ANNUAL REPORT 2018

ANNUAL REPORT

II

–— VIVENDI –— ANNUAL REPORT 2018 –—

–— VIVENDI –— ANNUAL REPORT 2018 –—

01

The Annual Report in English is a translation of the French Document de référence

provided for information purposes.

This translation is qualified in its entirety by reference to the Document de référence.

The Annual Report is available on the Company’s website www.vivendi.com

II

–— VIVENDI –— ANNUAL REPORT 2018 –—

–— VIVENDI –— ANNUAL REPORT 2018 –—

01

QUESTIONS FOR YANNICK BOLLORÉ AND ARNAUD DE PUYFONTAINE 02

PROFILE OF THE GROUP — STRATEGY AND VALUE CREATION — BUSINESSES,

FINANCIAL COMMUNICATION, TAX POLICY AND REGULATORY

ENVIRONMENT — NON-FINANCIAL PERFORMANCE 04

1. Profile of the Group 06

2. Strategy and Value Creation 12

3. Businesses – Financial Communication – Tax Policy and Regulatory Environment 24

4. Non-financial Performance 48

RISK FACTORS — INTERNAL CONTROL AND RISK MANAGEMENT —

COMPLIANCE POLICY 96

1. Risk Factors 98

2. Internal Control and Risk Management 102

3. Compliance Policy 108

CORPORATE GOVERNANCE OF VIVENDI — COMPENSATION

OF CORPORATE OFFICERS OF VIVENDI — GENERAL INFORMATION

ABOUT THE COMPANY 112

1. Corporate Governance of Vivendi 114

2. Compensation of Corporate Officers of Vivendi 150

3. General Information about the Company 184

FINANCIAL REPORT — STATUTORY AUDITORS’ REPORT

ON THE CONSOLIDATED FINANCIAL STATEMENTS — CONSOLIDATED

FINANCIAL STATEMENTS — STATUTORY AUDITORS’ REPORT

ON THE FINANCIAL STATEMENTS — STATUTORY FINANCIAL STATEMENTS 196

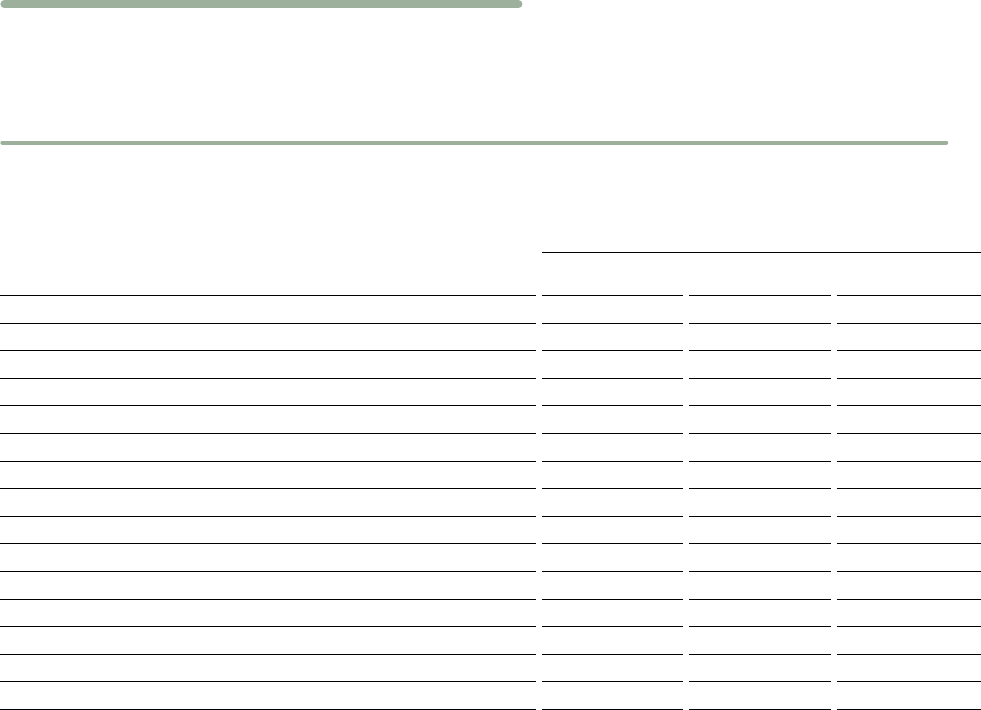

Key Consolidated Financial Data for the last five years 198

I – 2018 Financial Report 199

II – Appendix to the Financial Report 222

III – Audited Consolidated Financial Statements for the year ended December 31, 2018 223

IV – 2018 Statutory Financial Statements 319

RECENT EVENTS — OUTLOOK 358

1. Recent Events 360

2. Outlook 361

RESPONSIBILITY FOR AUDITING THE FINANCIAL STATEMENTS 362

1. Responsibility for Auditing

the Financial Statements 364

Content

2

3

4

5

6

1

02

–— VIVENDI –— ANNUAL REPORT 2018 –—

–— VIVENDI –— ANNUAL REPORT 2018 –—

03

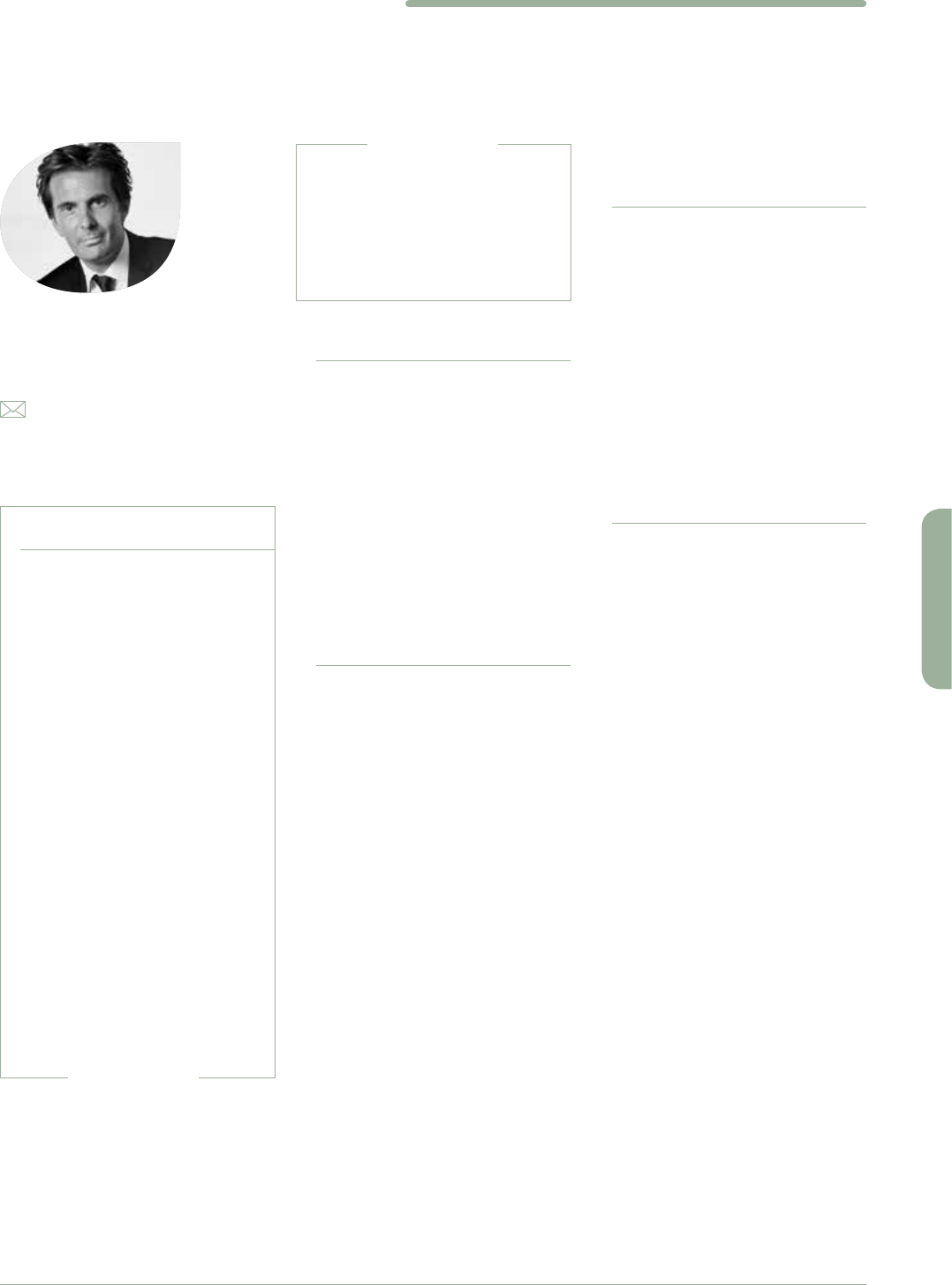

Questions for Yannick Bolloré

and Arnaud de Puyfontaine

How did Vivendi perform in 2018?

Yannick Bolloré: Vivendi posted strong results in 2018. Universal Music

Group (UMG), the world’s leading recorded music company, had an

excellent year, led by the quality of its management teams and artists

and the rise of streaming services. Income from recorded music

through subscriptions and streaming rose by 36% in 2018 to represent

54% of total sales. UMG’s roster of talent features some of the most

popular and award-winning artists in the world.

As well as improving its performance in France,

Canal+ Group gained nearly 0.9million subscribers

in other countries. In addition to Africa, it made

inroads in the Asian market, with the launch of a

pay-TV offer in Myanmar. In France, the group

renewed its agreement with the French film indus-

try (Canal+ is the industry’s partner of choice) and

signed new regulations reducing the window

between the time when a movie is released in

theaters and when it can be aired on its channels.

It also secured the broadcasting rights to numerous

sports events, including the next three seasons of

the English Premier League.

Havas enjoyed stronger profitability in 2018, particu-

larly in the second half, due to account wins in crea-

tive advertising and media. The Palau Pledge campaign

is a shining example of Havas’s creativity and commit-

ment. As well as winning a whole host of festival awards,

the company also received the “Champion for Humanity”

award from the United Nations.

Our other businesses –Gameloft, Vivendi Village and

Dailymotion– also delivered solid performances, each contributing to

the value chain of the integrated group that Vivendi is today. The group

pressed ahead with new joint initiatives between its subsidiaries in

2018, with Havas and Capitol Music Group founding Annex Tower

Creative, an agency whose aim is to foster greater collaboration

between artists and brands, and Canal+ and Universal Music France

joining forces to give television viewers the chance to tune in to one of

the most exciting Top14 finals. Olympia Production was able to capitalize

on Canal+ and L’Olympia’s expertise and assets, while the CanalOlympia

venues in Africa benefited from the establishment of Canal+ Group on

the continent and from Studiocanal films. And these are just a few

examples of the successful strategy that drives our integrated group.

Why did Vivendi acquire Editis?

Arnaud de Puyfontaine: The acquisition of Editis marked an important

milestone in the implementation of Vivendi’s business plan. It adds

another brick to our development of a world-class content, media and

communications group based in Europe. Editis has a large portfolio of

internationally acclaimed authors, including Marc Lévy, Michel Bussi,

“Our strategy is aimed at

launching joint initiatives

between our different

businesses. These synergies

developed by our subsidiaries

will help promote growth

for Vivendi.”

YANNICK BOLLORÉ

Chairman of the Supervisory Board

02

–— VIVENDI –— ANNUAL REPORT 2018 –—

–— VIVENDI –— ANNUAL REPORT 2018 –—

03

Raphaëlle Giordano, Haruki Murakami and Ken Follett. The group

brings together close to 50prestigious houses (e.g., Nathan, Robert

Laffont, Julliard, Plon, LeRobert, Presses de la Cité, Pocket and Solar)

that publish general interest, children’s and young adult literature,

how-to books, illustrated titles, textbooks and reference works.

While Editis will allow Vivendi to expand its creative capacity, Vivendi will

enable Editis to broaden its appeal to authors, explore new markets and

experiment with innovative formats. The combination

of our two groups creates opportunities for developing

joint projects. We have already started working

together and we will strengthen our efforts in this

direction.

What future do you see

for Universal Music Group?

Arnaud de Puyfontaine: The music market is under-

going total transformation. Today, there are more

than 175million music streaming subscribers

worldwide. This dynamic, along with the talent and

expertise of UMG’s artists and teams, is driving the

expansion of the world’s top recorded music com-

pany. Sir Lucian Grainge called 2018 a “historic

year”. We have initiated a process to open up UMG’s

share capital to one or several partners to leverage the

value of this unique asset and support its development.

What are your ambitions for the group?

Yannick Bolloré: Vivendi’s ambitions, which were outlined five

years ago, are clear. They are focused on building a global content,

media and communications group with European roots. Demand for

entertainment content is strong on every continent in the world. Innovation

and digital technology are opening up new markets. Our strategy is aimed

at launching joint initiatives between our different businesses. These

synergies developed by our subsidiaries will help promote growth for

Vivendi, as I mentioned at the beginning of this interview.

In 2018, we said we were ready to enter a new phase of growth. This has

now been accomplished with the acquisition of Editis and our return to

publishing. A new era has begun for Vivendi.

Our goal is to provide overall support for the creation of new value in all

our businesses, wherever we are, and to offer quality content to as many

people as possible. Through the impact of its content, our group plays a

prominent role in society. Our influence bears a special responsibility.

In addition, Vivendi’s ambitions should also be viewed from a long-term

perspective. Our extremely sound balance sheet and having a core

shareholder –the Bolloré Group– leave us free from short-term pressure

and means that we can implement our strategy in calmness and

confidence. That is a real strength. •

“Editis adds another

brick to our development

of a world-class content,

media and communications

group based in Europe.”

ARNAUD DE PUYFONTAINE

Chief Executive Officer

–— VIVENDI –— ANNUAL REPORT 2018 –—

05

UNIVERSAL MUSIC GROUP

–— VIVENDI –— ANNUAL REPORT 2018 –—

05

Profile of the Group, Strategy and Value Creation,

Businesses – Financial Communication –

Tax Policy and Regulatory Environment,

Non-financial Performance

1

Bigflo & Oli

Gregory Porter

PROFILE OF THE GROUP 06

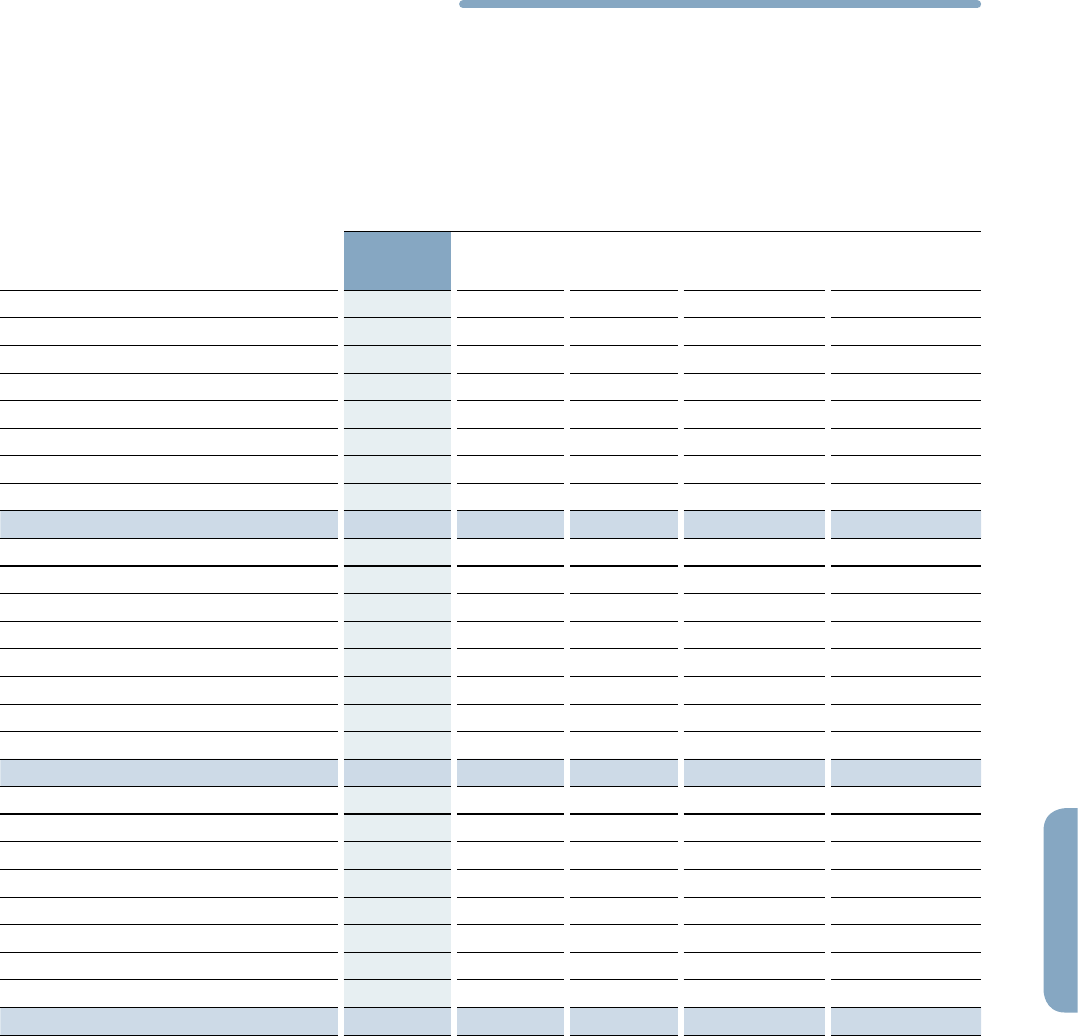

1.1. Simplified Organization Chart of the Group 06

1.2. Key Figures 08

1.3. 2018 Highlights 10

STRATEGY AND VALUE CREATION

12

2.1. Strategy 12

2.2. Business model 14

2.3. Value creation 16

BUSINESSES – FINANCIAL COMMUNICATION –

TAX POLICY AND REGULATORY ENVIRONMENT

24

3.1. Businesses 24

3.2. Holdings 43

3.3. Operations Sold 44

3.4. Financial communication, tax policy

and regulatory environment 44

3.5. Tax Policy 45

3.6. Insurance 46

3.7. Investments/Divestitures 46

3.8. Seasonality of Group Businesses 47

3.9. Raw Materials 47

NON-FINANCIAL PERFORMANCE

48

4.1. Vivendi’s Societal Project 48

4.2. Governance centered on non-financial performance 48

4.3. Main non-financial risks 52

4.4. Our key commitments 53

4.5. Indicator tables 82

4.6. Correspondance table 89

4.7. Verification of non-financial data 90

06

–— VIVENDI –— ANNUAL REPORT 2018 –—

–— VIVENDI –— ANNUAL REPORT 2018 –—

07

PROFILE OF THE GROUP

1

Recorded

Music

UMG

Music

Publishing

UMPG

Merchandising

Bravado

Canal+

(France)

Canal+

International

(International)

Studiocanal

(Motion Pictures)

Havas

Creative Group

Havas

Media Group

Havas

Health & You

SECTION 1. PROFILE OF THE GROUP

1.1. Simplified Organization Chart of the Group

UNIVERSAL

MUSIC GROUP

CANAL+

GROUP

HAVAS

100% 100% 100%

1.1. Simplified Organization Chart of the Group

(1) Since January 31, 2019.

(2) Percentage of controlling interest as of December 31, 2018.

(3) Listed Company.

(4) Based on the aggregate number of ordinary shares with voting rights.

(5) On April 9, 2018, in compliance with the undertakings given to

the AGCOM, Vivendi transferred the portion of its shareholding in excess

of 10% of Mediaset’s voting rights to an independent Italian trustee.

(6) Of the share capital (% interest).

06

–— VIVENDI –— ANNUAL REPORT 2018 –—

–— VIVENDI –— ANNUAL REPORT 2018 –—

07

PROFILE OF THE GROUP

13

1

Performances

Venues

23.94%

Telecom

Italia

(3) (4)

Gameloft SE

(France)

Fiction

Educational

& Reference

books

Selling

& Distribution

Dailymotion Inc.

Gameloft Inc.

(United States)

Flab Prod

Gameloft Inc.

Divertissement

(Canada)

Gameloft

Software

Beijing Ltd.

(China)

Ticketing

GVA Group

Vivendi Africa

Talents

Live

EDITIS

(1)

GAMELOFT VIVENDI

VILLAGE

NEW

INITIATIVES

HOLDINGS

(2)

100% 100% 100% 100%

1.1. Simplified Organization Chart of the Group

28.80%

Mediaset

(3) (5) (6)

31.4%

Banijay Group

Holding

08

–— VIVENDI –— ANNUAL REPORT 2018 –—

–— VIVENDI –— ANNUAL REPORT 2018 –—

09

PROFILE OF THE GROUP

1

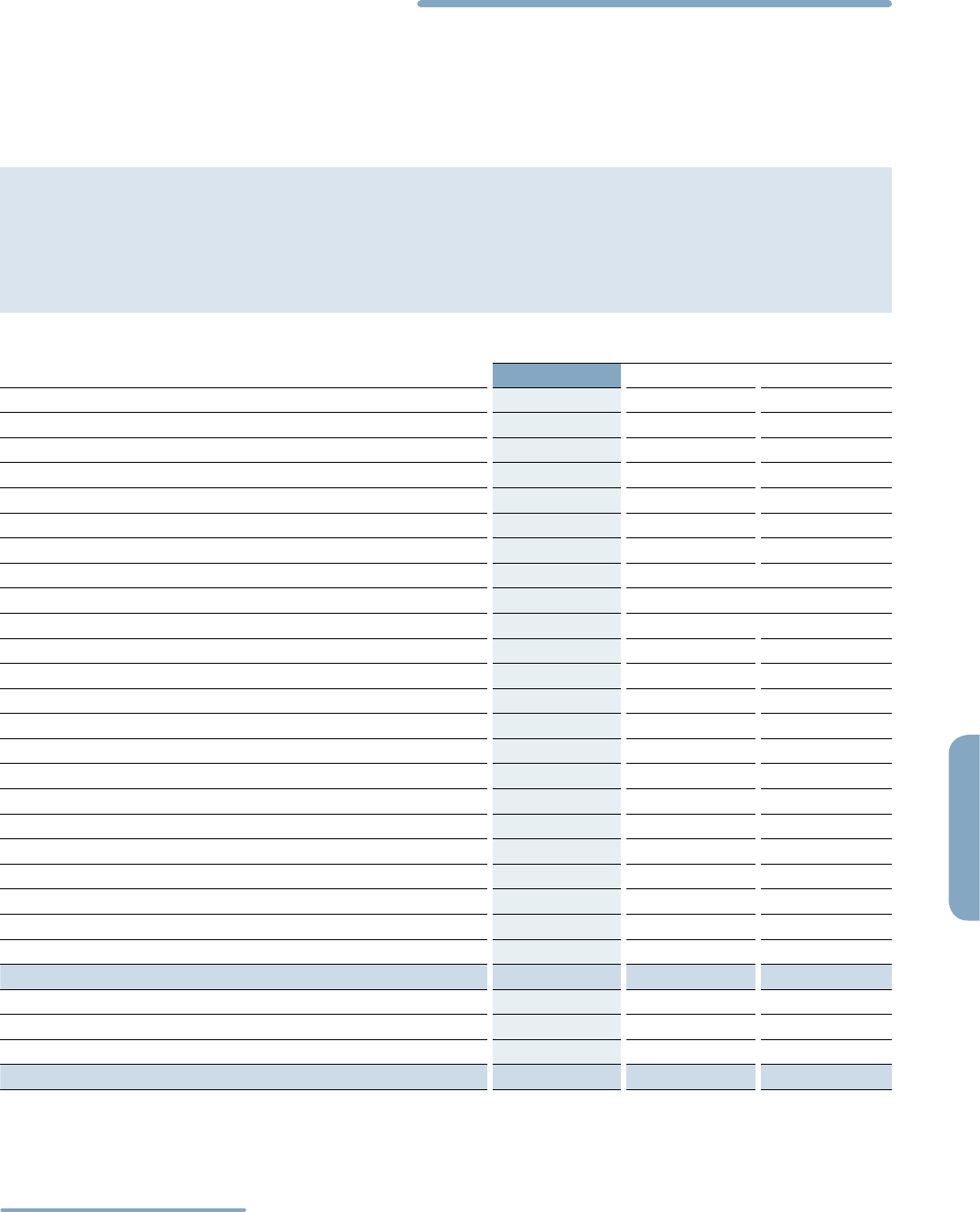

1.2. Key Figures

HEADCOUNT BY GEOGRAPHIC ZONE

(*)

7,729

NORTH

AMERICA

3,500

SOUTH AND

CENTRAL AMERICA

7,074

ASIA-PACIFIC

23,807

EUROPE

(including France)

2,032

AFRICA

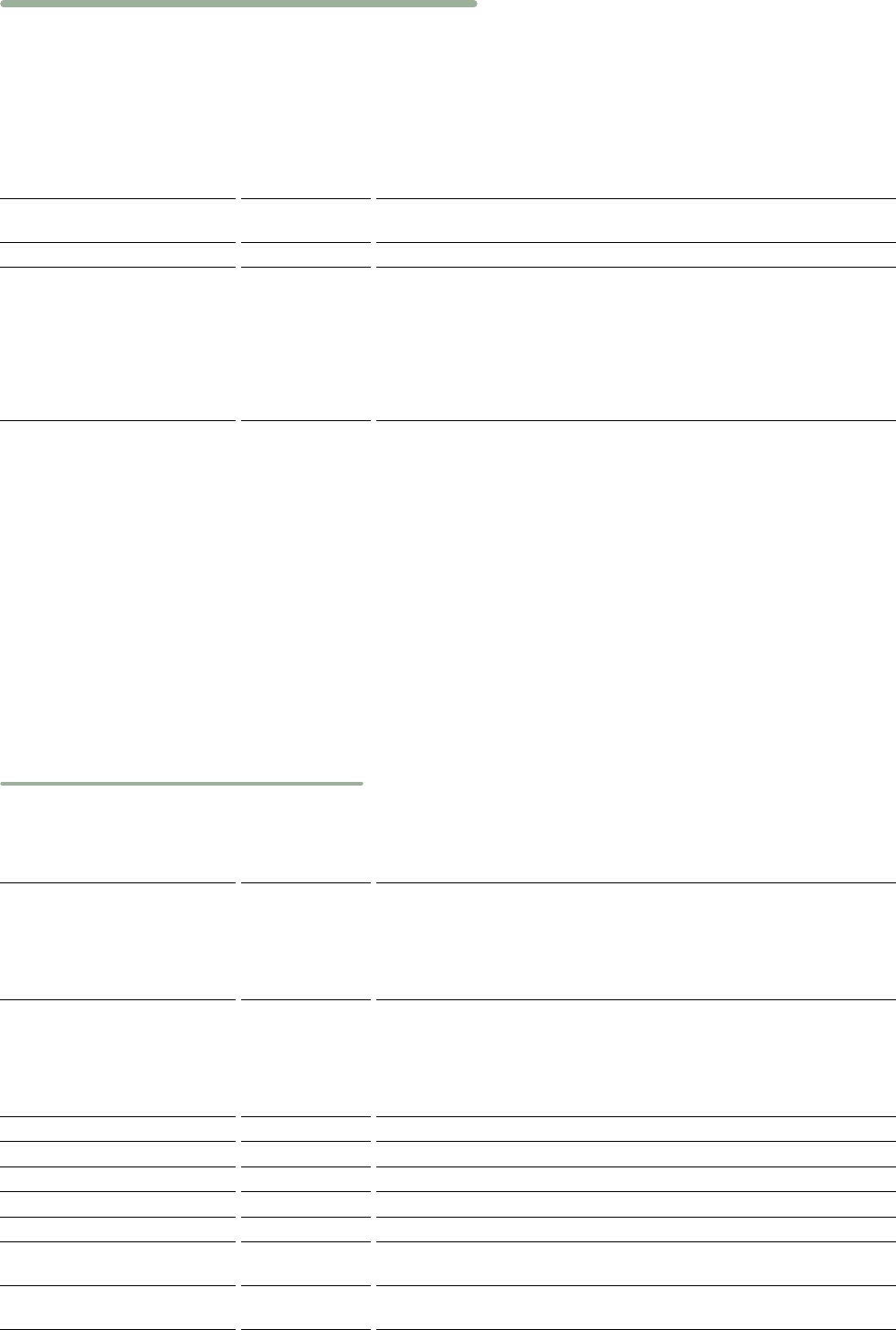

HEADCOUNT BY BUSINESS SEGMENT(*)REVENUES BY BUSINESS SEGMENT

Year ended December 31 – in millions of euros

2018 2017

3

Universal Music Group 6,023 5,673

3

Canal+ Group

5,166 5,198

3

Havas

(1) 2,319 1,211

3

Gameloft 293 320

3

Vivendi Village 123 109

3

New Initiatives

66 51

3 Elimination of intersegment transactions

(58) (44)

TOTAL 13,932 12,518

(1) Consolidated since July 3, 2017.

1.2. Key Figures

44,142

8,319 Universal

Music Group

7,739 Canal+

Group

19,622 Havas

Gameloft

4,456

Editis

2,542

Vivendi

Village

640

New

Initiatives

567

Corporate

257

TOTAL

44,142

TOTAL REVENUES 2018

€13,932M

€7,562M

EUROPE

(including France)

€4,395M

THE AMERICAS

€1,373M

ASIA & OCEANIA

€602M

AFRICA

(*) Includes Editis, which was acquired on January 31, 2019.

08

–— VIVENDI –— ANNUAL REPORT 2018 –—

–— VIVENDI –— ANNUAL REPORT 2018 –—

09

PROFILE OF THE GROUP

13

1

1.2. Key Figures

In 2018, Vivendi applied two new accounting standards:

3 IFRS 15 – Revenues from Contracts with Customers: in accordance with IFRS 15, Vivendi applied this change of accounting standard to 2017 revenues, thereby ensuring

comparability of the data relative to each period of 2018 and 2017 contained in this report; and

3 IFRS 9 – Financial Instruments: in accordance with IFRS 9, Vivendi applied this change of accounting standard to the 2018 Statement of Earnings and Statement

of Comprehensive Income and restated its opening balance sheet as of January 1, 2018; therefore, the data relative to 2017 contained in this report is not

comparable.

For a detailed description, please refer to Notes 1 and 28 to the Consolidated Financial Statements for the year ended December 31, 2018, in Chapter 4.

3 The non-GAAP measures of Income from operations, EBITA, Adjusted net income and Net Cash Position (or Financial Net Debt) should be considered in addition

to, and not as a substitute for, other GAAP measures of operating and financial performance. Vivendi considers these to be relevant indicators of the group’s

operating and financial performance. Vivendi Management uses these indicators for reporting, management and planning purposes because they exclude most

non-recurring and non-operating items from the measurement of the business segments’ performances. In addition, it should be noted that other companies may

have definitions and calculations for these indicators that differ from those used by Vivendi, thereby affecting comparability. Each of these indicators is defined in

Section 1 of the Financial Report, in Chapter 4, or in Note 1 to the Consolidated Financial Statements for the year ended December 31, 2018, in Chapter 4.

NET CASH POSITION/

(FINANCIAL NET DEBT)

As of December 31 – in millions of euros

EARNINGS ATTRIBUTABLE TO VIVENDI SA

SHAREOWNERS AND ADJUSTED NET INCOME

Year ended December 31 – in millions of euros

■■ Earnings attributable to Vivendi SA shareowners

■■ Adjusted net income

ADJUSTED NET INCOME

PER SHARE (BASIC)

Year ended December 31 – in euros

(1) Submitted to the approval of the

Annual General Shareholders’ Meeting

of April 15, 2019.

DIVIDEND

With respect to fiscal year – in euros

INCOME FROM OPERATIONS BY BUSINESS SEGMENT

Year ended December 31 – in millions of euros

2018 2017

3

Universal Music Group 946 798

3

Canal+ Group

429 349

3

Havas

(1) 258 135

3

Gameloft

4 10

3

Vivendi Village (9) (6)

3

New Initiatives (79) (87)

3

Corporate

(110) (101)

TOTAL 1,439 1,098

EBITA BY BUSINESS SEGMENT

Year ended December 31 – in millions of euros

2018 2017

3

Universal Music Group 902 761

3

Canal+ Group 400 300

3

Havas

(1) 215 111

3

Gameloft

2 4

3

Vivendi Village

(9) (18)

3

New Initiatives (99) (92)

3

Corporate

(123) (97)

TOTAL 1,288 969

2018

127

2018

(2,340)

2018

0.92

2018

2018 (1)

1,157

0.50

2017

1,216

2017

2017

1.04

2017

2017

1,300

0.45

176

(1) Consolidated since July 3, 2017.

10

–— VIVENDI –— ANNUAL REPORT 2018 –—

–— VIVENDI –— ANNUAL REPORT 2018 –—

11

PROFILE OF THE GROUP

1

JANUARY

• Canal+ announces the

prepurchase of the My Brilliant

Friend series, based on Elena

Ferrante’s bestselling novel.

• Vivendi Sports organizes

the first Le Tour de l’Espoir

cycle race in Cameroon for

cyclists under 23, registered

on the International Cycling Union

calendar.

• The Modern Combat Versus

game is selected for the Android

Excellence 2018 program for

high-quality mobile apps.

FEBRUARY

• BETC is ranked among the

top ten agencies in the world by

the Gunn Report.

• The launch of Polar+ is the

most successful launch of any

specialist-interest channel in

ten years.

• Canal+ Group launches

in Myanmar.

• The Vivendi Create Joy

solidarity program celebrates

its 10

th

anniversary.

MARCH

• Havas announces the launch

of Havas China Desk, a new

service across all of the group’s

agencies to support clients wanting

to strengthen their presence in

China and to partner with Chinese

brands looking to expand

internationally.

• Group Vivendi Africa launches

its CanalBox service in Lomé, Togo.

APRIL

• See Tickets acquires

the Dutch company Paylogic and

builds a ticketing network covering

Europe and the United States.

• Canal+ Group and UMG

launch Deutsche Grammophon+,

a TV channel dedicated to classical

music.

• CanalOlympia and Orange

team up to help make cinema more

accessible in Africa.

1.3. 2018 Highlights

1.3. 2018 highlights

MAY

• UMG artists Kendrick

Lamar, Luis Fonsi, Daddy

Yankee, Justin Bieber,

Taylor Swift, Chris Stapleton,

Imagine Dragons and U2 are

the big winners at the 2018

Billboard Music Awards.

• Gameloft launches Dungeon

Hunter Champions, the latest

opus in the Dungeon Hunter series,

which achieved 100 million

downloads.

• Havas launches

an innovation lab devoted

to artificial intelligence

and developing the group’s

expertise in new technologies.

JUNE

• Canal+ Group joins forces

with Apple to adapt the

short-format audio series Calls

for English-speaking audiences.

• Dailymotion creates

a new advertising ecosystem

with its own programmatic

platform and content

monetization system.

• Mika’s performance at

the French Top 14 rugby final

is produced and broadcast

by UMG, Havas, Canal+

and Dailymotion.

• Havas wins 47 Lion awards

at the International Festival

of Creativity in Cannes.

JULY

• Gameloft launches

Asphalt 9: Legends, the latest

installment in the mobile video

racing game series with the most

downloads worldwide.

• The Rolling Stones sign a

global deal with UMG covering

the band’s recorded music and

audiovisual catalog and brand

management.

• Vivendi announces its plan

to sell up to 50% of UMG’s

share capital to one or more

strategic partners.

10

–— VIVENDI –— ANNUAL REPORT 2018 –—

–— VIVENDI –— ANNUAL REPORT 2018 –—

11

PROFILE OF THE GROUP

13

1

1.3. 2018 highlights

OCTOBER

• Olympia Production

announces the acquisition

of Garorock, located in

Marmande, one of France’s

leading music festivals.

• Vivendi Sports organizes

Jab & Vibes, the Super-

lightweight Boxing World

Championship in Dakar.

NOVEMBER

• Canal+ renews its agreement

with the French cinema

industry to continue to support

movie production until

year-end 2022.

• UMG signs a multi-year

global contract with pop star

Taylor Swift, who joins

the Republic Records label.

• Canal+ releases its latest

Créations Originales series,

Hippocrate, a unique insight

into the world of medicine.

DECEMBER

• Canal+ signs a new media

scheduling agreement and will

now be able to broadcast

movies six months after their

theater release.

• CanalOlympia opens

its 11

th

cinema and live

performance venue in Africa,

located in Port-Gentil, Gabon.

• With 4.3 million tickets sold,

Sink or Swim (Le Grand Bain)

becomes Studiocanal’s most

successful release in France.

• Gameloft signs an

agreement with LEGO

®

to create a new game in 2019.

• Queen’s Bohemian

Rhapsody officially ranks

as the most-streamed song

from the 20

th

century.

• Gameloft acquires

FreshPlanet, creator of music

trivia game SongPop.

JULY

• Havas announces the

acquisition of Catchi, specialized

in CRO (conversion rate optimization)

in Australia and New Zealand.

• Vivendi begins exclusive

negotiations with Grupo Planeta

to acquire 100% of the share

capital of Editis, the second-largest

French-language publishing group.

AUGUST

• Dailymotion is partner

for more than 300 leading

content publishers, including

the Financial Times, TF1, GQ

and AC Milan.

• Canal+ Afrique launches

Canal+ Comédie, Canal+ Action

and its fifth channel, Canal+ Sport.

SEPTEMBER

• Havas took a participation

in Republica, the number 1

independent multicultural marketing

agency in the USA, based

in Miami (Florida).

• Canal+ announces the acquisition

of exclusive distribution rights

for several seasons of MotoGP™,

Moto2 and Moto3, starting in 2019.

• Invisibles, the series co-produced

by Canal+ Afrique, wins Best

Foreign Francophone Story

at the La Rochelle International TV

Drama Festival.

• UMG and Elton John enter

into a global partnership

spanning recorded music, music

publishing and copyright

protection.

OCTOBER

• Canal+ acquires exclusive

rights for the 2019-2020,

2020-2021 and 2021-2022 seasons

of the English Premier League.

• Puma selects Havas Media

as its new global agency partner

for media buying and planning.

2.1.Strategy

STRATEGY AND VALUE CREATION

1

2.1.Strategy

2.1.1. ACCELERATION OF VIVENDI’S

STRATEGICROADMAP

2018 once again demonstrated the value of the strategic roadmap that has

guided Vivendi’s activities since 2014. With a Chairman of the Supervisory

Board, Yannick Bolloré, who benefits from a wide-ranging vision for the

group’s business lines (content, media and communications) and the

experience of integrating a global industrial group, Vivendi is on track to

become a world class European champion in the creative industries.

The group’s strategy of investing in its cultural entertainment business lines

is bearing fruit, as its 2018 results confirm. Revenues reached €13.9billion,

a 4.9% increase compared to 2017 (at constant currency and perimeter),

driven by strong results from the group’s main business lines.

Universal Music Group had a historic year both creatively and commercially.

With year-on-year growth of 10% in revenues (at constant currency and

perimeter), UMG was able to consolidate its global leadership position due

to its unique expertise in supporting talent and its ability to successfully

exploit the full potential of streaming. Partner to more than 400streaming

platforms, GAFAM and major players in Asia, UMG saw its income from

subscriptions and streaming soar by 36% in 2018.

UMG artists’ Drake, Ariana Grande, Post Malone and Taylor Swift all

released chart-toppers during the year. In Spotify’s global ranking, the five

most-streamed songs of 2018 were all performed by UMG artists: God’s

Plan and In My Feelings by Drake, rockstar and Psycho by Post Malone, and

SAD! from XXXTentacion. The most popular albums worldwide during the

year included records by Post Malone, The Beatles and XXXTentacion, along

with the A Star is Born soundtrack featuring Lady Gaga.

A numberof major artists, including Taylor Swift, The Rolling Stones and

Elton John, signed or renewed a contract with UMG or entered into

innovative partnerships during the year. As an example, Taylor Swift signed

a multi-year global recording contract with UMG in November2018. The

music company will now be Taylor’s exclusive recorded music partner

worldwide and Republic Records, a subsidiary of UMG, will serve as her

label in the United States. The partnership draws on the considerable

success that the singer has had with Big Machine Records, the label that

brought her into the UMG family.

In audiovisual content, Canal+ Group pursued its turnaround in France and

continued to win over new subscribers internationally. In all, the group’s

portfolio totaled 16.2million subscribers, a year-on-year increase of

654,000.

Canal+ Group also continued to expand in international markets, with

subscribers in Africa, Asia, Poland and French overseas territories reaching

7.8million. Growth in the subscriberbase was particularly strong in Africa,

now standing at more than 4million.

In France, as a result of the transformation plan implemented in 2015,

Canal+ Group reported stable figures. The group added to its line-up by

expanding its three editorial verticals: sports, series and cinema.

Its sports offering was enhanced in 2018 through the acquisition of all

rights to broadcast the next three seasons of the English Premier League –

the most popular premier football championship in the world – in France

and Poland. The group also diversified its sports content further during the

year, following on from its investments in boxing and women’s football in

2017. It will now feature more motor sports due to its first-time acquisition

of the rights to the MotoGP

TM

World Championship. The Créations

Originales (original programming), central to Canal+ Group’s editorial line,

shone particularly in 2018. The fourth season of espionage drama The

Bureau des Légendes and new series Hippocrate and Nox were very well

received by subscribers and critics alike.

Canal+, a long-standing partner of the cinema industry, renewed its

agreement with the French cinema industry until 2023 in a partnership

spanning over 30 years. The agreement resulted in the signing of a new

planned media release in late December2018. Canal+ Group will now be

able to broadcast films to its subscribers just six months after their theater

release. Studiocanal enjoyed a buoyant 2018 due to a numberof highly

successful releases, including Gilles Lellouche’s Sink or Swim, which

attracted 4.3million moviegoers, Mia and the White Lion (1.2million

viewers) and the touching Pupille, with 0.8million tickets sold.

In communications, Havas had a very successful year, driven by an excellent

performance in the fourth quarter. The group pursued its acquisition policy,

with five new agencies from a variety of geographies and markets joining

the Havas family in 2018. A numberof its agencies, from BETC to Rosapark

and Havas Host, were recognized for their creativity at major international

festivals during the year, most notably at the Cannes Lions Festival, where

Havas won three Grand Prix awards and 47 Lions.

Eighteen months on from joining Vivendi, Havas has made a name for itself

within the group through several joint projects run with other entities.

Havas Sport & Entertainment, Universal Music & Brands and Canal+ all

joined forces to turn the rugby Top 14 final at the Stade de France last

Juneinto a multi-faceted viewing experience.

Lastly, Gameloft had a great success with the latest launch of its mobile

racing game, Asphalt 9: Legends. Released on July26, 2018, the game has

been downloaded more than 35million times. Over the year, Gameloft has

1.8million games played per day and 98million monthly players.

In addition to the franchises it develops in its own right, Gameloft is

associated with many rights holders through partnerships to create games

in connection with universes and famous people. After having collaborated

with Disney

®

, Universal, Illumination Entertainment, Hasbro

®

, and Fox

Digital Entertainment, Gameloft and the LEGO group announced the release

in 2019 of a new LEGO

®

game that will bring the famous miniatures and

their world to mobile.

At year-end 2018, Gameloft acquired the FreshPlanet studio, the creator of

the hit SongPop music quiz games, which have won several awards and

have been downloaded more than 100million times. This acquisition marks

a new step in Gameloft’s strategy, reinforcing its leading position in the

mobile gaming industry.

Vivendi is now a well-balanced group, with its complementary business

lines (from music to ticketing and series) working together to promote the

group’s primary resource: content. Strengthened with the addition of Havas’

communications business, Vivendi represents an alternative to major

players from the United States and Asia operating on the global cultural

entertainment market. With its European background, Vivendi is able to

offer its customers and partners a competitive line-up with unique origins

and sensibilities.

SECTION 2. STRATEGY AND VALUE CREATION

12 –— VIVENDI –— ANNUAL REPORT 2018 –—

—

VIVENDI

—

ANNUAL REPORT 2018

—

13

1

2.1.Strategy

STRATEGY AND VALUE CREATION

23

1

As well as its main businesses, Vivendi is also strengthening its presence in

markets that will act as growth drivers in the coming years. In 2018, Vivendi

consolidated its value chain while ensuring that content and intellectual

property remained at the heart of its model. The announcement of its acqui-

sition of Editis, new developments in live performances and the group’s work

on connected devices are an integral part of Vivendi’s strategic vision. In

2018, the group focused in particular on:

3 Optimizing Vivendi franchises

Due to its diverse expertise, Vivendi is able to lead cross-business

projects and create specialized offerings with original formats, such

as the Le Crxssing festival, which was held for the second time in

London at the end of September2018. From the concept to ticketing,

each step was supported by group entities, similarly to the various

initiatives recently undertaken in relation to the Paddington

franchise. This synergy model will be used for future acquisitions

and new franchises, particularly for Gameloft’s and Editis’s content.

3 Developing live activities

Vivendi considerably expanded its portfolio of festivals in 2018.

Garorock Festival is the latest addition to the 14 festivals all over

the world now wholly or partially owned by Vivendi through its

Olympia Production and ULive businesses. At the intersection of the

group’s business lines, the festival industry appeals to an ever-

increasing audience. France counted more than 7million festival

goers in 2018. To meet this growing demand, See Tickets acquired

Dutch ticketing company Paylogic in April 2018, building a global

network covering Europe and the United States.

3 Winning over new markets

In a two-year span, Vivendi has successfully established itself on

the African market. The continent’s young, connected population

and growing demand for cultural content make it ideal for Vivendi’s

creative businesses. The group launched CanalOlympia, which has

become the leading network of movie theaters and performance

venues, now with 11 locations in eight countries in West Africa. It

also created Vivendi Sport, which designs and organizes sporting

events in the continent. Vivendi Sports held its first two competi-

tions in 2018, both recognized by international federations: Le Tour

de L’Espoir, a cycle race in Cameroon, and the Jab & Vibes

Super-lightweight Boxing World Championship in Senegal.

Vivendi is also stepping up its presence in other markets and is

gradually establishing itself in Asia, particularly China and India,

where it has set up ad hoc committees and entered into partner-

ships with major industry players.

3 Distributing content online

Creating content would mean nothing without being able to distribute

it. A year on from its strategic repositioning, Dailymotion has made a

turnaround and is now retaining its audience with premium content.

This editorial shift was also reflected in the forming of more than 300

partnerships in 2018 with world leaders in content creation, including

the Financial Times, Variety, GQ and Brut. Dozens of partnerships were

signed in regions where Dailymotion’s presence was minimal (South

Korea, Vietnam and India), resulting in a surge in viewing figures.

Dailymotion has come into its own as the group’s digital showcase.

2.1.2. VIVENDI’S COMMITMENT TO ITS INDUSTRY,

CULTURE AND SOCIETY

Vivendi has high hopes for 2019 and a clear objective: to continue on its

way to becoming a world-class European champion in content, media and

communication, with two main focus areas on its roadmap for the year:

3 On January31, 2019, the group finalized the acquisition of Editis,

thereby securing a foothold in publishing, a new creative industry for

Vivendi that supplements its other content businesses. The Editis

acquisition marks Vivendi’s entry into France’s biggest cultural market

and is an exceptional asset for the group. Publishing is central to the

field of intellectual property, with two thirds of movies and series

based on original literary works; and

3 Vivendi has decided to offer one or several strategic partners the

opportunity to purchase up to 50% of UMG’s share capital with a

view to accelerating UMG’s development while still retaining the

music company, a precious asset, in its portfolio. A reserve price will

be set.

Vivendi forms a unique ensemble with high-potential assets and talent,

from Lady Gaga to the heroes of the Engrenages drama, the little dragons

from its Dragon Mania Legends game and, since January2019, Editis

authors such as Michel Bussi and Ken Follett. With its diverse business

lines, Vivendi is able to harness the creative potential of major players in

the entertainment industry alongside smaller structures working to promote

a talent, work or brand. This diversity in content, business lines and talent is

central to the group’s foundation and DNA, allowing it to stand out in an

increasingly globalized content market alongside GAFAM and BAT in Asia

(Baidu, Alibaba and Tencent).

By supporting content creation in all the regions where it operates, Vivendi

upholds a commitment to its stakeholders to promote multiculturalism,

open up access to entertainment and empower young people in their use of

digital media. In 2018, €2.7billion has been invested in content production.

Vivendi and its business lines, with their diverse and broad content, are

aligned on a shared corporate social responsibility policy. Their commitment

goes well beyond the group’s cultural content, leading initiatives that benefit

society and establish Vivendi as a driver of change, including “Create Joy”, a

solidarity program to support disadvantaged young people, its “Femmes

Forward” initiative to promote women in businesses, “Solidarité Climat”,

which funds community projects to protect the climate, and Paddington,

Unicef’s champion for children.

These undertakings above will create value and enable Vivendi to launch

new projects, attract and develop talent, and pursue further growth.

12 –— VIVENDI –— ANNUAL REPORT 2018 –—

—

VIVENDI

—

ANNUAL REPORT 2018

—

13

2.2.Business model

STRATEGY AND VALUE CREATION

1

2.2.Business model

EBITDA

1,740

VALUE SHARING

Vivendi, Living Together

MUSIC VIDEO GAMESAUDIOVISUAL LIVECOMMUNICATION PLATFORM

Sales

and Fees

Subscription

and Advertising

Fees Sales and

Advertising

Advertising Sales

and Fees

Figures in millions of euros.

REVENUES

13,932

GOVERNMENT

917

SHAREHOLDERS

615

SUPPLIERS

9,250

EMPLOYEES

2,538

INVESTMENTS

IN CONTENT

UMG CANAL+ GROUP

974 1,751

INVESTMENTS/

DISINVESTMENTS

(1,609)

CAPEX

341

CLIENTS

14 –— VIVENDI –— ANNUAL REPORT 2018 –—

—

VIVENDI

—

ANNUAL REPORT 2018

—

15

1

2.2.Business model

STRATEGY AND VALUE CREATION

23

1

Vivendi is a worldwide leader in media, content and communications.

In 2018, its revenues were €13,932million, a 11.3% increase from 2017, as

reported and a 4.9% increase at constant currency and perimeter, while

EBITA was €1,288million, a 33% increase from 2017, as reported and a

24.7% increase at constant currency and perimeter.

Vivendi operates in 78 countries and has 44,142 employees (including

Editis). Approximately 54.5% of its revenues originates from Europe, 31.5%

from the Americas, 10% from the Asia-Pacific region and 4% from Africa.

Being a worldwide leader in media, content and communications means

operating in a variety of sectors. Vivendi is active in the music industry

(Universal Music Group), television and movies (Canal+ Group), communica-

tions (Havas), video games (Gameloft), digital distribution (Dailymotion) and

live entertainment and ticket sales (Vivendi Village).

In 2018, music, television, movies and communications accounted for

almost 97% of group revenues (details on the business models for these

operations are provided below). The value created is shared primarily

between employees and suppliers, with government and shareholders also

receiving a portion. Cash flow is then directed toward investments in

content, capital expenditures and financial investments (see diagram on the

opposite page).

Vivendi’s balance sheet position is sound. The group had a net cash position

of €0.2billion (as of December31, 2018) and €3.7billion in available bank

facilities (as of February11, 2019).

Accounting for 43.2% of Vivendi’s revenues over the year, in 2018, UMG

posted revenues of €6,023million for an EBITA of €902million, and

employed 8,319 members of staff. UMG operates in more than 60countries.

With more than 50 labels (including Capitol Records, Republic Records,

Interscope Geffen A&M Records, Island Records, Decca Records, Deutsche

Grammophon, Blue Note Records and Verve Records) representing all

musical styles, UMG supports some of the biggest local and international

artists, from The Rolling Stones, U2, Taylor Swift, Lady Gaga, Drake and

Post Malone to Helene Fischer, Florent Pagny and Eddy de Pretto.

UMG has three main businesses: recorded music, music publishing and

merchandising. Accounting for more than 80% of revenues, its recorded music

business is devoted to the discovery and development of artists and the

marketing, promotion and distribution of their music. It also includes live

performances, sponsorship and the production of film and television programs.

Recorded music distribution has undergone radical change. The industry has

shifted from the sale of physical media such as vinyl records, tapes (1963)

and CDs (1983) to digital downloads (1999), followed by music streaming

platforms (2007) that consumers can either pay for via subscription or use for

free. After a decade and a half of decline linked to digital transformation, the

sector began to recover in 2015 due to the success of streaming platforms

such as Spotify, Deezer, Apple Music, Amazon Music, YouTube Music, Qobuz

and Tidal. Although these platforms are available worldwide, different

countries have reached different stages in their digital transformation.

According to Nielsen’s 2018 mid-year report, in the United States, which is

the world’s biggest music market, streaming represented 66% of business

volumes. According to the Recording Industry Association of Japan report

published in September2018, however, despite Japan being the second-

largest global market, CDs and vinyl still account for approximately 70% of

sales. There is therefore still considerable growth potential for streaming.

UMG has signed licensing agreements with more than 400 digital services

around the globe. In 2018, subscriptions and streaming generated 54% of

total recorded music revenues.

Licensed streaming platforms earn recurring revenue, which is based on

consumption (i.e., how often a song is played). They also provide statistical

data, unlike the point-of-sale model, that stops generating revenue and data

after the initial sale. The streaming model has accentuated the importance of

catalog ownership. This is an advantage for UMG, which owns the biggest

recorded music catalog in the world (more than 3million titles).

Its music publishing entity, Universal Music Publishing Group (UMPG),

licenses titles for use in sound recordings, films, television, advertising,

video games, and live and public performances. It also licenses

compositions for use in printed sheet music and song portfolios. Generally,

UMPG licenses titles after acquiring a direct interest in their copyrights by

entering into agreements with the artists. UMPG owns and controls a vast

catalog of original music and arrangements.

Bravado, UMG’s merchandising business, connects new and established

artists with brands. It offers full-service brand campaigns including product

creation, partnerships and promotion. The resulting products are sold

through global in-store and online retailers, specialty stores and concert

tours, and in limited-edition retail initiatives. Bravado also grants licenses to

an extensive worldwide network of third-party companies.

Accounting for 37.1% of Vivendi’s revenues over the year, in 2018, Canal+

Group posted revenues of €5,166million for an EBITA of €400million, and

employed 7,739 members of staff. It operates in approximately 30 countries.

Canal+ Group has three main businesses: pay-TV, free-to-air TV and cinema.

Pay-TV in France represents the biggest share of the group’s revenues. It has

16.2million individual and collective subscribers in France and worldwide.

In recent years, the French pay-TV market has been transformed by the

arrival of new entrants from inside and outside France and by new television

viewing habits (increased in-car consumption, catch-up TV and TV on

demand). Faced with these changes, Canal+ restructured its offers to make

them more modular (two basic bundles and two additional sports or movie/

TV bundles) and flexible (with or without a 12- or 24-month minimum

subscription period). Canal+ has also signed partnership agreements with

Internet service providers (Free, Orange and Bouygues) that include some

Canal+ channels in their subscription packages.In addition, the group has

developed myCanal, an app that allows live or catch-up viewing of programs

on all of the group’s French channels. myCanal is the French market’s top

online media/television/video platform, with 1.6million unique visitors per

day and more than 50million hours of video consumed each month.

Canal+ Group has also significantly expanded its international operations. It

is active in Poland, Asia (Vietnam and Myanmar) and more than 25 African

countries. It currently has 7.8million individual subscribers outside France.

In France, Canal+ produces a general-interest channel (Canal+), showing

movies, sports, drama, documentaries, entertainment programs and five

specialized channels (Cinéma, Sport, Family, Décalé and Séries). The Canal+

channel is offered in Canal packages, which include the group’s proprietary

themed channels (around 20 in all) and 130 French and international third-

party channels. Canal+ notably broadcasts series under the Créations

Originales label. In 2007, it began producing Créations Originales series and

dramas such as Engrenages, Le Bureau des Légendes, Hippocrate and

Versailles. These critically acclaimed programs draw large viewerships in

France and have also achieved international success. For example,

Le Bureau des Légendes has been sold in more than 90 countries.

Canal+ earns most of its revenues from monthly subscriptions. Its offerings

are a clear success: more than 95% of subscribers sign up for a 24-month

period, and subscription cancellations fell to 13.6% at year-end 2018, a

decrease of 2.2 points compared to year-end 2017. Subscriptions are sold

14 –— VIVENDI –— ANNUAL REPORT 2018 –—

—

VIVENDI

—

ANNUAL REPORT 2018

—

15

2.3.Value creation

STRATEGY AND VALUE CREATION

1

directly on all distribution networks (Internet, satellite and DTT). Canal+

Group also has partnerships with telecom operators that offer some of its

channels to their customers (3.1million customers at year-end 2018).

Canal+ Group operates in the free-to-air TV market with three national

channels (C8, CNews and CStar). Its advertising division sells air time on

the group’s channels as well as on more than a dozen themed channels.

Canal+ Group also produces and distributes feature films and TV series

through its subsidiary Studiocanal. In 2018, its biggest hit, Sink or Swim

(LeGrand Bain), sold more than 4.3million tickets in France. Studiocanal

also manages one of the world’s largest audiovisual catalogs, with 5,500

titles from more than 60 countries.

Accounting for 16.6% of Vivendi’s revenues, in 2018, Havas had revenues of

€2,319million and an EBITA of €215million, and employed 19,622 members

of staff.

Havas has three business units specializing in advertising, creative and

consulting services (Havas Creative), health and wellbeing communications

consultancy (Havas Health & You) and media expertise and advertising

space sales (Havas Media).

To better meet client needs, Havas has implemented a client-centric “Together”

strategy organized by region. At the same time, it brings together the most

talented people from across all communications disciplines under one roof, the

Havas Village. Havas Group has 58 villages worldwide. In June2018, Havas

launched the “Together” strategy’s second phase by expanding its operations in

specialized areas such as performance marketing, public relations, blockchain

communications and social media.

Together, Havas Creative and Havas Health & You represent approximately

63% of Havas Group’s net income.They employ nearly 11,400 experts in

75countries and have agreements with groups, government organizations

and associations that generally run for one, two or three years. Contracts

for one-time projects may be as short as a few months.

Havas Media accounts for 37% of Havas’s net income. Online advertising

continues to grow. Aside from its extensive experience in media strategy

and advertising, Havas Media has developed specialized expertise in pro-

grammatic services, social media, mobile and geolocalized communications,

online performance marketing and data analysis. Havas Media earns its

revenue as a percentage of advertising space sales.

2.3.Value creation

A priority for Vivendi in 2018 was defining a business model that promotes

value creation through its businesses over the medium and long term, and

expressing that model through a series of key indicators that reflect its

overall and non-financial performance.

The approach draws first and foremost on the analyses provided by the

group’s subsidiaries at each stage of the value chain, from content creation

to talent discovery, publishing, production and distribution, as well as on

input from its external stakeholders.

It is used alongside components from the group’s strategy (Section 2.1),

business model (Section 2.2) and corporate social responsibility commit-

ments (Section 4.4), which together form a comprehensive overview of how

value is created and shared at group level.

Through this approach, Vivendi is able to show how its value model fits in

with and complements the models applied by its subsidiaries, as well as

show the compatibility of financial value creation and a positive societal

impact. Vivendi is consistent with the current trend of companies redefining

their role in society, such as the draft PACTE law in France.

2.3.1. VALUE CREATION APPROACH

Vivendi’s value creation approach is overseen by a steering committee and

coordinated by the Corporate Social Responsibility (CSR) and Compliance

Department. It is being rolled out gradually and has currently been

implemented in three group subsidiaries: Universal Music Group (UMG),

Canal+ Group and Gameloft. The Havas Group, Editis and Live activities at

Vivendi Village will adopt the same approach in 2019.

To identify aspects of value creation at the very heart of Vivendi’s business,

the value and financial performance of the group’s activities have been

thoroughly analyzed through interviews with representatives from each

subsidiary, establishing key financial value drivers and strategic business

priorities. The contribution that each subsidiary makes to society was also

analyzed in terms of value created.

In addition to this internal review, an external analysis based on market

studies and input from the group’s stakeholders was carried out. Each

subsidiary’s specific business and societal issues were then incorporated

into a materiality matrix, which emphasized the convergence between the

business and its societal impact and helped prioritize the key issues to be

addressed.

An infographic was drawn up to illustrate the drivers of value creation in

each subsidiary, including the components of each business, the associated

expertise, those who benefit from value sharing and the contribution to

society.

The analysis of financial and non-financial indicators helped establish

baseline indicators for each subsidiary. The review’s findings and outcomes

were compared against the CSR commitments, so as to improve the way in

which the selected indicators are presented.

In 2019, the CSR and Finance Departments will work to take the same

approach one step further by implementing better integrated financial and

non-financial reporting. The group will also consider how best to align its

development goals with the value creation drivers identified. Once this work

has been carried out, a strategic report will summarize all the information

related to value creation for the Vivendi group.

16

–— VIVENDI –— ANNUAL REPORT 2018 –—

—

VIVENDI

—

ANNUAL REPORT 2018

—

17

1

2.3.Value creation

STRATEGY AND VALUE CREATION

23

1

2.3.2. VALUE CREATION DRIVERS FOR VIVENDI

Vivendi’s value creation drivers have been identified from the financial value

models and societal contribution models used by the subsidiaries taking

part in the approach in 2018. The financial value models show Vivendi’s

presence along the entire value chain. The seamless integration of UMG’s

recorded music and music publishing activities, Canal+ Group’s combination

of audiovisual content production and distribution, and Gameloft’s in-house

video games design and development capabilities illustrate this positioning.

The societal contribution models reflect the close alignment of Vivendi’s

business and CSR commitments.

Talent

discovery

Global talent

development

Promotion of catalog and

intellectual property

An attractive

editorial line

Talent discovery

Being able to identify talented people who will enhance the originality and

quality of the group’s content and services and suit its customers’ cultural

sensibilities is a key source of value for Vivendi. Teams with recognized

expertise in their business sectors are tasked with discovering unique, creative

personalities for music, audiovisual content, movies and video games.

Their ability to analyze artistic and technological trends and forge partner-

ships with innovative players to stay one step ahead in creative projects is

also essential for detecting the talent of tomorrow. Added to this is the

capacity to design new formats or value-creating business models that will

increase the group’s potential for attracting new talent. Lastly, the resources

at the group’s disposal to offer opportunities for promotion and development

also add to its attractiveness for new talent.

Global talent development

Experienced artists and talented newcomers alike receive artistic and

media support from specialized teams, as well as having access to the

group’s infrastructure to bring their projects to life. They enjoy exposure to a

wide audience due to the group’s recording studios, venues for live

performances and capacity to promote artists and broadcast their work on

an international scale.

Collaboration between the group’s talent and “client brands”, where musicians

join forces with advertisers or video game producers, helps boost their renown,

and the group’s expert understanding of shifts in trends and consumer

expectations in the market segments helps cement the artist’s success.

Promotion of catalog and intellectual property

Maintaining the wealth, quality and diversity of the group’s music, film and

video game catalogs is crucial to meet user expectations for local content

that matches their sensibilities. The group’s extensive distribution

capabilities, drawing on distribution networks and partnerships with digital

players, help ensure that its multi-genre catalogs reach audiences all

around the world.

To use its content in a way that best meets user expectations, the group

invests in innovative recommendation programs to steer users to its catalog

of films and series or match them with a specific style of music.

Marketing artists’ catalogs and digitizing older works to make them acces-

sible to new generations is a way of supporting the continued development

of established artists, encouraging funding and risk-taking for more newly

discovered artists and broadening access to the work of artists whose

repertoire has a more limited audience.

The group promotes the work for which it holds the intellectual property (IP)

rights with a view to developing brands that are guaranteed to be a success

and building a robust brand portfolio. To this end, Vivendi has set up an IP

Committee which meets regularly, bringing together representatives from

its executive management and subsidiaries to discuss the promotion of

brands for which the group holds the IP rights, either by capitalizing on

opportunities to boost the visibility of its existing brands (e.g., Paddington

and L’Olympia, festivals) or by acquiring established brands in line with its

business. The subsidiaries contribute to promoting brands within their own

business lines (e.g., turning a series into a film) or in collaboration with

other subsidiaries (e.g., a video game inspired by a movie). Designing

value-creating cultural events that can be rolled out on an international

level, such as the Crxssing festival, will also be the focus of discussions in

2019. In addition, the arrival of Editis in the group opens up new prospects

for promoting IP on literary works.

An attractive editorial line

Vivendi’s editorial line is underpinned by the production of an ambitious and

highly diverse range of content that adds to the originality of the group’s

catalogs, as well as by the introduction of new forms of entertainment. This

editorial approach means that the group is able to showcase a varied,

high-quality and competitive offering on the market.

16 –— VIVENDI –— ANNUAL REPORT 2018 –—

—

VIVENDI

—

ANNUAL REPORT 2018

—

17

2.3.Value creation

STRATEGY AND VALUE CREATION

1

2.3.2.1. Value creation for UMG

Discovering and supporting future musical talent is one of

the key characteristics of UMG’s value creation model. Its

labels and A&R teams are essential assets for identifying stand-

out personalities in all musical genres who match popular music trends. They

leverage their expertise to shepherd new musical projects in UMG’s catalog

to success. Their presence all over the world means they can identify local

artists that suit the sensibilities of a multicultural audience. It was with this

in mind that UMG created two new units in Africa in 2018 to support young

artists on the African music scene.

At UMG, being able to adapt to the different needs of individual artists to

attract and retain talent means adopting a flexible approach. Artists have

the option of signing with a label for comprehensive support, signing a

music services deal (e.g., digital marketing and distribution), or retaining

their independence through the digital distribution platform, Spinnup.

UMG’s teams are also always on the look-out for talent that is in tune with

the latest developments in technology to remain at the forefront of inno-

vation and offer fans cutting-edge listening experiences. It works closely

with music tech startups through incubator programs such as Abbey Road

Red and the Accelerator Engagement Network (see Section 4.4.1.4), which

specialize in virtual and augmented reality technologies.

The group’s wide range of expertise means it can provide

artists with artistic and media management from track and

album releases to live events, merchandising, music publishing,

audiovisual and film rights management, and brand partnerships. This

diversified, comprehensive support is what makes UMG’s services so

unique, and positions the group’s labels among the most dynamic and

innovative offerings on an international scale.

Fan bases are essential stakeholders in the value creation chain. The

momentum they generate is key to promoting artists and their music. UMG

places particular importance on developing more interaction between fans

and artists and increasing the numberof innovative experiences to make

this connection even stronger. Its merchandising activity also builds on

these relationships with innovative products tailored to each artist and their

brand.

Data analysis is a key asset for UMG. Its “artists insight, consumers insight,

brands insight” approach means it has a better understanding of its artists,

is able to meet audience expectations more effectively and is better

equipped to identify potential collaboration between artists and brands that

will create value for both sides.

Creating value for artists also means gaining maximum exposure for their

work, which is why UMG has forged strategic partnerships with major digital

streaming platforms (e.g., Apple, Spotify, Amazon, Pandora and Google) and

has music video licensing agreements with social media networks.

UMG’s deep catalog of titles is also highly diverse, due in

particular to the group’s investments in local artists. UMG

optimizes the reach of its music assets by developing different

ways for users to access content.

To maximize the potential of its catalog, UMG has invested in a data

analysis program that is based on musical descriptions. By making searches

more fluid using criteria such as genre, mood, tempo and instrumentation,

the system makes discovering new music a much more user-friendly

experience when using streaming services and voice activated devices (see

Section 4.4.1.3).

Mindful of the value of its catalog, UMG conserves and digitizes analog

tapes from its archives, produces documentaries on the lives and works of

iconic artists such as Pavarotti and The Beatles, and partners with museums

for exhibitions on the theme of music.

As part of its strategy to optimize its catalog, UMG also protects the

accompanying rights from infringements that undermine its value. To limit

access to unlicensed music content and prevent music being copied from

streaming sites, UMG has put measures in place in consultation with

various music and digital industry players.

IP rights on original works and covers have a significant financial value. In

particular, the group benefits from its IP rights when music is used in films,

adverts, television programs and content on new media.

UMG’s editorial line gives listeners access to a diverse

range of genres, allows them to share the artists’ emotions

through music and provides audiences with entirely new musical

experiences. It also plays an important role in showcasing the group’s

wealth of content and artists.

Supporting talent takes significant investment. In the group’s top five markets (United States, United Kingdom, France, Germany and Japan), 34.9% of UMG’s

marketing and recording investment is dedicated to artists releasing their first album.

UMG’s catalog reflects audience desire for content that is highly diverse both musically and culturally, with content by local artists in their own country

accounting for nearly 60% of sales, contributing to total revenues of €6,023million in 2018. UMG’s music publishing business has more than

184,000 agreements with songwriters presently in effect which contributes to the richness of the catalog.

UMG takes a multi-pronged approach to supporting and promoting its artists, as demonstrated by its €3,4billion in investments for artistic development,

192merchandising deals and international campaigns partnering artists with brands in more than 70countries to date. UMG’s ability to adapt to new ways

of listening to music and goal to continue increasing the reach of its content are reflected in the group’s more than 400partnerships with digital platforms and

the fact that digital sales account for 63.7% of its recorded music sales.

Finally, the digitization of 85,000 audio master recordings from analog tapes in its archives and its music videos makes the group’s back catalog even more

valuable.

Performance indicators

18

–— VIVENDI –— ANNUAL REPORT 2018 –—

—

VIVENDI

—

ANNUAL REPORT 2018

—

19

1

2.3.Value creation

STRATEGY AND VALUE CREATION

23

1

A unique culture of labels

helping develop

and strengthen

an artist’s career

An integrated and

comprehensive value

creation process

VALUE

CREATION

Early investment

Investing in artists at the beginning of their careers,

including production, creative development and tour

support

Content creation

Combining the strength of our labels and publishing

business to bring together recording music artists,

songwriters and producers to work together on music

creation

Marketing and promotion

Using the expertise of our labels to help artists stand

out in a sea of crowded content platforms and connect

with fans around the world

Long-term career development

Developing and nurturing artists over the course

of their entire career in our various labels

Protecting artists’ rights

Protecting IP, making artists’ voices heard, lobbying

for fair compensation, fighting piracy, supporting

trade organizations

Helping local artist reach a global audience

Operating in more than 60 countries with more

than 400 distribution partners around the world

Supporting all aspects of an artist’s career

Providing artists with world-class resources beyond

recorded music and music publishing (merchandising,

licensing, audiovisual, artist management, touring,

brand management, events and sponsorship…)

Technological excellence

With the greatest access to industry data

and dedicated teams in analytics and insights,

UMG offers a wide-ranging approach to integrating

data into an artist’s creative and business decisions,

helping create partnerships between artists,

media and brands

ARTISTS

Fulfilling music demand for all types

of consumers and audiences

Offering our music through digital radio, ad-supported

or subscription streaming, CDs, downloads and vinyl

to provide fans the music they love in whichever way

they choose to consume it

Promoting music from all genres

Giving audiences great music of all genres, promoting

languages and values, self-expression, feelings

and ideas and bringing people together with music

Protecting a priceless heritage

Preserving decades of cultural heritage and artistic

expression for generations to come – and fostering

tomorrow’s cultural treasures

Connecting artists and fans

UMG brings fans closer to the artists they love,

through social media, meet-and-greet events,

pop-up stores, promotions and brand partnerships

Preserving culture

Music is an important part of local cultures

and UMG invests in local content development

around the world

Supporting charitable efforts

Music has the unique ability to inspire and unify.

Our companies and artists use music to do good

around the world

FANS & AUDIENCE

Wide variety of distribution partners

400+ digital partners around the world including Apple,

Spotify, Amazon, YouTube, Facebook and local partners

such as Tencent and Anghami; physical distribution from

large chains to small, independent physical retailers

Partnering with independent labels

Partnership with independent labels to help support

their artists through both distribution and other more

comprehensive partnerships

Anticipating and fueling technological transitions

By working with a wide range of technology partners,

we anticipate and help make possible the many ways

music will be enjoyed in the future

Early-stage venture partnerships

Helping develop and grow new music-based businesses

Licensing music for use in other forms of content

Partnerships that extend well-beyond the music

industry, including film and TV, video games, and sports

Emerging music markets

Working with partners in emerging music markets to

establish legitimate business models for selling music

where piracy was previously dominant

BUSINESS PARTNERS

UMG: music with and for the world

18 –— VIVENDI –— ANNUAL REPORT 2018 –—

—

VIVENDI

—

ANNUAL REPORT 2018

—

19

2.3.Value creation

STRATEGY AND VALUE CREATION

1

2.3.2.2. Value creation for Canal+ Group

At Canal+ Group, talent-spotting teams tasked with disco-

vering and supporting artists also draw on the organization’s

analyses of entertainment trends. This expertise is vital for

bringing presenters, columnists and comedians to the group’s channels on

the small screen, where they contribute to its signature style. Canal+

Group’s pool of scriptwriters, short features unit, digital creation hub and

Création Décalée label actively work to create original and innovative

audiovisual content.

The group’s support for young talent in the film industry is another part of its

value model. Investments by Canal+ and Studiocanal in debut and second

films foster diversity and fresh ideas in the channels’ catalogs. The group

boosts its attractiveness to future talent by setting up tailored financial

partnerships (payment of overheads or minority stakes in exchange for first

refusal rights), providing support to talent incubator programs and developing

training courses to unlock the potential of young screenwriters and authors.

The group applies a similar approach outside of France: Canal+ International,

which has teams in Africa, Vietnam, Poland and Myanmar, focuses in

particular on writers of TV dramas and series and producers of documen-

taries and films in those countries and promotes locally created content

with an editorial line that takes cultural sensibilities into account (see

Section 4.4.1.2).

Newfound and established artists alike are supported in

their careers. They also benefit from a wealth of opportunities

for development, such as collaborative projects with professio-

nals from the group, the possibility of using event venues such as theaters

and concert halls, and the option to capitalize on the group’s various

platforms to develop new content (e.g., light entertainment TV shows,

movies and series). Through these initiatives, artists are able to share the

content they create and win the loyalty of audiences.

The group also offers a numberof pathways to talented creatives with a

view to (i) increasing their exposure, (ii) promoting their work via partnerships

with new artists to acquire distribution rights for their shows and enhance

the group’s lineup, (iii) participation in the production of an event and/or (iv)

funding for a feature film by an established figure.

Through Studiocanal, Canal+ Group has a catalog of more

than 5,500 titles and manages the local rights to several

thousand films, predominantly in Germany, France and the United

Kingdom. Due to its policy of investing in local content, Canal+ International

has built up a catalog of works representative of its subscribers’ cultural

sensibilities.

It promotes its content through high-performing distribution systems for an

innovative, surprising and inviting user experience, tailored to audiences who

view content in a variety of different ways. For example, myCanal and Canalplay

take these viewer expectations into account in their digital packages.

On an international level, the group’s content in Africa is also broadcast in line

with new viewing habits, using the myCanal platform along with a mobile-only

video-on-demand service in partnership with Iroko, a major African

entertainment company. Roll-out of a fibernetwork in African countries where

the group operates will allow for ultra-high-speed distribution and facilitate

access to Canal+ International’s content. In addition, Canal+ Group has

strengthened its stake in Thema, a company that distributes general-interest,

special-interest and local channels to cable, satellite and IPTV operators in

France and abroad, as part of its aim to optimize the reach of its diverse

offering.

Showcasing works produced under its own brand and maximizing the

potential of franchises it has acquired is another part of Canal+ Group’s

strategy to promote its content. With this in mind, the Paddington franchise

has inspired a movie soundtrack, video game, theme park ride and TV

series, which illustrates the multitude of ways to position a brand to a wide

audience and generate financial value from the associated IP rights.

This strategy is complemented by measures to protect audiovisual content

and films from piracy, which can greatly undermine their value. The group

now favors a commercial approach rather than digital watermarking for

tackling piracy. In particular, it offers attractive tariffs to young audiences,

runs campaigns to raise awareness about the consequences of piracy and

puts in place measures to limit financing from advertising for illegal sites.

The editorial line of Canal+ Group helps boost the attrac-

tiveness of the group’s content by prioritizing original, quality

audiovisual and film creations, reflecting the cultural diversity of

its audiences, meeting viewer expectations with entertaining or meaningful

programs and adapting to new consumer habits.

The emergence of new talent in the motion picture and audiovisual industry is part of Canal+ Group’s value creation approach. In 2018, this was reflected in its

pre-purchasing policy, providing support to 15 debut and 25 second films by young directors. Alongside the close to 600 original works that the group

co-financed or pre-purchased, these films together form a wide array of content to offer subscribers. The group’s policy of investing in original, diverse content

is supported by programs funding totaling €3 billion, with more than 50% for local content.

Canal+ Group leverages digital innovation and adapts to new viewing habits to promote its content and catalog of movies. With its platform MyCanal,

Canal+ Group is a pioneer of digital technology in Europe.

As a result of its policy of innovation and the diversity of its content, the group has won 16.2million subscribers, close to 50% of whom are outside of France.

This reflects the international development of the group’s activities, with coverage across 70% of the world. Canal+ Group’s international expansion

is strengthened by the 45 nationalities. Support is also given to international professionals who work with the group from time to time. In 2018, they received

more than 1,500 hours of training to build on their expertise in the audiovisual field.

Canal+ Group also has a policy to conserve and promote its movie assets by restoring and digitizing works in its catalog. In 2018, 162 films benefited from these

measures.

Performance indicators

20 –— VIVENDI –— ANNUAL REPORT 2018 –—

—

VIVENDI

—

ANNUAL REPORT 2018

—

21

1

2.3.Value creation

STRATEGY AND VALUE CREATION

23

1

Canal+ Group: unique creativity that transcends borders

Actors, singers, comedians, sportspeople, authors,

journalists, presenters, developers and producers

Discovery, incubation and financing

Original content expertise

Editorial concepts, strong brand image in the production of films

and documentaries and processing of information

Canal talent factory

Support, exposure in television and film, continual development

over the production’s entire life cycle

Development of regions

Introduction of new technologies, development of infrastructure,

engagement with local communities and detection of local talent

Support for the movie and audiovisual industry

Financial contribution to the audiovisual industry, training of talents,