Prepared For

City of Asheville Community and

Economic Development Department

70 Court Plaza, 5th Floor

Asheville, North Carolina 28802

Effective Date

August 26, 2019

Revised: September 17, 2019

Job Reference Number

19-346 (Patrick Bowen)

155 E. Columbus Street, Suite 220

Pickerington, Ohio 43147

Phone: (614) 833-9300

Bowennational.com

Housing Needs Update

Buncombe County, North Carolina

Bowen National Research

155 E. Columbus Street, Suite 220

Pickerington, Ohio 43147

(

614

)

833-9300

September 17, 2019

Mr. Paul D’Angelo

City of Asheville

Community and Economic Development Department

70 Court Plaza, 5th Floor

Asheville, North Carolina 28802

Re: Buncombe County, North Carolina Housing Needs Update (Final Draft)

Dear Mr. D’Angelo:

Bowen National Research is pleased to provide you with the final draft of the Housing

Needs report of Buncombe County, North Carolina that we completed on your behalf.

This draft is a reduced scope from the original regional housing study we completed in

2014 and incorporates revisions to our August 26, 2019 draft that you requested. This

includes an Executive Summary that you asked to be added.

This update includes key demographic characteristics and trends (including projections

through 2023), a telephone survey of over 100 multifamily apartments, a sample survey

of more than 100 non-conventional and vacation rentals, nine years of for-sale housing

activity and an inventory of the available for-sale housing stock, identification of housing

product in the development pipeline (under construction and planned), and housing gap

estimates for rental and for-sale housing at various affordability levels.

We provided several comparisons of the housing market conditions of 2014 with the

latest 2019 housing supply that illustrate key changes in both the rental and for-sale

housing markets that we believe you will find interesting. We did not include any of the

raw data collected and used in this analysis, but we can provide such data upon request.

We have enjoyed working on this project.

Respectfully,

Patrick M. Bowen

Enc:

Executive Summary- 1

EXECUTIVE SUMMARY

The purpose of this report is to assess the Buncombe County housing market through an

evaluation of key demographic characteristics and trends along with an inventory and

analysis of the most

common housing

alternatives offered in the

county. Additionally, we

compare key metrics

from our 2014 analysis

of the area with the most

current data to illustrate

changes and trends in the

market. We conclude the

report by conducting a

housing gap analysis for

rental and for-sale

housing at various

affordability levels. This

Executive Summary

considers key findings

from our analysis.

Demographics

Overall Population and Household Demographic Trends have been Positive Since 2010

and are Projected to Experience Notable Growth through at Least 2023 - Buncombe

County experienced significant overall population and household growth rates between

2010 and 2018, outpacing both the Asheville MSA and the state of North Carolina.

Between 2018 and

2023, it is projected

that the Buncombe

County population will

increase by 17,899

(6.7%) and the number

of households will

increase by 7,145

(6.4%). This rapid

growth will continue to

contribute to the

ongoing demand for

housing for the

foreseeable future.

Executive Summary- 2

Senior Households (Ages 65 and Older) are Projected to Experience the Greatest

Growth in the County between 2018 and 2023 - While all household age segments are

projected to grow between 2018 and 2023, it is expected that most of the growth will

be among households with ages 65 to 74 and ages 75 and older. While this growth is

primarily attributed to

households aging in

place, these projected

growth trends indicate a

likely growing need for

senior-oriented housing

within the county.

However, with growth

also expected among all

age groups, the market

demand for a variety of

housing product types

and designs will exist.

While the Majority of Area Renter Households Earn Less Than $40,000 Annually

and the Majority of Homeowner Households Earn $60,000 or More Annually, Most

Growth through 2023 will Occur Among Moderate- to High-Income Households –

In 2018, over half (56.4%) of renter households in Buncombe County had annual

income below $40,000, while over half (51.9%) of owner-occupied households had

income of $60,000 or greater. New renter household growth is projected to be among

both moderate- (earning between $30,000 and $59,999) and high- (earning $60,000

and higher) income households between 2018 and 2023. During this same time

period, owner household growth in the county will primarily be among homeowners

with incomes of $50,000 and higher, though some notable growth will occur among

homeowners earning below $20,000 a year.

Executive Summary- 3

Substandard Housing Conditions and Households in Cost Burdened Housing

Situations Remain a Significant Challenge Among Area Households - In Buncombe

County, 2,718 (7.1%) renter households and 817 (1.2%) owner households are

experiencing overcrowded housing situations. A total of 17,643 (46.1%) renter

households are cost burdened (paying over 30% of their income towards housing

costs) and 7,439 (19.4%) are severe cost burdened (paying over 50% of their income

towards housing costs). As such, more than 3,500 households live in substandard

housing conditions and nearly 18,000 renter households are paying disproportionately

high shares of income towards their housing costs. These characteristics stress the

importance of both affordability and quality/modernization of the local housing stock.

Multifamily Rental Housing Supply

While the Area’s Overall Occupancy Rate (95.3%) for Multifamily Rental Housing

Stock has Declined Since 2014 (99.2%), Most Affordable Rental Properties Remain

Full with Long Wait Lists - The 122 surveyed multifamily rental properties have a

combined occupancy rate of 95.3%, down from the 99.2% occupancy rate from

December of 2014. This is considered a healthy occupancy rate and indicates the

overall market has a good balance of occupied and vacant units. Currently, a total of

719 vacant units were identified in the county. This is a significant increase from the

99 vacant units that were identified in late 2014. It appears the influx of new

multifamily apartments has put the overall market into a better balance at this time.

However, there remains limited availability for lower income households seeking

affordable rental housing.

Surveyed Multifamily Apartments – July 2019 December 2014

Project Type

Projects

Surveyed

Total

Units

Vacant

Units

Occupancy

Rate

Occupancy

Rate

Market-rate 70 10,348 616 94.0% 98.8%

Market-rate/Tax Credit 8 1,687 99 94.1% 100.0%

Market-rate/Government-Subsidized 1 123 0 100.0% 100.0%

Tax Credit 24 1,087 2 99.8% 100.0%

Tax Credit/Government-Subsidized 7 511 0 100.0% 100.0%

Government-Subsidized 12 1,392 2 99.9% 100.0%

Total 122 15,148 719 95.3% 99.2%

Executive Summary- 4

The Introduction of New Rental Product Over the Past Few Years has not

Limited Rent Increases, as both Market-rate and Tax Credit Annual Rent

Growth has Averaged Around 5.0% Since 2014 - While the market-rate rental

vacancy rate has increased from 1.2% in 2014 to 6.0% in 2019 due to the

introduction of

thousands of new

market-rate units, the

overall median market-

rate rent has increased at

a relatively rapid rate of

5.4% annually.

Although vacancies are

much more limited

among the Tax Credit

supply, rents among this

supply have increased at

an annual rate of 4.8%

over the past five years.

There is Limited Availability and Long Wait Lists Among Government-

Subsidized Projects and for Housing Choice Vouchers - A total of 20 multifamily

properties were surveyed in the county that operate with a government subsidy.

There were only two vacant units among the 1,831 total government-subsidized

units surveyed. According to management at the surveyed subsidized projects,

most of these properties have long wait lists. According to a representative with

the Housing Authority of the City of Asheville, there are approximately 2,781

Housing Choice Voucher holders within the housing authority’s jurisdiction and

1,442 people currently on the waiting list for additional vouchers. These market

metrics indicate a strong level of pent-up demand for rental housing serving the

lowest income households in the market.

Executive Summary- 5

Efforts Made by the Local Government to Encourage the Development of

Affordable Housing have Increased the Number of Such Units, yet there

Remains Pent-up Demand for Housing Serving Lower Income Households - As

a result of local government efforts to support affordable rental housing, there have

been several mixed-income projects developed in recent years that include a

combination of both market-rate and Tax Credit apartments. Additionally, several

projects are in the development pipeline (either under construction or planned for

development) that will include mixed-income units. Of the 2,441 units either

existing or in the development pipeline that are within mixed-income projects, 368

are income restricted. These 368 units represent 15.1% of the overall units offered

at these projects. The income restrictions preserve these particular units for low-

income households earning up to 80% of AMHI and are developed through such

things as the Low-Income Housing Tax Credit (LIHTC) program, the Housing

Trust Fund, or the Asheville Affordable Housing Program. It is worth pointing out

that over two-thirds of the affordable housing units at these projects were

developed after 2014, illustrating the improved efforts to address rental

affordability issues in the market. Despite these efforts, there are very few

available units among the affordable rental housing supply and many projects have

wait lists.

For-Sale Housing

For-Sale Housing Activity has Remained Steady Since 2013, While Median

Home Prices Continue to Escalate - Home sales activity within the county has

remained relatively steady since 2013, with the market experiencing an average

sales pace around 3,300 to 3,600 homes annually over the past six years. Sales

activity for 2019 is on pace for nearly 3,500 home sales, continuing the trend of

stable sales activity recently experienced in the market. The county has

experienced rising median sales prices over the past eight years. The current

median home sales price of $315,000 represents a 10-year high. The positive

trends among sales volume and sales prices are good indications of a healthy and

stable for-sale housing market in Buncombe County.

Executive Summary- 6

The Available Inventory of For-Sale Housing has Diminished Significantly

Since 2014, with a Substantial Decrease Among Product Priced Under $200,000

- The 1,300 housing units currently available for purchase in the county is 434

fewer than there were in late 2014, representing a decrease of 25.0%. The

available inventory of product priced under $200,000 has diminished to just 63

units, down from 460 homes at these price points in 2014. Demand for product

priced between $100,000 and $199,999 remains rather strong, as evidenced by the

average days on market of just 78 for such product. Meanwhile, higher priced

product, generally at $400,000 or higher, has increased dramatically. Product at

these higher price points now represents 56.6% of the available inventory (up from

35.6% in 2014). The significantly diminishing overall supply of available product

has likely contributed to the continued increases in home prices. Moreover, with

the lower priced (under $200,000) product virtually non-existent, lower income

households generally earning below $60,000 have very limited home buying

choices.

Residential Development Pipeline

With Approximately 3,800 Rental Housing Units Either Under Construction or

Planned for the Market, the Area is at Some Risk of Having an Overbuilt Market

– According to local planning departments, it is believed that approximately 3,800

multifamily apartments are currently under construction or in some stage of the

planning process. It is believed that roughly 2,300 of these units will have rents of

over $1,400 per month, with an additional 1,100 units priced between $900 and

$1,399. Only about 450 units are in the pipeline that would be priced under $900, yet

such units will serve a housing segment with pent-up demand. Given that the

current overall market-rate vacancy rate has reached 6.0% and more than 2,000 units

are expected to be added to the market-rate supply over the next 18 to 24 months, the

market-rate rental housing segment may be reaching a point of saturation.

Conversely, the pent-up demand for rental product priced under $900 should

positively affect the absorption of such units in the development pipeline.

Executive Summary- 7

Housing Gap Estimates

Bowen National Research conducted housing gap analyses for rental and for-sale

housing for the subject county that considered a variety of affordability and

income levels.

While All Affordability and Income Levels Demonstrate Housing Gaps for

Rental Product, the Greatest Gaps are For Product Affordable to Households

with the Lowest Incomes - While there is a housing gap deficit among each of the

income segments, the largest is among the lowest income segment. Although most

of the product in the development pipeline (either under construction or planned)

falls within the $875 to $1,999 rent ranges, there still remains demand for housing

at this price level. Based on these estimates, while a variety of product types by

rent level can be supported, the greatest gaps appear to be for housing that serves

lower income households and workforce households.

Demand

Component

Rental Housing Gap Estimates

AMHI <30% 30%-50% 51%-80% 81%-120% 121%+

Income <$20k $20k-$35k $36k-$55k $56k-$80k $81k+

Rent <$500 $500-$874 $875-$1,374 $1,375-$1,999 $2,000+

New Households (2018-2023) -658 -263 845 439 1,366

Balanced Market 576 436 407 58 55

Substandard Housing 787 306 183 55 31

Commuter Support 696 582 516 936 288

Step-Down Support 0 85 47 961 -1,093

Development Pipeline -277 -102 -968 -1,545 -496

Total Housing Gap 1,124 1,044 1,030 904 151

AMHI – Area Median Household Income

Executive Summary- 8

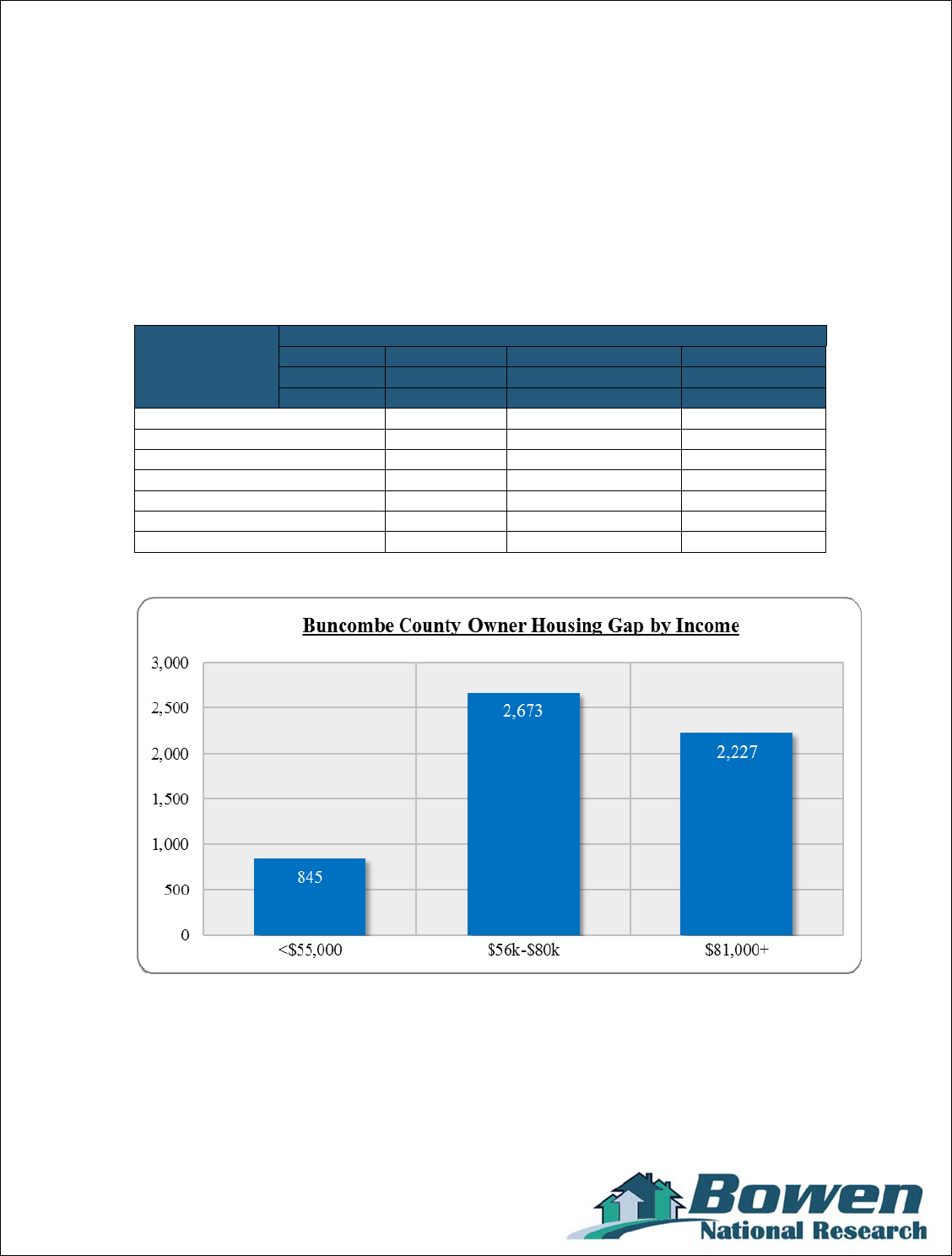

The Housing Gaps for For-Sale Housing are Significant Among All Affordability

and Income Levels, with the Greatest Gap Existing Among Product that Serves

Moderate-Income Households - As shown in the owner housing gap analysis, the

greatest housing gap is for product priced between $200,000 and $299,999, with a

nearly equal housing gap for housing priced at $300,000 and higher. These particular

gaps are primarily driven by the new household growth projected through 2023.

While smaller in scale, there still remains a notable housing gap for product priced

under $200,000. The demand for the lower priced project originates from a variety of

sources, with a notable amount resulting from the lack of available product at this

price range.

Demand

Component

For-Sale Housing Gap Estimates

AMHI <80% 81%-120% 121%+

Income <$55k $56k-$80k $81k+

Home Price <$200,000 $200,000-$299,999 $300,000+

New Households (2018-2023) -242 1,620 3,696

Balanced Market 257 65 -508

Substandard Housing 189 56 32

Commuter Support 209 321 123

Step-Down Support 486 739 -739

Development Pipeline -54 -128 -377

Total Housing Gap 845 2,673 2,227

AMHI – Area Median Household Income

1

BUNCOMBE COUNTY HOUSING NEEDS ASSESSMENT

A. INTRODUCTION

The focus of this analysis is to assess the market characteristics of, and to determine

the housing needs for, Buncombe County. To accomplish this task, Bowen National

Research evaluated various socio-economic characteristics, inventoried and analyzed

the housing supply (rental and owner/for-sale product), identified product in the

development pipeline, and provided housing gap estimates to help identify the housing

needs of the county.

This report is an update to a 2014 Housing Needs Assessment of this market and

includes some data points from that original analysis.

B. COUNTY OVERVIEW

Buncombe County is located within the western portion of North Carolina and serves

as the region’s economic and cultural center. It encompasses a total of 656 square

miles. Primary thoroughfares within the county include U.S. Highways 23, 25 and 74,

and Interstate Highways 26, 40 and 240. Notable natural landmarks and public

attractions include the

Blue Ridge Parkway, the

Pisgah National Forest,

Biltmore Estate and the

North Carolina

Arboretum. In 2018, the

county had a total

population of 266,322

(7th largest in the state).

Asheville, with a 2018

population of 92,452, is

the largest community in

the county and the 12

th

largest city in the state.

Additional details

regarding demographics

and housing, and other

pertinent research and

findings are included on

the following pages.

2

C. DEMOGRAPHICS

This section of the report evaluates key demographic characteristics for Buncombe

County. Through this analysis, unfolding trends and unique conditions are revealed

regarding populations and households residing in the county. Demographic

comparisons provide insights into the human composition of housing markets.

This section is comprised of three major parts: population characteristics, household

characteristics, and income data. Population characteristics describe the qualities of

individual people, while household characteristics describe the qualities of people

living together in one residence.

It is important to note that 2000 and 2010 demographics are based on U.S. Census data

(actual count), while 2018 and 2023 data are based on calculated projections provided

by ESRI, a nationally recognized demography firm, and the 2013-2017 American

Community Survey. The accuracy of these projections depends on the realization of

certain assumptions:

Economic projections made by secondary sources materialize;

Governmental policies with respect to residential development remain consistent;

Availability of financing for residential development (i.e. mortgages, commercial

loans, subsidies, Tax Credits, etc.) remains consistent;

Sufficient housing and infrastructure are provided to support projected population

and household growth;

Significant unforeseen changes or fluctuations among any of the preceding

assumptions could have an impact on demographic projections.

Population and household data for selected years within Buncombe County are

compared with the broader Asheville Metropolitan Statistical Area (MSA) and the

state of North Carolina in the following table:

Buncombe County Asheville MSA North Carolina

Population Households Population Households Population Households

2000 Census 206,366 85,791 369,163 154,283 8,049,315 3,131,018

2010 Census 238,384 100,439 424,850 179,909 9,535,490 3,745,159

Change 2000-2010 32,018 14,648 55,687 25,626 1,486,175 614,141

Percent Change 2000-2010 15.5% 17.1% 15.1% 16.6% 18.5% 19.6%

2018 Estimated 266,322 111,165 469,781 197,562 10,455,567 4,087,415

Change 2010-2018 27,938 10,726 44,931 17,653 920,077 342,256

Percent Change 2010-2018 11.7% 10.7% 10.6% 9.8% 9.6% 9.1%

2023 Projected 284,221 118,310 499,606 209,698 11,061,161 4,317,051

Change 2018-2023 17,899 7,145 29,825 12,136 605,594 229,636

Percent Change 2018-2023 6.7% 6.4% 6.3% 6.1% 5.8% 5.6%

Source: 2000, 2010 Census; ESRI; Urban Decision Group; Bowen National Research

3

Buncombe County experienced significant overall population and household growth

rates between 2010 and 2018, outpacing both the Asheville MSA and the state of

North Carolina. Between 2018 and 2023, it is projected that the Buncombe County

population will increase by 17,899 (6.7%) and the number of households will increase

by 7,145 (6.4%). The percent of projected growth for both population and households

are expected to be greater than the MSA and state. This rapid growth will continue

to contribute to the ongoing demand for housing for the foreseeable future.

Household heads by age cohorts for selected years are shown in the following table:

Household Heads by Age

<25 25 to 34 35 to 44 45 to 54 55 to 64 65 to 74 75+

Buncombe County

2010

4,459

(4.4%)

14,981

(14.9%)

17,170

(17.1%)

19,582

(19.5%)

19,554

(19.5%)

12,804

(12.7%)

11,890

(11.8%)

2018

4,466

(4.0%)

15,651

(14.1%)

17,626

(15.9%)

18,889

(17.0%)

21,871

(19.7%)

18,509

(16.7%)

14,153

(12.7%)

2023

4,639

(3.9%)

15,825

(13.4%)

18,552

(15.7%)

18,944

(16.0%)

21,873

(18.5%)

21,205

(17.9%)

17,272

(14.6%)

Change

2018-2023

173

(3.9%)

174

(1.1%)

926

(5.3%)

55

(0.3%)

2

(0.0%)

2,696

(14.6%)

3,119

(22.0%)

North Carolina

2010

192,967

(5.2%)

588,691

(15.7%)

712,157

(19.0%)

771,239

(20.6%)

673,803

(18.0%)

443,535

(11.8%)

362,762

(9.7%)

2018

187,547

(4.6%)

640,341

(15.7%)

696,488

(17.0%)

747,708

(18.3%)

772,560

(18.9%)

618,322

(15.1%)

424,449

(10.4%)

2023

192,122

(4.5%)

661,029

(15.3%)

735,426

(17.0%)

729,219

(16.9%)

778,971

(18.0%)

702,384

(16.3%)

517,900

(12.0%)

Change

2018-2023

4,575

(2.4%)

20,688

(3.2%)

38,938

(5.6%)

-18,489

(-2.5%)

6,411

(0.8%)

84,062

(13.6%)

93,451

(22.0%)

Source: 2000, 2010 Census; ESRI; Urban Decision Group; Bowen National Research

4

In 2018, it was estimated that the largest share (19.7%) of households by age in

Buncombe County was among the 55 to 64 age cohort. The distribution of households

by age among all other age groups within the county is relatively balanced above the

age of 24. While all household age segments are projected to grow between 2018 and

2023, it is expected that most of the growth will be among household ages 65 to 74

and age 75 and older. While this growth is attributed to households aging in place,

these projected growth trends indicate a likely growing need for senior-oriented

housing within the county. However, with growth also expected among all age

groups, the market demand for a variety of product types and designs will exist.

5

Renter households by income for selected years are shown below:

Renter Households by Income

<$10,000

$10,000 -

$19,999

$20,000 -

$29,999

$30,000 -

$39,999

$40,000 -

$49,999

$50,000 -

$59,999

$60,000 -

$99,999 $100,000+

Buncombe

County

2010

4,853

(14.1%)

7,792

(22.6%)

6,564

(19.1%)

4,331

(12.6%)

3,341

(9.7%)

2,339

(6.8%)

3,883

(11.3%)

1,333

(3.9%)

2018

3,692

(8.9%)

8,057

(19.5%)

6,169

(14.9%)

5,438

(13.1%)

5,243

(12.7%)

3,011

(7.3%)

6,473

(15.6%)

3,322

(8.0%)

2023

3,198

(7.4%)

7,893

(18.3%)

5,840

(13.5%)

5,570

(12.9%)

6,009

(13.9%)

3,038

(7.0%)

7,289

(16.9%)

4,299

(10.0%)

Change

2018-2023

-494

(-13.4%)

-164

(-2.0%)

-329

(-5.3%)

132

(2.4%)

765

(14.6%)

26

(0.9%)

816

(12.6%)

977

(29.4%)

North

Carolina

2010

195,723

(15.7%)

268,627

(21.5%)

209,386

(16.8%)

164,802

(13.2%)

128,213

(10.3%)

77,749

(6.2%)

154,325

(12.4%)

48,430

(3.9%)

2018

180,236

(12.3%)

259,703

(17.7%)

215,938

(14.7%)

186,030

(12.7%)

157,384

(10.7%)

108,406

(7.4%)

245,739

(16.8%)

113,455

(7.7%)

2023

163,917

(10.9%)

242,546

(16.2%)

204,555

(13.6%)

181,648

(12.1%)

164,150

(10.9%)

116,752

(7.8%)

280,098

(18.7%)

146,889

(9.8%)

Change

2018-2023

-16,318

(-9.1%)

-17,158

(-6.6%)

-11,383

(-5.3%)

-4,383

(-2.4%)

6,766

(4.3%)

8,346

(7.7%)

34,359

(14.0%)

33,434

(29.5%)

Source: 2000 Census; 2010 Census; ESRI; Urban Decision Group; Bowen National

The distribution of owner households by income is included below:

Owner Households by Income

<$10,000

$10,000 -

$19,999

$20,000 -

$29,999

$30,000 -

$39,999

$40,000 -

$49,999

$50,000 -

$59,999

$60,000 -

$99,999 $100,000+

Buncombe

County

2010

3,408

(5.2%)

6,601

(10.0%)

8,067

(12.2%)

7,463

(11.3%)

7,458

(11.3%)

6,971

(10.6%)

14,883

(22.5%)

11,153

(16.9%)

2018

2,436

(3.5%)

5,928

(8.5%)

5,735

(8.2%)

6,133

(8.8%)

6,410

(9.2%)

6,905

(9.9%)

18,401

(26.4%)

17,811

(25.5%)

2023

2,470

(3.3%)

6,367

(8.5%)

5,606

(7.5%)

5,927

(7.9%)

6,194

(8.2%)

7,263

(9.7%)

20,996

(27.9%)

20,352

(27.1%)

Change

2018-2023

34

(1.4%)

439

(7.4%)

-129

(-2.2%)

-206

(-3.4%)

-215

(-3.4%)

359

(5.2%)

2,595

(14.1%)

2,541

(14.3%)

North

Carolina

2010

132,072

(5.3%)

229,311

(9.2%)

255,992

(10.2%)

264,204

(10.6%)

246,306

(9.9%)

235,841

(9.4%)

610,090

(24.4%)

524,083

(21.0%)

2018

106,219

(4.1%)

187,667

(7.2%)

214,174

(8.2%)

231,524

(8.8%)

222,681

(8.5%)

232,889

(8.9%)

677,425

(25.9%)

747,945

(28.5%)

2023

109,029

(3.9%)

194,106

(6.9%)

219,003

(7.8%)

237,048

(8.4%)

235,831

(8.4%)

248,033

(8.8%)

742,500

(26.4%)

830,946

(29.5%)

Change

2018-2023

2,809

(2.6%)

6,440

(3.4%)

4,829

(2.3%)

5,525

(2.4%)

13,150

(5.9%)

15,144

(6.5%)

65,075

(9.6%)

83,001

(11.1%)

Source: 2000 Census; 2010 Census; ESRI; Urban Decision Group; Bowen National Research

6

The largest share (19.5%) of renter households in Buncombe County in 2018 was

estimated to be among households with incomes between $10,000 and $19,999, which

is similar to the state average. Meanwhile, the largest share (26.4%) of owner-

occupied households at this same time will be among those with incomes between

$60,000 and $99,999, which is near the state share of 25.9%. New renter household

growth is projected to be among both moderate (earning between $30,000 and

$59,999) and high (earning $60,000 and higher) income households between 2018 and

2023. During this same time period, owner household growth in the county will

primarily be among homeowners with incomes of $50,000 and higher, though some

notable growth will occur among homeowners earning below $20,000 a year. The

projected growth among lower income households, particularly among home owners

is likely influenced by the large number of area seniors reaching retirement age and

experiencing declines in income. While the large amount of renter growth is expected

to occur among households that can generally afford market-rate rents, the large share

(39.2%) of renter households earning below $30,000 stresses the importance of having

product such as Tax Credit and government-subsidized housing to serve such

households in the market.

The following graph compares households by income and tenure for 2018:

7

The following graphs illustrate the projected household growth by income and tenure

from 2018 to 2023.

8

Overcrowded housing is considered a housing unit with 1.01 or more persons per

room, while severe overcrowded housing is considered a unit with 1.51 or more

persons per room. The following table illustrates the overcrowded households by

tenure for Buncombe County and North Carolina.

Overcrowded Severe Overcrowded

Renter Owner Renter Owner

County Number Percent Number Percent Number Percent Number Percent

Buncombe County

2,718 7.1% 817 1.2% 2,109 5.5% 240 0.4%

North Carolina

59,922 4.4% 31,649 1.3% 19,513 1.4% 7,250 0.3%

Source: 2013-2017 American Community Survey

In Buncombe County, 2,718 (7.1%) renter households and 817 (1.2%) owner

households are experiencing overcrowded housing situations. The shares of such

households within North Carolina are 4.4% for renters and 1.3% for homeowners.

Severe overcrowded housing in the county totals 2,109 (5.5%) for renters and 240

(0.4%) for owners. While the shares of overcrowded and severe overcrowded

homeowners in Buncombe County are similar to the state averages, such overcrowded

and severe overcrowded households are much more pronounced among renters in the

county. As such, substandard housing conditions associated with overcrowding

remains a significant challenge for county renters. It is believed that the challenges

associated with affordability and availability are contributing to the overcrowded

housing in the county.

9

Evaluating the share of income that a household pays towards housing costs is an

important factor to consider when evaluating housing needs. Cost burdened

households are those paying over 30% of their income towards housing costs, while

severe cost burdened households are those paying over 50% of their income towards

housing costs. The following table illustrates the cost burdened and severe cost

burdened households for the county and the state.

Cost Burdened Severe Cost Burdened

Renter Owner Renter Owner

County Number Percent Number Percent Number Percent Number Percent

Buncombe County

17,643 46.1% 14,310 21.3% 7,439 19.4% 5,283 7.9%

North Carolina

600,819 44.3% 538,137 21.4% 292,735 21.6% 213,458 8.5%

Source: 2013-2017 American Community Survey

Among Buncombe County’s renter households in 2018, a total of 17,643 (46.1%) are

cost burdened and 7,439 (19.4%) are severe cost burdened. The shares of cost

burdened and severe cost burdened renter households in the county are comparable to

state averages. Among owner households in the county, a total of 14,310 (21.3%) are

cost burdened while 5,283 (7.9%) are severe cost burdened. These ratios are also very

similar to state averages. Based on this analysis, while the shares of households paying

a disproportionately high share of their income toward housing costs within

Buncombe County are similar to state shares, several thousands of renters and

homeowners are dealing with housing affordability challenges.

10

The graphs below illustrate the shares of cost burdened and severe cost burdened

households by tenure for Buncombe County and the state of North Carolina.

11

D. HOUSING SUPPLY

This housing supply analysis considers both rental and owner for-sale housing.

Understanding the historical trends, market performance, characteristics, composition,

and current housing choices provides critical information as to current market

conditions and future housing potential. The housing data presented and analyzed in

this section includes primary data collected directly by Bowen National Research and

from secondary data sources including American Community Survey (ACS), U.S.

Census housing information and data provided by various government entities and real

estate professionals.

While there are a variety of housing alternatives offered in Buncombe County, we

focused our analysis on the most common options. The housing structures included in

this analysis are:

Rental Housing – Multifamily rentals that generally include 20 or more units were

inventoried and surveyed. Additionally, rentals with three or fewer units, which

were classified as non-conventional rentals, were identified and surveyed. Other

rentals such as vacation rentals were also considered in this analysis.

Owner For-Sale Housing – We identified attached and detached for-sale housing,

which may be part of a planned development or community, as well as attached

multifamily housing such as condominiums.

This analysis includes Bowen National Research’s telephone survey of area rental

alternatives and an inventory of owner for-sale housing data (both historical sales and

available housing alternatives) obtained from secondary data sources (Multiple Listing

Service, REALTOR.com, and other on-line sources). Finally, we contacted local

building and planning departments to determine if any residential units of notable

scale were currently planned or under review by the local government. Any such units

were considered in the housing gap/needs estimates included later in this section.

a. Rental Housing

Multifamily Rental Housing

We identified and personally surveyed 122 multifamily housing projects

containing a total of 15,148 units within the county. This survey was conducted to

establish the overall strength of the rental market and to identify trends in the

multifamily rental market. Managers and leasing agents for each project were

surveyed to collect a variety of property information including vacancies, rental

rates, design characteristics, amenities, utility responsibility, and other features.

Projects were also rated based on quality and upkeep (based on our previous on-

site evaluations of this market), and each was mapped as part of this survey.

12

The following table illustrates the distribution of surveyed multifamily rental

housing supply by product/program type. It also includes a comparison of overall

occupancy rates for July of 2019 with December of 2014:

Surveyed Multifamily Apartments – July 2019 December 2014

Project Type

Projects

Surveyed

Total

Units

Vacant

Units

Occupancy

Rate

Occupancy

Rate

Market-rate 70 10,348 616 94.0% 98.8%

Market-rate/Tax Credit 8 1,687 99 94.1% 100.0%

Market-rate/Government-Subsidized 1 123 0 100.0% 100.0%

Tax Credit 24 1,087 2 99.8% 100.0%

Tax Credit/Government-Subsidized 7 511 0 100.0% 100.0%

Government-Subsidized 12 1,392 2 99.9% 100.0%

Total 122 15,148 719 95.3% 99.2%

As the preceding table illustrates, these multifamily rentals have a combined

occupancy rate of 95.3%, down from the 99.2% occupancy rate from December of

2014. This is considered a healthy occupancy rate and indicates the overall

market has a good balance of occupied and vacant units. Currently, a total of 719

vacant units were identified in the county. This is a significant increase from the

99 vacant units that were identified in late 2014. It appears the influx of new

multifamily apartments has put the overall market into a better balance at this time.

However, as evidenced by the high occupancy rates among the affordable (Tax

Credit and government-subsidized) rental inventory, there remains limited

availability for lower income households seeking such housing.

13

The following tables summarize the breakdown of non-subsidized units surveyed

by program type and bedroom/bathroom configuration within the county.

Market-rate Multifamily Apartments – July 2019

Bedroom Baths Units Share Vacancy

%

Vacant

Median

Collected

Rent

12/2014

Median

Collected

Rent

Change in

Rents

2014 to

2019

Average

Annual

Change in

Rents

Studio 1.0 150 1.3% 1 0.7% $825 $667 23.7% 4.7%

One-Bedroom 1.0 3,612 30.6% 196 5.4% $1,054 $830 27.0% 5.4%

One-Bedroom 2.0 43 0.4% 1 2.3% $2,155 N/A N/A N/A

Two-Bedroom 1.0 1,080 9.1% 51 4.7% $1,100 $800 37.5% 7.5%

Two-Bedroom 1.5 539 4.6% 7 1.3% $1,068 $915 16.7% 3.3%

Two-Bedroom 2.0 4,688 39.7% 337 7.2% $1,308 $1,022 28.0% 5.6%

Two-Bedroom 2.5 219 1.9% 10 4.6% $1,310 $1,031 27.1% 5.4%

Three-Bedroom 1.0 88 0.7% 1 1.1% $889 $739 20.3% 4.1%

Three-Bedroom 1.5 163 1.4% 0 0.0% $1,245 $1,000 24.5% 4.9%

Three-Bedroom 2.0 1,123 9.5% 102 9.1% $1,490 $1,242 20.0% 4.0%

Three-Bedroom 2.5 76 0.6% 1 1.3% $1,600 $1,303 22.8% 4.6%

Three-Bedroom 3.0 4 0.0% 0 0.0% $1,400 $1,100 27.3% 5.5%

Three-Bedroom 3.5 1 0.0% 0 0.0% $6,928 N/A N/A N/A

Four-Bedroom 1.5 20 0.2% 0 0.0% $1,000 $789 26.7% 5.3%

Four-Bedroom 2.0 8 0.1% 0 0.0% $1,560 $1,005 55.2% 11.0%

Total Market-rate 11,814 100.0% 707 6.0% - - - 5.4%

N/A – Not Available

Tax Credit Multifamily Apartments - July 2019

Bedroom

Baths Units Share Vacancy

%

Vacant

Median

Collected

Rent

12/2014

Median

Collected

Rent

Change in

Rents

2014 to

2019

Average

Annual

Change in

Rents

Studio 1.0 19 1.3% 0 0.0% $308 $222 38.7% 7.7%

One-Bedroom 1.0 606 40.3% 7 1.2% $555 $467 18.8% 3.8%

Two-Bedroom 1.0 418 27.8% 0 0.0% $590 $531 11.1% 2.2%

Two-Bedroom 1.5 34 2.3% 0 0.0% $655 N/A N/A N/A

Two-Bedroom 2.0 186 12.4% 3 1.6% $694 $388 78.9% 15.8%

Three-Bedroom 1.0 67 4.5% 0 0.0% $741 $658 12.6% 2.5%

Three-Bedroom 2.0 150 10.0% 0 0.0% $689 $580 18.8% 3.8%

Four-Bedroom 1.5 21 1.4% 0 0.0% $969 $706 37.3% 7.5%

Four-Bedroom 2.0 2 0.1% 0 0.0% $578 $335 72.5% 14.5%

Total Tax Credit 1,503 100.0% 10 0.7% - - - 4.8%

N/A – Not Available

The overall vacancy rate among surveyed market-rate product is currently 6.0%,

which is notably higher than the 1.2% vacancy rate for this product type in 2014.

While the vacancy rate has increased over the past five years, the overall median

market-rate rent has increased at a relatively rapid rate of 5.4% annually.

Vacancies are much more limited among the Tax Credit supply, with just 10

vacant units identified in the county. The resulting Tax Credit vacancy rate of

0.7% is higher than but comparable to the 0.0% vacancy rate for this same product

type in 2014. The limited availability and introduction of newer Tax Credit units

are likely contributing factors to the rapidly increasing Tax Credit rents, which

experienced a 4.8% annual rent increase over the past five years.

14

The following graphs illustrate the overall vacancy rates (2014 vs. 2019) and the

average annual rent growth that occurred between 2014 and 2019:

15

A total of 20 multifamily properties were surveyed in the county that operate with

a government subsidy. The table below summarizes the distribution of subsidized

projects (both with and without Tax Credits) in Buncombe County.

Subsidized Tax Credit

Bedroom Baths Units Distribution Vacancy % Vacant

One-Bedroom 1.0 165 51.4% 0 0.0%

Two-Bedroom 1.0 118 36.8% 0 0.0%

Two-Bedroom 1.5 11 3.4% 0 0.0%

Three-Bedroom 1.0 16 5.0% 0 0.0%

Four-Bedroom 1.5 11 3.4% 0 0.0%

Total Subsidized Tax Credit 321 100.0% 0 0.0%

Government-Subsidized

Bedroom Baths Units Distribution Vacancy % Vacant

Studio 1.0 90 6.0% 0 0.0%

One-Bedroom 1.0 579 38.3% 0 0.0%

Two-Bedroom 1.0 464 30.7% 2 0.4%

Two-Bedroom 1.5 49 3.2% 0 0.0%

Three-Bedroom 1.0 238 15.8% 0 0.0%

Three-Bedroom 1.5 24 1.6% 0 0.0%

Four-Bedroom 1.0 20 1.3% 0 0.0%

Four-Bedroom 1.5 36 2.4% 0 0.0%

Five-Bedroom 1.5 10 0.7% 0 0.0%

Total Subsidized 1,510 100.0% 2 0.1%

The subsidized Tax Credit units are 100.0% occupied and the government-

subsidized units are 99.9% occupied, with a total of only two vacant units among

the overall total of 1,831. According to management at the surveyed subsidized

projects, most of these properties have long wait lists. As such, there continues to

be clear pent-up demand for multifamily rental housing product for very low-

income households.

Another resource residents can use that enables them to reasonably afford rental

housing is through Housing Choice Vouchers, which allows residents to pay 30%

of their income towards housing. These vouchers are issued by the local housing

authority. According to a representative with the Housing Authority of the City of

Asheville, there are approximately 2,781 Housing Choice Voucher holders within

the housing authority’s jurisdiction and 1,442 people currently on the waiting list

for additional vouchers. The waiting list is open. Annual turnover is estimated at

41 households, indicating minimal turnover and long waits for households seeking

vouchers. This reflects the continuing need for Housing Choice Voucher

assistance.

16

The following is a distribution of multifamily rental projects (market-rate, Tax

Credit and government-subsidized) and units surveyed by year built for Buncombe

County:

Year Built Projects Units Vacancy Rate

Before 1970 21 1,565 0.9%

1970 to 1979 14 2,241 0.8%

1980 to 1989 16 1,706 0.7%

1990 to 1999 10 1,067 4.6%

2000 to 2009 24 2,511 3.1%

2010 to 2014 9 1,272 2.2%

2015 9 1,543 4.3%

2016 2 288 5.2%

2017 9 1,633 7.8%

2018 7 1,282 24.3%

2019* 1 40 0.0%

*As of July

A substantial amount of new rental product has been added to the county over the

past several years. Since 2015, a total of at least 28 projects with 4,786 units have

been introduced into the Buncombe County market. As the preceding table

illustrates, most development periods or years have relatively low vacancy rates.

However, among the seven properties opening in 2018, the overall occupancy rate

is 24.3%, reflective of several projects still in their initial lease-up phase. Based

on information from management at some of the area’s newest properties, typical

absorption rates are around 14 (affordable/income restricted) to 18 (market-rate)

units per month. These are relatively fast monthly absorption rates and good

indications of a strong rental housing market.

17

The local government has made efforts to encourage the development of affordable

housing in the market. As a result of such efforts, there have been several mixed-

income projects developed in recent years that include a combination of both

market-rate and Tax Credit apartments, serving both market-rate renters and low-

income renters (generally earning up to 80% of Area Median Household Income).

Additionally, several projects are in the development pipeline (either under

construction or planned for development) that will include mixed-income units.

The table below summarizes the number of market-rate and affordable (income-

restricted) units within mixed-income properties in the market.

Mixed-Income Apartments

Type

Market-Rate

Units

Income-Restricted

Units Total Units

Established 1,461 226 1,687

Planned/Under Construction 612 142 754

Total 2,073 368 2,441

Of the 2,441 units either existing or in the development pipeline that are within

mixed-income projects, 368 are income restricted. These 368 units represent

15.1% of the overall units offered at these projects. The income restrictions

preserve these particular units for low-income households earning up to 80% of

AMHI and are developed through such things as the Low-Income Housing Tax

Credit (LIHTC) program, the Housing Trust Fund, or the Asheville Affordable

Housing Program. It is worth pointing out that over two-thirds of the affordable

housing units at these projects were developed after 2014, illustrating the

improved efforts to address rental affordability issues in the market.

In addition to the mixed-income projects offering units affordable to lower income

households, several projects have been built or are planned for development that

operate exclusively with income and rent restrictions (they include no market-rate

units). We identified and surveyed 24 apartment properties operating under the

programmatic requirements of the LIHTC program. These projects generally

serve up to 60% or 80% of AMHI. There are only two vacant units among these

properties, resulting in a very high overall occupancy rate of 99.8%. According to

property managers at these properties, most LIHTC projects operate with wait

lists. As such, there is pent-up demand for affordable rental housing in the market.

Since 2014, four properties operating exclusively under the LIHTC program have

been built in the market. These projects include a total of 315 units, of which 210

(66.7%) are general occupancy and 105 (33.3%) are senior restricted. These 315

newer LIHTC units represent 29.0% of the units operating exclusively under the

LIHTC program. This is a notable increase in the affordable rental housing stock.

Despite these recent additions in the affordable rental housing supply, limited

availability among such rentals still exists.

18

Non-Conventional Rental Housing

Buncombe County has a large number of non-conventional rentals which can come

in the form of detached single-family homes, duplexes, units over storefronts,

mobile homes, etc. As a result, we have conducted a sample survey of non-

conventional rentals within the county. Overall, a total of 118 individual units

were identified and inventoried. While this does not include all non-conventional

rentals in the market, we believe these properties are representative of the typical

non-conventional rental housing alternatives in the market.

The following table aggregates the 118 vacant non-conventional rental units

surveyed in Buncombe County by bedroom type.

Surveyed Non-Conventional Rental Supply

August 2019

November 2014

Bedroom

Vacant

Units

Rent

Range

Median

Rent

Median Rent

Per-Square-Foot

Median

Rent

Median Rent

Per-Square-Foot

Studio

4 $1,306 - $1,441 $1,361 $2.58

- -

One-Bedroom

17 $895 - $1,975 $1,200 $1.82

$575 $0.89

Two-Bedroom

35 $895 - $3,000 $1,575 $1.57

$950 $1.01

Three-Bedroom

44 $1,290 - $3,500 $1,700 $1.16

$1,225 $0.87

Four-Bedroom+

18 $475 - $5,000 $2,248 $1.16

$1,750 $0.85

Total

118

As the preceding table illustrates, the rents for non-conventional rentals identified

range from $475 to $5,000. The median rent per-square-foot by bedroom type

ranges from $1.16 to $2.58, up from the rents of $0.85 to $1.01 per-square-foot

from 2014. It needs to be acknowledged that the non-conventional rentals

included in the current inventory are different than those of 2014. Regardless, this

inventory of available non-conventional rentals illustrates that most such rentals

have rents of $1,200 or more per month and may be difficult for many of the area

households to afford.

The rental rates of non-conventional rentals are generally comparable to most

market-rate multifamily apartments surveyed in the county. However, when

utilities are considered, as most non-conventional rentals require tenants to pay all

utilities, the rental housing costs of non-conventional rentals are generally higher

than multifamily apartments. When also considering that a much larger share of

the non-conventional product was built prior to 1980 and their amenity packages

are relatively limited, it would appear the non-conventional rentals represent less

of a value than most multifamily apartments in the market. However, given the

relatively limited number of vacant units among the more affordable multifamily

apartments, many low-income households are likely forced to choose from the

non-conventional housing alternatives.

The map on the following page illustrates the location of non-conventional rentals

identified as available in the market.

19

20

Vacation Rental Housing

Buncombe County has a large number of vacation rentals which are typically in

the form of cabins, detached single-family homes, condominiums, etc. As a result,

we have conducted a sample survey of vacation rentals within the county.

Overall, a total of 56 individual units were identified and surveyed. While this

does not include all vacation rentals in the market, we believe these properties are

representative of the typical vacation rental housing alternatives in the market.

The following table aggregates the 56 vacant/available vacation rental units

surveyed in the county by bedroom type. The current (August 2019) data is

compared with data collected during the original (November 2014) study of the

county. It should be noted that while most rents are charged on a daily or weekly

basis, rents are shown and analyzed on a monthly basis.

Surveyed Vacation Rental Supply

August 2019

November 2014

Bedroom Vacant Units Rent Range Median Rent Rent Range Median Rent

One-Bedroom

3 $1,764 - $3,924 $1,825

$1,620 - $28,500 $4,575

Two-Bedroom

39 $1,734 - $7,422 $3,255

$2,400 - $12,720 $5,250

Three-Bedroom

13 $2,342 - $8,425 $3,954

$3,750 - $16,260 $6,300

Four-Bedroom+

1 $2,920 - $2,920 $2,920

$4,320 - $75,705 $10,965

Total

56

As the preceding table illustrates, the rents for inventoried vacation rentals range

from $1,825 to $3,954. These median rents are much lower than the median rents

from 2014. While the median rents have decreased, they still are well above most

of the multifamily rental alternatives surveyed in the market. As a result, vacation

rentals are generally not affordable to most households seeking rental housing on a

long-term basis. However, due to this rent differential, such housing may appeal

to owners of traditional, long-term rentals who may want to convert their housing

to vacation rentals and thereby reduce the inventory of rental stock available to

people seeking long-term rentals in the area. This posses a risk to have some long-

term rentals removed from the market.

Note: we were unable to map any of the vacation rentals as their addresses were

not available.

21

b. Owner For-Sale Housing

Bowen National Research, through a review of the Multiple Listing Service

information for Buncombe County, identified both historical (sold since 2010) for-

sale residential data and currently available for-sale housing stock.

The following table summarizes the available and recently sold (since January

2010) housing stock for Buncombe County.

Sold/Currently Available For-Sale Housing Supply – Buncombe County

Status Homes Median Price

Sold* 29,970 $245,000

Available 1,300 $438,471

Source: Multiple Listing Service/Keller Williams Realty

*Sales from Jan. 1, 2010 to Jul. 31, 2019

There were 29,970 homes sold since 2010 and 1,300 homes currently available in

Buncombe County.

Historical Sales

The following table includes a summary of annual for-sale residential transactions

that occurred within Buncombe County since 2010. It should be noted that the

2019 sales cover only the first seven months of the year.

Owner For-Sale Housing by Year Sold

Year

Units Sold Median Price Sold

Number Change Price Change

2010 2,174 - $199,900 -

2011 2,262 4.0% $188,000 -6.0%

2012 2,716 20.1% $196,000 4.3%

2013 3,365 23.9% $206,608 5.4%

2014 3,573 6.2% $215,000 4.1%

2015 3,354 -6.1% $240,000 11.6%

2016 3,563 6.2% $265,000 10.4%

2017 3,561 -0.1% $285,000 7.5%

2018 3,365 -5.5% $303,000 6.3%

2019* 2,037 - $315,000 4.0%

Source: Multiple Listing Service/Keller Williams Realty

*Sales as of July 31, 2019

Home sales activity within the county has remained relatively steady since 2013,

experiencing an average sales pace around 3,300 to 3,600 homes annually over the

past six years. Sales activity for 2019 is on pace for nearly 3,500 home sales,

continuing the trend of stable sales activity recently experienced in the market.

The county has experienced rising median sales prices over the past eight years.

The current median home sales price of $315,000 represents a 10-year high. The

positive trends among sales volume and sales prices are good indications of a

healthy and stable for-sale housing market in Buncombe County.

22

The following graphs illustrate the overall annual number of homes sold and

median sales prices for Buncombe County since 2010 (2019 was excluded because

only partial year data is available).

23

The distribution of homes recently sold by price for the county is summarized in

the table below.

Buncombe County

Sales History by Price

(Jan. 1, 2010 to Jul. 31, 2019)

Sale Price

Number

Sold

Percent of

Supply

Average Days

on Market

Up to $99,999 2,182 7.3% 130

$100,000 to $199,999 8,355 27.9% 113

$200,000 to $299,999 8,825 29.4% 94

$300,000 to $399,999 4,776 15.9% 100

$400,000 to $499,999 2,484 8.3% 107

$500,000+ 3,348 11.2% 159

Total 29,970 100.0% 111

Source: Multiple Listing Service/Keller Williams Realty

As the preceding table illustrates, home sales by price point within the county

since 2010 were primarily concentrated among product priced between $200,000

and $299,999 (29.4%). Product priced between $100,000 and $199,999 has also

been very active, with 27.9% of the product sold within this price range. The

product within these two price ranges have been selling quickly, as evidenced by

the fact that the average days on market (number of days a home is listed before it

is sold) are 113 days or fewer. Interestingly, homes priced at $300,000 to

$499,999 have also had a large volume of product sold at relatively rapid rates

(generally around 100 days on market).

In an effort to understand the changing home buying trends, we have compared

historical sales of 2010 to 2014 with sales from 2015 to 2019 (through July) in the

following table.

Buncombe County

Sales History by Price

Sale Price

(Jan. 1, 2010 to Dec. 31, 2014) (Jan. 1, 2015 to Jul. 31, 2019)

Number

Sold

Percent of

Supply

Average

Days on

Market

Number

Sold

Percent of

Supply

Average

Days on

Market

Up to $99,999 1,623 11.5% 143 559 3.5% 89

$100,000 to $199,999 5,286 37.5% 141 3,069 19.3% 64

$200,000 to $299,999 3,550 25.2% 150 5,275 33.2% 56

$300,000 to $399,999 1,699 12.1% 162 3,077 19.4% 65

$400,000 to $499,999 832 5.9% 166 1,652 10.4% 77

$500,000+ 1,100 7.8% 258 2,248 14.2% 110

Total 14,090 100.0% 157 15,880 100.0% 70

Source: Multiple Listing Service/Keller Williams Realty

Home sales activity since 2015 has changed significantly from the preceding five-

year period (2010 to 2014) in Buncombe County. Specifically, home sales of

product priced $300,000 and higher have increased from 25.8% of all sales

between 2010 and 2014 to 44.0% since 2015.

24

The graphs below illustrate the share of homes sold by price point for 2014 and

2019 and the average number of days on market by price for 2014 and 2019.

As these graphs illustrate, the for-sale housing market has experienced a shift

towards higher priced homes, yet the average number of days on market has

decreased significantly over the past five years.

25

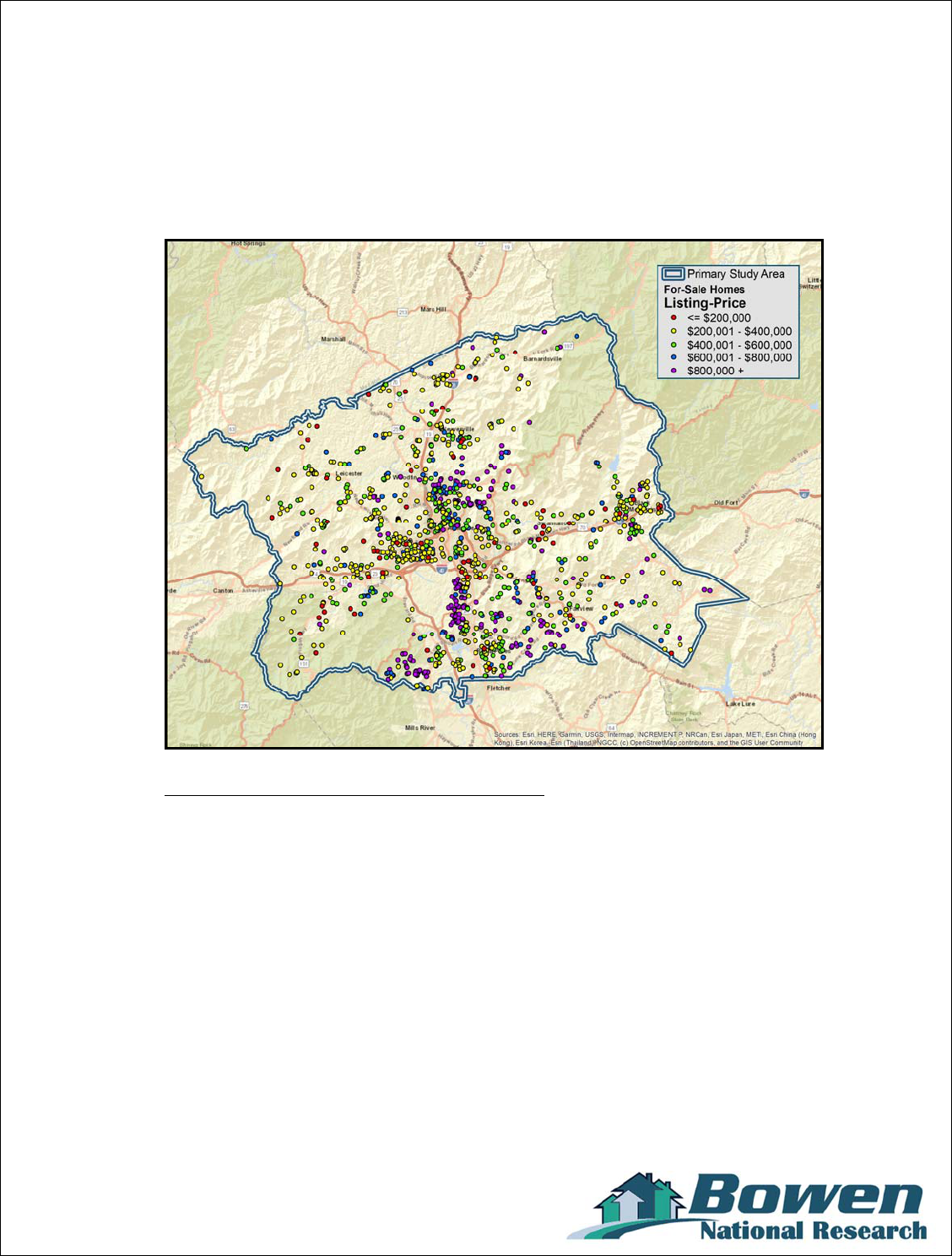

A map of the historical (2010 to 2019) home sales identified in the county is

shown below:

Available Supply

The table below summarizes the distribution of available for-sale residential units

by price point for Buncombe County.

Buncombe County

Available For-Sale Housing by Price

List Price

November 21, 2014 As of July 31, 2019

Number

Available

Percent

of

Supply

Average

Days on

Market

Number

Available

Percent

of

Supply

Average

Days on

Market

Up to $99,999 76 4.4% N/A 6 0.5% 176

$100,000 to $199,999 384 22.2% N/A 57 4.4% 78

$200,000 to $299,999 403 23.2% N/A 214 16.5% 88

$300,000 to $399,999 254 14.6% N/A 286 22.0% 95

$400,000 to $499,999 166 9.6% N/A 206 15.8% 124

$500,000+ 451 26.0% N/A 531 40.8% 169

Total 1,734 100.0% N/A 1,300 100.0% 128

Source: Multiple Listing Service/Keller Williams Realty

N/A – Not Available

26

The 1,300 housing units currently available for purchase in the county is 434 fewer

than there were in late 2014, representing a decrease of 25.0%. The available

inventory of product priced under $200,000 has diminished to just 63 units, down

from 460 homes at these price points in 2014. Demand for product priced between

$100,000 and $199,999 remains rather strong, as evidenced by the average days on

market of just 78 for such product. Meanwhile, higher priced product, generally at

$400,000 or higher, has increased dramatically. This price point now represents

56.6% of the available inventory (up from 35.6% in 2014). With a significantly

diminishing overall supply of available product, the housing market’s limited

supply has likely contributed to the continued increases in home prices. Moreover,

with the lower priced (under $200,000) product virtually non-existent, lower

income households generally earning below $60,000 have very limited choices.

The distribution of available homes by year built for the county is summarized in

the table below.

Buncombe County

Available For-Sale Housing by Year Built (As of July 31, 2019)

Year Built

Number

Available

Average

Beds/Baths

Average

Square

Feet

Price

Range

Median

List Price

Median

Price per

Sq. Ft.

Average

Days on

Market

Before 1950 160 3/2.5 2,129 $89,900 - $3,995,000 $377,000 $247.42 111

1950 to 1959 88 2/2.0 1,805 $33,000 - $1,490,000 $354,000 $226.14 105

1960 to 1969 88 3/2.5 1,991 $110,000 - $1,395,000 $327,450 $193.19 95

1970 to 1979 80 3/2.75 2,361 $138,500 - $2,750,000 $384,000 $193.33 95

1980 to 1989 101 3/3.0 2,559 $79,500 - $1,990,000 $420,000 $187.97 106

1990 to 1999 157 3/3.5 3,126 $82,000 - $3,350,000 $469,900 $172.86 112

2000 to 2009 277 4/3.75 3,631 $110,000 - $10,750,000 $575,000 $191.03 144

2010 to present 349 3/3.0 2,362 $158,000 - $4,250,000 $439,900 $226.62 159

Total 1,300 3/3.0 2,648 $33,000 - $10,750,000 $438,471 $211.14 128

Source: Multiple Listing Service/Keller Williams Realty

27

As shown in the preceding table, nearly one-half of the available for-sale housing

product in the county was built in 2000 or later. These newer homes are generally

priced well over $400,000, though even older product built prior to 1980 has a

median asking price of more than $300,000.

A map of the identified available for-sale housing stock is illustrated below:

c. Planned & Proposed Residential Development

In order to assess housing development potential, we evaluated recent residential

building permit activity and identified residential projects in the development

pipeline for Buncombe County. Understanding the number of residential units and

the type of housing being considered for development in the county can assist in

determining how these projects are expected to meet the housing needs of the area.

28

Multifamily Apartments

Based on our interviews with local building and planning representatives, it was

determined that there are multiple housing projects planned within Buncombe

County. These planned developments, by location, are summarized as follows.

Multifamily – Asheville City Limits

Project Name & Address Type Units Developer Status/Details

Hawthorne at Mills Gap

60 Mills Gap Road

Asheville

Market-rate

& 10%

Affordable 256

Hawthorne Residential

Partners

Under Construction: High-end, luxury

development; One- thru three-bedrooms; Luxury

finishes in units and “class A” property amenities;

10% of units will set aside as affordable; ECD

spring 2020

Five Points Mixed Building

257 Broadway Street

Asheville

Market-rate 46 White Point Partners

Under Construction: Site work is underway;

Five-story building; Some affordable units are

planned; Estimated rents $1,750 to $3,300; 4,700

sq. ft. commercial space; ECD fall 2019

Swannanoa Bend

(FKA Beaucatcher

Commons)

43 Simpson Street

Asheville

Affordable 30 Kirk Booth Real Estate

Under Construction: All one-bedrooms for

those earning below 60% AMHI; Funded by

Housing Trust Funds; 40 units opened in Feb.

2019 and leased by April 2019; Rent is $ 619; No

onsite amenities; Remaining 30 units ECD

September 2019

River Mill Lofts

100 River Mill Drive

Asheville

Market-rate 134 Southeast Management

Under Construction: 130 units opened in 2017,

134 units under construction; 40 one-bedrooms,

80 two-bedrooms, and 14 three-bedrooms;

Current units renting from $1,150 to $1,875; ECD

early 2020

ABCCM Transformation

Village

53 Rocky Ridge Road

Asheville

Subsidized

Transitional

&

Permanent

Supportive

Housing 152

Asheville Buncombe

Community Christian

Ministry (ABCCM)

Under construction: For homeless women and

children; Emergency shelter for short-term stay

(33 short-term apartments with a total of 90 beds)

and transitional housing units for women with

recovery from abuse issues, job skills will be

provided, and permanent supportive housing

units; Community and health center

White Oak Grove

275 and 281 Hazel Mill

Road

Asheville

Market-rate

& 10%

Affordable 113

Berltex Real Estate

Holdings, LLC

Planned: Approved February 2019; 10% of the

units (12) will meet the city’s standards for

affordability at 80% AMHI for 10 years;

Developer must provide bus passes for two years

for residents who request one; Construction is to

begin September 2019

Former Sears Site

3 S. Tunnel Road

Asheville

Mixed-Use

Market-rate

& 40%

Affordable 204

Seritage Growth

Properties

Proposed: In council review; $45 million

redevelopment project; Ten-story building;

Studios, one-, two- and three-bedroom units;

If

built will have up to 10% of units affordable

below 80% AMHI; 114,000 sq. ft. retail space

with a ten screen, upscale theater, restaurants and

a plaza.

TBD – To be determined

N/A – Not Available

ECD – Estimated completion date

TRC – Technical Review Committee

BOA – Board of Adjustment

29

(Continued)

Multifamily – Asheville City Limits

Project Name & Address Type Units Developer Status/Details

Hillard Apartments

338-360 Hilliard Avenue

Asheville

Market-rate

&

Affordable 86

Kassinger Development

Group

Planned: Approved; 31 market-rate units and 16

units for those earning below 80% AMHI, 18

units at 60% AMHI; Hope to begin construction

in 2019 and complete by fall 2020

TBD

123 Haywood Street

Asheville

Market-rate 18 N/A

Planned: Four-story building (3 residential

stories) over one-story parking garage

Lee Walker Heights

17 Wilbar Avenue

Asheville

Mixed-Use

Tax Credit

&

Subsidized 212

Asheville Housing

Authority & Mountain

Housing Opportunities

Planned: Demolition of public housing complex

to be replaced by new construction; 116 for those

at 60% AMHI, 96 units will be at 30% AMHI and

have Project Based Rental Assistance through

RAD Program; 11,000 square feet of commercial

space to be constructed at 50 Wilbar Ave.; Hope

to break ground in 2019 and ECD 2021

Lee Walker Heights Phase II

319 Biltmore Ave.

Asheville

Mixed-use

Tax Credit

&

Subsidized 310

Asheville Housing

Authority and Mountain

Housing Opportunities

Proposed: Phase II of Lee Walker Heights

replacement housing project; Also, to include

retail and commercial space. City owned property.

Tribute Project-Scattered

Sites

FKA Ledford Site

72 Asheland Avenue, 185

Coxe Avenue, 5 Federal

Alley

Asheville

Mixed-use

Market-rate

&

Affordable 541 Tribute Companies

Planned: Commercial space, office space and a

1,000-space parking deck; 541 units planned;

Possibly 20% of units to be affordable at 80%

AMHI; 973 parking spaces; Plan to begin

construction early 2020; Initial TRC meeting date

6/1/2019

Collier Avenue Apartment

11 Collier Avenue

Asheville

Affordable 54

Colliers Avenue

Properties

Planned: A request for the review of a Level II

site plan to develop 54 residential units in 53,680

square feet, five-story building:

54 live-work lofts

and studio units. Plans not submitted.

Beacham’s Curve

Neighborhood

315 Haywood Road

Asheville

Market-rate 24 Big Jake Enterprises

Planned: Three-phased project; Apartments will

be part of Phase III of this mixed-use development

and will consist of 24 units; Phases I and II

consist of two mixed-use condo buildings with ten

live/work units for sale; Construction of 18 one-

bedrooms and six two-bedrooms to begin spring

2019

TBD

45 South French Broad

Asheville

Mixed-use

Market-rate 22 Ball Family

Planned: In TRC; 43,582 square foot, three-story

commercial and residential expansion to an

existing one-story commercial building

Verde Vista Phase II

99999 Verde Vista Circle

Asheville

Market-rate

& 10%

Affordable 56

Pike Real Estate

Development

Planned: Six units affordable at 80% AMHI;

Addition to an existing development with 257

units that opened in 2012

Create 72 Broadway

99999 Broadway Street, 67

Market Street, and 61

Market Street

Asheville

Mixed-use

Affordable 6

BPR Properties and S&R

Investment LTD

Planned: In TRC: Nine-story, 184,000 square

foot mixed-use building with 24 condos, 150 hotel

rooms, retail and office space include six

workforce apartments for artists earning 30%

AMHI, renting for $500 monthly

Roberson-Smokey Park

Development

877 & 885 Smokey Park

Highway

Asheville

Mixed-use

Market-rate 20

Roberson Land

Development Co, LLC

Planned: In TRC Development Review for 20

residential units, 20,839 square feet of retail space

and 4,145 square feet of medical facility in seven

buildings

TBD – To be determined

N/A – Not Available

ECD – Estimated completion date

TRC – Technical Review Committee

BOA – Board of Adjustment

30

(Continued)

Multifamily – Asheville City Limits

Project Name & Address Type Units Developer Status/Details

Amaranth Apartments

1 Brookside Circle

Asheville

Tax Credit 70 Workforce Homestead

Planned: In TRC Development review for a 70-

unit affordable housing multifamily apartment

complex; 52 units for families with incomes under

60% AMHI; 18 apartments set aside for

households at or below 30% AMHI. This project

will receive a $1.2 million Housing Trust Fund

TBD

296 Short Michigan Avenue

Asheville

Permanent

Supportive

Housing 11 Homewood Bound

Planned: Will rehabilitate five buildings with

eight, one-bedroom and three, two-bedroom units;

They will provide permanent supportive housing

for people experiencing homelessness

Sweet Grass Apartments

39 Bradley Branch Road

Asheville

Market-rate

& 10%

Affordable 255 Mtn-Comm, LLC

Under Construction: Preliminary grading

began May 2019; 26 units will be affordable for

15 years for earners below 80% AMHI

TBD – To be determined

N/A – Not Available

ECD – Estimated completion date

TRC – Technical Review Committee

BOA – Board of Adjustment

Multifamily – Buncombe County (Outside Asheville City Limits)

Project Name & Address Type Units Developer Status/Details

Enclave-Piney Mountain

Apartments

85 Piney Mountain Drive

Asheville (Buncombe

County)

Market-rate 200 McCall Capital

Planned: Conditional use permit applied for

March 2019

Reflection Pointe

812 New Leicester Highway

Asheville (Buncombe

County)

Market-rate

&

Affordable 270 Southwood Realty

Planned: BOA approved May 2019 for 10 three-

story buildings and 30 detached garages, 473

parking spaces; Clubhouse and pool; 81 units will

be affordable workforce housing for those earning

below 80% AMHI

Hawthorne at Haywood

1951 Old Haywood

Asheville (Buncombe

County)

Market-rate 240

Foggin-Powel Properties/

Hawthorne Residential

Partners

Planned: BOA approved 2018

Asheville Heights

251 Charlotte Highway

Asheville (Buncombe

County)

Market-rate 192 NTPP Investments, LLC

Planned: BOA approved 2018; One- and two-

bedroom apartments with 405 parking spaces

Retreat at Arden Farms

539 Long Shoals Road

Arden

Market-rate 318 Tynes Development

Planned: BOA approved; Rents proposed from

$1,000-$1,600; Hope to break ground by fall 2019

Riverstone at Long Shoals

556 Long Shoals Road

Arden

Market-rate 96 Long Shoals Holdings

Planned: Existing property of 256 one- thru

three-bedrooms renting from $995 to $1,660;

Have plans for a Phase II

Villas at Avery Creek

260 Amethyst Circle

Arden

Market-rate 255 Universal Development

Under Construction: One-bedroom garden units

and two- and three-bedroom townhomes renting

from $799 to $1,499; 109 units to be complete

August 2019 and are all preleased, remaining

units complete by June 2020

TBD – To be determined

N/A – Not Available

ECD – Estimated completion date

TRC – Technical Review Committee

BOA – Board of Adjustment

31

(Continued)

Multifamily – Buncombe County (Outside Asheville City Limits)

Project Name & Address Type Units Developer Status/Details

East Haven

2244 U.S. 70

Swannanoa

Tax Credit 95

Mountain Housing

Opportunities

Under Construction: Ground broken spring

2019; One- thru three-bedrooms; Targeting those

earning below 30%, 50%, and 60% AMHI; 16

Home fund units, 19 units for the Integrated

Supportive Housing Program; Proposed rents

range from $257 to $697; Interior courtyard with

playground, picnic area, garden space, elevators,

community room, computer center, laundry

facilities, fitness room; ECD summer 2020

Jasper Apartments

1944 U.S. Highway 70

Swannanoa

Tax Credit 100 Workforce Homestead

Planned: Applied for conditional use permit in

April 2019; Targeting those earning below 60%

AMHI; 22 one-bedrooms, 60 two-bedrooms, and

18 three-bedrooms in three-story buildings;

Clubhouse, playground, and picnic pavilion

Blue Ridge Crossing

Garrison Branch Road

adjacent to Monticello Road

and U.S. 25/70

Weaverville

Market-rate 176 828 North, LLC

Under Construction: Preliminary plat approved;

Infrastructure installation currently ongoing

TBD

40 Doan Road

Weaverville

Market-rate 16

MS Properties of

Weaverville LLC

Planned: BOA approved 2018 with five years

vested rights

Riverside Stump Dump

135 Monticello Road

Weaverville

N/A 238 Crest Residential

Planned: Had recent voluntary annexation and

initial zoning for multifamily residential; Zoning

density and acreage present will support

approximately 238 units; In Plan Review

10 Newbridge Apartments

10 Newbridge Parkway

Woodfin

Market-rate 40 Hawthorne Management

Under Construction: First 262 units completed

and rented; One-, two-, and three-bedrooms

renting from $950 to $1,935; Final 40 units ECD

summer 2019

TBD – To be determined

N/A – Not Available

ECD – Estimated completion date

TRC – Technical Review Committee

BOA – Board of Adjustment

Senior Facilities

According to planning and building representatives, there is currently one senior

living project planned and/or under construction within Buncombe County. This

property is summarized in the table that follows.

Project Name & Address Units Developer Status/Details

Julian Woods Retirement Community

213 Long Shoals Road and

433 Overlook Road Ext.

Asheville

130

Asheville Pentecostal

Holiness Church, C&B

Toothland of Overlook

Ext LLC

Planned: A request for the conditional zoning review of 130

dwelling units located in a three-story building located on 7.23

acres; Amenities will include a fitness center, theater, salon,

chapel; First TRC meeting June 2019

TRC – Technical Review Committee

32

For-Sale Housing

According to planning and building representatives, there are multiple for-sale

projects planned within the Buncombe County. These projects are summarized in