and future commitments under the FILO Facility were reduced to $0.

22

Table of Contents

BARNES & NOBLE EDUCATION, INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

For the 13 and 26 weeks ended October 28, 2023 and October 29, 2022

(Thousands of dollars, except share and per share data)

(unaudited)

March 2023 Credit Agreement Amendment

On March 8, 2023, we amended our existing Credit Agreement to (i) extend the maturity date of the Credit Agreement by six months to August 29, 2024,

(ii) reduce the commitments under the Credit Agreement by $20,000 to $380,000, (iii) increase the applicable margin with respect to the interest rate under the

Credit Agreement to 3.375% per annum, in the case of interest accruing based on a Secured Overnight Financing Rate, and 2.375%, in the case of interest

accruing based on an alternative base rate, in each case, without regard to a pricing grid, (iv) reduce advance rates with respect to the borrowing base (x) by

500 basis points upon the achievement of certain liquidity events, which may include a sale of equity interests or of assets (a “Specified Event”), or, if such a